Whether it’s cost-of-living pressures, housing affordability or rate rises, Aussies have been doing it tough lately.

So when there’s good news, let’s not miss the chance to celebrate it.

If you’re a working Australian you woke up on 1 July this year with a little more money in your pocket. Yes, the long-awaited tax cuts to help with the cost of living have arrived.

Now the changes are locked in, we know how much tax we’re getting back. Here’s what we all received.

Tax cuts on 1 July 2024

| Your taxable income | Income tax you paid in 23/24 | Income tax you'll pay in 24/25 |

Extra take-home pay |

| $40,000 | $4,367 | $3,713 | $654 |

| $60,000 | $11,067 | $9,888 | $1,179 |

| $80,000 | $18,067 | $16,388 | $1,679 |

| $100,000 | $24,967 | $22,788 | $2,179 |

| $120,000 | $31,867 | $29,188 | $2,679 |

| $140,000 | $39,667 | $35,938 | $3,729 |

| $150,000 | $43,567 | $39,838 | $3,729 |

| $160,000 | $47,467 | $43,738 | $3,729 |

| $180,000 | $55,267 | $51,538 | $3,729 |

| $190,000 | $59,967 | $55,438 | $4,529 |

| $200,000 | $64,667 | $60,138 | $4,529 |

In practice, the tax cuts mean the average Australian with an annual salary of $73,000 will be better off by around $29 a week1.

This may not sound like a huge amount but can easily add up and make a real difference over time.

For many Australians the extra money back in their pockets could simply provide much-needed respite from cost-of living pressures.

But for some it could also present a great opportunity to help pay off debt, invest, save for a home or retirement…or even just getting back to saving for a rainy day.

Here are some ways you can use your tax cut

Boost your borrowing power

If you’re in the market to buy a home – or even top up your current loan or buy an investment property you could boost your borrowing power.

As you can see in the table below, the 1 July tax changes mean that Australians earning $100,000 would be able to borrow an extra $21,800. And those with an overall household income of $250,000, could borrow $59,180 more.

| Annual income | Before tax cuts | After tax cuts | Extra borrowing power | |||

| Net monthly income | Maximum home loan | Net monthly income | Maximum home loan | |||

| $100,000 | $6,252 | $514,800 | $6,434 | $536,600 | $21,800 | |

| $250,000 | $15,122 | $1,213,000 | $15,615 | $1,272,180 | $59,180 |

|

Assumed interest rate 6.40%. Based on a lower than 80% loan-to-value ratio (LVR) so lenders mortgage insurance (LMI) is not required.

Get on track to paying off your mortgage

If you have a mortgage, you could pay off it off sooner by using your tax cut to make extra repayments and potentially pay off your mortgage sooner.

Let’s look at paying down an average home loan over 30 years. As you can see below, the more you earn, the more time you’ll save.

For example, if you earn $140,000, and you put all your savings from the tax cut towards your mortgage repayments, you’ll save five years and five months – time back to really enjoy your later years, footloose and fancy free!

| Income | Tax cut yearly | Tax cut monthly | Life of loan interest savings with tax cuts applied | Years saved |

| $70,000 | $1,429 | $119.09 | $74,165 | 2 years 4 months |

| $90,000 | $1,929 | $160.75 | $96,426 | 3 years 1 month |

| $100,000 | $2,179 | $181.58 | $106,961 |

3 years 5 months |

| $120,000 | $2,679 | $223.25 | $126,959 | 4 years 1 month |

| $120,000 | $3,729 | $310.75 | $164,855 | 5 years 5 months |

Assumptions: Average home value $636,597 and interest rate 6.27%.

Top up your super

If you’re looking to boost your retirement savings, you could contribute a little extra to your super.

This could make a big difference to your retirement savings over the long term.

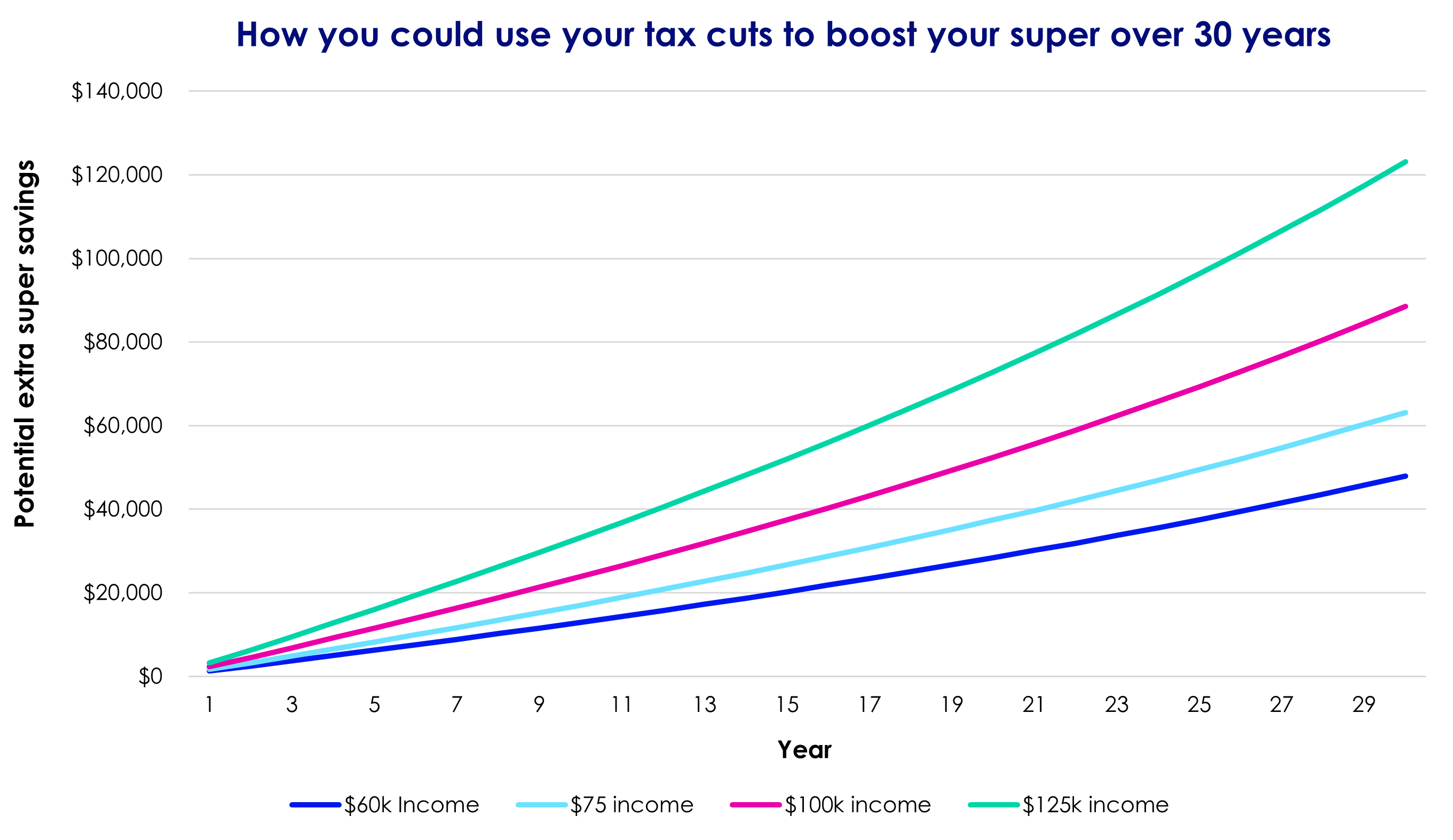

Now, let’s see what happens if you contribute your additional take home pay every month for 30 years from age 30 to 60. As you can see in the table below you could get a pretty hefty super boost, depending on how much you earn. For example, Australians earning $100,000 could get a $88,520 super boost after 30 years. Now, where’s that cruise brochure?

| Annual income | Extra contribution of the tax cut per month | Super boost after 30 years |

| $60,000 | $98.25 | $47,897 |

| $75,000 | $129.50 | $63,131 |

| $100,000 | $181.58 | $88,520 |

| $125,000 | $252.42 | $123,054 |

The following graph shows how your retirement savings could increase over time if you make regular additional contributions to your super. Each line on the bar graph represents a different income level.

Contribution is indexed by 2.5% each year (CPI inflation). 6.09% return on balanced (70% growth) option. Investment fees and fund fees are based on the current AMP MySuper Lifestage option.

No insurance costs or advice fees are taken into account.

The after-tax contribution for the year is within the persons’ annual non-concessional contributions cap. Tax on earnings within super is at 15% each year (worst case scenario). Government co-contribution and low-income super tax offset are not taken into account.

You can learn more about the tax cuts and what they mean for you on the Treasury website or estimate how much you're getting back using the Tax cuts calculator.

We're here to help

If you’re curious about how your super is going, how much more you could borrow on your home loan or what your retirement could look like, check out the below.

- Understand your income and expenses with AMP’s Budget planner calculator.

- Find out how much you can borrow with our Borrowing power calculator.

- See how much income you might have in retirement with our My retirement simulator.

- If you’re an AMP Super member, get closer to your super by speaking to a super coach at no extra cost.

- And if you’re buying your dream home, refinancing or looking to invest in property, we’ve got an AMP home loan that’s right for you.

Combatting social inequality through a love of food and culture

30 October 2024 | Blog Shaun Christie-David, Founder and CEO of Plate it Forward and 2020 AMP Foundation Tomorrow Maker awardee, shared his inspiring journey from banking to running a social enterprise. Through his love for food and commitment to breaking the cycle of inequality, Shaun has created a movement that exceeds the culinary realm. Plate it Forward, which started with Colombo Social, has grown to include multiple ventures. Shaun's story is a testament to resilience, cultural exchange, and the power of community support. Read more

7 ways to save this Father's Day

20 August 2024 | Blog Let's be real, when it comes to buying presents for your Dad on Father’s Day, some gifts and experiences are going to set you back a fair bit. So here's some tips on how to let Dad know you love him, without breaking the bank. Read more

7 ways to give your home a spring spruce-up

20 August 2024 | Blog Spring is in the air…and that means new beginnings. And what better way to start than with your home? Here's our tips to giving your home a makeover without breaking the bank. Read moreWhat you need to know

The credit provider for all banking products is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian Credit Licence 234517. Approval is subject to AMP Bank guidelines. Terms and conditions apply and are available at amp.com.au/bankterms or by calling 13 30 30. Fees and charges are payable.

Any advice and information is provided is general in nature. It hasn’t taken your financial or personal circumstances into account.

It’s important to consider your particular circumstances and read the relevant product disclosure statement, Target Market Determination or terms and conditions, available from AMP at amp.com.au, or by calling 13 30 30, before deciding what’s right for you. You can also email us at info@ampbanking.com.au.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

All information on this website is subject to change without notice. AWM Services is part of the AMP group.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.