Key points

- A cyclical slowing in the US economy alongside new policy announcements from the Trump administration has led to a weakening in activity indicators, concern over the US outlook for 2025 and a fall in sharemarkets.

- Tariff uncertainty and DOGE cutbacks to the size of the public sector mean a reduced fiscal impulse are both weighing on economic growth. But if personal income tax cuts are extended, along with a reduction in the corporate tax rate (alongside Trump’s deregulation agenda), US growth should benefit later into 2025.

- More downside to US shares is likely in the near-term as US policy is going to remain messy for now. But we are still optimistic about US investment returns over the next 12 months as Federal Reserve interest rate cuts will help the cyclical parts of the economy and Trump’s pro-growth policies will support the economy later in 2025 and in 2026.

Introduction

Trump’s trifecta win in the 2024 Presidential election which saw the Republicans take the popular vote, Congress and the White House led analysts to believe that his pro-growth plans would outweigh more tenuous policies around tariffs and immigration. There was also some expectation of a “Trump put”, a belief that Trump and his team are sensitive to changes in the sharemarket and would step in as necessary to support markets (similar to the “Fed put”).

US shares rallied 8% from election date to their February record high but have fallen by 9% since then. Recent economic data in the US has been soft and some analysts are revisiting their shelved recession predictions. Comments from Trump and his team have not helped to allay downturn fears. Trump said that he is not looking at sharemarket performance and implied that short-term movements in shares miss the bigger picture if shares rise over the long-term from better economic policies. Treasury Secretary Bessent saying “there’s no [Trump] put… if we have good policies, then markets will go up”. Bessent also said “there’s going to be a natural adjustment as we move away from public spending…there’s going to be a detox period”. As a result, many are questioning whether the barrage of new policy announcements (with Trump already signing 89 Executive Orders in less than 2 months in office… the most signed by any President since Truman in the late 1940s-50s) will slow the US economy and markets in turn. In this edition of Econosights, we look at these issues.

What has recent US data been indicating?

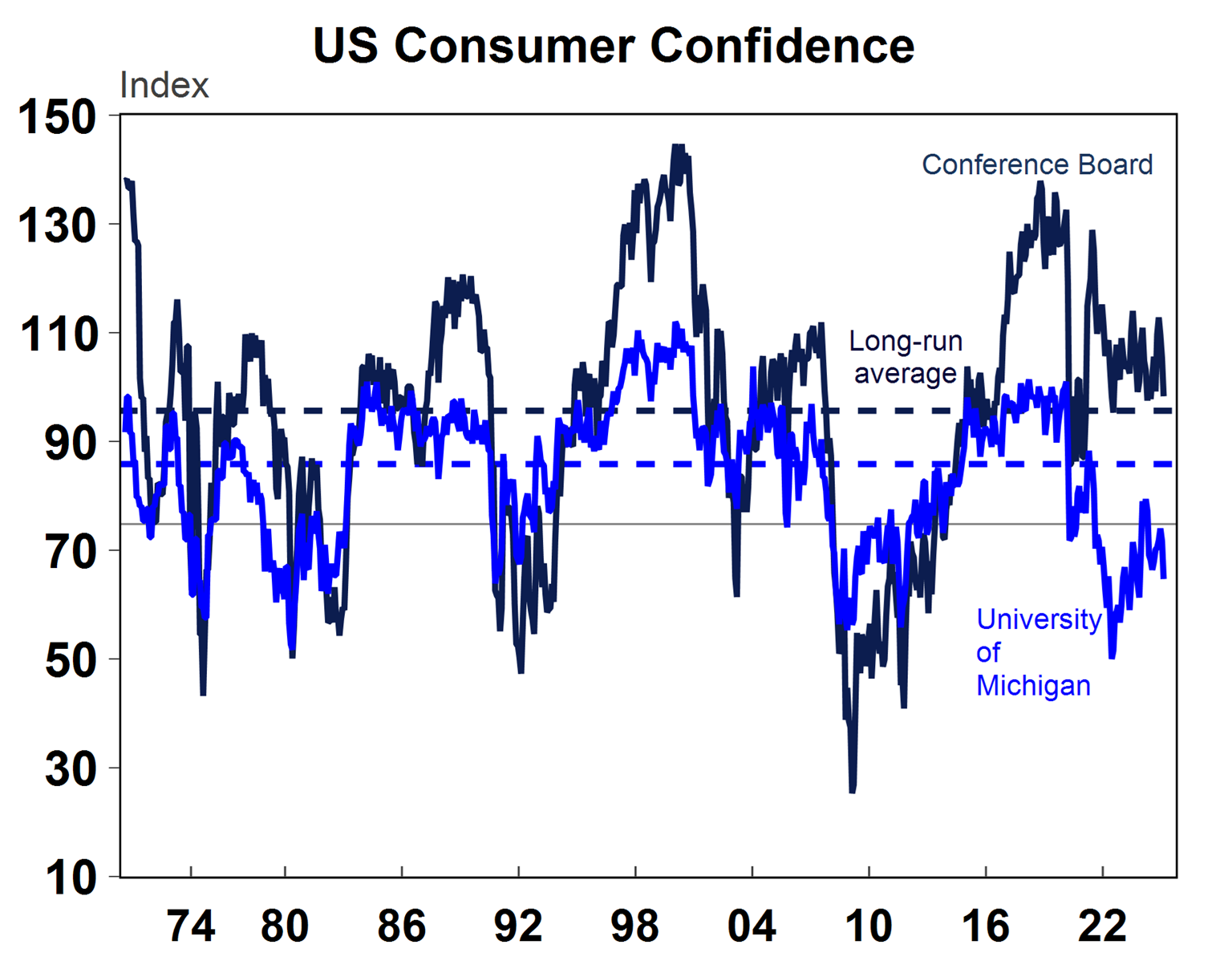

Many of the “soft” (survey-based) and hard (data based) indicators have weakened. Consumer confidence has trended down on both the University of Michigan and Conference Board measures (see the chart below), with the two main differences between the indicators that the Conference Board measure is more related to labour market measures and the University of Michigan is closer to cost-of-living indicators. Small business confidence has also slumped, after rising post-election. The uncertainty around the timing and magnitude of tariffs, their impact on inflation and cuts to US government spending is weighing on confidence.

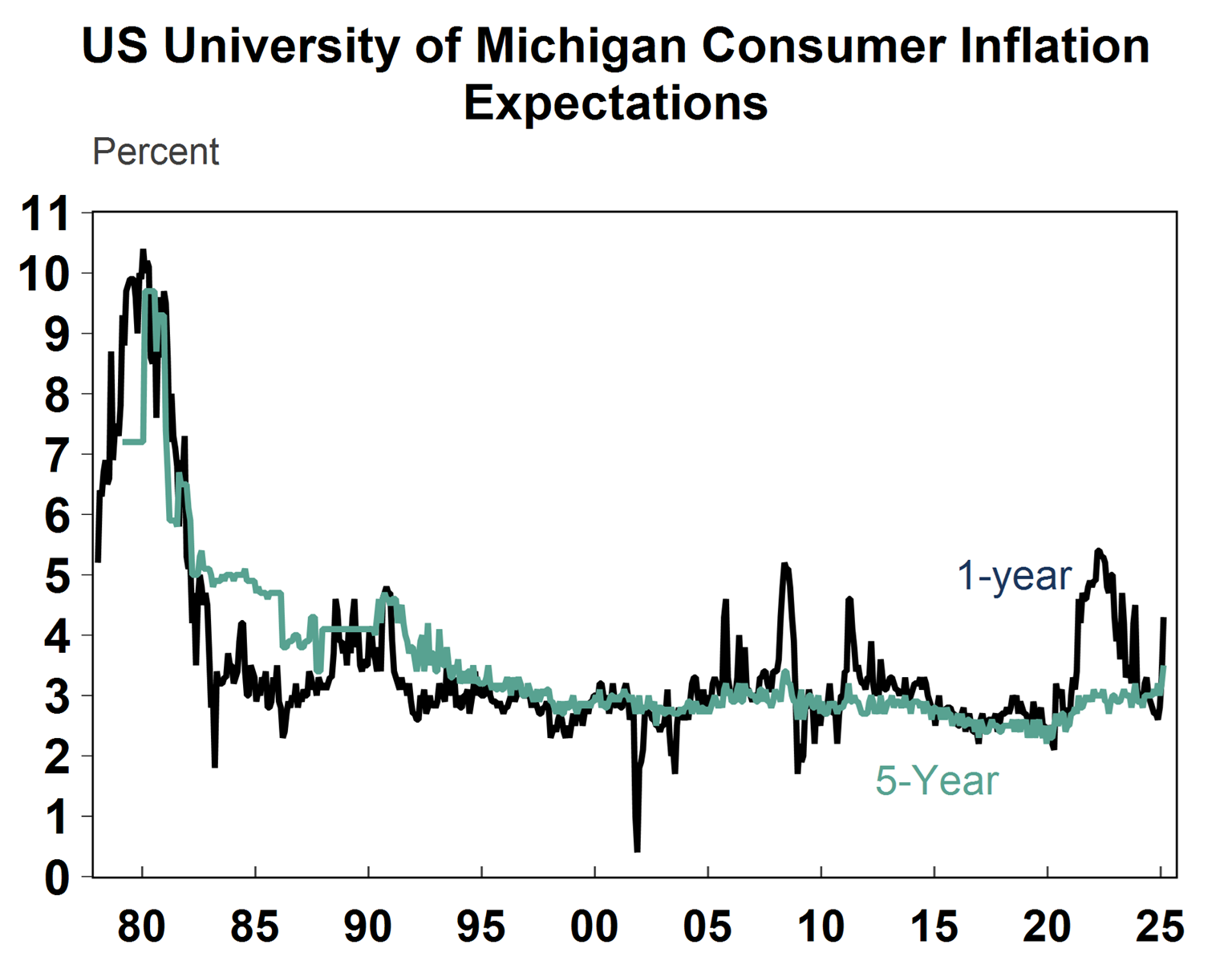

Consumer inflation expectations have also lifted noticeably (see the chart below), reflecting consumer perceptions that tariffs will lift prices. The rise in 5-year inflation expectations to the highest level since the mid 1990s is especially concerning. Even the 40-year high in inflation during the pandemic did not lead to this breakout in long-term inflation expectations.

“Hard” activity data has also slowed, leading to a collapse in the March quarter “GDPNow” estimate, the forecasting tool for GDP growth run by the Atlanta Fed. It is currently tracking at -2.4% (at an annualised quarterly rate), having fallen from +3% in January (see the next chart). But, some caution is warranted. A lot of the fall was due to rise in imports (which drags on GDP growth), particularly in non-monetary gold which isn’t included in the final GDP figure. The “gold-adjusted” GDPNow measure is at 0.4%, rather than the headline figure of -2.4%. March quarter data has also been notoriously volatile due to seasonal adjustment issues with bad weather. Some indicators for February are also yet to be released. The slowing in GDP growth from its 2024 level of around 2.5% is leading to concern about an outright recession (two consecutive negative quarters of GDP growth), which we think has a ~40% risk in the next 12 months. Our base case is US GDP growth of around 2% in 2025.

Recent US policy decisions

There have been multiple iterations of tariff announcements from the administration. Some tariffs have started (including an additional 20% on China, some on Canada and Mexico and steel and aluminium) but most are due to start from 2 April and the average US tariff rate is likely to rise to its highest level since the 1950s. Because tariffs have just begun, there has been no impact on inflation data, but the anticipation of tariffs is lifting consumer inflation expectations and increasing consumer and business uncertainty. Trump and his team claim they are using tariffs as a negotiating tactic to restore “fair” trading conditions for US exporters, lifting US production and other issues cited by Trump around Fentanyl flows and immigration. It will be difficult for the US economy to maintain permanently higher tariffs, because history shows that growth will suffer. So, it’s likely that some tariffs will be negotiated down but it may take months before negotiations are finalised which will keep markets nervous in the meantime.

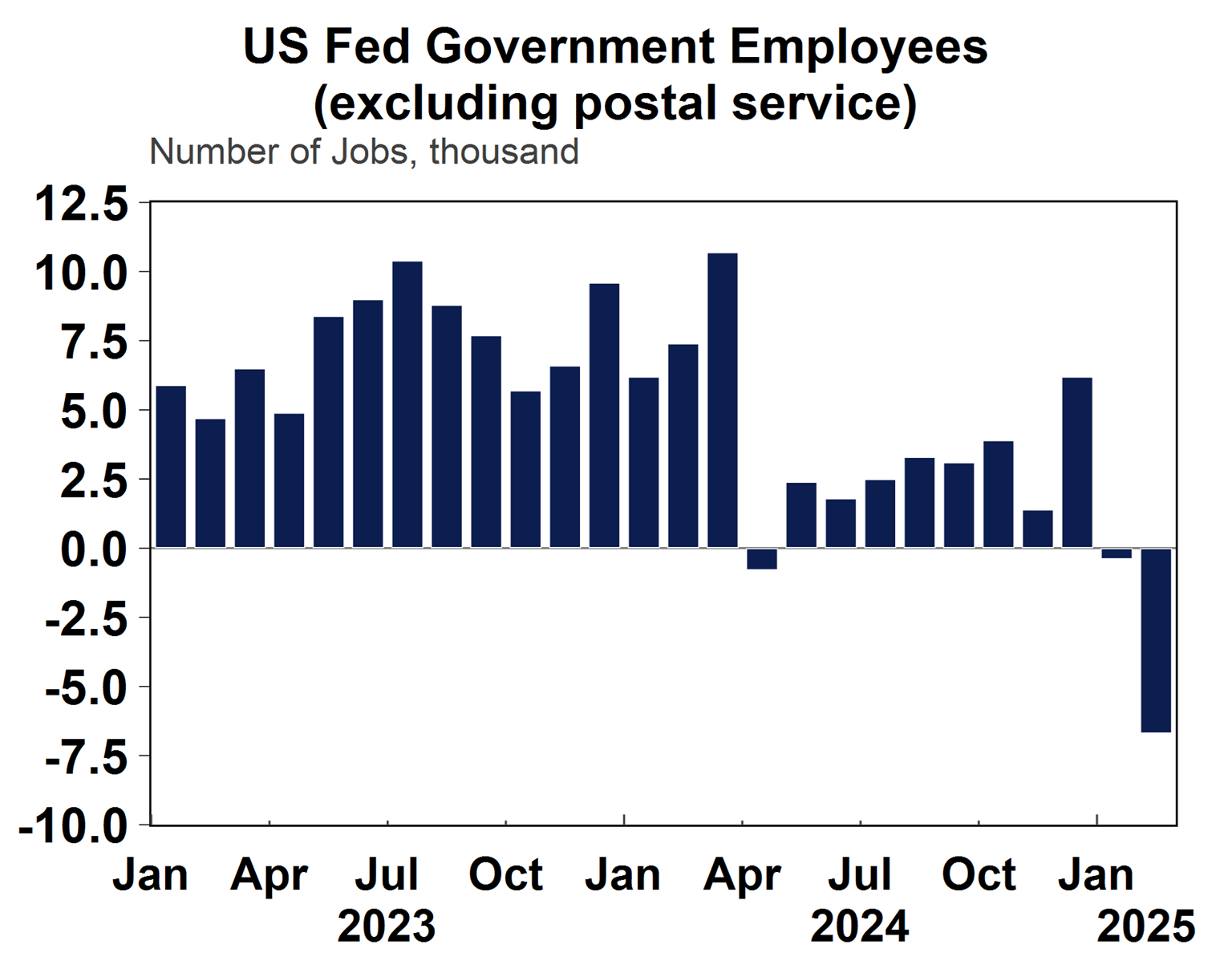

Elon Musk’s Department of Government Efficiency department (DOGE) has been making cutbacks to the size of the public sector through federal government workers, although there is no official specific targeted number of jobs that the program is aiming to cut down. There are ~2.4mn Federal government (ex postal service) workers in the US which is 1.5% of total non-farm payrolls. The White House said that military service, postal workers and positions related to national security, immigration and public safety would be exempt from these changes. So far, around 75K employees have accepted voluntary “buyout” (i.e. a redundancy package) which still gives them pay until September. And the other tranche has been laying off “probationary” employees (usually those who have been in the job for less than a year). There has been a slowing in the pace of Federal government jobs (see the next chart), with jobs now declining. It is unclear how many more layoffs there will be to probationary or permanent staff, resignations and the impact from a federal hiring freeze. There is also an indirect impact for private contractors to the government which estimate vary but appear to be ~5.2mn, another 3% of non-farm payrolls. Then there is also the broader impact to private business hiring from policy uncertainty. All up, DOGE employment impacts are likely to subtract around 50K from jobs per month over 2025, so we should expect some slowing in the pace of jobs growth throughout 2025 and a further rise to the US unemployment rate.

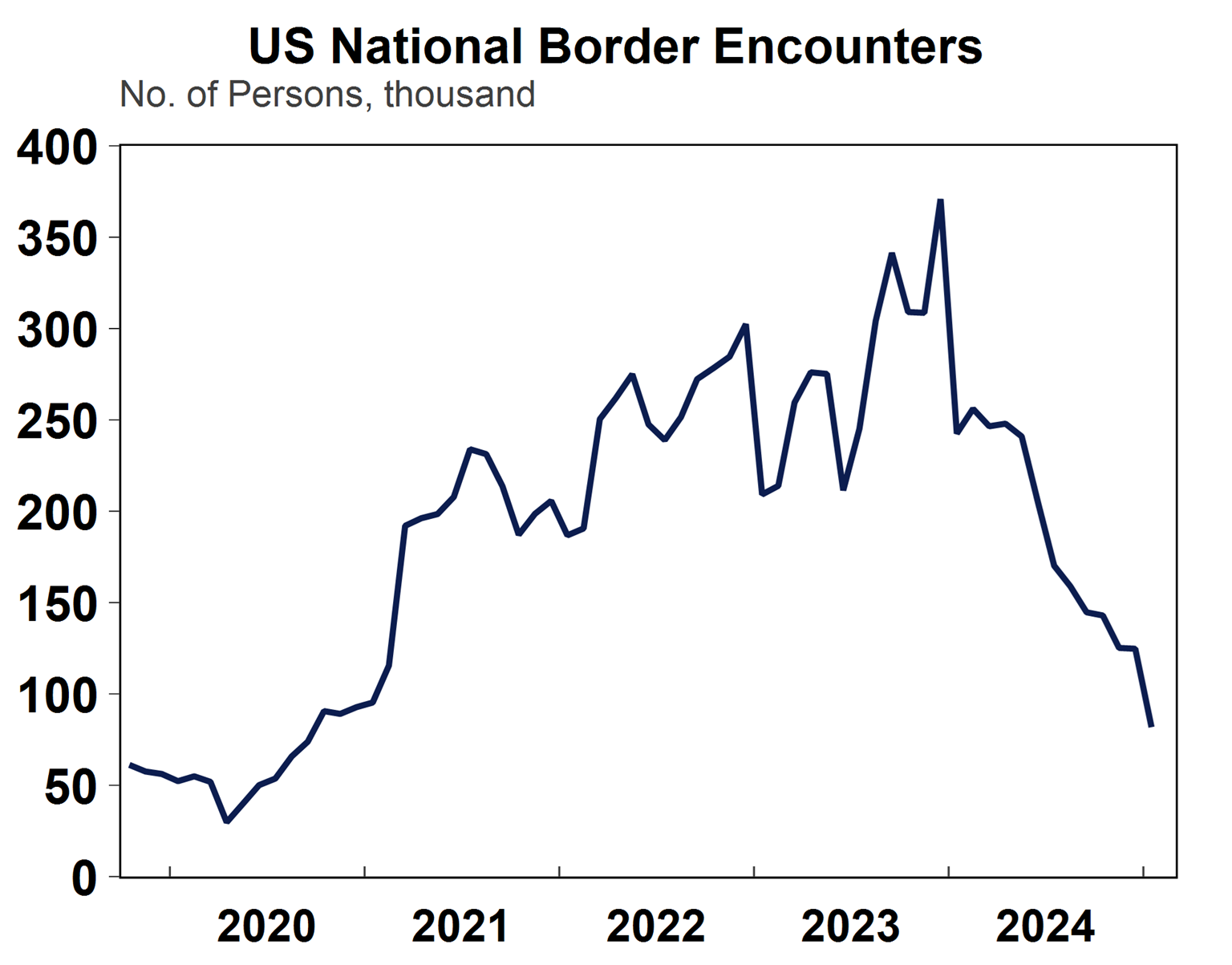

Tougher restrictions on the border have seen a drop in border “encounters” (although this trend was already in place since mid-2024). From an economic point of view, lower immigration could weigh on labour supply which slows GDP growth and could be inflationary via-wages.

Trump’s more pro-growth policies include the campaign to extend tax cuts (which were due to expire at the end of the year), reduce the corporate tax rate and a deregulation push, would provide a boost to the economy. The House of Representatives has passed a large reconciliation bill, including $4-4.5tn worth for the tax cuts extension, $300bn of new defence and border spending and $1.5-2tn of spending cuts. This bill will still need to go through the Senate before it is passed but could provide a fiscal impulse, especially if spending cuts get watered down.

Conclusion

The interest rate tightening cycle from 2022 was already leading to a cyclical slowing in the US economy from late 2024. Credit card, auto and mortgage loan delinquencies were rising, the labour market was weakening and there were already question marks about the sustainability of US tech outperformance. Recent policy changes have introduced another layer of uncertainty. This means that US sharemarkets may have more downside in the near-term, until there is some more clarity around the longer-term impact of new policy announcements. Outperformance from European sharemarkets, based on expectation of higher fiscal stimulus could continue in the near-term. US tech is likely to see lower performance in 2025 given already high valuations, softer earnings estimates and competition from new entrants. But we are still optimistic about US investment returns over the next 12 months as Federal Reserve interest rate cuts will help the cyclical parts of the economy and Trump’s pro-growth policies will support the economy from later in 2025.

Diana Mousina, Deputy Chief Economist, AMP

Important note

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance.

This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.