Money comes in. Money goes out. And the Federal Budget is set. Early to arrive, this year’s Budget has had every news and media outlet talking.

Unlike last year, we’re starting this year’s Budget in a deficit, wrapped in an uncertain economy, global trade wars and rising tariff tensions to boot.

While that all sounds a tad gloomy for a Wednesday morning, the Government is addressing these challenges. And using existing funds to bring you less tax, energy rebates and disaster relief for those impacted by Cyclone Alfred. Medicare and education cash injections will also ease the sting of everyday cost-of-living for many Australians.

What this means for you

Here’s our breakdown. Before you get too comfy, these proposals are not set in stone. Anything can change before legislation passes through parliament.

Tax

Keep more of what you earn with tax cuts

Few people like paying tax, and the Government plans to lower tax rates by a further 2% over the next two years.

If these changes go ahead, every Australian taxpayer will receive a tax cut of up to $268 from 1 July 2026, increasing to $536 from 1 July 2027.

How does this translate to money in your pocket?

Combined with the first round of tax cuts from 2024-25, this means you can save $2,229 in tax in 2026-27 and $2,548 in 2027-28. Or $50 a week.

Advice to low-income earners

You’re better off making after-tax contributions to save for retirement, than making pre-tax super contributions.

Medicare Levy: Higher income limits for low-income Aussies

From 1 July 2024, the Government is raising the low-income thresholds for the Medicare levy. This means more low-income earners, families, seniors, and pensioners won’t have to pay the levy - or will pay less. It’s part of a plan to help with the rising cost of living.

Energy

Keep your lights on with extended Energy Bill Relief

If you’ve been loving the $300 that goes towards your house or small business energy bills, you can expect an extra $150 off your energy bill as of 1 July 2025.

This will be received quarterly in the second half of 2025.

Healthcare

Get bigger Medicare rebates from GP visits

If you’ve ever balked at a GP bill or had to delay or cancel a visit due to out-of-pocket costs, these new Medicare rebates will mean you can go to the doctor when you need to.

From 1 November 2025, the Medicare rebates for a standard GP consultation will increase to:

$69.56 from $42.85 for metropolitan areas

A maximum of $86.91 for remote areas

Less out-of-pocket costs for GP visits

Current bulk billing is geared towards children under 16 and those with a concession card. As of 1 November, anyone that’s eligible for Medicare can look forward to bulk billing.

This could mean that nine out of 10 of your GP visits will be free of out-of-pocket expenses by 2030.

Pay less for medicines as a Medicare card holder

As of 1 January 2026, you won’t pay more than $25 for a medicine script covered under the Pharmaceutical Benefits Scheme (PBS), which is currently $31.60. Pensioners will continue to pay the locked in fee of $7.70.

More affordable urgent care

A further 50 Medicare Urgent Care Clinics will be set up, giving more Aussies access to bulk-billed, urgent care. Meaning more affordable options for you, and less pressure on hospital emergency departments.

Women

Better healthcare for women

Women’s health is in top focus, with more affordable options across different life stages. This includes everything from reproductive health to menopause.

What women can look forward to:

150% increase in Medicare rebates and bulk billing for IUD insertion and removal

Cheaper and more accessible oral contraceptives, as well as treatment for uncomplicated urinary tract infections

Medicare rebates for menopause assessments

PBS listings for both oral contraceptives and menopause hormone therapies, with around 150,000 women saving hundreds of dollars each year

Better wages for women

Aged care workers and childhood educators, a predominantly female workforce, can expect a boost to earnings in this sector.

Gender equality will now sit under the Fair Work Act 2009 to ensure the work of women is not undervalued in female dominated industries.

More support and protection for domestic violence victims

The Government is investing $21.4 million over three years from 2025 to better support and protect women and children experiencing domestic violence.

There will also be a strong focus on helping First Nations communities, with $21.8 million going towards prevention, early intervention, and response services between 2025 and 2026.

Boosting Construction

New incentives for eligible apprentices

More construction tradies = more housing. The Government plans to entice more people into housing construction trades with the Housing Construction Apprenticeship stream as part of the new Key Apprenticeship Program. From 1 July 2025, eligible apprentices in housing construction occupations will receive up to $10,000 in financial incentives over the course of their apprenticeships. An added bonus: employers of apprentices in priority occupations may also be eligible for up to $5,000 as a Priority Hiring Incentive, which includes many occupations relevant to housing construction.

Education

Shave a further 20% off student debt

Student debt can hold many young Australians back, as they try to earn a living after uni. Students can look forward to a further 20% off their Higher Education Loan Program (HELP) debts before indexation is applied on 1 June 2025.

Around 70% of people repaying a HELP debt are 35 or younger, which is a key time for saving, buying a home or starting a family. If passed, this one-off discount will benefit more than 3 million Australians.

A uni graduate with an average debt of $27,600 will have $5,520 shaved off their outstanding loan.

Fairer repayments for all students

As a student, you will only be asked to start repaying your loan once you earn $67,000. And this will be based on a portion of your income, not your total income. This is up from the current repayment income threshold of $54,435.

Anyone earning less than $180,000 will also pay lower compulsory repayments. These reductions will kick in on 1 July 2025.

What this means for students

This means younger Aussies will have more disposable income, and lower income earners can build up their earnings, to repay their loan when they can afford it.

That said, making smaller repayments earlier on could increase the amount of interest students pay over the life of their loan, leading to greater debt.

Social Security

Better childcare subsidies for all families

The cost of childcare means many parents, particularly mums, who either have to forgo their careers or contribute almost all of their salary to childcare fees.

As of 5 January 2026, all families – except those earning more than $533,280 – will get 3 days of subsidised childcare per fortnight.

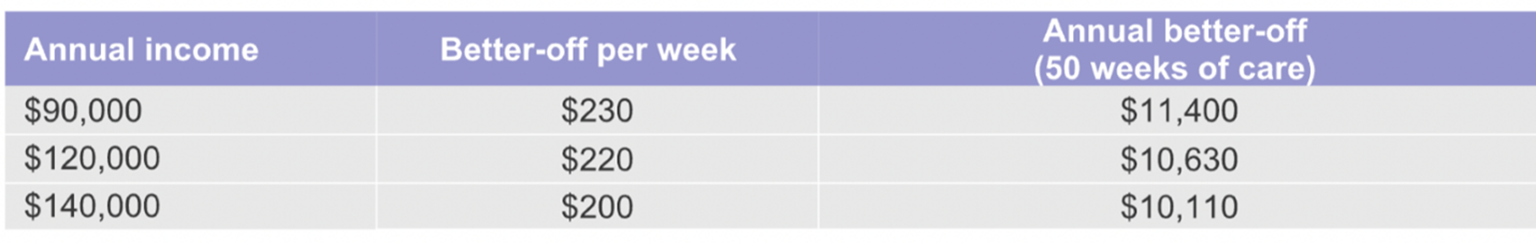

How much will your family be better off?

These subsidies are intended to encourage families, particularly women, to work, study, volunteer, or engage in other activities they choose to.

Disaster relief for those impacted by Cyclone Alfred

If your income was affected by the Queensland Ex-Tropical Cyclone Alfred, you may be eligible for a Disaster Recovery Allowance (DRA).

The DRA is income relief set at the same rate as the Jobseeker Payment or Youth Allowance, and is available for up to 13 weeks.

Are you eligible for DRA?

Must be aged 16 or older at the time of the disaster

Must be an Australian resident or meet other residence rules

Must work or live in a declared Local Government Area

Must have lost some or all income as a direct result of the disaster and earn less than $1,924.60 per week before tax in the 13 weeks after the income loss

Must not be in receipt of an income support payment during the claim period.

If you don’t meet these criteria, you may still be able to receive an Australian Government Disaster Recovery Payment (AGDRP). This is a lump sum of $1,000 per adult, or $400 for each child under the age of 16. This payment is not taxable and doesn’t need to be included in your tax return. Find out if you are eligible here.

You can make a claim up until September 2025

See the information relevant to your state via the Services Australia Website.

Housing

Co-buy your house with the Government

The “Help to Buy” scheme has been around since 2024 and allows first home buyers the chance to co-buy their property with the Government. This lowers deposit and mortgage repayments.

The Government will now open this up to existing homes, offering 30% of the purchase price for an existing home and up to 40% of the purchase price for a new home.

The income cap will be increased to:

$100,000 from $90,000 for single applicants,

$160,000 from $120,000 for couples and single parent applicants.

The property price cap will also increase according to the median house price for the region. For example:

$1.3 million from $950,000 in Sydney,

$1 million from $700,000 in Brisbane,

$950,000 from $850,000 in Melbourne.

The full list of the new property price caps can be found here.

The fine print

The Help to Buy scheme was put in place in December 2024, but is not yet operational.

While the increase will make the scheme available to more people, the total number of places available remains at 10,000 per year, for 4 years.

Employment

Say goodbye to non-compete clauses

Non-compete clauses can get in the way of people going for higher paying jobs or starting their own businesses. So, in 2027, the Government is banning them.

This will apply to workers earning less than $175,000. And is intended to boost earnings, giving Aussies more options to spread their wings.

Supporting small businesses

Ease the pressure on small businesses

As mentioned earlier, the Government is extending energy bill relief for one million eligible small businesses. The Energy Efficiency Grants for Small and Medium Sized Enterprises program is providing $56.7 million in grants of up to $25,000 to over 2,400 businesses to help fund a range of energy upgrades, like replacing inefficient systems and appliances.

The Government is also adding extra support to the hospitality sector and alcohol producers, by pausing indexation on draught beer excise and excise equivalent customs duty rates and by support available under the existing Excise remission scheme for manufacturers of alcoholic beverages and Wine Equalisation Tax Producer rebate. This is estimated to decrease receipts by $165 million over five years from 2024–25.

Levelling the playing field

The Government will work with states and territories on extending Unfair Trading Practices protections to small businesses.

The Government is providing $7.1 million over two years to strengthen the Australian Competition and Consumer Commission’s enforcement of the Franchising Code. The Government will extend protections from Unfair Contract Terms and Unfair Trading Practices to businesses regulated by the Franchising Code, subject to consultation.

No changes to super

The Government did not announce any major superannuation changes in the 25-26 Budget, and did not announce any changes to the timing of the final Super Guarantee increase. The Super Guarantee rate is currently legislated to increase from 11.5% to 12% on 1 July 2025.

You may also like

-

Oliver's insights - Seven reasons Australia is likely to avoid recession from Trump’s shock President Trump’s trade war poses a threat to Australian economic growth particularly via the indirect impact of weaker global activity driving less demand for our exports and lower commodity prices. -

How to spot scams during the holiday season - AMP Ensure your holidays and travel breaks remain relaxing and scam-free. Here are some red flags to watch out for. -

How much I spent on converting a campervan for travel - AMP Laura and Brendan combined their love for the outdoors with their DIY skills to convert a van into the campervan of their dreams. Here’s how much they spent.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.