Share markets fell over the last week on the back of concerns about the economic outlook. The key US share market fell 1.7%, with Trump’s policies appearing to depress consumer confidence and business conditions data and with options expiries adding to weakness on Friday. Eurozone shares also fell 0.3% and Japanese shares fell 1%, but Chinese shares rose 1%. Australian shares fell 3% for the week on the back of disappointing earnings news particularly from the banks and cautious RBA comments on the outlook for further interest rate cuts. The falls were led by financials, energy and retail shares. Bond yields fell in the US on concerns about growth but rose in Europe, Japan and Australia. Oil and copper prices fell on global growth concerns, but gold rose to a new record high and the iron ore price rose. Bitcoin fell with US shares. The $US and the $A were little changed.

Shares remain vulnerable to increased volatility and a correction. The key risk factors are stretched valuations, Trump’s tariffs and other policies potentially adding to US inflation and cutting into global and Australian growth and various geopolitical risks. So, we continue to see a high likelihood of a 15% plus correction at some point this year. But ultimately, we still see shares doing okay this year as Trump’s more negative policies are constrained by a desire to see shares rise at the same time that some of his policies reinvigorate the US, and with most central banks including the RBA continuing to cut rates boosting growth and profits.

The loud daily noise out of the Trump Administration continues and will be an ongoing source of volatility for investors.

- Trump’s extraordinary tirade against the Ukrainian President Zelinsky reinforces his “America first” approach (maybe he is trying to send a message to other countries not to pick a fight with big neighbours that want to take them over like Panama, Greenland and Canada!) and will add to geopolitical uncertainty with a clear implication being an ongoing increase in defence spending (good for defence related shares). This is particularly likely to be the case in Europe and could help reinvigorate short term growth there, despite the obvious longer term negatives.

- Trump’s deregulatory focus continues to gather momentum with Trump signing an executive order to bring independent regulatory agencies (like the Fed with respect its regulatory responsibilities, the Securities Exchange Commission and the Federal Communications Commission) under his control meaning all regulations will be reviewed by the White House.

- Progress towards resolving Trump’s tax and fiscal agenda in Congress is slow. DOGE won’t find enough spending cuts to offset the cost of extending the 2017 tax cuts and enacting more tax cuts without cutting into things like Medicaid. This is creating pushback from some House Republicans and there is a high risk of a Government shutdown on 14 March when government funding runs out. Fortunately, shutdowns tend not have major economic or market consequences. The bigger threat is the debt ceiling, but it won’t be reached till the September quarter.

The good news is that we got a break from formal new tariff announcements over the last week…but they are still coming with Trump reiterating that he will likely impose tariffs on cars, semi-conductors and pharmaceuticals with this likely to be around 25% and a formal announcement likely soon after his trade policy reviews are complete by 1 April. This will also be when other tariffs will be announced including around “reciprocal tariffs.” As with steel and aluminium and potentially reciprocal tariffs, Australia is also likely to be caught up. Last year we exported about $2.1bn of pharmaceuticals to the US, bigger than the $800m of steel and aluminium. But as with the latter the case for an exemption is high because the US has a trade surplus with Australia. But an exemption is not assured. Its worth reiterating though that steel, aluminium and pharmaceuticals exports to the US are only a small proportion of the Australian economy at just 0.11% of GDP and the bigger threat to Australia from Tariff Man comes from the indirect effect of a global trade war with the US leading to the less demand for our exports.

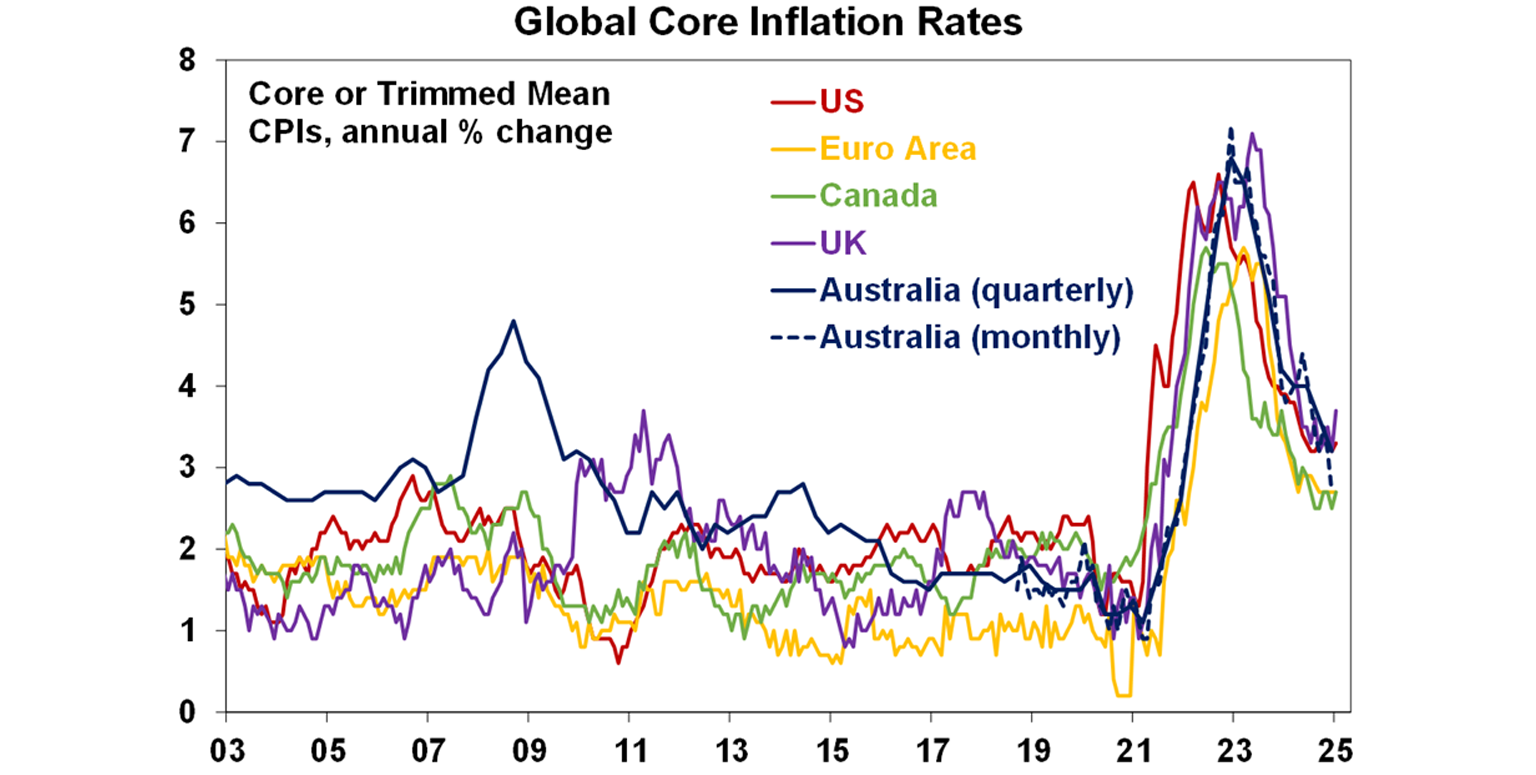

On the global inflation and interest rate front increases in core inflation in the UK and Canada will see their central banks take a cautious approach to further rate cuts although they are both expected to cut further. And the minutes from the last Fed meeting reiterated its wait and see approach to further monetary easing given increased uncertainty as it awaits a resumption of falling inflation before easing again. That said a positive for shares is that the Fed is discussing an end to quantitative tightening – which would remove a form of monetary tightening.

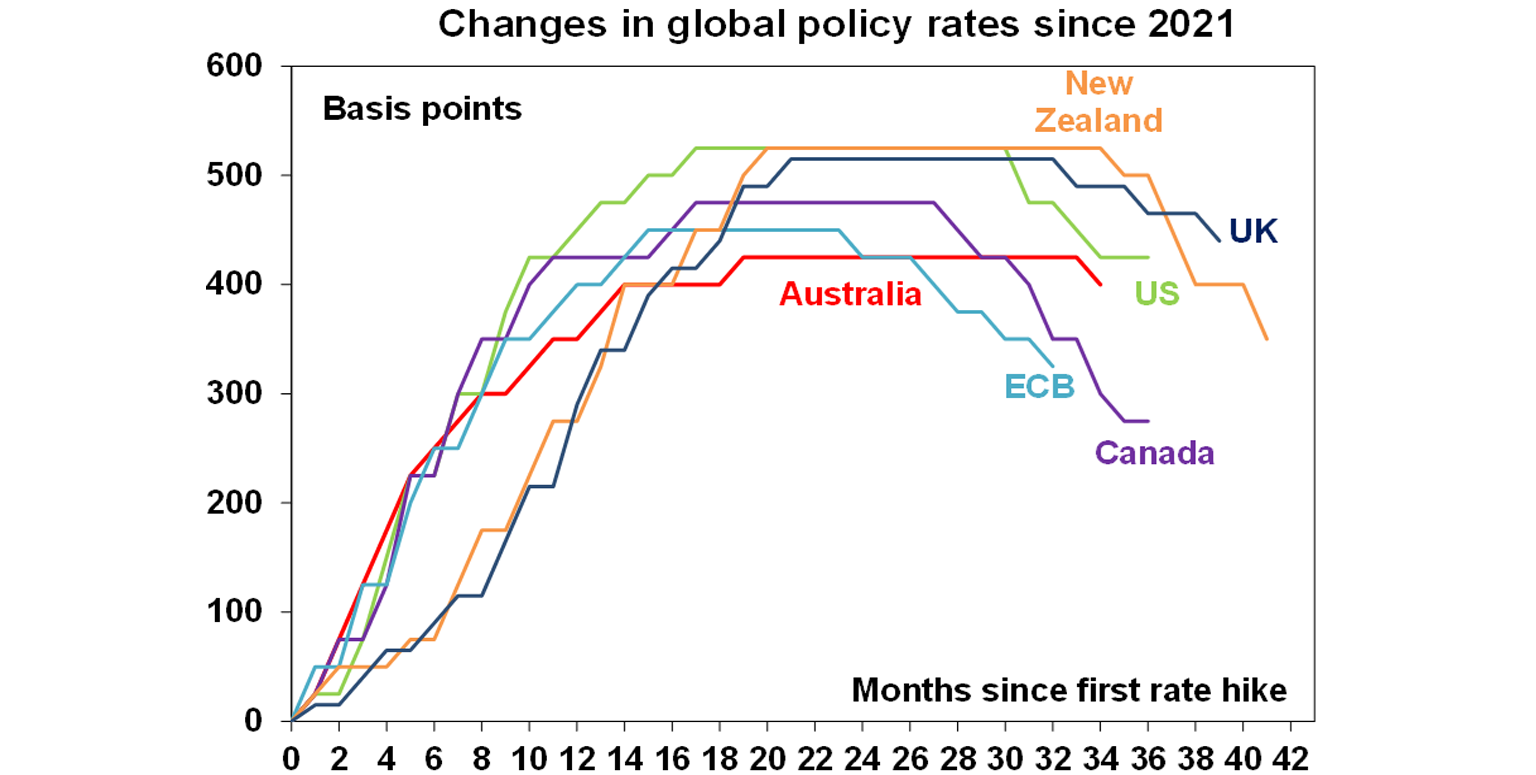

However, in our view the easing was justified economically, RBA caution is overdone and further easing is likely this year.

- First, the easing was justified economically by the faster than expected fall in trimmed mean inflation – this is what caused the consensus of economists to bring forward their expectation for the first rate cut from May to February and that had nothing to do with politics! And the RBA looks at the same data as economists. RBA Deputy Governor Hauser also noted that if they didn’t cut their modelling showed inflation falling below 2.5% next year.

- Second, monetary policy is still tight with the rate cut reversing only one of 13 hikes and the RBA revising down its estimate of the “neutral” cash rate to around 3% (based on an average of the models it uses to estimate this) from around 3.5%, leaving it well below the now 4.1% cash rate. So monetary policy is now even tighter than the RBA previously assumed and is still acting to constrain growth and inflation.

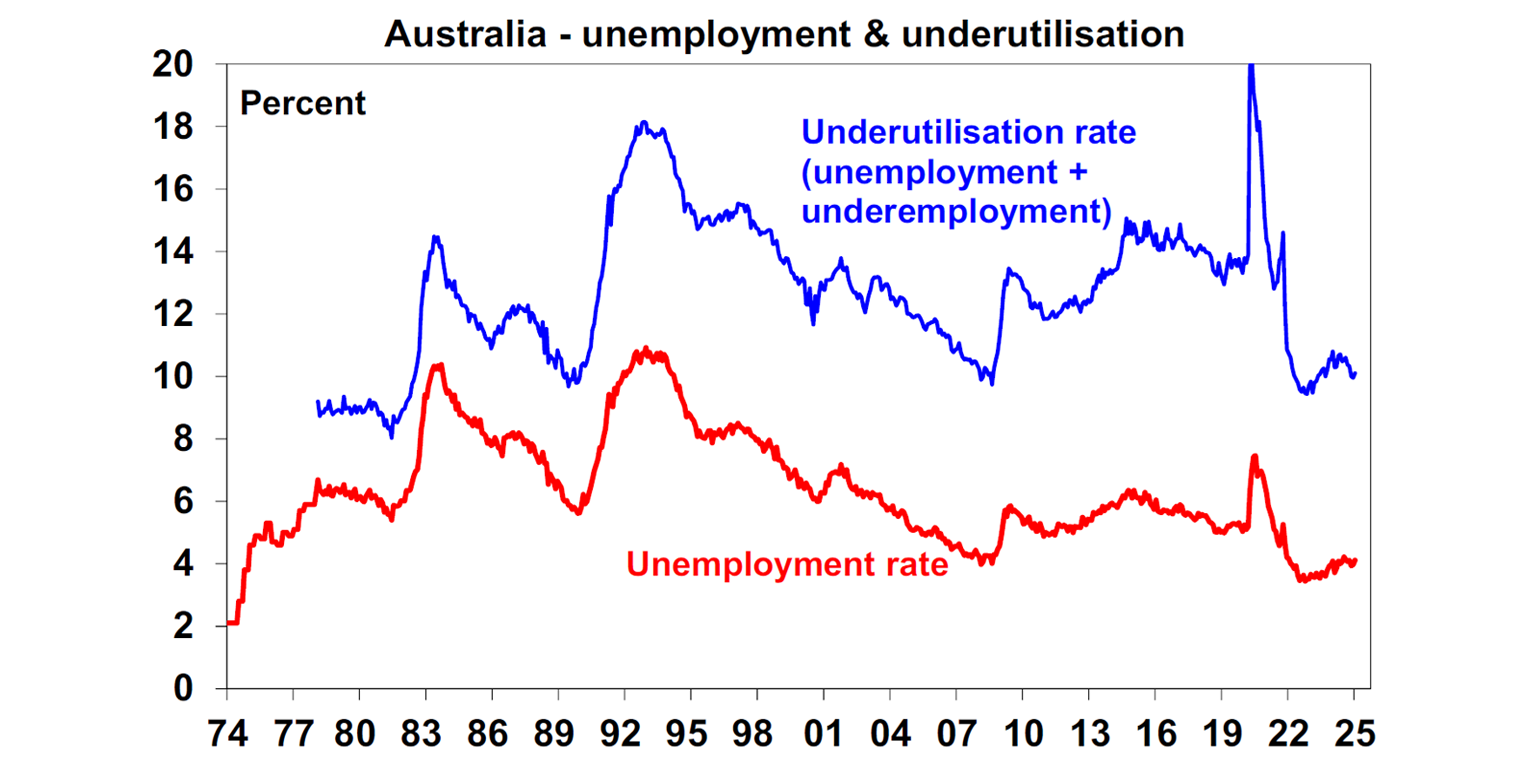

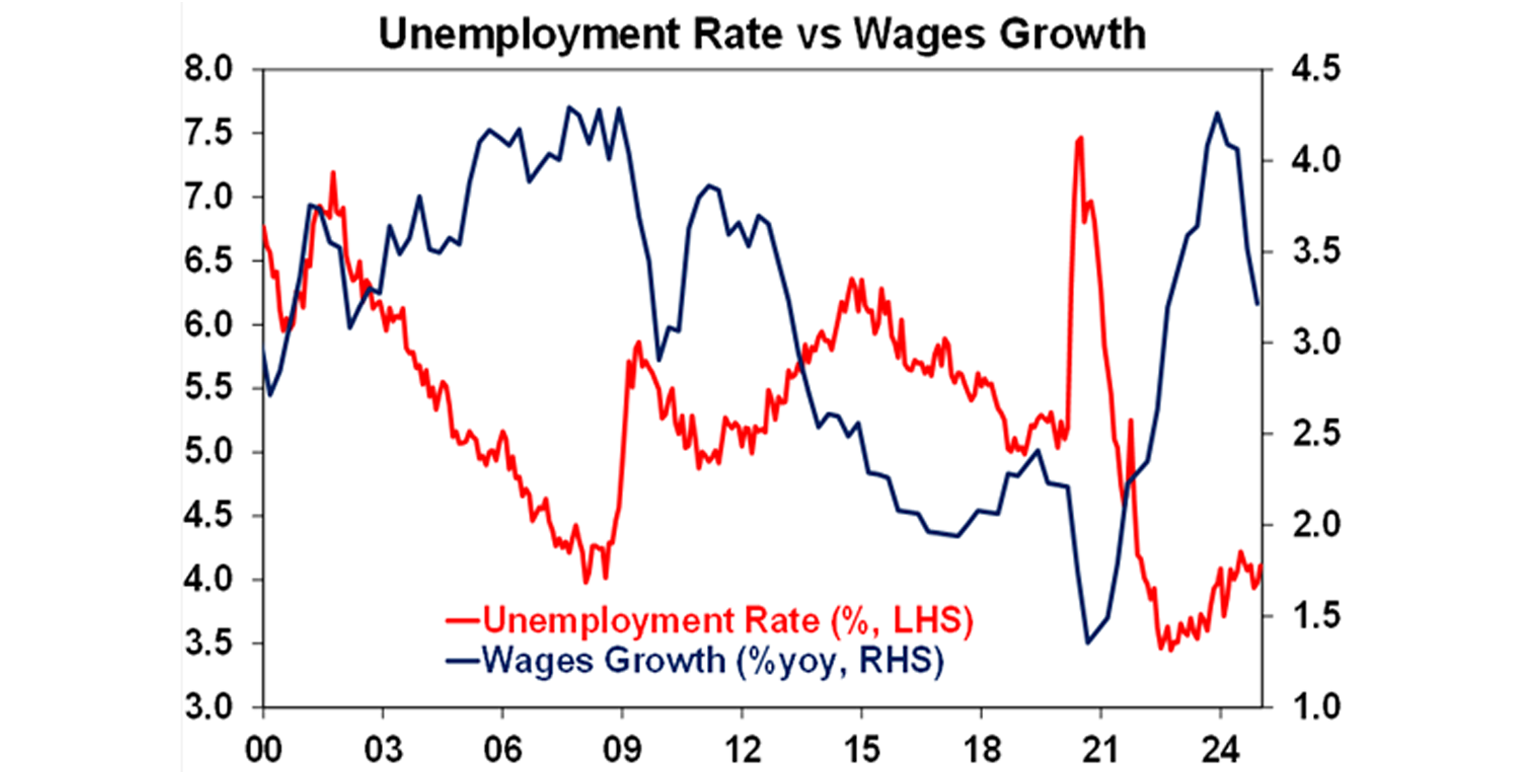

- Third, while unemployment around 4% is low compared to the experience of recent decades its not generating the faster wages growth that would be suggested if the economy were really operating above full employment. In fact, wages growth has slowed to 3.2%yoy, suggesting that the non-accelerating inflation rate of unemployment (NAIRU) is actually lower than the 4.5% the RBA is assuming. While its assessment is that there is not yet a “compelling case” to conclude this, its forecasts that see wages growth fall further to 3.1%yoy despite it now seeing unemployment stay below 4.5% suggests that it is allowing for this.

- Fourth, the upwards revision to its 2026 trimmed mean inflation forecast was just 0.1% leaving it just 0.2% above the mid-point of the inflation target, which is less than the normal forecasting error and hardly enough to get too excited about.

- Finally, Governor Bullock’s comment that the RBA “didn’t want to be late” in cutting rates after its 2022 experience in being slow to raise them also offers a bit of an offset to its cautiousness on further cuts.

So, our base case remains for 0.25% rate cuts in May and August with one more cut early next year taking the cash rate to 3.35%. Underpinning this we see growth this year coming in slightly slower than the RBA is allowing and so trimmed mean inflation doing the same. A cut in April is possible but its doubtful there will be enough data by then to further increase the RBA’s confidence that inflation is falling sustainably to target. The money market is pricing in just less than two cuts by year end.

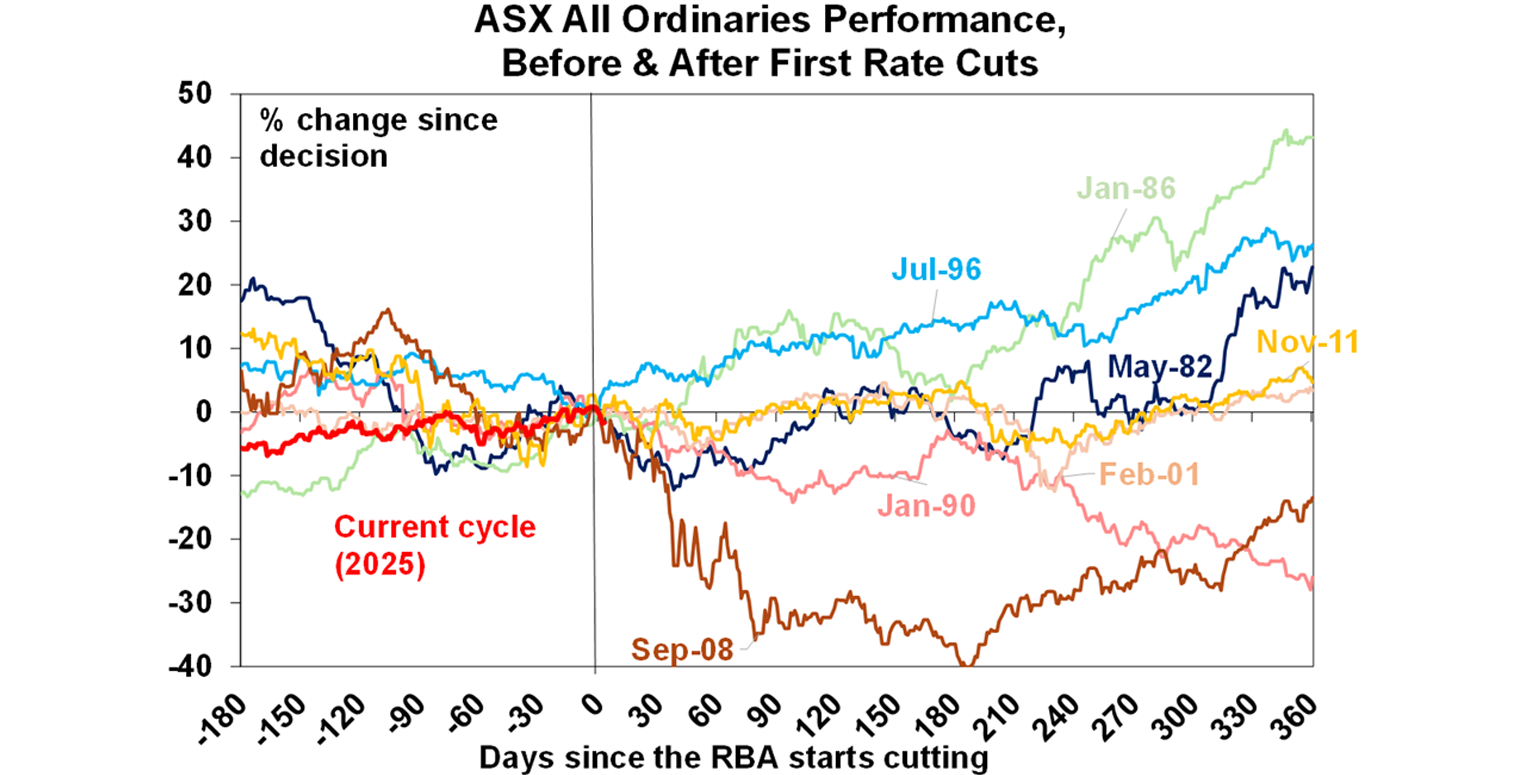

Finally, for the Australian share market the historical experience tells us that the start of an easing cycle can be good news – providing there is no recession in Australia or the US (as occurred in the GFC).

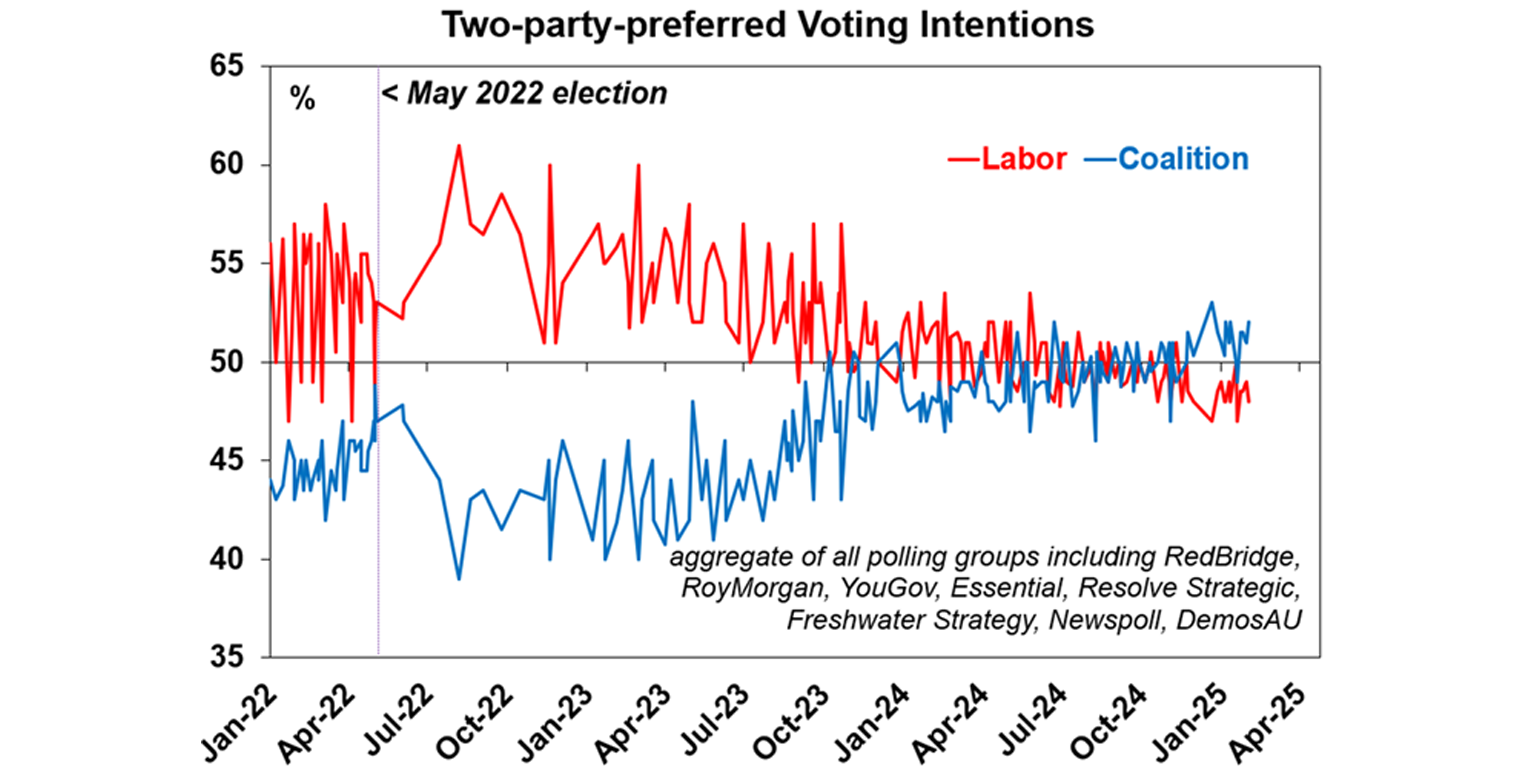

The big question now is whether the Labor Government takes advantage of the rate cut hoping to get a poll boost and call an early election for late March or early April. Labor is currently trailing in two party preferred polling averages. Historically there is some evidence that Australian shares track sideways in the run up to elections and then see a relief rally once its over. However, there is a wide variability around this with recessions and global events sometimes dominating (like after elections in 1987, 2007 and 2022).

Major global economic events and implications

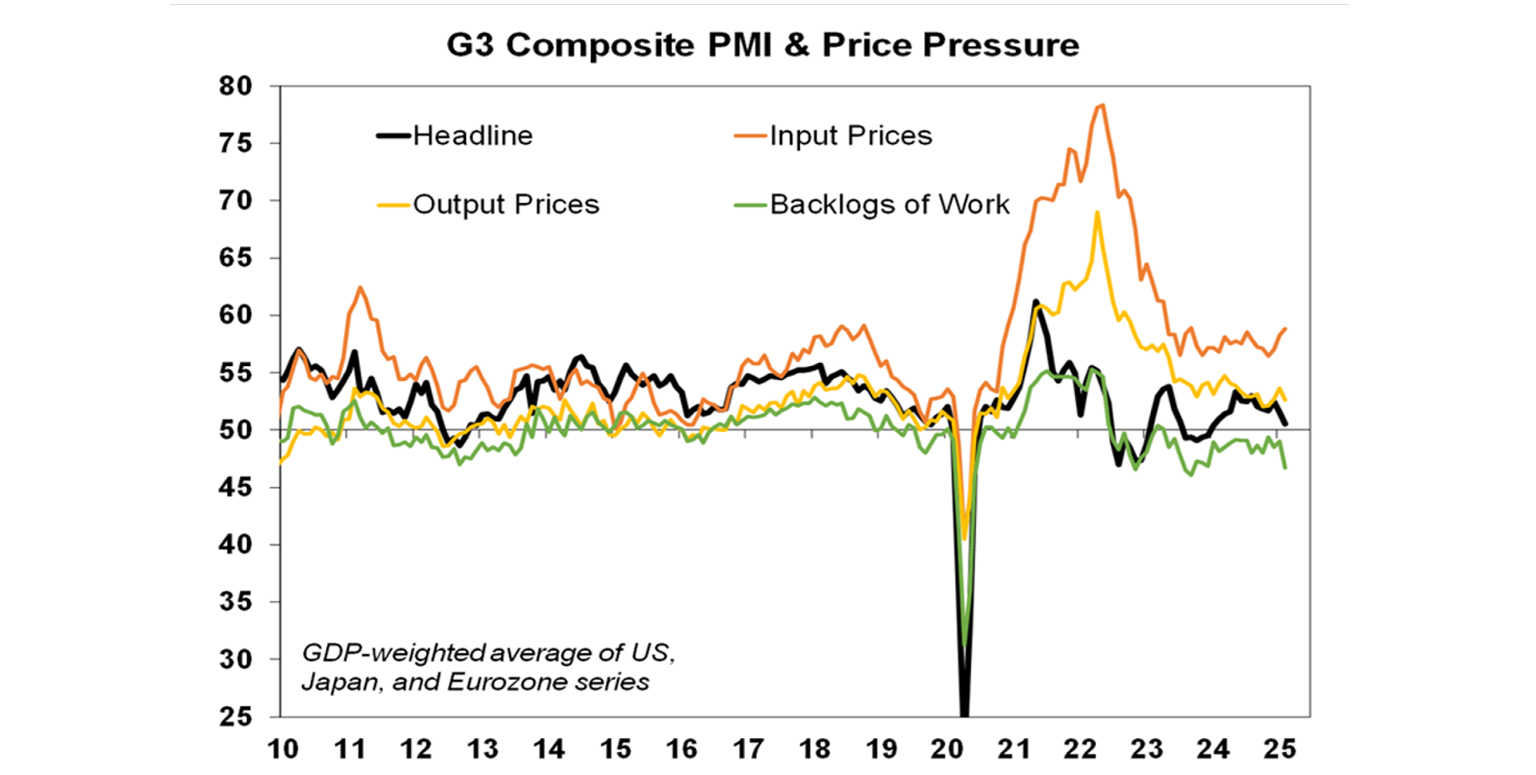

Aggregated business conditions PMIs in developed countries for February fell again driven by the US with conditions flat in Europe but up in Japan. There was also a narrowing in the divergence between manufacturing, which has improved, and services, which has weakened. Unfortunately input prices rose a bit further, but output prices slowed.

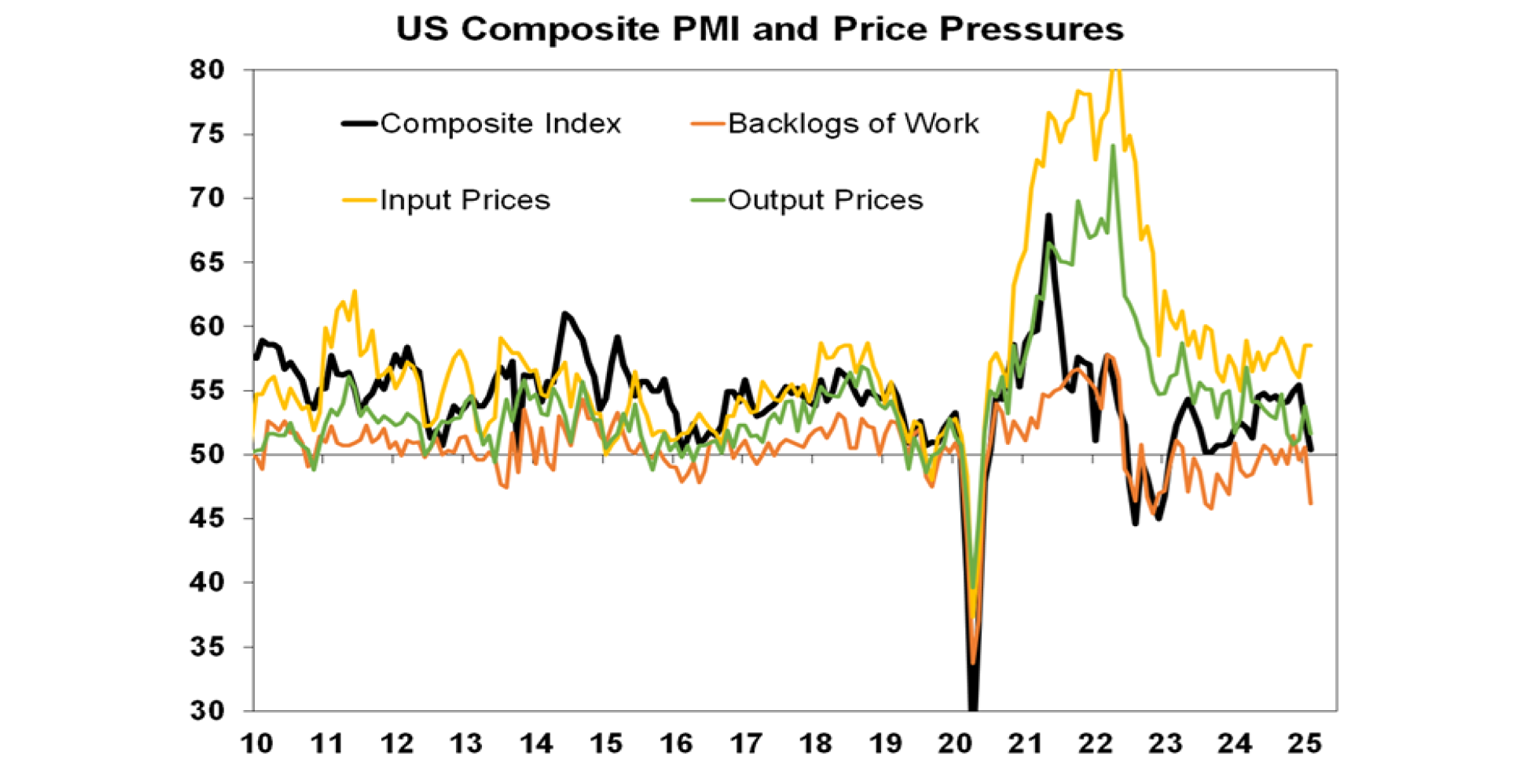

The US composite PMI fell sharply in February to 50.4, which is less than Australia’s at 51.2! The fall as driven by a sharp fall in services conditions with respondents citing uncertainty around Federal spending cuts and policy impacts on inflation. Manufacturing input prices rose reflecting tariffs. Weaker growth and higher prices flowing from Trump’s policies are not a good combination.

US economic data was messy providing more evidence of Trump’s policies having an adverse impact. Manufacturing conditions in the New York and Philadelphia regions are continuing to trend up but price pressures are rising again on the back of tariffs. Housing starts fell and home builder conditions remain weak not helped by higher mortgage rates and concerns about the impact of tariffs on building materials. Consumer sentiment fell again according to the University of Michigan survey which also showed a rise in 5 year ahead inflation expectations to their highest since 1995 on the back of concerns about tariffs. Rising inflation expectations will add to the Fed’s worries about the impact of tariffs. Initial unemployment claims rose, with Federal public service layoffs showing up, but remain low overall. The clear message is that Trump’s policy impacts are starting to show in weaker business conditions and consumer confidence and higher price expectations.

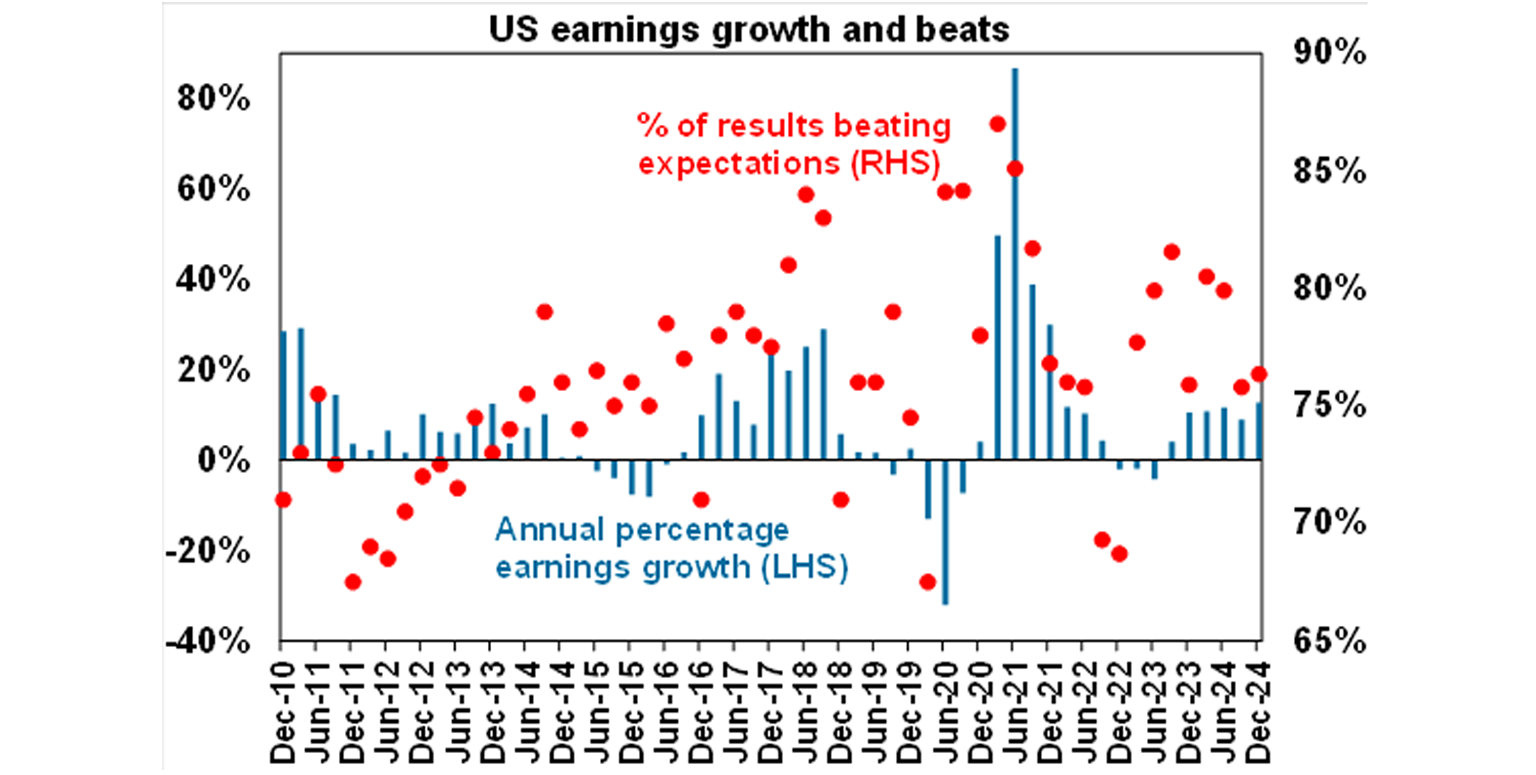

Around 86% of S&P 500 companies have now reported December quarter profit results and they are solid with 76.6% beatings earnings expectations against a norm of 76%. Consensus earnings growth expectations for the quarter have risen to 12.8%yoy, which is up from 8.4%yoy at the start of the reporting season. The only problem is that earnings expectations for this year as a whole are being revised down.

UK jobs growth continued in the December quarter with unemployment unchanged at 4.4%, wages growth remaining solid at 6%yoy and inflation ticking up in January all of which will keep the Bank of England cautious in cutting, although we still see further rate cuts this year. Some of the rise in inflation was due to budget tax & regulated price rises with underlying details softer.

Canadian inflation rose slightly to 1.9%yoy in January with core inflation slightly stronger than expected at 2.7%yoy, which leaves a Bank of Canada rate cut for March as a 50/50 proposition.

Japanese December quarter GDP came in stronger than expected at 0.7%qoq or 1.2%yoy, with firm final demand, consumption up slightly (rather than down as expected) and trade adding to growth. What’s more business conditions PMIs for February improved slightly. Meanwhile, inflation rose to 4%yoy in January due largely to higher food prices but with core inflation falling slightly to 1.5%yoy. Better growth will keep the Bank of Japan on track for more rate hikes, but benign core inflation will keep it gradual with the next hike unlikely until around mid-year.

The Reserve Bank of New Zealand cut its cash rate by 0.5% as widely expected taking it to 3.75%. With dovish guidance on the back of weak economic conditions and slowing inflation further easing is likely to take the cash rate to 3% or a bit lower this year.

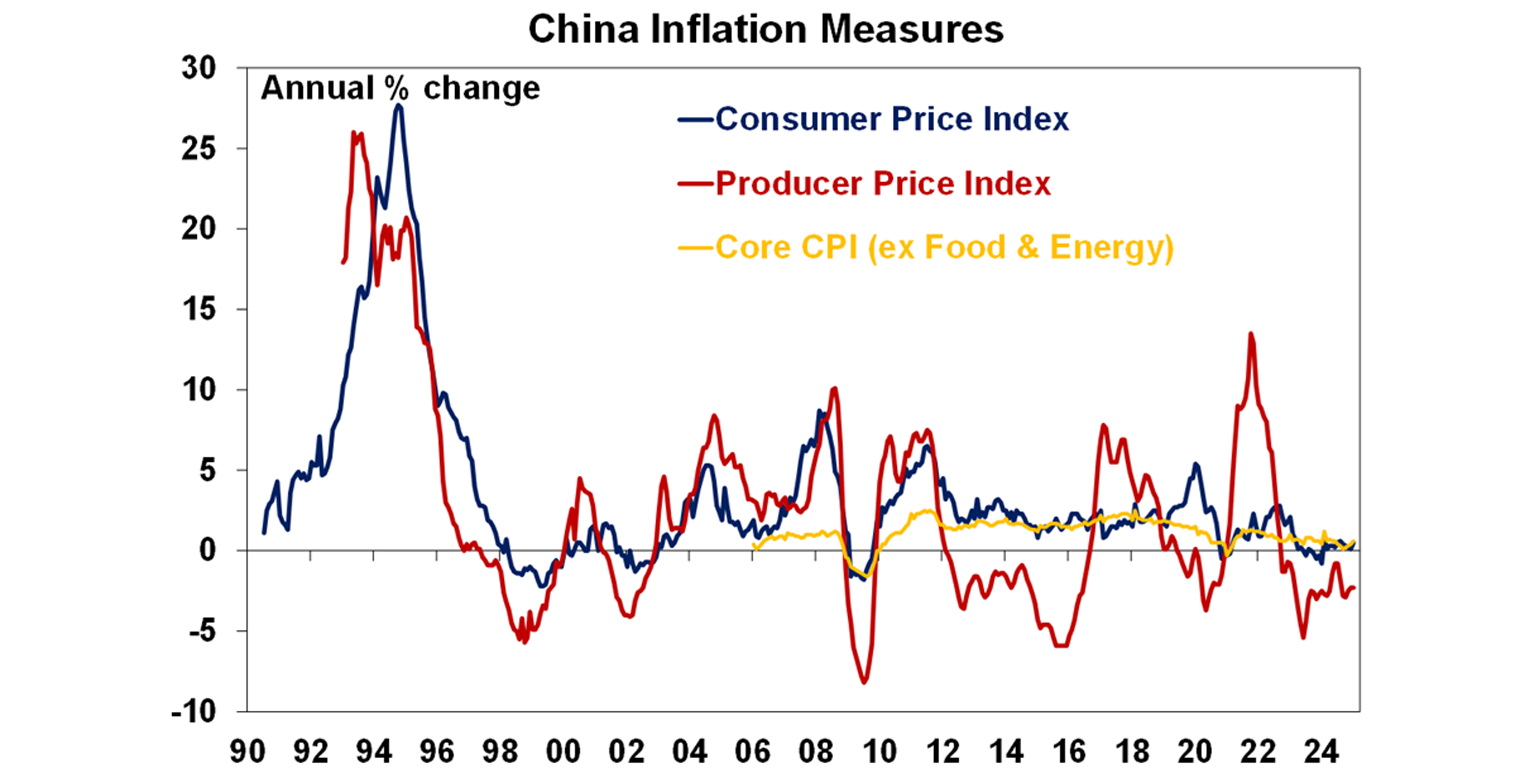

Chinese new property prices fell again in January but the rate of decline has slowed to a crawl. The worst could be over.

Australian economic events and implications

Another mostly strong jobs report for January. Employment rose again by a stronger than expected 44,000, underemployment remained around its 2022 lows and the participation rate and share of population in employment rose to new highs. There was a fall in hours worked and unemployment rose but only to 4.1%.

However, while unemployment and most other labour market indicators when compared to the experience of the last two decades suggest that the labour market is strong, this may not actually be the case as: strong public sector jobs growth has kept overall employment strong whereas private sector employment growth has been more in line with the slump in GDP growth; the surge in immigration and hence population growth has helped fill the new public sector jobs without requiring a surge in wages; low hiring and voluntary job switching suggest less competition for workers; and private employers facing tough economic conditions have not been able to afford pay significantly higher wages.

Consistent with this wages growth has slowed rather than accelerated as might be expected if the labour market were really tight. This was confirmed with December quarter wages data showing a further slowing in wages growth to just 0.65%qoq (its lowest in nearly three years) or 3.2%yoy, which is down from a peak of 4.2%yoy a year ago. In other words, “full employment” or the ”non-accelerating inflation rate of unemployment” (NAIRU) is maybe around 4% and not the 4.5% that the RBA is assuming.

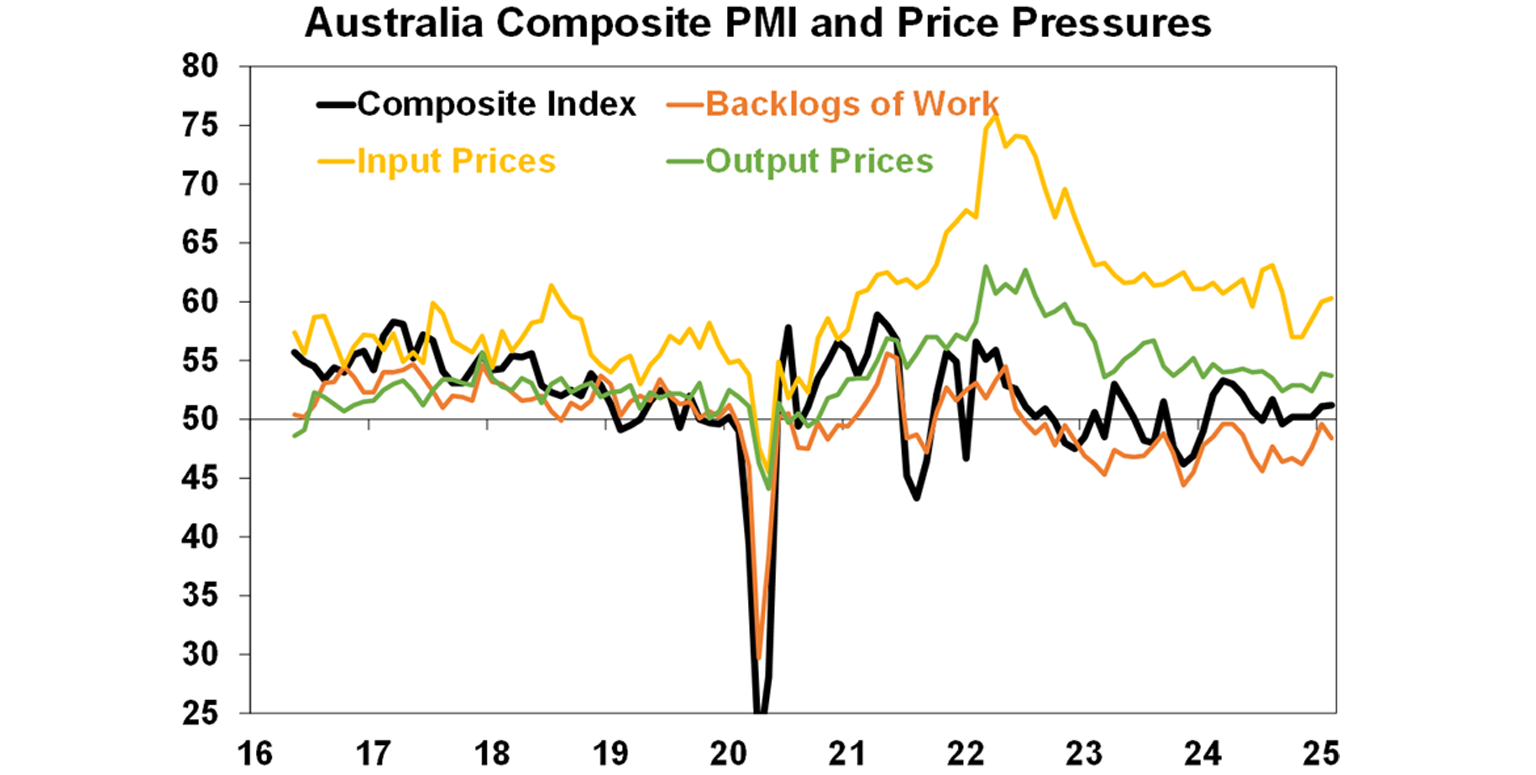

Australian business conditions PMIs for February rose slightly but remain soft. Employment and new orders both improved. Input prices rose driven by services, but output prices fell slightly.

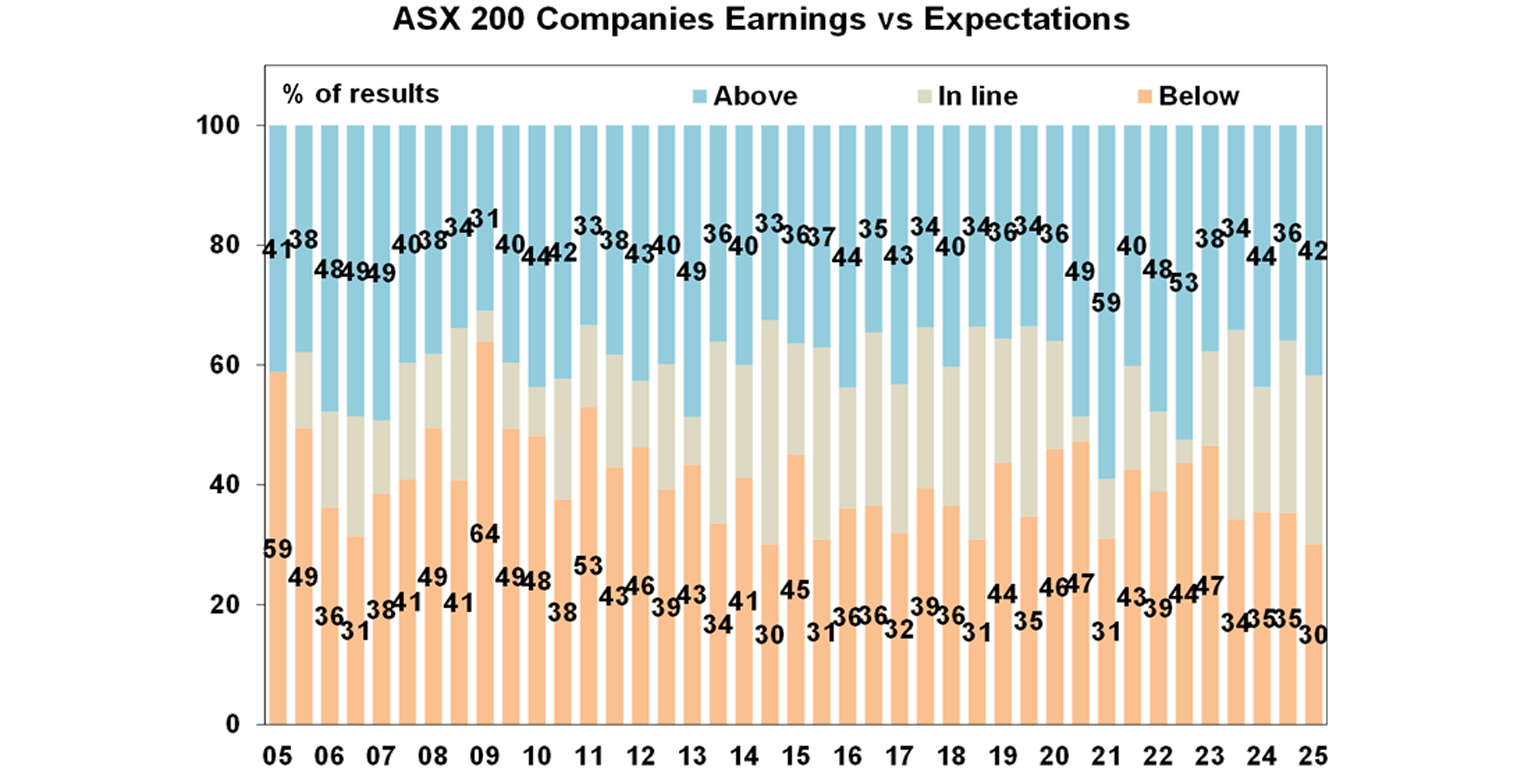

Nearly 70% of major Australian companies have now reported December half earnings – bad news from the banks and resources companies but most companies are doing better. While the reporting season started off strongly as is often the case, results over the last week were softer with disappointing bank results and falling earnings and dividend cuts from resources companies. Of course, with the market priced for perfection, and financials dominating in the ASX 200 its taken a hit as they disappointed. We have also been seeing a further increase in share price volatility around results with company share prices moving more than 9% on average on reporting day. UBS suggests this may be due to increasingly stale earnings estimates going into reporting day resulting in bigger surprises up and down. Rich valuations are likely also playing a role. However, despite the bad news from the banks and resources, most companies appear to be doing better.

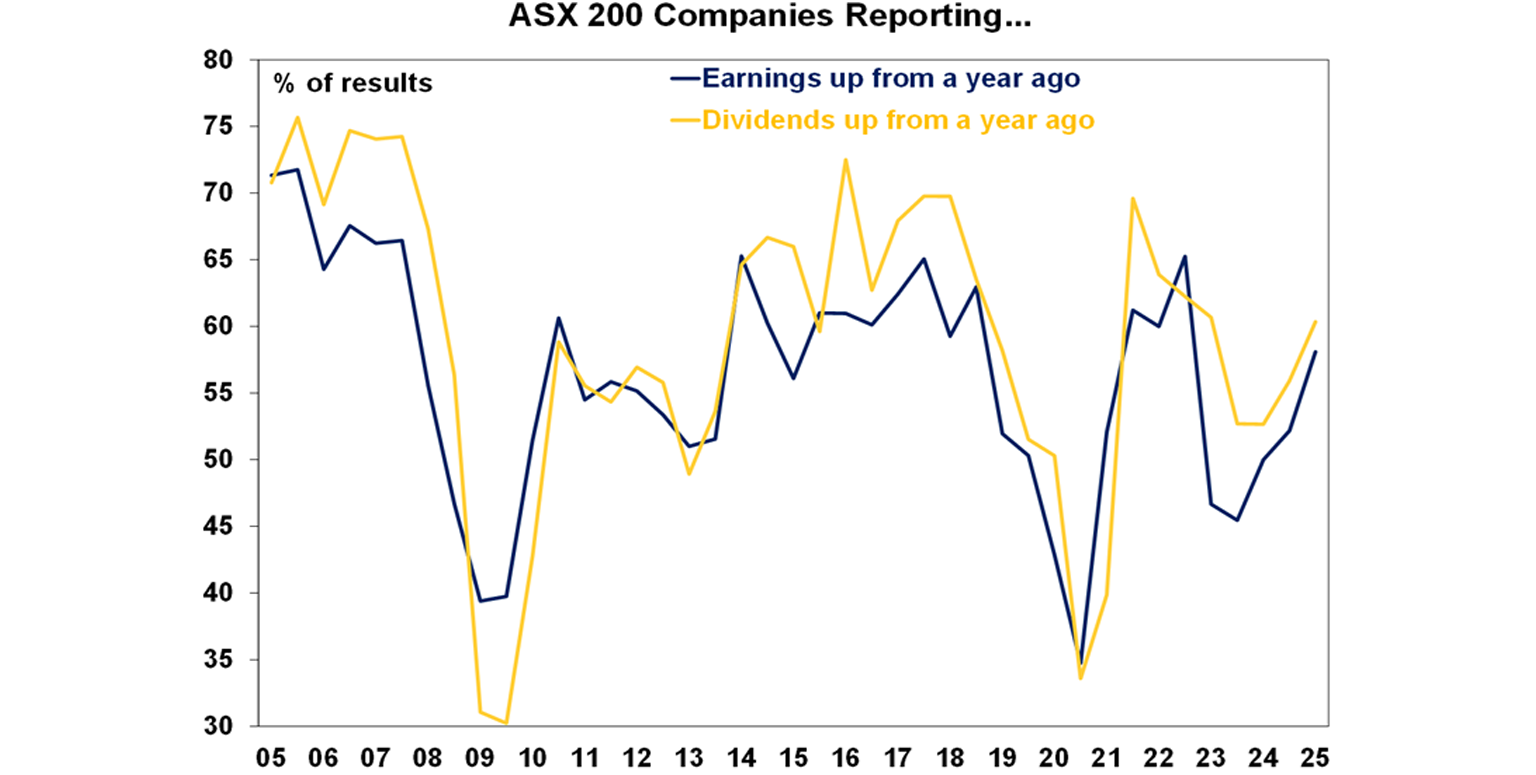

- Beats are still running above misses with 42% of results surprising consensus earnings expectations on the upside, which is just above the norm of 40%, versus 30% surprising on the downside which is less than the norm of 41%.

- 58% of companies have seen earnings rise on a year ago, slightly above the norm of 56%. But it’s better than in 2023 and highlights while there may have been some bad news from banks and resources most companies are seeing improvement.

- 60% of companies have increased their dividends on a year ago which is in line with the norm, but also up from its recent low.

What to watch over the week ahead?

In the US, the focus is likely to be on core private final consumption deflator inflation data for January (Friday) which is likely to come in at an okay 0.26%mom with the annual rate dropping to 2.5%yoy. In other words far better than the earlier reported rise in the core CPI. In other data expect continuing moderate growth in home prices but a fall in consumer confidence (both Tuesday) and a continuing modestly rising trend in underlying capital goods orders (Thursday). The US earnings reporting season will start to wrap up with Nvidia reporting.

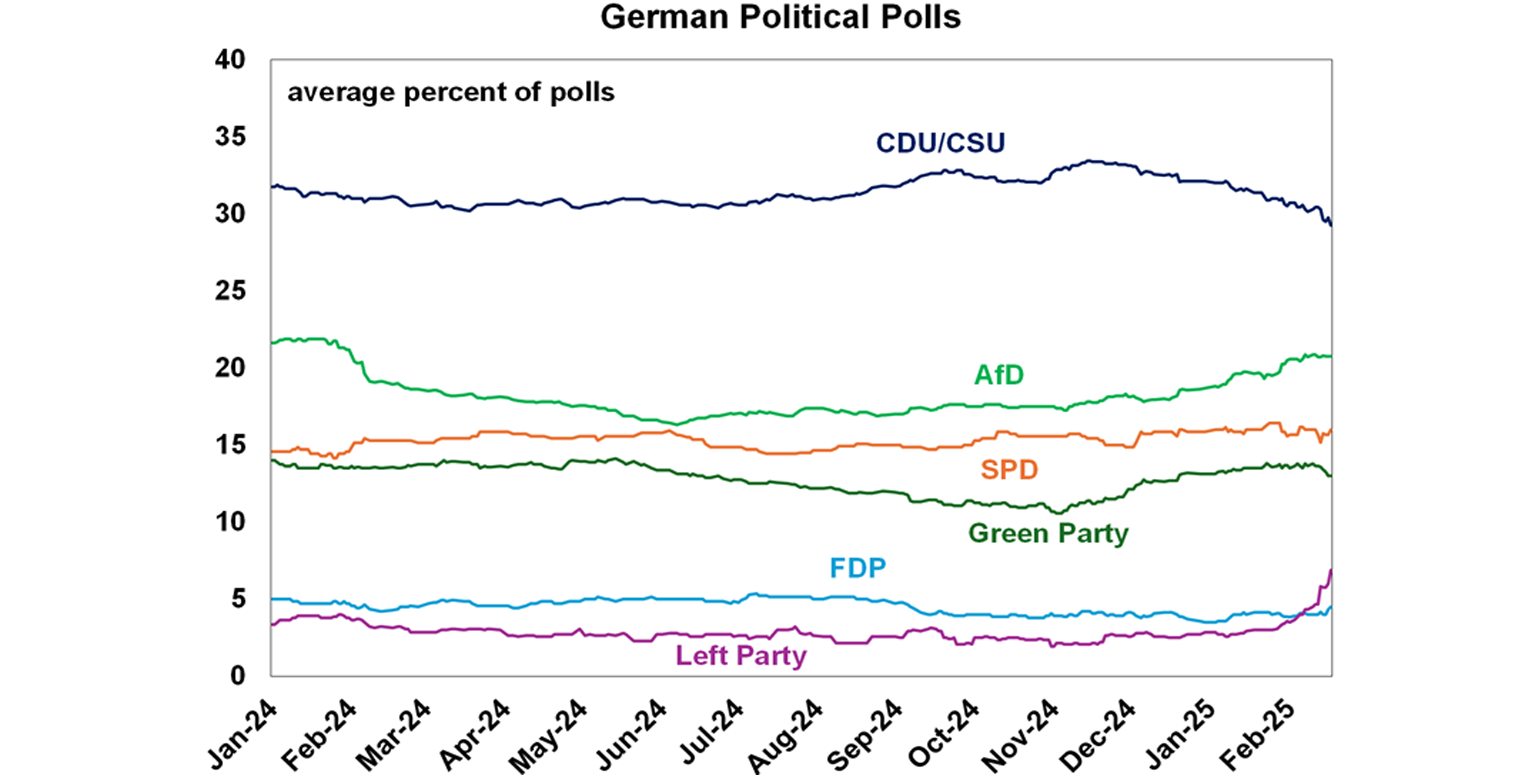

The German election on Sunday will likely see a rightward shift highlighted by increasing support for the far right AfD with 21% support in polls, but the centre right CDU/CSU are ultimately likely to lead a coalition Government with the centre left SPD and other parties. This is likely to see increased defence spending.

In Australia, January monthly CPI data (Wednesday) is likely to rise to 2.8%yoy as the energy rebates continue to roll off with trimmed mean inflation also rising slightly to 2.8%yoy from 2.7%. December quarter construction data (Wednesday) is expected to show a 1.7%qoq gain and business investment data (Thursday) is expected to rise 0.9%qoq. Private sector credit growth will be released Friday. The profit reporting season will wrap up with 55 major companies reporting including Sims (Tuesday), Woolworths and Worley (Wednesday), Qantas (Thursday) and TPG (Friday).

Outlook for investment markets in 2025

After the double digit returns of 2023 and 2024, global and Australian shares are expected to return a far more constrained 7% in the year ahead. Stretched valuations, the ongoing risk of recession, the risk of a global trade war and ongoing geopolitical issues will likely make for a volatile ride with a 15% plus correction somewhere along the way highly likely. But central banks, including the RBA, still cutting rates, prospects for stronger growth later in the year supporting profits, and Trump’s policies ultimately supporting US shares, should still mean okay investment returns.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows to target, and central banks cut rates.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices may still see a bit more softness in the very short term but are then likely to start to see a boost from lower interest rates. We see home prices rising around 3% in 2025.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between changing perceptions as to how much the Fed will cut relative to the RBA, the negative impact of US tariffs and a potential global trade war and the potential positive of more decisive stimulus in China. This could leave it stuck between $US0.60 and $US0.70, but with the risk skewed to the downside if Trump ramps up tariffs more than expected.

Important information

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.