Key points

- As widely expected, the RBA cut its cash rate to 4.1% from 4.35% after 13 rate hikes reflecting “more confidence that inflation is moving sustainably towards” the 2-3% target.

- However, the RBA noted that it is “cautious on prospects for further policy easing”.

- We expect the RBA to cut again in May and August taking the cash rate to 3.6% this year with another cut next year.

- The start of a gradual easing cycle should help provide support for the shares and home prices, albeit some of the good news on rates has already been factored in.

The RBA cuts rates after 13 hikes

Last December the RBA noted that “if the future flow of data continued to evolve in line with or weaker than [RBA] expectations…it would in due course be appropriate to begin relaxing the degree of monetary policy tightness.” So, with underlying inflation for the December quarter coming in weaker than expected, the RBA has acted on its guidance and moved to cut rates. Specifically, the RBA noted that the faster than expected fall in trimmed mean inflation has led to “more confidence that inflation is moving sustainably towards the mid-point of the 2-3% target range”.

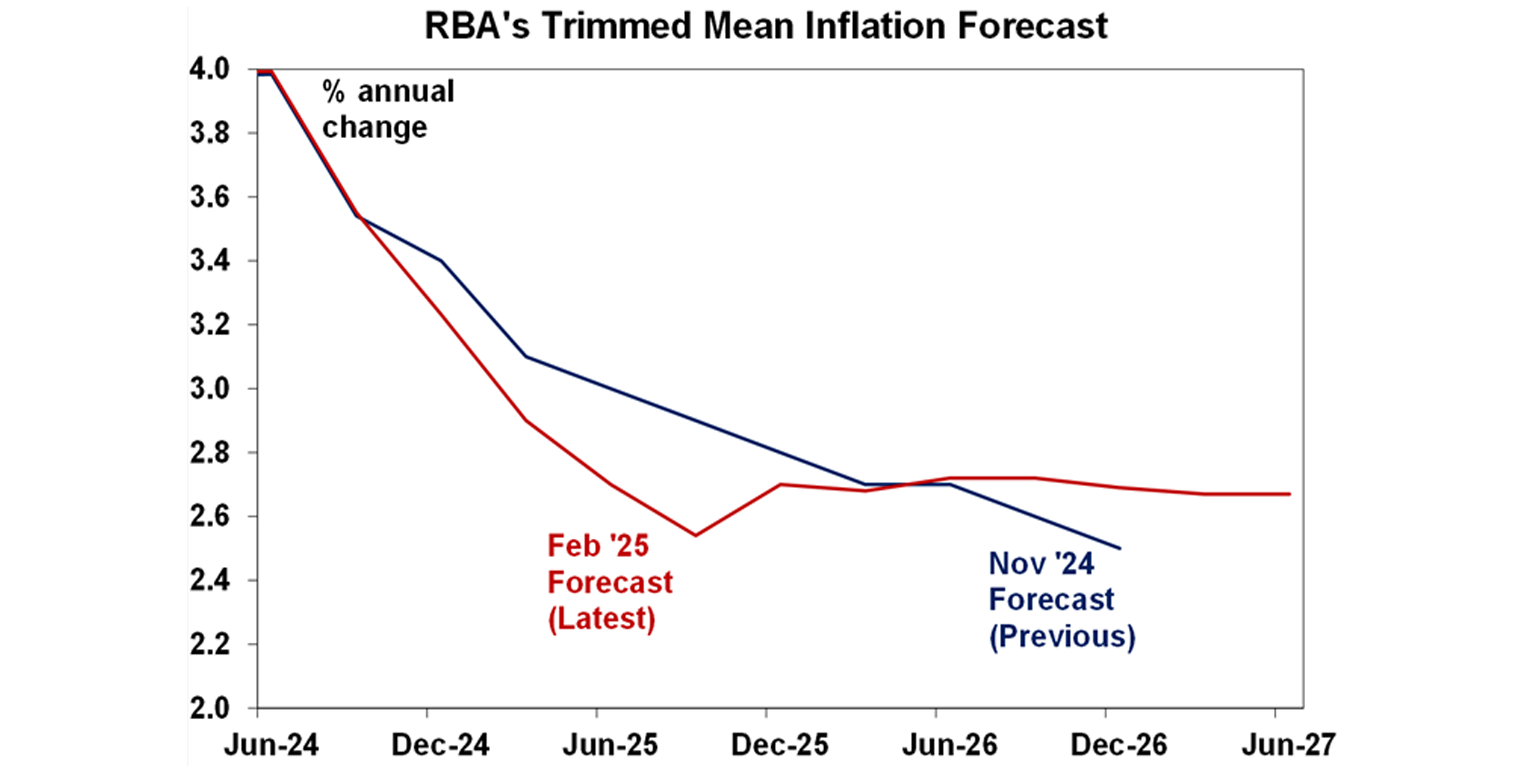

Consistent with this it revised down its forecasts for trimmed mean inflation for this year to now show it close to target at 2.7%yoy by June. So, it’s now seen as being back in the 2-3% target range a year earlier than previously expected. It also revised down slightly its near-term GDP growth forecasts, and it still sees wages growth slowing to 3.1% next year.

Despite the easing it’s worth noting that monetary policy is still tight with the 0.25% rate cut reversing just one of the 13 rate hikes between May 2022 and November 2023 which totalled 4.25%. For mortgage payments it will reverse about 8% (or $1300) of the $16,300 increase in annual payments on a $660,000 mortgage since May 2022. Consistent with this the RBA notes that monetary policy will still be restrictive after the rate cut.

Having made the decision to cut the RBA is “cautious” on future cuts noting that while there are “risks on both sides”, for inflation “upside risks remain”, the labour market remains tight, productivity growth remains weak and while it revised down its trimmed mean inflation forecasts for this year it revised them up slightly for next year. And it is concerned that if it eases too quickly in line with market forecasts for more cash rate cuts, inflation could settle above the mid-point of the target range. The implication is that in the RBA’s view the market is too optimistic on inflation and rates. This seems too pessimistic though - despite the tight jobs market the RBA has still been revising down its 2025 inflation forecasts.

We think the RBA will cut again in May and August

RBA’s caution is understandable to some degree as it’s still too early to declare “mission accomplished”. Given the lingering uncertainty about the strong jobs market and the low $A posing risks for inflation along with the uncertainty around Trump’s tariffs, in the absence of any major economic shock the RBA will likely leave rates on hold at its next meeting that concludes on 1 April. This will also enable it to avoid the controversy of cutting rates in an election campaign or just before one has to be called.

However, we continue to see further rate cuts ahead as we see economic growth picking up more slowly than the RBA is forecasting and slowing wages growth will cool sticky services inflation likely taking it to the mid-point of the target range next year.

- Sure, unemployment is historically low at 4% but there is no sign of a wages breakout with wages growth slowing implying that the non-accelerating inflation rate of unemployment (NAIRU) is likely lower than the RBA’s assumed 4.5%. While the RBA acknowledges that this may be the case it notes that it does not yet see a “compelling case to change our assessment of full employment” or NAIRU.

- The $A fell sharply into January but has since had some recovery and the trade weighted index is in the same range it’s been in for four years, suggesting only modest upside pressure on inflation.

- Trump’s latest trade war adds to uncertainty but absent any retaliatory tariffs by Australia which is unlikely or a plunge in the $A, the tariffs pose more of a downside threat to Australian growth than an upside threat to inflation and so add to the case for cutting rates.

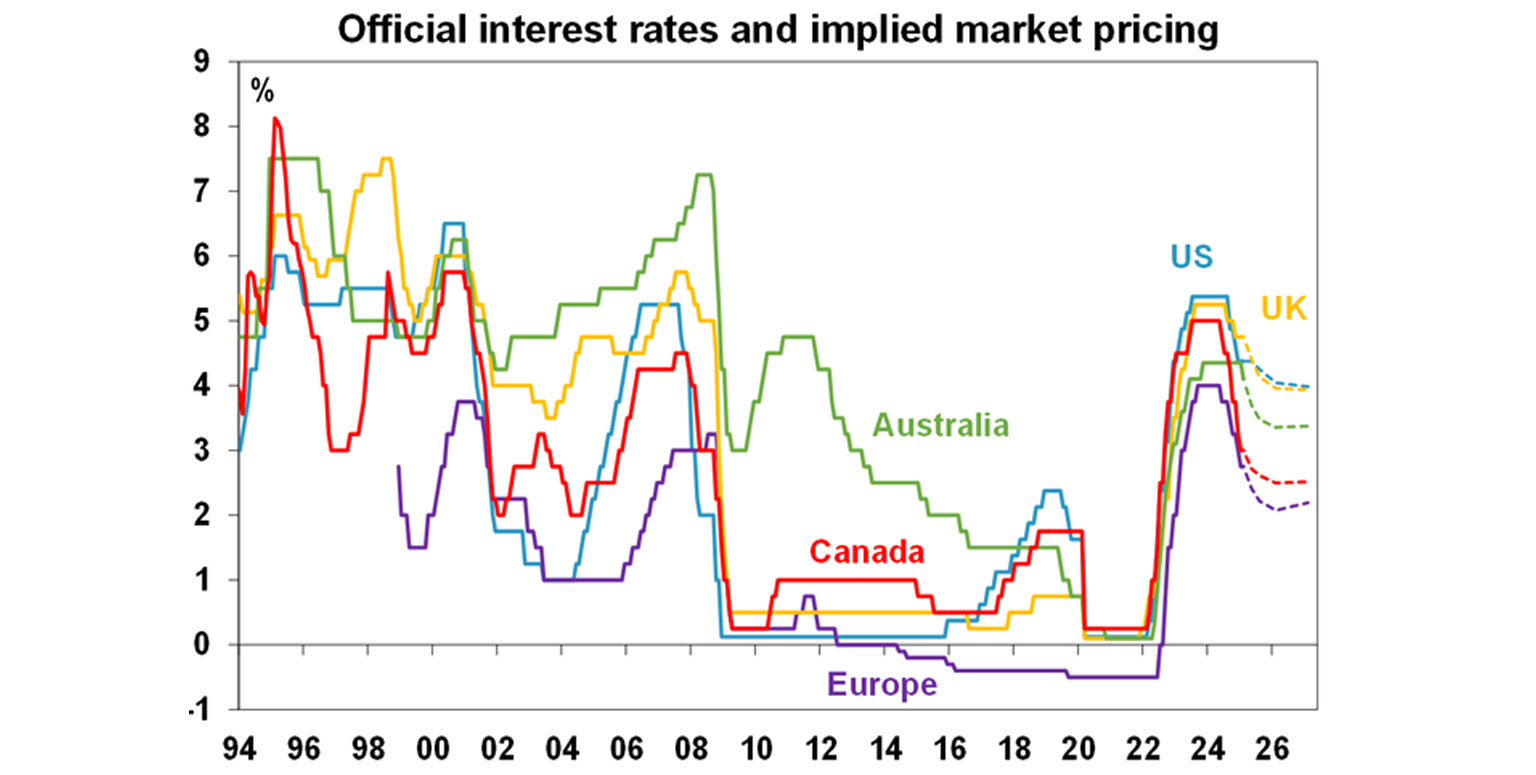

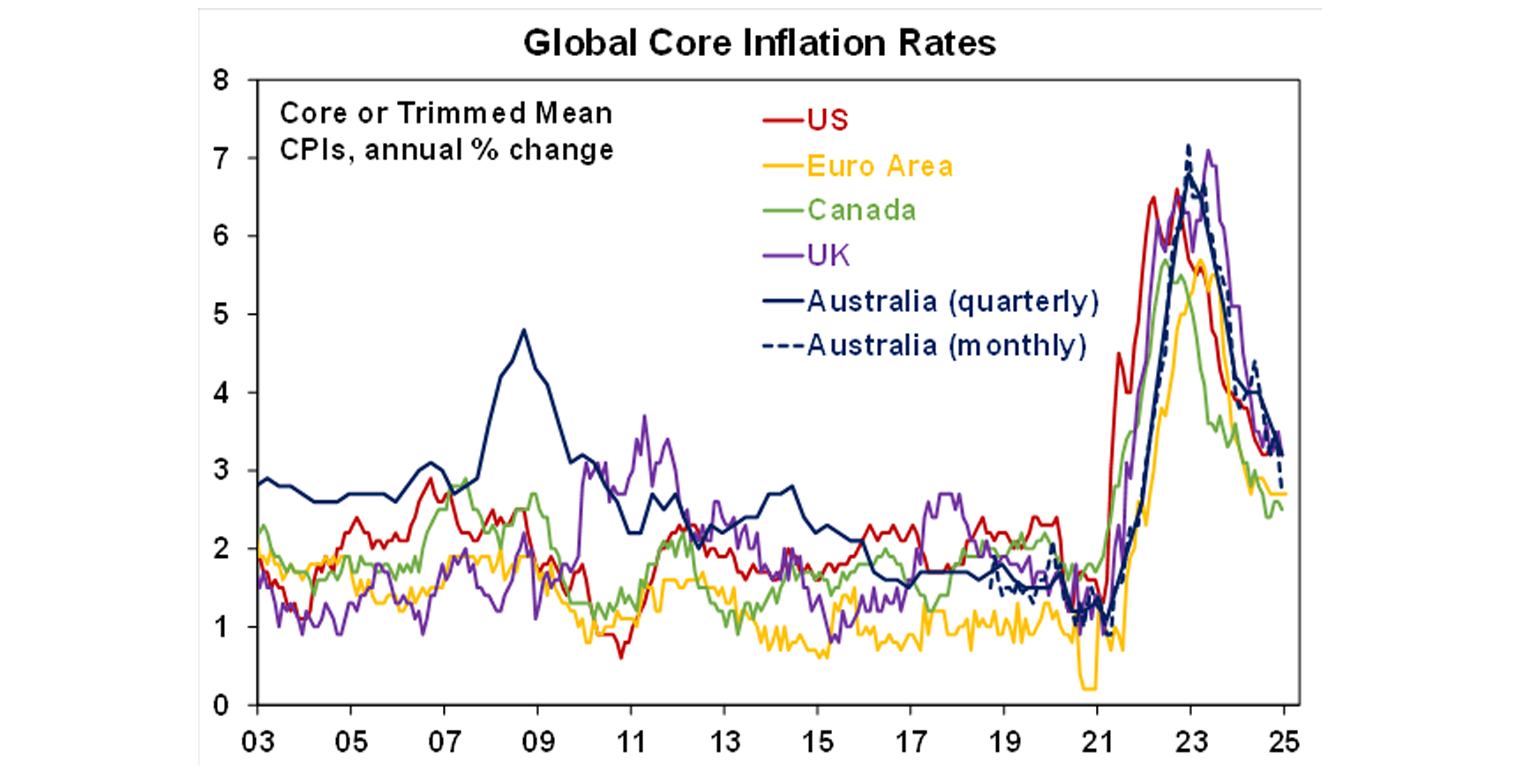

So, while the low unemployment rate means that the RBA can be gradual in easing, we expect two more rate cuts this year. One in May after the election is out of the way and then again in August, taking the case rate down to 3.6% with another rate cut next year. In support of further rate cuts, underlying inflation in Australia is now in line with other countries which are cutting rates with the December monthly trimmed mean rate of 2.7%yoy similar to core inflation in Europe and Canada, which have cut rates below the RBA’s cash rate.

Expect a modest boost to economic growth

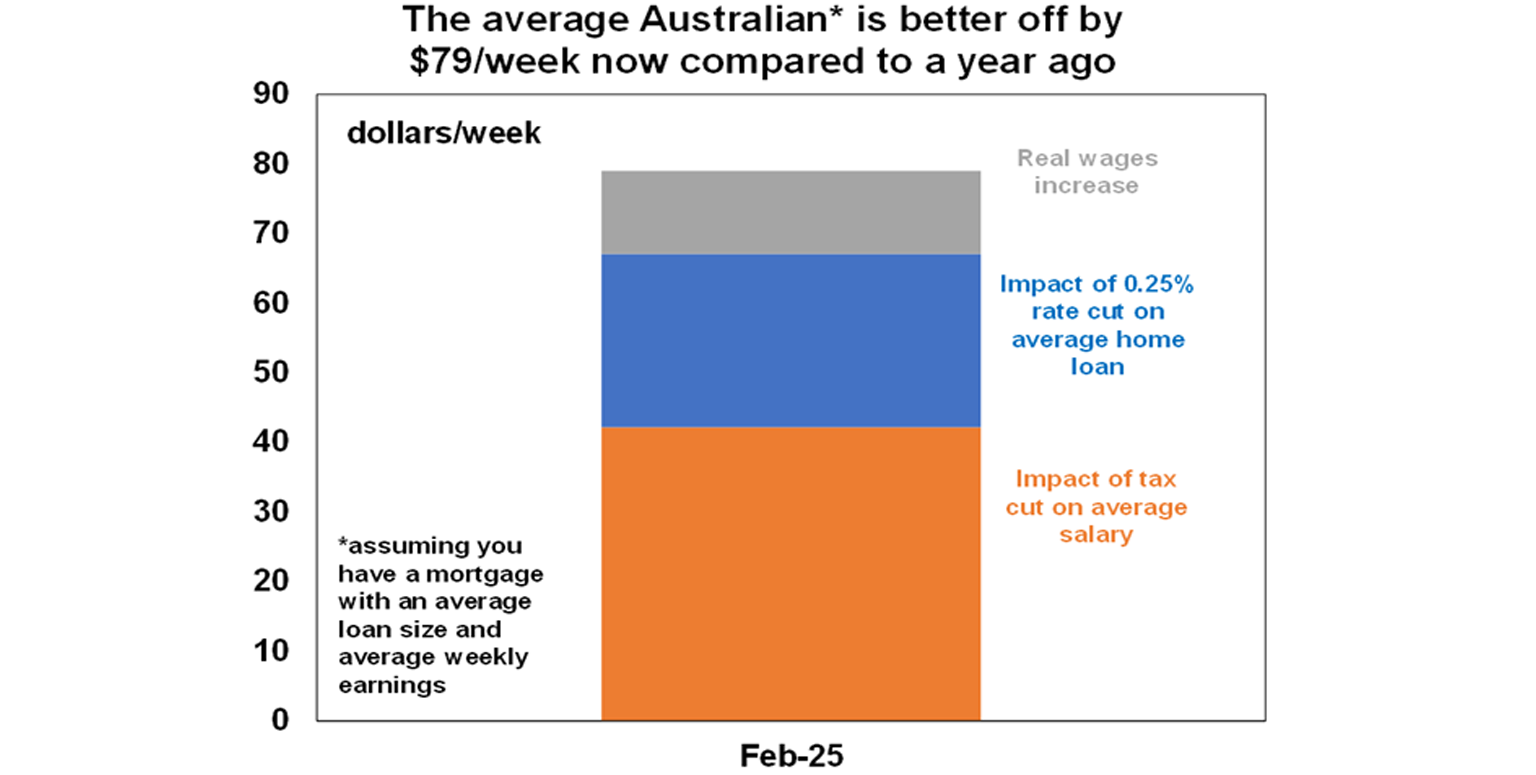

We expect the start of an RBA rate cutting cycle to support a modest uptick in Australian economic growth this year to around 2%yoy, slightly below RBA forecasts. The 0.25% rate reduction (which the banks are passing on) will cut $108 off monthly mortgage payments on a $660,000 mortgage freeing up some spending power. In fact, the combination of the mortgage rate cut, last year’s July tax cuts and wages growth running above inflation will provide nearly an $80 a week boost to someone on average earnings with a mortgage compared to a year ago.

However, the impact on spending is likely to be modest initially as: it takes a while for interest rate moves to start impacting spending as we saw in 2022; rate cuts this year are expected to reverse only 3 of the 13 hikes; and rate cuts will be gradual particularly compared to the rapid fire rate hikes back in 2022 which may dampen expectations.

Rate cuts and Australian shares

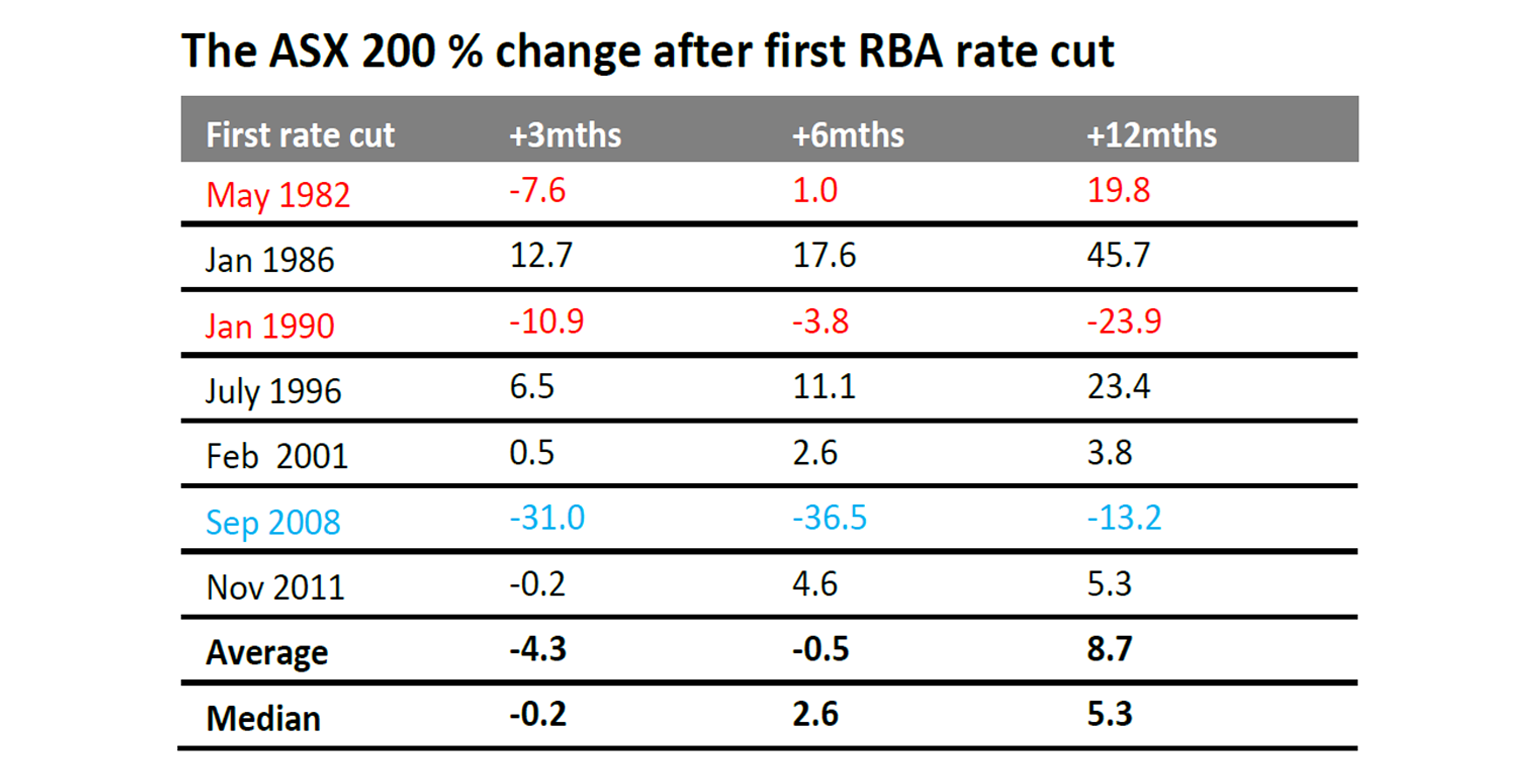

RBA rate cuts can be positive for Australian shares because they help boost future profit growth and make shares relatively more attractive relative to cash. The next table shows the Australian share market’s response after the first rate cut at the start of an easing cycle.

Clearly the experience is mixed, with recessions in 1982 and 1990 seeing falling share markets at least initially and the GFC impacting the outcome after the first easing in 2008. Fortunately, a recession is unlikely, suggesting a better outcome is possible this time. But shares have already had strong gains in anticipation of RBA rate cuts (helped along by rate cuts overseas), valuations are a bit stretched and Trump’s trade war and various other risks will no doubt make for a volatile ride. However, the start of rate cuts in the absence of recession still point to reasonable gains on a 12-month view.

What about the $A?

The start of a rate cutting cycle with the RBA likely to cut more this year than the Fed will be a drag on the $A against the $US. However, the $A has already had an 11% fall against the $US since September to its recent low partly anticipating this along with Trump’s tariff war. We see the $A being range bound between $US0.60 to $US0.70.

What about residential property?

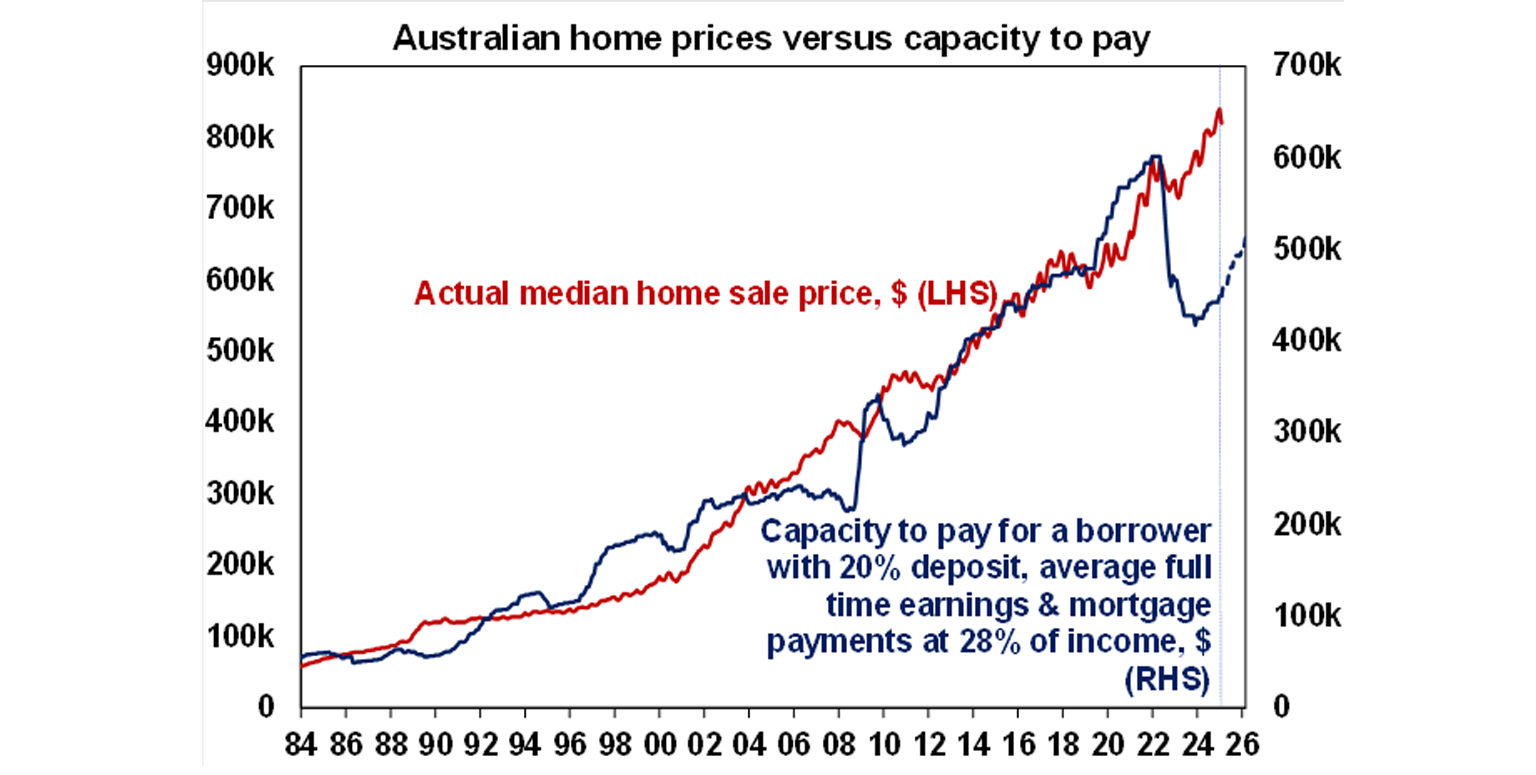

Lower rates are positive for property because they take pressure off existing homeowners who may have been struggling with their mortgages and as they increase the amount a borrower can borrow from a bank and hence pay for a property which supports demand. Buyers know this and so can sometimes move to anticipate it as we have seen recently with stronger auction clearance rates in Sydney and Melbourne since late last year. Roughly speaking the 0.25% rate cut when passed on to variable mortgage rates will add about $9000 to how much a buyer on average earnings can borrow which along with three further rate cuts into early next year will drive a significant increase in the capacity of buyers to pay for a property. See the next chart. However, with housing affordability remaining poor, the capacity to pay set to remain well below the 2021-22 high with a wide gap to home prices and rate cuts likely to be gradual we are only anticipating a 3% rise in average home prices this year.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist, AMP

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.