Key points:

Share markets have fallen sharply in recent weeks as uncertainty around US President Trump’s policies have led to renewed concerns about the risk of recession at a time when share market valuations were stretched.

It’s still too early to say markets have bottomed and we continue to see a high risk of a 15% plus correction, although calendar year returns should still be okay.

This will weigh on short term super fund returns but follows two years of very strong returns.

Key things for investors to bear in mind are that: share pullbacks are healthy and normal; in the absence of a recession a deep and long bear market should be avoided; selling shares after a fall locks in a loss and timing markets is hard; share pullbacks provide opportunities for investors to buy them more cheaply; shares still offer an attractive income flow; and to avoid getting thrown off a long-term investment strategy it’s best to turn down the noise.

Introduction

Much of the time share markets are relatively calm and so don’t generate a lot of attention. But periodically they tumble and generate headlines like “billions wiped off share market” and “biggest share plunge since…” Sometimes it ends quickly and the market heads back up again and is forgotten about. But every so often share markets keep falling for a while. Sometimes the falls are foreseeable (usually after a run of strong gains), but rarely are they forecastable (which requires a call as to timing and magnitude) despite many claiming otherwise. In my career, I have seen many periodic share market tumbles and so they are nothing new.

And now it’s happening again with share markets falling from record highs just a few weeks ago. From their all-time highs to their lows in February US shares have fallen 9%, global shares have fallen 8% and Australian shares have fallen nearly 9%. Always the drivers are slightly different. But as Mark Twain is said to have said “history doesn’t repeat but it rhymes”, and so it is with share market falls. This means that from the point of basic investment principles, it’s hard to say anything new. Which is why this note may sound familiar with “key things for investors to keep in mind”, but at times like this they are worth reiterating.

What’s driving the plunge in share markets

The key drivers of the fall in shares are a combination:

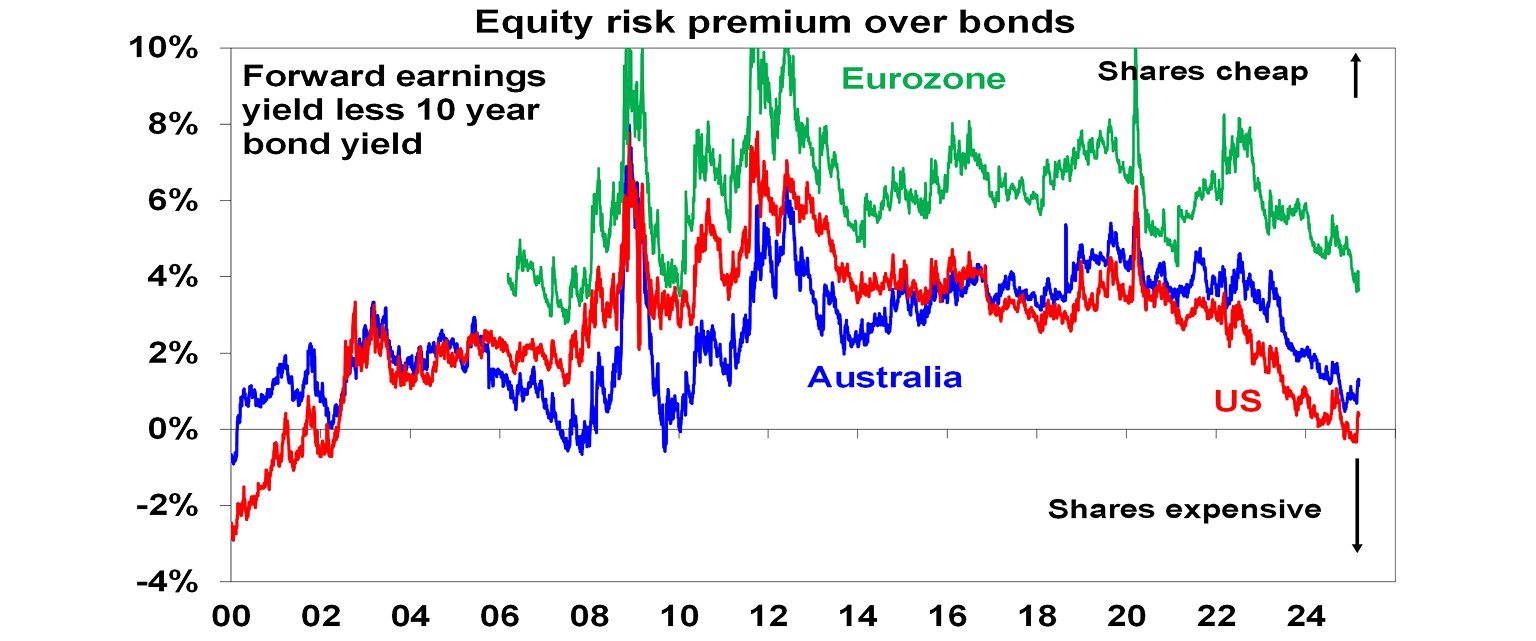

Stretched valuations after a relatively calm year last year with strong returns. The strong gains in share markets after the inflation driven weakness of 2022 and still relatively elevated bond yields left US shares offering no risk premium over bonds (as measured by the gap between the forward earnings yields and 10 year bond yields). Australian shares were not much better. This left shares vulnerable to bad news. The equity risk premiums have improved a bit with recent falls but still remain low.

While investor sentiment was not seeing the euphoria often evident at major share market tops, there was a bit of speculative froth evident in the huge gains in the Magnificent Seven stocks (Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla). These had accounted for nearly two thirds of US share market gains in 2023 and over 50% in 2024 taking them to roughly 35% of the S&P 500’s market capitalisation. Their huge gains left them vulnerable to a pull back with DeepSeek’s apparent success weighing on Nvidia and Telsa shares plunging more than 50% since their January high partly owing to signs of a buyer backlash against Elon Musk. This heavy reliance on a handful of shares added to the US share markets vulnerability.

Another bout of sticky US inflation saw expectations for Fed rate cuts this year wound back a few weeks ago.

But the trigger for the pullback has really come from the frenetic and often contradictory policy announcements from the White House around tariffs, public sector cutbacks and US relations with allies. This has contributed to a run of weaker US economic data, fears of recession and desire by investors for a higher risk premium from shares. Those fears intensified after Trump and members of his team seemed to not rule out a recession with Trump talking about a “period of transition” and saying that he is not worried about falls in the share market and Treasury Secretary Bessent talking about 6-12 months of pain and “a detox period” (presumably from government).

As always, the most speculative “assets” are getting hit the hardest and this includes tech stocks (with the Magnificent Seven down 20% and Nasdaq down 14%) and Bitcoin (which has fallen 23%).

Share markets are oversold and so may see a short-term bounce. But our assessment is that increasing uncertainty and stretched valuations mean there is a high risk of further falls in shares. At some point economic weakness and its impact on support for Trump and Republican politicians along with share market falls – with Trump ultimately seeing share gains as a key performance indicator – will put pressure him to reverse course and focus on more positive policies. But we are likely not at that point yet. So, we continue to see a high likelihood of a 15% plus correction in shares before more positive forces around Trump’s tax cuts and deregulation and more Fed rate cuts get the upper hand.

Key things for investors to bear in mind

Sharp market falls are stressful for investors as no one likes to see their investments (including their super) fall in value. But there are some key things investors should keep in mind:

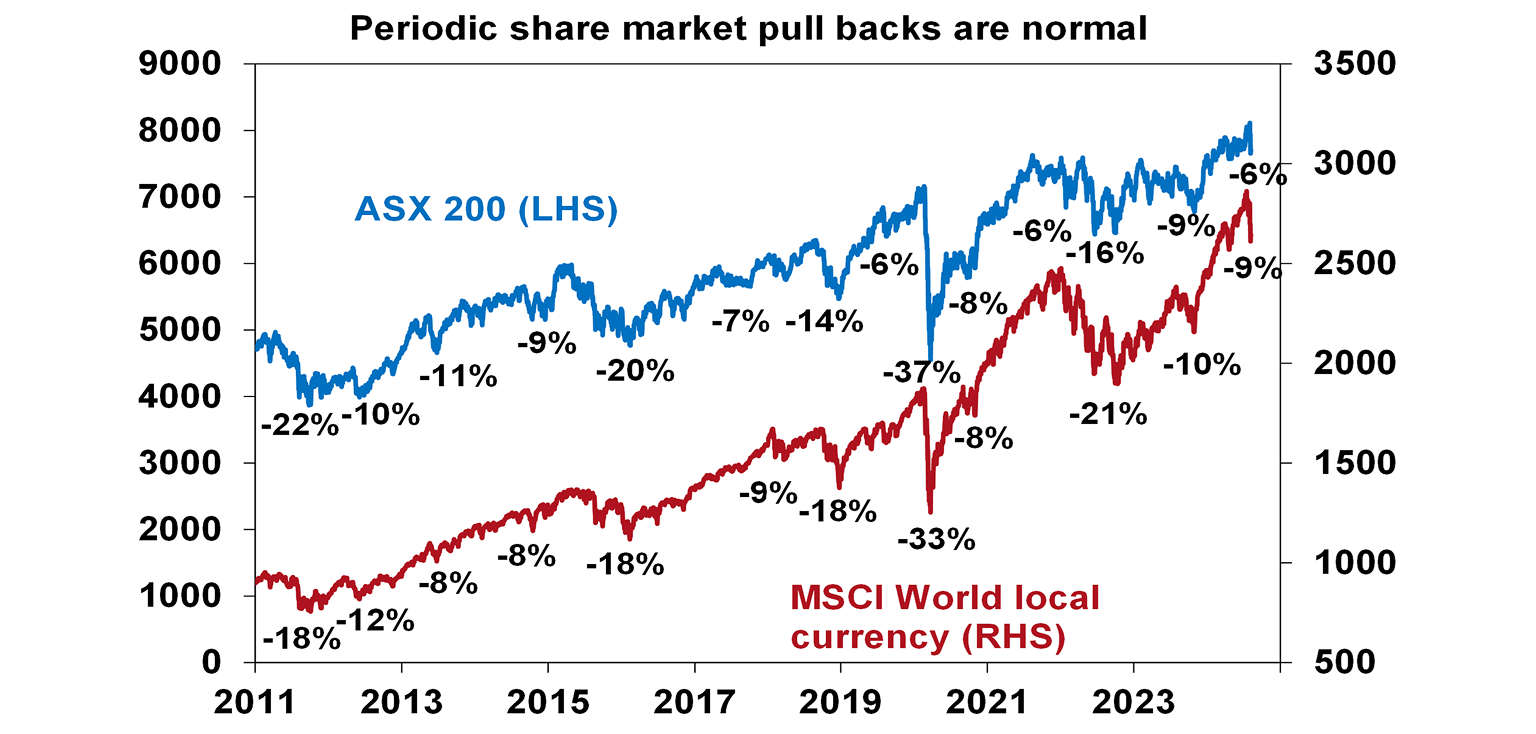

First, while they unfold differently, periodic share market corrections and occasional bear markets (which are usually defined as falls greater than 20%) are a normal part of investing in shares. See the next chart.

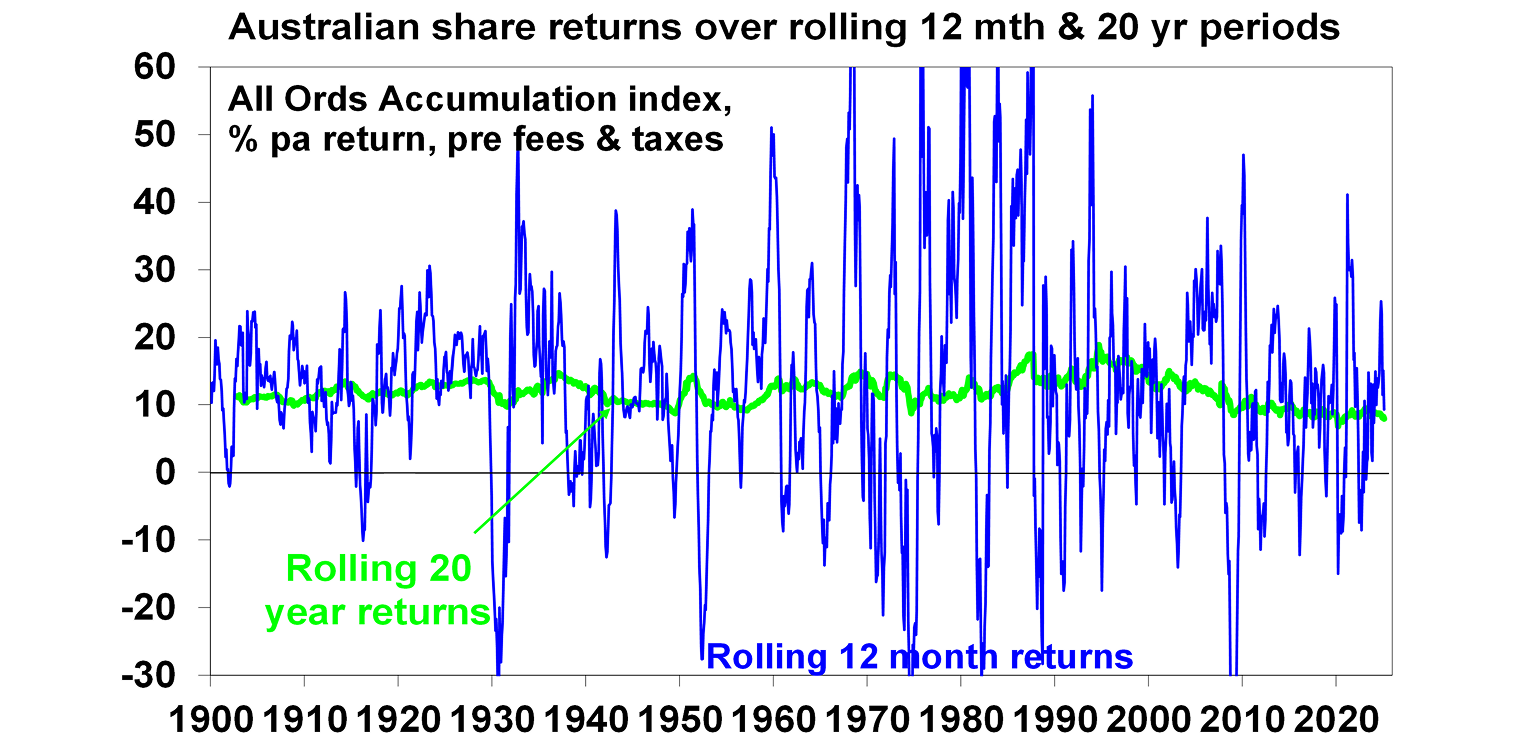

And, as can be seen in the next chart rolling 12 month returns from shares have regularly gone through negative periods.

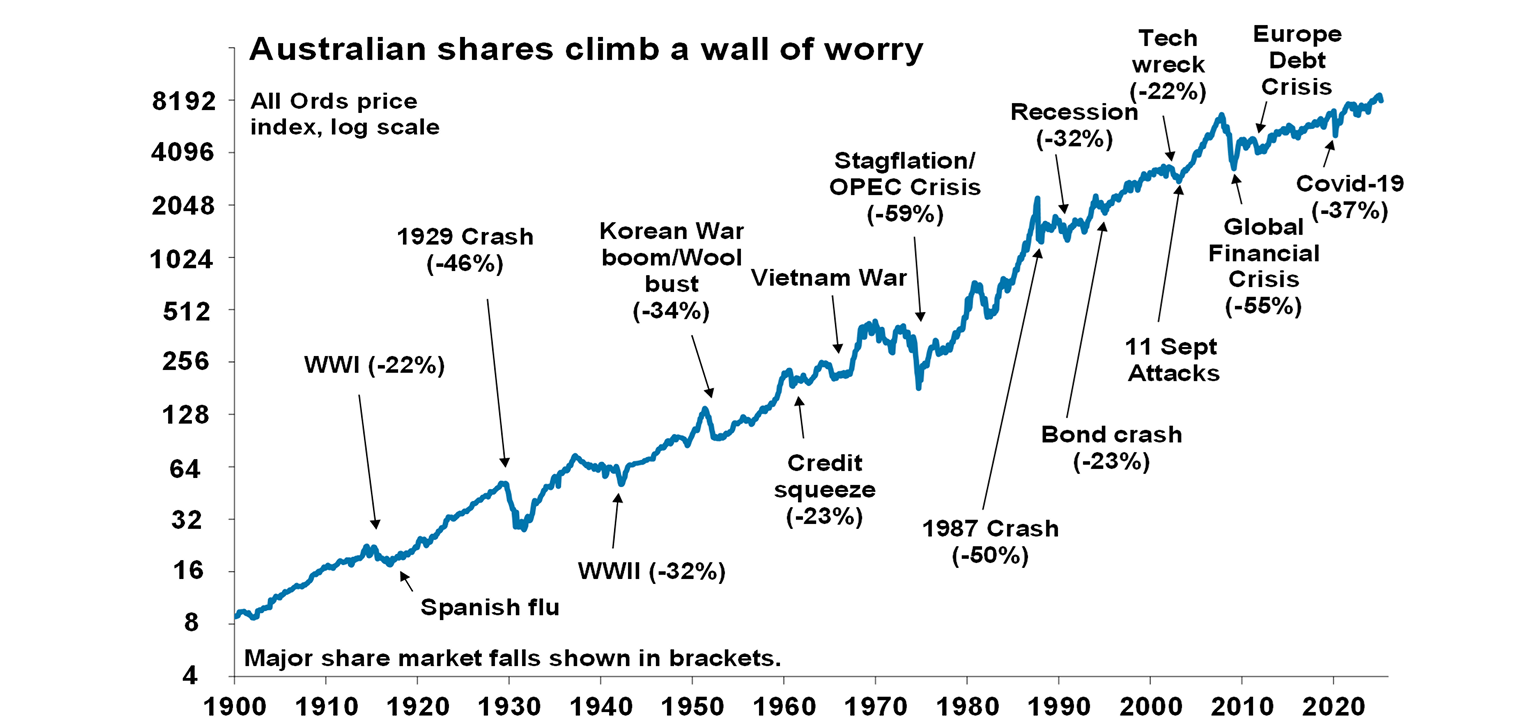

But while the falls can be painful, they are healthy as they help limit excessive risk taking. Related to this, shares climb a wall of worry over many years with numerous events dragging them down periodically (next chart), but with the long-term trend ultimately up and providing higher returns than other more stable assets. As can be seen in the previous chart, the rolling 20-year return from Australian shares has been relatively stable and solid. Which is why super funds have a relatively high exposure to shares along with other growth assets. Bouts of volatility are the price we pay for the higher longer-term returns from shares compared to more defensive assets like cash and government bonds.

Second, historically, the main driver of whether we see a correction (a fall of say 5% to 15%) or even a mild bear market with say a 20% or so decline that turns around relatively quickly like we saw in 2015-2016 in Australia – which may be called a “gummy bear market” – as opposed to a major “grizzly” bear market (like that seen in the mid-1970s or the global financial crisis when shares fell by around 55%) is whether we see a recession or not – notably in the US, as the US share market tends to lead most major global markets. While Trump’s policies and the noise around them has increased the risk of a US/global recession our base case is that it will be narrowly avoided as Trump pulls back under political pressure and signs of weaker growth enable the Fed to start easing again and other global central banks including the RBA continue to cut rates. But recession is now a more significant risk so it’s too early to say share have bottomed. Of course, short-term forecasting is fraught with difficulty and should not be the basis for a long-term investment strategy, so it’s better to stick to long term investment principles.

Third, selling shares or switching to a more conservative superannuation investment strategy whenever shares fall sharply just turns a paper loss into a real loss with no hope of recovery. Even if you get out and miss a further fall, the risk is that you won’t feel confident to get back in until long after the market has fully recovered. The best way to guard against deciding to sell on the basis of emotion after falls in markets is to adopt an appropriate long-term strategy and stick to it.

Fourth, when shares fall, they’re cheaper and offer higher long-term return prospects. So, the key is to look for opportunities’ pullbacks provide. It’s impossible to time the bottom but one way to do it is to “average in” over time. Fortunately, the Australian superannuation system does just that by regularly putting money into shares for employees (via their super) taking advantage of the fact they are cheaper.

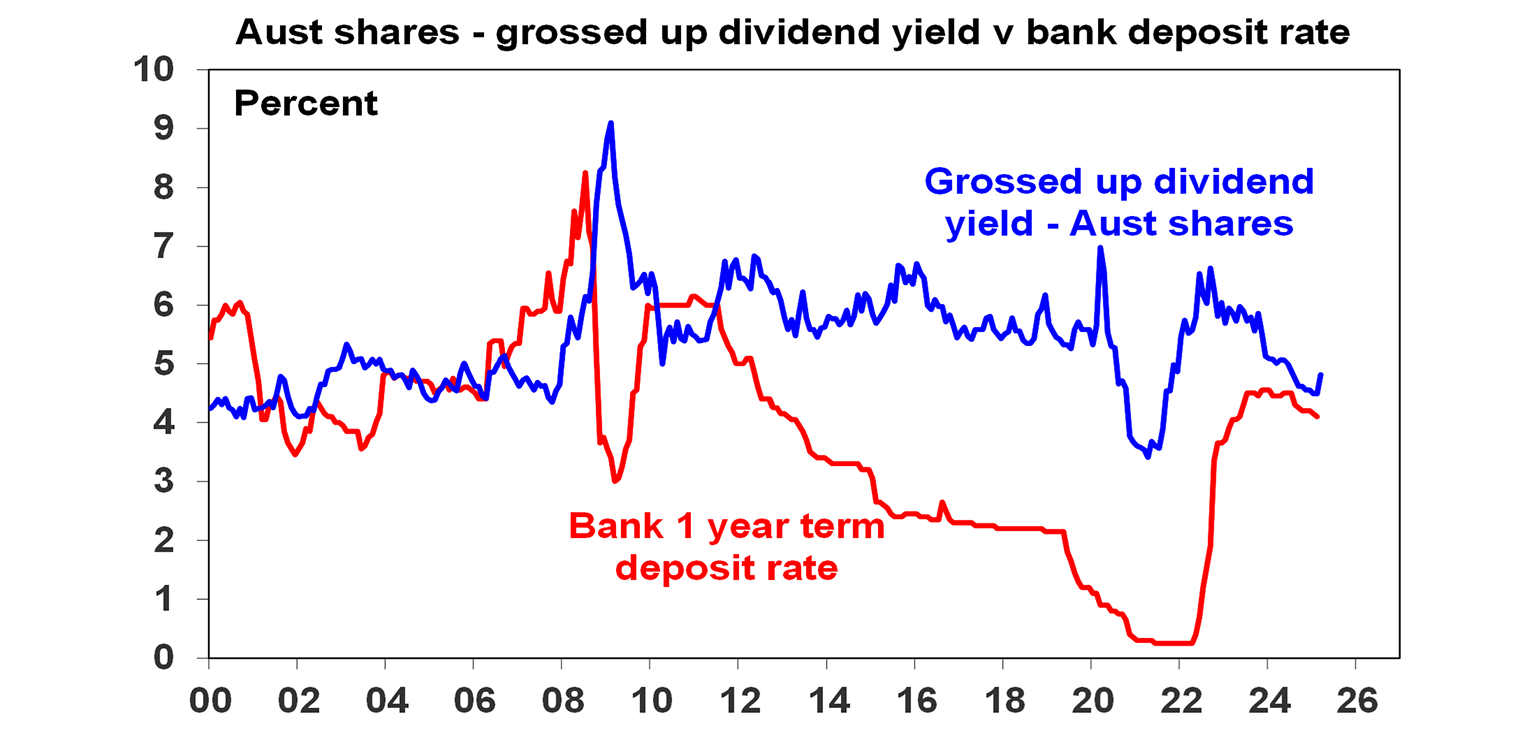

Fifth, while share prices have fallen dividends have not. While the rebound in interest rates since 2022 reduced the yield advantage shares had over cash it’s likely now starting to wide again with the RBA starting to cut interest rates and likely to do more. 54% of companies raised their dividends compared to a year ago in the just completed December half earnings reporting season so the income flow from a well-diversified portfolio is likely to remain attractive.

Sixth, shares and other related assets often bottom at the point of maximum bearishness, i.e. just when you and everyone else feel most negative towards them. So, the trick is to buck the crowd. “Be fearful when others are greedy. Be greedy when others are fearful,” as Warren Buffett has said.

Finally, turn down the noise. At times of uncertainty like now, the flow of negative news reaches fever pitch. Talk of billions wiped off the share market and of “crashes” help sell copy and generate clicks. The share market has a total value of $2.77trillion so a 1% fall will wipe off $28bn. But less newsy are the billions that market rebounds and the rising long-term trend in share prices add to the share market. Eg, a 10% rise is worth $277bn. Moreover, such headlines provide no perspective and only add to the sense of panic. All of this makes it harder to stick to an appropriate long-term strategy – which is particularly important when it comes to super as it has to be seen as a long-term investment, except for many of those near to retirement. So best to turn down the noise and watch the third series of White Lotus (or Brady Bunch re-runs).

You may also like

-

Weekly market update - 12-12-2025 Global shares mostly rose over the last week, as the Fed cuts rates and its commentary was mostly friendly for risk assets. -

Oliver's insights - RBA holds rate with hawkish tones The RBA’s decision to leave rates on hold at 3.6% was no surprise with it being the consensus amongst all 29 economists surveyed by Bloomberg and the money market factoring in zero chance of a change. -

Oliver's Insights 2026 Predictions after 2025 success 2025 initially saw turmoil as US President Trump announced tariffs that were much higher than expected along with a bunch of other moves to upend US institutions and the global economic order. But the global economy held up okay.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.