Every investment has different risks

Super funds can invest in a range of different assets like the Australian share market, global shares, cash, fixed interest, infrastructure, property, and private equity.

Some investments tend to fluctuate in value more than others.

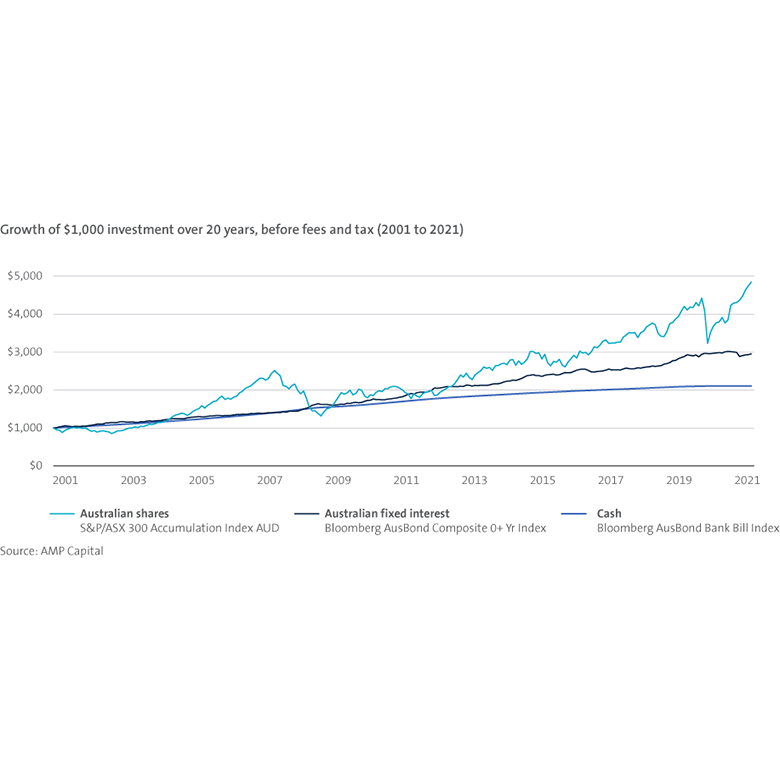

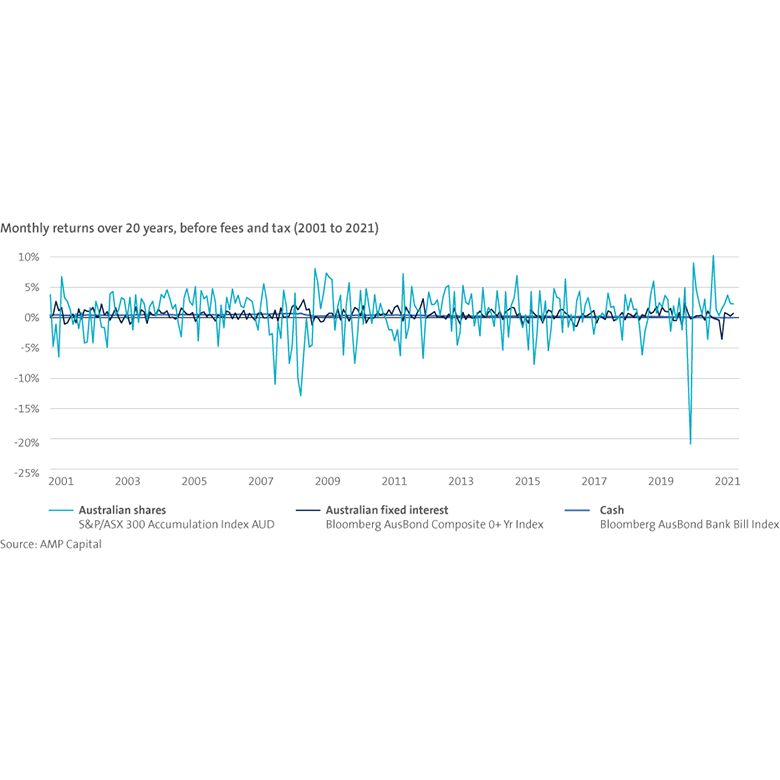

- Growth assets (including shares, property and infrastructure) usually have a higher level of volatility than defensive assets, and their values can change from day-to-day (sometimes by quite a lot). However, over the longer-term, growth assets have more potential for higher returns than defensive assets.

- Defensive assets (including cash and fixed interest) are less volatile than growth assets, and their overall return potential is also lower.

The charts below help show the relationship between risk and return.

Note: These charts are illustrative only. Past performance is not a reliable indicator of future performance. Returns may vary considerably over time. The value of investments may go up or down and you may not get back the amount you invested. These returns don't take into account management fees or taxation. Benchmark indices have been used in these charts to measure performance of various asset classes.

Super investment choices

When you open a super account, you have a choice about how you’d like your super to be invested. This includes having the super fund make the investment decisions for you - called MySuper or deciding on your own investment mix.

- The AMP MySuper Lifestage option changes your asset allocation through time. Younger investors will have a strategy that focuses on growth because they have a while to go before their retirement, and can afford to take more risk. On the flip side, investors who are closer to retirement, will have more of a focus more on preserving their super balance and reducing risk, while also keeping some exposure to growth assets.

- Choosing your own super investment mix gives you the flexibility and control to build your portfolio as you like. You can choose up to 15 investment options across a range of different investment approaches.

Risk when choosing your own super investments

As your super investments may be your main source of savings for retirement, it’s important to understand how investment risk plays a role and how you feel about it.

You can also consider these three things:

- Your investment goals: Are they short-term or long-term goals? How much will you need?

- Your timeframe: When do you want to retire? If you’ve already retired, how long will your money last?

- Your attitude to risk: Are you comfortable with negative returns in the shorter-term when seeking higher returns over the longer-term? Or, are you more comfortable with moderate and consistent returns? While it’s not a substitute for advice, you can get an idea about your attitude to risk via our Investment risk profiler.

Also remember that an annual review of your investment choices is worthwhile because it’s likely your personal situation and answers to the above points will change over time. And, as these change, you should check your investment strategy and adjust the mix to meet your new needs where required. Remember, your investment mix can make a big difference to the amount of income you’ll receive in retirement.

Your attitude to risk

Everybody has different investment goals, timeframes and attitudes to risk which will probably change overtime, depending on their circumstances and life stage.

The AMP Investment Risk Profiler is a quick way to help you work out your investment style and what types of investments you might like to consider.

How your attitude to risk can help with your investment strategy

You can use your risk profile to determine an investment strategy and work out which investments to make. For example, if you have a conservative profile, then your investments might look something like this.

These examples are illustrative only.

Once you invest according to your risk profile, your target mix won’t change unless you change it. You can also have your investments regularly rebalanced to make sure your investment mix stays on target.

Types of risk

Another thing to keep in mind is that there are different types of risks to consider when investing. Here are some main ones:

- Investment risk – the value of investments can rise and fall.

- Inflation risk – Your money may lose its purchasing power with inflation. When prices go up, your investment also needs to go up by at least the rate of inflation or the real value of your investment will decline. Learn more

- Legislative risk – the laws that affect your super or investments can change.

- Timing risk – your investments may be bought or sold at an unfavourable time in the market.

- Market risk – changes in market conditions which may adversely impact your investments.

- Systemic risk – major movements across several asset classes, or to the entire system simultaneously. This is generally due to some event affecting the economic system, eg global financial crisis.

- Liquidity risk – the risk that an investment can’t be sold without incurring a loss relative to its fair value. Learn more

- Interest rate risk – changes in the level of interest rates may impact the value of an investment.

- International investment risk – the value of your investment may be impacted by changes in the foreign exchange rate and the law, regulations and political environment of the country where the investment is located.

- Individual asset class risk - each type of market, also known as an asset class, has its own risks. Learn more in your investment guide

- Single asset class risk – the risk of investing in only one type of asset (like shares), rather than spreading the risk across different asset classes (known as diversification).

Reviewing your choices

An annual review of your investment choices is usually worthwhile. This is because personal preferences, financial situations and long-term goals tend to change over time, meaning your investment strategy should be reviewed and adjusted to meet your new needs.

Simple super investment advice

If you’re an AMP Super member and would like advice about how your super’s invested, book a 20-minute super coaching session, at no extra cost.

Learn more about super

-

Six tips to supercharge your retirement savings Find six actionable tips to maximise your retirement savings and secure a financially stable future that your future self will thank you for. -

7 ways to get ready for tax time The end of financial year on 30 June 2025 is fast approaching so here’s a quick checklist to help you prepare in advance and maximise your tax time benefits. -

How the 2025-26 Federal Budget affects you From tax cuts to healthcare benefits and more cost-of-living support, find out what this year’s budget means for you.

Important information

Products in the AMP Super Fund are issued by N.M. Superannuation Proprietary Limited (N.M. Super) ABN 31 008 428 322 (trustee), which is part of the AMP group (AMP).

Product disclosure

This information is general only, hasn’t taken your circumstances into account, and is provided by AWM Services Pty Ltd ABN 15 139 353 496 (AWM Services), which is part of the AMP group (AMP).

Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Terms and Conditions and Target Market Determination available from AMP at amp.com.au or by calling 131 267. Read AMP’s Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

Simple Super (Intrafund) advice is provided by AWM Services Limited (AWM Services) ABN 15 139 353 496, AFS Licence No. 366121 (AWMS) to eligible members of the AMP Super Fund. AWM Services is a wholly-owned subsidiary of AMP.

Terms, conditions and footnotes