Documents & links

Find detailed information applicable to your AMP Super account.

Past performance is not a reliable indicator of future performance.

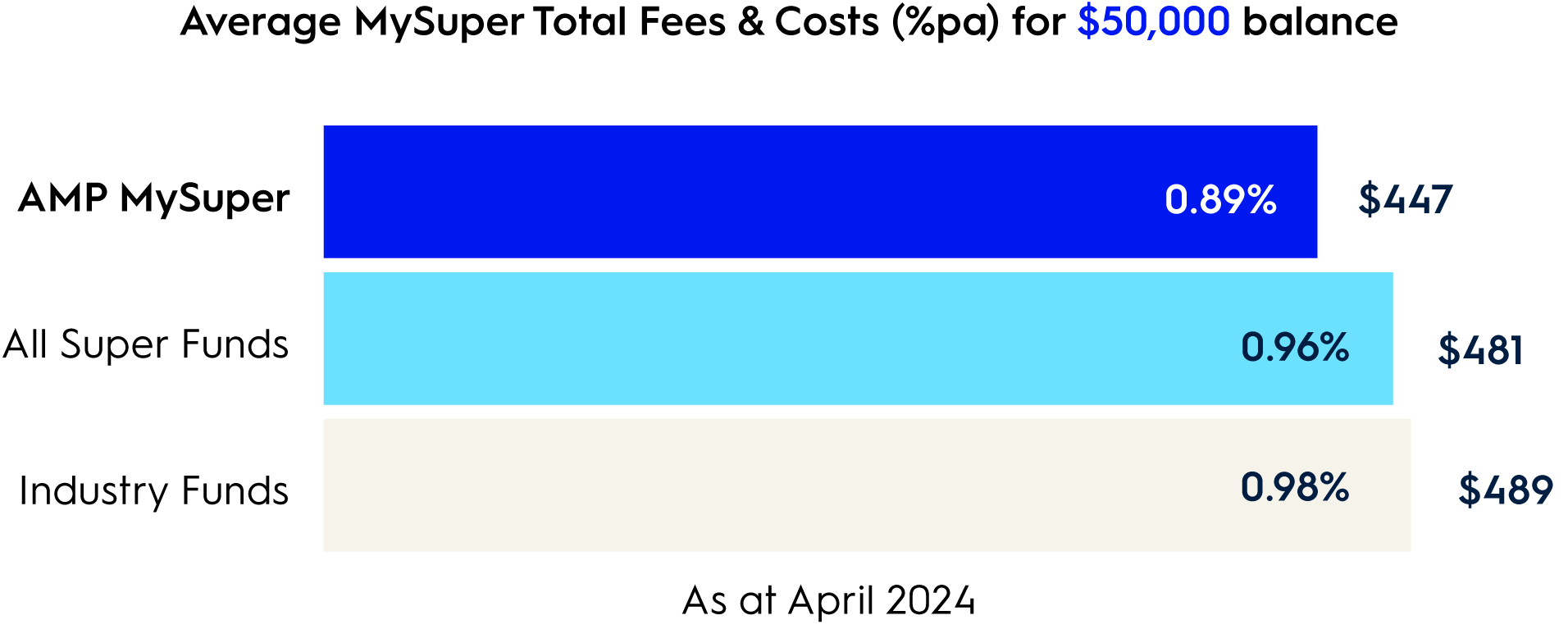

We deliver consistent strong returns versus the industry median, and AMP MySuper fees are lower than the average super fund meaning more money for you to retire with.

AMP’s MySuper fees are lower than the average super fund, including the average industry fund1. Plus, our percentage administration fee is capped for account balances over $500,0003. This means more money for you for when you retire.

For a full list of fees and costs applicable to your super account, please see the Product Disclosure Statement (PDS).

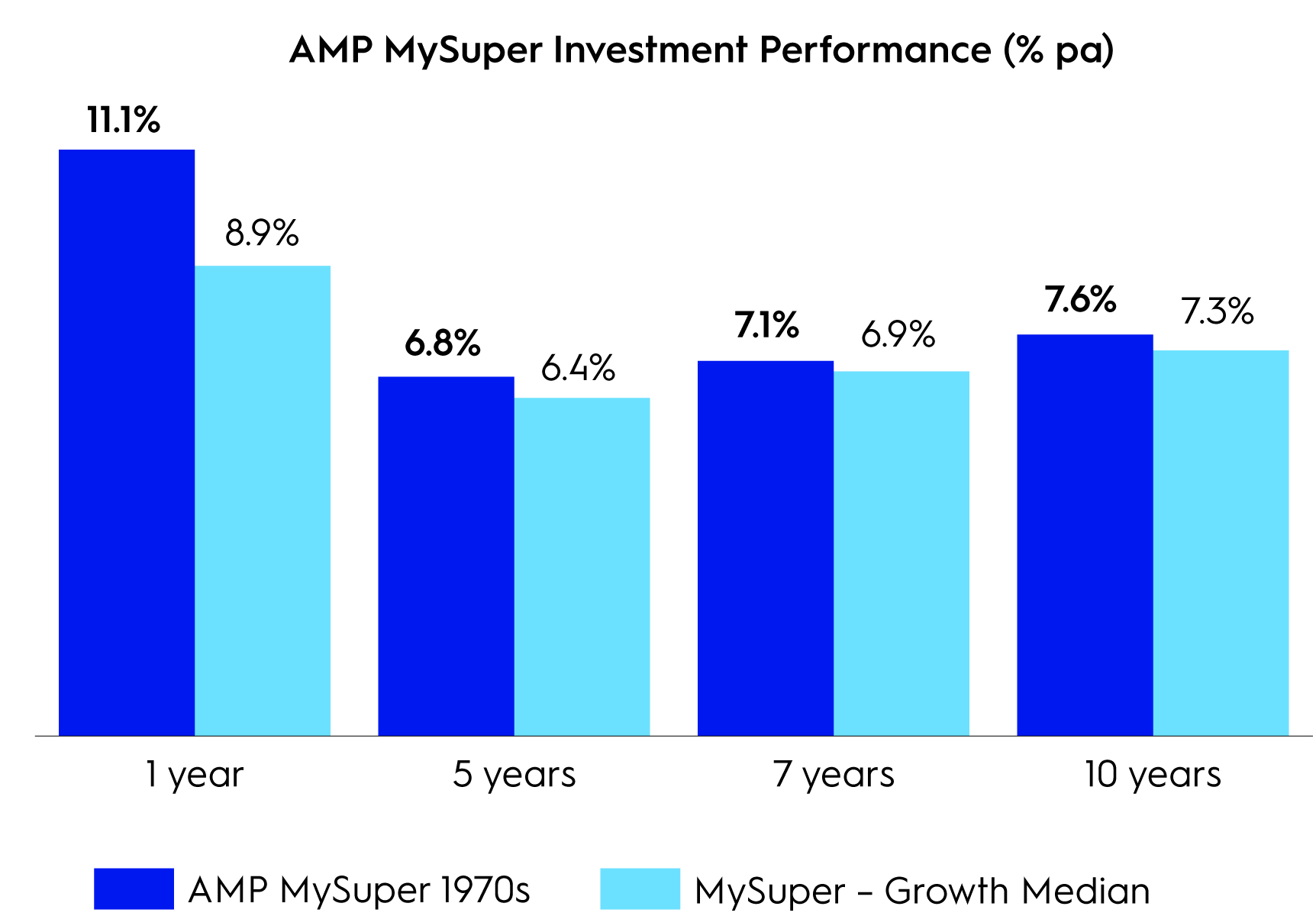

AMP Super is proud to deliver consistent strong returns for our members across market conditions. For investment performance across all AMP MySuper Lifestages options, visit our MySuper dashboard.

Based on the simple average of total administration and investment fees and costs across all AMP MySuper Lifestages options (Capital Stable, 1950s, 1960s, 1970s, 1980s, 1990s Plus). Compared against the simple average of industry funds’ and all super funds’ MySuper options included in the Chant West Super Fund Fee Survey March 2024.

Investment performance is as at 30 September 2024 and is net of investment fees, costs and tax (but excludes administration fees, member fees, amounts paid from the super fund’s assets and member activity fees). The “MySuper – Growth Median” is taken from the Chant West Super Fund Performance Survey September 2024, being the median of all options contained in the MySuper – Growth table with a growth asset allocation of between 61-80%. AMP MySuper 1970s is our biggest MySuper option and has a higher allocation to growth assets (approximately 90%) than other super funds’ MySuper options. However, this graph enables you to compare our MySuper offer with key competitors. Past performance is not a reliable indicator of future performance.

MySuper Lifestages: this solution offers a single investment option tailored to your age group and managed by a team of investment experts.

Your choice: for more control over how your super is invested, select up to 15 investments options from our range of 27 to suit your financial goals.

Use the Investment Risk Profiler tool to understand your risk appetite and once you’re a member you can login to My AMP and manage your investment options in real time!

We have partnered with TAL, one of Australia’s leading life insurers to bring you lifestages cover so you only pay for the cover you need based on your stage of life.

When joining you can apply for a basic level of Death, Total and Permanent Disablement and Income Protection cover by answering a short number of health and lifestyle questions.

Need more personalised cover? Call to speak to one of our team.

Use the Insurance Needs Calculator to estimate cover types and premiums.

Learn more about insurance in the insurance guide.

AMP Super has been recognised and awarded by the industry for many years. And we’re proud to add more awards to our long list.

Find detailed information applicable to your AMP Super account.

SignatureSuper is an allocated pension account that helps you access your super as a regular income in retirement.

Standard Hours

Mon - Fri: 8.30am – 7pm (Sydney time)

1 Based on the simple average of total administration and investment fees and costs across all AMP MySuper Lifestages options (Capital Stable, 1950s, 1960s, 1970s, 1980s, 1990s Plus). Compared against the simple average of all super funds’ MySuper options included in the Chant West Super Fund Fee Survey March 2024 at balances of $50,000 to $750,000.

2 Investment performance is as at 30 September 2024 and is net of investment fees, costs and tax (but excludes administration fees, member fees, amounts paid from the super fund’s assets and member activity fees). Industry median refers to the “MySuper – Growth Median” and is taken from the Chant West Super Fund Performance Survey September 2024, being the median of all options contained in the MySuper – Growth table with a growth asset allocation of between 61-80%. AMP MySuper 1970s is our biggest MySuper option and has a higher allocation to growth assets (approximately 90%) than other super funds’ MySuper options. However, this graph enables you to compare our MySuper offer with key competitors. Past performance is not a reliable indicator of future performance.

3 If a member holds more than one account, a separate percentage administration fee cap will apply to each account held by the member. For more information, please refer to the product disclosure statement.

AMP Super refers to SignatureSuper® which is issued by N.M. Superannuation Proprietary Limited (NM Super) ABN 31 008 428 322 and is part of the AMP Super Fund (the Fund) ABN 78 421 957 449. NM Super is the trustee of the Fund.

Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant product disclosure statement, target market determination or terms and conditions available from us at amp.com.au or by calling 131 267.

Any advice and information provided is general in nature, hasn’t taken your circumstances into account, and is provided by AWM Services Pty Ltd (AWM Services) ABN 15 139 353 496. NM Super and AWM Services are part of the AMP group. Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. All information on this website is subject to change without notice.

® SignatureSuper is a registered trademark of AMP Limited ABN 49 079 354 519.