Freedom to go your own way

All features, no filler

The AMP Bank app is packed with features just for you. Dive in and explore some of them below. And guess what? We’re not stopping here - we’ll keep adding more to the list.

Manage your account anytime, anywhere with My AMP

The AMP Bank app is now available on your mobile

Or login to

Freedom to go your own way

The AMP Bank app is packed with features just for you. Dive in and explore some of them below. And guess what? We’re not stopping here - we’ll keep adding more to the list.

Knowing where your money goes is the first step in taking control of your finances and living your dream life.

What is it?

Think of Spaces as little pots within your account. You can sort your money, by giving your space a name, add a picture and set a saving goal. Whether it’s for GST, a company car, end-of-year staff party or just a rainy day, you can create Spaces for whatever you want.

1. Tap 'Spaces' and then select 'New Space'

2. Hit 'Space' and then give it a name

3. Set a target amount, and add or withdraw money whenever you like

4. Tap 'Manage' to change the name, add an image or start saving automatically with Round Ups

What is it?

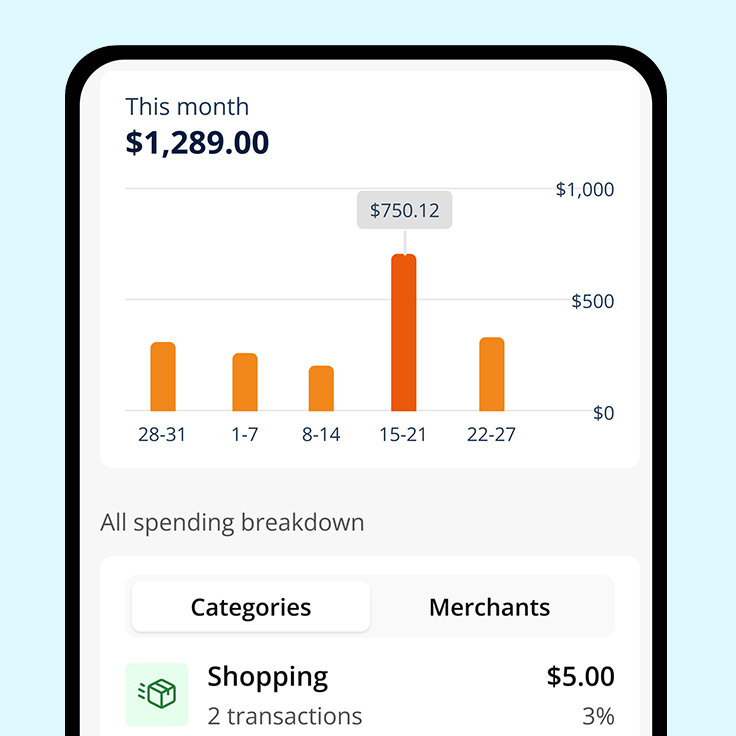

Keep an eye on spending across different categories. Discover trends with intuitive graphs that show you exactly where your money is going and what you’re spending.

Simply switch between category or merchant to get the view you need. Need more details on a transaction? Just tap it.

What is it?

Round up your day-to-day spending to the nearest dollar and transfer the spare change into one of your Spaces. Spend $4.80 on a coffee? We’ll round it up to $5.00 and pop the 20 cents into your designated Space for you.

Want to reach your savings easily in the AMP Bank app? Multiply your spare change by x2, x5 or x10 in your app.

1. Head to ‘Spaces’ at the bottom right of the AMP Bank app.

2. Create a new Space or choose an existing one.

3. Click ‘Manage Space,’ then ‘Round Ups’ and switch the toggle on.

Know your banking is in safe hands with enhanced security protocols, proactive fraud protection and real-time transaction monitoring.

What is it?

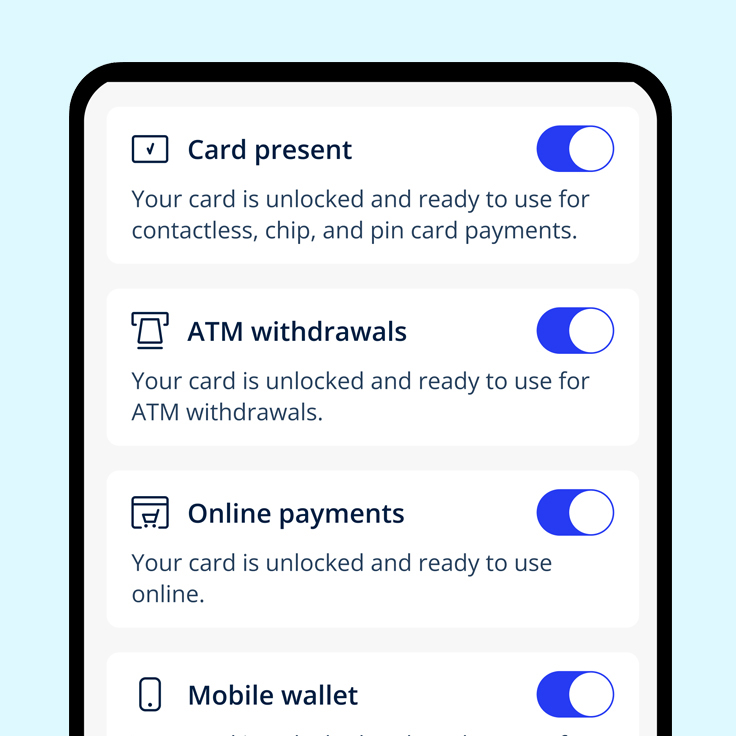

Whether you’ve had your card stolen, simply misplaced it or want further controls around how you use your card. You can instantly lock, block or cancel your card all from within the AMP Bank app.

Head over to card controls where you can easily toggle to enable or disable contactless and chip & PIN payments, ATM withdrawals, online payments, and mobile wallet. You can also freeze your card or activate the gambling block with just a tap.

What is it?

Take control of your spending with our in-app flexible slider. You can set your own contactless payment limit, up to $100. AMP Bank app customers can easily adjust the limit for each card or even turn off contactless payments altogether.

1. Head to your AMP Bank app and tap ‘Card’, then ‘Card and Payment Limits’, then tap on ‘Maximum Contactless Payment Limit’.

2. You can then adjust the slider, moving left and right until you’ve found the amount that is right for you.

AMP Bank keeps you moving forward, whatever direction suits you.

What is it?

Get notifications every time you’re paid or paying a bill so you can keep on top of the ins and outs of your money.

No need to lift a finger. Every time you spend on your card or digital wallet, or receive a payment, we'll send a notification straight to your phone.

Feeling overwhelmed? You can turn off alerts anytime with just a tap.

What are they?

At AMP Bank, we prioritise your convenience, so we won’t send you paper statements. Instead, you can easily check your spending month-by-month or download custom statements with just a few taps in the app.

1. Just tap the top right icon in the app to open the account menu

2. Tap on ‘Statements’, then ‘Statement history’ and select your desired date range

3. Choose the option to export in PDF or CSV

The product issuer and credit provider is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517. This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. All information on this website is subject to change without notice.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available on our TMD page.

For accounts with BSB number 939 900 and accessed via the AMP Bank app, Terms and Conditions apply and are available here.

For accounts with BSB number 939 200 and accessed via the My AMP app, Terms and Conditions are available here.