Card transaction limits

|

| Daily cash withdrawal at ATM and eftpos | $1,000 per day |

| Visa payWave (Tap and Go) transaction without PIN | $200 per transaction |

| Bank@Post cash withdrawal | $1,000 per day |

| Bank@Post cash deposit | $9,999.95 per day |

Link your AMP Visa Debit card to your digital wallet

You can link your AMP Visa Debit card to your digital wallet to use with a smartphone or device.

This means you'll no longer need to carry a physical wallet, and it speeds up online shopping and transactions.

Card safety and security

At AMP Bank we offer a range of services and security features to help protect your account and cards against the ever-increasing threat of card fraud and scams.

- 24/7 fraud monitoring - We leverage a system developed by Cuscal which operates in near real-time to identify transactions that are potentially fraudulent, based on your usage history and other significant data. By monitoring card activities 24 hours a day, we can detect and sometimes stop fraudulent or suspicious transactions before they affect your account.

- Protection for any unauthorised transactions via Visa’s zero liability insurance, which means you'll be protected for any unauthorised transactions.

- Card management features in My AMP help you control and protect your card.

- Contact the AMP Bank Contact Centre 24/7 via 13 13 30.

- For more information, please visit our Online Security page.

Here's what you can do to protect your AMP Visa Debit Card:

Protecting your card online:

- Stay in control of your card using the card management features in My AMP.

- Regularly monitor your card transaction history in My AMP to check against fraud.

Protecting your Access Card:

- Sign your card as soon as you get it.

- Don't record or disguise your PIN or other Security Access Code on your card, on anything you normally carry with you, e.g. your wallet, or in any low security electronic device of any kind, including calculators, personal computers, electronic organisers, mobile phones.

- If you're no longer using your card or it has expired, cut it into pieces and return it to us.

- Carry your card with you whenever possible.

- Regularly check you have your card.

- Don't let the card leave your sight when making purchases.

- Don't let anyone swipe your card more than once without giving you with a ‘transaction cancelled’ receipt.

- Retrieve your card from ATMs.

- Treat your card as if it were cash.

- Don't give your card to anyone else, including family and friends.

Please refer to Access card security guidelines.

Card FAQs

Accepted anywhere you see the Visa or Plus logos.

| Daily cash withdrawal at ATM and eftpos | $1,000 per day |

| Visa payWave (Tap and Go) transaction without PIN | $200 per transaction |

| Bank@Post cash withdrawal | $1,000 per day |

| Bank@Post cash deposit | $9,999.95 per day |

AMP will reimburse all domestic ATM fees when you use an AMP Visa Debit card (not international).

Apple Pay is a digital wallet from Apple which lets you use a compatible iPhone, Apple Watch, iPad or Mac to make secure contactless purchase in stores, within selected apps and participating websites.

No, your card details are not stored on the device or in the Cloud. When a card is added to Apple Pay, a Device Account Number replaces the need for the card number.

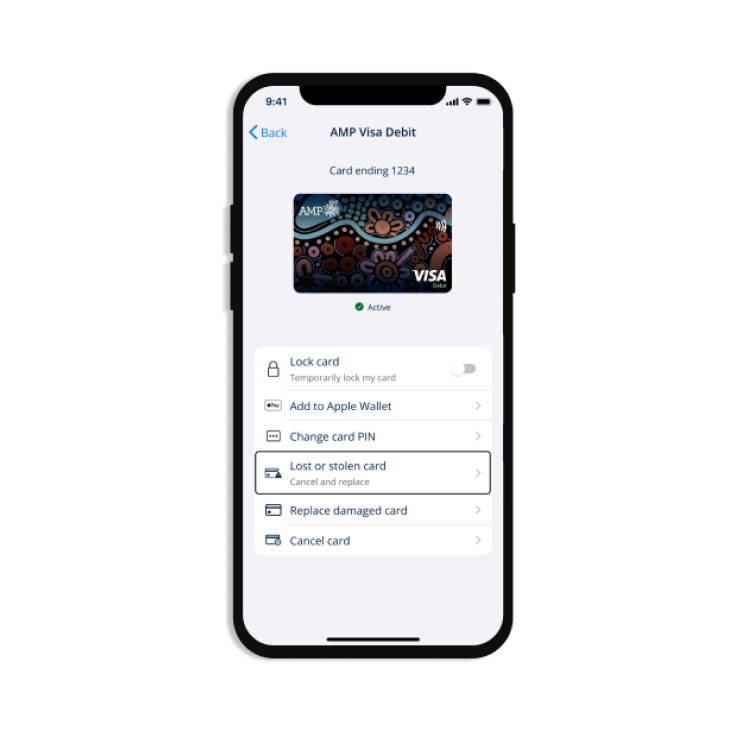

You can use the My AMP app to activate your card, change PINs and order a replacement card if your card is damaged. And now, you can also lock/unlock your card, report it lost/stolen and cancel your card. On My AMP web you can activate your card, change PINs and order a replacement card if your card is damaged.

Lock card – if you’ve misplaced your card, you can lock it which will block any new transactions that need to be authorised.

Report lost/stolen – if your card has been lost/stolen, you can report it so your card can be cancelled, and a new card ordered.

Cancel card – if you no longer want a card, you can cancel it. A new card won't be ordered.

Replace damaged card – if your card has been damaged or the magnetic strip no longer works, you can request a replacement card. The card number will be the same.

Important information

Credit and deposit products are issued by AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517.

It’s important to consider your circumstances and read the relevant Product Disclosure Statement or Terms and Conditions before deciding what’s right for you. This information hasn’t taken your circumstances into account. Information including interest rates is subject to change without notice.

Any application is subject to AMP Bank’s approval. Terms and conditions apply and are available at amp.com.au/bankterms or 13 30 30. Fees and charges may be payable. Full details are available in the Fees and charges guide.

This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. All information on this website is subject to change without notice.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available on our TMD page.