The AMP Financial Wellness Report 2024 reveals over six million Australians are feeling some degree of financial stress and many are in distress.

The increased cost of living is taking its toll and Aussies who are unemployed, studying or earning lower incomes are feeling the pinch more than others.

But pressure is starting to creep into higher income brackets, with almost a quarter of Australians earning between $100k and $150k experiencing moderate to severe financial stress.

And owning a home doesn’t seem to be making much difference to our stress levels. Almost a third of mortgage holders believe their repayments won’t be sustainable if interest rates continue to rise – that’s over a million households. Meanwhile, renters are also under pressure, with 38% of Australians paying rent reporting moderate or severe financial stress.

So how are we responding?

- We’re cutting expenses and looking for deals – 1 in 3 Australians have cancelled non-essential services such as streaming subs and gym memberships.

- We’re socialising less – Half of Australians feeling stress are spending less time with friends.

- We’re fretting about our finances – More than half of us are worrying about money at work.

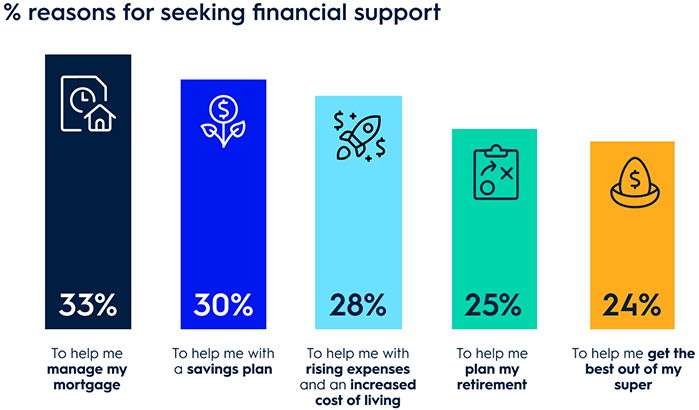

- We’re not seeking as much help as we could – More than one in four of us have financial secrets we haven’t shared with anyone. And when we do seek help, it’s for more immediate challenges – managing our mortgages (33%), helping with saving plans (30%) and dealing with the rising cost of living (28%).

On a personal front, this can lead to a more pessimistic outlook, reduced happiness and feeling disconnected. While almost half (48%) of us rate our overall mental wellbeing as good, this drops to 22% among Australians who are moderately or severely financially stressed.

And on the work front, it can often mean reduced productivity, either through absenteeism – taking more days off – or presenteeism – feeling pressured to turn up for work unwell.

We’re focusing on immediate challenges…

Unsurprisingly, people under moderate to severe financial stress tend to be more pessimistic about the future than mildly stressed and financially secure groups.

They’re focusing more on cutting costs to make immediate changes, rather than planning for the future – only 16% of stressed Australians have clear financial goals, versus nearly one in four (24%) of those who are financially secure or mildly stressed.

The same attitudes are apparent in savings habits – while 31% of Australians are putting away more money to combat future cost-of-living pressures, those already feeling stressed are busy dealing with daily financial challenges rather than looking ahead, with just one in five focused on building their savings.

Over two-thirds of moderately to severely financially stressed Australians (68%) believe cost of living pressures will continue to increase over the next two years, compared with only 45% of financially secure or mildly stressed Australians.

People are reaching out for support, but it’s more about dealing with day-to-day challenges like budgeting and expenses, than planning for the future through their super.

…and we’re cutting back

While discretionary spending has taken a hit as the cost of living rises, consumers are also re-evaluating the essentials and seeking out cheaper options – especially those in the financially stressed groups.

More than half (60%) of financially stressed Australians have significantly cut spending, which means dropping non-essentials like streaming services and gym memberships (44%), as well as luxuries like holidays (49%).

Groceries are in the firing line, as shoppers look to stretch their dollar when it comes to putting dinner on the table. As many as 71% of financially stressed consumers have cut back on grocery costs, while 83% say they are now more aware of discounts and promotions on offer. More than half (65%) are on the hunt for a bargain, actively seeking out websites and apps that offer cheaper alternatives.

Every journey begins with a small step…

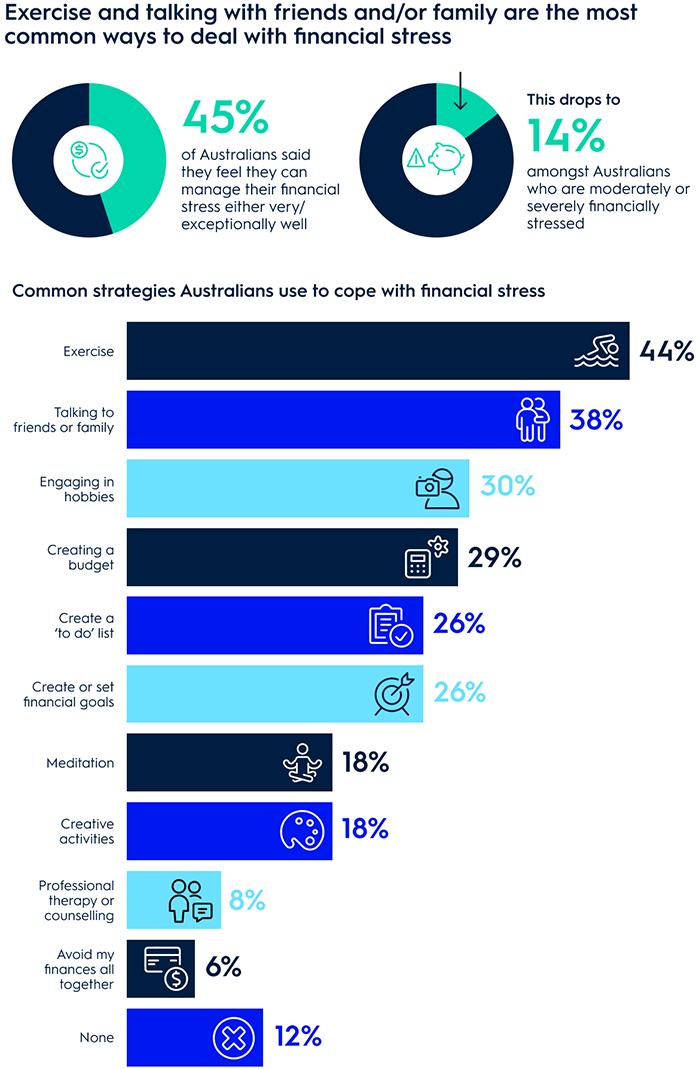

Sometimes when you’re under pressure it’s hard to know where to start. And thinking big can be a bit overwhelming. So many Aussies are benefiting from taking small steps – grabbing a coffee with a friend, going for a brisk power walk or dusting off that old bike they used to enjoy tinkering with.

And the same goes when you’re looking at restoring your financial wellness. Like many Aussies, you could benefit from working on the foundations, brick by brick – your weekly budget, your savings plan, your spending habits.

5 ways Australians can get the support they need

1. Consult the right sources. Financial professionals. Newsletters. Podcasts. Seminars. The key to making good financial decisions is information.

2. Take more control of your super. It’s an investment in your future that should work as hard as you do, so get up to speed on how to invest, manage risk and plan ahead.

3. Make sure your home loan is right for you. There are ways to manage your mortgage stress, whether it’s an offset account, redraw facility, repayment adjustment, debt consolidation or complete refinancing.

4. Start planning ahead. Think about where you are now and where you’d like to be. Taking action now can help keep your retirement plans on track.

5. Build a better business. If you run your own show, it helps to be money smart by understanding money management, maintaining a positive cashflow and finding new avenues of funding.

We’re here to help

At AMP we can help you get to grips with your daily spending, saving and budgeting.

- Understand your income and expenses with AMP’s Budget planner calculator.

- Grab some useful financial tips, tools and news to help achieve your financial goals, whatever they are, check out our Insights hub.

- Get rewarded for saving more with a high-interest AMP Saver account.

And then once you’re on firmer financial foundations, you could benefit from getting closer to your super and building your long-term wealth.

What you need to know

The credit provider for all banking products is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian Credit Licence 234517. Approval is subject to AMP Bank guidelines. Terms and conditions apply and are available at amp.com.au/bankterms or by calling 13 30 30. Fees and charges are payable.

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account.

It’s important to consider your particular circumstances and read the relevant product disclosure statement, Target Market Determination or terms and conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

All information on this website is subject to change without notice. AWM Services is part of the AMP group.