Qantas Frequent Flyer

Qantas Frequent Flyer is a loyalty program where members can earn Qantas Points to use on flights, hotels and holidays, wine, Marketplace and more.

If you are a Qantas Frequent Flyer member, you can earn Qantas Points by linking your Everyday Account to your Qantas Frequent Flyer account.

You can earn 1 Qantas Point for every $10 of your average monthly account balance, up to $5,000,000. For example, a $10,000 average balance earns 1,000 Qantas Points in that month.

Qantas Points are calculated at the end of each calendar month and applied to your Qantas Frequent Flyer account within 30 days.

Not a Qantas Frequent Flyer member? AMP Bank customers can join for free here .

You can use your Qantas Points to choose from a wide range of rewards such as flights, hotels and holidays, shopping at Qantas Marketplace and more.

Customers who have the AMP Bank app can join Qantas Frequent Flyer for free by using this link. Once you have a Qantas Frequent Flyer account link it to your Everyday Account to start earning Qantas Points.

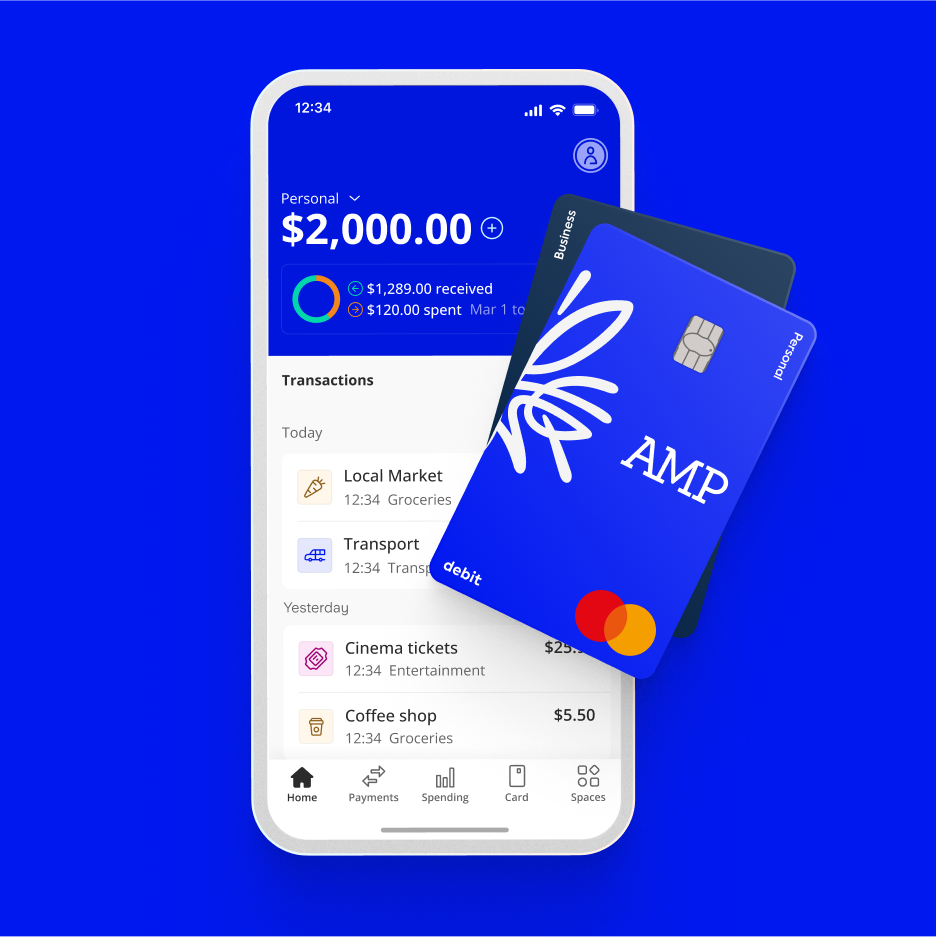

You can link your account by going to the 'Qantas Frequent Flyer' section within your Personal Profile in your AMP Bank app.

All you’ll need is your Qantas Frequent Flyer membership number.

If you do not know your Qantas Frequent Flyer number, it appears at the top of most emails sent to you by Qantas or you can find it in the Qantas App.

For more information about your Qantas Frequent Flyer account, you can call the Qantas Frequent Flyer Service Centre on 13 11 31.

Your Everyday Account on the AMP Bank app is eligible to earn Qantas Points.

Please check that your Qantas Frequent Flyer account is active, and that the surname on your Everyday Account matches the surname captured on your Qantas Frequent Flyer account.

If you're still experiencing difficulties, please call the Qantas Frequent Flyer Service Centre on 13 11 31.

You can view your Qantas Points balance in your Qantas Activity Statement or by logging into the Qantas App.

Qantas Points are calculated at the end of each month and applied to your Qantas Frequent Flyer account within 30 days. It may take up to 30 days for points to appear on your Qantas Activity Statement.

Qantas Points are earned on the monthly average balance. If your monthly average balance was below $10, you will not qualify to earn points for that month. If your monthly average balance was above $10, please check the AMP Bank App to ensure your QFF account is correctly linked to your Everyday Account. You can do this by accessing the Qantas Frequent Flyer menu option ensuring your QFF account is linked. If you're still experiencing issues, please get in touch with us via the ‘Help’ section of the AMP Bank app.

If you unlink your Qantas Frequent Flyer account, you will no longer earn Qantas Points on your Everyday Account. You can re-link your Qantas Frequent Flyer number at any time to start earning Qantas Points again.

Qantas Business Rewards

Qantas Business Rewards is a loyalty program that connects Australian small to medium business with a range of services and products, allowing the business to earn Qantas Points on business expenses and unlock extra benefits when flying with Qantas. Qantas Points earned by your business are stored in your Qantas Business Rewards account.

Please visit Qantas Business Rewards for a full range of benefits.

If you have an ABN and are a Qantas Business Rewards member, you can earn Qantas Points by linking your Everyday Business Banking account to your Qantas Business Rewards Account.

You can earn 1 Qantas Point for every $10 of your average monthly account balance, up to $5,000,000. For example, a $10,000 average balance earns 1,000 Qantas Points in that month.

Points are calculated and applied monthly to your Qantas Business Rewards Account.

The benefits of being a Qantas Business Rewards member go beyond just earning points with AMP, you can also earn Qantas Points with over 50 program partners on a range of everyday business expenses. From fuel to finance, hotels to hardware, paint to power bills, your business expenses could add up to even more rewards for your business*.

Not yet a Qantas Business Rewards member? AMP Bank customers can join for free here.

Use the points your business earns to reinvest in your business and save on costs such as flights, seat upgrades and baggage, or transfer them to your Frequent Flyer Account to use on hotels, car hire and more.

You can join Qantas Business Rewards free as an AMP customer (saving a $89.90 one-off join fee) via this link*. All you need is your business’s active ABN handy.

Plus, there are no ongoing annual fees to be a Qantas Business Rewards member. You can see the full program terms and conditions at qantasbusinessrewards.com/terms.

You can link your account by going to the 'Qantas Business Rewards' section within your Business Profile in your AMP Bank app.

All you’ll need to do is confirm that your ABN we've captured matches the one registered to your Qantas Business Rewards Account.

For more information about your Qantas Business Rewards Account, you can call the Qantas Business Rewards Service Centre on 13 74 78.

If you are an AMP Bank business customer with an ABN, your Everyday Business Account is eligible to earn Qantas Points.

Please check that your Qantas Business Rewards Account is active, and that your ABN is registered to Qantas Business Rewards.

If you're still experiencing difficulties, please call the Qantas Business Rewards Service Centre on 13 74 78.

You can view your Qantas Points balance in your Qantas Activity Statement or by logging into the Qantas App.

Qantas Points are calculated at the end of each month and applied to your Qantas Business Rewards account within 30 days. It may take up to 30 days for points to appear on your Qantas Business Rewards Activity Statement.

Qantas Points are earned on the monthly average balance. If your monthly average balance was below $10, you will not qualify to earn points for that month. If your monthly average balance was above $10, please check the AMP Bank App to ensure your Qantas Business Rewards QBR Account is correctly linked to your Everyday Business Account. You can do this by accessing the Qantas Business Rewards menu option and ensuring your membership number is linked.

If you're still experiencing issues, please get in touch with us via the ‘Help’ section of the AMP Bank app.

If you unlink your Qantas Business Rewards Account, you will no longer earn Qantas Points on your Everyday Business Account. You can re-link your Qantas Business Rewards Account at any time to start earning Qantas Points again.

Xero

You can sign up to Xero through the AMP Bank app:

- Log into the AMP Bank app

- Select the profile menu (top right)

- Select Connect to Xero

- Click Sign up

Once you've set up an account with Xero you need to return to the AMP Bank app and follow the set up flow.

For any question feel free to reach out to our 24/7 Customer Service team on 1800 950 105.

The Xero bank feed integration allows you to connect your Everyday Business account with your Xero account.

By integrating, all your business bank transactions are automatically imported into your Xero account.

This integration simplifies the process of reconciling accounts, tracking income and expenses, and maintaining accurate financial records.

To connect your AMP Bank business account Xero successfully, ensure that you've created an account through Xero before attempting to connect your Everyday Business account.

If any errors occur during the setup process, please contact our Customer Service team at 1800 950 105.

By sharing data with Xero, you are permitting Xero to:

- View your financial transactions (which includes your account balance).

- View your personal information (which includes your account holder information and account identifiers i.e. account number and BSB).

Other help and support

-

Needing financial support?

In difficult times, we'll support you and help you get back on track.

-

Feedback & complaints

If you are unhappy with our products or service, we want to know about it.

-

Ways to contact us

Get in touch for help with your AMP account.

Important information

The product issuer and credit provider is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517. This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available here.

For accounts with BSB number 939 900, that you access via the AMP Bank mobile app, the Terms and conditions that apply are available here.

For accounts with BSB number 939 200, that you access via the My AMP mobile app, the Terms and conditions that apply are available here.