Why AMP Super

Past performance is not a reliable indicator of future performance.

Digital tools and simple advice with no extra fees

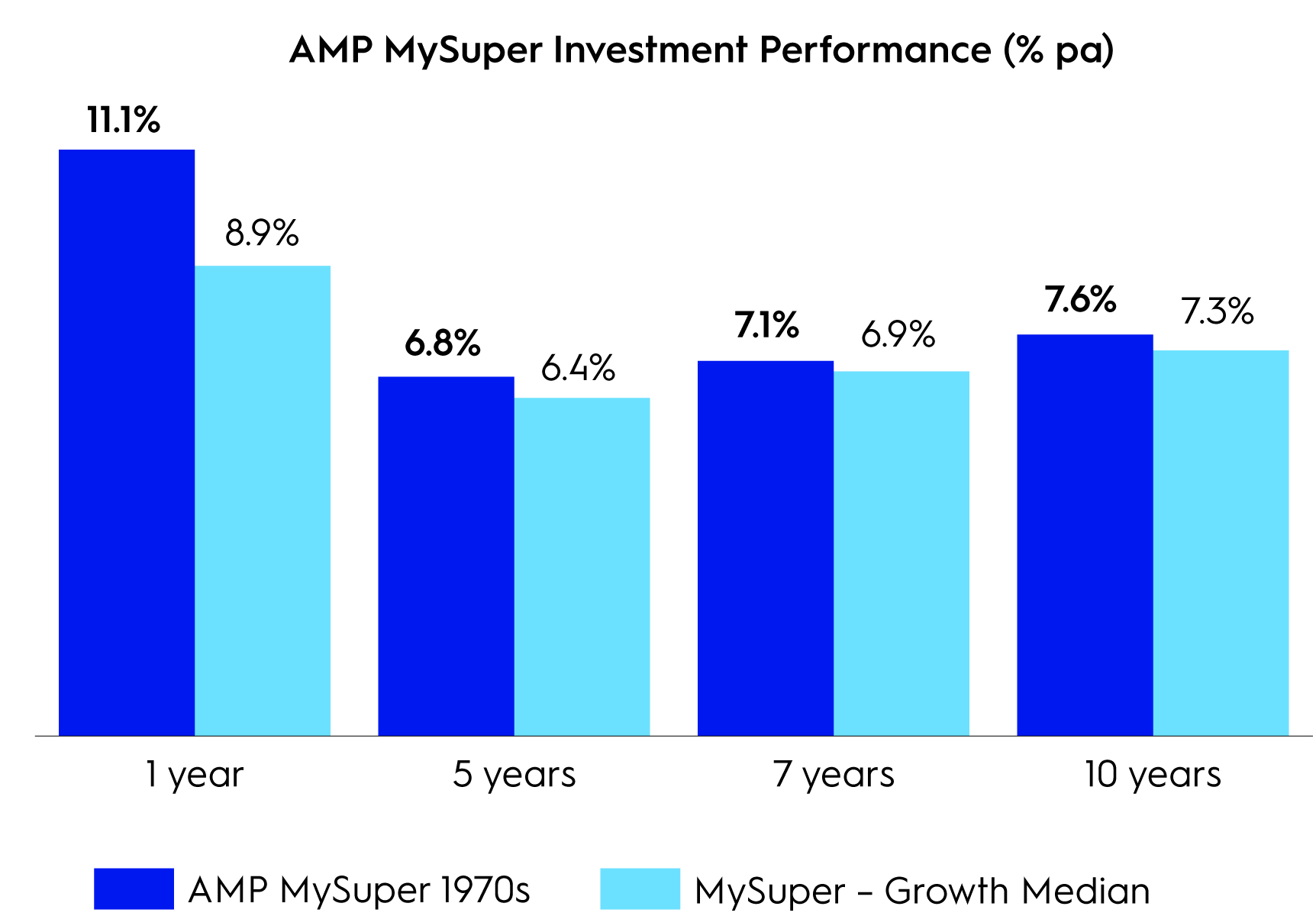

We’re proud to deliver consistent strong returns for our members

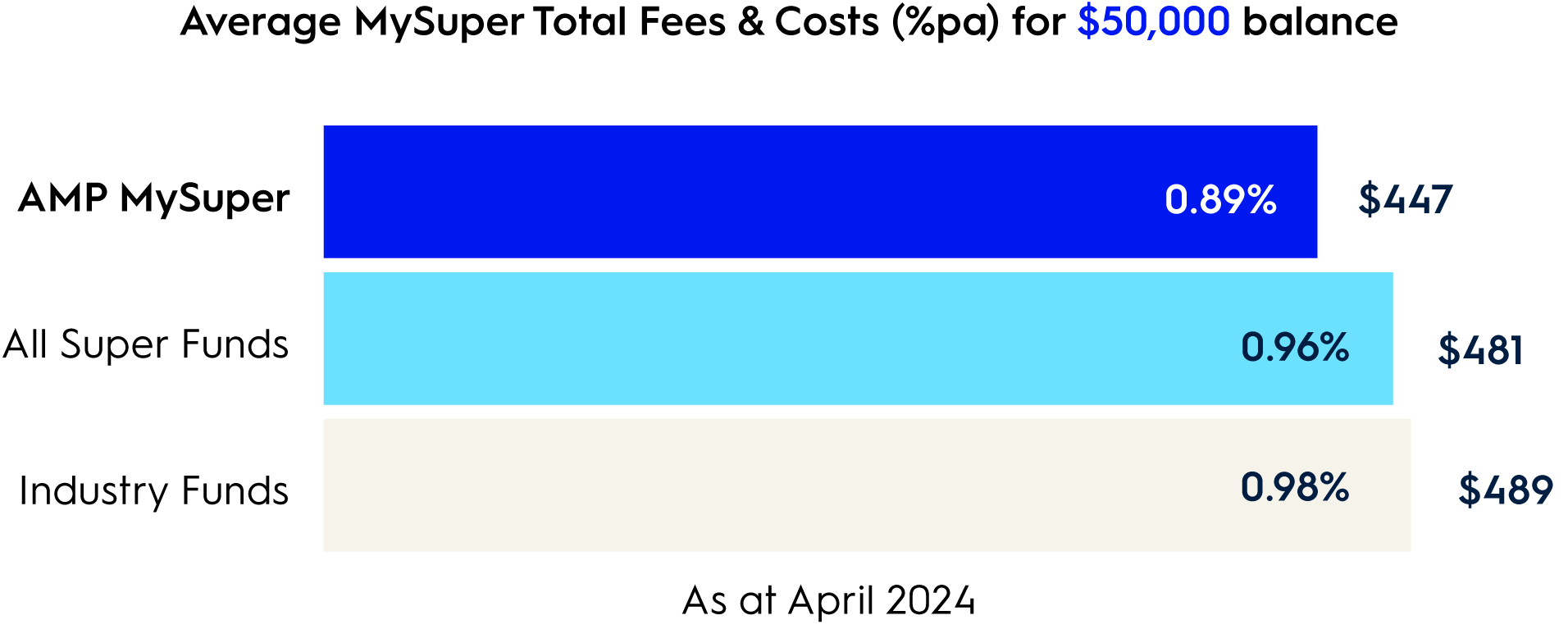

We deliver consistent strong returns versus the industry median, and AMP MySuper fees are lower than the average super fund meaning more money for you to retire with.

AMP’s MySuper fees are lower than the average super fund, including the average industry fund1. Plus, our percentage administration fee is capped for account balances over $500,0003. This means more money for you for when you retire.

For a full list of fees and costs applicable to your super account, please see the Product Disclosure Statement (PDS).

AMP Super is proud to deliver consistent strong returns for our members across marketing conditions. Learn more

For investment performance across all AMP MySuper Lifestages options, visit our MySuper dashboard.

Based on the simple average of total administration and investment fees and costs across all AMP MySuper Lifestages options (Capital Stable, 1950s, 1960s, 1970s, 1980s, 1990s Plus). Compared against the simple average of industry funds’ and all super funds’ MySuper options included in the Chant West Super Fund Fee Survey March 2024.

Investment performance is as at 30 September 2024 and is net of investment fees, costs and tax (but excludes administration fees, member fees, amounts paid from the super fund’s assets and member activity fees). The “MySuper – Growth Median” is taken from the Chant West Super Fund Performance Survey September 2024, being the median of all options contained in the MySuper – Growth table with a growth asset allocation of between 61-80%. AMP MySuper 1970s is our biggest MySuper option and has a higher allocation to growth assets (approximately 90%) than other super funds’ MySuper options. However, this graph enables you to compare our MySuper offer with key competitors. Past performance is not a reliable indicator of future performance.

Insurance designed for you

Insurance through super can help protect you and your family if something happens to you. AMP has worked with your employer to provide insurance specially designed for members of the plan. Eligible members may be able to access Death, Total and Permanent Disablement and/or Income Protection insurance without having to provide medical history. Members may also be able to transfer their insurance from other super funds to AMP, so that it’s all in the one place. For further information including eligibility requirements, refer to our Insurance Guide.

Learn more about insurance in super.

Before you sign-up, take some time to understand what comes with your employer’s sponsored AMP super plan (this web page is a good place to start). Or book a chat with a super coach.

If you’ve chosen the AMP super plan, you can join online in just two minutes.

Once you’ve signed-up to the AMP super plan, simply follow the prompts to let your employer know where to pay your contributions.

After you’re all set up, we’ll be in touch with ways you can stay on top of your super.

Here to talk all things super

With digital tools and simple advice, AMP Super can help you get super close to your super.

Learn moreAlready have an AMP super account?

If you have an existing AMP super account and want to use that instead of joining your employer’s sponsored plan, you can fill out this choice of fund form and give it to your employer.

There may be differences between the two AMP plans, so make sure you compare the features and benefits before deciding – a chat with a super coach may help.

We’re here to talk all things super

Digital tools

Access a range of smart and real time digital tools that help you get close to your super. From the Investment Risk Profiler to the Retirement Needs Calculator you can explore and play out your future today.

Find out which approach to investing could be right for you. The Investment Risk Profiler uses four simple questions to help work out what investment style may suit you.

Play with different scenarios to understand the retirement lifestyle you want. Or use the simulator to find out find out how much you could spend in retirement and how long your money may last.

Check your balance, switch investment options and manage your insurance all in real time in one place with My AMP and the My AMP app.

Simple advice and super coaches

We want you to get super close to your super. That’s why we have a range of advice choices with no extra fees.

Super check-in

Speak to a super coach - they’ll help you to understand your current balance, contributions, investments and insurance, and answer general super questions.

Super advice

Have a question about your AMP super? Connect with a qualified super financial adviser to get personalised advice on five super topics including investment options and insurance.

Find out moreRetirement advice

Approaching retirement? Our retirement specialists are qualified financial advisers who can discuss your personal retirement goals and questions.

Join AMP Super today

Awarded for putting you first

AMP Super has been recognised and awarded by the industry for many years. And we’re proud to add more awards to our long list.

Documents

SignatureSuper is designed for members who want to grow their super savings for their retirement. It's also a personal super and pension product for members to use throughout their life.

SignatureSuper is an allocated pension account that helps you access your super as a regular income in retirement. Get all the detail of its performance, and download the fact sheets.

Insurance guides

Not quite sure yet?

Talk to a super coach

We're here to help

Standard Hours

Monday to Friday 8.30am – 7pm (Sydney time)

More from AMP

What you need to know

1 Based on the simple average of total administration and investment fees and costs across all AMP MySuper Lifestages options (Capital Stable, 1950s, 1960s, 1970s, 1980s, 1990s Plus). Compared against the simple average of all super funds’ MySuper options included in the Chant West Super Fund Fee Survey March 2024 at balances of $50,000 to $750,000.

2 Investment performance is as at 30 September 2024 and is net of investment fees, costs and tax (but excludes administration fees, member fees, amounts paid from the super fund’s assets and member activity fees). Industry median refers to the “MySuper – Growth Median” and is taken from the Chant West Super Fund Performance Survey September 2024, being the median of all options contained in the MySuper – Growth table with a growth asset allocation of between 61-80%. AMP MySuper 1970s is our biggest MySuper option and has a higher allocation to growth assets (approximately 90%) than other super funds’ MySuper options. However, this graph enables you to compare our MySuper offer with key competitors. Past performance is not a reliable indicator of future performance.

3 If a member holds more than one account, a separate percentage administration fee cap will apply to each account held by the member. For more information, please refer to the product disclosure statement.

AMP Super refers to SignatureSuper® which is issued by N.M. Superannuation Proprietary Limited (NM Super) ABN 31 008 428 322 and is part of the AMP Super Fund (the Fund) ABN 78 421 957 449. NM Super is the trustee of the Fund.

Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant product disclosure statement, target market determination or terms and conditions available from us at amp.com.au or by calling 131 267.

Any advice and information provided is general in nature, hasn’t taken your circumstances into account, and is provided by AWM Services Pty Ltd (AWM Services) ABN 15 139 353 496. NM Super and AWM Services are part of the AMP group. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. All information on this website is subject to change without notice.

® SignatureSuper is a registered trademark of AMP Limited ABN 49 079 354 519.