Investment markets and key developments

Shares mostly rose over the last week helped by lower-than-expected underlying inflation in the =US which boosted confidence that the Fed was still on track to continue cutting interest rates this year. Japanese shares were the exception reflecting the increasing likelihood that the Bank of Japan will raise rates in the week ahead. The positive global lead also helped boost the Australian share market which is on track for a rise of around 0.3% for the week, with resources, property and utility shares leading the way. That said shares are yet to decisively break out of the modest downtrend they have been in since early December. Bond yields also fell back after recent sharp rises as inflation concerns faded a bit. Oil prices rose further on the back of tighter US sanctions on Russian oil exports and metal and gold prices also rose with Bitcoin making it back to just above $US100,000 with a pull back in the US dollar helping. The fall in the US dollar also helped the $A stage a small bounce.

Shares have had a bit of a wobbly start to the year reflecting a messy combination of negative and positive drivers. The big negatives are rich valuations, higher bond yields, uncertainties as to how much the Fed will cut rates, uncertainties around Trump and various geopolitical risks. Against this the big positives are global central banks still being in an easing cycle, goldilocks economic conditions particularly in the US, optimism that Trump will reinvigorate the US economy and prospects for stronger profits ahead in Australia. The past week has been better and ultimately we see the positives dominating resulting in positive returns for shares this year, but we expect a far more volatile and constrained ride over the year ahead than we saw in 2024.

Here we go again...the return of Trump as US President on Monday will be the big focus in the week ahead and could blow investment markets around. Trump’s return means increased economic, trade and geopolitical uncertainty given the more extreme nature of many of his policies and his own erratic approach to policy making often characterised by grand statements on social media that may or may not go anywhere. This is likely to contribute to a volatile ride for investors. Trump’s policy agenda is somewhat schizophrenic for investment markets in that it includes some very pro-market aspects – with tax cuts and deregulation – but some negative aspects – notably around tariffs and immigration - and the market impact will ultimately depend on what dominates. Trump’s desire to see shares go up, political pressure to bring down the cost of living (whereas big tariff hikes would do the opposite) and fiscally conservative House Republican’s will hopefully keep a lid on Trump’s populist inflation boosting tendencies (including the tariffs) but this may not be clear for a while. In the meantime, expect a flurry of Day One pronouncements in the week ahead on: immigration restrictions; energy deregulation; financial de-regulation; crypto; the federal workforce; and tariffs. Tariffs are likely to be ultimately less than the 10-20% general tariff, 25% on Canada and Mexico and 60% on China as flagged in the campaign and immediately after. Some reports suggest that they may be phased in but this may only make them more inflationary and is contrary to Trump’s go in hard up front negotiating style. Treasury Secretary nominee Scott Bessent’s confirmation hearing comments suggest that tariffs on China are likely to be more aggressive but those on the rest of the world will be for negotiation purposes. With the US having a trade surplus with Australia its likely we will ultimately avoid US tariffs and only 4% of our exports go to the US anyway, but we are vulnerable to tariffs on China as 35% of our goods exports go there.

With bond yields and the US dollar having already seen a big increase since last September and shares having wobbles since early December there is some chance that uncertainty around Trump has already been factored in which could see bond yields and the $US initially pull back a notch and shares rally providing Trump is no more disruptive than expected. But I don’t really have a strong view on this.

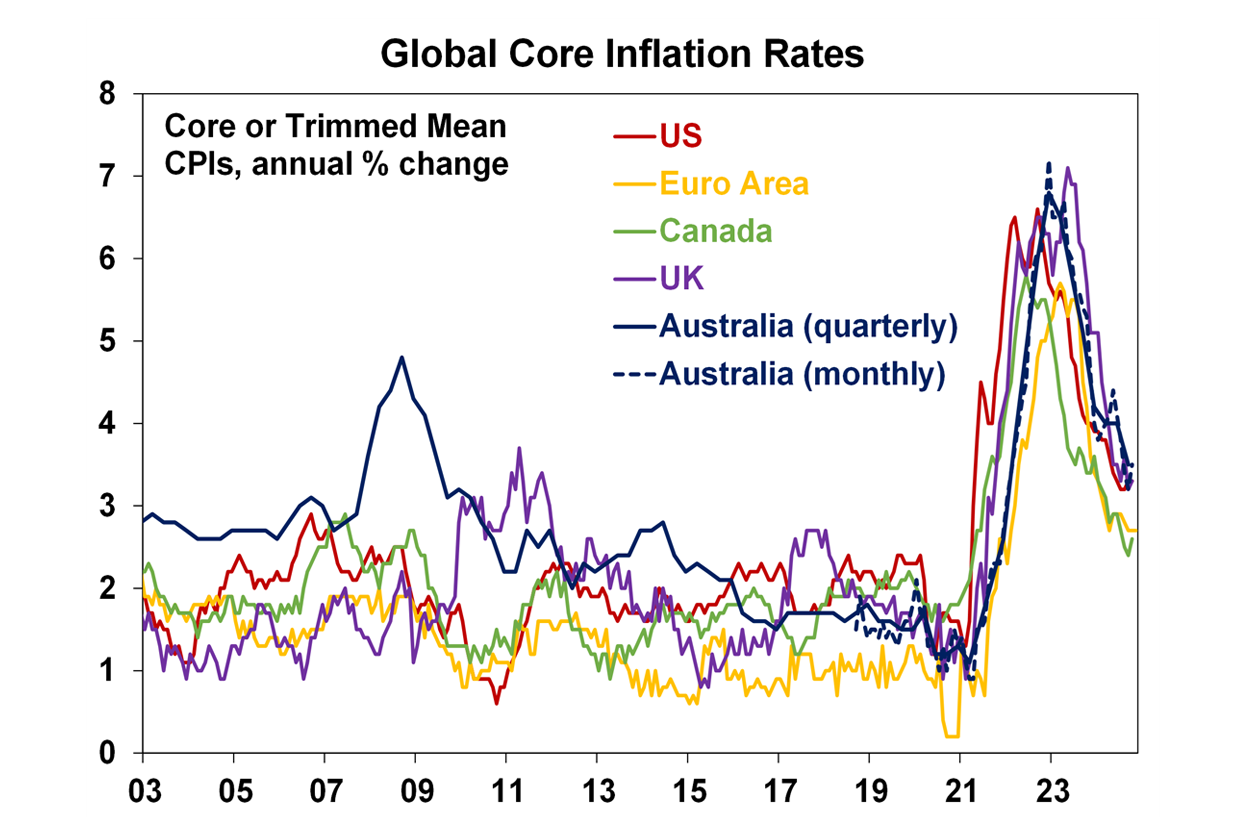

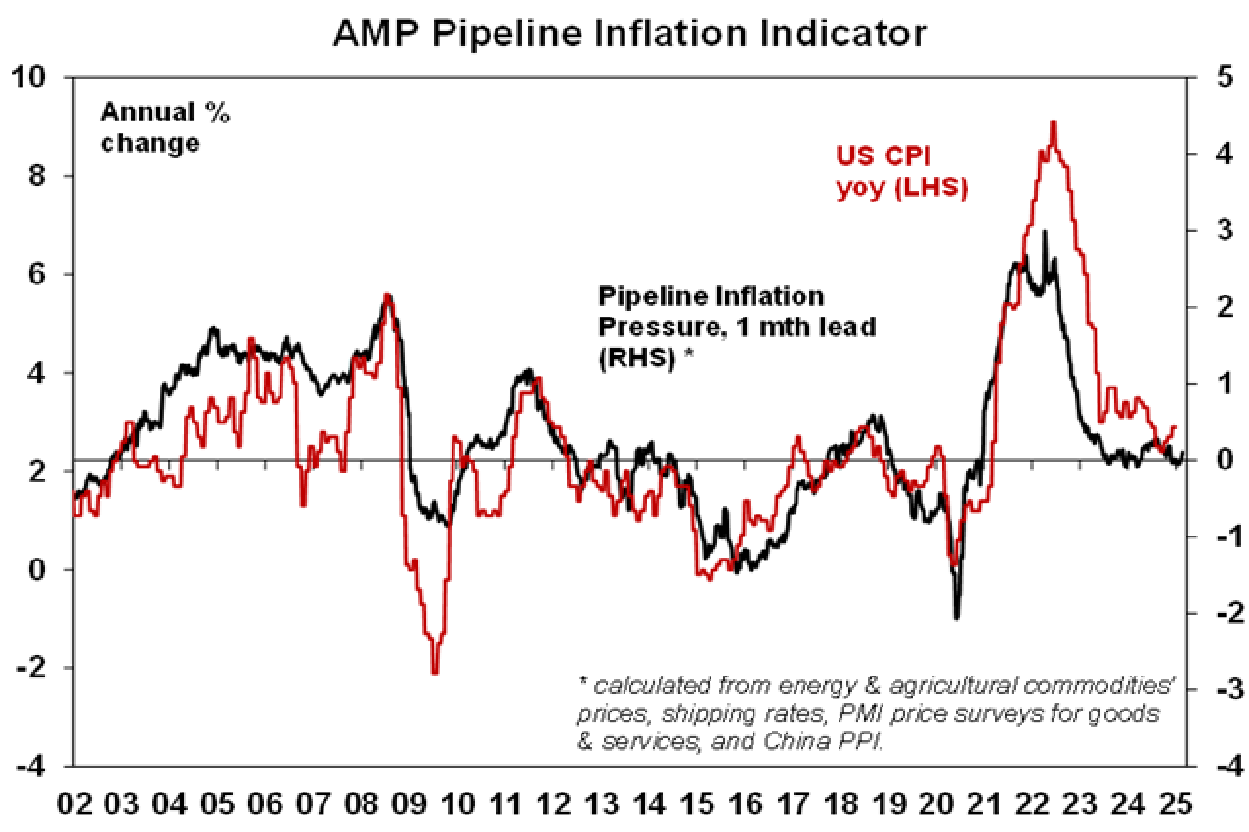

Global disinflation is continuing with good news on US and UK inflation. Despite widespread fear evident in the rise in bond yields since last September that disinflation may have stalled, inflation data for the US and UK surprised on the downside in the past week. Headline inflation in the US rose to 2.9%yoy due largely to higher energy prices but core inflation came in weaker than expected at 0.2%mom or 3.2%yoy after four consecutive readings of 0.3%mom, with this and producer price data implying a December core private final consumption deflator reading of 0.2%mom or 2.8%yoy. Similarly, UK core inflation fell more than expected to 3.2%yoy. This adds to confidence that global disinflation is continuing and suggests that the back up in bond yields may be overdone, albeit uncertainty still remains around Trump along with broader concerns about budget deficits in both countries.

Our US inflation indicator points to US inflation around its 2% target.

The better inflation outcomes keep the Fed and Bank of England on track for more rate cuts. With the recent strong jobs data and the more cautious approach signalled in December the Fed is almost certain to leave rates on hold this month, but the moderate core CPI for December likely keeps it on track for a 0.25% cut in March, providing jobs data confirms that December strength was a blip and Trump’s initial policy actions are not too threatening to inflation. The BoE remains on track to cut in February.

But what about the RBA? Ongoing global disinflation and most importantly the fall in trimmed mean inflation evident in the November CPI indicate that there is a good chance of a February rate cut by the RBA. However, the case to cut in February has been weakened by the still strong jobs market as evident in December data and the slide in the Australian dollar. Neither should necessarily prevent the RBA from cutting though as:

- while the jobs market is strong, wages growth has slowed suggesting that the so-called non-accelerating inflation rate of unemployment (NAIRU) may be around 4% rather than 4.5%, in other words the labour market may not really be that tight; and

- while the $A is down 9% against the $US since the end of 2023, with expectations for higher US rates than Australian rates, Trump worries and softer iron ore prices being the key drivers, it’s mainly a weak US dollar story with other currencies also down against the $US so over the same period the trade weighted $A is down less than 5% which is neither here nor there in terms of adding to inflation.

But the resilient jobs market means there is no urgency for the RBA to cut and the slide in the $A will leave it cautious lest if keep falling. Against this, it’s worth noting that while consumer spending looks to have benefitted from the Black Friday sales in November, the CBA’s household spending indicator and retail data from Kepler Analytics suggests it fell back in December. Ultimately it will come down to December quarter inflation data to be released at the end of the month. If trimmed mean inflation comes in at 0.6%qoq or less as looks likely as against implied RBA expectations for a 0.7%qoq rise it will be very hard for the RBA not to cut, assuming the $A is not in free fall. So we think it’s a very close call as to whether it will be February or May but would not argue with the money market which has priced in about a 69% chance of a cut in February.

Good news with an Israel/Gaza ceasefire finally (assuming its ratified) - but whether it leads to lasting peace is dubious and there remains the issue of Iran and its nuclear capabilities. And its of no consequence for oil prices that have surged 11% so far this year as the Biden Administration no longer worried about the impact on gasoline prices and so tightened sanctions on Russian oil exports, which, by restricting exports to countries like China, could boost demand for non-Russian oil. This could remain an issue for a while – potentially up until Trump negotiates any Ukraine war peace deal and possibly beyond given issues with Iran.

Major global economic events and implications

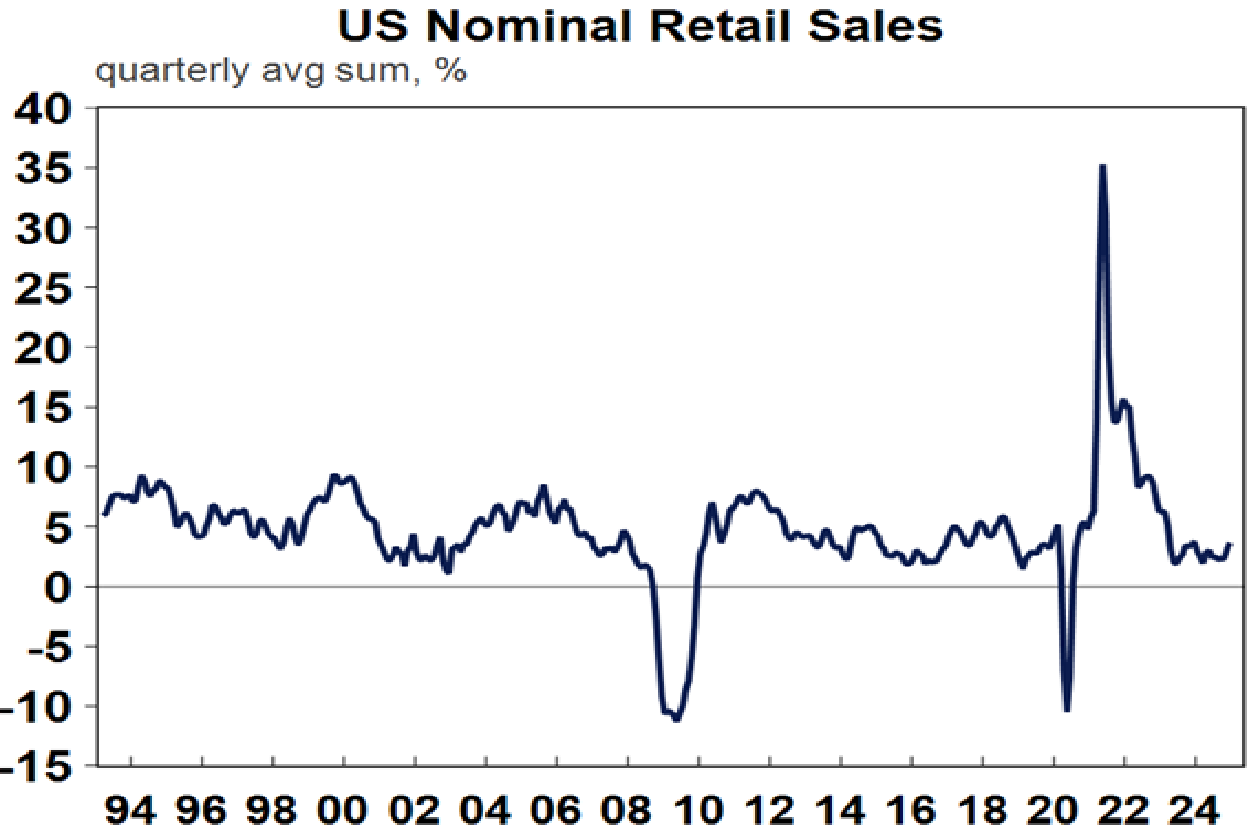

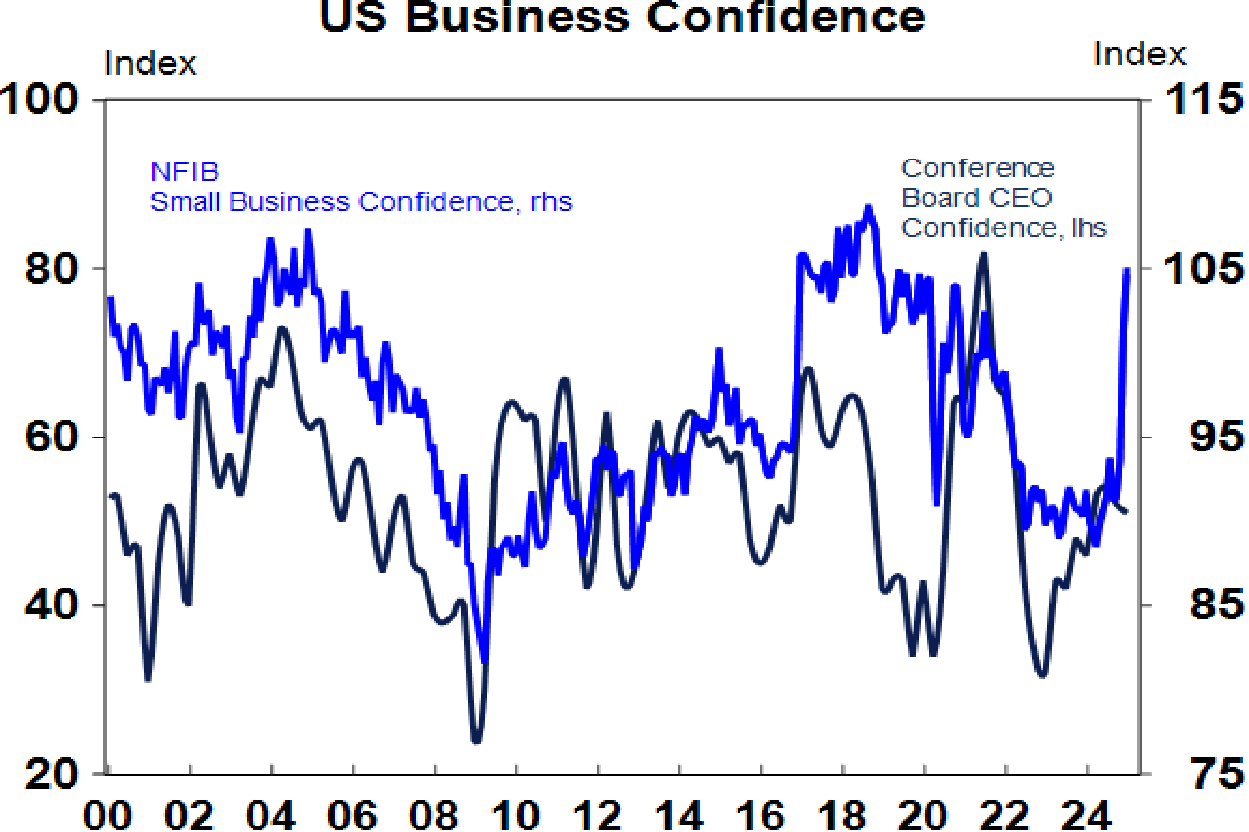

US economic data released over the last week was mostly solid and the Atlanta Fed’s GDPNow tracker for December quarter growth is running at 3% which is strong. Retail sales growth was solid in December and small business optimism rose sharply possibly helped by optimism about Trump. Regional manufacturing conditions indexes were mixed with a fall in New York but a sharp rise in Philadelphia with the trend remaining up. And jobless claims remain low. Against this CEO confidence and home builder conditions remain soft.

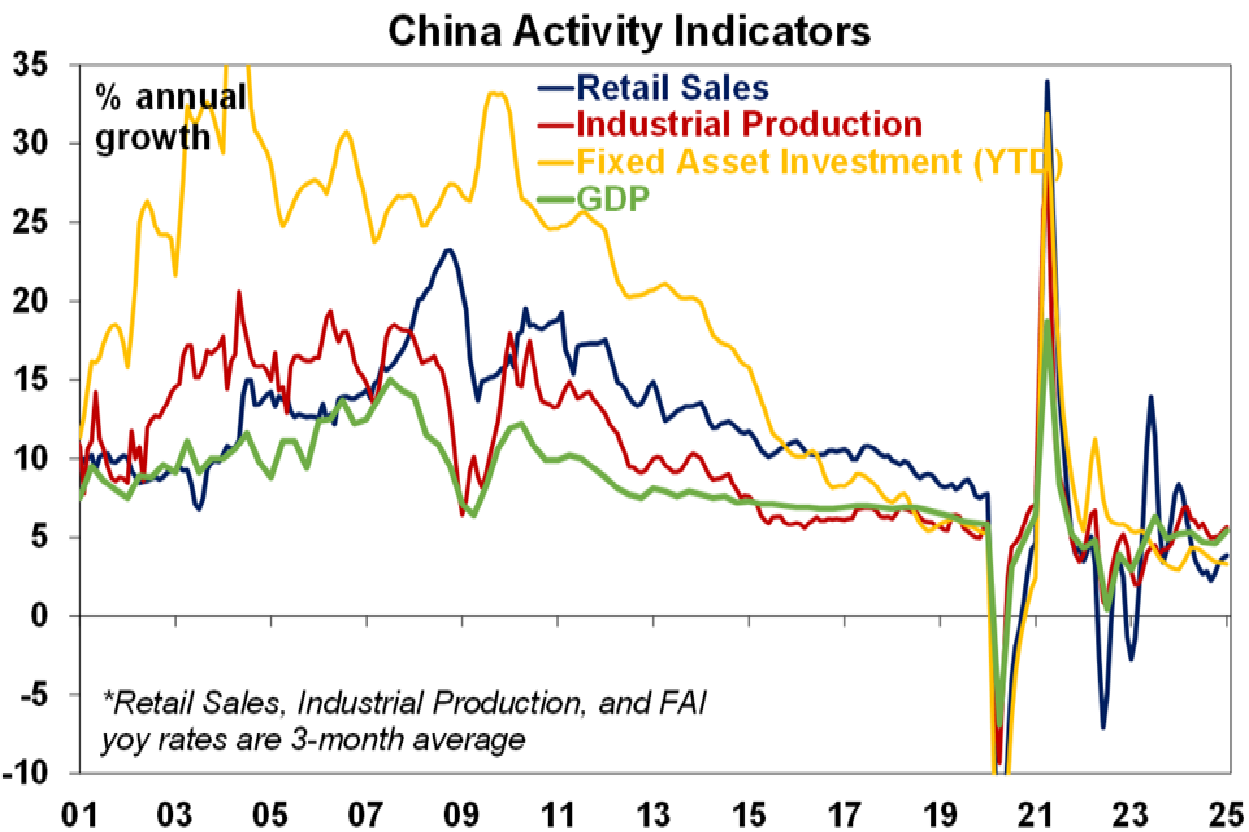

China grew at target last year, helped by additional policy stimulus. GDP rose a stronger than expected 5.4% over the year to the December quarter and rose 5% in 2024 compared to 2023, in line with the “around 5%” growth objective. Additional policy stimulus appears to have helped boost quarterly growth from 1.3%qoq in the September quarter to 1.6%qoq in the December quarter. December data also showed a stronger than expected acceleration in growth in industrial production to 6.2%yoy and retail sales to 3.7%yoy, while growth in investment was little changed at 3.2%. Export and import growth picked up in December with front loading ahead of Trump tariffs likely helping exports to the US. Money supply and credit growth also picked up. Property sales and property investment continued to slide but the pace of decline in sales and home prices slowed which is good news. All up there are signs that policy stimulus is helping, and this is good news for Australian exports to China. But more likely needs to be done to help the Chinese consumer and particularly if Trump is aggressive with tariffs. GDP growth is likely to be “around 5%” this year as well – maybe a bit below.

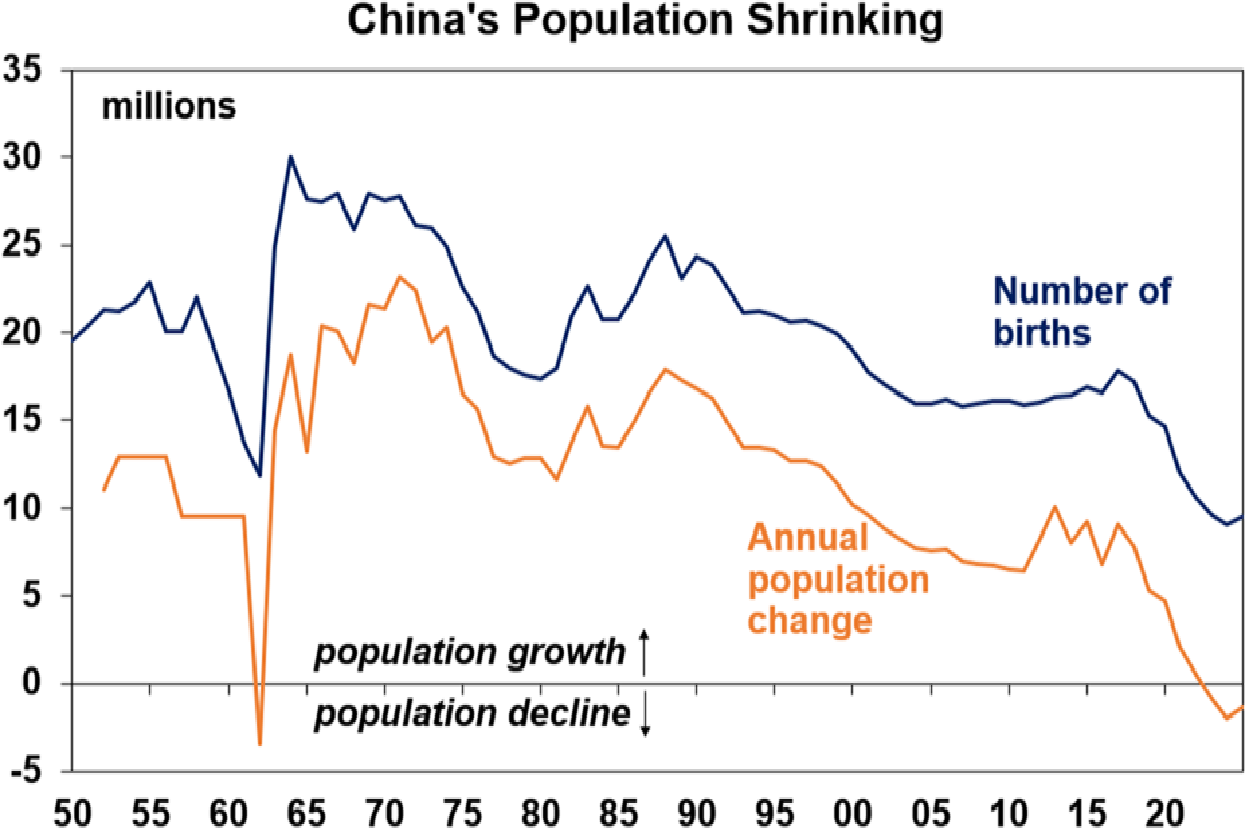

Interestingly, China’s birth rate picked up slightly last year, but it was not enough to stop the population falling further and the trend remains down.

Australian economic events and implications

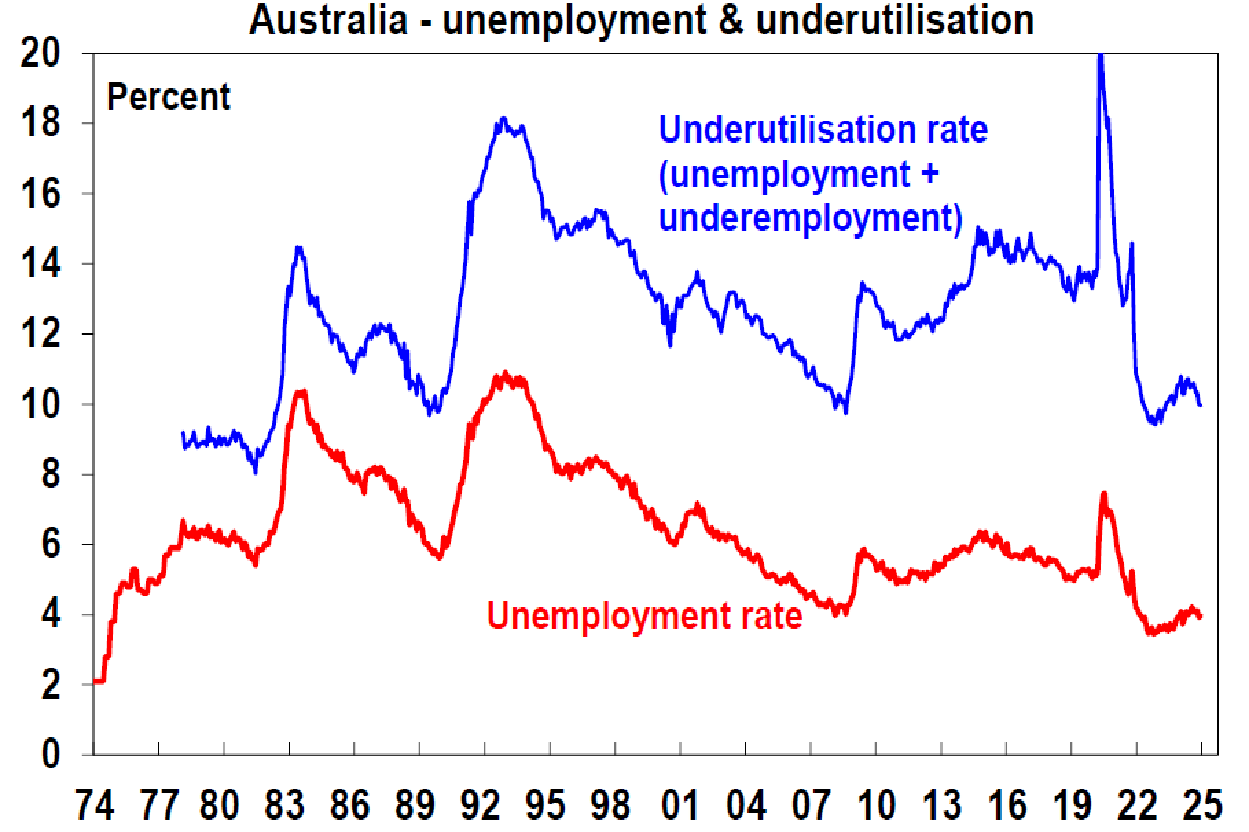

Another mostly strong jobs report for December. Employment rose a stronger than expected 56,300 but unemployment also edged up to 4%. With unemployment and underemployment remaining relatively low the labour market is still strong.

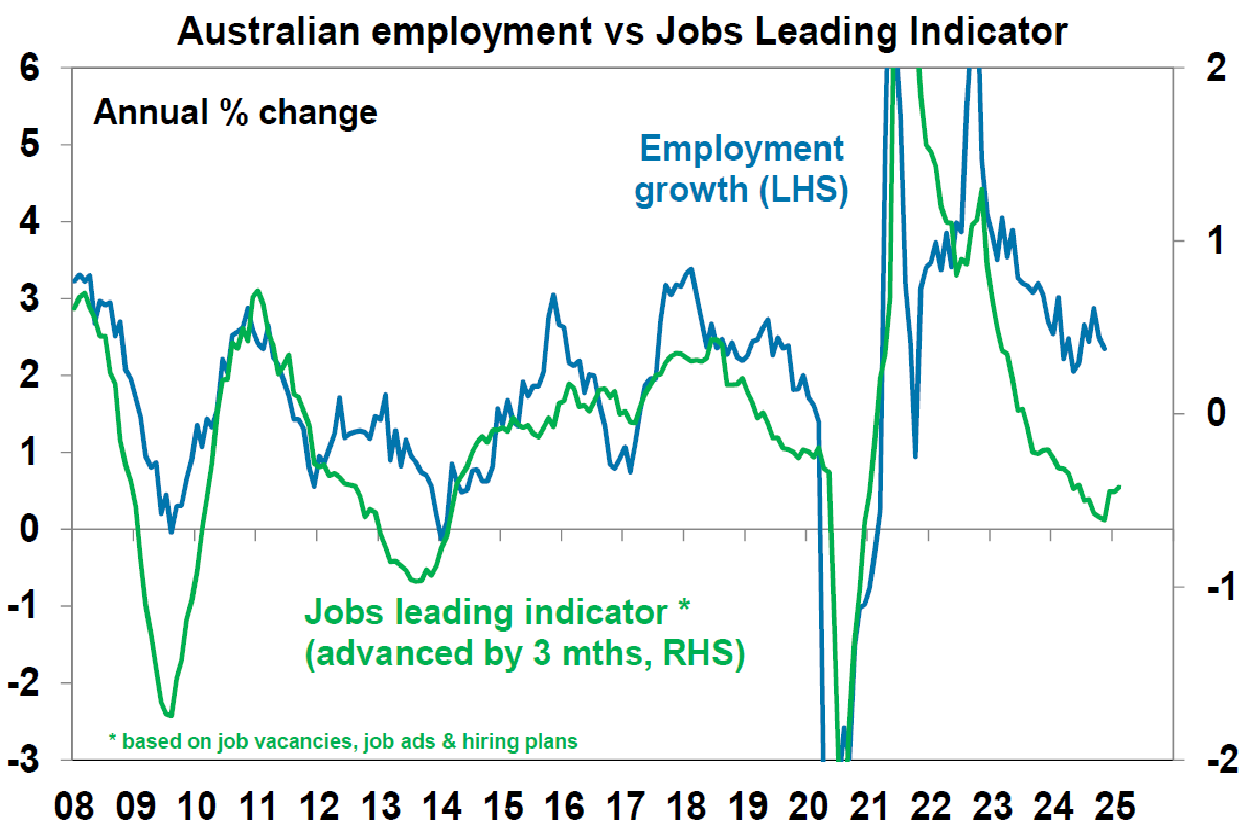

However, as noted earlier this shouldn’t on its own prevent the RBA from easing. Firstly, it’s hard to square the strong jobs market with the slump in GDP growth - maybe it’s due to ongoing strength in public sector employment and labour hoarding. Second, the fall in job vacancies and hiring plans as evident in our Jobs Leading Indicator continues to point to a moderation in jobs growth ahead. And thirdly, the main reason to worry about a tight labour market in relation to inflation is if its fuelling strong wages growth – but there is no sign of this with wages growth slowing to 3.5% suggesting that the so called non-accelerating inflation rate of unemployment (NAIRU) is maybe 4% and not the 4.5% or so that the RBA is assuming.

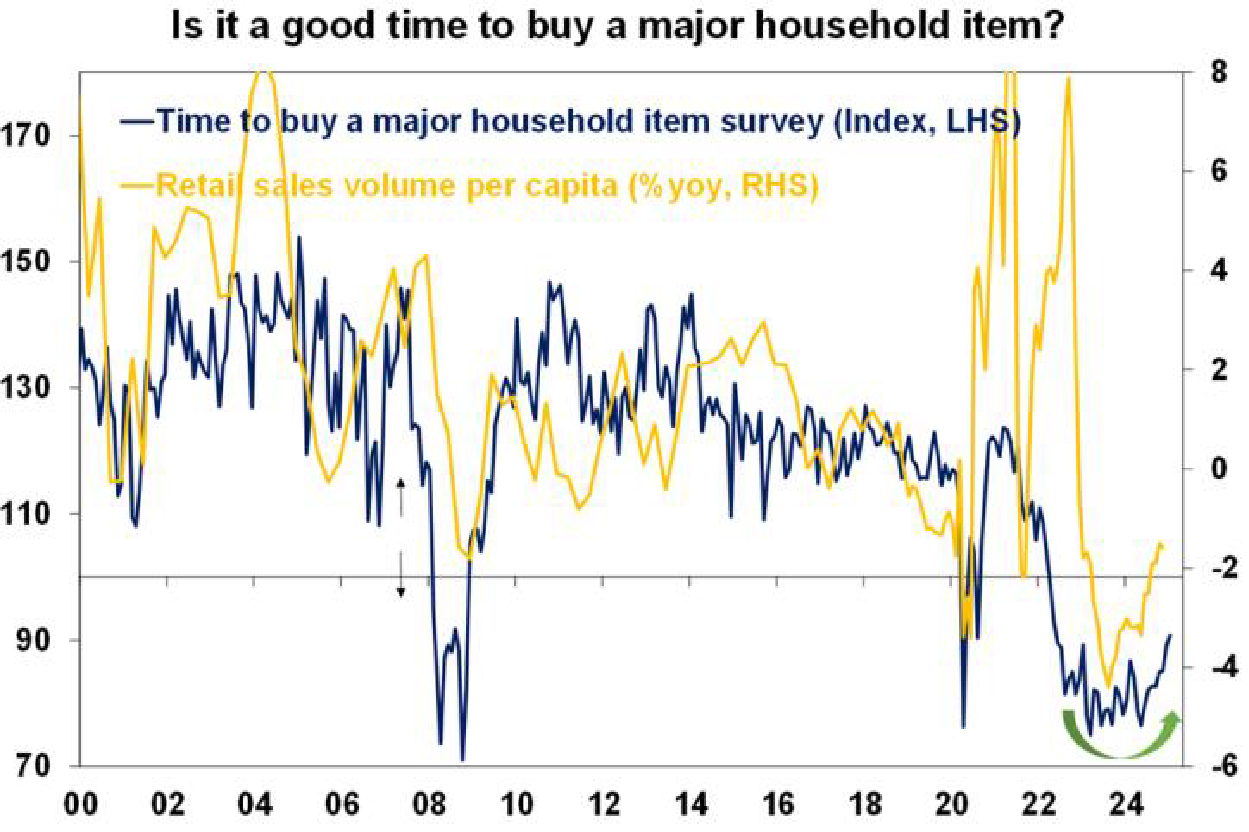

Consumer confidence slipped again in January. The latest Westpac/Melbourne Institute consumer sentiment survey fell for the second month in a row. This was despite better-than-expected inflation data and may reflect concern about the falling Australian dollar. Confidence is up from recent lows but remains weak. It’s a similar story in terms of consumer perceptions as to whether now is a good time to buy a major household item.

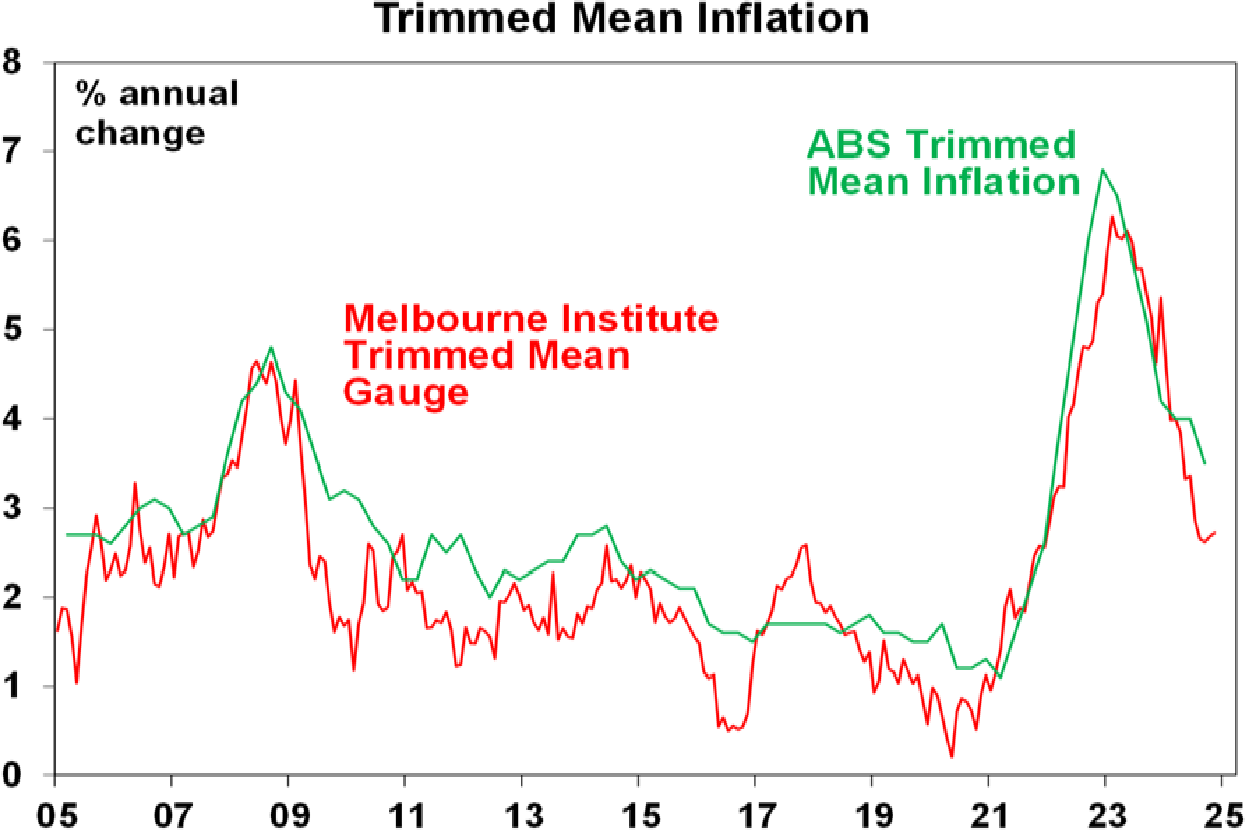

While its more volatile, the Melbourne Institute’s Inflation Gauge for December points to a further fall in trimmed mean inflation as measured by the ABS.

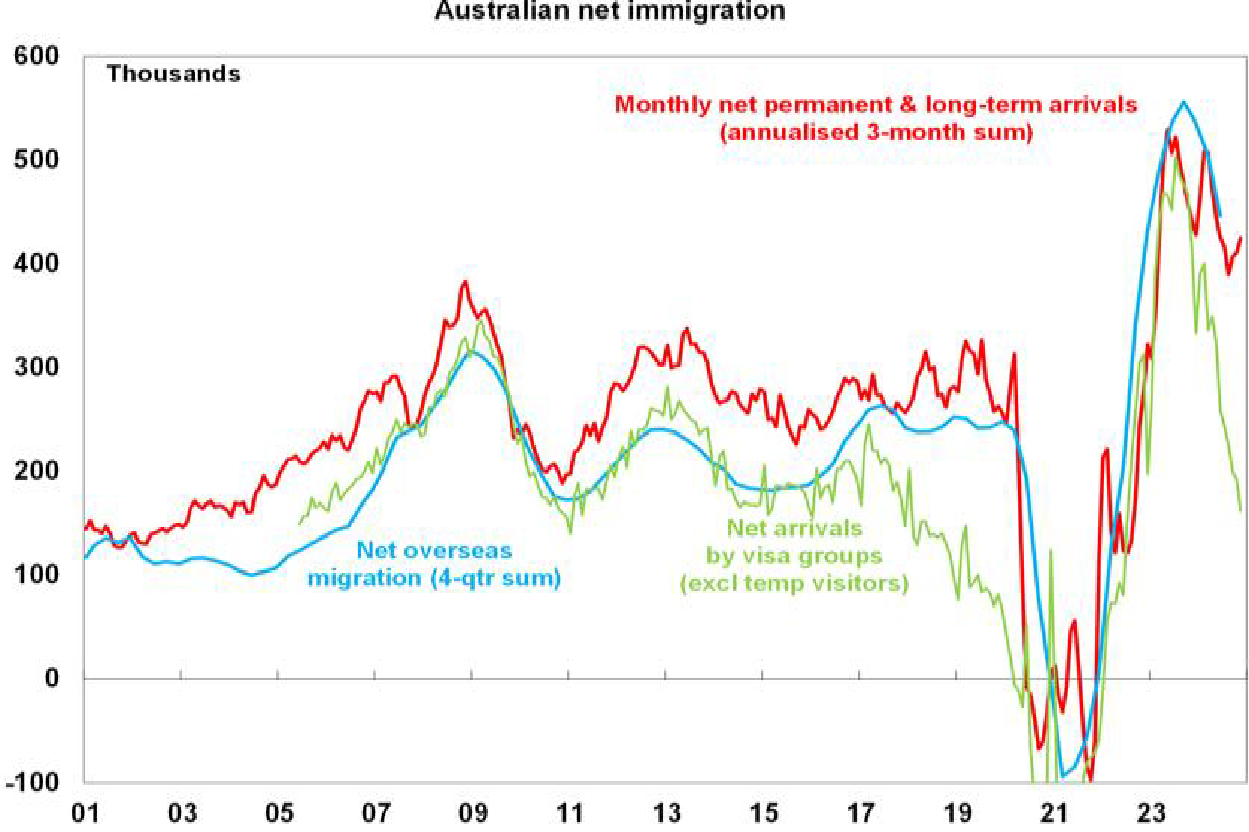

Monthly visa data excluding tourists and monthly net permanent and long-term arrivals data point to a further slowing in net migration with the former suggesting a fall back to pre-pandemic levels but the latter suggesting it’s still higher.

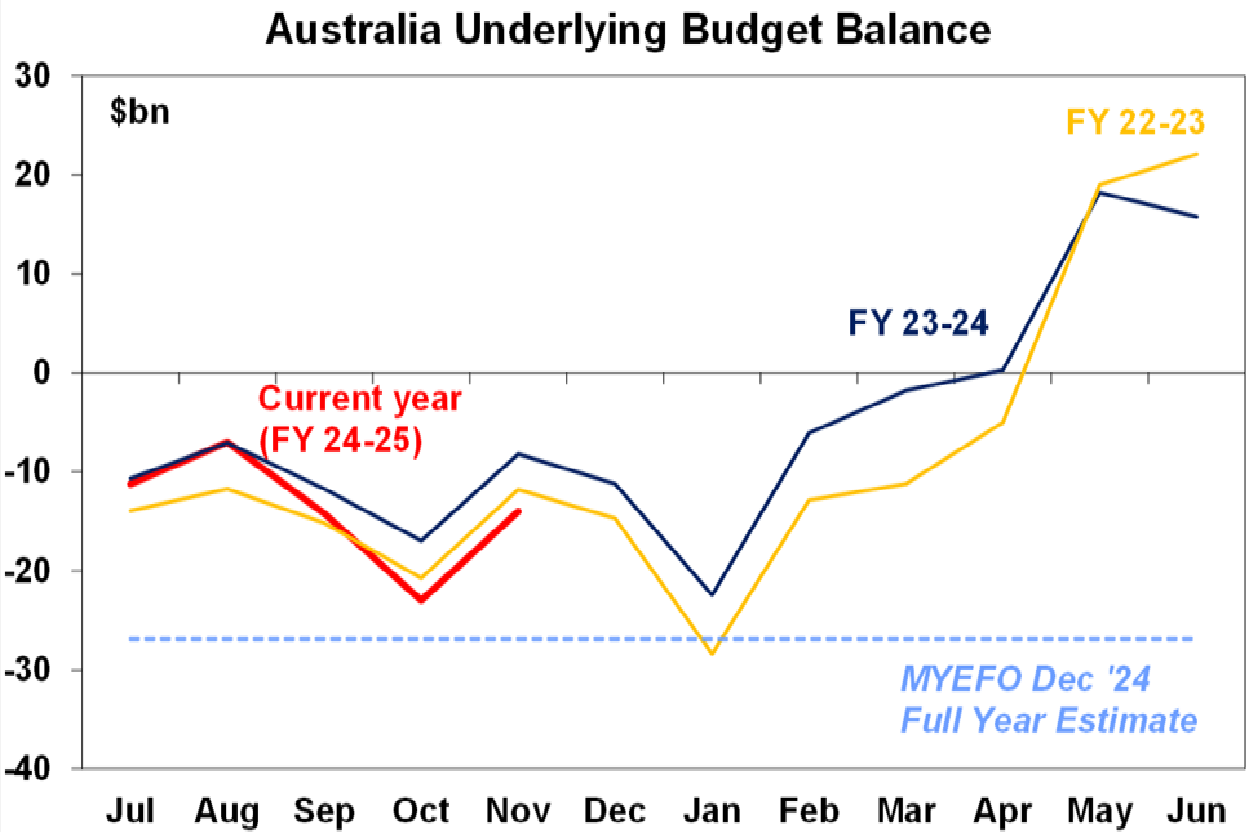

It’s not our base case but it’s possible Australia could see another budget surplus. Just after the mid-year economic and fiscal outlook (MYEFO) showed a likely return to budget deficits, monthly budget data for November shows the budget balance for the financial year to date still tracking along the levels seen in the last two years both of which ended in surpluses. Clearly revenue is continuing to surprise on the upside with a still strong jobs market and commodity prices remaining high in Australian dollar terms, offsetting the strong growth in public spending. It begs the question whether the Government massaged the MYEFO projections so updates nearer the election (like the Pre-Election Fiscal Outlook) would be able to show a better picture. A stronger for longer budgetary position is good news, but it doesn’t alter the reality that public spending is growing rapidly, and this is keeping inflation higher for longer and depressing productivity. And eventually the luck on the revenue side will run out – so it’s no excuse to further ramp up spending.

What to watch over the week ahead?

As noted earlier, the return of Trump will be the main focus for markets over the week ahead.

On the data front, we will see the release of business conditions PMIs for January on Friday. These are likely to remain at okay levels on average but with strength in the US and softness in Europe, Japan and Australia and with services strong but manufacturing weak. Key to watch will be whether the broad-based weakness in manufacturing conditions flows through to services.

In the US, the December quarter earnings reporting season will start to ramp up. The consensus is expecting a 9% rise in earnings compared to December quarter 2023, from 8.9%yoy in the September quarter, but this looks too pessimistic given the ongoing strength of US economic data. A final outcome closer to 12% is more likely. Tech is likely to be the strongest sector.

Canadian inflation for December (Wednesday) is likely to fall to 1.8%yoy with underlying measures falling to around 2.5%yoy.

In Japan, the BoJ on Friday will likely raise its policy rate again from 0.25% to 0.5% with Governor Ueda and Deputy Governor Himino indicating a hike will be under consideration on the back of the economy being strong, positive news on wages growth and increasing confidence inflation will be around the 2% target.

Outlook for investment markets in 2025

After the double digit returns of 2023 and 2024, global and Australian shares are expected to return a far more constrained 7% in the year ahead. Stretched valuations, the ongoing risk of recession, the likelihood of a global trade war and ongoing geopolitical issues will likely make for a volatile ride with a 15% plus correction somewhere along the way highly likely. But central banks still cutting rates with the RBA joining in, prospects for stronger growth later in the year supporting profits, and Trump’s policies ultimately supporting US shares, should still mean okay investment returns.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows to target, and central banks cut rates.

Unlisted commercial property returns are likely to start to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices are likely to see further near-term softness as high interest rates constrain demand. Lower rates should help from mid-year, and we see average home prices rising around 3% in 2025.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow in the second half as the cash rate falls.

The $A is likely to be buffeted between changing perceptions as to how much the Fed will cut relative to the RBA, the negative impact of US tariffs and a potential global trade war and the potential positive of more decisive stimulus in China. This could leave it stuck between $US0.60 and $US0.70, but with the risk skewed to the downside.

Important information

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.