Share markets had a roller coaster ride over the last week – first plunging on the back of ongoing worries about Trump’s tariffs before rebounding mid-week after Trump delayed some of the tariffs for 90 days before falling again as investors realised that the average US tariff would be higher than announced on 2nd April and as signs of stress in the US bond market remained. This left US shares up 5.7% for the week but Eurozone shares down 1.4%, Japanese shares down 0.6% and Chinese shares down 2.9%. The Australian share market fell 0.3% with falls led by resources, health and financial shares. From their closing highs to their recent closing lows US shares have had a fall of 19%, global shares 17%, Eurozone shares 15% and Australian shares 14%. Clearly the US has been bearing the brunt of it as Trump has put it into a trade war with the rest of the world whereas the rest of the world is only in a trade war with the US. And it’s been made worse in the US because of a gathering loss of investor confidence in its economic policies and its safe haven status. Reflecting the latter, bond yields rose sharply in the US and this flowed on to bond yields in other countries. Metal prices rose but oil and iron ore prices fell as did Bitcoin and the $US (which is now below its September low last year before Trump’s election prospects began to improve). Gold continues to be the main safe haven reaching a new record high. And even the $A rose thanks to the falling $US.

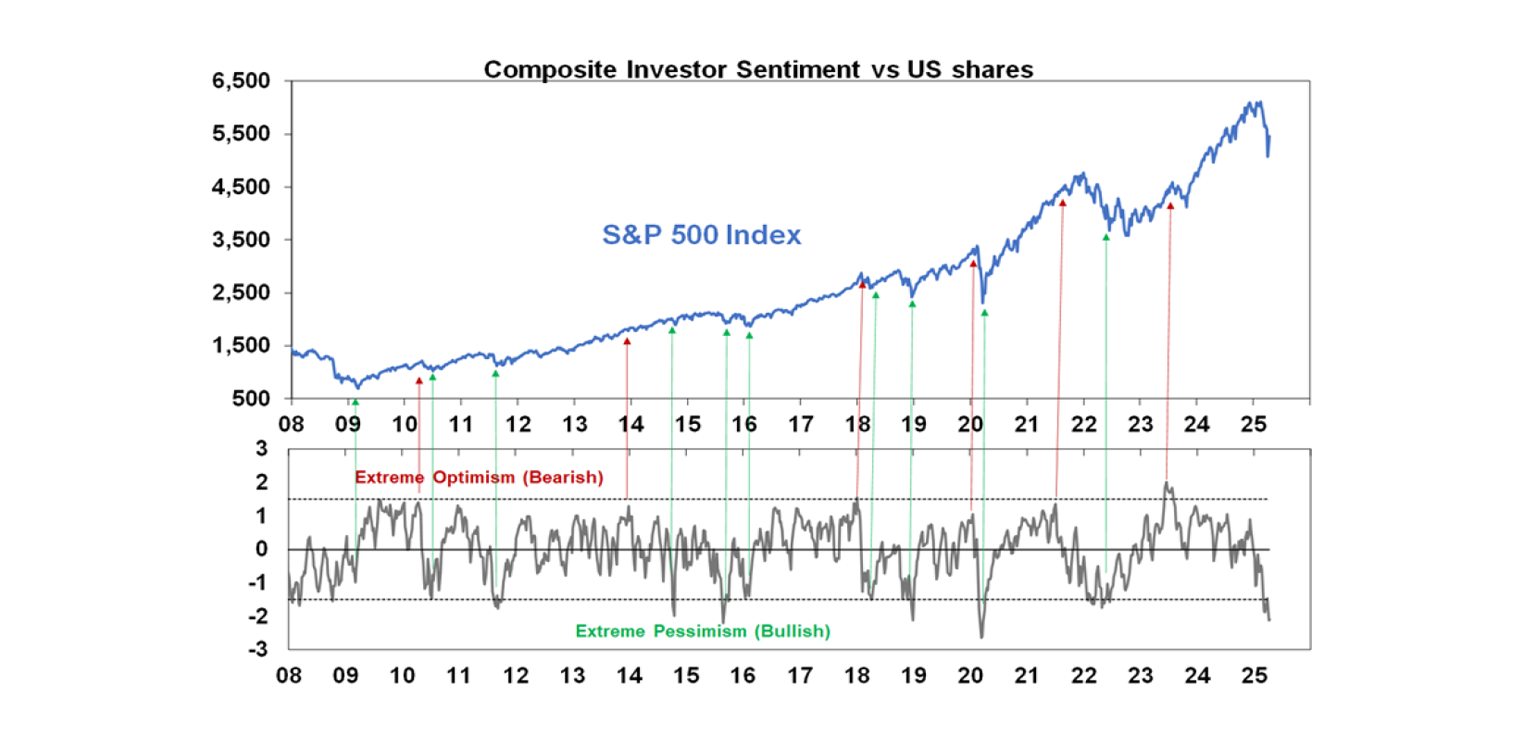

Trump blinks in the face of market stress as people were getting “a little bit yippy…afraid”. After weeks of increasing mayhem Trump blinked Wednesday and announced a partial backdown on his tariff plans by pausing all reciprocal tariffs at the 10% minimum for 90 days and dressed it up as a victory by announcing that more than 75 countries are “calling us up, kissing my …. dying to make a deal”. The reality of course is that Trump was getting nervous as shares were on the brink of a bear market, which headlines would blame on him, and most importantly the US bond market was (and still is!) showing increasing stress with a sharp back up in bond yields (0.5% in two days) driven by a loss of confidence in US Treasuries and US dollars as a safe haven, rumours of China and other countries selling bonds and hedge funds unwinding long cash Treasuries/short Treasury futures positions in the face of rising volatility. Rising bond yields make it harder for Trump to finance massive US debt and cut taxes at the same time and the sell off was (and still is) feeling a bit like the surge in UK gilts in the face of Liz Truss’ policies. Sure, the Fed could buy US bonds with another round of QE but it would hardly go along with that given its worries about inflation. So, Trump had to backdown. Adding to this pressure was arguably a loss of support from business leaders including Bill Ackman and Elon Musk calling Trump’s hardline trade adviser Peter Navaro a “moron” and pushback from Jamie Dimon. This came when shares were way oversold technically, around technical support from the 2023 break higher and when investor sentiment was super negative, so they were primed for a bounce on any good news – with US shares up 9.5% Wednesday and Australian shares up 4.5% Thursday on Trump’s backdown.

The good news is that Trump clearly has a pain threshold and that share and bond markets are still able to impose some constraints around his policies. We expect this to become more apparent in the second half of the year forcing Trump to back down further on tariffs and pivot towards the positive aspects of his agenda, ie tax cuts and deregulation, helping to support a more sustained recovery in share markets.

However, it’s way too early to say that we have seen the low in shares as there is a long way to go with the tariff battle, stress is continuing to build in US asset markets and much damage has already been done to the growth & profit outlook. In particular:

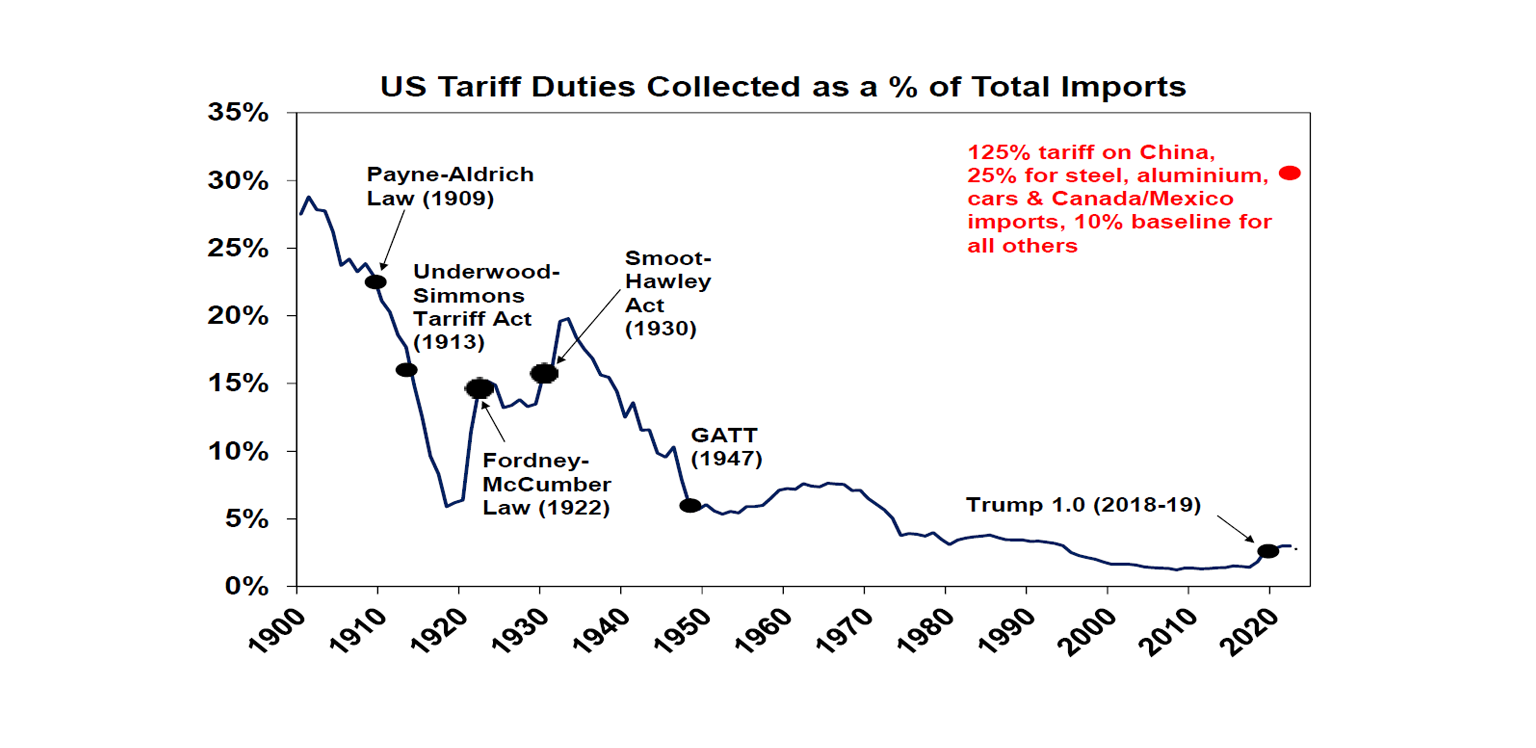

The average US tariff on imports is now around 30% (before allowing for any switching) which is higher than the 25% estimated after the 2nd April announcement and way up on 3% back in January because the tariff on imports from China (13% of US imports) is now 145%, other countries are now 10% and there are 25% tariffs on imports from Canada and Mexico and on steel cars and aluminium.

The pause is only for 90 days - while small countries may come to deals quickly, large countries like China, the EU, Canada and Mexico may be less inclined to give in to unreasonable US demands. And many countries may no longer trust Trump.

There is still no sign of any talks with China and the US/China tit for tat trade war has continued, with China raising its tariff on US imports to 125% after Trump raised the US tariff on imports from China to 145%. Fortunately, its said that it may not match further US tariff hikes but only because US goods are “no longer marketable in China”.

The huge reliance now on tariffs on China will likely diminish the revenue they will actually raise making it harder for Trump to pay for income tax cuts as the 145% tariff will lead to a sharp fall in imports from China over time. Reagan popularised the Laffer Curve and now Trump appears to be ignoring it!

Trump is vowing more sectoral tariffs eg on pharmaceuticals.

Because of his erratic announcements Trump has injected a permanent sense of unpredictability into US economic policy which will make it very hard for other countries and businesses to make decisions. Can Trump be trusted? Policy uncertainty is a key problem in economics.

Despite a brief reprieve on news of Trump’s backdown, US bond yields have resumed their rise and the $US has resumed its fall suggesting that Trump’s policy uncertainty is causing an ongoing loss of confidence in the US resulting in capital outflows. This is highly unusual in that US bonds and the $US normally rally in times of uncertainty. US exceptionalism may be coming to an end. While the Fed’s Susan Collins indicated that the Fed was prepared to help stabilise the bond market this does not appear imminent as she said the bond market is still functioning well with no liquidity concerns and its hard to see the Fed jumping in with QE given inflation worries.

The gyrations in US tariff policy of the last two months means that lots of damage has already been done to economic confidence which will be hard to quickly reverse and will flow through to spending, hiring and investment such that weaker hard economic data and profits ahead looks inevitable.

And big one day bounces like we saw in the last week are common in share market downturns as investors turn short and have to close positions when there is any good news. There were even bigger one day bounces in October and November 2008, but shares didn’t bottom in the GFC till March 2009. The key is to watch any re-rest of the lows.

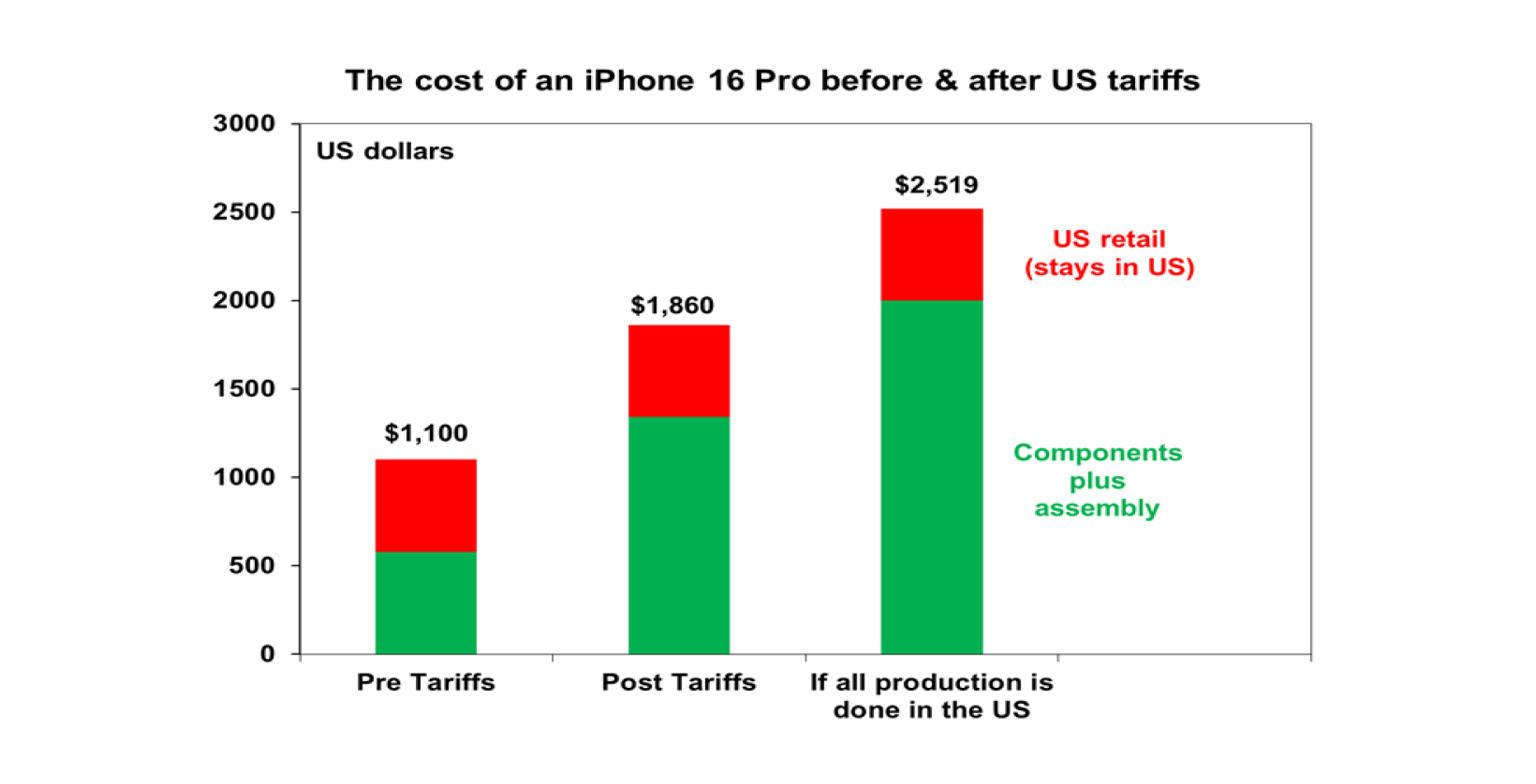

The disruption in the US can be illustrated with the Apple iPhone 16 Pro. It retails in the US for around $1100. But because its mostly assembled in China the 145% tariff will boost its imported price to $1340 from $580) and its retail price to $1860 if Apple maintains the same retail margin. If alternatively, production is fully moved to the US it will retail for around $2519 reflecting much higher wage rates in the US. So, either there is a squeeze on the Chinese price and Apple’s margin or US consumers will have to pay much more, with probably a bias to the last two. Which is bad for consumers and for Apple. Of course, more iPhone production could be moved out of China to say India but that will only annoy Trump and will take time anyway.

So given the ongoing policy chaos, hit to confidence and supply chains the risk of a US recession remains high at around 45%, Chinese growth looks likely to be closer to 4% than 5% (assuming extra policy stimulus offsetting the blow out tariffs) and global growth may be closer to 2% rather than the 3% we had been assuming pre all the tariff noise.

For Australia, the direct hit to our industries that have tariffs on them (including pharmaceuticals that likely soon will) will likely be a less than a 0.2% drag on GDP with maybe a 0.5% additional indirect impact flowing from weaker global growth and less demand for our exports. But while this may constrain growth, Australia is likely to avoid a recession in the absence of Trump continuously ramping up tariffs as: only 5% of our exports go the US; a lower $A is acting as a shock absorber to the hit from the tariffs – from Trump’s election win to its recent low it fell roughly 10% offsetting the tariffs; & there’s lots of scope for RBA rate cuts.

We continue to see the tariff shock as potentially adding to RBA rate cuts this year. Things have not become bad enough to justify an emergency RBA meeting as some have been calling for or make a 0.5% cut in May a base case. The local financial markets are functioning well and the banking system is well capitalised with no signs of unusual stress. In fact, an emergency meeting may just create a sense of panic, but we are of the view that the RBA will cut in May by 0.25% with maybe a 35% chance that it’s a 0.5% cut with several more rate cuts into early next year. While the $A recently fell to a five-year low, posing some upside risks to inflation this is likely to be minor in the face of the potential shock to growth and the diversion of some other countries exports from the US to Australia. The $A fell 39% in the GFC and 19% in the pandemic and yet the RBA still cut rates then because the threat to growth swamped any threat of higher inflation and the same will likely apply now.

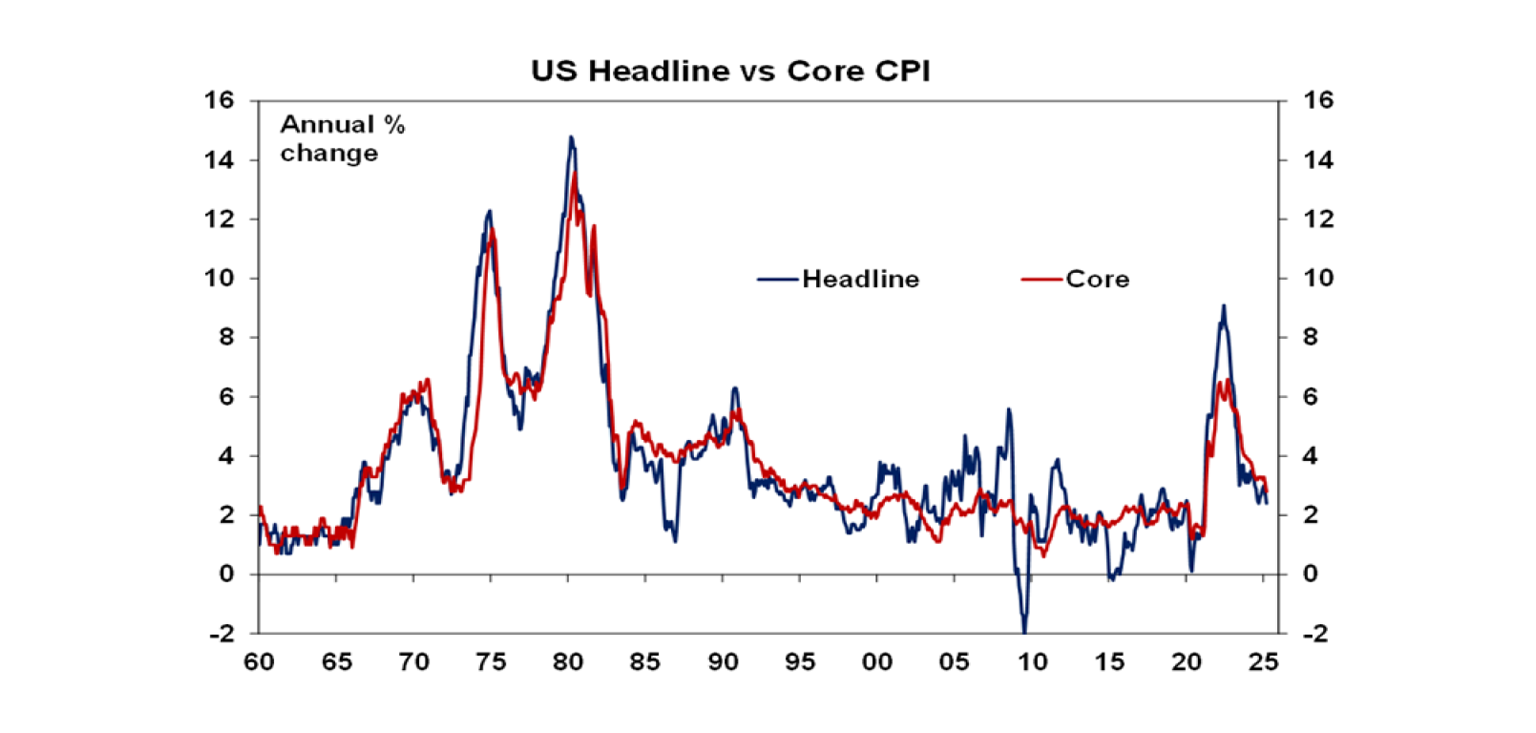

For the Fed, lower than expected March quarter inflation would normally have been good news, but the threat to inflation expectations from tariffs will keep it wary for now. Core CPI inflation was just rose again to 0.1%mom, with annual core CPI inflation falling to 2.8%yoy, its first time below 3% since 2021. Producer price inflation was also weaker than expected. This is good news and would normally be celebrated as it would set the Fed up for a quick resumption of rate cuts but the impact of the tariffs will start to show up in the months ahead and could add 1% or more to inflation and push up inflation expectations which will worry the Fed. In fact, the University of Michigan consumer survey for April showed a further rise in inflation expectations to levels not seen in more than 30 years. So the Fed is unlikely to rush into cutting rates. However, ultimately, we see the threat to growth dominating the boost to inflation and so see the Fed cutting from around mid-year with four rate cuts this year. In fact, falling discretionary services inflation may reflect consumers cutting back demand already.

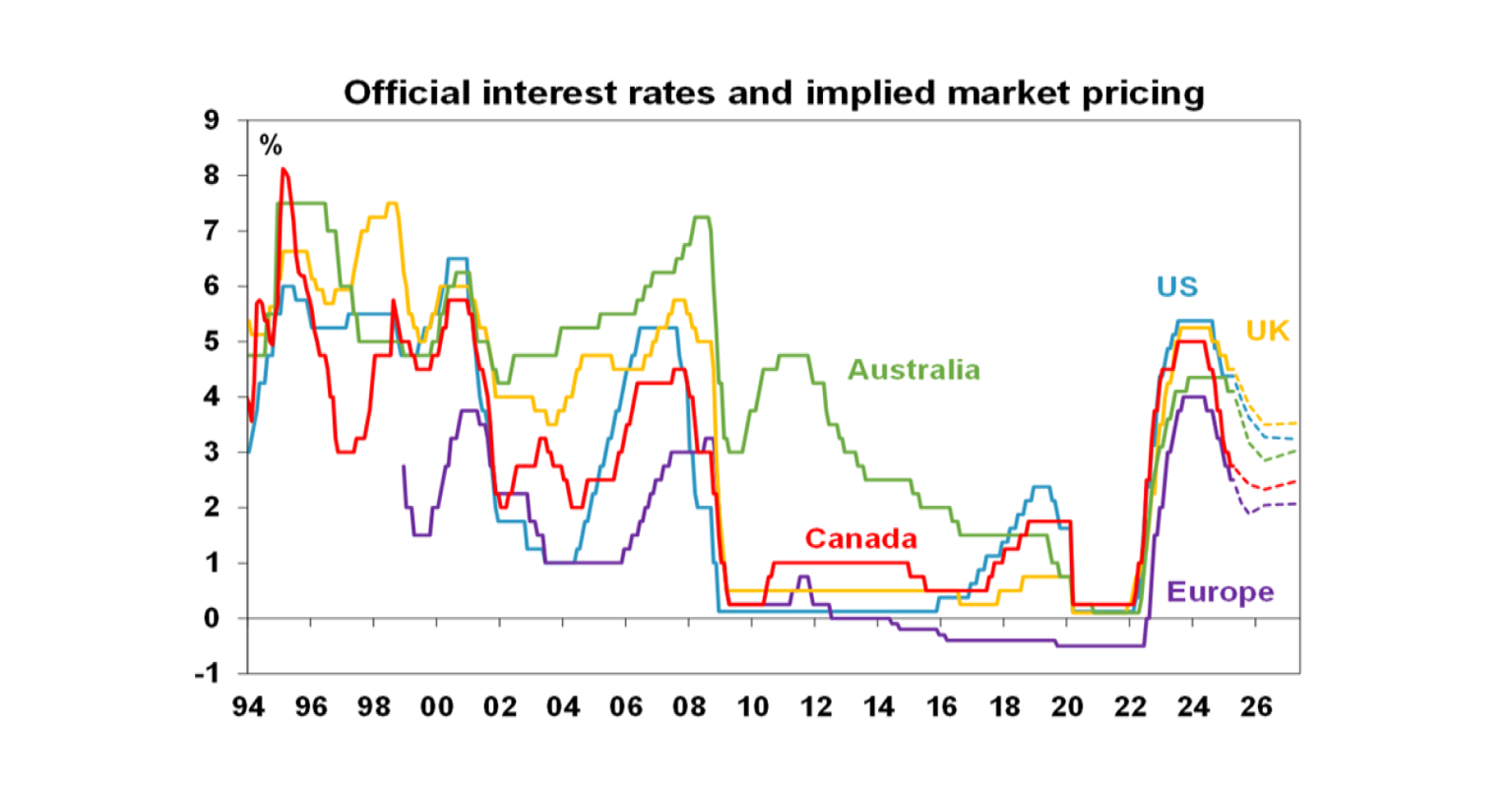

Money markets are continuing to allow for a significant further decline in official interest rates this year, including more than five 0.25% cuts in Australia.

Impact on Trump’s trade war on the Australian election. Trump’s trade war with the rest of the world and manic governing if anything appears to be strengthening support for incumbent governments in other countries. Canada is an obvious example but its also evident in Australia with the LNP arguably getting a boost from Trump into January which has now been fully reversed forcing a backdown from Trump inspired policies (like public servants having to fully return to working from the office). That said polling is still running around 50/50 with a slight lead to the ALP, which likely means they lose their majority and have to form a minority government. The broader issue from the Trump shock is that it further increases the pressure on Australia to do all it can to strengthen the economy in a medium-term sense by fundamental long term productivity enhancing reforms…but unfortunately there is still no sign of that.

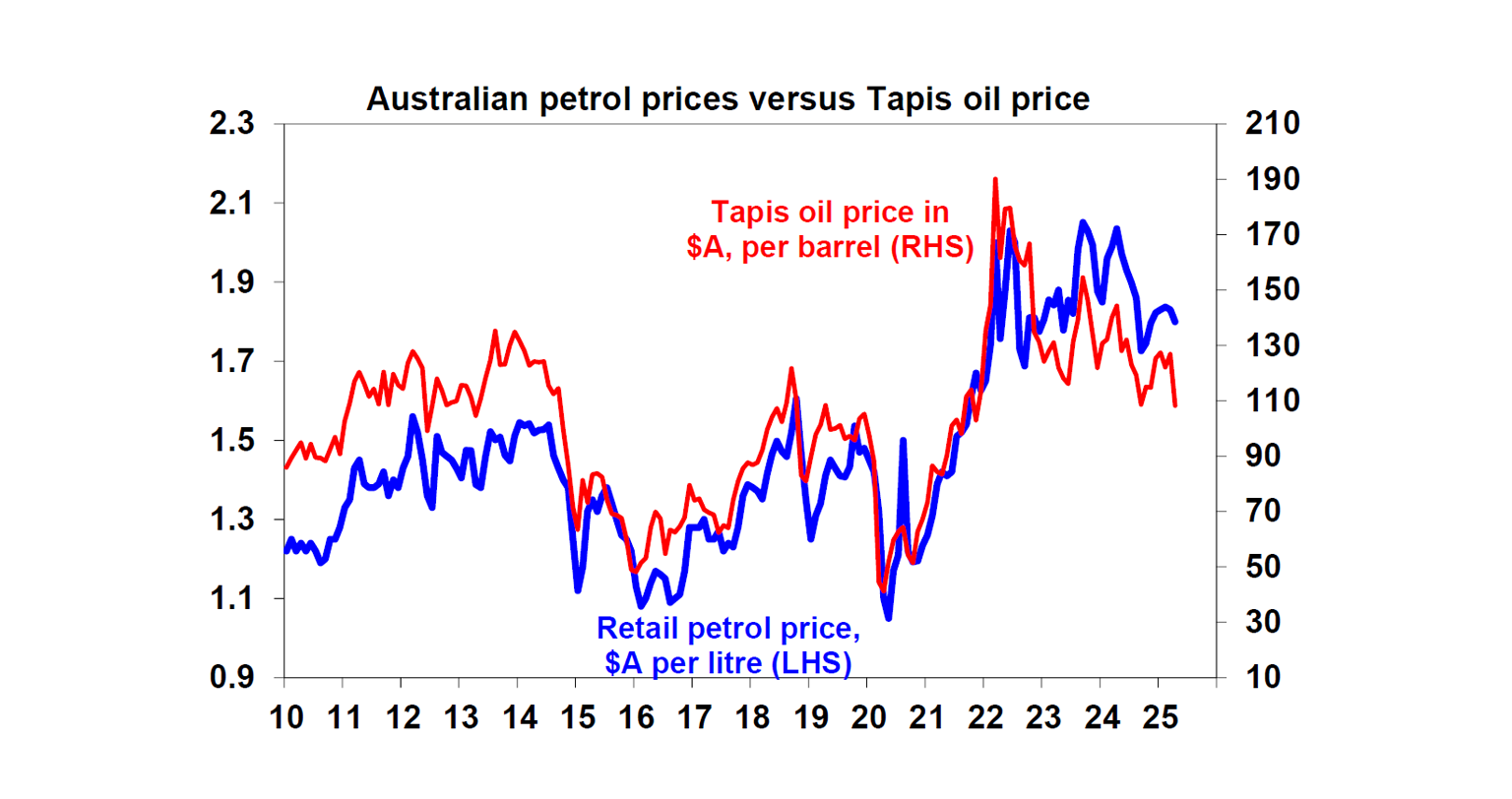

Some good news – lower petrol prices. The plunge in world oil prices even with the somewhat lower $A points to an up to 10 cents a litre fall in average petrol prices in Australia, across the normal discounting cycles in each city. So lower petrol prices and mortgage rates could be the silver lining to the Trump cloud.

But perhaps the highlight of the week was President Trump signing an executive order to protect “beautiful hair” by rolling back water flow pressure regulations in relation to shower heads. This was hot on the heals of an executive order the week before for US cultural institutions to remove “improper ideology.”

Major global economic events and implications

US economic data continues to highlight the negative impact of tariffs and policy uncertainty. Jobless claims remain low but small business confidence fell again in March and consumer sentiment fell again in April.

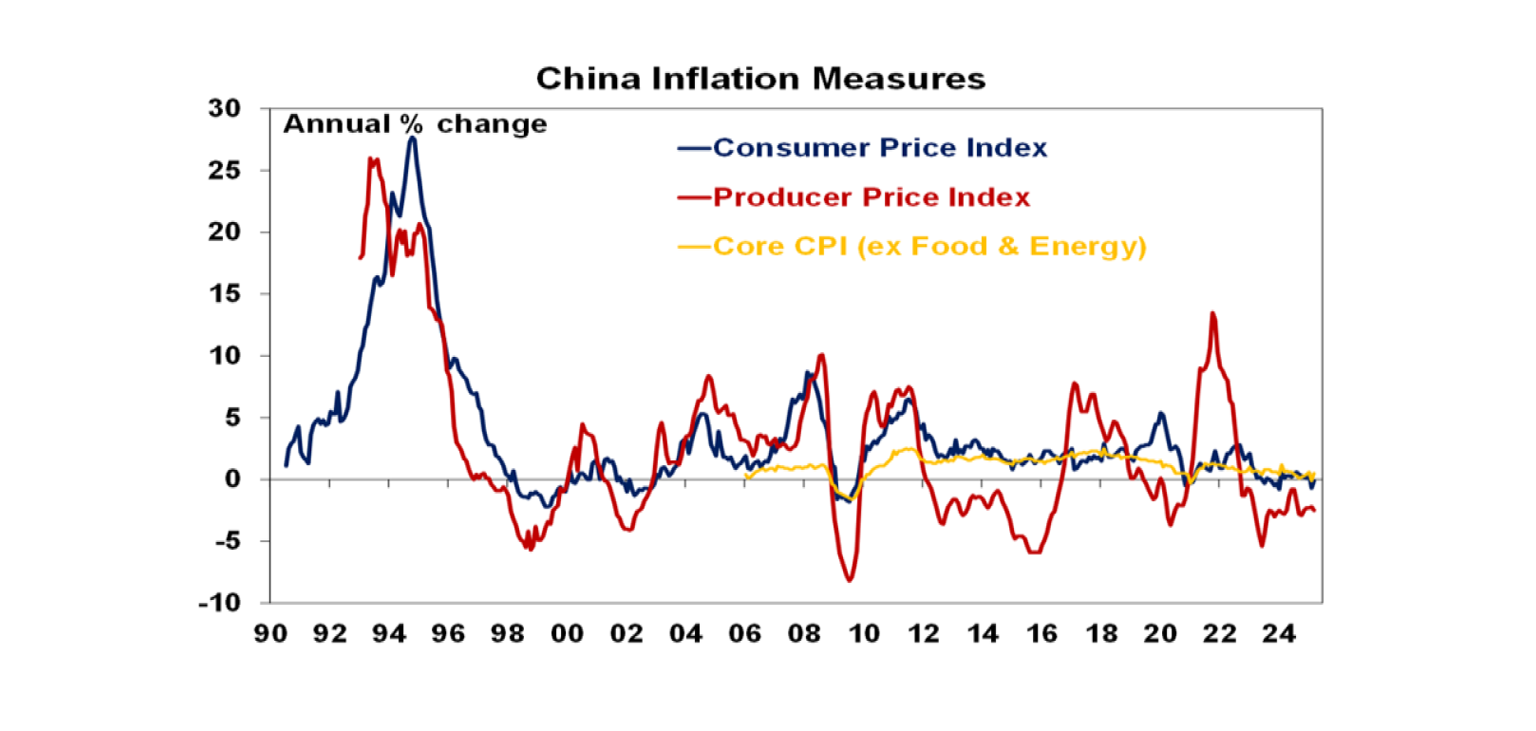

China remained in deflation in March, with the CPI down 0.1%yoy on weaker food prices, although core (ex food and energy) inflation rose but to a still weak 0.5%yoy. Producer prices fell 2.5%yoy. Tariffs on US imports will help boost inflation but it continues to highlight the need for more policy stimulus.

The RBNZ cut its cash rate by 0.25% to 3.5% and retained an easing bias noting that US tariffs pose downside risks to activity and inflation. Expect the cash rate to fall to 2.75% by year end.

Australian economic events and implications

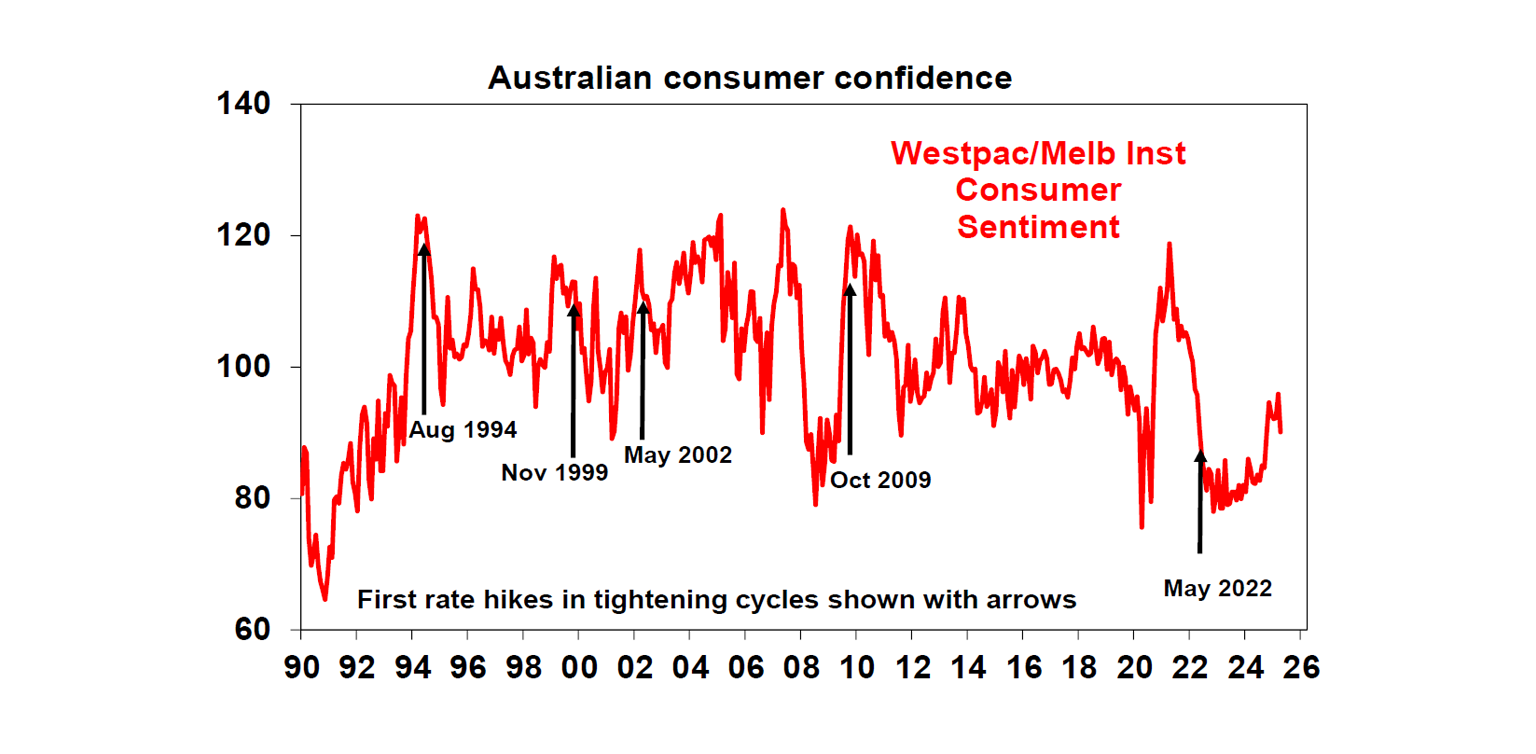

Australian consumer confidence is starting to show the impact of Trump’s tariff hikes with a sharp 6% fall in April reversing 6 months of gains.

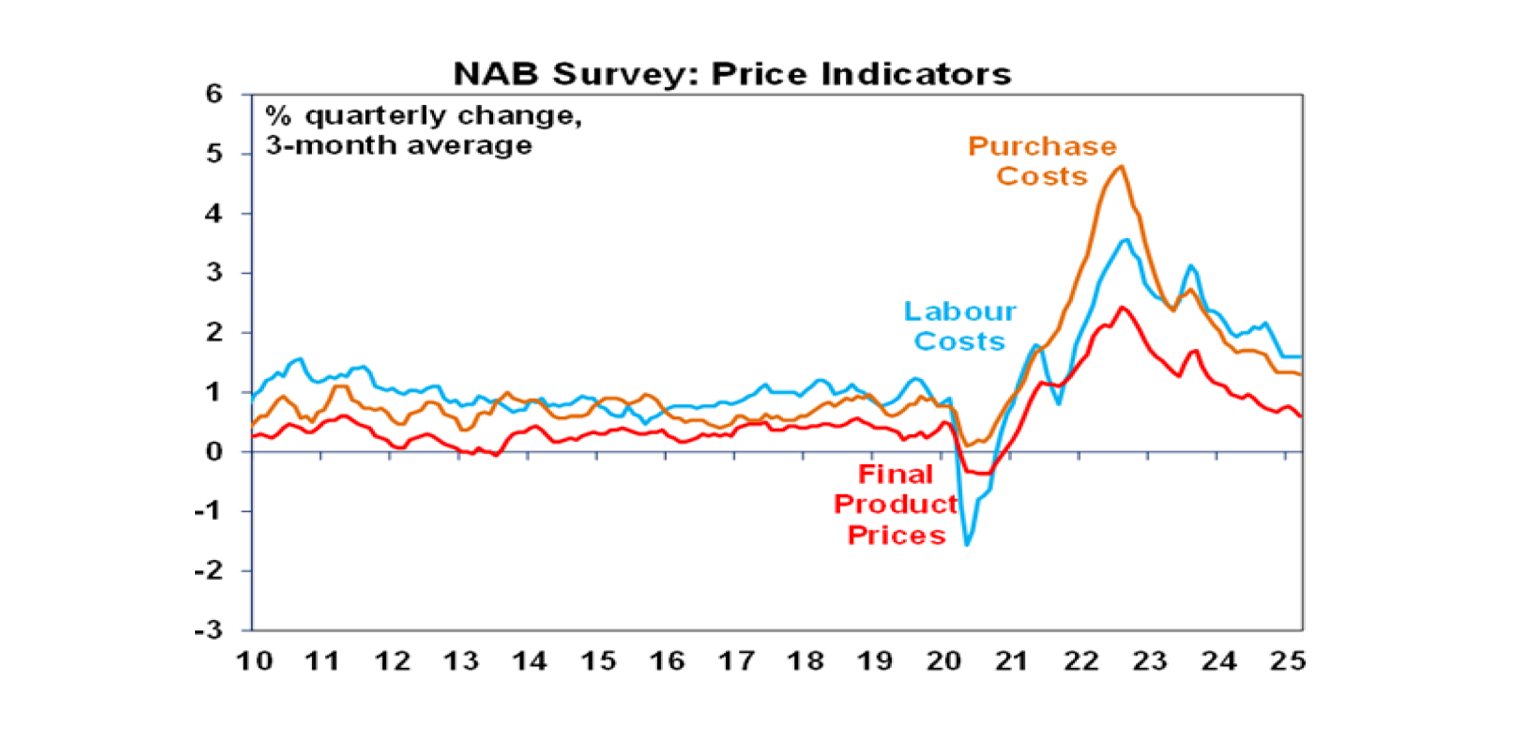

Business conditions and confidence are still ok but the latest NAB survey was for March so predates the ratcheting up of the tariffs this month. That said business confidence did fall back into negative territory. Expect a bigger fall in data for this month.

The good news though is that cost and final product price growth indicators were flat to down in March with the trend still down suggesting inflationary pressures remain in retreat.

What to watch over the week ahead?

Tariffs and noise around them will likely remain the big market mover over the week ahead with most data being ancient history, but for what its worth…

In the US, expect manufacturing conditions indexes for the New York and Philadelphia regions to show the ongoing impact of tariff concerns (due Tuesday and Thursday), March retail sales to show modest underlying growth, industrial production to fall and home builder conditions to remain weak (all due Wednesday).

The Bank of Canada (Wednesday) is expected to leave rates on hold at 2.75% but with about a 40% chance of a cut.

The ECB (Thursday) is expected to cut its deposit rate by another 0.25% or possibly 0.5% taking it to 2.25% or 2%, reflecting softer than expected inflation data and the threat to growth from Trump’s tariffs. It’s likely to retain an easing bias.

Japanese inflation for March (Friday) is likely to show a rise but with core (ex food and energy) inflation still low at just 1.7%yoy.

Chinese March quarter GDP data is expected to show a rise of 1.2%qoq or 5.2%yoy, down from 5.4%yoy in the December quarter. Monthly data for March is likely to show a slowing in industrial production to 5.6%yoy, stable investment growth of around 4.1%yoy and a pick-up in retail sales growth to 4.2%yoy.

New Zealand inflation for the March quarter (Thursday) is expected to tick up to 2.3%yoy from 2.2%yoy.

In Australia, March jobs data (Thursday) is likely to show a 65,000 gain in employment after the distortion in February with unemployment rising to 4.2%. The minutes from the last RBA meeting (Tuesday) will be dated but will likely reinforce the impression the RBA is a bit more dovish than back in February.

Outlook for investment markets

Shares are at high risk of further falls given the ongoing tariff war with the US, increased recession risk particularly in the US and the risk of a US/Israeli strike on Iran’s nuclear capability if diplomacy doesn’t work. Even if the low has been seen volatility is likely to remain high. But with Trump likely to ultimately back down further on the tariffs (after declaring victory of course!) and pivot towards more market friendly policies like tax cuts and deregulation, and central banks, including the RBA, likely to cut rates further shares are likely to recover on a more sustainable basis into year end. But it’s likely to be a rough ride.

Bonds are likely to provide returns around running yield or a bit more, as growth weakens, and central banks cut rates.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest with tariff worries constraining buyers and posing a near term threat of a reversal in prices and affordability remaining poor. We see home prices rising around 3% in 2025.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between the negative impact of US tariffs and the global trade war and the potential positive of more decisive stimulus in China. This could leave it weak around or just below $US0.60 in the near term. Undervaluation should support it on a medium-term view with fair value around $US0.73.

Important information

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance.

This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.