AMP's 2022 Financial Wellness report reveals that financial stress among working Australians is increasing after a four-year period of relative security.

This is our fifth report over the past decade and we’re starting to see some trends appearing as we look back on a rollcall of prime ministers, presidents and pandemics.

Big events 2014 - 2022

The past is another country…

Back in 2014, Tony Abbott (remember him?) was in the Lodge, Barack Obama (and him?) was in the White House and almost three million of us across the country were tuning into My Kitchen Rules.

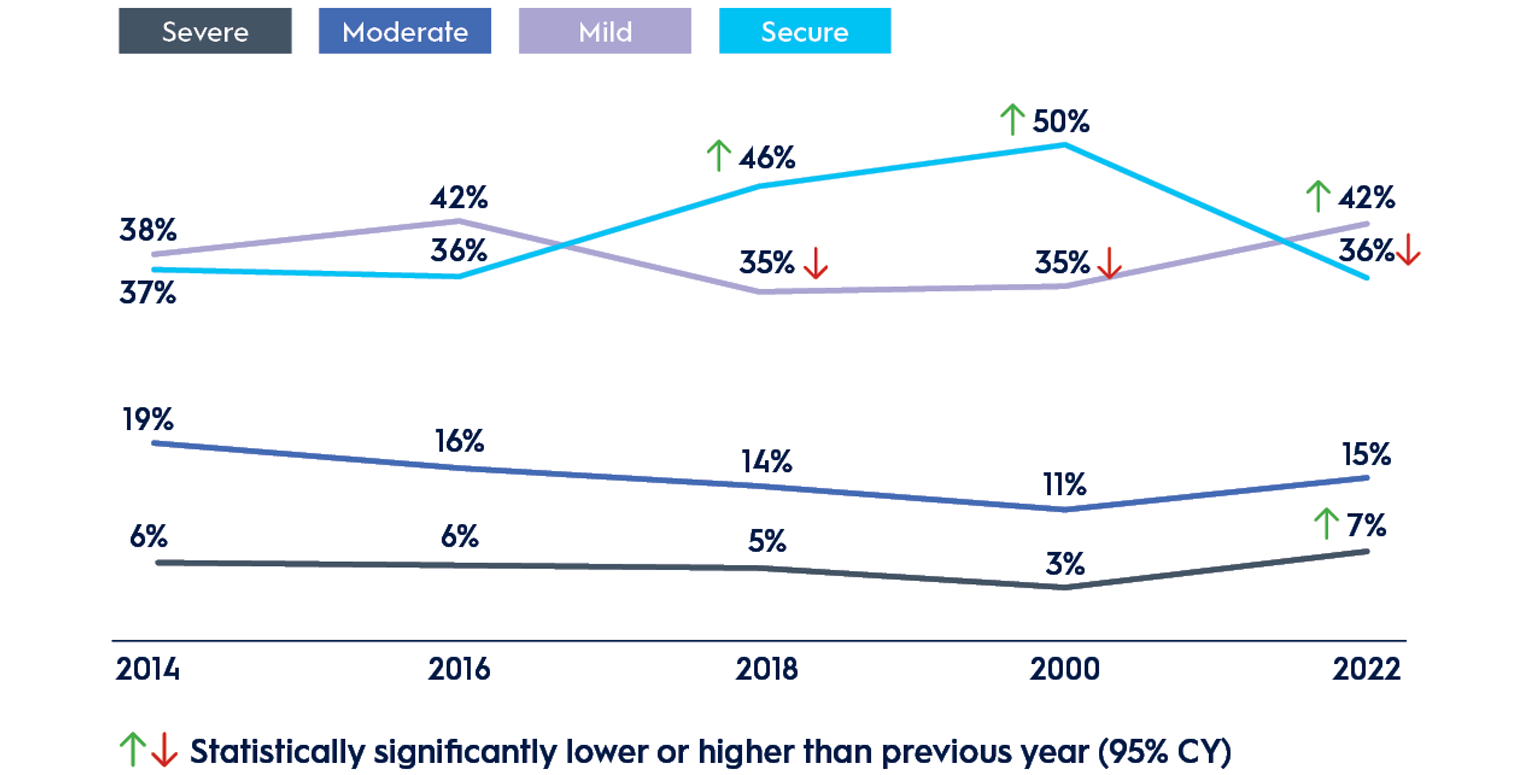

The first Financial Wellness report revealed quite a polarised country, with one in four working Australians feeling severely or moderately financially stressed while 37% of us were feeling pretty secure about our finances.

Two years on and plenty was happening on the global stage. The UK voted to leave the EU in a bombshell Brexit decision, Donald Trump won the US Presidential Election and our athletes were in Rio for the Summer Olympics, picking up 29 medals for 10th place overall.

Back home, the Liberal-National coalition won the Federal Election, returning PM Malcolm Turnbull to the Lodge.

And on the financial wellbeing front things were looking up, with fewer working Australians feeling stressed and more feeling secure.

…they do things differently there

Fast forward two more years to 2018 and Malcolm Turnbull’s time as PM had come to an end, with Scott Morrison taking over. Globally the #MeToo movement was transforming culture and politics. And meanwhile there was a modest wedding ceremony over in England at Windsor Castle, with a certain Harry and Megan tying the knot.

In terms of financial wellbeing the positive trend continued, with a big jump of seven percentage points in Australians feeling secure—in fact, almost half those surveyed were pretty happy with their lot.

Then came 2020—an annus horribilis if ever there was one.

Oil prices were plummeting, inflation was starting to creep up and reports of an obscure coronavirus emerged to take centre stage.

The 2020 Financial Wellness report was conducted in the first wave of lockdowns and, perhaps as a result of widespread government assistance for individuals and businesses affected by restrictions, financial wellness peaked, with half of us feeling secure and only 14% moderately or severely stressed.

Beating the COVID blues

So, after two years dominated by COVID disruptions to our working and personal lives, how are we feeling?

Well, it’s fair to say the mood is darkening. With prices continuing to rise at the checkout and the bowser, the Reserve Bank of Australia has raised rates for the first time in a decade.

There’s been a sharp fall in the number of working Australians feeling secure, down to 36%. And there’s been a significant increase in severe stress to 7%—the highest proportion since the survey began.

Financial wellness index

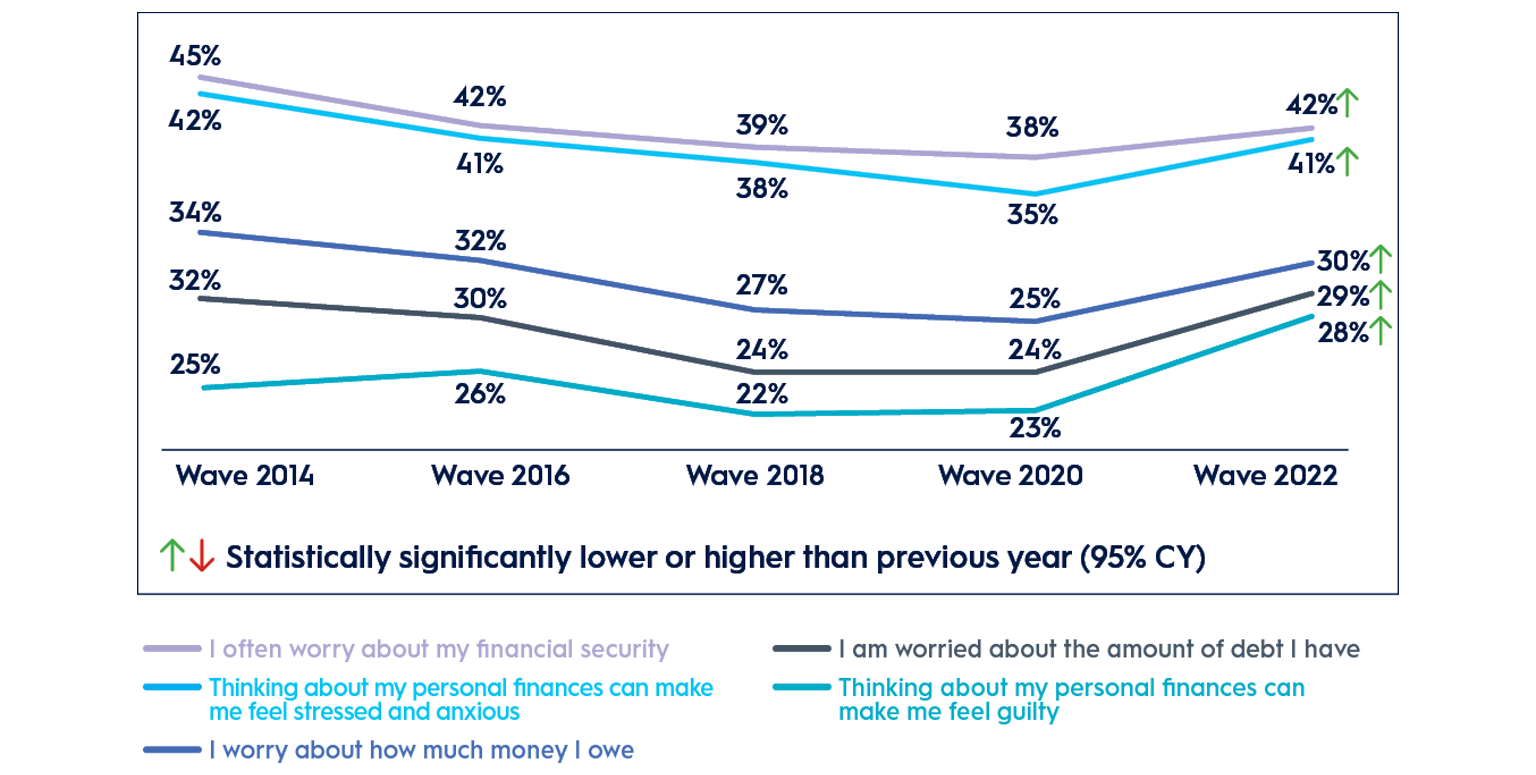

More of us are feeling worried, anxious and guilty about our finances.

%Agree/ stongly agree with each statement

(7-10 score, 0-10 scale)

And in the workplace this means we’re less energised, less vigorous and less inspired. But in line with previous reports, if you’re older—or a man—you tend to be a bit less worried and a bit more satisfied with your financial situation.

It starts with super…

When times are tough it’s understandable to focus on your day-to-day needs. After all, you need to put food on the table and keep paying the bills.

But as probably your biggest asset after the family home, super is the cornerstone of your long-term finances. So it could pay to get on top of your retirement savings…and taking control in one area of your finances could make it easier to start getting to grips with more pressing challenges like budgeting and saving.

If you’re an AMP customer you can check your super balance by logging in or registering for My AMP.

Important information

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account. Taxation issues are complex. You should seek professional advice before deciding to act on any information in this article.

It’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you. The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy. All information on this website is subject to change without notice. AWM Services is part of the AMP group.