Investment markets and key developments

Share markets mostly fell over the last week. US shares were down 0.1% being buffeted by bouts of profit taking in tech stocks and Nvidia and rising election uncertainty after the presidential debate but with economic data and more news of lower inflation remaining supportive of the Fed cutting rates this year. Japanese shares rose 2.6% for the week, but Eurozone shares fell 0.6% remaining under pressure ahead of the French parliamentary elections with French shares down 6.5% since the election was called. Chinese shares fell 1%. Australian shares fell 0.4% not helped by news of higher inflation and fears of another interest rate hike with IT and energy shares up sharply, but retail and property shares down. Bond yields mostly rose. Oil and metal prices fell, but the iron ore price rose slightly. The $A rose, and the $US also rose but mainly against the Yen.

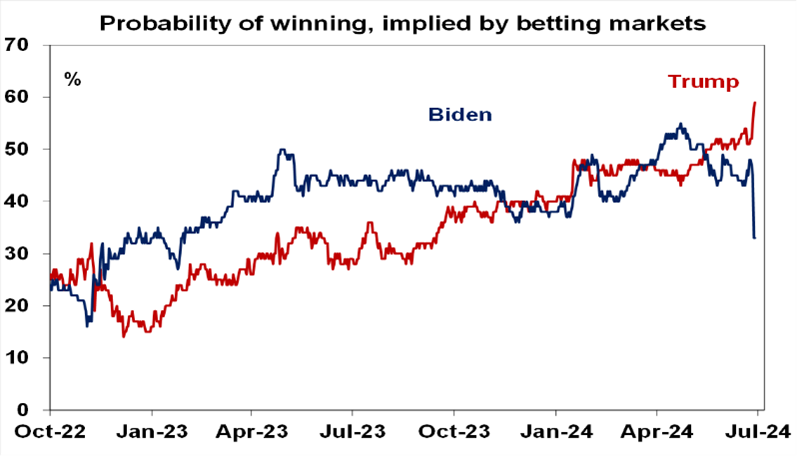

Despite a soft week the past financial year saw strong investment returns, but can it continue? Shares were star performers over the last financial year with US shares returning around 25%, global shares around 21% and Australian share shares around 12%. Cash returned around 4.5% and bonds returned around 2-3% but unlisted commercial property remained negative as office valuations remained under pressure. Key drivers of the strength in shares were the anticipation of lower interest rates on the back of lower inflation, stronger than expected economic activity and profits particularly in the US and, for US shares, the enthusiasm for AI. Australian shares did well but were relative laggards on the back of ongoing China worries and concerns about the impact of rate hikes on Australian households. More constrained and more volatile returns are likely over the 2024-25 financial year reflecting: poor valuations evident in the narrow earnings yield less bond yield gap; elevated levels of investor sentiment; and technically overbought conditions with narrowing breadth in the critical US market at a time when Nvidia and the tech sector is seeing some wobbles; and high geopolitical risks around France and the US as the first presidential debate focusses attention on the big negative of a renewed trade war if Trump is re-elected with Biden’s shaky performance not helping his prospects at a time when Trump is already ahead in the polls. The PredictIt betting market now has a 57% probability of Trump winning versus Biden on 35%.

Source: PredictIt, AMP

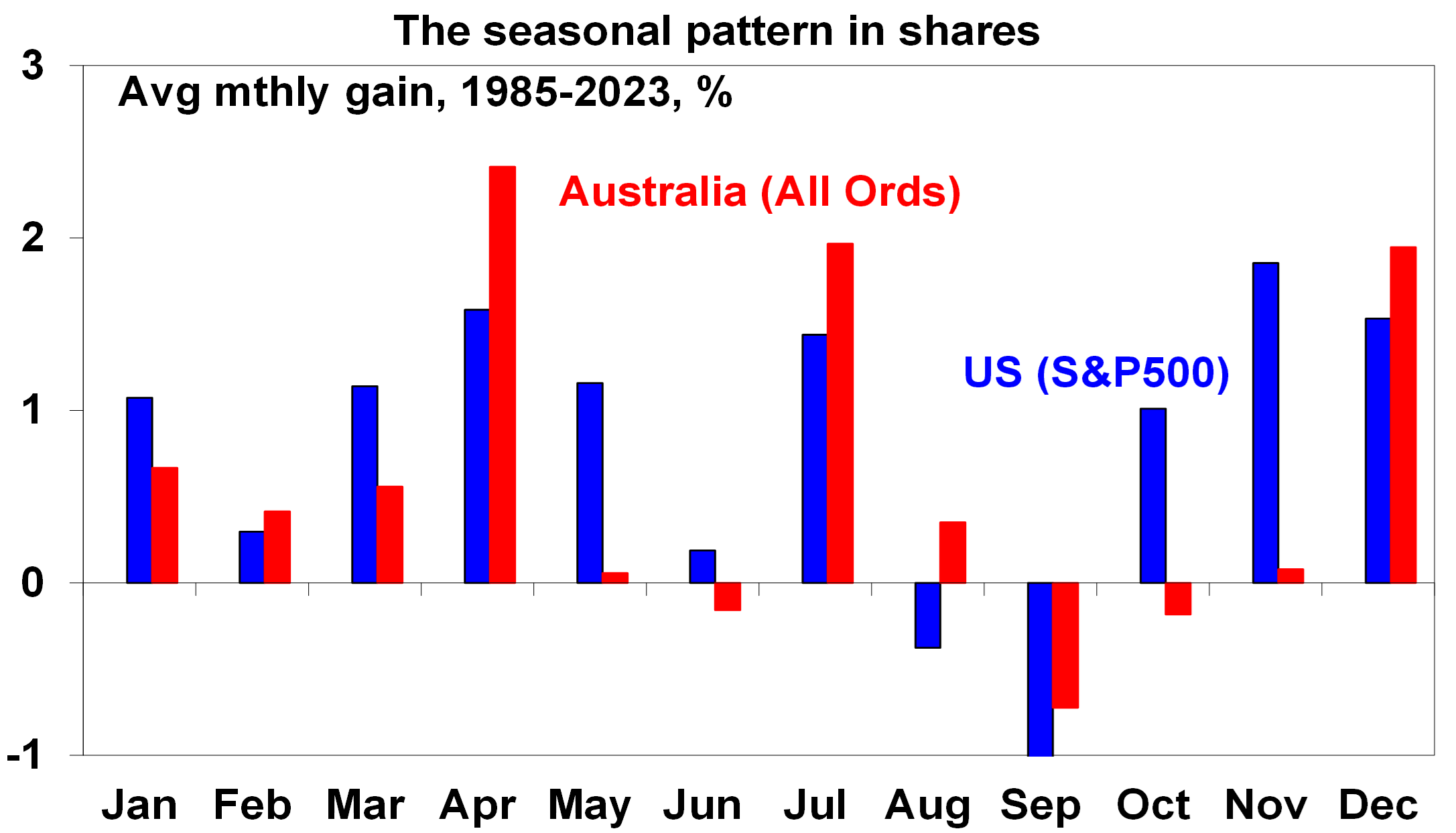

All of which leaves shares globally and in Australia at risk of another correction. The risk of another rate hike in Australia before cuts commence will likely see the Australian share market remain a relative underperformer. July is often a solid month seasonally, but August and September are seasonally weak months. That said, despite the risk of another correction we continue to see further gains in shares this year as disinflation continues, more central banks including the Fed join in cutting rates and as recession is avoided or proves mild.

Source: Bloomberg, AMP

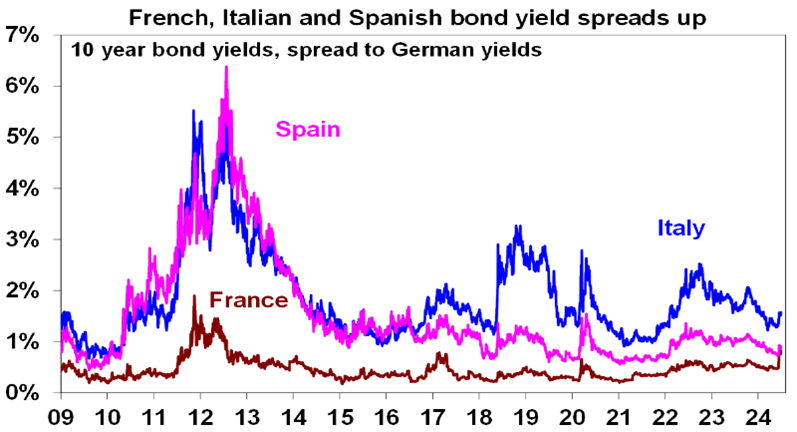

Eurozone markets remain on edge ahead of the French election (Sunday) with the spread between French and German bond yields still around its highest since 2012. Opinion polls have the far-right National Rally & its allies ahead at 36%, followed by the leftist New Popular Front on 29% and Macron’s centrist group on 21%. Given the high hurdle on making it to the second-round vote many of Macron’s centrists may not make it. Projections point to the NR getting the most parliamentary seats in the second round on 7 July, but short of a majority. A NR led (or a leftist) government threatens a reversal of President Macron’s reforms (such as raising the retirement age to 64) and a clash over fiscal policy with the European Commission with the blow out in French bond yields (and contagion to Italy & Spain) reflecting concerns it could reignite another Eurozone crisis. However, there are reasons not to be too concerned: surging bond yields will likely influence NR to modify its extreme policies much as occurred for extremist parties over the last decade in Europe most recently with the Giorgia Meloni and the Brothers of Italy – and this already appears to be occurring; popular support for the Euro remains high and NR long ago dropped its policy to leave the Euro; the outcome could well be that no party can form government leaving gridlock which would prevent a reversal of Macron’s pro market reforms; and finally the ECB has tools that can be deployed to calm individual bond markets if necessary (providing the country meets certain criteria). However, the uncertainty in Europe could be around for a while yet particularly if NR does well as polls suggest. And this could impact global and Australian markets.

Source: Bloomberg, AMP

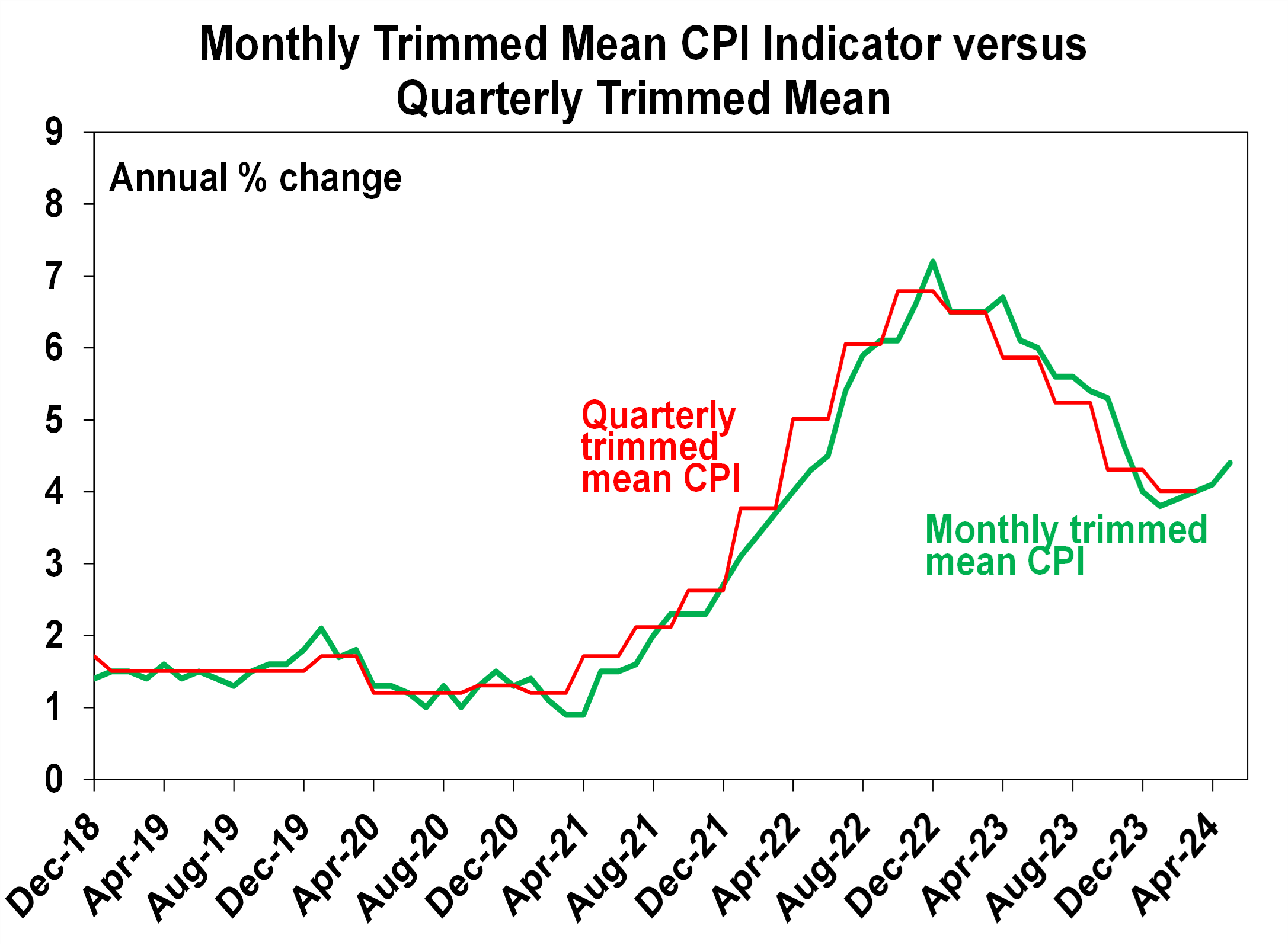

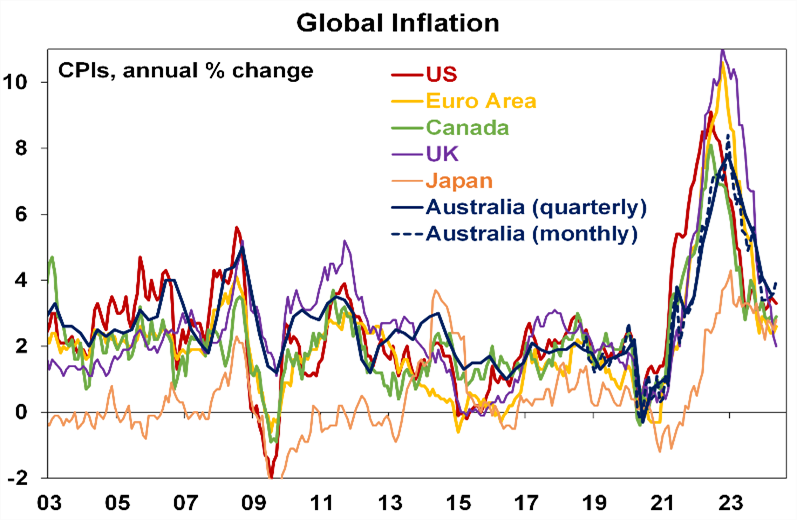

High May CPI inflation makes the August RBA meeting “live” for a rate hike. The sad reality is that Australia’s Monthly CPI indicator has now gone up for three months in a row driven by an upswing in services inflation at a time that goods inflation has stopped falling. While headline inflation may still be in line with the RBA’s forecast for 3.8%yoy in the June quarter, trimmed mean inflation based on monthly data so far risks being materially above its forecast which is also at 3.8%yoy and implies a 0.8%qoq rise. See the next chart. If confirmed in June quarter inflation data to be released late July – with a trimmed mean rise of 1%qoq/4%yoy or more - this would be troubling for the RBA and likely prompt an upwards revision to its underlying inflation forecasts through next year and given the RBA’s low tolerance for any further upside surprises on inflation and any slowing in the pace at which inflation returns to target could set the scene for another rate hike at its August meeting.

Source: ABS, AMP

However, another hike is not fait accompli though and our base case remains that rates have peaked. Firstly, June quarter inflation may surprise on the downside as the monthly CPI is an unreliable guide to the quarterly, which remains the gold standard. For example, softer than expected monthly inflation readings of 3.4%yoy through December, January and February were a poor guide to higher than expected March quarter inflation. So the higher than expected rises in monthly inflation though March, April and May could be exaggerating the upside risks to June quarter inflation. More fundamentally, the RBA needs to be cautious here as monetary policy is judged by the Bank itself to be “restrictive” and working to slow the economy, the lagged effect of past hikes is yet to fully show up, growth has slowed to a crawl and the RBA is likely to revise down its growth forecasts, households are under pressure that will only be partly relieved by the tax cuts from 1 July which are worth $37 a week for workers on average earnings and the RBA is also likely to revise down its forecasts for headline inflation on the back of further energy rebates. As such the risk of overdoing the rate hikes is high adding to the risk of recession. This is something we saw in the last drawn out big monetary tightening of the late 1980s. And finally, other countries like the US have seen pauses in progress in getting inflation down only to see it resume and the same is likely in Australia. So, while the rising trend in monthly inflation over the last three months can’t be ignored and we have pushed up our assessment of the risk of another hike to 45% and pushed out our expectation for the first cut to February next year, our base case remains that rates have peaked. Key to watch of course will be June quarter inflation data - with a 1%qoq/4%yoy or more rise in the trimmed mean likely to be a big concern for the RBA, upcoming data on retail sales and jobs and any early readings on how the tax cuts are impacting spending.

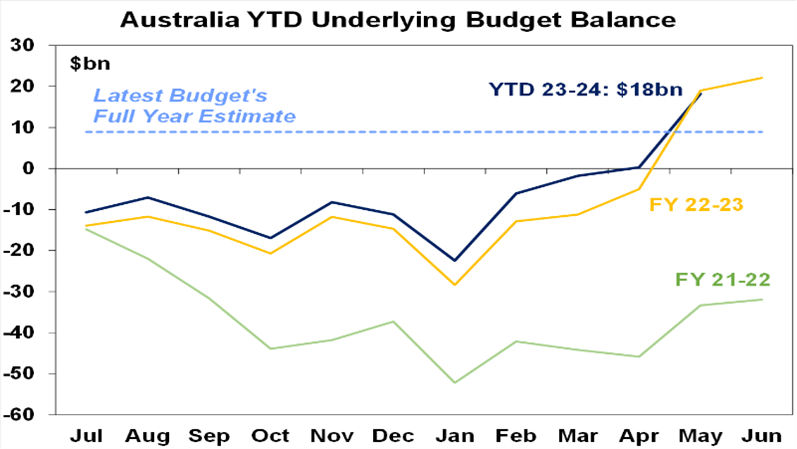

More broadly, the ongoing stickiness of inflation in Australia highlights the role Australian Federal and state governments have played in making the RBA’s job harder. While average households have cut back their spending as the RBA wants to happen, public spending across Federal and state governments has gone up adding to demand in the economy and competing for workers and ultimately keeping inflation and hence interest rates higher than otherwise would have been the case. Yes, May data confirms that the budget is on track for another big surplus in 2023-24 possibly of around $20bn thanks to the ongoing tax revenue windfall. But a return to deficit is likely in the 2024-25 financial year as a result of a slowing revenue windfall, structural spending pressures and short-term fiscal easing. The changes to the 1 July tax cuts by adding $800 a year to the size of the tax cut for a worker on average earnings also added to the risk that the tax cuts will be inflationary.

Source: Aust Treasury, AMP

Globally the news on inflation and interest rates over the last week was mixed. Expectations for the start of cuts in the US remain for around September helped by softish economic data. Canadian inflation surprisingly rose in May (albeit its lower than in Australia at 2.9%yoy for both the CPI and the core trimmed mean) indicating that the Bank of Canada will likely wait till September before cutting again. And the Swedish central bank left rates on hold after cutting at its last meeting but is now projecting 2-3 cuts assuming its inflation forecasts are unchanged.

Source: Bloomberg, AMP

Major global economic events and implications

US economic data over the last week was soft with a fall in consumer confidence, softer momentum in home prices, falls in new and pending home sales, falls in underlying capital goods orders and shipments and a small fall in initial jobless claims but a further rise in continuing claims indicating that once a job is lost its getting harder to find a new one. And disinflation was confirmed as being back on track with core private final consumption deflator inflation (which is what the Fed targets) rising just 0.1% in May bringing the annual inflation rate down to 2.6%yoy, which is actually below the Fed’s 2.8%yoy forecast for year end. We remain of the view that the Fed is on track to start cutting in September with two cuts likely this year.

Eurozone economic confidence was little changed in June remaining relatively subdued. Bank lending is running flat.

Japanese economic data was on the strong side with a bounce in industrial production, strong growth in retail sales and unemployment remaining low at 2.6%.

Australian economic events and implications

Apart from the hot monthly CPI, Australian economic data was mixed over the last week. The good news is that household wealth surged 10% over the year to the March quarter on the back of the rebound in home prices and share markets. This provided a boost to household via a positive wealth effect offsetting some of the drag from higher mortgage rates - although its worth noting that the wealth boost would have been small relative to the drag from high rates, the ratio of net wealth to income is still below its 2022 high and the ratio of household debt to income while down slightly still remains around record levels.

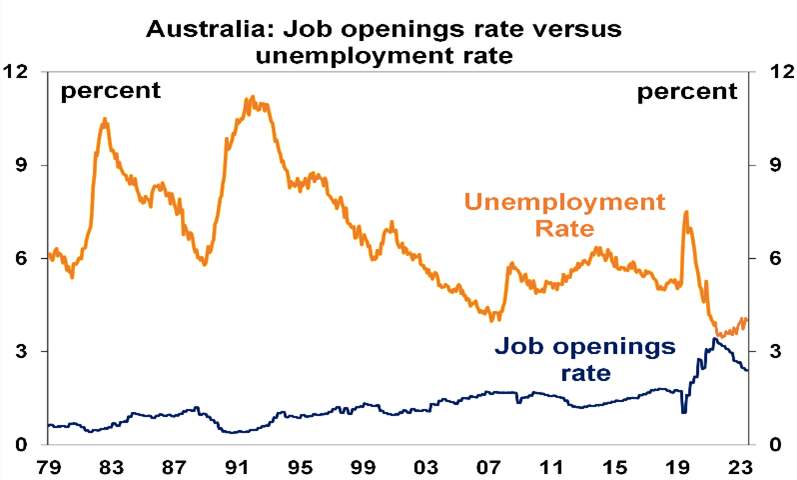

The labour market is still tight but job vacancies fell for an eighth consecutive quarter and warn that its cooling rapidly. For the three months to May vacancies fell another 2.7% and are now down 26% from their high two years ago. Vacancies are still high, particularly for customer facing services jobs, but the falling trend is consistent with private sector surveys and points to weaker jobs growth ahead and higher unemployment.

Source: ABS, AMP

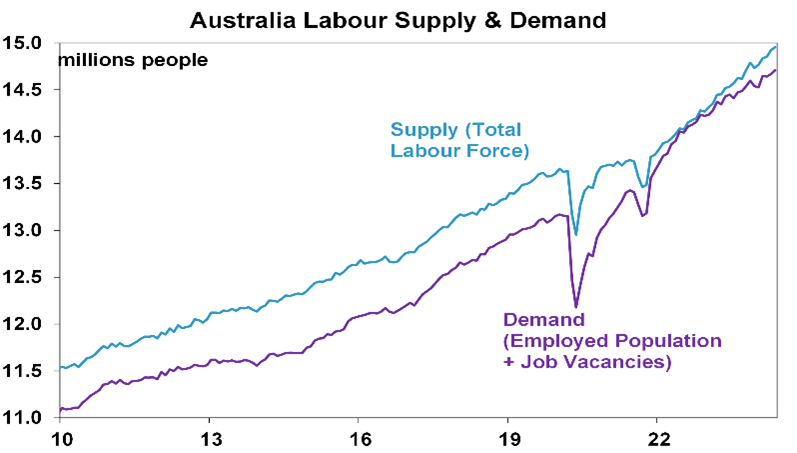

The gap between labour supply and demand is now widening again in Australia. Supply is being boosted by the surging population and high labour force participation and now demand growth is starting to cool as job vacancies fall and jobs growth slows.

Source: ABS, AMP

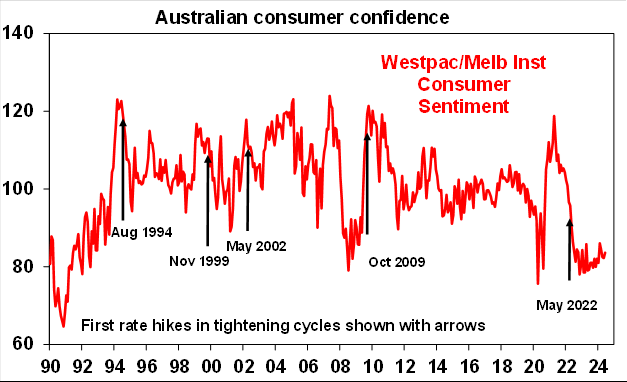

Consumer confidence rose slightly in June but remained weak and is likely to be even weaker now after the all the talk of another rate hike following the May CPI data.

Source: Westpac/Melbourne Institute, AMP

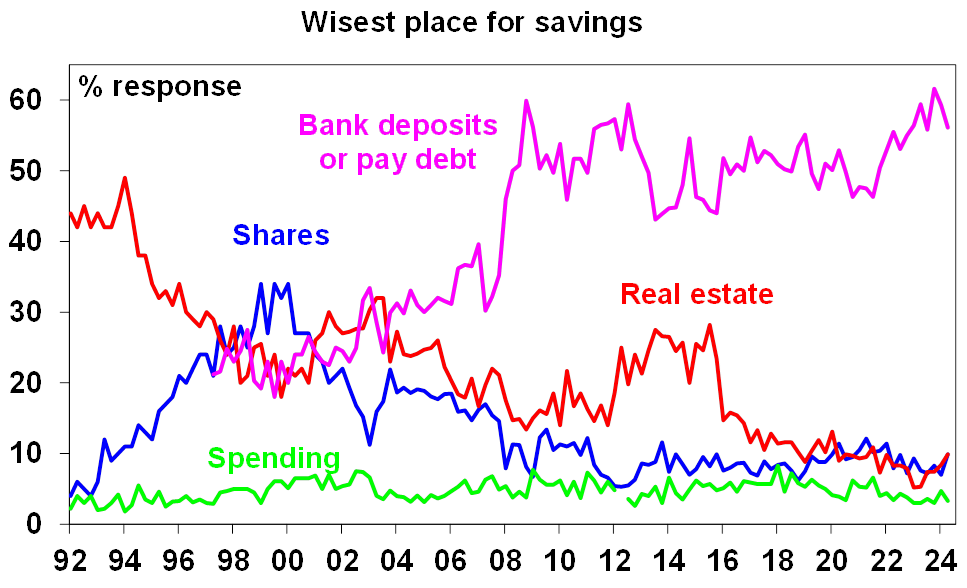

The June Westpac/MI consumer survey showed that consumers were slightly less cautious in their investing but its only marginal with most still nominating bank deposits and paying down debt as the wisest place for saving.

Source: Westpac/Melbourne Institute, AMP

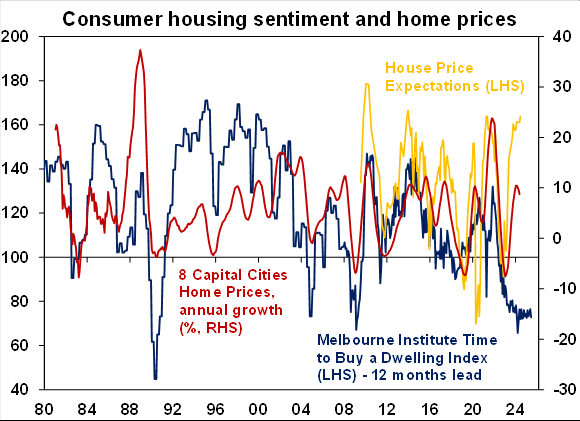

And while home price expectations are up (with home prices), perceptions about whether now is a good time is to buy a dwelling remain low.

Source: Westpac/Melbourne Institute, AMP

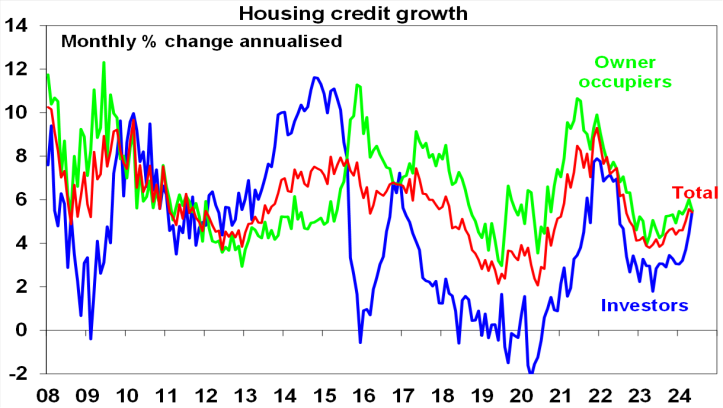

Private credit growth slowed slightly in May with a slowing in housing, other personal and business credit and annual growth remains moderate at 5.2%yoy. The slowing in housing credit was driven by owner occupiers but the trend remains up particularly for investors.

Source: RBA, AMP

What to watch over the next week?

In the US, the focus will be back on jobs (Friday) with June non-farm payrolls expected to slow to a 190,000 gain after a surprise surge in May, unemployment expected to hold at 4% and wages growth likely to slow to 3.9%yoy. The June ISM manufacturing conditions index (Monday) is expected to improve slightly to 49 but the services ISM index (Wednesday) is expected to slow to 52. Job openings data (Tuesday) is expected to confirm a further slowing in the jobs market. The minutes from the last Fed meeting (Wednesday) will be rather dated given the lower inflation readings seen since then.

In Europe the focus will be on the results from the first round of the French parliamentary elections on Sunday, where strong outcomes for the far-right National Rally may be taken badly. The final round will be held on seventh July. Eurozone inflation for June (Tuesday) is likely to slow slightly to 2.5%yoy with core inflation edging down to 2.8%yoy and unemployment for May (also Tuesday) is likely to be unchanged at 6.4%.

The Japanese Tankan business survey for the second quarter will be released Monday.

China’s Caixin business conditions PMIs will be released on Monday and Wednesday.

In Australia, CoreLogic data is expected show a 0.7% gain in home prices for June (Monday), May retail sales are likely to have increased by a modest 0.2%mom with building approvals (both Wednesday) expected to rise 2% after several months of weakness and the trade surplus (Thursday) is expected to remain around $6.5bn for June. The minutes from the last RBA meeting (Tuesday) are likely to retain a hawkish inclination.

Outlook for investment markets

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for reasonable investment returns this year. However, with a high risk of recession, delays to rate cuts and significant geopolitical risks, the remainder of the year is likely to be rougher and constrained.

We expect the ASX 200 to return 9% this year and end the year around 7900. A recession is probably the main threat.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows, and central banks cut rates.

Unlisted commercial property returns are likely to remain negative again due to the lagged impact of high bond yields and working from home.

Australian home prices are likely to see more constrained gains this year as the supply shortfall remains, but still high interest rates constrain demand and unemployment rises. The delay in rate cuts and talk of rate hikes risks renewed falls in property prices as its likely to cause buyers to hold back and distressed listings to rise.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.70 over the next 12 months, due to a fall in the overvalued $US, but in the near term the risks for the $A are on the downside.

Oliver's insights - Trump challenges and constraints

19 November 2024 | Blog Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory. Read more

Econosights - strong employment against weak GDP growth

18 November 2024 | Blog The persistent strength in the Australian labour market has occurred against a backdrop of poor GDP growth, which is unusual. We go through this issue in this edition of Econosights. Read more

Weekly market update 15-11-2024

15 November 2024 | Blog Global share markets were messy over the last week, not helped by the ongoing rise in bond yields and a wind back in Fed rate cut expectations after some elevated US inflation data and slightly hawkish comments from Fed chair Powell. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.