Whether you’re planning a family road trip, a camping trip in the campervan, a romantic weekend away or an all-out overseas vacay, the very first thing on your holiday to-do list should be a budget. With a plan in place, you’ll hopefully spend less time stressing about money and more time enjoying your break.

How much money should I take on holiday?

Determining how much money to take on holiday depends on a few things: your destination's cost of living, the duration of your stay, planned activities and who you’re going with. Research the typical expenses for meals, accommodation, and entertainment at your destination to create a realistic budget. Think about what you plan to do while you’re there: Sampling local cuisine for lunches and dinners? Museum entry tickets? Walking tours? It all adds up. Don't forget to include a buffer for emergencies and unexpected costs.

Separate your everyday money from your holiday money

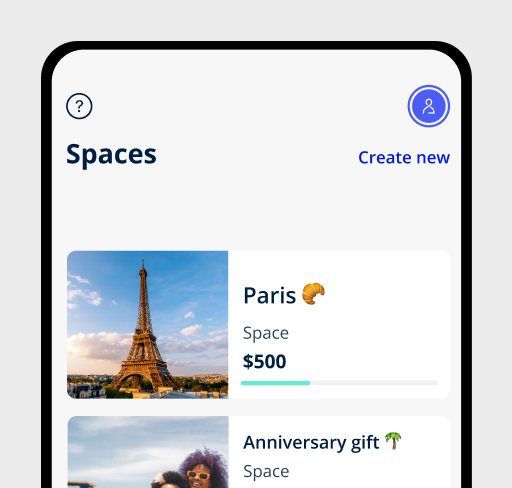

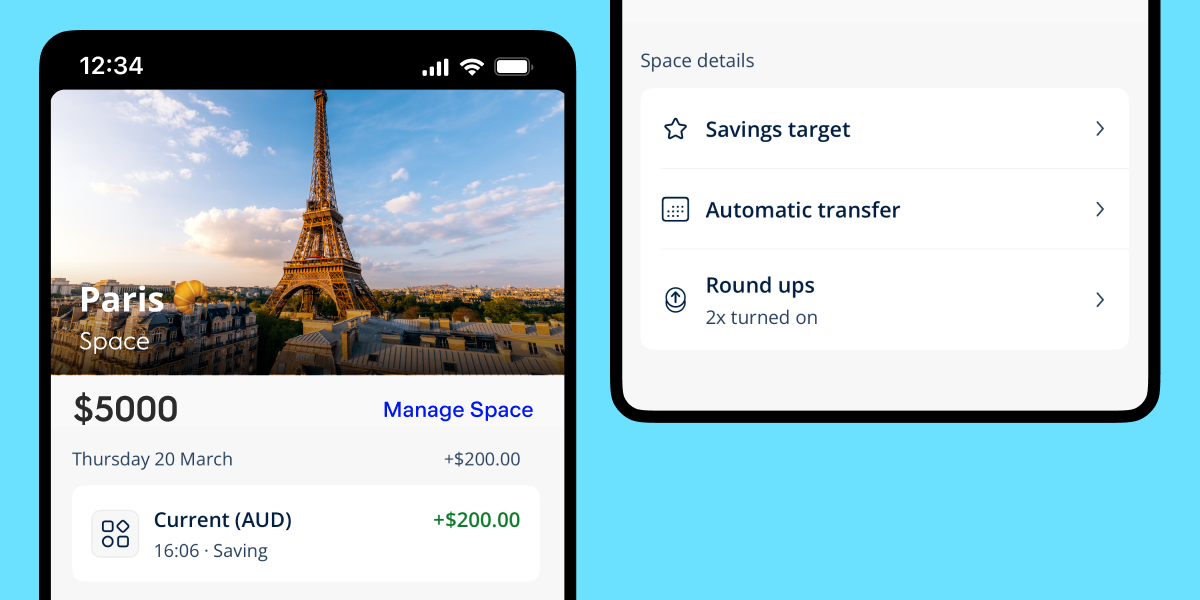

It’s a good idea to separate your everyday spending money from your travel money. If it’s in your account, there's a good chance you'll use it accidentally, so keep it in a different account so the money is less visible. If you use the AMP Bank app, you can keep your holiday money separate from your main balance by creating a 'Holiday' Space. That way, you won’t accidentally dip into the money you've set aside for your trip.

You can top up your 'Holiday' Space at any time and even set a target for your goal amount.

You can also add a photo of your destination for added motivation. Anything goes – a campervan for a road trip down the Great Ocean Road, the Sydney Opera House for a weekend in the city – it’s up to you.

Packing for your trip

To avoid dipping into your holiday money for things you’ve forgotten to pack – like a phone charger, an adaptor, or sunglasses – write a list of what you’ll need before you start packing. If you don’t already have travel insurance, you may also want to budget for that. It’s also a good idea to have a buffer of money for emergencies and the unexpected.

Holiday currency exchange

It’s important to consider how you will actually pay for things when you are overseas, as some bank cards can charge you exorbitant fees for international transactions. If you don’t feel like taking over wads of cash on your trip, consider a bank card that doesn’t charge international fees. AMP Bank’s Everyday Account Debit Mastercard doesn’t charge any fees for currency conversion on international purchase or overseas ATM withdrawals, and the transaction will be converted to Australian dollars so you can easily access your cash without being penalised.

Also keep in mind that some overseas ATMs will charge operator fees for each withdrawal, so you may want to limit the number of times you take out cash.

Giving yourself a daily spend cap

It’s helpful to have a rough daily spend target to stay within your holiday budget. For example, $30 for lunch, $60 for dinner, and a little extra for hiring a kayak might mean a daily budget of about $100.

That said, do build in some flexibility. You’ll probably have a day or two where you have a group picnic and spend less on lunch, or an evening where you go somewhere special for dinner. But having a daily figure can act as a guide.

Tracking your spending

With the AMP Bank app, you can easily track your holiday spending as you go along. Every time you spend from your AMP Bank Everyday Account, the app automatically categorises the transaction, for example as ‘Eating Out’ or ‘Transport’.

You can also re-categorise transactions, for example from ‘Shopping’ to ‘Gifts’, to make your Spending Insights even more personal.

Stay scam-safe while on holidays

Tourists are prime targets for scammers and it’s important to stay aware and savvy while you’re out and about. Book tours and accommodations through trusted sites and relish the peace of mind that comes with reading reviews from fellow travelers. Dive into local experiences with confidence by using secure payment options like debit or credit cards or trusted mobile apps, giving you the added perk of fraud protection. Keep your valuables safe and out of sight, and let your intuition guide you away from any deals that seem too good to be true.

AMP Bank has added an extra layer of security with its new numberless cards, reducing the risk of card number theft and potential fraud. If your debit card does get lost or stolen while you’re overseas, you can instantly lock, block or cancel your card simply from within the AMP Bank app. The app also gives you instant notifications when you spend, so if you spot any unusual activity you can act fast.

The more you understand your spending, the easier it will be to keep to your budget – and hopefully breathe easier on holiday.

You may also like

-

Oliver's insights - Seven reasons Australia is likely to avoid recession from Trump’s shock President Trump’s trade war poses a threat to Australian economic growth particularly via the indirect impact of weaker global activity driving less demand for our exports and lower commodity prices. -

How to spot scams during the holiday season - AMP Ensure your holidays and travel breaks remain relaxing and scam-free. Here are some red flags to watch out for. -

How much I spent on converting a campervan for travel - AMP Laura and Brendan combined their love for the outdoors with their DIY skills to convert a van into the campervan of their dreams. Here’s how much they spent.

Important information

AMP Bank Limited ABN 15 081 596 009, AFSL and Australian Credit Licence 234517. Any advice and information is provided is general in nature. It hasn’t taken your financial or personal circumstances into account.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account.

It’s important to consider your particular circumstances and read the relevant product disclosure statement, Target Market Determination or terms and conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

All information on this website is subject to change without notice. AWM Services is part of the AMP group.