This is a common question people have when thinking about getting financial advice. The general answer is financial advice can help change the way you feel about your money and financial future. It can give you peace of mind, knowing that this part of your life is under control.

"I have so much confidence in my adviser. I’m happy to just connect the dots and allow them to do the rest. I would say 'everyone who values informed decision making (financially) needs to have a financial adviser,' because having one gives you incredible reserve to get the most out of your hard work."

- Advice First client, AMP Financial Planning, March 20201

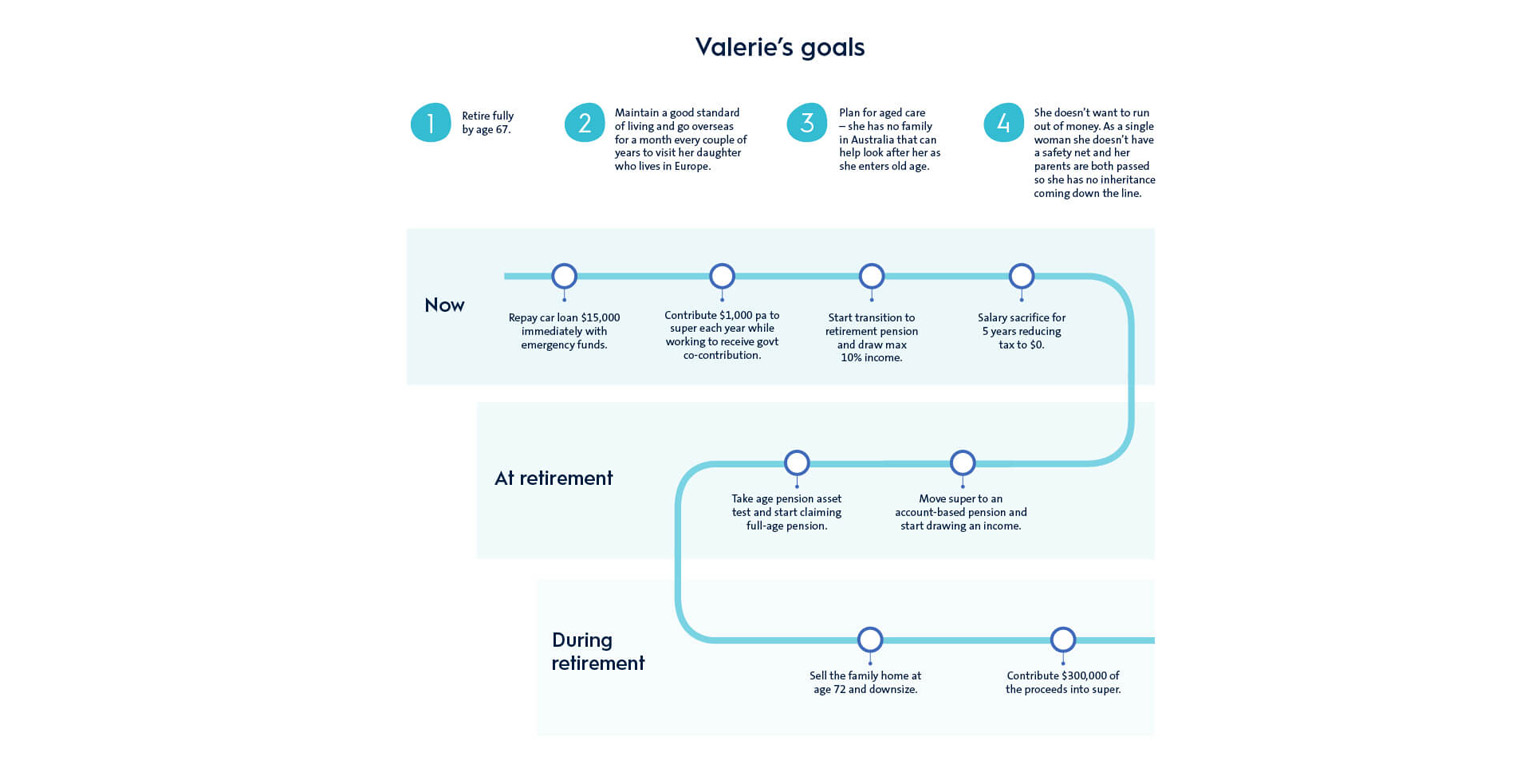

To see how financial advice can help, read Valerie’s2 story. With retirement on the horizon, she wants to start winding down her work but is worried she might not have enough in her super savings to last.

Valerie is a hypothetical client and her story is illustrative only. It isn’t an estimate of any investment returns you’ll receive or the fees and costs you’ll incur.

Secure enough to scale back

Valerie is 62 and works as an office manager. She’s worked full-time since her children left high-school and is now ready to scale back her working hours to three days a week. However, she isn’t confident her finances will be able to cope. Valerie is seeking reassurance from a financial adviser that she has enough saved to go part-time, and still have a comfortable retirement.

Her adviser starts by getting a picture of her financial position.

Assumptions:

Return assumptions include:

Superannuation: 70% balanced portfolio, (2.5% income, 2.75% growth, 25.51% franked) return and 0.69% fee

Consumer Price Index is 3.2%

Average Weekly On Time Earnings – 3.5%

Cash return is 3%

Property growth is 4% pa

Car loan at 6%

Property sale assumptions:

Current property indexed by growth rate of 4% pa

Sell at age 72 for $1,184,195 and transfer costs = $45,000. Repurchase new home for $780,000

Advice Fees

Valerie paid $1,780 in the first year and $1,250pa for phone-based financial advice. Indexed with CPI.

Together they define Valerie’s goals. Once Valerie’s clear on what she wants now, and in retirement, her adviser works out a tailored roadmap on how she might be able to achieve those goals.

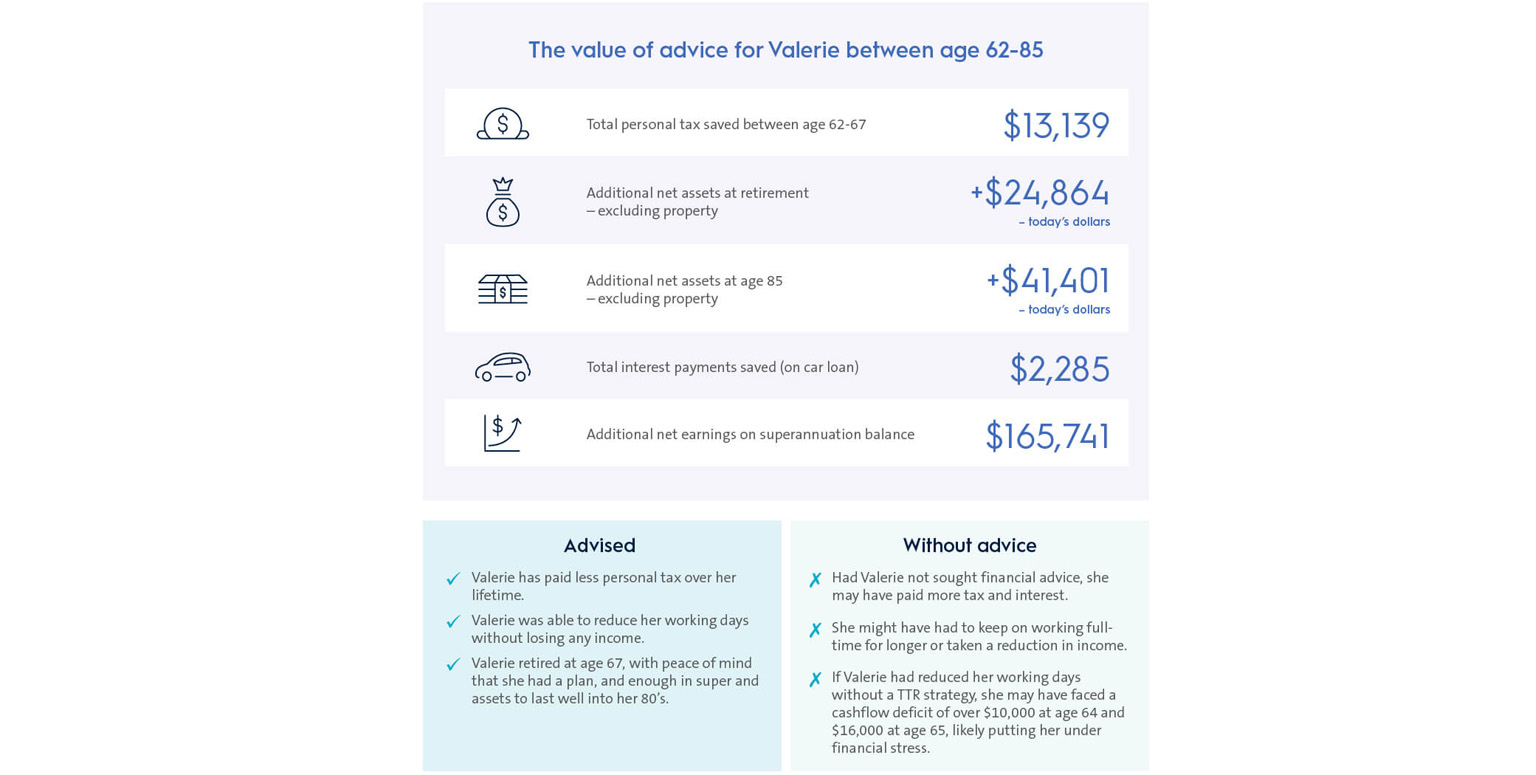

By using a transition-to-retirement strategy, Valerie’s able to keep her income amount the same while reducing her working hours and continuing to add more to her super. She’s also maximising the government contributions available, and saving on personal tax.

Her adviser works out Valerie will run out of money by age 75. He suggests selling the family home will help to free up her money. They agree to downsize when she reaches 72. Doing this can help to ensure she’ll have funds lasting well into retirement and shouldn’t have to reduce her standard of living or solely rely on the Age Pension to cover her day-to-day expenses.

What value does Valerie get from financial advice?

Having a plan for her financial future gives Valerie peace of mind. The relationship with her adviser gives Valerie confidence she’s not in this alone. She no longer feels overwhelmed by making financial decisions because she’s got someone there, giving her the information needed to make choices that are right for her.

You may also like

-

Weekly market update - 19-12-2025 Global shares were mixed over the last week. US shares were initially dragged lower by ongoing AI bubble worries but rose later in the week helped by lower-than-expected inflation data and a solid outlook from a key tech company, leaving them up 0.1% for the week. -

Econosights - Lessons learnt in 2025 This year in the US there were many important policy changes. The main one was the increase to tariffs under Trump 2.0. Trump threatened to increase tariffs to above 30% in April (“Liberation Day”) from ~3% at the start of the year, which would have taken US tariffs to their highest level since the late 1800’s. -

Weekly market update - 12-12-2025 Global shares were mixed over the last week with the Fed cutting rates but AI worries remaining.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.

1 AMP internal research, client interview.

2 Valerie is a hypothetical client.