It's a great time to think about your super savings.

MySuper is an important part of these government changes and you'll find more about it below.

MySuper is a simple default investment option for people who haven't made an active choice about how their super is invested.

If you haven't made an investment choice:

- your super contributions can be automatically directed to the AMP MySuper investment option

- you can choose to continue to contribute to your existing default investment option (if applicable), or

- you can select other investment options within your AMP super product.

If you have made an investment choice, your existing super balance and ongoing contributions will remain in your current investment option(s).

Your MySuper Solution

AMP has designed a MySuper arrangement, specifically for members of AFLPA & AFL Industry Superannuation Plan that continues to provide competitive features and fees. This MySuper default investment option is called AFLPA & AFL MySuper.

This default investment option is designed to give you a quality superannuation investment solution, one that takes you all the way through your superannuation savings journey.

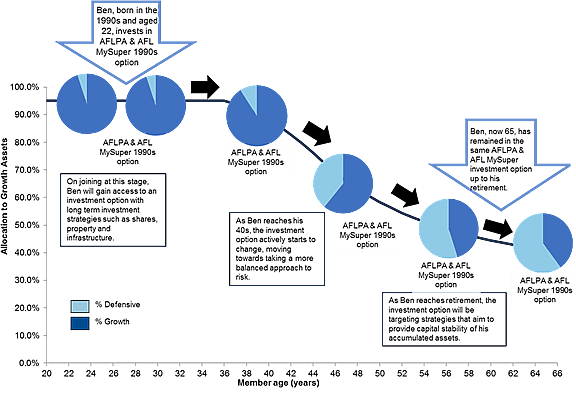

This approach, known as lifecycle investing, delivers an investment strategy that continuously evolves to align with the changing stages of a member's life, because we all have different needs at different times.

It takes the hard work out of deciding how to invest your savings by providing the simplicity of a single investment choice.

For more information on AFLPA & AFL MySuper, refer to your plan summary or contact us.

How it works

If you have not selected an investment option, your super contributions will be invested in the AFLPA & AFL MySuper lifecycle investment option specific to your decade of birth. In this option, the investment strategy and asset allocation are actively managed and changes as the investment risk profile of your age group changes.

This means that younger investors will be invested into higher-growth investment strategies, because they have a long period to retirement and can afford to take more risk. For those approaching retirement, investments will focus more on preserving the capital you've have built up, reducing risk and changing the focus towards assets that preserve your savings.

Most importantly, your investment allocation will be actively managed as you get older, even if you don't take any interest in your super.

The following table shows the different decades of birth and the name of the applicable AFLPA & AFL MySuper investment option:

| Decade of birth | AFLPA & AFL MySuper investment option |

| 1990s or later | AFLPA & AFL MySuper 1990s |

| 1980s | AFLPA & AFL MySuper 1980s |

| 1970s | AFLPA & AFL MySuper 1970s |

| 1960s | AFLPA & AFL MySuper 1960s |

| 1950s | AFLPA & AFL MySuper 1950s |

| Prior to 1950 | AFLPA & AFL MySuper Capital Stable |

The following diagram shows the lifecycle investment of a member born in the 1990s:

Does everyone go into MySuper?

If you have made an investment choice, your existing super balance and ongoing contributions will remain in your current investment option(s).

If you haven't selected an investment option in the AFLPA & AFL Industry Superannuation Plan, your contributions will now be automatically directed to the AFLPA & AFL MySuper investment option.

You'll continue to have one super account but, for the time being, you'll have balances in two investment options:

- AFLPA & AFL MySuper, where your contributions from 1 January 2014 will be invested, and

- your current default investment option, where your contributions to 31 December 2013 are invested.

Alternatively, you can choose to switch your investment option by logging into My Portfolio or by completing and returning this Investment option selection form (80009.15).

Before July 2017, the balance of your current default investment option will be transitioned across to AFLPA & AFL MySuper. We'll give you at least three months' notice before this transition, as you may wish to provide an investment direction at that time. Before making an investment decision, please refer to Choosing investment options.

If you wish to consider any of the other investment options available to members of AFLPA & AFL Industry Superannuation Plan, you can switch your investment from your current default investment option or AFLPA & AFL MySuper at any time.

Fees and costs

The fees associated with the AFLPA & AFL MySuper are listed in the MySuper information brochure, current Product Disclosure Statement (PDS) and Plan Summary available from AMP.

What advice fees can be charged?

You can agree with your Financial Planner to pay a fee for services provided to you. This fee may be:

- a one-off dollar amount paid as a lump sum, and/or

- an ongoing advice fee, paid monthly, which is either:

- a fixed dollar amount, or

- a set percentage of your account balance.

From 1 January 2014, if you have a percentage of your account balance or one-off amount that you have agreed to pay for financial planning services, this won't include the amount or be deducted from money invested in the AFLPA & AFL MySuper investment option.

MySuper dashboard

These dashboards provide a summary of the investment performance, risk and fees for your MySuper option.

- AFLPA & AFL Industry MySuper dashboard - 1950s investment option

- AFLPA & AFL Industry MySuper dashboard - 1960s investment option

- AFLPA & AFL Industry MySuper dashboard - 1970s investment option

- AFLPA & AFL Industry MySuper dashboard - 1980s investment option

- AFLPA & AFL Industry MySuper dashboard - 1990s Plus investment option

- AFLPA & AFL Industry MySuper dashboard - Capital Stable investment option

Leaving the employer plan

Other product changes as a result of MySuper

Reviewing your choices

Staying on top of your super is easy through AMP's secure member site, My AMP, an online site that provides you with the ability to manage your AMP accounts online 24/7.

It takes two minutes to register and you can plan you super future online including selecting investment options, checking your balance, updating contact details, simulating your retirement future and producing your own Super Future report.

You can access or register for My AMP at amp.com.au/myamp.

Choosing investment options

We can help minimise the risks of investing by providing access to a wide range of investment options. This allows investors to diversify their portfolios across different asset classes, investment managers, investment styles or to select multi-sector investment options.

Here are three things to consider when selecting investment options:

1. Your investment goals

Once you've settled on your personal investment goals, you need to see how well various investment options match your goals and consider whether you require a high return or if a moderate or stable return will be enough. The information provided for each investment option covers issues like the returns the option aims to achieve and the level of risk to which you would be exposed.

2. Your timeframe

The amount of time you intend to invest for is a key factor when making your investment decisions. Investment markets move up and down over time and the value of your investment will move with them. For example, if you want to access your money in the near future, you might prefer investment options whose returns are expected to be less variable (or less volatile). This will give you greater protection against capital loss in the short term. The reverse is also true if you are looking for a long-term investment. In this case, the higher returning investment options usually come with the potential for much more volatility in capital values in the short term.

3. Your attitude to risk

Are you comfortable with receiving low or negative returns in the short term with the aim of obtaining higher returns in the long term or would you be more comfortable with receiving moderate but consistent returns? Your attitude to risk is one of the most important factors to consider before investing. Learn more about the risks of investing and how they are managed. Choosing investment options provides general information on investing and investment options. It's not a substitute for personal financial advice and we recommend that you consider obtaining advice from a qualified financial adviser before selecting investment options.

More information

For more information about your superannuation plan visit the SignatureSuper page, call us on 1300 366 019 or email signaturesuper@amp.com.au. Alternatively, you can contact your financial adviser or the designated financial advisers for your plan: Brad Wira or Mark Porter on 1300 763 359, or email brad.wira@sfg.com.au or mark.porter@sfg.com.au.

FAQs

We are here to help

For more information about your superannuation plan visit the SignatureSuper page, call us on 1300 366 019 or email signaturesuper@amp.com.au. Alternatively, you can contact your financial adviser or the designated financial advisers for your plan: Brad Wira or Mark Porter on 1300 763 359, or email brad.wira@sfg.com.au or mark.porter@sfg.com.au.

Superannuation plan

Brad Wira

Mark Porter

What you need to know

Past performance is not a reliable indicator of future performance. The value of investments may go up or down and you may not get back the amount you invested.

Information on this dashboard relates to AFLPA & AFL Industry MySuper (APRA My Super product unique identifier 78421957449083). Prior to 15 May 2020, AMP MySuper No. 3 uses the performance history of AMP MySuper No 2. Products in the AMP Super Fund (ABN 78 421 957 449) are issued by N.M. Superannuation Proprietary Limited (N.M. Super) ABN 31 008 428 322 (trustee), which is part of the AMP group (AMP). Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or terms and conditions available from AMP at amp.com.au/signaturesuper or by calling us on 131 267. Read AMP’s Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Any advice and information provided is general in nature, hasn’t taken your circumstances into account, and is provided by AWM Services Pty Ltd ABN 15 139 353 496 (AWM Services), which is part of the AMP group (AMP). All information on this website is subject to change without notice.