It’s all too easy to treat your super as an investment that takes care of itself. After all, it could be years before you can get your hands on your money.

But the choices you make today could make a big difference to the quality of your retirement tomorrow.

So if you’ve been keeping super at arm’s length up to now, it could be a great idea to start getting closer to your super. It’s your money and your future.

Let’s start with the basics.

Superannuation – or simply ‘super’ – is money set aside while you’re working so you’ll have money for retirement. Your money is put into a fund, where it’s invested on your behalf by a Trustee to earn returns and grow your savings.

The amount of super you’ll end up with when you retire depends on a number of factors.

- How many contributions have been made over the years.

- How long your super’s been invested.

- What investment options you’re invested in and how those investments have performed.

- How much you’ve earned in wages or salary.

- How much you’ve paid in fees and insurance premiums.

Now let’s take a look at your annual statement – here’s where you’ll find all the key info about your AMP super or pension.

- The basics | Your balance, your investment performance and how you're tracking toward retirement.

- Beneficiaries | Who your super will go to when you pass away.

- Insurance | How much cover you have and what it costs.

- Transactions | All the ins and outs over the past year.

- Returns | How much money your super investments have made.

- Contribution caps | How much you’re allowed to contribute.

- Fees and costs summary | How much you’re paying.

- What you need to do | A quick checklist of the important stuff – investments, insurance and beneficiaries.

- Details about our annual report | How to take a deep dive into AMP Super.

- Pension details | If you hold a pension account, then your withdrawal benefit details and income payment details.

Sounds a bit daunting? No probs. Let’s zoom in on four key areas.

1. What you need to do

Here we lay out a few quick reminders about what you can do to keep your super on track.

Perhaps it’s time to review your insurance or check you have the right beneficiaries?

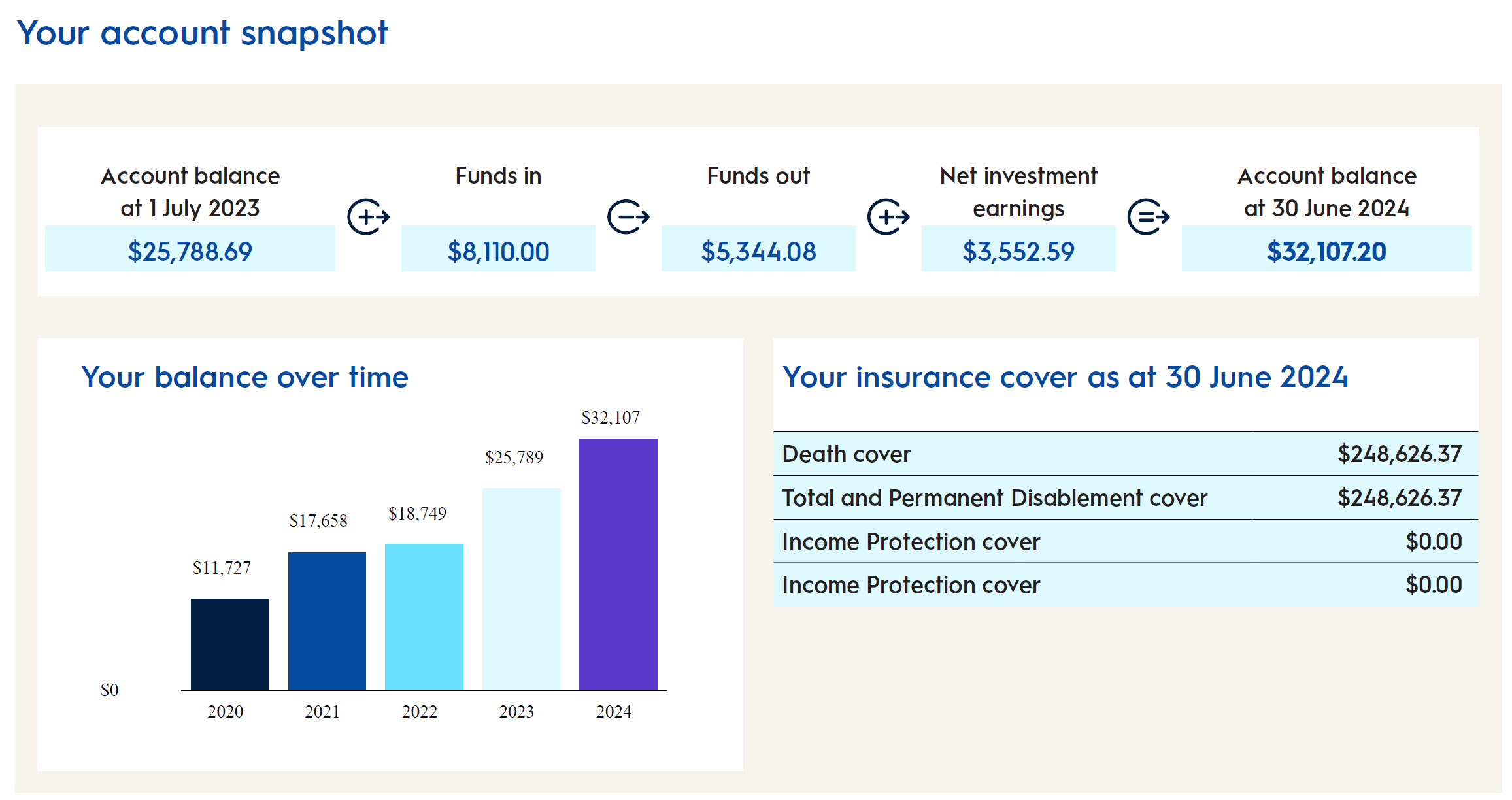

2. Your account snapshot

This is a quick grab of the numbers that matter and how they’ve changed over the course of the year.

- Account balance one year ago | How much you had in your super a year ago.

- Funds in | All the funds that have come in, such as contributions and rollovers from other super accounts.

- Funds out | Everything you’ve paid out, including 15% contribution tax, admin and investment fees, and insurance premiums.

- Net investment earnings | How much you’ve earned over the year. Remember, asset prices can move up and down so occasionally this could be negative if there’s been a tough year on the markets.

- Account balance this year | How much you have in your super at the end of the statement period.

- Your balance over time | How your balance has changed over the past five years.

- Your insurance cover | If applicable, how much death, total and permanent disablement, and temporary salary continuance cover you have.

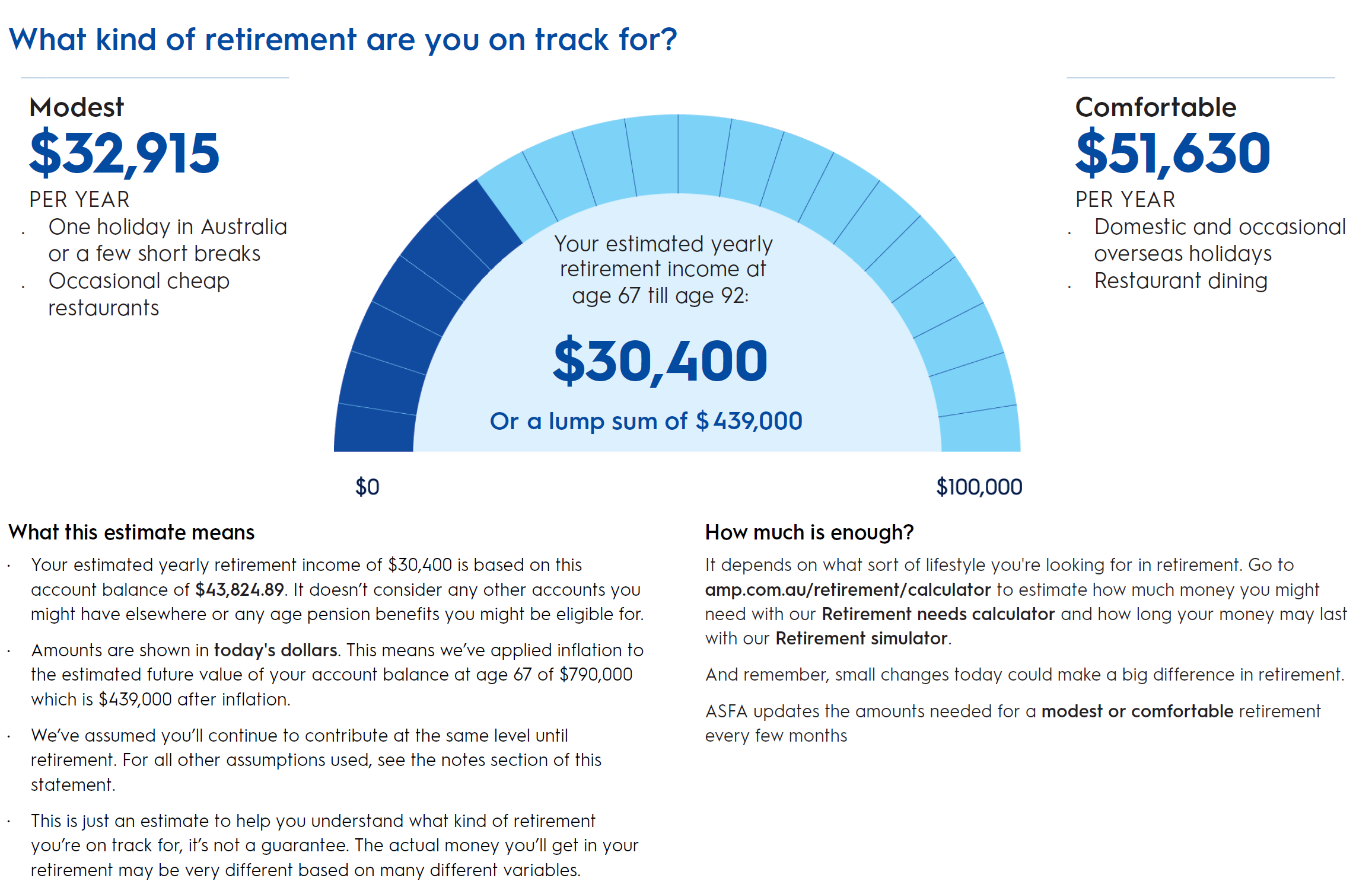

3. Retirement outcomes tracking

Here you’ll find out whether you’re on track to enjoy the lifestyle you aspire to in retirement.

It’s an estimate of what your super might look like at age 67 (in today’s dollars) – based on the ASFA Retirement Standard, a quarterly update on how much you’ll need for a comfortable or modest lifestyle.

If you’re not happy with how you’re tracking, there’s plenty you can do to bridge the gap.

- Review where your money is invested, how it’s performing and whether you’re happy with the level of risk you’re taking.

- Consider how much you earn and how your income might grow over the long term.

- Think about how old you are and how much time you have left before retirement.

- Consider making extra contributions – if you have spare funds, you might be able to tip more money into super up to the standard yearly cap without incurring additional tax.

- Remember the 11.5% super guarantee (SG) rate that your employer pays into your super is increasing to 12% on 1 July 2025.

- Think about whether you’re paying for the right amount of insurance cover.

4. How you're invested and your investment performance

Here you can find a more detailed breakdown about the type of assets your super or pension is invested in – such as shares, property and cash. There is also more detail on how your investments have performed.

Many of our members are invested in the AMP MySuper Lifestages option based on the decade you were born – for example, if you were born in 1996 you might be in the AMP MySuper 1990s Plus.

Before updating your investment options, it’s important to understand how your super or pension is invested and what level of risk you’re comfortable with. It's also best to chat to a financial adviser before making any decisions.

...and for pension members

If you hold an AMP Pension account you’ll also find all your income payment details.

We're here to talk about all things super

It’s good to talk. If there’s anything you’d like to know about your super – investment options, insurance cover, retirement goals, anything at all – just drop us a line at 131 267 (Monday - Friday 8.30am - 7pm Sydney time) or email us at askamp@amp.com.au.

And if you’re looking to get up close and personal with your super you can book a 20-minute session with one of our super coaches, at no extra cost.

Speak to a super coach

How to maximise your 2024 tax refund

18 July 2024 | Finance 101 With tax time nearly upon us, you might be interested in the following tips, which may help to increase the amount of money you get back. Read more

Your super checklist for EOFY

15 May 2024 | Finance 101 With the end of financial year fast approaching, now is a good time to consider how you can use superannuation to maximise your tax benefits. Read more

What's capital gains tax?

15 May 2024 | Blog Capital gains tax may be payable when you sell a certain asset (such as shares, land or property) and make a profit. Read moreWhat you need to know

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature only. Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant product disclosure statement or terms and conditions available from AMP at amp.com.au or by calling 131 267.

The super coaching session is a super health check and is provided by AWM Services and is general advice only. It does not consider your personal circumstances.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

All information on this website is subject to change without notice. AWM Services is part of the AMP group.