Key points

- The newest release of China’s DeepSeek’s-R1 AI model has caused disruption to the US tech sector in the S&P500.

- This AI chatbot basically offers the same proposition as its US rivals, but at a cheaper cost.

- This has caused investors to reevaluate the billions of dollars of spending US companies are investing in designing and manufacturing AI hardware as well as on data centres.

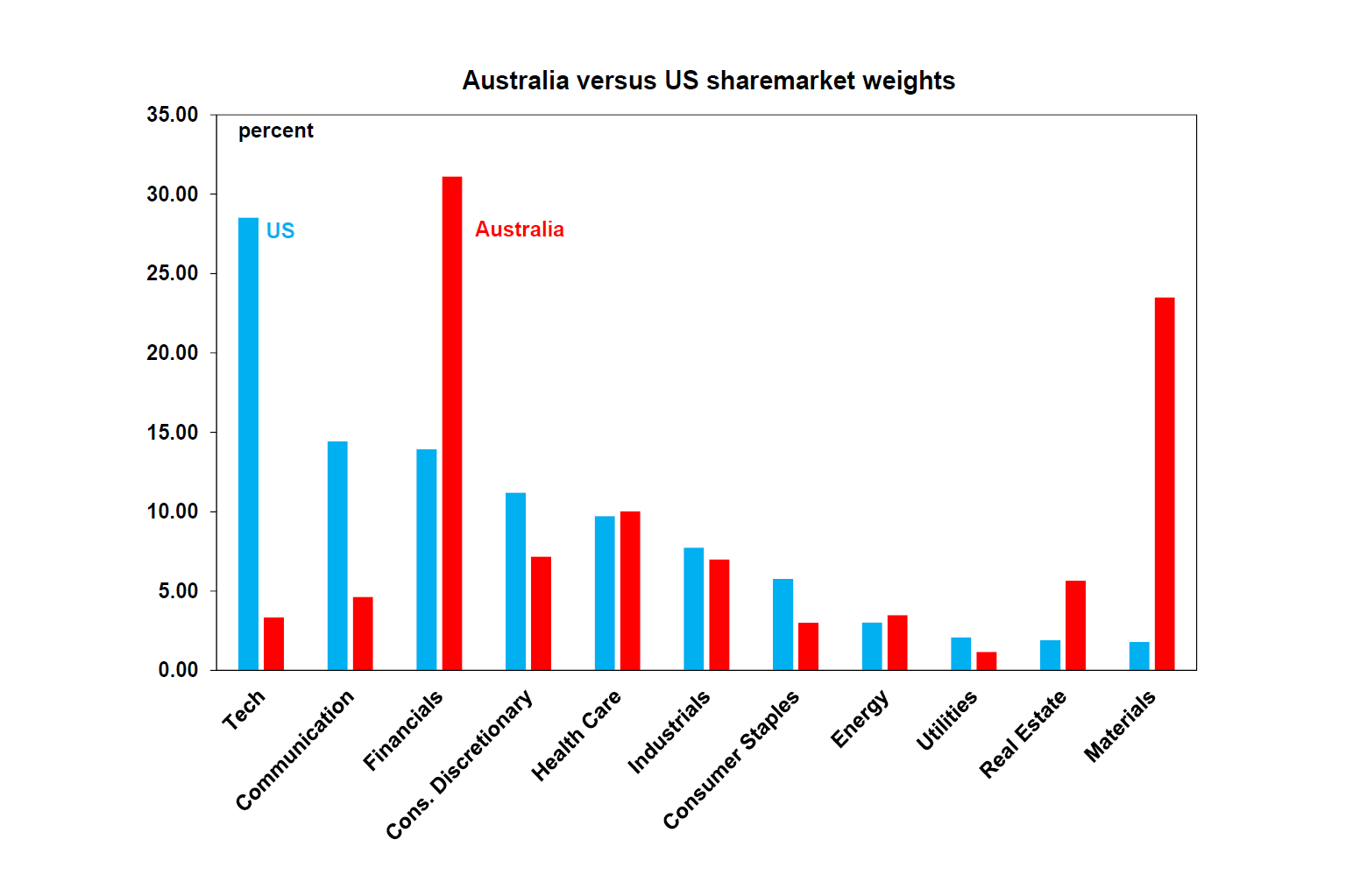

- US tech and communication services (which is mostly tech now due to the dominance of companies like Meta, Alphabet and Amazon) make up over 40% of the total S&P500. So, large movements in these stocks have an important bearing on the broader market.

- The view for US shares and the US economy is still positive. But 2025 will be a rockier year for shares compared to last and there are long-term implications for US tech from the release of DeepSeek.

Introduction

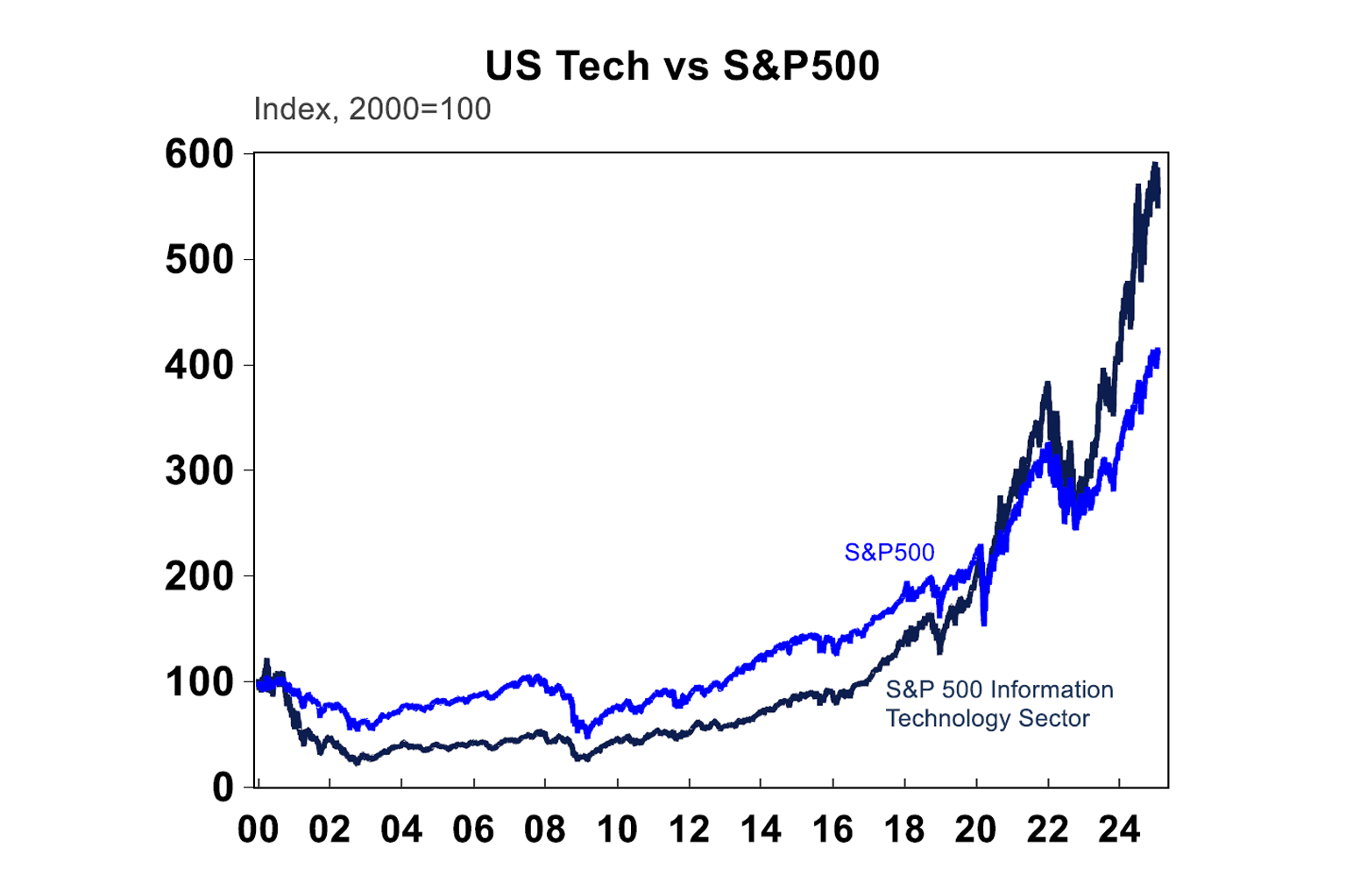

We wrote about “The AI threat” nearly 2 years ago here. Since then, the AI sector has grown, in its value (as evidenced by the 94% increase in the US S&P500 IT sector versus 50% for the broad index– see the chart below) and its proven usefulness with many companies slowly embracing AI tools to help with menial tasks, as well as spending more on computer chips and data centres.

Despite some initial hysteria about the potential loss of humankind to AI, this is yet to occur (of course it has only been two years so let’s wait and see). In this Econosights we look at how the AI world has evolved over the past few years, including recent DeepSeek developments and what the economic implications of this are.

DeepSeek

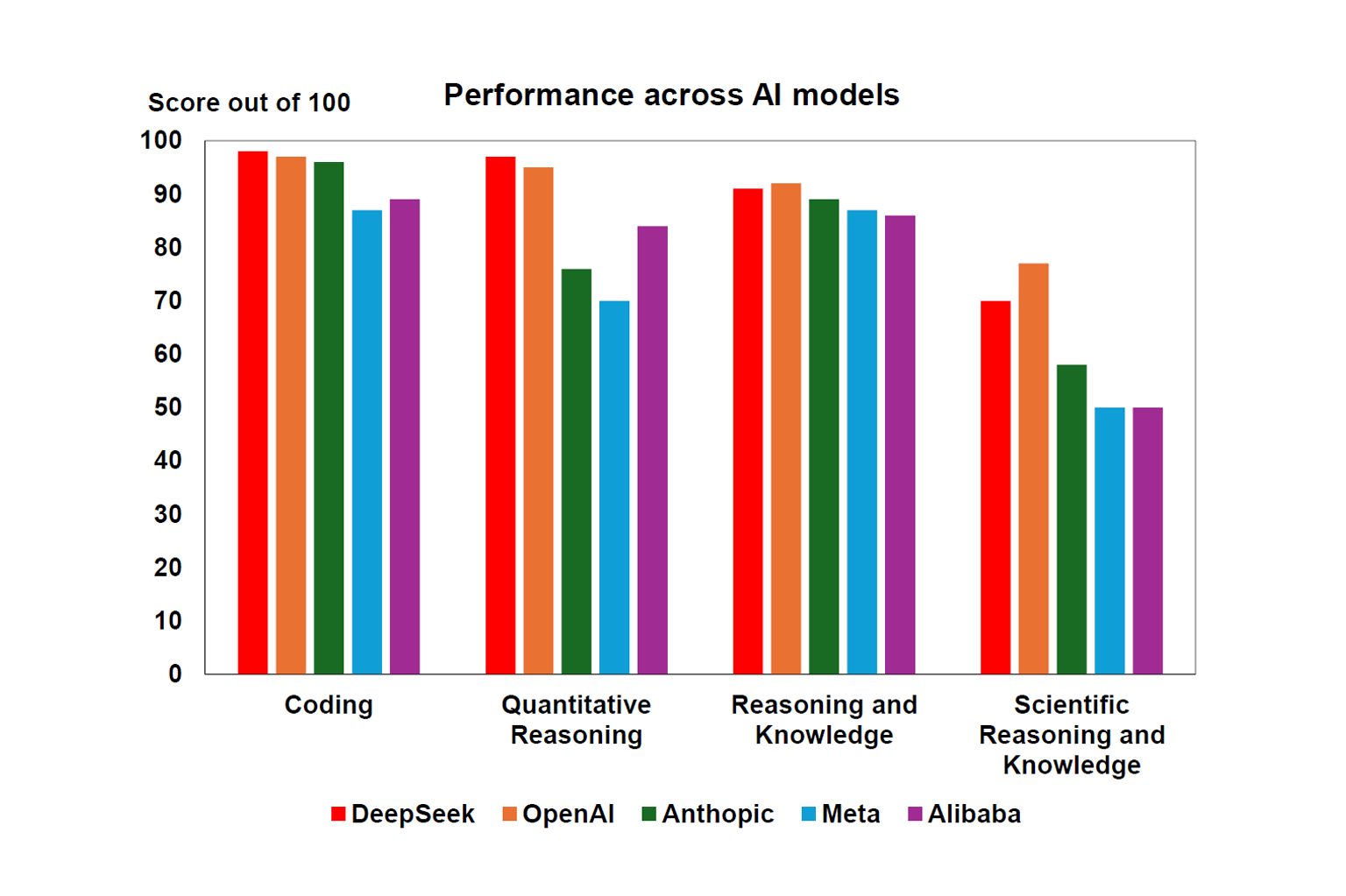

In recent weeks, a Chinese start-up called DeepSeek released a new open-source (which means that the original source code is made freely available, can be redistributed and modified) AI model called R1, rivalling US chatbots like OpenAI’s ChatGPT and Google’s Gemini. While this seems to have come out of thin air, DeepSeek had prior models released in late 2023, with the latest R1 seen to be the best rival to its US peers across most functions (see the chart below).

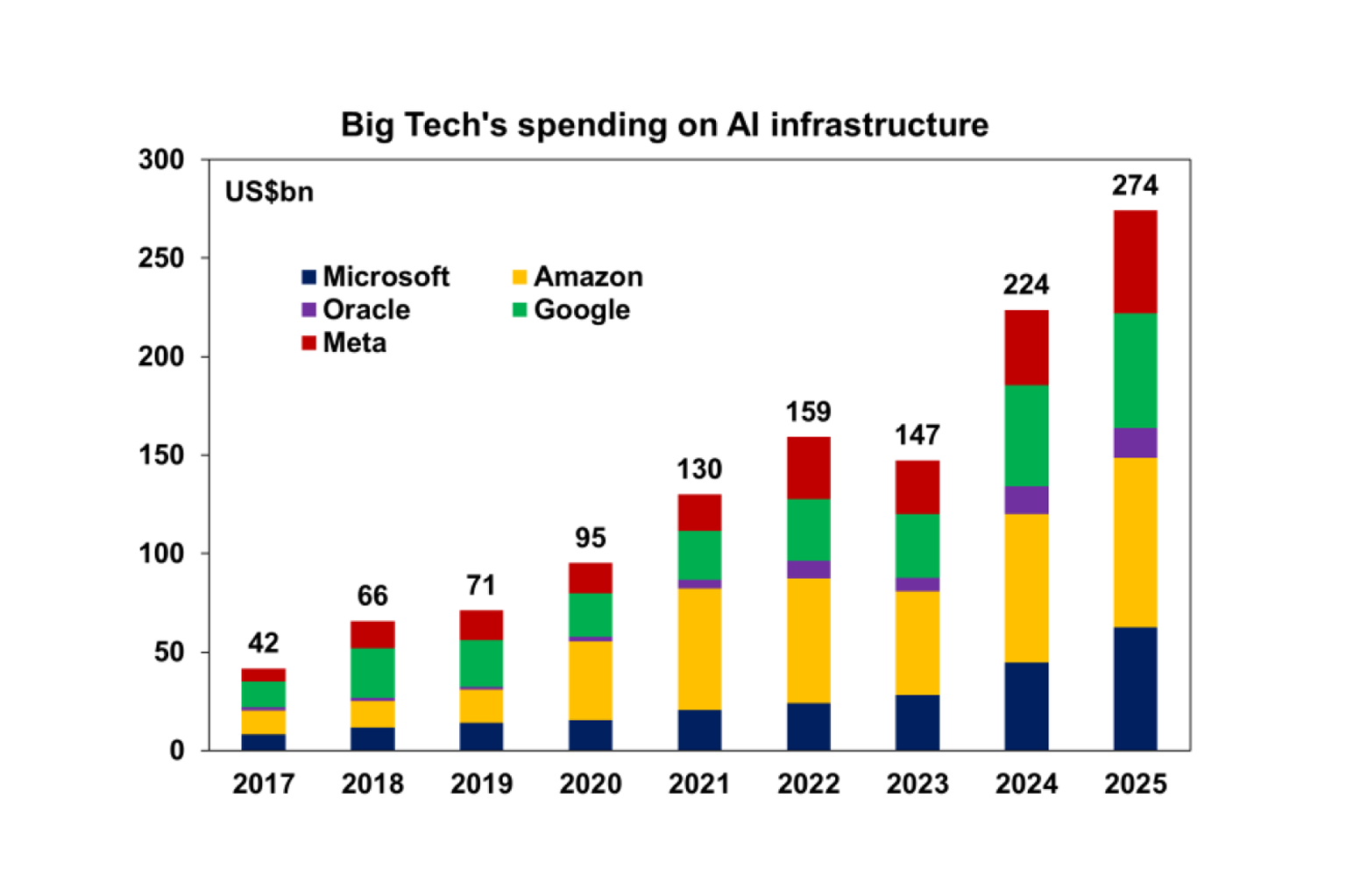

Not only is the DeepSeek version comparable to other chatbots, but the cost to build it seems to be a fraction of its competitors. Reportedly, DeekSpeek spent $5.6mn on developing R1, while US companies are spending billions on equivalent programs (see the chart below).

DeepSeek is free to use (so far) while OpenAI charges up to $200USD per month for unlimited access (although most people would probably just used the free version!).

As a result, investors have questioned the hefty valuations of US tech/communication services stocks like Nvidia, Apple, Microsoft, Alphabet, Amazon and Meta who are either developing the hardware (i.e. chips) that are used for AI models or investing heavily into AI). It also question’s Trump’s new “Stargate” project which is an AI project between OpenAI, Oracle and SoftBank planning to spend $500bn (nearly 2% of GDP) to building essential data centres and computing infrastructure.

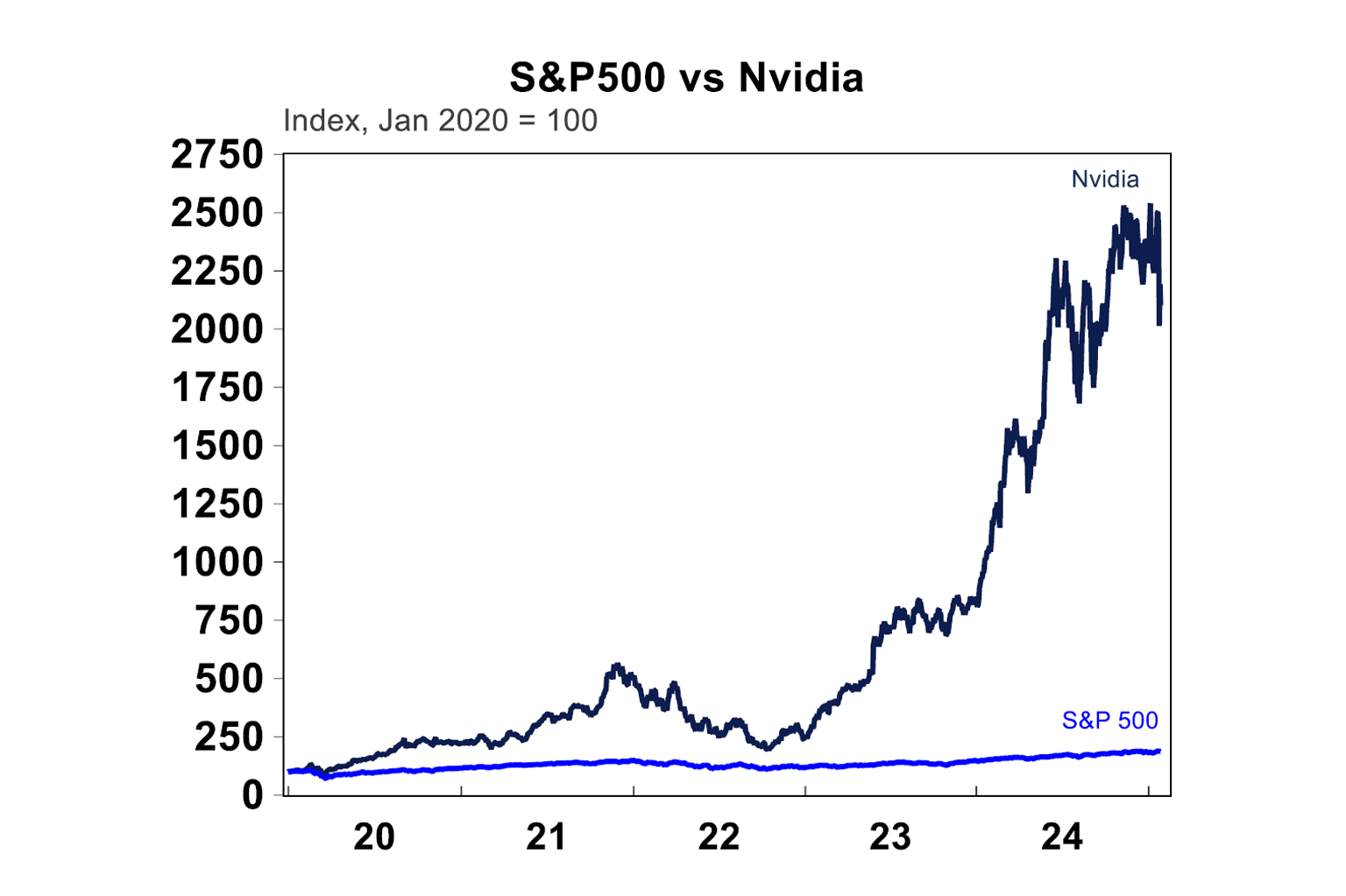

Nvidia’s share price fell by 17% in one day after news of DeepSeek broke out (it has since partly recovered by around 5%). Given that Nvidia itself is worth ~5% of the US S&P500 this had a large impact on the broader index, and also the flow-through to other tech names. Nvidia generates around 40% of its revenues from the other major tech companies, so they are all heavily interlinked.

Around 40% of the US S&P500 is made up of tech/communication services, much larger compared to Australia’s 8% (see the chart below). So changes to the US tech sector have big implications for the US sharemarket, and its relative outperformance in recent years to its peers.

Long-term impacts on the tech sector and investors

The release of DeepSeek’s R1 is good news for the tech sector, consumers and most businesses because it means better efficiency at a cheaper cost which is good for productivity growth in the future. The dominance of the US tech sector was always likely to be challenged by China (which the US already tried to ward off with prior (and likely future) tariffs and bills like the CHIPS and science Act. Innovations are always met with new iterations and DeepSeek will force US players to become more efficient. There is also the positive energy efficiency story, as DeepSeek reportedly uses less energy to run which means less demand for fossil fuels like oil, coal and gas.

But, the DeepSeek news is negative for US hardware and chip makers, as well as AI developers and those investing heavily into AI. The sensitivity of the US tech component of the S&P500 to news of DeepSeek indicates some degree of fragility in the market and also the case of continuing “US exceptionalism”. At the same time, it was always likely that extraordinary earnings growth in the US tech sector was unlikely to continue at the same pace, with question marks over Nvidia’s earnings already evident in late 2024.

There are of course still questions about DeepSeek itself. The US is questioning whether stolen US technology was used for the program. This risks larger-than-expected tariffs on China. Trump has not announced any specific new tariffs on China yet, but they are still likely to occur.

In our view, the outlook for US shares is still positive. The US is still likely to have stronger economic growth, solid earnings growth (the US tech sector is expected to have earnings growth of around 20% in 2025, compared to an average of 13% across the US S&P500), a further reduction to US interest rates, the likelihood of lower taxes and more investment into US manufacturing. But there are also things weighing on US shares including the prospect of tariffs, lower population growth from a tougher border and deportations, lower US government spending. In the near-term, we think that US shares can still outperform its peers. But, 2025 will be a more volatile year compared to last.

Current US tech names that have been massively outperforming the market for years may not be the actual “winners” from the AI revolution. In the future, the benefits will probably go to those that can utilise the efficiency and declining cost of AI and its still unclear which companies that will be.

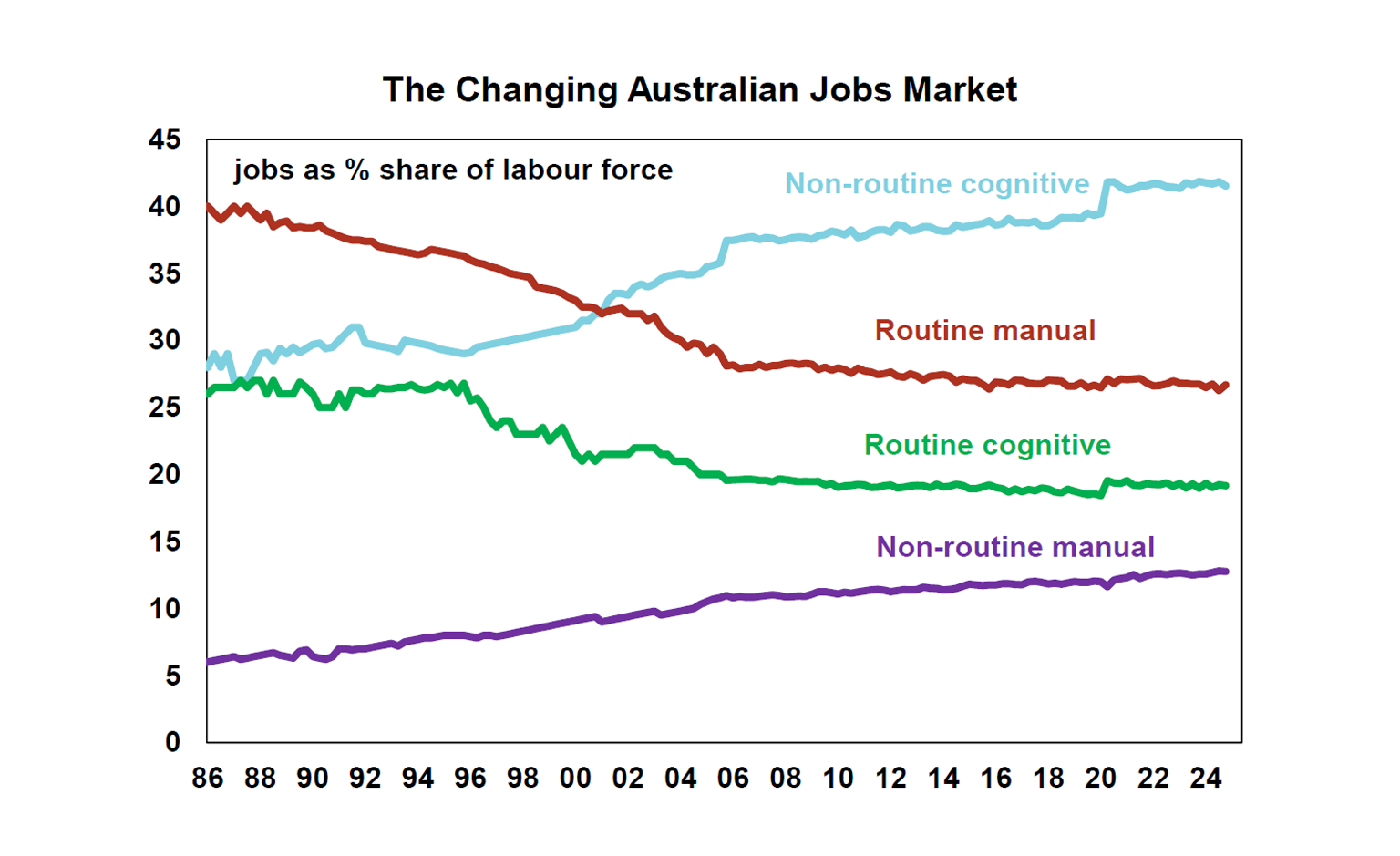

Finally, one of the biggest concerns around tech has been the labour market impact and whether machines would take over from humans. While there has been a clear trend in non-routine jobs becoming a larger share of the market (see the chart below) at the expense of routine jobs, it is a very slow process. And history tells us that as jobs are destroyed from AI, there will be new opportunities created in its place. The important thing is to have the right training and skills for humans to be able to do those jobs.

Diana Mousina, Deputy Chief Economist, AMP

Important note

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance.

This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.