Card payment disputes

The first thing you should do is lock your card from the Card screen in the mobile app.

Once you’ve done that, it’s worth checking:

- Online: Searching the company name might provide the answer.

- Subscriptions: A free trial might have rolled into a paid service.

- Recurring payments: Check if there are any ongoing payments that may have been arranged on a recurring basis.

If you still don’t recognise the card transaction, please get in touch with our customer service team as soon as possible on 1800 950 105.

Please get in touch with our customer service team as soon as possible.

Call us on 1800 950 105 so we can investigate for you.

If the activity relates to debit card transactions, you can also lock your card from the Cards tab in the app.

If you’re waiting for a refund it’s best to allow the company enough time to complete it - sometimes it can take up to 15 calendar days to reach your account.

We suggest you contact the company if you’re still waiting to find out what the status of your refund is.

If you’ve waited 15 days and the original payment you’re expecting a refund and you have still not received it, you can contact us to raise a dispute.

To do this:

Head to the app and select the payment from your transaction history.

Tap Need help with this transaction? to start.

Select 'I recognise this transaction but there's a problem'

Alternatively, you can get in touch via the Help section in the app.

Things you need to know:

Depending on the dispute type, we may need to see evidence that supports your claim. This could be proof of the purchase, documents or screenshots of conversations you’ve had with the company.

When you raise a dispute, you're asking AMP bank to attempt to claim your money back from the company. We can’t guarantee that we will be able to recover it, but we will assess your case fairly, using all the information and evidence you give us.

In most cases, the fastest way to resolve an issue is with the company directly. You should also contact the courier or company you made the payment with e.g. PayPal (if applicable).

If you’ve been unable to resolve the issue or you don't get a response, we may be able to dispute the payment. It’ll need to show as "settled" on your transaction history.

To raise a dispute:

Head to the app and select the payment from your transaction history.

Tap Need help with this transaction? to start.

Select 'I recognise this transaction but there's a problem'

Alternatively, you can get in touch via the Help section in the app.

Things you need to know:

We may need to see evidence that supports your claim. This could be proof of the purchase, documents or screenshots of conversations you’ve had with the company.

When you raise a dispute, you're asking AMP Bank to attempt to claim your money back from the company. We can’t guarantee that we will be able to recover it, but we will assess your case fairly, using all the information and evidence you give us.

If you didn’t receive your cash from an ATM, the ATM provider may refund it automatically if they identify an error. This can take up to 5 days after the payment shows as ‘settled’.

If it's been 5 days since it’s shown as settled and you haven’t received a refund, you can raise a dispute.

To do this:

Head to the app and select the payment from your transaction history.

Tap Need help with this transaction? to start.

Select 'I recognise this transaction but there's a problem'

Alternatively, you can get in touch via the Help section in the app.

Things you need to know:

We can only raise a dispute 5 days after the payment has shown as settled.

When you raise a dispute, you're asking AMP to attempt to claim your money back from the company. We can’t guarantee that we will be able to recover it, but we will assess your case fairly, using all the information you provide.

Contactless Payments

This limit is set at $100 contactless payment by default which means a count of transactions that add to more then $100 and you’ll be prompted to enter your PIN if you exceed this limit. Once you enter your PIN the count will reset or reset within 24 hours. You can adjust this limit to an amount you prefer in ‘Card & Payment Limits’ for each card you have.

These limits are in place to keep you safe and to ensure your card is always in the right hands.

Our default contactless limit is $100. We give you the option to lower your limit below $100 maximum per single payment.

To do this for your main card, head to the Cards tab:

- Select Card & payment limits.

- Tap Maximum single contactless payment.

- Move the slider to the amount you want.

Yes, to turn off contactless payments on your account card, head over to ‘Card & Payment Limits’ in the ‘Card’ section. Tap on ‘Maximum contactless payment limit’ and reduce the limit to $0.

Bear in mind that due to the way some merchants’ card machines are set up, certain contactless transactions could still go through.

Transaction issues

You can see why your payment was declined in your app - just tap the payment in the feed. If you’re still not sure you can try checking that you have enough money, you’ve used the correct PIN and your card is unlocked. You can also check the card controls on the Card screen.

In general, pending transactions can't be reversed or cancelled. Usually transactions stay pending on your account for up to 8 days, but can sometimes take up to 31 days (i.e. hotel & car rental deposits). Transactions are automatically reversed if the merchant does not collect the funds within this time.

If you have a pending transaction and don’t expect the funds to be collected, this could be because the transaction has since been cancelled or failed to complete, we may be able to release the funds earlier if you have evidence to support this. If we do this, the merchant may still collect the funds, in which case your account would be debited.

Supporting evidence could be:

A void receipt from the merchant, stating the date, time and amount of the transactions.

A screenshot of an email from the merchant stating the date, time and amount of the transactions, as well as confirmation that they will not settle/complete the transaction.

Supporting evidence can be attached to a message inside the App. Just head to the Help section to get in touch.

If you don’t recognise the transaction at all and think it may be fraudulent, please get in touch immediately and we will assist you.

Travelling overseas

| There's no need to let us know |

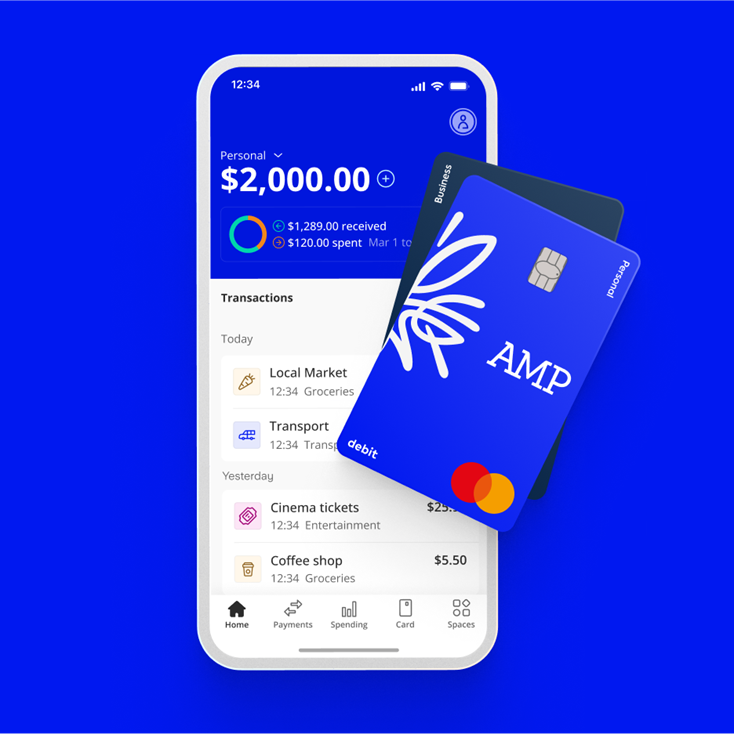

AMP Bank is great for travel. You can use your AMP Bank card in a whole load of countries – almost anywhere you see the Mastercard logo, in fact!

Unlike a lot of other banks, we don’t add fees or charges when you use your card overseas. It’s also free to withdraw cash from ATMs outside of Australia. However, please keep in mind that you may still be charged by the ATM provider, as you would in Australia.

Card payments are converted into AUD using the Mastercard rate. When using your card abroad, always select the option to pay in local currency to obtain this rate.

Debit Card

You can block gambling payments in the app. You can do this by:

- heading to the Card tab

- tapping Card controls or Card & currency controls

- scrolling to Gambling payments

- slide it off

This feature stops gambling payments based on the MasterCard code the merchant uses to categorise themselves. So it may not capture every gambling payment. It also stops you from sending payments by bank transfer to known AU gambling retailers.

If you've been able to make a payment while the block was on, please get in touch with us. We’ll then review this payment with the aiming of adding the processor to our block.

We can’t stop gambling charges where the merchant mainly sells another product. For example, a supermarket with a lottery terminal.

If you’d like help to stop gambling, we’re here to help. If you feel comfortable doing so, please contact our customer services team. You can chat with us on the app or call us on 1800 950 105. If you're calling from overseas you can call us on +61 2 5135 1930

If you still have access to the app, you should lock your card from the Card screen so it can't be used if it falls into the wrong hands. If you find it again, you can just unlock it – no need to order a new card.

Sure your card has been lost or stolen? You can cancel it and order a replacement in the app – just go to the Card screen and tap Cancel & Replace Card. You can re-add the new card to Apple Pay or Google Pay as soon as you've ordered your replacement, so you can carry on spending before the physical card arrives.

If you don’t have access to the app, please call us on 1800 950 105 or +61 2 5135 1930 if you're calling from overseas.

You can order a replacement by going to the Card screen and tapping 'Cancel & Replace Card.' The 'Replace Card' option will allow you to keep your old card active while you wait for your new card to arrive.

To get a reminder of your PIN, head to your app, and then:

Tap Cards.

Tap Get a PIN Reminder.

Enter your AMP Bank password to view your PIN.

In the first instance, try unblocking your PIN in the AMP Bank app.

Tap Cards.

Tap Card Controls.

Then at the bottom, under Unblock PIN/CVC, tap Unblock.

In most cases, this should allow you to use your card again.

If you are having issues, please get in touch with us via the app.

Once you've got your new card, head into the app and open the Cards tab. You then need to select 'Activate card' and enter the 3 digit number from the signature strip on the back of the card when prompted. That's it - your new card will be active and ready to use.

You can change your cards Pin Number via the AMP Bank App.

1. Tap Cards

2. Tap Card PIN

3. Enter Your Password

4. Select 'Change your PIN'

5. Enter your new PIN, and then reconfirm it

6. Enter your password

7. Your new PIN is now updated

If you ever need a reminder of your PIN, just go to the Cards tab in the app, select 'Card Pin', enter your password, and select 'Show Pin'. This will display your card pin number.

The AMP Bank app is really powerful when it comes to controlling your card! Whether it’s locking your card for all payments or stopping a certain type of payment, head to the card screen to find out more.

Below is a list of the card controls as they appear in the card screen and within the ‘card and currency controls’ menu.

Card Locked/Unlocked - the first control you’ll see when you head into the card screen. This one stops all payments on your card and overrides all the other controls.

Card & Payment limits - This option will allow you to view your card limits and control your contactless payment limit. More information about your limits here: (link to below FAQ)

EUR Card Spending - If you have a EUR account and have connected your account to your card, this option will show. Turning this on will mean that any charges that come through in EUR will come from your EUR account.

(Business Accounts ONLY) USD Card Spending - If you have a USD account and have connected your account to your card, this option will show in the card and currency controls. Turning this on will mean that any charges that come through in USD will come from your USD account.

Card Present - This controls whether your card can be used for card-present charges. These are payments made with the physical card, including chip and PIN, contactless, magstripe (if it is enabled) and in-person mobile wallet payments (where your device is physically tapped at a card reader).

ATM Withdrawals - This controls if the card can be used for ATM withdrawals.

Online Payments - This controls whether your card can be used online. These are payments made by providing the retailer with details from the card, rather than using the physical card itself. It also covers online/app payments made via mobile wallet.

Mobile Wallet - This controls whether the card can be used via mobile wallet.

Gambling Payments - This controls Gambling Payments (made using either card and Faster Payment). Turning this off will mean that gambling payments cannot be made. Turning this on will trigger a 48-hour cooling off period before gambling payments can be made, more information is available here (link to below FAQ)

Magstripe Payments - This controls payments that use the magnetic strip on the back of the card. It’s disabled by default. If you want to make payments using the magnetic strip, you’ll need to turn this on. If you don’t make a magstripe payment after 48 hours, it’ll turn itself off for your protection.

Unblock PIN/CVC - This button will allow you to unblock your PIN/CVV if it has been locked. In some cases, you may need to visit a ATM in the UK and use the pin services option to unblock your PIN.

Other help and support

-

Customer care

We know that you might need additional help, around products, deceased estates, legal documentation or customer care. Please get in touch with us.

-

Needing financial support?

When life throws unexpected challenges your way, your financial situation can change dramatically. In difficult times, we'll support you and help you get back on track.

-

Feedback & complaints

If you are unhappy with our products or service, we want to know about it. We treat every complaint seriously and aim to resolve your concerns as quickly as possible.

-

Ways to contact us

Are you overseas? See our overseas travel support.

Important information

The product issuer and credit provider is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517. This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available here.

For accounts with BSB number 939 900, that you access via the AMP Bank mobile app, the Terms and conditions that apply are available here.

For accounts with BSB number 939 200, that you access via the My AMP mobile app, the Terms and conditions that apply are available here.