Investment markets and key developments

Global and Australian shares rose over the last week to record or near record levels as newly inaugurated President Trump talked big about boosting the US economy, provided no negative surprises and there was a lack of detail regarding his tariffs. This saw US shares rise 1.7% for the week, Eurozone shares gain 1.3%, Japanese shares rise 3.9% and Chinese shares gain 0.5%. The positive global lead helped boost the Australian share market by 1.2% taking it to within 1% of its record high with IT, financial, retail and property shares leading the rise, but with tariff worries and a fall in oil prices weighing on resources shares. Bond yields were little changed – flat in the US, up a bit in Germany and Japan but down a bit in Australia. Oil prices fell on Trump’s policies to boost production and his exhortation to OPEC to do the same. Metal prices fell, iron ore prices were flat, gold prices rose, and Bitcoin rose, briefly touching a record high. The absence of detailed tariff announcements saw the US dollar fall and the $A rise.

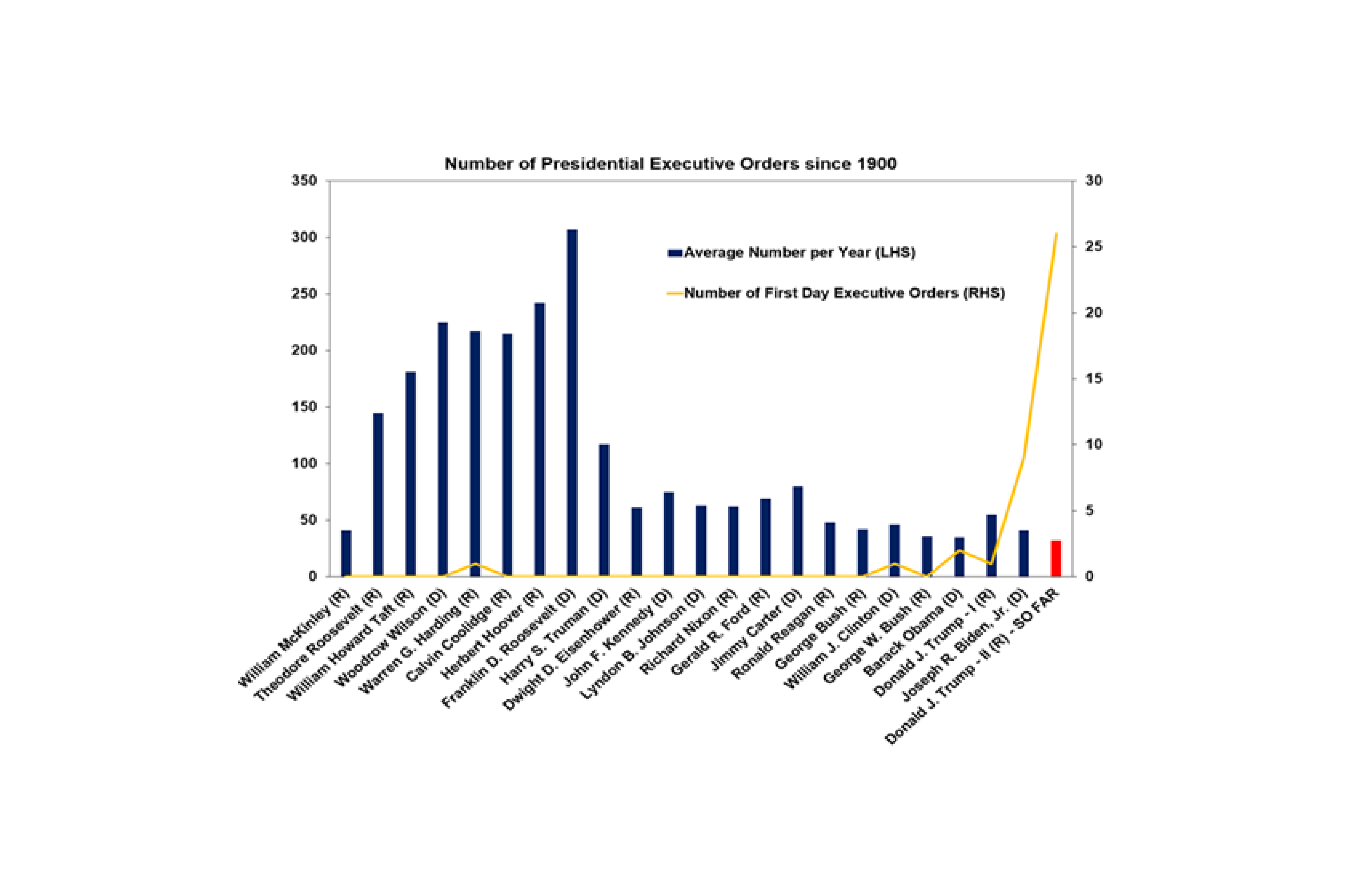

Trump’s first week was pretty much as expected with no big negative surprises for markets but expect lots of noise to come. While Trump’s return provided lots of angst and excitement, depending on your perspective, with a flurry of executive orders marked by big US policy reversals in several areas it was really no more than expected by investment markets and so shares were able to rally, bond yields were little changed and the US dollar fell as his initial policies to a large degree had already been factored in. In other words, there was a bit of “buy on the rumour, sell on the fact”. This was particularly the case in relation to tariffs with markets taking some comfort from the lack of specific announcements on Day One. That said there is a long way to go yet.

Here are five key takeouts from Trump’s first week:

· First, Trump’s return confirms, for better or worse, an ongoing backlash against progressive centre left policies - bigger government, higher taxes, woke policies, high immigration and climate policies are losing support partly in response to the “cost of living” crisis. This is not quite the economic rationalist/Washington consensus model of Thatcher, Reagan and Hawke and Keating as there is a contradictory element of populism around protectionism and state direction that wasn’t there in the 1980s. But its still a big change that will potentially further boost US productivity growth. And it presents a big challenge to Australia – with eg, more companies potentially thinking of relocating to the US given the attraction of lower taxes and less regulation. Trump’s policy shift will mean pressure for Australia to respond with policies to boost the supply side of our economy – like tax reform and deregulation – and to curtail government spending. Amongst other things, this is what Australia needs to boost our own productivity growth.

· Secondly, if Trump is really going to usher in a “Golden Age of America”, some of this could be very positive for shares. And indeed, he will ultimately want to see shares go up as an affirmation that he and the US are “winning”.

· Thirdly, there will be lots of noise along the way as this is the way Trump does things. We were reminded again in the last week how Trump can whipsaw markets – with markets initially relieved that there were no Day One tariff details announced and that there would be a review of unfair practices with a due date of 1 April giving the impression that the focus would be on negotiation, but then Trump indicating 25% tariffs on Mexico and Canada and 10% on China were still on the table with a probable 1 February start date seeing markets then start to fret again. This whipsawing is likely to continue with the uncertainty being on purpose as part of Trump’s approach to negotiations. But as we saw in relation to tariffs in 2018 this can cause a big hit to markets before things settle.

· Fourthly, in terms of his policies there is a long way to go before we get much clarity – along with tariffs this includes his tax and spending cuts and whether the budget deficit will be blown out further which is largely up to Congress and what he does in relation to the Russia/Ukraine war and Iran’s nuclear capabilities.

· Finally, as with his first term there will be lots of crazy stuff along the way – with eg the Gulf of Mexico being renamed, the US retaking the Panama Canal (a bit like Russia retaking Crimea), loud public conflicts amongst his team (eg, Musk versus everyone else), a demand for an immediate cut in interest rates – we saw this in Trump 1.0 and the Fed will just ignore it - and his billions of paper profits on his freshly made up $Trump meme coin. In terms of the latter, Meme coins are literally just made up and have no intrinsic value and unlike Bitcoin or Ethereum have no hope of being of any value beyond pure speculation. But unfortunately, it just looks to many like the US President seeking to cash in on the crypto craze and in the process may do more harm for crypto than good.

Ultimately our view remains that various constraints - Trump wanting shares to go up not down, his voters wanting a lower cost of living, bond vigilantes and fiscally conservative Republican politicians - will keep a lid on Trump’s populist inflation boosting tendencies, but this may not be clear for a while, and it will be a rough ride along the way.

So allowing for the negatives of rich valuations, uncertainties as to how much the Fed will cut rates, uncertainties around Trump and various geopolitical risks against the positives of global central banks still cutting rates, goldilocks economic conditions particularly in the US, optimism that Trump will reinvigorate the US economy and prospects for stronger profits ahead in Australia we remain of the view that this year will see a far more volatile and constrained, but still positive, ride for shares than what we saw in 2024.

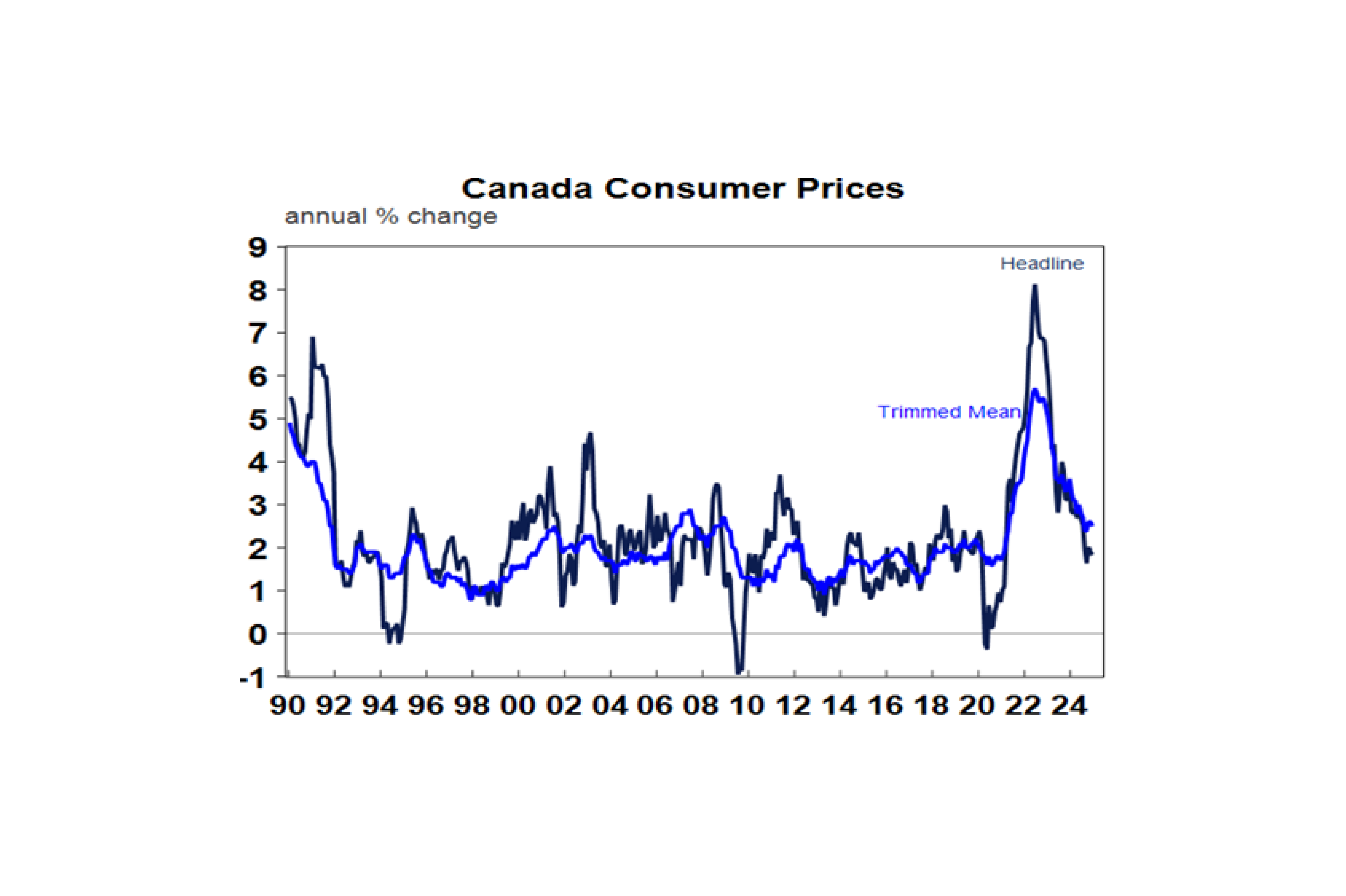

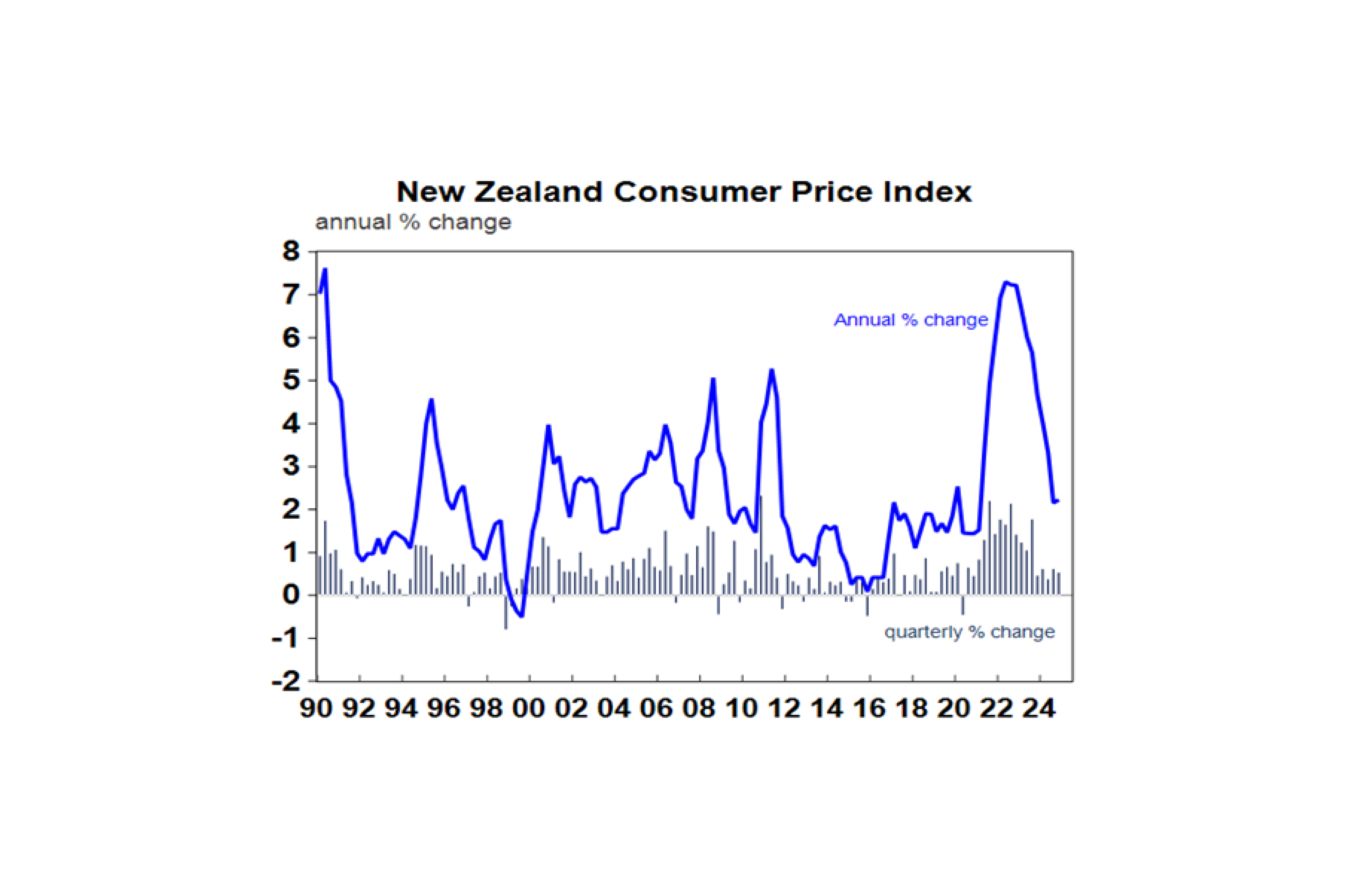

Meanwhile, the last week provided more good news on global disinflation with lower inflation readings in Canada and New Zealand with both their central banks on track for more rate cuts.

For the RBA, December quarter inflation data to be released in the week ahead will be critical in determining whether we will see a rate cut in February. Our view remains that if trimmed mean inflation comes in at 0.6%qoq or less, as we expect, against implied RBA expectations for a 0.7%qoq rise it will be very hard for the RBA not to cut in February, and that the softer $A and still strong jobs market should not be barriers to this. So, we wouldn’t argue with the money market which is pricing in about a 77% chance of a cut in February. See the “What to watch over the week ahead?” section below for our December quarter CPI forecast.

Major global economic events and implications

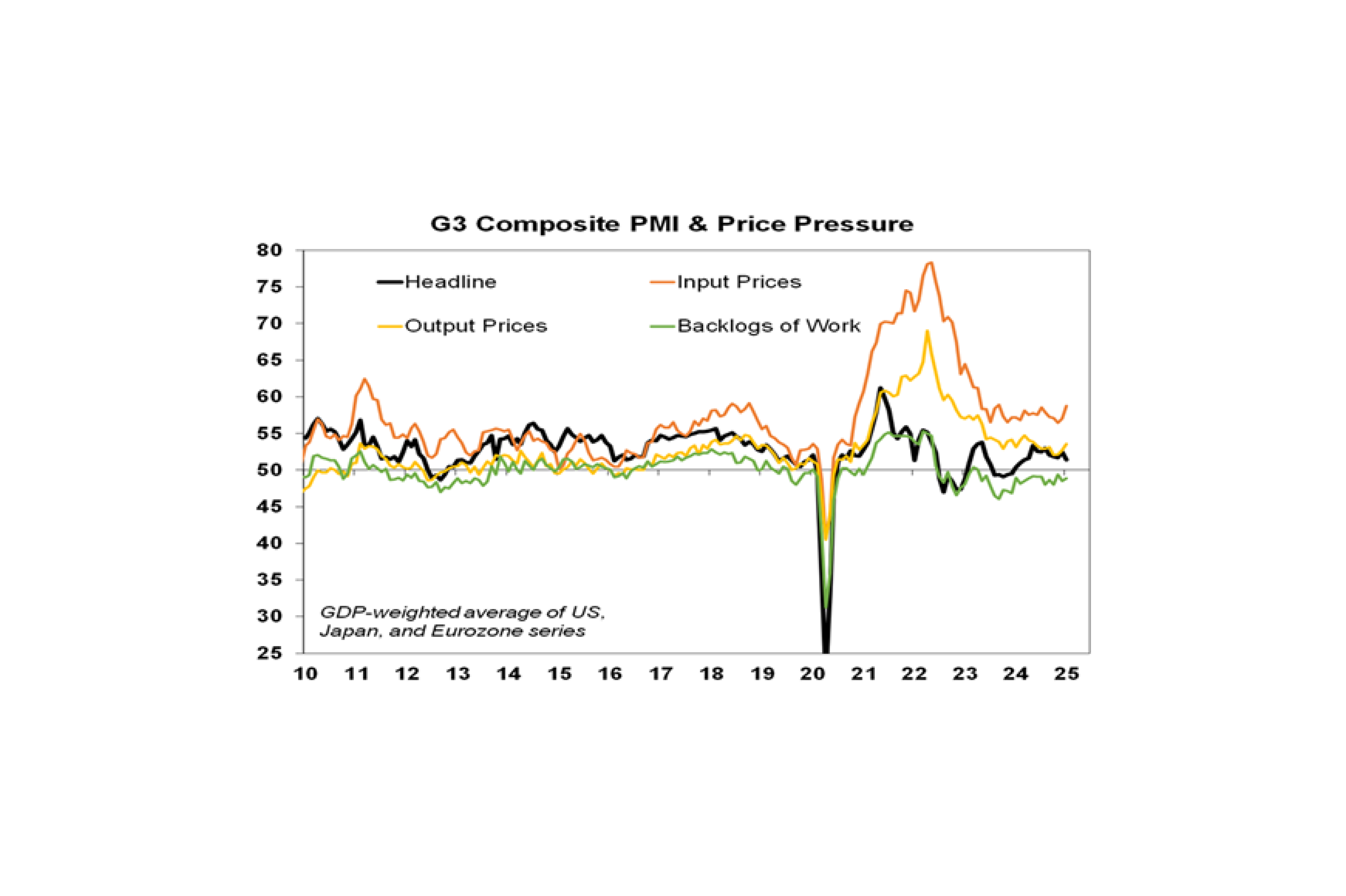

Aggregated business conditions PMIs in developed countries for January fell slightly but still suggest okay global growth. Interestingly there was some reduction in developed country growth divergence with the strong US slowing sharply and Europe, the UK and Japan still soft but improving a bit. There was also a narrowing in the divergence between manufacturing which remains weak but improved a bit and services which remains strong but slowed. Unfortunately input prices and output prices rose, possibly reflecting the sharp rebound in oil prices recently, but output prices remain in their pre pandemic range and work backlogs remain below normal suggesting the disinflation trend remains in place.

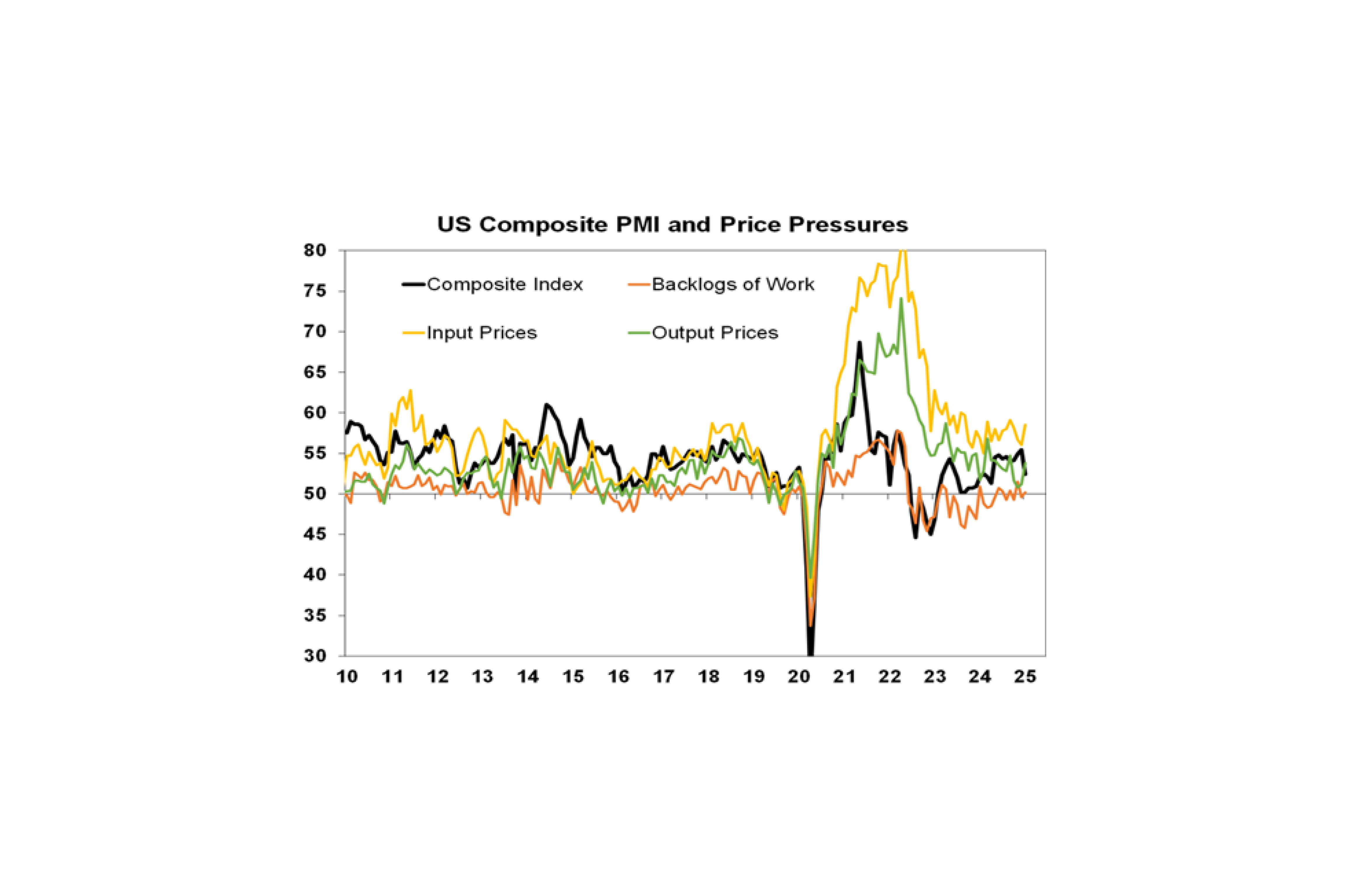

The US composite PMI fell sharply in January with a sharp fall in services. Input prices and output prices rose but the trend remains down in the latter and its around pre pandemic levels suggesting that disinflation remains in place allowing the Fed to continue cutting rates this year, albeit with strong growth resulting in a more gradual pace.

Other US data was mixed. Jobless claims remained low, albeit with claims in California following the fires driving some increase and the US leading economic index fell back in December after a rise in November but after falling for much of the time since 2021. The US leading economic index continues to warn of recession but hasn’t been reliable through this cycle. The University of Michigan’s consumer survey showed a slight fall in confidence and a slight fall in 5-10 year ahead inflation expectations to 3.2%. Existing home sales rose in December but remain low.

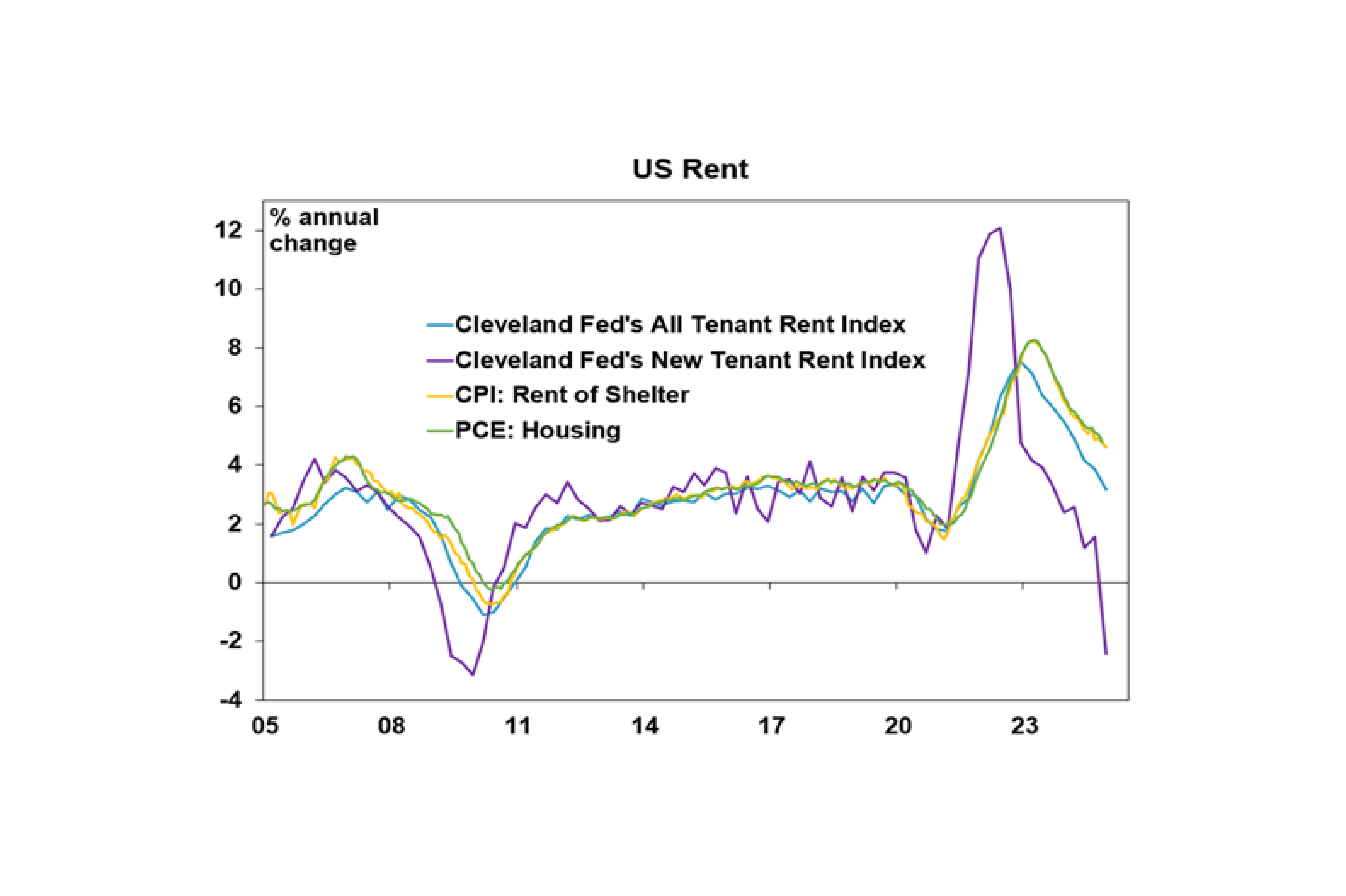

Meanwhile, falling US rents for new tenants augurs well for a further slowing in shelter costs in the US CPI and private final consumption deflator (PCE) measures of inflation.

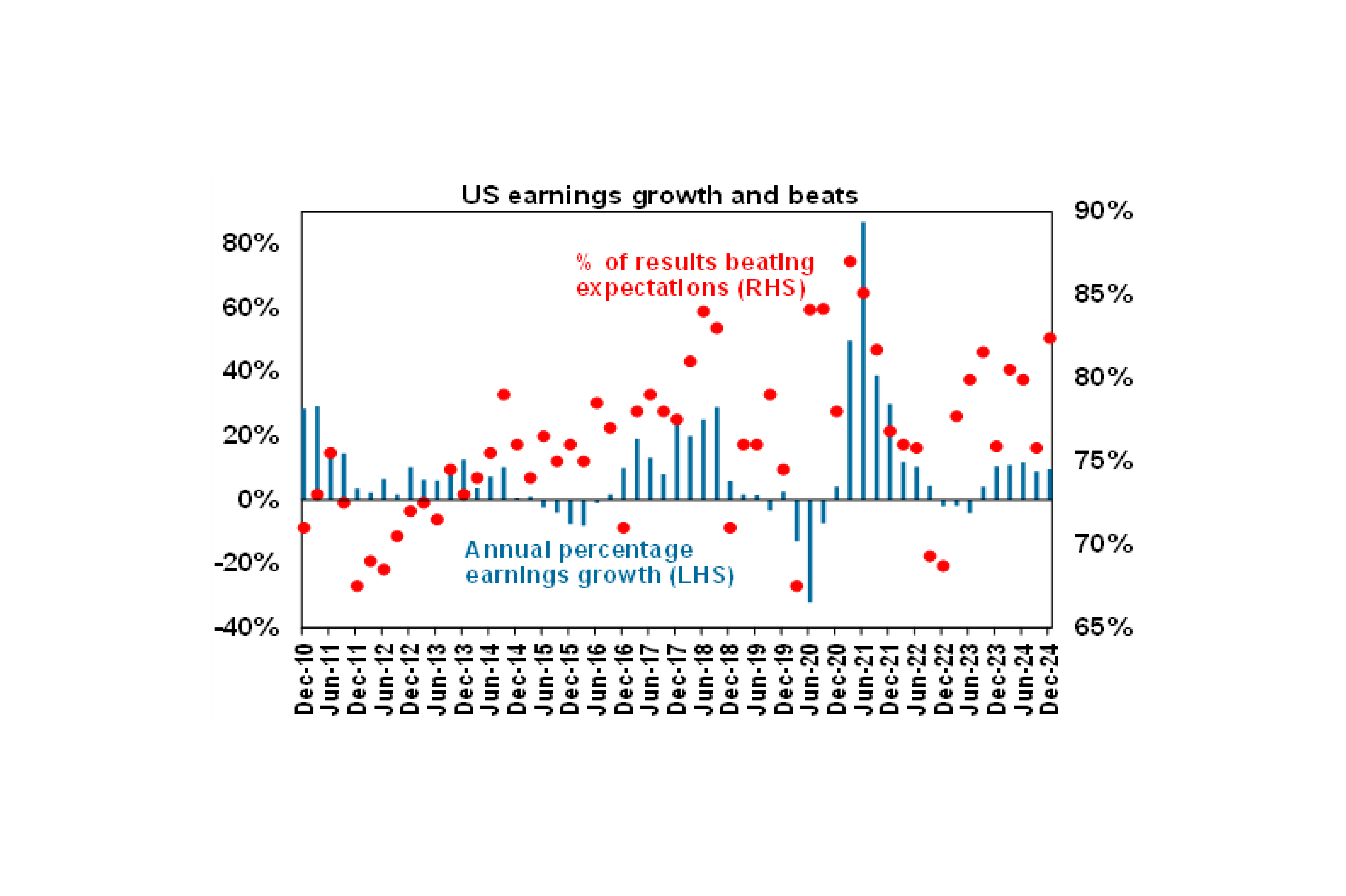

Its early days in the US December quarter profit reporting season with so far only 16% of S&P companies reporting results but so far so good with 79% beatings earnings expectations on the upside against a norm of 76%. And consensus earnings growth expectations for the quarter are at 9.5%yoy, which is up from 8.4%yoy at the start of the reporting season but still looks too low given the strength of the US economy. A final outcome of around 12.5%yoy is likely with tech and financials leading the way.

Canadian inflation fell more than expected to 1.8%yoy in December with underlying measures falling as expected to around 2.5%, leaving the Bank of Canada on track for another rate cut in the week ahead.

UK jobs data was mixed with strong wages growth of 5.6%yoy, but falling employment and slightly higher unemployment. Ultimately the slowdown in jobs will dominate and contribute to a further fall in services inflation. The Bank of England remains on track to cut rates again in February.

The Bank of Japan raised its cash rate again by 0.25% taking it to 0.5% as widely expected and foreshadowed by the BoJ. The further normalisation in rates reflects increasing confidence that inflation will stay around the 2% target helped by stronger wages growth and the economy being strong. The tightening process is likely to remain gradual though with one more rate hike later this year taking the cash rate to 0.75%, so we don’t see a major upset to carry trades. Meanwhile, Japan’s composite business conditions PMI improved in January with services up and manufacturing down and inflation for December rose to 3.6%yoy from 2.9%yoy due to higher food and energy prices with core (ie ex food and energy) inflation falling slightly to 1.6%yoy from 1.7%yoy.

Inflation in New Zealand of 2.2%yoy in the December quarter with core inflation slowing to 3%yoy was basically as expected and with the depressed economy leaves the Reserve Bank of New Zealand on track to cut by 0.5% in February.

Australian economic events and implications

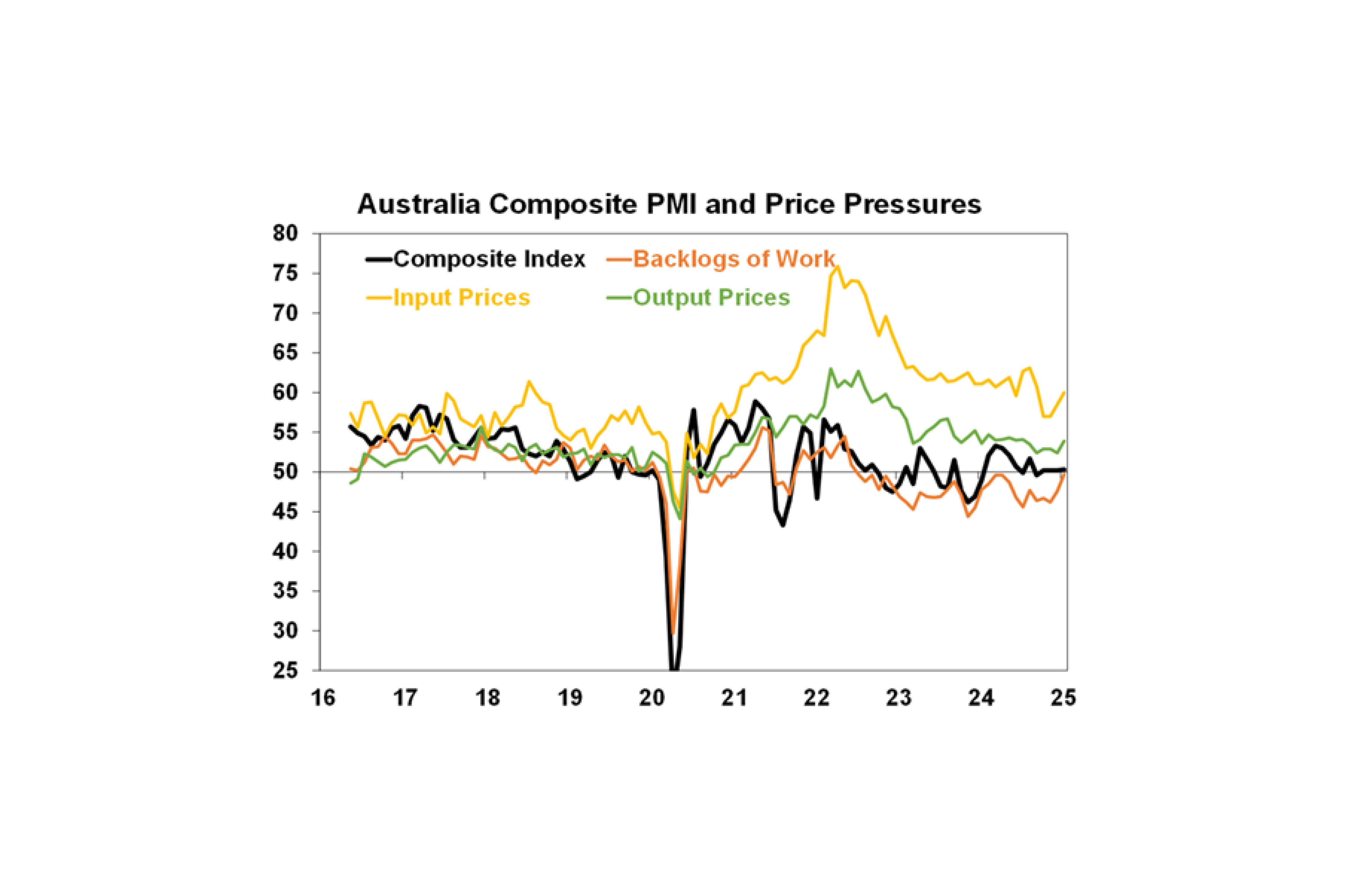

Australian business conditions PMIs for January remained soft, with manufacturing improving and services softening. The employment component remained negative for the second month in a row and still warns of slowing jobs growth ahead. Output and input prices rose, particularly the latter mainly due to manufacturing. Output prices remain around their pre-covid range so it shouldn’t stop a February RBA rate cut if December quarter trimmed mean inflation is good, but will be a concern if the pickup in output and input prices continues, which seems unlikely given the softness in economic activity.

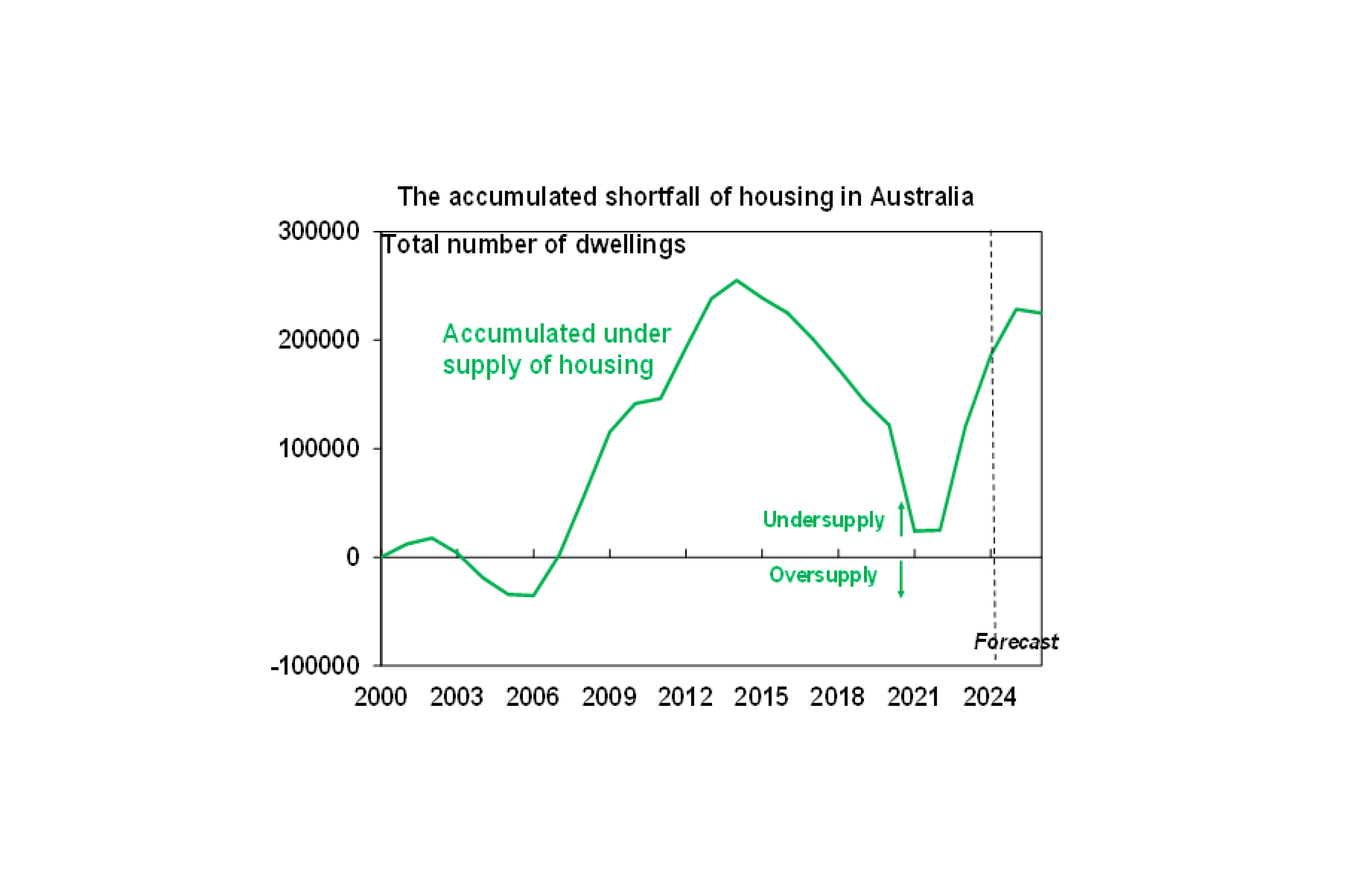

Consistent with a rising trend in home building approvals the level of housing starts rose 4.6%qoq in the September quarter taking them to an annualised pace of 173,000. With building approvals running around 180,000 and a large pipeline of work yet to be done starts are likely to rise further but remain well below underlying demand for housing which has been running around 240,000 pa and also well below the National Housing Accord target to build 240,000 dwellings a year. So the accumulated housing shortfall, which we currently estimate to be at least 200,000 dwellings and possibly 300,000 depending on how many people occupy each dwelling, is likely to get worse this year.

What to watch over the week ahead?

The week ahead will see a bunch of central bank meetings, earnings results for five of the Magnificent 7 tech companies and key inflation data released in Australia.

In the US the Fed (Wednesday) is expected to leave rates on hold at 4.25-4.5% consistent with its more cautious guidance from December, some stickiness in inflation, still solid economic data and uncertainty around what Trump’s policies will mean for inflation. However, with recent data showing that disinflation is continuing its likely to indicate that it remains on track for more rate cuts this year with the next move possibly in March providing Trump uncertainty settles a bit. On the data front in the US expect gains in consumer confidence and durable goods orders (Tuesday), December quarter GDP (Thursday) to show that growth remains robust at around 2.6% annualised, December core private final consumption deflator inflation to show a benign rise of 0.2%mom or 2.8%yoy and the December quarter employment cost index to pick up slightly to 1%qoq (both due Friday). US December quarter earnings results will also continue to flow with Meta, Amazon, Microsoft, Tesla and Apple all due to report.

The Bank of Canada is expected to cut its key policy rate again to 3% from 3.25% on Wednesday reflecting ongoing disinflation.

The ECB is expected to cut its key policy rates by another 0.25% on Thursday, taking its deposit rate to 2.75% and its refinancing rate to 2.9% reflecting soft economic conditions and ongoing disinflation with further easing likely ahead. Eurozone December quarter GDP is expected to have increased by 0.2%qoq or 1.1%yoy and unemployment is expected to be unchanged at 6.3% (both due Thursday)

Japanese data for December retail sales, jobs and industrial production will be released Friday.

Chinese business conditions PMIs for January (Monday) will be watched to see whether the rise in December is maintained.

In Australia December quarter inflation data (Wednesday) will be key to whether the RBA cuts rates in February or not. Monthly CPI indicators and falls in final product price increases in business surveys point to good news. Consistent with this we expect headline inflation to slow to 0.2%qoq or 2.4%yoy, down from 2.8%yoy in the September quarter thanks to various government “cost of living” measures including electricity rebates, lower public transport costs and caps on childcare fees along with lower new dwelling costs, slowing rent growth, flat household equipment and services prices and seasonal softness in clothing prices. But given the influence of “cost of living” measures the focus will be on the trimmed mean inflation rate which is also expected to slow to 0.5%qoq or 3.2%yoy, down from 3.5%yoy. This would mean an annualised trimmed mean inflation rate of 2% over the quarter and 2.5% over the last six months, ie at or below target. As it would be 0.2% below the RBA’s forecasts it would imply a downwards revision to its inflation forecasts for much of this year and 12 month ended trimmed mean inflation being back in the target range earlier than its current forecasts indicate. So, if the trimmed mean inflation rate cools in line with our expectations it will be very hard for the RBA not to cut rates at its February meeting. The December monthly CPI Indicator is expected to show a rise to 2.6%yoy from 2.3%yoy as electricity subsidies drop off but a fall in the all-important trimmed mean to 2.9%yoy from 3.2%yoy. The December NAB business survey will be released Tuesday and is likely to show continued soft business conditions and a continuing downtrend in cost and price pressures.

Outlook for investment markets in 2025

After the double digit returns of 2023 and 2024, global and Australian shares are expected to return a far more constrained 7% in the year ahead. Stretched valuations, the ongoing risk of recession, the risk of a global trade war and ongoing geopolitical issues will likely make for a volatile ride with a 15% plus correction somewhere along the way highly likely. But central banks still cutting rates with the RBA joining in, prospects for stronger growth later in the year supporting profits, and Trump’s policies ultimately supporting US shares, should still mean okay investment returns.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows to target, and central banks cut rates.

Unlisted commercial property returns are likely to start to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices are likely to see further near-term softness as high interest rates constrain demand. Lower rates should help from mid-year, and we see average home prices rising around 3% in 2025.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow in the second half as the cash rate falls.

The $A is likely to be buffeted between changing perceptions as to how much the Fed will cut relative to the RBA, the negative impact of US tariffs and a potential global trade war and the potential positive of more decisive stimulus in China. This could leave it stuck between $US0.60 and $US0.70, but with the risk skewed to the downside if Trump acts more decisively on tariffs.

Important information

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.