Save on coffee, boost your super

Did you know skipping your daily coffee could make a big difference to your super?

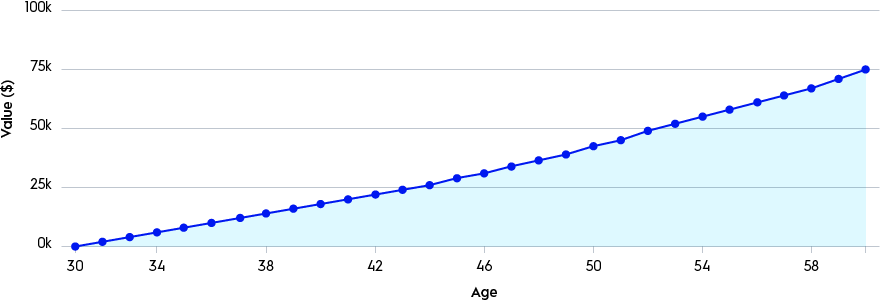

Amy, 30, has set herself a challenge to boost her super by this time next year. She’s decided to ditch her daily barista brew and make coffee at home for the next 365 days. The estimated super she can accumulate upon turning 60 years by forgoing a coffee ($5) a day for 7 days and voluntarily contributing $35 per week (or $1,820 p.a.) into super as after-tax contributions is $73,718.*

Personal (after-tax) contributions

Personal (after-tax) contributions are made using after-tax dollars, such as when you transfer funds from your bank account into your super.

Tax-deductible contributions

Whether you're employed, self-employed, unemployed or retired, you might be eligible to claim a tax deduction on your after-tax super contribution.

Other ways you can grow your super further

Choose to have some of your before-tax income paid into your super by your employer on top of what they might pay you under the Superannuation Guarantee.

If you’ve made an after-tax contribution to your super, you might be eligible for a co-contribution of up to $500 from the government, depending on your income.

Contributions you could make into your spouse’s super account, which you may want to do if they’re a low-income earner or not working at the moment.

Contributions you could make into your super at age 55 or over (up to $300,000) using the proceeds from the sale of your main residence.

What to keep in mind

- If you exceed the super contribution limits, additional tax and penalties may apply.

- The value of your investment in super can go up and down. Before making extra contributions, make sure you understand and are comfortable with any potential risks.

- The government sets general rules about when you can access your super, which means you typically won’t be able to access your super until you retire.

- You should always seek financial advice and consider your personal financial circumstances before making additional contributions.

Boost your super balance

How to make a voluntary contribution

After logging in, click on ‘Superannuation’ at the top navigation bar. On the My AMP app, tap on MORE at the bottom right corner of your screen.

Navigate to ‘I want to‘ (if using desktop) and then choose ‘Contributions and transfer in’ which will direct you to the available contribution options.

Select your preferred contribution method, and you’ll be guided through a process based on your payment choice. Come tax return season, return to this page to claim a tax deduction if you’re eligible.

You might also be interested in

10 Ways to Boost Your Super

01 July 2024 | Super Check out what you could do while you’re still earning an income and have time on your side, noting not everyone will be eligible for the government’s Age Pension when they retire. Learn more

How much super should I have at my age?

01 July 2024 | Super See the average super balance for your age group, so you can get an idea of how your super savings compare. Learn more

How to boost your retirement savings as super and tax laws change

29 March 2024 | Super If you’re looking to maximise your superannuation in the lead-up to retirement, it’s a good idea to be up to speed on any legal updates that could affect the super and tax landscape. Learn moreSpeak to a super coach

What you need to know

*Contribution is indexed by 2.5% each year (CPI inflation). 6.09% return on balanced (70% growth) option. Investment fees and fund fees are based on the current AMP Mysuper Lifestage option. No insurance cost is taken into account. No advice fees are taken into account. The after tax contribution for the year is within the persons’ annual non-concessional contributions cap. Tax on earnings within super is at 15% each year (worst case scenario) Government co-contribution and low-income super tax offset are not taken into account.

Products in the AMP Super Fund and the Wealth Personal Superannuation and Pension Fund are issued by N.M. Superannuation Proprietary Limited (N.M. Super) ABN 31 008 428 322 (trustee), which is part of the AMP group (AMP). Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product Disclosure Statement, Target Market Determination or Terms and Conditions available from AMP at amp.com.au or by calling 131 267. Read AMP’s Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Any advice and information provided is general in nature, hasn’t taken your circumstances into account, and is provided by AWM Services Pty Ltd ABN 15 139 353 496 (AWM Services), which is part of the AMP group (AMP). All information on this website is subject to change without notice.