Your super is your money. So it’s important to consider investment performance as well as any fees and long-term benefits when choosing which fund is right for you.

Fees

The WesTrac Pty Ltd Superannuation Plan provides access to discounts on the administration and member fees. So, if you’re going to compare, make sure you use the fees below. We’ve included a total fee for different balances, as the comparison sites use different balances too.

You can find fee definitions related to the WesTrac Pty Ltd Superannuation Plan here in the AMP SignatureSuper product disclosure statement. If you’ve got any questions about what you are reading contact us.

AMP MySuper

AMP MySuper is the default investment option for the WesTrac Pty Ltd Superannuation Plan. It takes a lifecycle approach, automatically applying different levels of risk to your investments, dependent on your age.

To demonstrate we’ve used the AMP MySuper 1970s option in the fee table below. This is based on the accumulation category.

If you were born in another decade and want to check those fees, you’ll find them here in the Investment Guide Fact Sheet or your relevant plan summary.

AMP MySuper 1970s investment option fee examples

| Annual % fee | $50,000 balance | |

| Investment fee (i)(ii) | 0.26% | $130 |

| Administration fee (i)(ii)(iv) | 0.21% | $105 |

| Member fee (ii) | $0 | $0 |

| Indirect cost ratio (i)(iii) | 0.62% | $310 |

| Total fee (i)(ii)(iii)(iv) | $545 |

Note: This example is illustrative only. What it costs you will depend on your individual investments.

(i) If your account balance for your AMP MySuper investment option is less than $6,000 at 30 June, the total combined amount of administration fees, investment fees and indirect costs charged to you is capped at 3% (after the benefit of any tax deduction passed on to you) of the account balance for your AMP MySuper investment option. Any amount charged in excess of that cap will be refunded

(ii) The fees you actually pay are reduced by up to 15% to allow for the tax deduction passed onto you in relation to the fees charged by us

(iii) Costs are variable and may be more or less than the estimated amounts shown which are based on the known actual or estimated costs incurred for the last financial year. Past costs are not a reliable indicator of future costs

(iv) The percentage based Administration fee is only charged on the first $500,000 in your account.

Other investment options are also available in the WesTrac Pty Ltd Superannuation Plan. For more information on the available investment options and associated fees refer to the Investment Guide Fact Sheet or your relevant plan summary.

To find the fees and performance that apply to your existing WesTrac Pty Ltd Superannuation Plan login to MyAMP.

Performance of the WesTrac Pty Ltd Superannuation Plan

Investment performance is an important consideration when choosing a fund that’s right for you. You can find more information on judging the performance of your super fund on ASIC’s MoneySmart website.

However, you should exercise extreme caution in making any judgements about the quality of a superannuation fund or investment option based on past performance, because past performance is not an indication of future performance. Investment option returns are calculated from changes in the unit price (or crediting rate declared) of the investment option over the period shown, and after the deduction of fees, costs, and superannuation fund earnings tax, which is included in the unit price (or crediting rate declared).

Investment option returns assume a sum of money is invested at the beginning of the time period and neither drawn upon or added to throughout that period. Your actual rate of return of your account will vary from those displayed depending on the timing of contributions, switches or withdrawals that you have made, and any fees and rebates charged directly to your account.

AMP MySuper

The table below sets out the investment option returns for the available AMP MySuper investment options as at 31 August 2020. For the most recently published investment performance figures visit the Product Performance section on amp.com.au. Past performance is not necessarily an indication of future performance because investment option returns are calculated from changes in the unit price (or crediting rate declared) of the investment option over the period shown, and after the deduction of fees and costs, and superannuation fund earnings tax, which is included in the unit price (or crediting rate declared).

| Unitised investment options | 1 month | 3 month | 6 month | 1 year | 3 year | 5 year | 10 year | Since inception* | Inception date |

|---|---|---|---|---|---|---|---|---|---|

| AMP MySuper investment options | (% flat) | (% flat) | (% flat) | (% p.a.) | (% p.a.) | (% p.a.) | (% p.a.) | 1/1/2014 | |

| AMP MySuper 1990s | 2.12 | 4.81 | -1.89 | -0.11 | 5.13 | 5.98 | N/A | 6.51 | 1/1/2014 |

| AMP MySuper 1980s | 2.09 | 4.83 | -1.55 | 0.44 | 5.44 | 6.24 | N/A | 6.72 | 1/1/2014 |

| AMP MySuper 1970s | 2.08 | 4.47 | -1.29 | 0.54 | 5.27 | 6.07 | N/A | 6.54 | 1/1/2014 |

| AMP MySuper 1960s | 1.38 | 3.15 | -0.96 | 0.92 | 4.60 | 5.02 | N/A | 5.37 | 1/1/2014 |

| AMP MySuper 1950s | 1.00 | 2.38 | -1.15 | 0.40 | 3.92 | 4.07 | N/A | 4.47 | 1/1/2014 |

| AMP MySuper Capital Stable | 0.66 | 2.38 | -1.37 | 0.18 | 3.61 | 3.74 | N/A | 4.17 | 1/1/2014 |

You can find the performance figures for all of the different investment options in the WesTrac Pty Ltd Superannuation Plan here.

AMP Future Directions Balanced

AMP Future Directions Balanced is another investment option available for the WesTrac Pty Ltd Superannuation Plan.

AMP Future Directions Balanced investment option is commonly used by comparison sites as many super funds use a balanced investment option as their MySuper investment default.

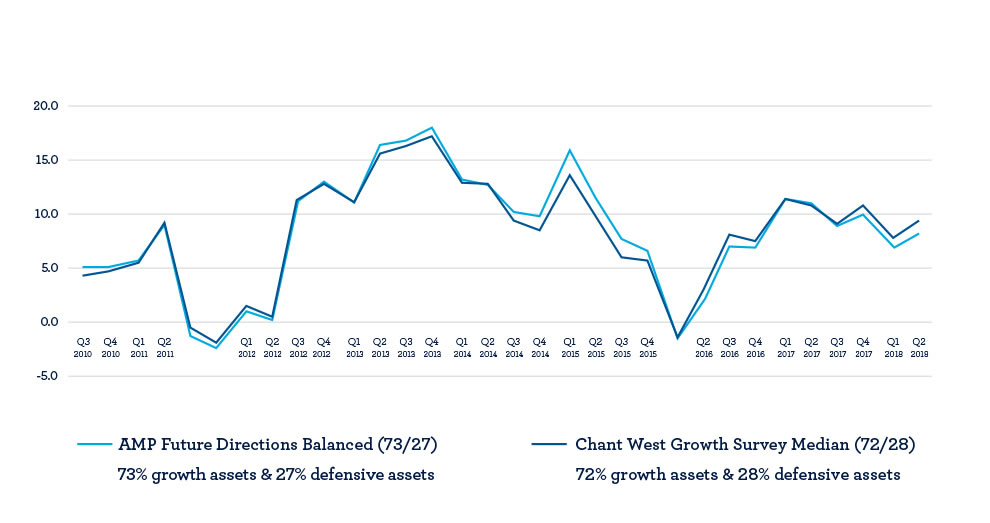

Here’s how the AMP Future Directions Balanced investment option has compared with the Chant West Growth Survey Median over a rolling 1-year period since 2010.

Source: Chant West Multi-Manager Growth Surveys 2010-2018

Note: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.

Important:

Past performance is not necessarily an indication of future performance. It’s important to know that these comparisons are based on assumptions and your actual investment option/s, performance and insurances may vary – it’s a good place to start.