Investment markets and key developments

Most global sharemarkets continued to rally this week, as economic data was mixed but indicated no urgency for higher interest rates along with communication from most central banks that signalled policymakers are in no rush to raise interest rates further for now (the RBA may be an exception here) and as bond yields remain below their recent highs. It was also a quieter week because of the US Thanksgiving holiday. The US S&P500 was up by 1.1% with gains across all sectors, Eurozone shares rose by 0.7% (despite the rise in German bond yields on a budget “crisis” due to changes in spending allocations), Japanese shares were 0.6% higher, Chinese shares fell by 0.4% and the Australian ASX200 fell by 0.1% due to large falls in tech, real estate and consumer stocks while energy, financials and materials rose. The $A was up slightly, now trading around $0.658 USD.

Shares have had a good rally from their October lows with US shares rallying consecutively for the past 4 weeks, and up by over 9% since the October low. The US S&P500 is now only 5% below its 2021 all-time record high. In the short-term, shares could lift further on positive seasonality into the end of the year, the temporary truce between Israel and Hamas which could see some eventual resolution to the conflict, signs that interest rates are not headed higher across most major economies and lower bond yields. It’s conceivable that US shares reach their all-time highs again before the end of the year. Australian shares have underperformed relative to the US for the majority of 2023 and more risk of further RBA rate hikes compared to the Fed means this underperformance is likely to continue for now.

However, there are still reasons to be cautious for investors because: inflation has fallen but remains higher than central banks would like and could start to rise again, the war in Israel could still escalate and broaden to other countries, the risk of a recession in 2024 is high, bond yields could drift up again and pressure share market valuations and investor sentiment is yet to fall to levels that are usually associated with major market bottoms. This means that shares could still have another leg down over coming months, and some caution is needed.

Oil prices fell to $75.5 USD on West Texas Intermediate and remain lower relative to the start of the US/Palestine conflict. Iron ore rose to $126, its highest level since June 2022 on optimism from Beijing’s latest stimulus (news that Chinese regulators were drafting a list of 50 private and state-owned developers eligible for financing which will help the property sector).

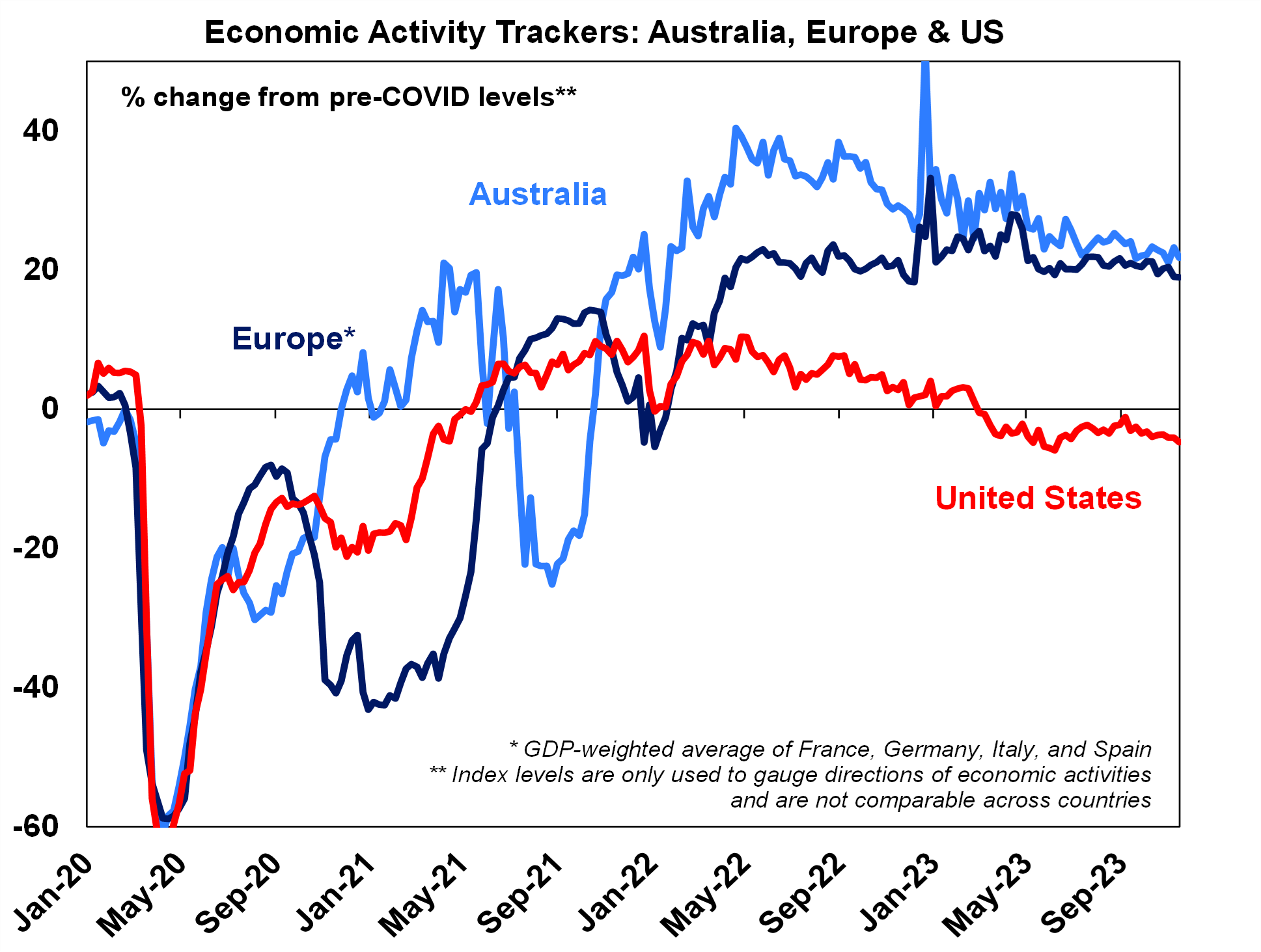

Economic activity trackers

Our Economic Activity Trackers remain relatively stable and are not showing a decisive upwards or downwards trend as a signal for economic activity.

Based on weekly data for eg job ads, restaurant bookings, confidence, mobility, credit & debit card transactions, retail foot traffic, hotel bookings. Source: AMP

Major global economic events and implications

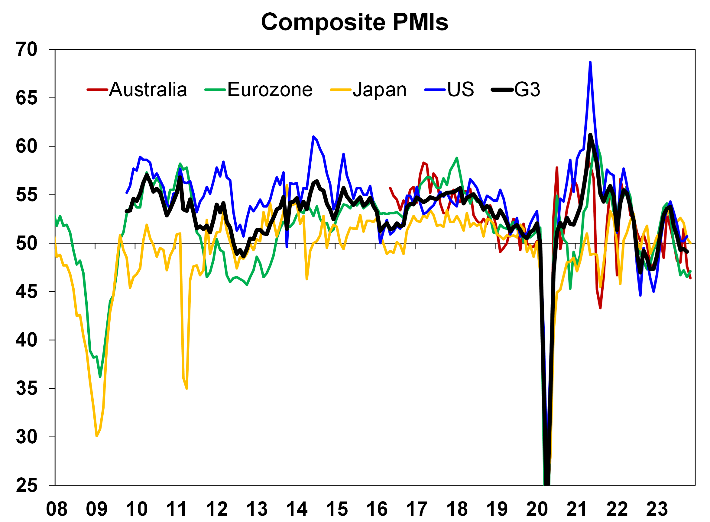

The flow of global PMI readings for November were mixed. The US composite PMI was unchanged at 50.7, with an improvement in services but deterioration in manufacturing. The composite Eurozone PMI was a little stronger than expected, rising to 47.1 (from 46.5) with both manufacturing and services readings stronger, although both are still below 50 which means that activity is contracting. The UK composite PMI rose into expansion, to a reading to 50.1. The Japanese PMI slowed to 50, with a larger decline in manufacturing relative to services. The Australian compositive PMI fell further in November, to 46.4 from 47.6 last month with both manufacturing down (to 47.7 from 48.2 last month) and services to 46.3 from 47.9. The US PMI is released tonight.

Source: Bloomberg, AMP

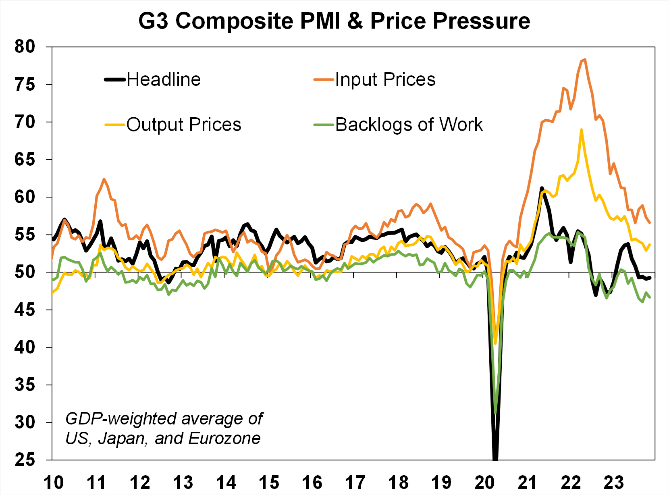

The components of the PMIs show that input and output prices are well down from their 2022 highs, the backlog of work remains low and the employment component of the PMIs have weakened in the US, UK and Eurozone.

Source: Bloomberg, AMP

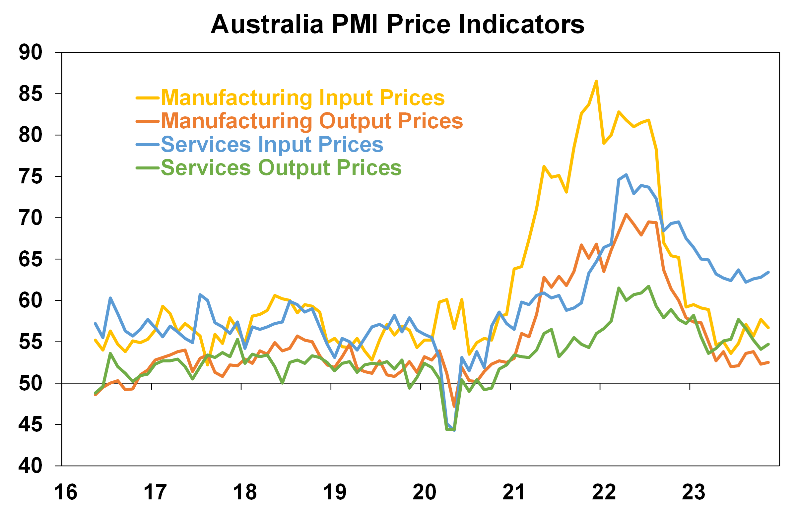

Within the Australian PMI, the input and output price components trended up but with services activity now contracting, this should see a slowing in services inflation.

Source: Bloomberg, AMP

The US data this week showed a further fall in US leading economic index in October which is still showing conditions consistent with a recession (see the chart below).

Source: Macrobond, AMP

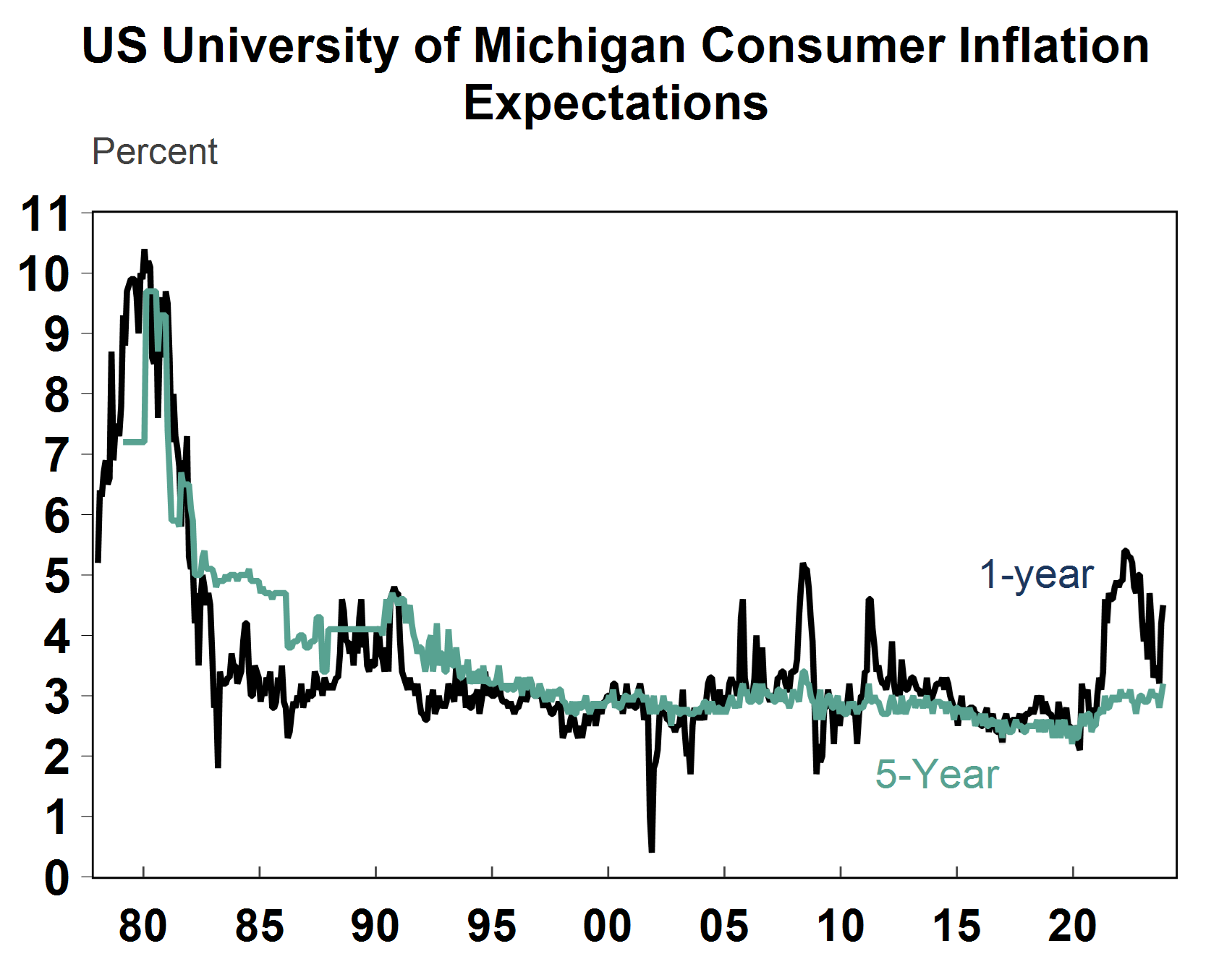

US existing home sales fell by a larger-than-expected 4.1% in October, taking existing home sales to the lowest level since November 2010 as the US residential construction industry is being hit from the impact of high interest rates. The Fed November meeting minutes were balanced, the central bank is still going to “proceed carefully” in terms of further rate hikes given signs that restrictive monetary policy was working to cool the economy. Initial jobless claims fell over the week to November 18 and have been more or less going sideways but continuing claims are trending up which shows that it is becoming harder to find work. Durable goods orders were down by 5.4% in October which may be impacted by the auto workers strike and means that orders should recover over coming months. University of Michigan inflation expectations were surprisingly revised up in November, with consumers now expecting 1-year inflation to be 4.5% (from 4.4% on the last measure) and 3.2% over 5-10 years (up from 3.1%) and above the Fed’s inflation target which is a problem if this trend continues.

Source: Macrobond, AMP

Canada’s consumer price data showed a rise of 0.1% over the month of October or 3.1% over the year, in line with expectations. The trimmed mean is up by 3.5% over the year to October and is a big fall from its peak of 8.1% in June 2022. Japan’s consumer price data was up by 3.3% over the year to October, a touch below expectations. Core CPI (excluding fresh food and energy) was up by 4% over the year to October. Japan’s CPI never rose as much as the other major economies and the peak occurred later (see the chart below), so the decline is also occurring slower relative to peers.

Source: Bloomberg, AMP

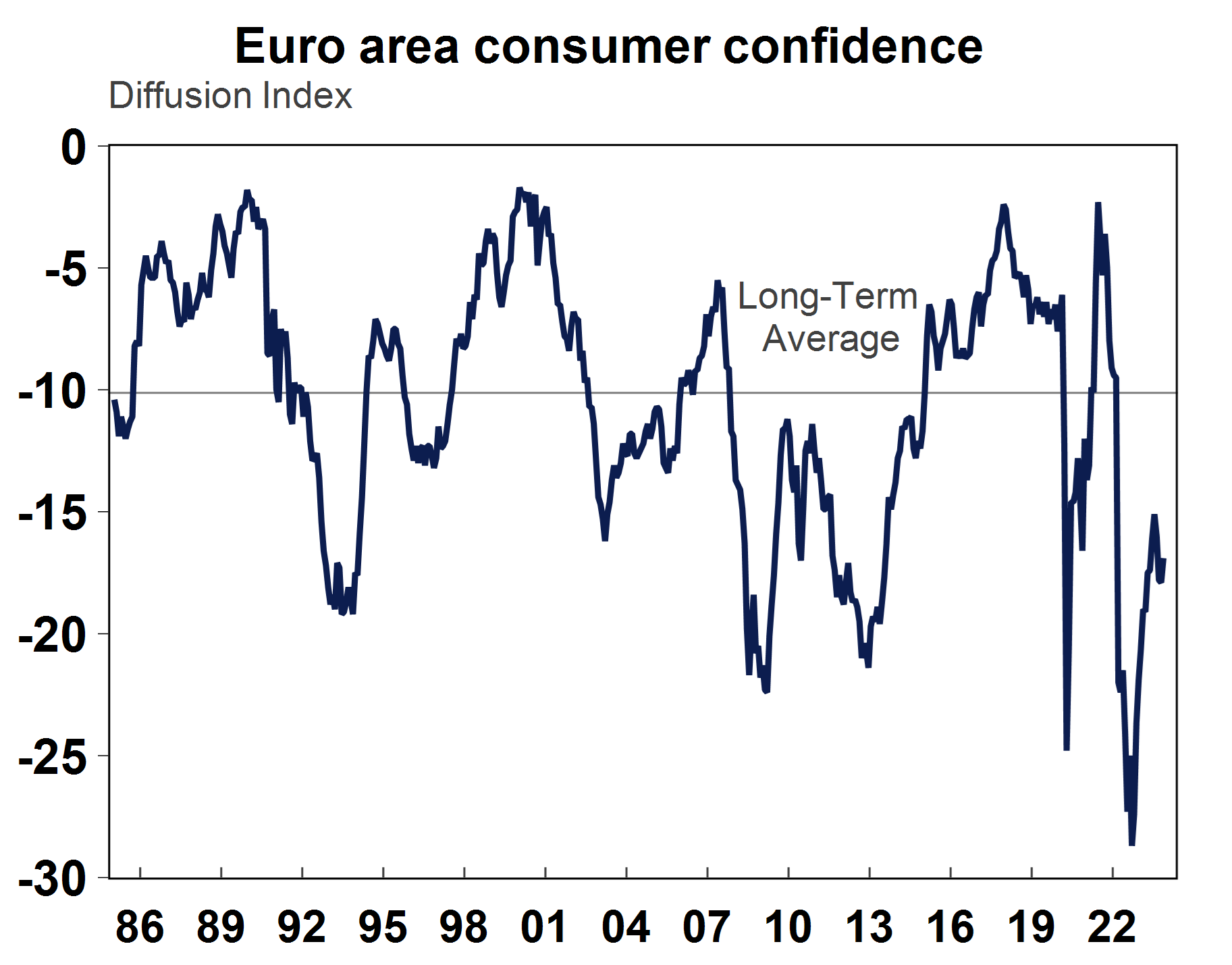

The ECB October meeting minutes indicate that the Governing Council was satisfied with the signs that monetary policy was working as intended and the impact of prior rate hikes was yet to materialise but there was still an option of another interest rate increase. Although, the Council also noted that further hikes were not part of the ECB’s current baseline scenario. Eurozone consumer confidence improved in November but still remains deeply negative (see the chart below).

Source: Macrobond, AMP

Sweden’s Riksbank kept rates on hold at 4%, despite 13 out of 21 economists surveyed by Bloomberg forecasting another 0.25% hike.

Out of interest, there are now more central banks cutting rates than hiking for the first time since January 2021.

Source: Deutsche Bank, AMP

New Zealand retail volumes were flat over the September quarter, beating expectations for a decline and follows 6 prior quarters of declines in retail volumes which could indicate some stabilisation in consumer spending.

Australian economic events and implications

There was numerous communication from the Reserve Bank of Australia. The November Board minutes (which saw the RBA lift the cash rate by 0.25% to 4.35%) had a hawkish tone and outlined the arguments for raising the cash rate (including that the outlook for inflation was stronger now compared to earlier months and it would mean a slower than expected return to the inflation target, a better growth outlook and a lower unemployment rate peak according to RBA staff forecasts) and keeping the cash rate unchanged (including that inflation was continuing to decline, the economy was slowing and the outlook was uncertain).

Governor Michelle Bullock delivered a speech at the annual Australian Business Economists dinner on “A Monetary Policy Fit for the Future” where she spoke about the current inflation challenge which is “increasingly homegrown and demand driven” which is being underpinned by services and also touched on the upcoming changes at the RBA in 2024 based on the recommendations from the RBA review (including a move from 11 to 8 Board meetings, longer Board meetings, Board attendance at RBA staff briefings and changes to RBA communication). In the Q&A, Bullock noted that the RBA and the government will release a new “Statement on the Conduct of Monetary Policy” which basically sets out the terms of agreement between the RBA and Government and the objectives of monetary policy and noted that the new statement will indicate that the RBA will target the mid-point of the 2-3% inflation target (which was a recommendation from the RBA review) and is a slight difference to the current more flexible wording that the “goal is to keep consumer price inflation between 2 and 3 per cent, on average, over time”. This change could be seen as hawkish as the RBA’s current forecasts have inflation at the top end (rather than the middle) of the target band by late 2025. In our view, inflation will continue to surprise to the downside in the next 12 months and the RBA will be forced to revise down its inflation forecasts.

Governor Bullock also spoke at an ASIC panel and commented that current wages growth around 4% per annum would only be consistent with the inflation target if productivity growth picked up. Current productivity growth is down by 3.5% over the year, well below its more normal levels of 1-1.5% per annum. The overall hawkish tone from all RBA communication this week led financial markets to price in around a 60% chance of another rate hike by mid-2024, up from ~25% a week ago. We think the risk of another hike has lifted to around 45% over the next few months. There doesn’t appear to be an urgency to do a follow-up hike in December but there is a risk of another hike in February after the quarterly consumer price figures in January.

What to watch over the next week?

In Australia, we expect the monthly consumer price index to be up by 5.2% over the year down from last month’s 5.6% which would imply a marginal increase in prices over the month. The monthly CPI index is not a complete picture of inflation, as many categories are not surveyed. October retail sales are expected to fall by 0.2%. Some of the September quarter GDP components are also released including the construction work done figures which are expected to show an increase of 3.4% and capital expenditure figures which we think will show a 2.7% rise in actual spending over the quarter while the 4th estimate of 2023-24 capital spending is expected to be around $165bn which would indicate some slowing in the pace of spending plans. Building approvals should bounce back by 5% after a fall last month, we expect a 0.4% rise in private sector credit and a 0.7% in CoreLogic home prices over November based on movements in the daily home price data. RBA Governor Bullock speaks on a panel next week at the HKMA-BIS High-Level Conference in Hong Kong.

The Reserve Bank of New Zealand meets next week and is expected to keep the Official Cash Rate unchanged at 5.5%, after last lifting interest rates in May. October building permits are also released, along with November house prices and consumer confidence.

Next week’s US data releases include new and pending home sales, home price data, consumer confidence readings, the Fed Beige Book, PCE inflation indicators, personal income and spending data and the November ISM.

China’s industrial profits and official PMIs are released which should show that activity was steady in November.

In Japan data includes the October industrial production, retail sales and the October unemployment rate.

The November Eurozone consumer price data should show a further moderation in prices, with headline CPI below 3% per annum and core around 4% per annum. The October Eurozone unemployment rate should show it tracking around 6.5%.

Outlook for investment markets

The next 12 months are likely to see a further easing in inflation pressure and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild. But for the near-term shares are at high risk of a further correction given high recession and earnings risks, the risk of high for longer rates from central banks, high bond yields which have led to poor valuations and the risk that the war in Israel escalates to include significant oil producing countries like Iran.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become dovish but given the recent rebound in yields this may be delayed a few months.

Unlisted commercial property and infrastructure are expected to see soft returns, reflecting the impact of the rise in bond yields on valuations. Commercial property returns are likely to remain negative as “work from home” continues to hit space demand as leases expire.

With an increasing supply shortfall, our base case remains that home prices have bottomed with more gains likely next year. However, uncertainty around this is high given the lagged impact of interest rate hikes and the likelihood of higher unemployment.

Cash and bank deposits are expected to provide returns of around 4-5%, reflecting the back up in interest rates.

The $A is at risk of more downside in the short term on the back of relatively lower short term interest rates in Australia and global uncertainties, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

Weekly market update 22-11-2024

22 November 2024 | Blog Against a backdrop of geopolitical risk and noise, high valuations for shares and an eroding equity risk premium, there is positive momentum underpinning sharemarkets for now including the “goldilocks” economic backdrop, the global bank central cutting cycle, positive earnings growth and expectations of US fiscal spending. Read more

Oliver's insights - Trump challenges and constraints

19 November 2024 | Blog Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory. Read more

Econosights - strong employment against weak GDP growth

18 November 2024 | Blog The persistent strength in the Australian labour market has occurred against a backdrop of poor GDP growth, which is unusual. We go through this issue in this edition of Econosights. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.