Requesting access to super

Understanding how and when to access your superannuation savings is crucial for your financial planning. We provide the necessary information and digital online forms to make the process of accessing your super as smooth as possible.

When the time comes to start drawing from your super, it helps to know how to make a withdrawal and limits you should consider. This is relevant to you if you're thinking about withdrawing your super early, approaching retirement or if you're a temporary resident who is permanently leaving Australia.

Generally, you can only access your preserved super when you meet one of the following conditions of release:

- You retire after reaching your preservation age - refer to the relevant preservation age table for details.

- You cease employment at age 60 or over.

- You reach age 65.

- You reach preservation age, but do not retire or cease employment and purchase a non-commutable income stream such as an allocated pension designed for this 'transition to retirement' purpose.

- Early release of super.

The below steps will guide you through how to access the forms to request early withdrawal of super based on age or financial hardship.

Make a cash withdraw of your super at preservation age

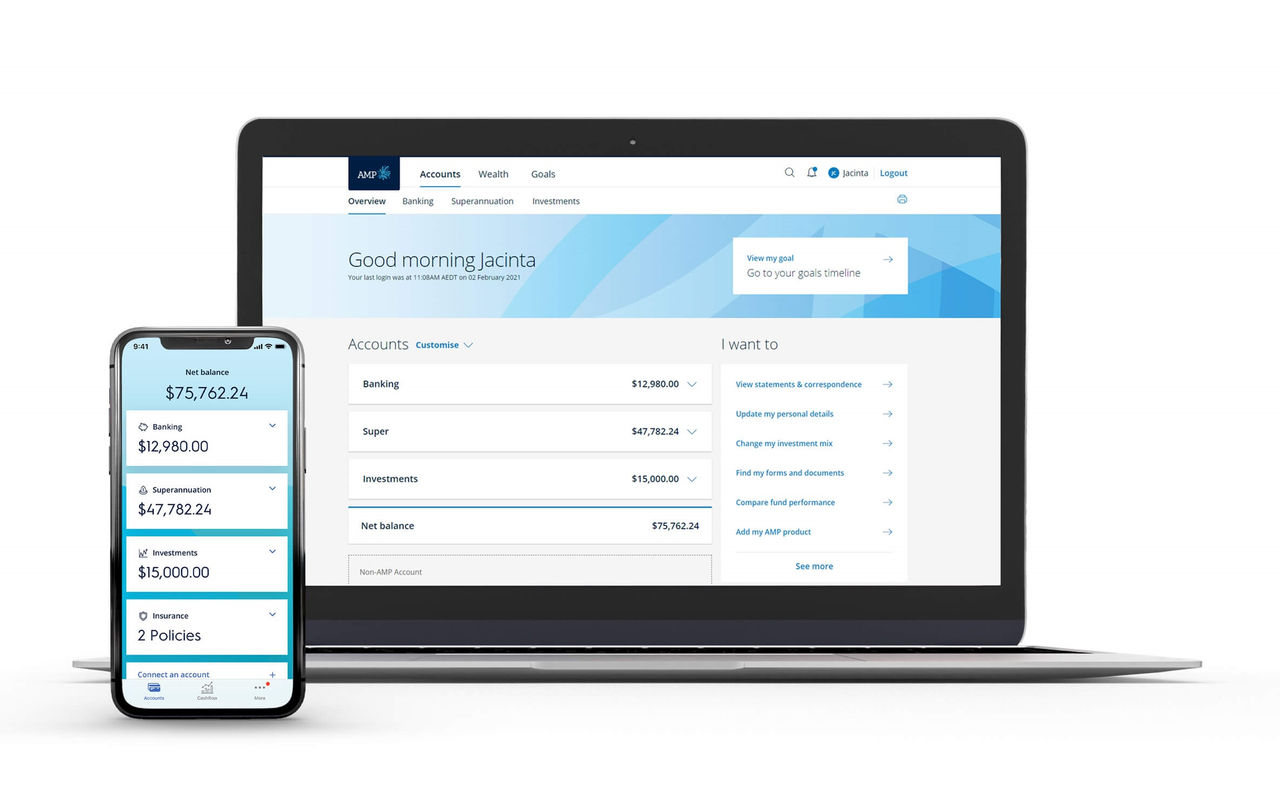

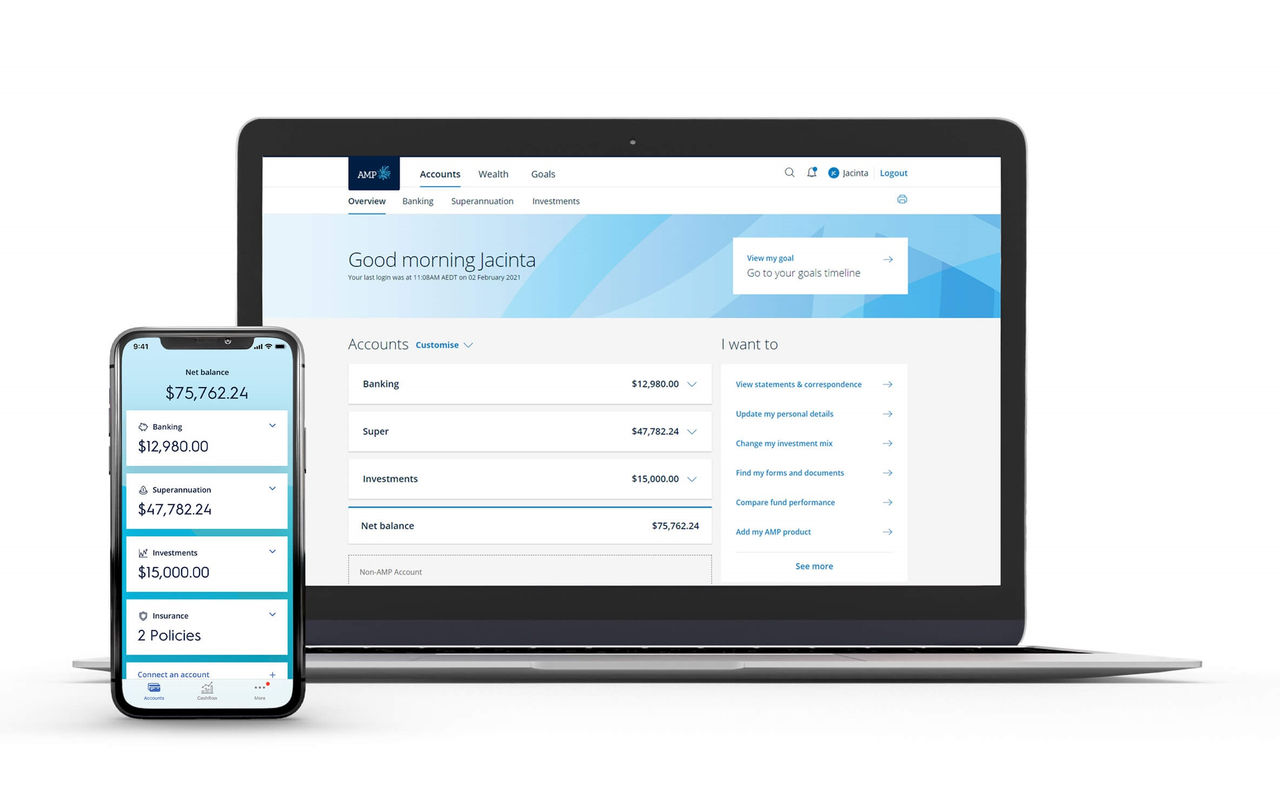

You can choose to withdraw your super in cash once you reach preservation age in My AMP. Follow the below steps to complete the online application:

- Login or register for My AMP

- Select the Super account you want to withdraw from

- Follow the Withdrawal link

- Select the reason for your withdrawal

- Review and update any personal details. You may be required to provide documentation such as an ID.

How to withdraw your super if you’re experiencing financial hardship in My AMP

You can choose to withdraw your super in cash if you’re experiencing financial hardship. Follow the below steps to complete the online application:

- Login or register for My AMP

- Select the Super account you want to withdraw from

- Follow the Withdrawal link

- Select the reason for your withdrawal

- Continue verification of eligibility for financial hardship. You’ll be asked to provide documentation to support your claim.

When can I access my super?

Withdrawal requests can be made based on:

- Unrestricted non-preserved - this amount can be accessed at any time.

- Restricted non-preserved - this amount can generally be accessed when you stop working for your participating employer.

- Preserved - this amount can only be released in the circumstances prescribed by legislation. Refer to early release of super.

- First Home Super Saver Scheme (FHSSS) — this amount can only be accessed if you've received a FHSSS determination from the Commissioner of Taxation. Visit ato.gov.au for more information.

Early release of super

There are some specific circumstances where the law allows you to draw on your super early. You’ll have to meet one of the following conditions where you:

- qualify on grounds of severe financial hardship

- become permanently incapacitated

- have a terminal medical condition

- have been granted release by the Australian Taxation Office (ATO) on compassionate grounds

- are the holder of an expired or cancelled temporary resident visa and you have permanently departed Australia (Note that this option is limited to certain visa categories and isn't available to New Zealand citizens).

Learn more about the eligibility criteria to access your super early.

What is preservation age?

Your preservation age is the minimum age you need to reach in order to access your super. It can be from 55 to 60 years of age, depending on what year you were born.

Find your preservation age in the table below.

Relevant preservation age

| Date of birth | Preservation age |

| Before 1 July 1960 | 55 years |

| 1 July 1960 - 30 June 1961 | 56 years |

| 1 July 1961 - 30 June 1962 | 57 years |

| 1 July 1962 - 30 June 1963 | 58 years |

| 1 July 1963 - 30 June 1964 | 59 years |

| After 30 June 1964 | 60 years |

What you need to know

Products in the AMP Super Fund and the Wealth Personal Superannuation and Pension Fund are issued by N.M. Superannuation Pty Ltd (NM Super), ABN 31 008 428 322.

Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product disclosure statement, Target market determination or Terms and conditions, available on this website or by calling 13 12 67.

Read AMP’s Financial services guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Any advice provided is general in nature only. It doesn’t consider your personal goals, financial situation or needs. It is provided by AWM Services Pty Ltd (AWM Services), ABN 15 139 353 496.

All information on this website is subject to change without notice.