Q. Who makes up 98% of businesses in Australia, employs over five million Aussies, accounts for a third of the nation’s GDP and generates $500bn of economic activity a year1?

A. Step forward Australia’s small business owners.

It’s no exaggeration to say small businesses are the beating heart of the nation’s economy.

So as part of the AMP Financial Wellness Report 2024 we asked business owners with fewer than 20 employees how they’re feeling about money matters.

And the answer was…remarkably chipper. Small business owners are a resilient mob, despite all the challenges that come with running their own show.

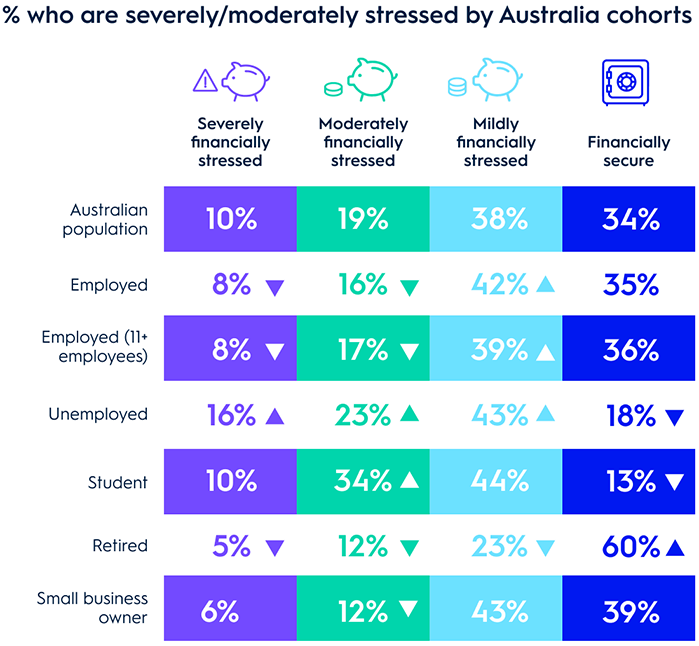

While the report overall highlights financial stress is costing the economy an eye-watering $88.95bn a year, small business owners are feeling more financially secure than the average Australian.

They’re less stressed than anyone else apart from retirees, which might come as a surprise.

Perhaps the challenges of running a business are offset by the advantages of being master of your own destiny?

Let’s take a deeper dive into how small business owners feel about money.

3 key insights into how small business owners feel about money

1. They’re making sacrifices

Small business owners are not afraid to take risks, putting their own money to good use. In launching their business, more than half (56%) used their personal savings or made sacrifices like cutting back on personal spending and luxuries (53%) and travelling less (38%).

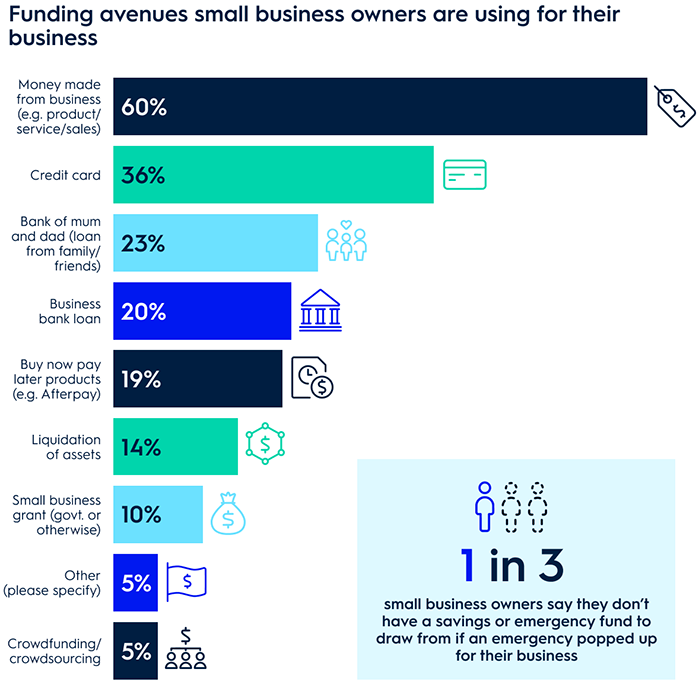

2. They’re juggling different sources of funding

Small business owners often use informal funding solutions in place of business finance – like borrowing from friends or family. Here are the top three sources of funding.

- Money made from their business (60%)

- Credit card (36%)

- Loans from friends and family (23%)

Worryingly, one in three small business owners don’t have savings or emergency fund to draw from if the proverbial hits the fan.

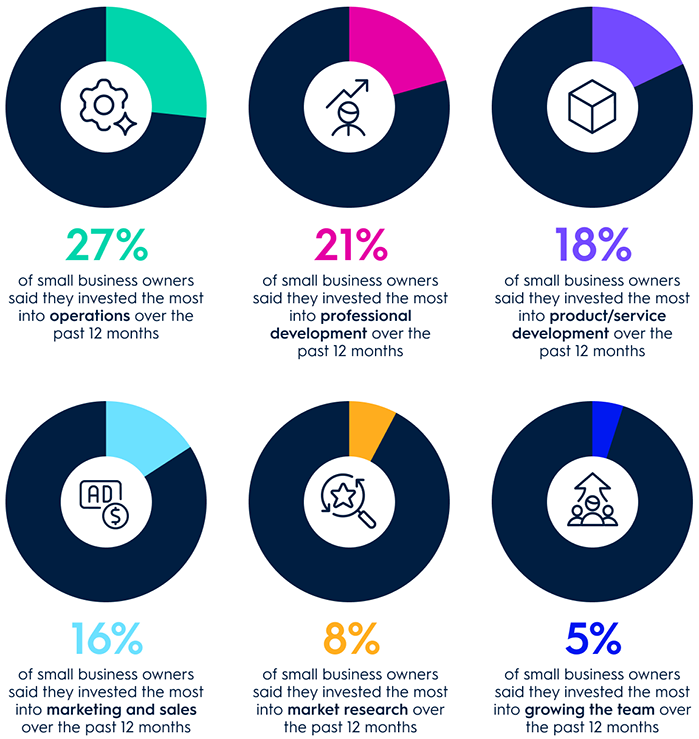

3. They’re investing in their business

So what are small business owners spending their money on? Almost half of them put their greatest investment into operations and professional development. Meanwhile, there’s less of a focus on areas like marketing and recruitment.

A business owner…but also a worker

Many small business owners aren’t just busy working on their business. They’re busy working in their business. So they can be in danger of a double stress whammy – both as an employer and as a worker. And the smaller the business, the more this tends to be the case.

So how are Aussie employees feeling?

The average employee spends a day and a half every month dealing with their personal financial matters during work hours. For more than half (55%), this entails spending time worrying about their finances rather than working, while for one in five (20%) it means dealing directly with credit card debt or bankruptcy matters. Nearly a quarter (22%) of employees spend time at work consulting with lenders, creditors or collection agencies to resolve an issue or discussing a personal financial problem with a colleague.

And when employees are feeling financially stressed, their job tends to suffer – almost 9 in 10 (88%) say that their productivity levels are directly affected by their current financial situation.

1 Small Business Matters, Australian Small Business and Family Enterprise Ombudsman, June 2023

What you need to know

The credit provider for all banking products is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian Credit Licence 234517. Approval is subject to AMP Bank guidelines. Terms and conditions apply and are available at amp.com.au/bankterms or by calling 13 30 30. Fees and charges are payable.

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account.

It’s important to consider your particular circumstances and read the relevant product disclosure statement, Target Market Determination or terms and conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

All information on this website is subject to change without notice. AWM Services is part of the AMP group.