Every couple of years we go out and take a pulse check of Australians’ finances.

We ask how you’re all feeling about money matters. Budgeting, spending, investing, saving, managing debt, borrowing, planning for retirement. The works.

The AMP Financial Wellness Report 2024 is in…and it’s a mixed bag.

Your state of mind depends on a bunch of factors – some obvious, some not so much.

How much you earn. Whether you own your home. What job you do. How old you are. Where you live.

It’s fair to say some Aussies are doing it tougher than others.

If you’re female, aged between 55 and 59, renting in Sydney, working in healthcare and earning less than $80k a year, you’re likely to be suffering more financial stress than the average Australian.

More than ever before, Australians are feeling the pinch. Only a third of us feel financially secure, while more than six million people are either severely or moderately financially stressed, including:

- 41% of Australians with disabilities

- 39% of single-parent families

- 38% of renters

- 35% of women.

The 2024 report highlights the ongoing impact of cost of living pressures, showing higher rates of severe financial stress than when the study kicked off in 2014, while the number of Australians feeling financially secure has also dropped.

And we’re still feeling the impact of the pandemic, with financial stress among Australian employees yet to return to pre-2020 levels.

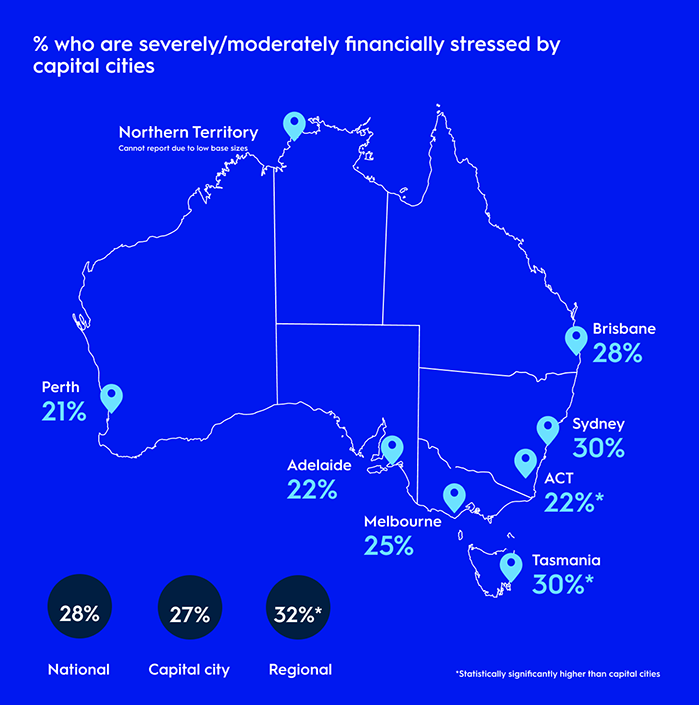

Let’s take a closer look around the country.

4 key factors that affect your stress levels

1. Where you live

Regional Australians are feeling particularly vulnerable, with 32% either moderately or severely financially stressed versus their counterparts in capital cities (27%).

Bucking the trend, 30% of Sydneysiders feel financially stressed – the same rate as Tassie – while Brisbane residents are doing slightly better at 28% - the national average.

Meanwhile, over in WA things are a little better, with Perth residents enjoying the lowest rate of stress at 21%.

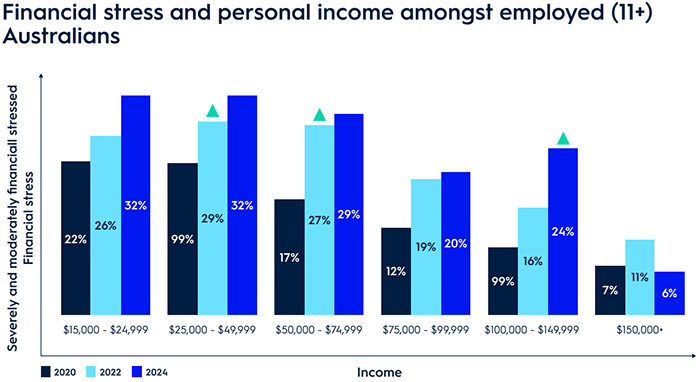

2. How much you earn

You might assume financial stress affects lower income Australians more. And to some extent that’s true.

Stress in lower income groups has increased marginally from the previous two surveys but dropped among those earning more than $150k a year – from 11% in 2022 to 6% this year.

And clearly having a job is better than not having one. Aussies in full-time study or who are unemployed say they’re more stressed than others.

But there’s been a notable creep in stress levels in higher income earners over the past four years, perhaps highlighting the effect of rapid interest rate rises on Australians who might have more housing debt.

Almost a quarter (24%) of employees in the $100-150k income bracket are moderately or severely financially stressed – up from 16% in 2022 and only 9% in 2020.

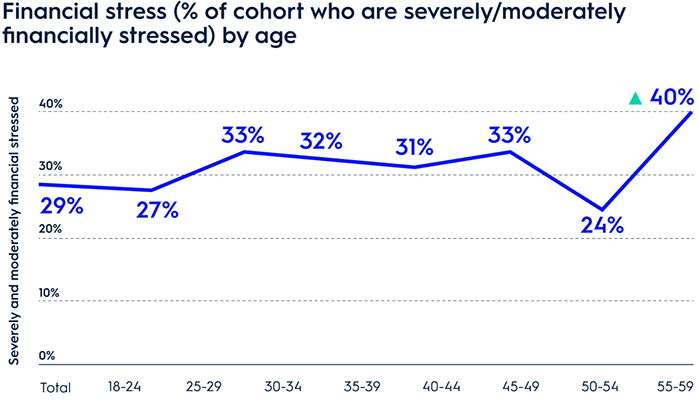

3. How old you are

Financial stress levels tend to rise when household costs are higher and major shifts in financial circumstances are imminent. So we’re seeing higher stress levels in the years between 30-50 and then a pre-retirement spike at 55-59 years.

Our relationship status also has a bearing on our stress levels. The unfortunate reality is that single parent households fare worse than married couples (39% vs 22%), while divorce and separation has a predictable effect on financial stress, lifting to 35% from a national average of 29%.

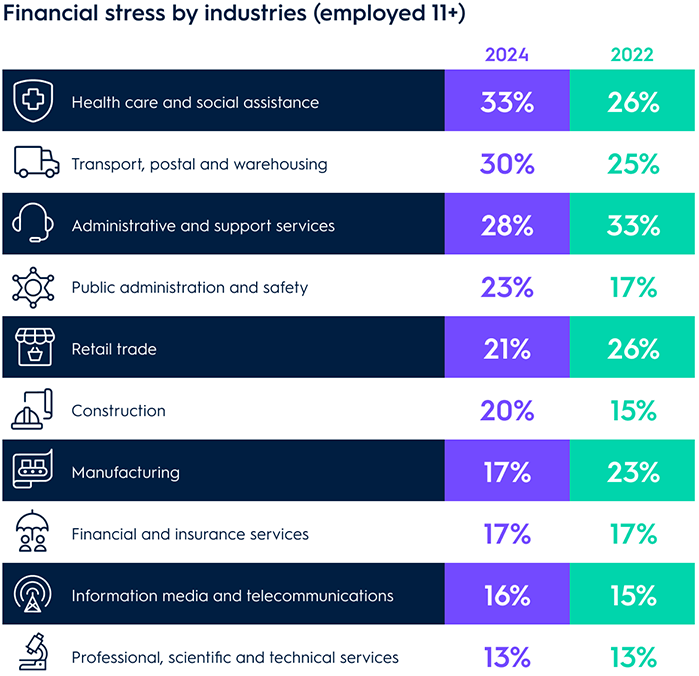

4. What job you do

There’s a huge difference in financial stress across industries. As you can see in the chart below, Aussies working in Healthcare & Social Assistance, Transport, Postal & Warehousing and Administration & Support Services are bearing the brunt of stress levels.

Meanwhile, Professional, Scientific & Technical Services, Information Media & Telecommunications and Financial & Insurance Services workers report much lower stress.

3 ways financial stress is affecting Aussies

1. It’s affecting our performance at work – whether you’re an employee or running your own business.

- Employees are spending an average of 11 hours dealing with personal financial matters at work every month.

- And 1 in 3 small business owners don’t have enough savings to draw from if an emergency pops up.

2. It’s affecting our ability to maintain our home loans. A million Australian homeowners may not be able to sustain their mortgage repayments if interest rates rise again.

3. And it’s making it tough to focus on the future. Only 20% of stressed Aussies are saving more money, compared with the average of 31% and only 16% have made clear financial goals, compared with the average of 22%.

How we’re fighting back and regaining our financial Zen

So what are we doing to meet these financial challenges?

We’re cutting back – 1 in 3 Australians have cancelled non-essentials such as streaming subscriptions and gym memberships.

We’re far more aware of discounts and promotions, and we’re more sensitive to the price of groceries.

And we’re on the hunt for bargains, with more than half of us actively seeking out websites or apps offering cheaper items.

Another option is getting some advice but the cost is putting some off, with 55% of Australians unlikely to seek professional financial advice over the next 12 months.

But people who do seek advice are finding it worthwhile. Among those who have used advice, a financial adviser was rated the most helpful, with 66% finding it valuable.

We’re here to help

We get it. You’re so busy dealing with daily financial challenges that it’s hard to focus on the future. But getting a bit closer to your super could help you feel more in control of your overall finances.

If you have an AMP super account, you can learn more about your super by booking a 20-minute session with one of our super coaches, at no extra cost.

And you can find out how much you’ll need in retirement with AMP’s Retirement needs calculator.

We also have plenty of tools to help you get to grips with day-to-day financial stress and feel more in control.

Understand your income and expenses with AMP’s Budget planner calculator.

Unlock bonus interest and reach your savings goals faster with an AMP Saver Account – plus put some money aside for emergencies.

Estimate your mortgage repayments and how much interest you’ll pay over the life of your loan with our Home loan repayments calculator.

And finally, if you’re after some useful financial tips, tools and news to help achieve your financial goals, whatever they are, check out our Insights hub.

For more insights, check out the full report.

What you need to know

The credit provider for all banking products is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian Credit Licence 234517. Approval is subject to AMP Bank guidelines. Terms and conditions apply and are available at amp.com.au/bankterms or by calling 13 30 30. Fees and charges are payable.

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account.

It’s important to consider your particular circumstances and read the relevant product disclosure statement, Target Market Determination or terms and conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

All information on this website is subject to change without notice. AWM Services is part of the AMP group.