Global share markets mostly fell again over the last week on the back of increasing concerns about the economic outlook with weaker data out of the US and new tariffs from Tariff Man along with concerns the AI share boom may be over. Despite a bounce on Friday on the back of dip buying and hopes the 25% tariffs on Mexico and Canada won’t go ahead on Tuesday, US shares fell 1% for the week and are down 3.1% from their recent high. Japanese shares fell 4.2% for the week and Chinese shares fell 2.2% but Eurozone shares gained 0.2%. Australian shares fell 1.5% for the week on the back of more US tariffs along with poor profit results, with falls led by IT, miners, property and retail shares. This leaves them down 4.5% from their record high two weeks ago. Bond yields fell on the back of concerns about growth. Oil, metal, gold and iron ore prices all fell. And Bitcoin fell again with the fall in US shares. All the tariff talk and concerns about global growth saw the $US rise and the $A fall. After a brief relief rally on seemingly false hopes US tariffs won’t be as bad as feared, it looks like the $A is on its way to a retest of its February lows.

Our view has long been that this year would see more constrained, but still positive share market returns as central banks including the RBA continue to cut interest rates boosting growth and profits and Trump’s more negative policies are constrained by a desire to see share market’s ultimately rise with his more positive policies dominating.

However, we continue to see a high likelihood of a 15% plus correction along the way reflecting stretched valuations and Trump’s more negative policies around trade and government spending and the risks around this are rising. Back in 2016 I worried that Trump would staff his administration with crackpots. By and large he didn’t and it led to constant team turnover but there were several adults in the room providing a brake on more extreme policies. This time around it seems there are a lot less with Trump appointing loyalists and being far better organised. There is much in Trump’s platform that makes sense from a rationalist economic perspective - notably tax cuts, smaller government and deregulation. But at present it seems his administration is going off the deep end with numerous extreme measures, including:

- multiple new (sometimes contradictory) tariff announcements every few days - the latest being on copper (this will have a “big impact” according to Trump), a 25% tariff on the EU (“which was formed to screw the US”), another 10% tariff on China on 4 March and the 25% tariffs on Canada and Mexico to start on 4 March (although they may still be headed off). All of which along with the uncertainty of more to come will wreak havoc with global trade, add to Americans’ cost of living and add to business uncertainty. And its increasingly likely Australia will face US tariffs too whether it’s on steel and aluminium or something else – but just remember Australian exports to the US are a small part of our economy and the real threat is from reduced global trade due to the tariffs hitting our exports;

- talk of an External Revenue Service to collect tariffs and replace income tax – yes tariffs will raise revenue but at best they will raise a fraction of income tax revenue and common sense tells us that if tariffs are raised to a level that production is shifted back to the US (as Trump says he wants) then the tariffs will raise no revenue as there will be no imports to tax;

- talk that the “the world owes us billions” for the security the US provides - much of the rest of the world will differ on this;

- DOGE undertaking heavy handed public service cutbacks (helped by an AI assessment of “what did you do last week?” and pitting Federal colleagues against each other) causing mayhem in public services and lots of legal challenges;

- Trump appearing to side with Russia against Ukraine; and

- Trump reposting a video seemingly confirming his envisioned transformation of Gaza into something like this…

While the US House has passed a budget deal which will increase the US budget deficit by $2.8trn over ten years, which may get even bigger after agreement is reached with the Senate, this stimulus won’t start to arrive till later this year and brings its own risks around higher bond yields. But the risk is increasing that the negatives around tariffs and DOGE cuts may see the US slide into the recession. This would be ironic as the US has done so well to avoid it through the “cost of living” crisis and surging interest rates of the last three years. Hopefully, commonsense prevails but at this stage the risk is we could be in for a rough ride for a while – until a backlash from US citizens and investment markets sees Trump moderate his policies. So far with US shares and bond yields both falling it appears investors are more concerned about a hit to growth rather than a boost to inflation. This is very different to 2022 when shares fell and bond yields rose on inflation worries.

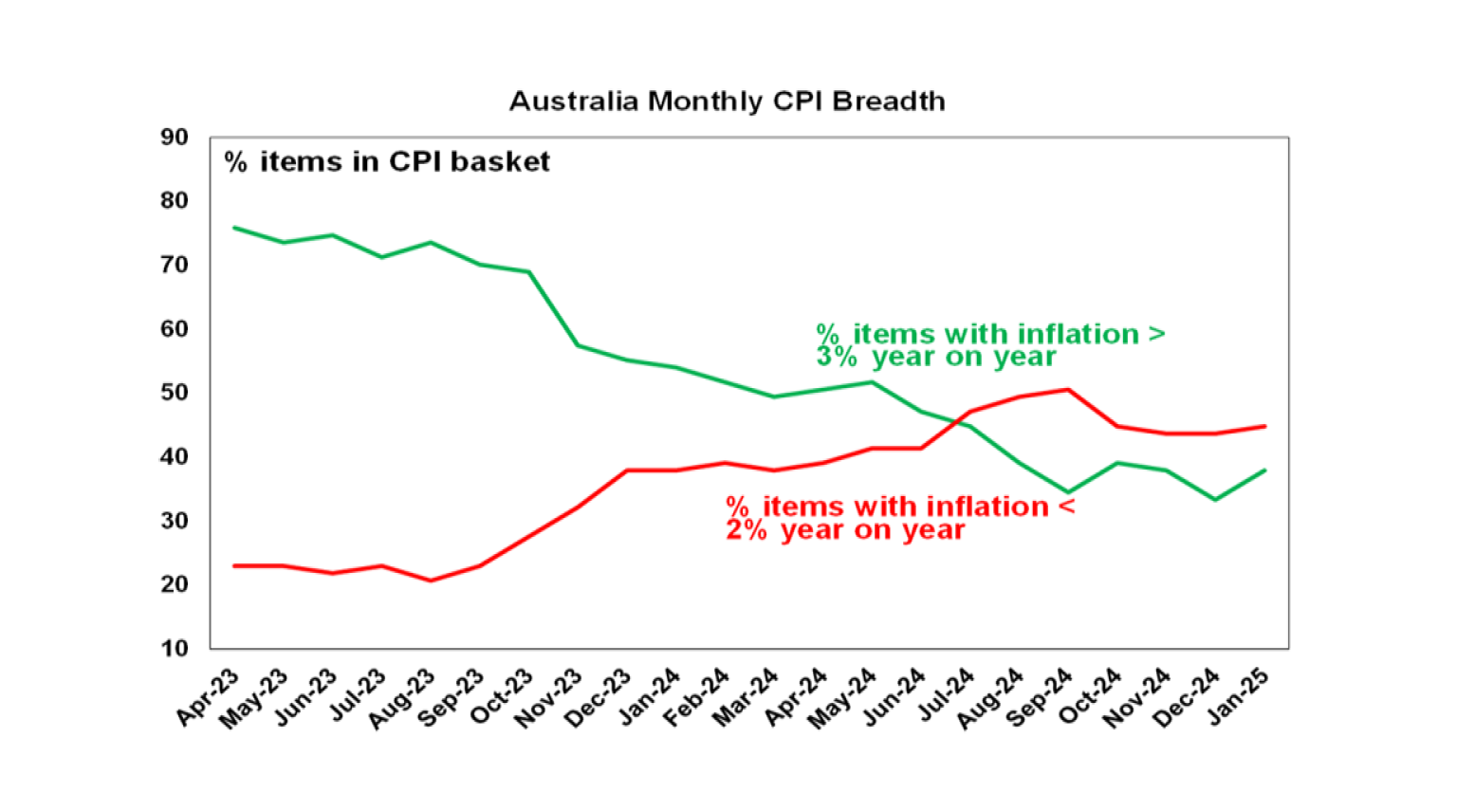

More good news on Australian inflation with monthly inflation holding at 2.5%yoy in January. While the monthly CPI Indicator needs to be treated with caution it provides a rough indication to the quarterly CPI and here the news is good. Despite an 8.9%mom rise in electricity prices as the energy rebates roll off CPI inflation was able to hold at 2.5%yoy as price increases slowed or prices fell in food, clothing, household goods, rents and new dwelling costs. There continues to be more CPI items with inflation running below 2%yoy than there are with inflation running above 3%yoy.

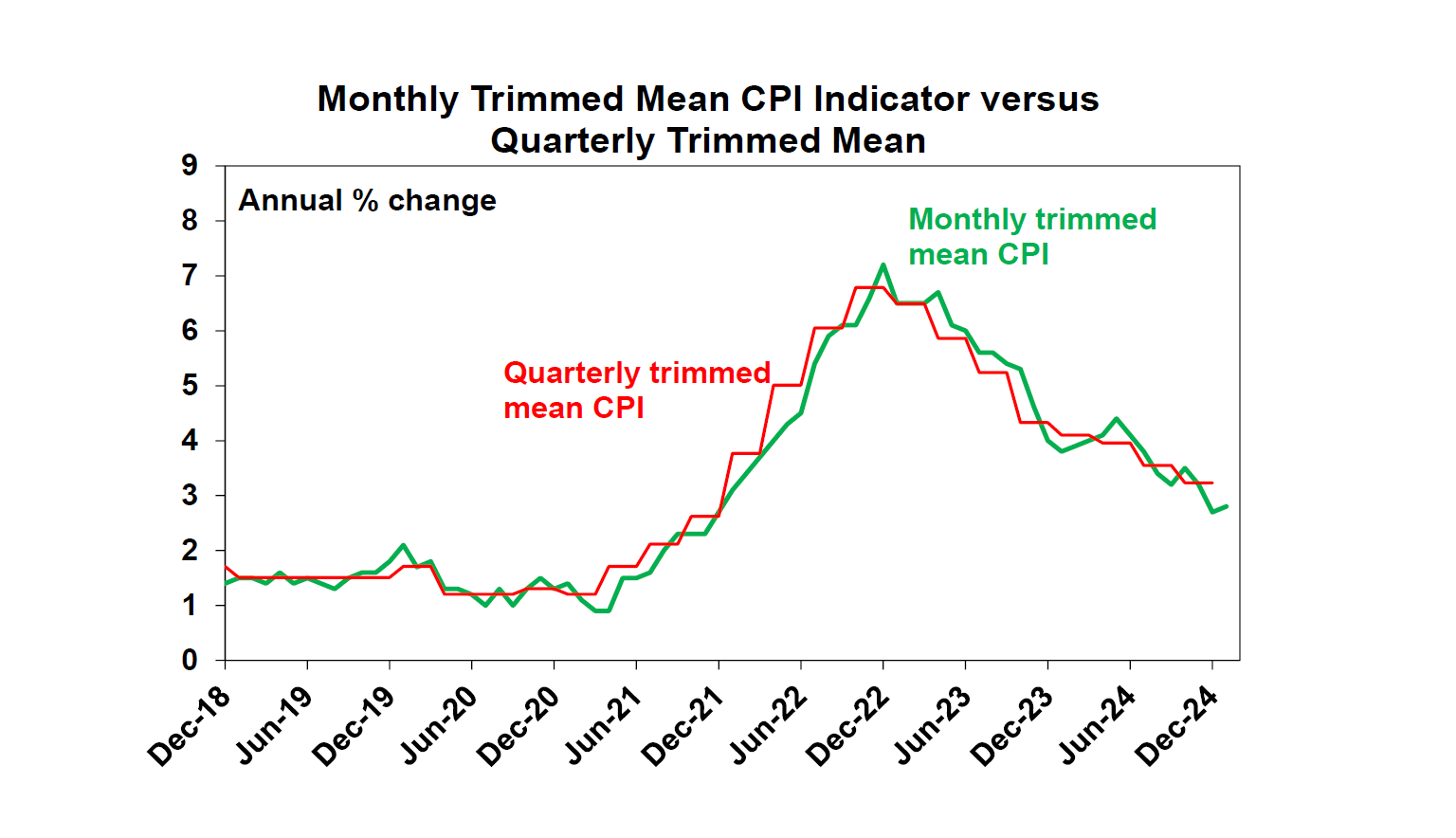

Underlying inflation as measured by the trimmed mean ticked up but only to 2.8%yoy. However, the downtrend in the monthly trimmed mean points to a further fall in quarterly trimmed mean to around 2.9%yoy or less this quarter. So back in the target range!

The ongoing evidence of falling inflation and indications that December quarter GDP data to be released in the week ahead will be soft supports our expectations for 0.25% RBA rate cuts in May and August with one more cut early next year taking the cash rate to 3.35%. A cut in April is possible but its doubtful there will be enough data by then to further increase the RBA’s confidence that inflation is falling sustainably to target. While the $A is falling again we don’t see this preventing further RBA rate cuts as the threat to economic growth from Trump’s tariffs is far greater than the threat to inflation from the lower $A. The money market is pricing two and a half rate cuts by year end.

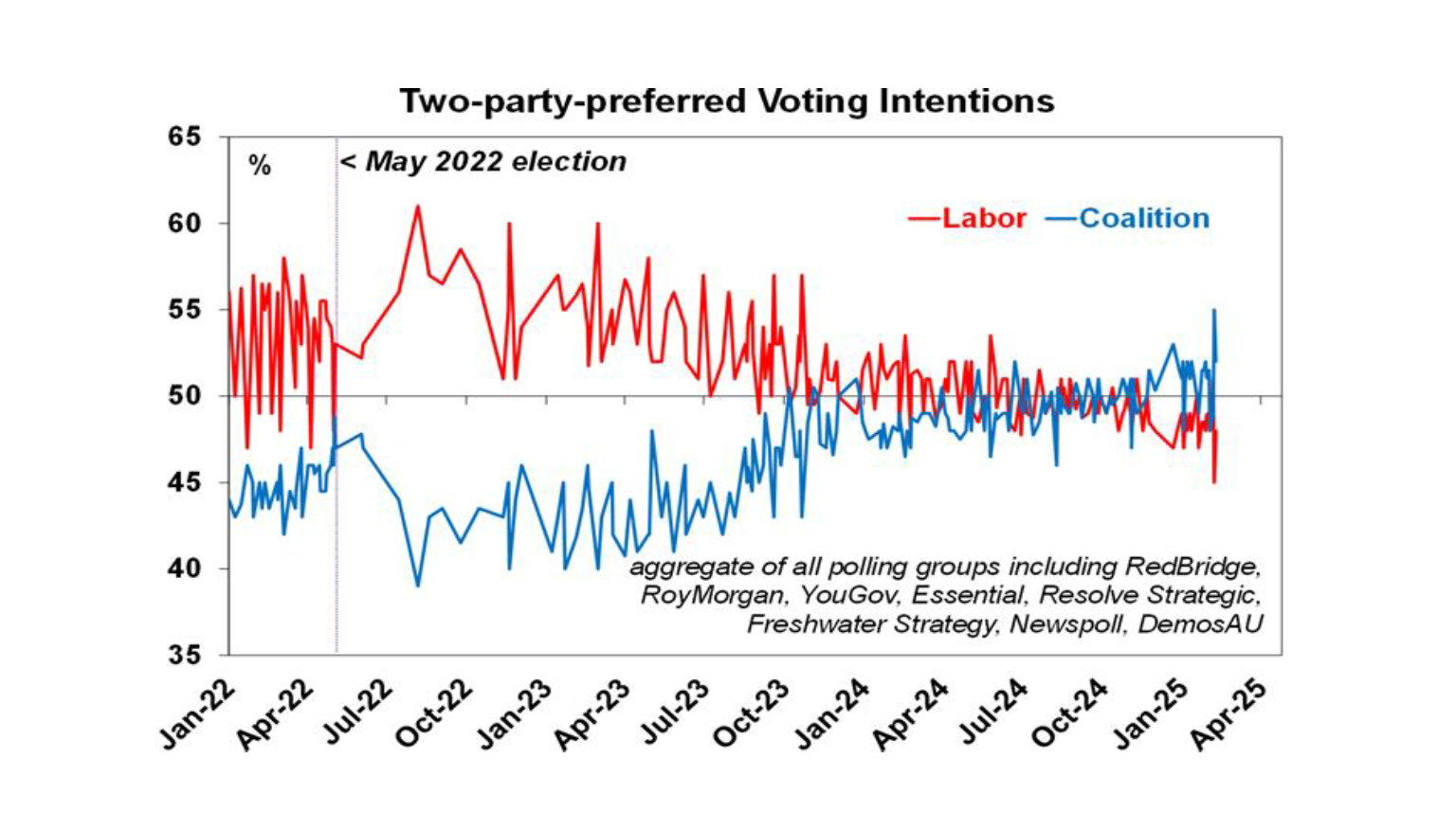

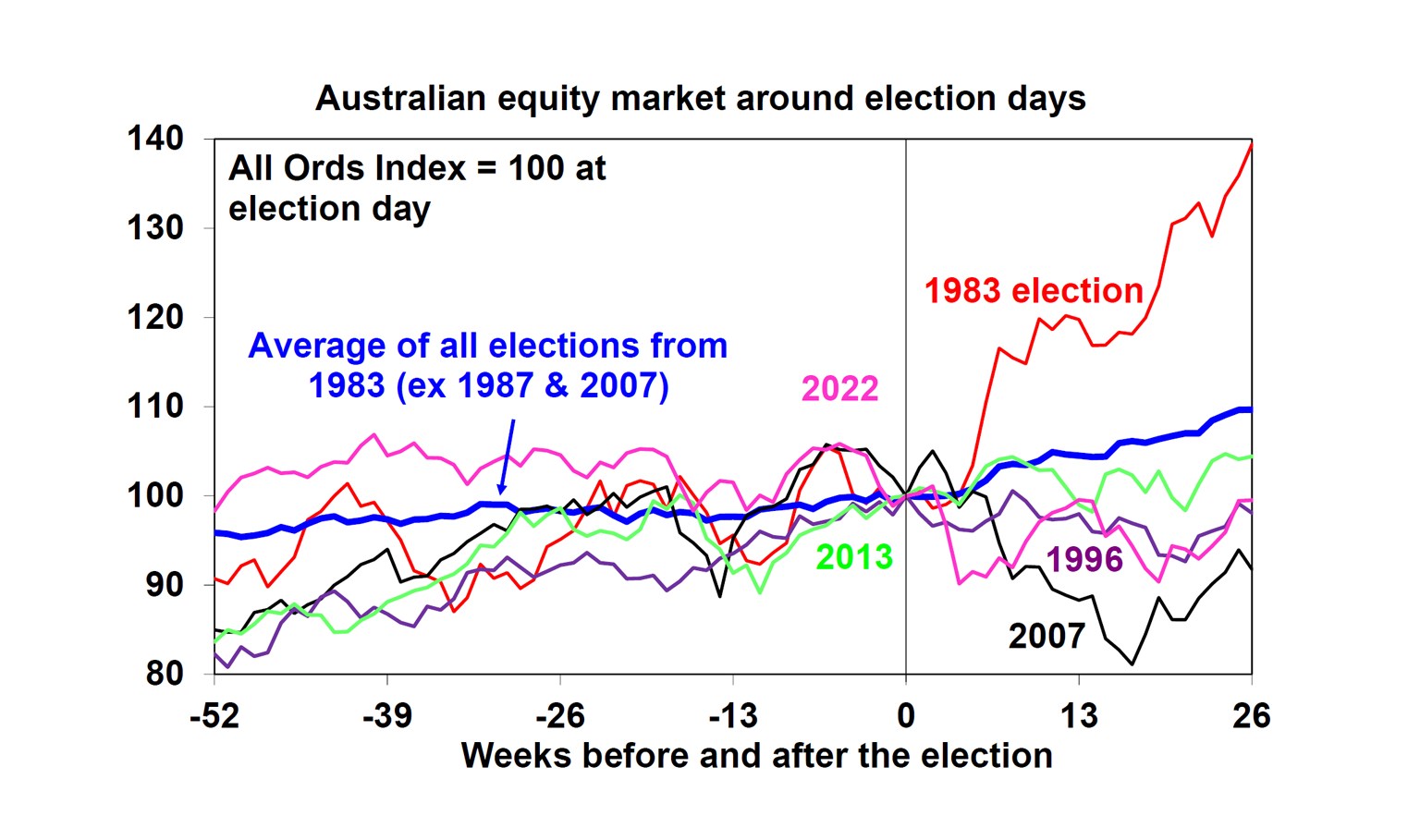

The next Australian federal election is due by 17 May but there is speculation it may be called early for 5 or 12 April. Labor is trailing in two party preferred polling with Albanese and Dutton neck and neck as preferred leader. Current polling suggests both parties may struggle to get a 76 seat majority raising the prospect of a hung parliament. The ALP currently has 78 seats and could easily lose three seeing it lose its majority, whereas the LNP gaining the 22 seats needed for a majority is a big ask. The main issue is the “cost of living” which has been exacerbated by excessive public spending. So far its not clear either side has fully learned the lesson from this although the LNP appears more focussed on constraining spending. If the election is called for early April there will be no March budget but could be an economic update from the Treasurer.

Historically there is some evidence that Australian shares track sideways in the run up to elections and then see a relief rally once it’s over. However, there is a wide variability around this with recessions and global events sometimes dominate.

So that’s it, Summer’s Gone.

Major global economic events and implications

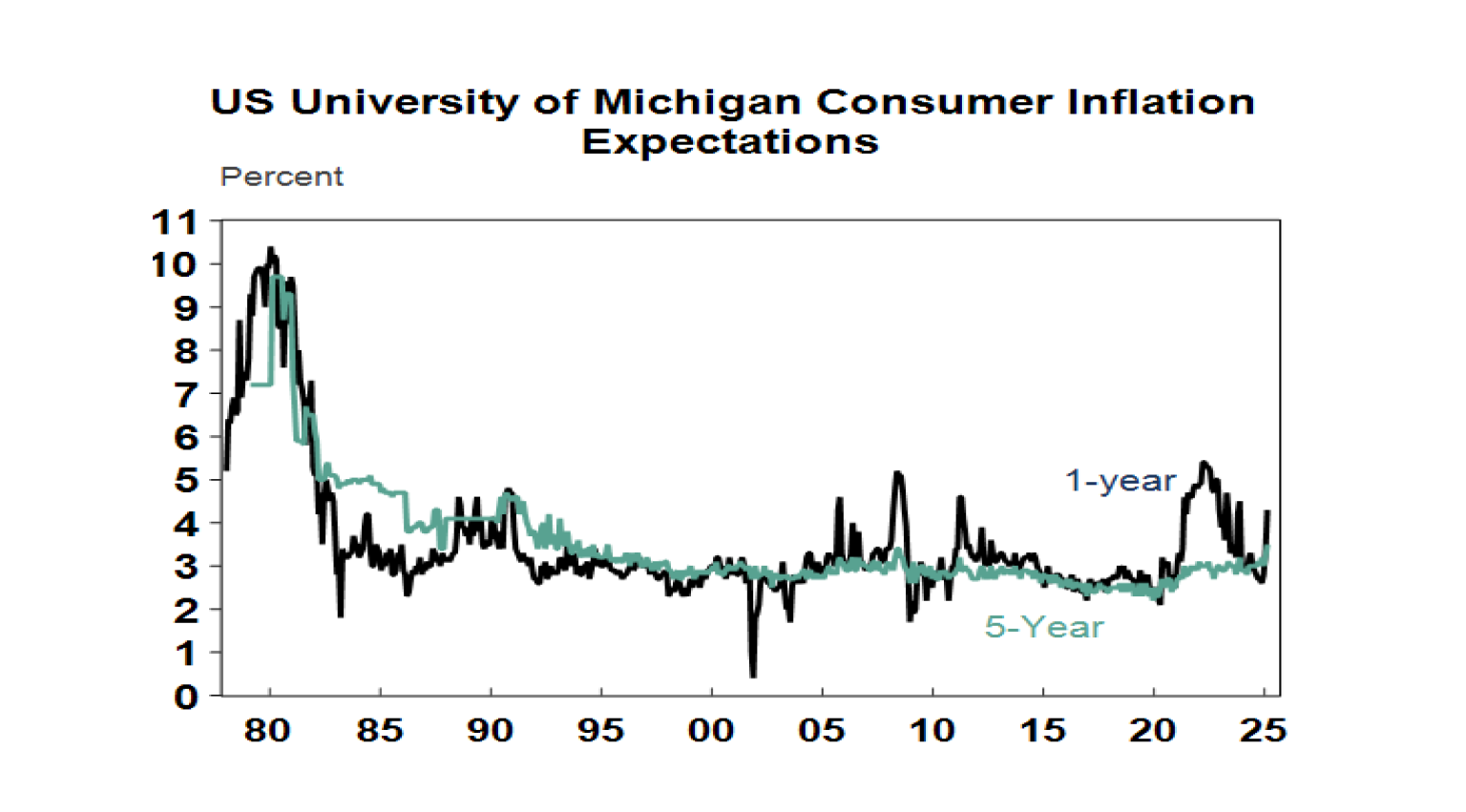

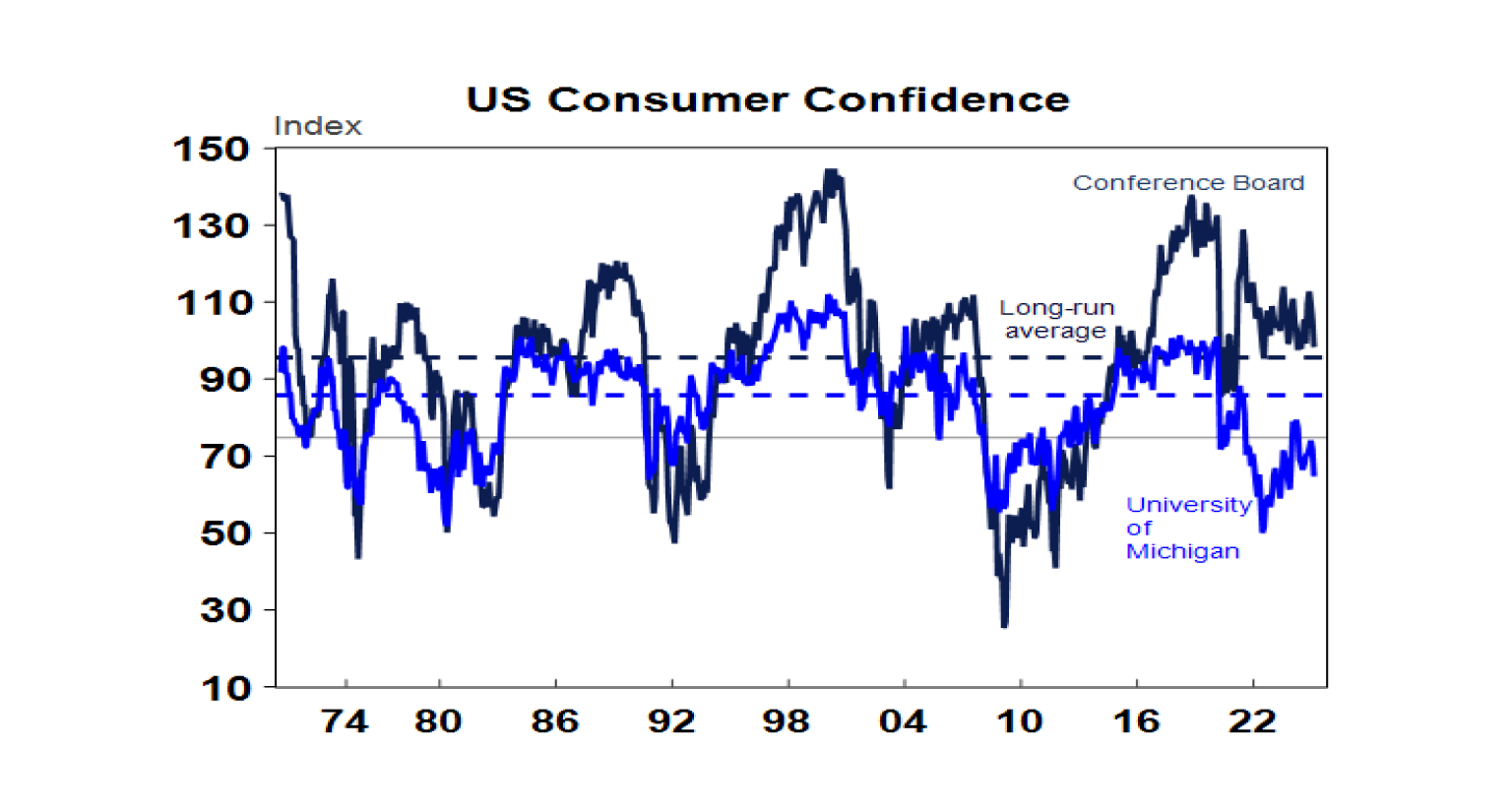

US economic data was mostly soft. December quarter GDP growth was confirmed at 2.3% annualised, core capital goods orders were continuing to trend up in January and home price gains remain solid. But against this personal spending fell in January, home sales are weak and the Conference Board’s consumer confidence index fell with consumers less confident on the labour market and more concerned about the inflation outlook, similar to what was seen in the University of Michigan consumer survey. Trump’s policies appear to be the main driver. Initial jobless claims also rose again, albeit they remain low. The fall in consumer spending and a surge in imports has seen the Atlanta’s Fed’s GDPNow estimate for current quarter GDP growth plunge to -1.5% annualised. Meanwhile core private final consumption deflator inflation was 0.28%mom with the annual rate falling to 2.6%yoy its equal lowest since 2021. This has boosted prospects for Fed rate cuts this year with the money market now allowing for nearly 3 cuts starting in June.

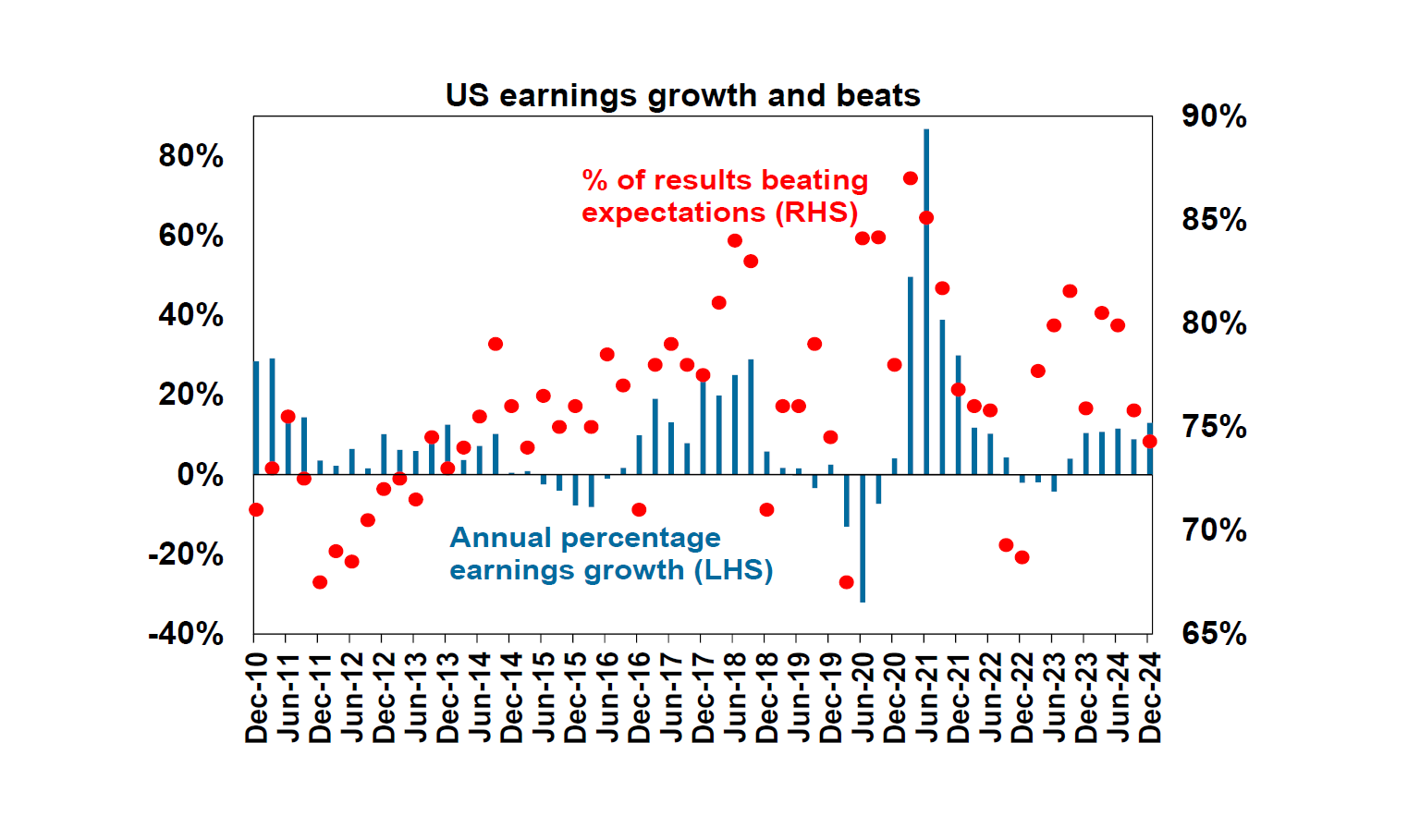

US December quarter earnings reports were strong, but tailed off at the end and expectations have softened. Around 97% of S&P 500 companies have now reported with 74.3% beating earnings expectations which is below the norm of 76%. Consensus earnings growth expectations for the quarter have risen to 13%yoy though, well up from 8.4%yoy at the start of the reporting season. Financials and tech led as expected. Key AI chip maker Nvidia did not beat expectations as much as hoped so its shares plunged. And earnings growth expectations are being revised down.

Meanwhile the German election provided no great surprises with the centre right CDU/CSU led by Friederich Merz set to lead a coalition with the centre left SPD, and the far right AfD getting 20% support. The bad news is that centrist parties fell short of the two thirds majority required to relax a constraint on debt but the centrist parties may legislate for a defence fund in the current parliament where they do still have the required majority. So Germany may still get a fiscal boost focussed on defence. Notably Merz see’s his priority as securing “independence” from the US.

Japanese industrial production fell again but retail sales were strong and inflation data for Tokyo slowed.

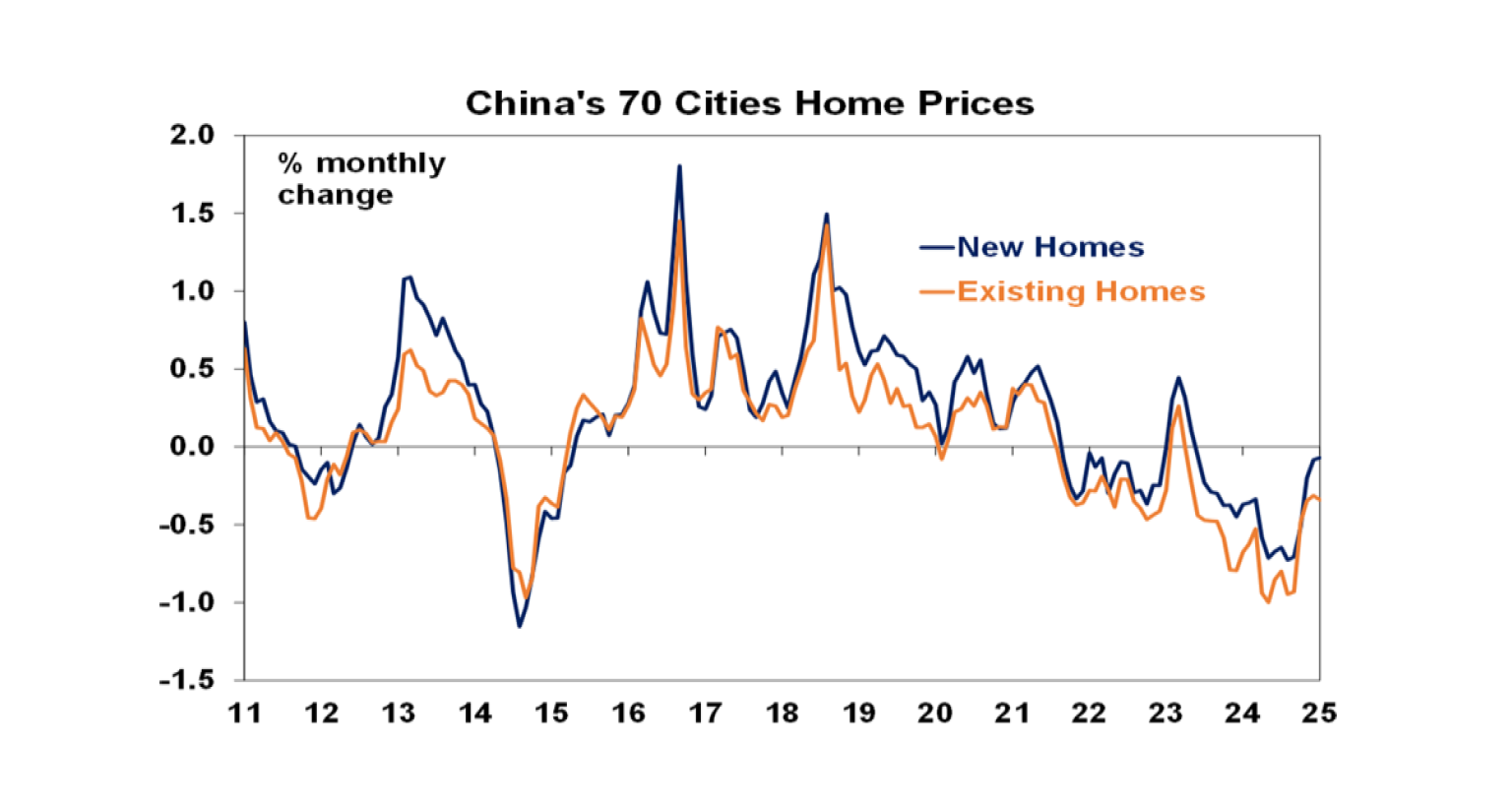

Chinese new property prices fell again in January, but the rate of decline has slowed to a crawl. The worst could be over.

Australian economic events and implications

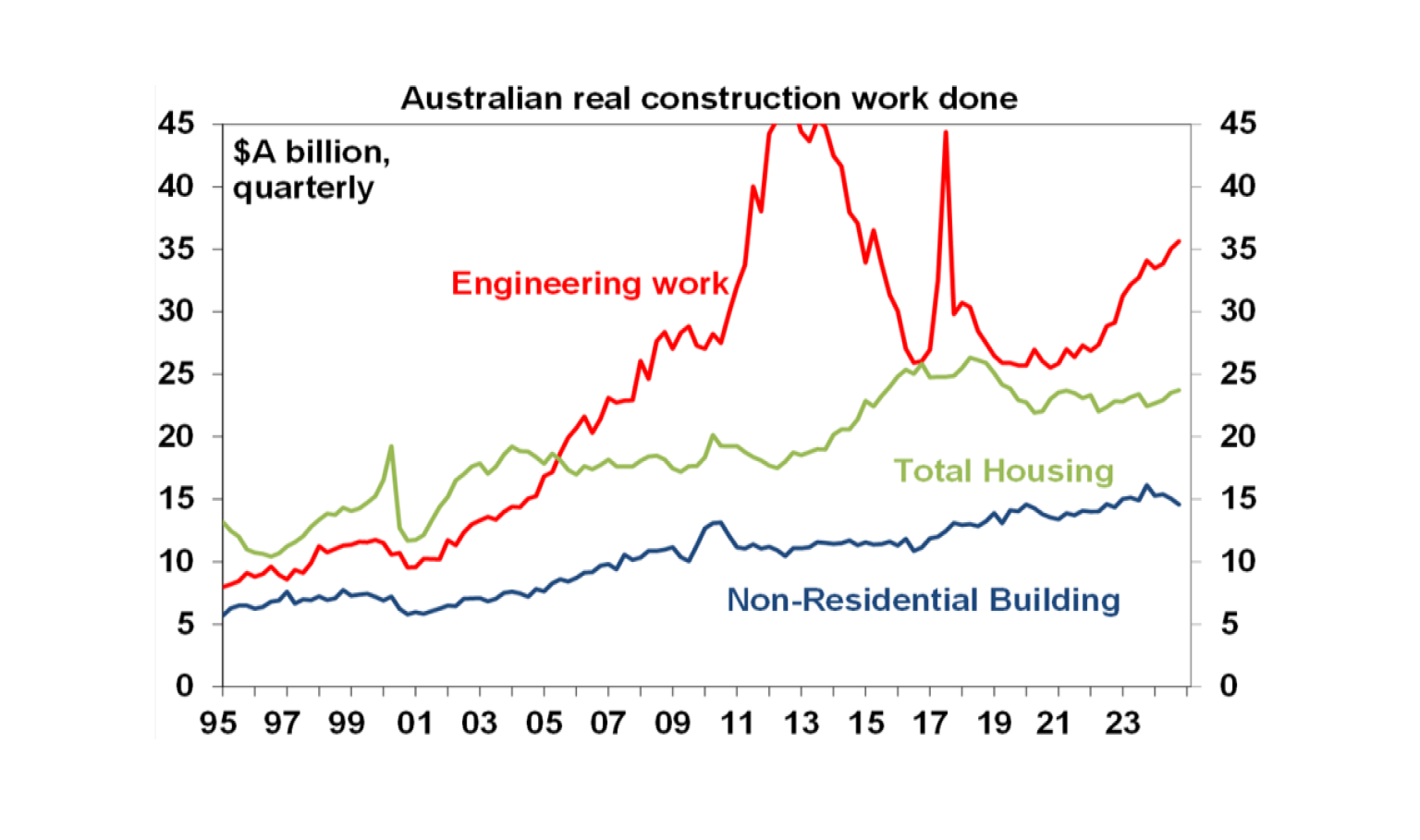

In Australia, December quarter construction activity was softer than expected with just a 0.5%qoq rise as engineering and home building rose but non-residential building fell. Public construction continued to trend up with private construction trending down.

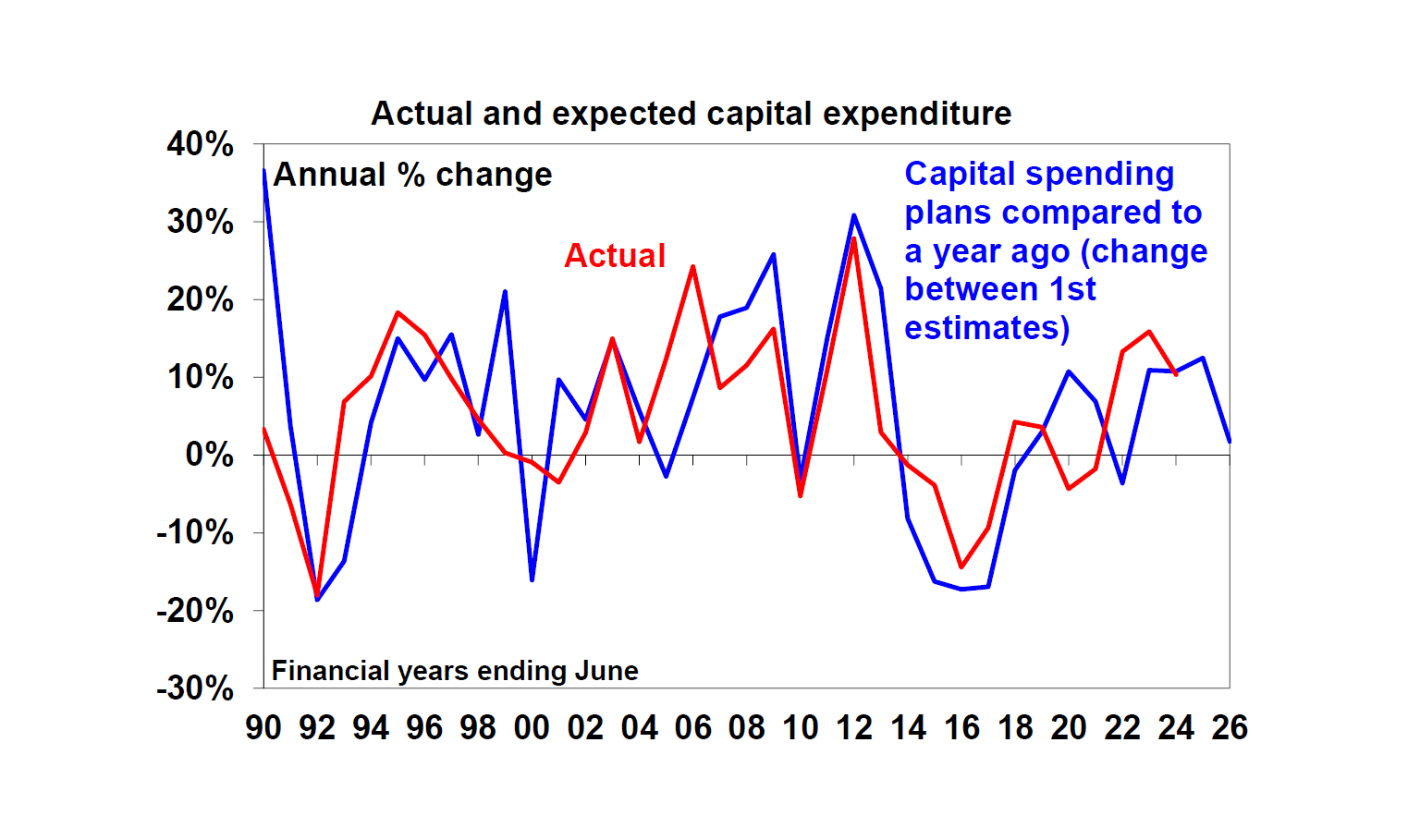

Business investment was also softer than expected. Capex fell 0.2%qoq in the December quarter, with mining investment down and non-mining only fractionally up. What’s more, investment plans imply a rise of just 3% for this financial year and around 2 to 4% in 2025-26 which implies pretty weak growth after inflation.

Private credit growth slowed slightly in January to 0.5%mom or 6.5%yoy with flat personal credit, solid growth in business lending and a slight slowing in housing credit to investors. Lower interest rates may provide some boost.

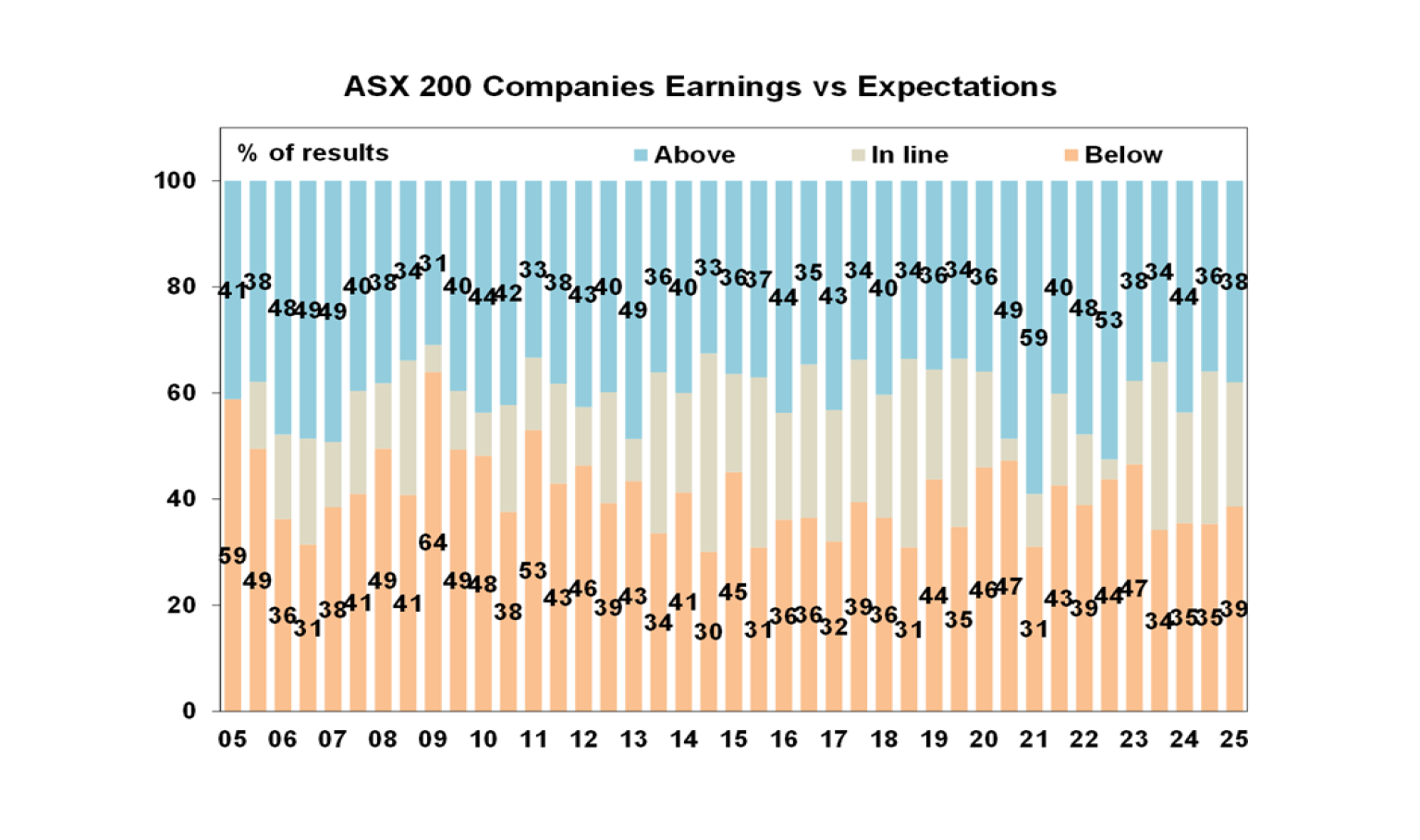

The Australian December half earnings reporting season for listed companies started off well but ended pretty ordinary and it wasn’t just the banks and resources. This was in line with soft economic conditions and along with cautious corporate guidance has led to downgrades to consensus earnings expectations of around 1% for 2024-25 and 2025-26. This financial year is now expected to show a 1% fall in earnings, resulting in three years of falling earnings, and next financial year is now expected to show 8% earnings growth as interest rates fall and activity picks up a bit.

- Beats came in just below misses – with 38% of results surprising consensus earnings expectations on the upside, which is just below the norm of 40%, versus 39% surprising on the downside which is less than the norm of 41%.

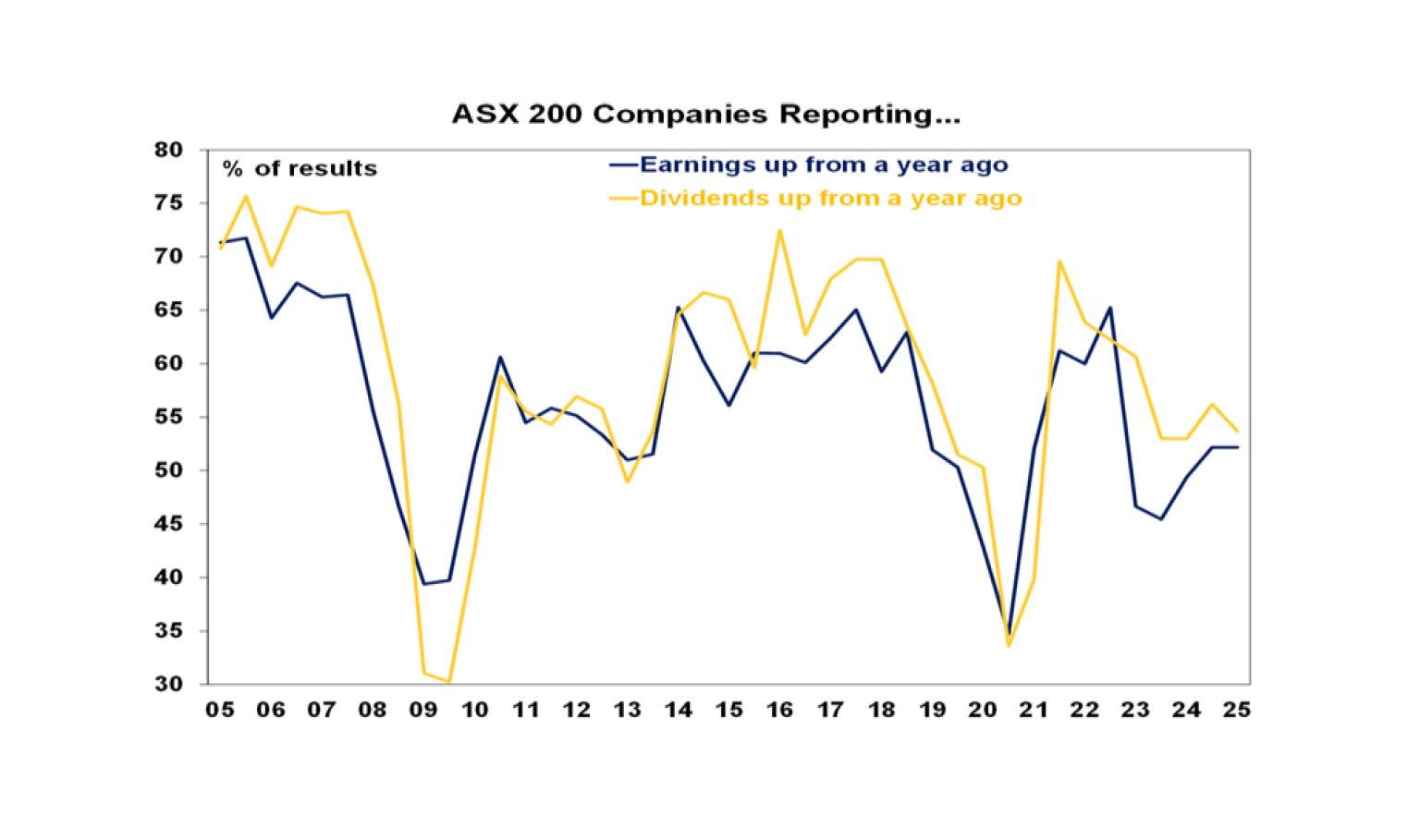

- 52% of companies have seen earnings rise on a year ago, slightly below the norm of 56%. But it’s better than in 2023 and highlights that while there has been some bad news things have improved a bit from two years ago.

- 54% of companies have increased their dividends on a year ago which is below the norm and not much better than two years ago, which is consistent with corporate caution.

January Federal budget data shows the deficit running $3.6bn better than expected suggesting the deficit won’t be as bad as the $26.9bn forecast by the Government but a surplus is also unlikely.

What to watch over the week ahead?

In the US, the focus will be on February jobs data which are expected to show the labour market remaining reasonably solid with a 155,000 gain in payrolls, unemployment unchanged at 4% but wages growth slowing to 0.3%mom or 4.2%yoy. In other data, expect a fall back in the ISM manufacturing conditions index (Monday) to possibly below 50 and the services conditions ISM to remain around 53.

The European Central Bank (Thursday) is expected to cut its key policy rates by another 0.25% taking the deposit rate to 2.5% reflecting weak economic conditions and falling inflation. Eurozone inflation (Monday) for January is likely to fall to 2.3%yoy with core inflation falling to 2.6%yoy with unemployment (Tuesday) likely to remain around 6.3%.

Chinese business conditions PMIs for February may see some improvement after the early Lunar New Year likely affected January data but they are likely to remain soft. Export data for February (Friday) is likely to show a further boost as a result exporters trying to front run US tariffs.

In Australia, GDP data (Wednesday) is likely to show that the economy remained subdued in the December quarter at 0.3%qoq or 1%yoy with a lift in consumer spending, dwelling investment and public spending but weak business investment and a detraction from net exports. While the pick-up in consumer spending will be good news its reliance on discounting suggests it may not be sustained. CoreLogic data for February (Monday) is expected to show a 0.3% gain in average home prices after a brief dip at the end of the last year with the RBA’s rate cut helping push prices up in Melbourne and Sydney, after several months of modest falls. In other data, expect a 0.2%mom rise in January retail sales (Monday), a 1% rise in building approvals with the goods trade surplus likely to be around $5.5bn and a 0.8% rise January’s household spending indicator (Friday). The minutes from the RBA’s last meeting (Tuesday) are likely to reiterate that the RBA was cautious in starting to cut interest rates.

Outlook for investment markets

After the double digit returns of 2023 and 2024, global and Australian shares are expected to return a far more constrained 7% in the year ahead. Stretched valuations, the increasing risk of a US recession, the risk of a global trade war and ongoing geopolitical issues will likely make for a volatile ride with a 15% plus correction somewhere along the way highly likely. But central banks, including the RBA, still cutting rates, prospects for stronger growth later in the year supporting profits, and Trump’s policies ultimately supporting US shares, should still mean okay investment returns.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows to target, and central banks cut rates.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices may still see a bit more softness in the very short term but are then likely to start to see a boost from lower interest rates. We see home prices rising around 3% in 2025.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between changing perceptions as to how much the Fed will cut relative to the RBA, the negative impact of US tariffs and a potential global trade war and the potential positive of more decisive stimulus in China. This could leave it stuck between $US0.60 and $US0.70, but with the risk skewed to the downside as Trump ramps up tariffs.

Important information

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.