Investment markets and key developments

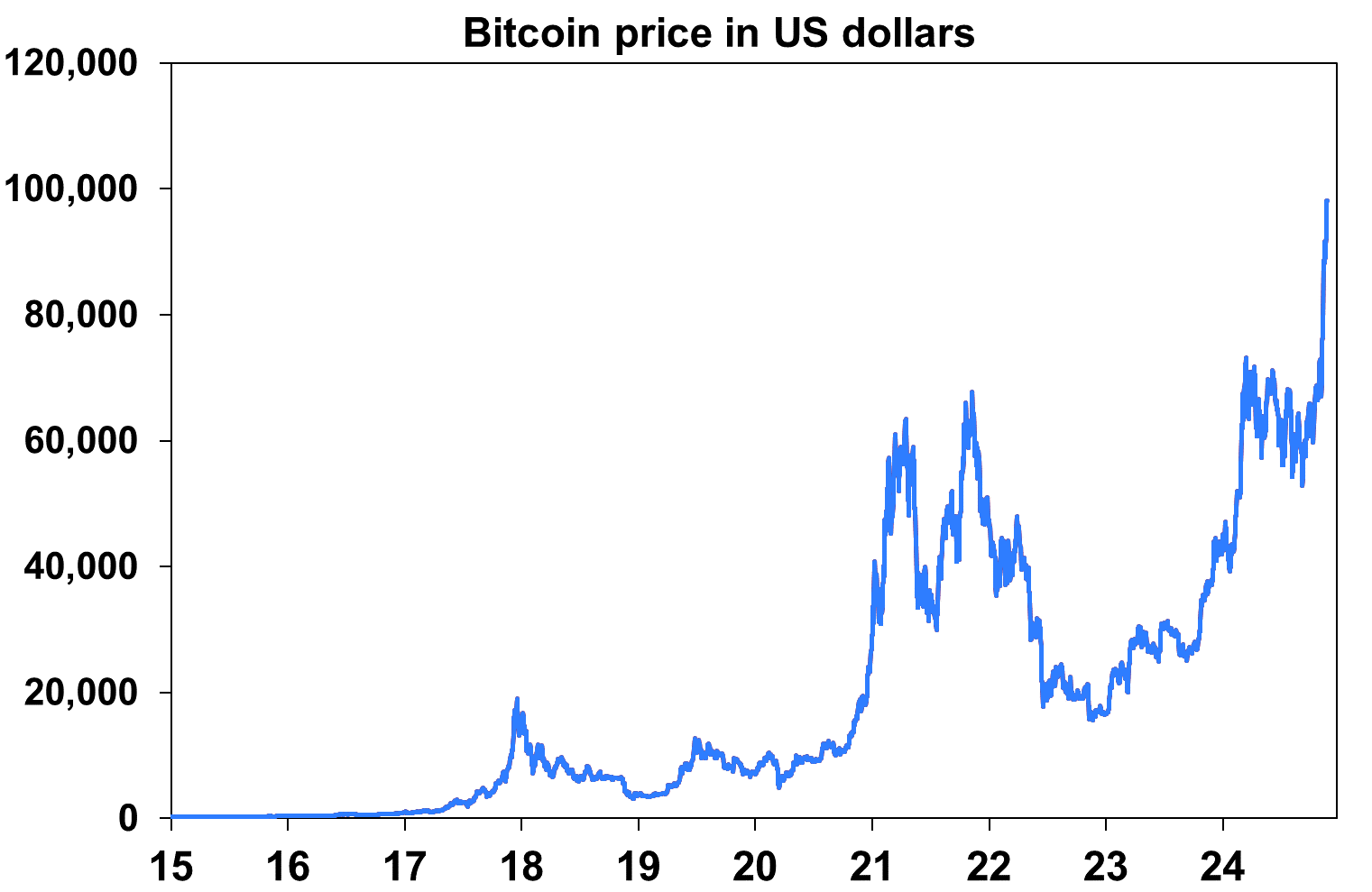

Against a backdrop of geopolitical risk and noise, high valuations for shares and an eroding equity risk premium, there is positive momentum underpinning sharemarkets for now including the “goldilocks” economic backdrop, the global bank central cutting cycle, positive earnings growth and expectations of US fiscal spending. US sharemarkets rose by 1.3% over the week (and are up by 24% over the year to date), Australia was up by 0.5% (and up by 9% over the year to date). Eurozone and Japanese shares were down this week. US 10-year bond yields have risen since the election but were unchanged at 4.4% this week. The US dollar has also continued to rise and is up by nearly 7% since the election, putting the $A under pressure, which is currently just over 0.65 USD, although on a trade-weighted basis our currency hasn’t fallen as much. Bitcoin is close to breaching $100K (see the chart below) because of expectations for a crypto-favourable administration.

Source: Bloomberg, AMP

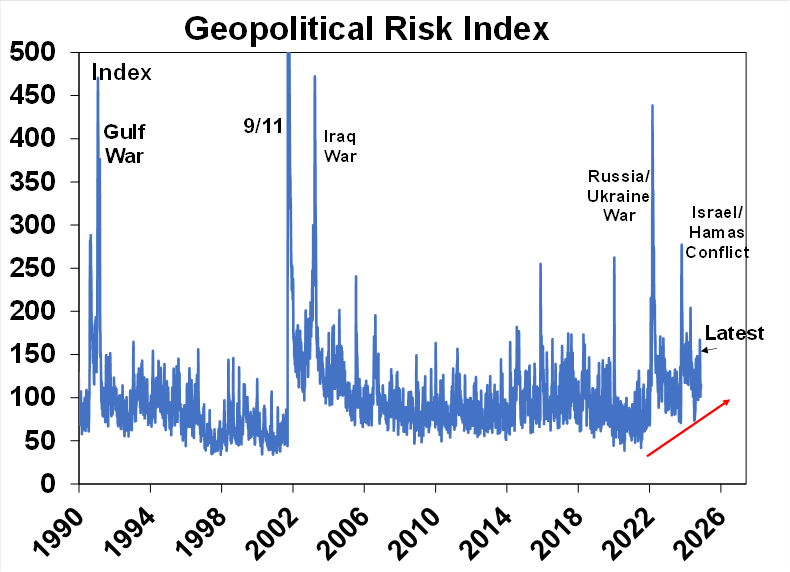

There was an escalation in the Russia/Ukraine war this week. After President Biden lifted the ban for Ukraine to use US weapons to strike Russia, Ukraine launched long-range missiles into Russia and Russia responded by launching its own missile which risks the use of nuclear weapons by Russia. Comments from Russia’s Foreign Minister Lavrov saying “we are strongly in favour of doing everything not to allow nuclear war to happen…. A nuclear weapon is first and foremost a weapon to prevent any nuclear war” tempered nuclear war risks but tensions are still clearly high. The Geopolitical Risk Index (see the chart below) which measures newspaper and media articles about issues related to geopolitics has risen in recent weeks (and has trended up since 2020) but is still below the spikes related to the start of the Russia/Ukraine war and sharemarkets looked through the news. Perhaps markets are focused on the new US administration coming in two months and Trump’s rhetoric that he will negotiate a deal with the two countries. Oil prices rose marginally but are still at $70/barrel, below recent highs. Unless there is a major escalation, such as a ground attack into Russia, sharemarkets are likely to keep looking through this issue.

Source: https://www.matteoiacoviello.com/gpr.htm, AMP

More Trump cabinet appointments are rolling in (and some are rolling out like Matt Gaetz), including Howard Lutnick to be Commerce Secretary who has spoken tough about China and tariffs. These appointments still need to be confirmed by the Senate. Trump’s pick for Treasury Secretary is keenly anticipated by financial markets because this is basically the “chief economist” job of the government and will drive the fiscal policy decisions of the governments. Our own Chief Economist Shane Oliver wrote a great note this week about what some of the constraints on Trump 2.0 will be here.

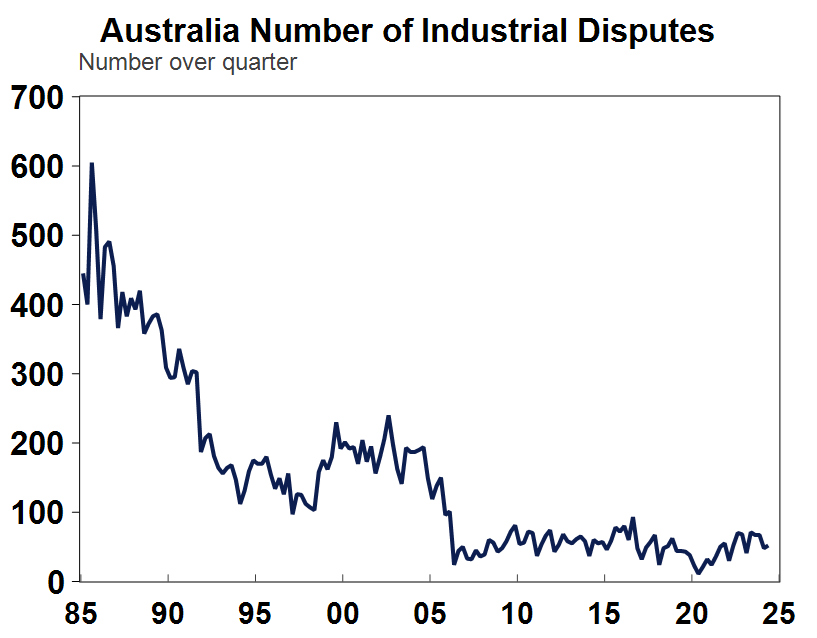

Sydney’s train strike was cancelled at the last minute, as the rail union and NSW government went into talks to resolve the industrial dispute. While it feels like there have been more industrial disputes in the last few years, over the very long-term there has been a clear decline in the number of industrial disputes (see the chart below). Over the quarter to June 2024 there were 52 disputes compared to ~450 the mid 1980’s!

Source: Macrobond, ABS, AMP

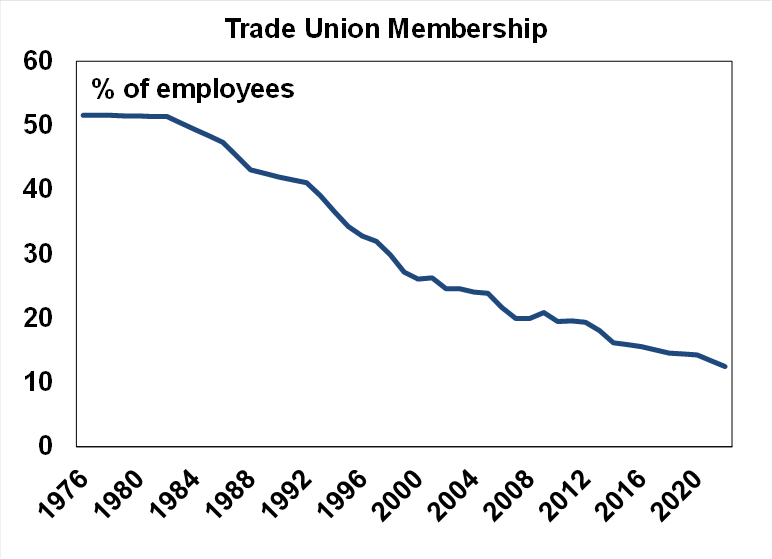

Around 0.2% of employees are affected by industrial disputes, down from 2% in the 1980’s and the ABS estimates that the number of working days lost to industrial disputes was 21,900 in the June quarter, down from over 300,000 in the 1980’s. The fall in industrial disputes is the result of a lower rate of participation in inion membership which is currently around 13%, from 52% in the mid 1970’s (see the chart below).

Source: ABS, AMP

Major global economic events and implications

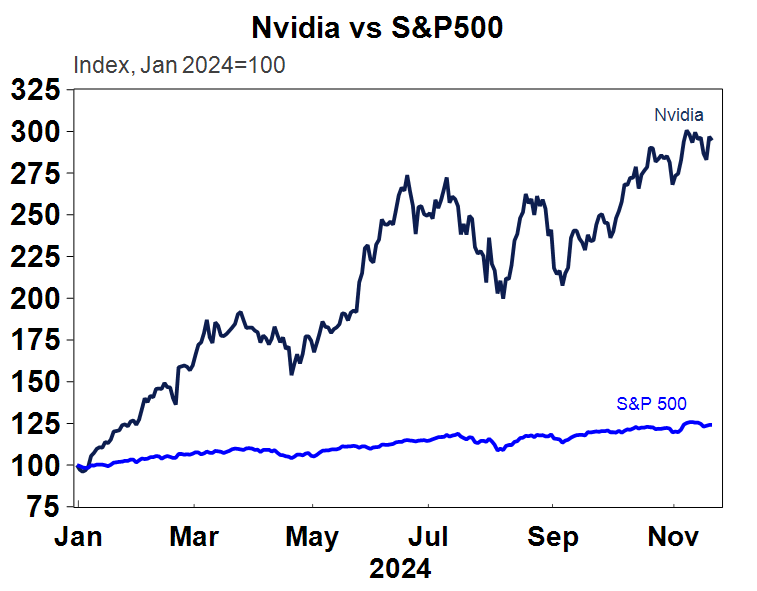

US September quarter earnings is basically complete with 95% of companies having now reported results. 75.6% of S&P 500 companies beat expectations, basically in line with the norm of 76%. Earnings growth is running at 8.7% year on year to September (or 2.3% excluding tech), up from 4%yoy expected at the beginning of the earnings season. Nvidia (arguably the most important company in the world!?) reported earnings which were in line with expectations but the market took this to be disappointing. Despite the somewhat disappointing market reaction, the outlook for Nvidia remains solid, with sales expected to double for the second year in a row. Given that Nvidia has consistently outperformed market expectations in recent periods, there is a high bar for its performance (Nvidia is already up by nearly 200% year to date!).

Source: Macrobond, AMP

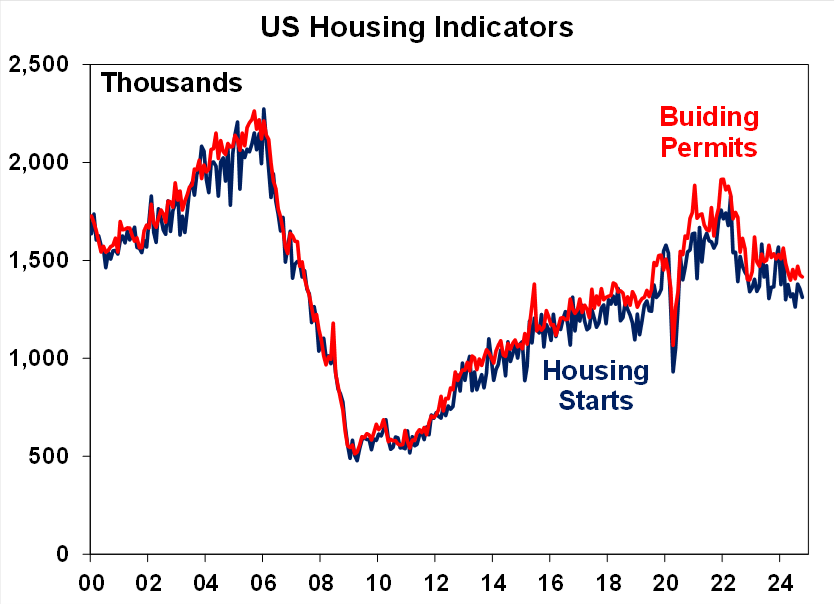

US housing starts fell by 3.1% in October (negatively affected by Hurricanes Helene and Milton) and building permits were down by 0.6%. US housing supply is also facing challenging conditions, with starts and permits on a downtrend since 2022 (see the chart below) which is pushing home prices up.

Source: Bloomberg, AMP

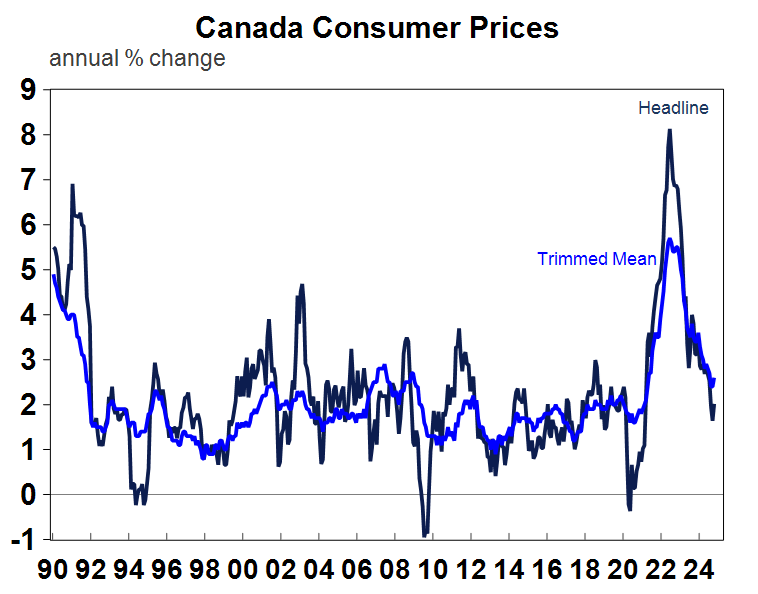

Canadian inflation data was a little higher than expected, with headline consumer price inflation at 2% over the year to October and the trimmed mean at 2.6% over the year (from 2.4% last month). The process of disinflation was never going to occur in a straight line so occasional higher price growth should be expected. The Bank of Canada is still expected to cut interest rates at its meeting in December.

Source: Macrobond, AMP

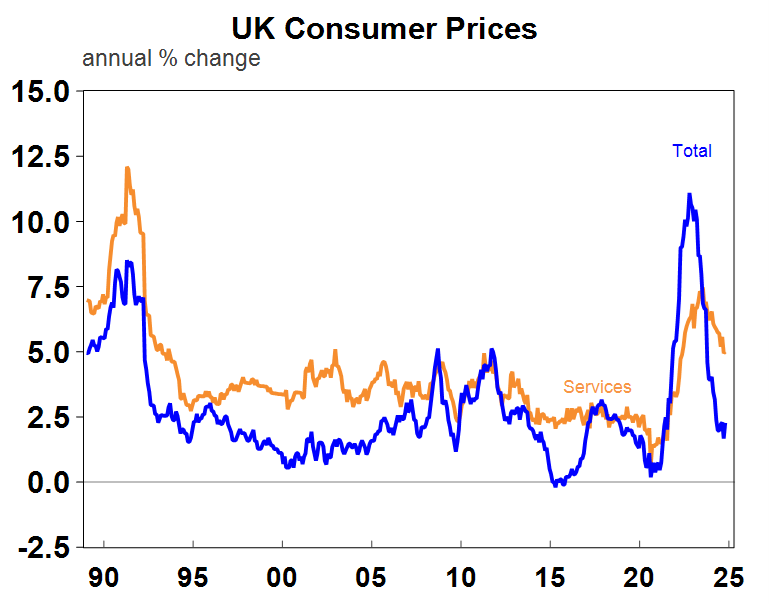

Similarly, the UK October consumer price data was also a tad higher, showing a 0.6% lift in the headline index over October, or 2.3% over the year, up from last months 1.7%. Core CPI rose to 3.3% and services inflation remains high at 5% per annum (see the chart below). The Bank of England is expected to skip a rate cut at its December meeting.

Source: Macrobond, AMP

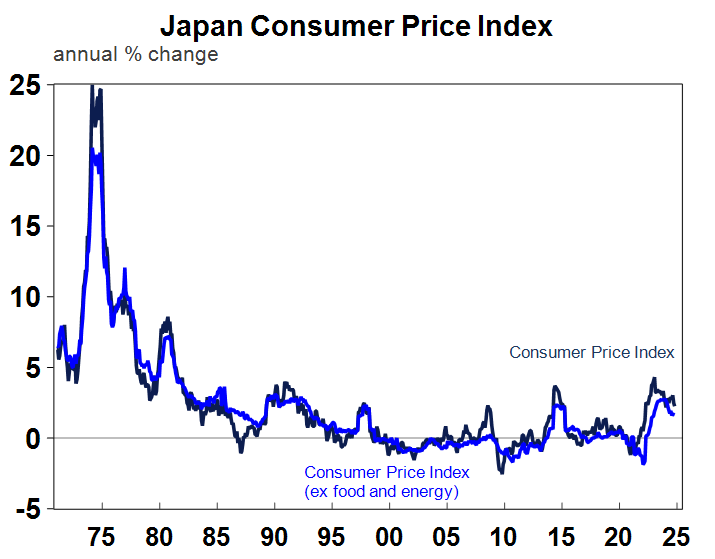

Japan’s consumer price data was in line with expectations, up by 2.3% over the year to October (down from 2.5% last month) with core inflation (ex food and energy up by 1.6%). There is the chance of another rate rise from the Bank of Japan at its December meeting, but it does not appear in a hurry to raise rates quickly, especially as the inflation data has moderated recently.

Source: Macrobond, AMP

Australian economic events and implications

The RBA meeting minutes for the November said that the board needed to remain forward-looking in its ability to adjust the future stance of monetary policy, and to avoid an “excessive reliance on backward-looking information” (which is indicators like the unemployment rate which has been persistently surprising to the downside, keeping the RBA hawkish). This would indicate that perhaps the RBA was closer to cutting rates than it appeared, if it was trying to be forward-looking and not wait as long for core inflation to be within in its target band. But on the other hand, in the discussion around different scenarios around the RBA’s baseline forecasts, there was a comment that “more than one good quarterly inflation outcome” was needed to be confident that the decline in inflation was sustainable. Given that the September quarter CPI data was not “good”, this would imply that the RBA would need to wait for the December and March quarter inflation data to potentially cut interest rates (we assume that a “good” inflation outcome is trimmed mean at 0.7% over the quarter or below). This would take us to the May 2025 meeting for any potential change to the cash rate, in line with market pricing. If you take the RBA at their word then a rate cut in February (which is our base case) looks unlikely. But, given lower September quarter wages growth, September quarter inflation just a touch above expectations and our peers cutting rates with similar rates of core inflation to us, there is still the chance of a February rate cut if the unemployment rate drifts higher, which is our expectation. But without a deterioration in the labour market, the RBA will not be in a hurry to lower rates. So the risk is with a later start to the cutting cycle in 2025.

RBA Assistant Governor Kent (Financial Markets) spoke this week on “The Financial System and Monetary Policy in Australia”. The speech was about the potency of monetary policy around the world, a topic that Kent has spoken about before. The RBA’s conclusion is that the aggregate transmission of monetary policy is no more potent in Australia compared to its peers, when you take all the interest rate transmission channels into account. Australia has a higher share of floating-rate and short-term fixed rate debt which means that there is faster pass-through of rate changes to households and businesses. This means the interest rate mechanism does work faster in Australia relative to its peers. However, Australia’s strong regulatory backdrop that has strengthened lending policies and the build-up of buffers means that Australians also tend to reduce their interest rate risk by paying down loans quickly and accumulating funds in offset and redraw accounts. The other transmission mechanisms from monetary policy is the cash-flow channel (the effect on those with a net asset position), the savings/investment channel, credit channel, asset price channel and exchange rate channel. Forward guidance is also part of the transmission mechanism because of the future path of interest rates that households and businesses take into account. Kent mentioned that the RBA has tended to provide forward guidance that is more infrequent, short-term and qualitative compared to many other central banks. But he also said that the RBA could consider other ways that the RBA might clarify its reaction function which opens the door for a change in the RBA’s forward guidance looking ahead. The other major central banks have been more explicit in the start of the cutting cycle compared to the RBA.

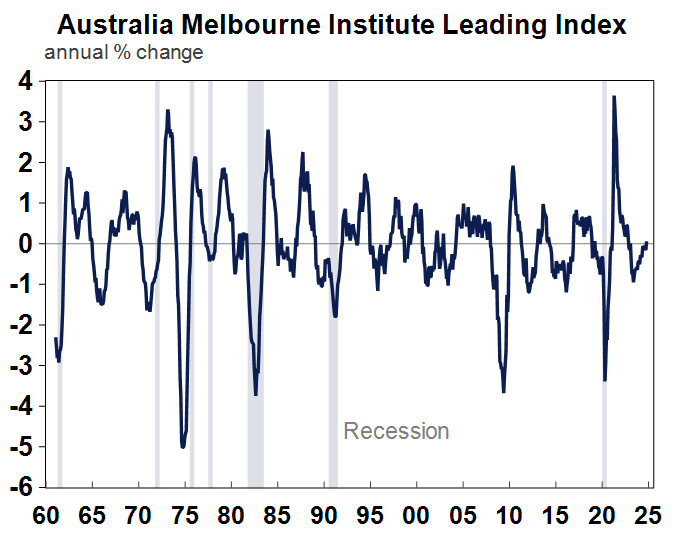

The Westpac/Melbourne Institute leading index rose by 0.2% in October and has now moved into positive territory over a year ago (see the chart below) for the first time January 2023.

Source: Macrobond, AMP

This is in line with an expected slow improvement in economic activity in Australia.

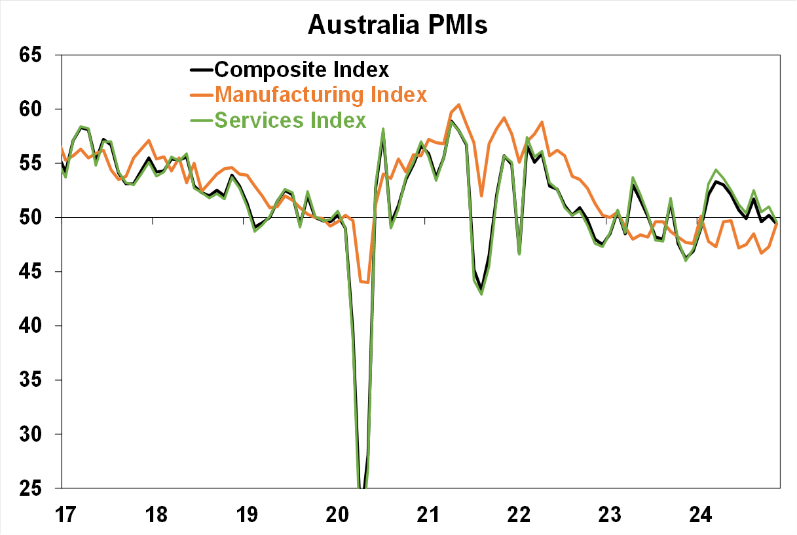

The Australian PMI data for November was soft – the manufacturing index improved to 49.4 (from 47.3) but services fell to 49.6 (from 51.0) with readings above 50 in “expansion” and readings below 50 in “contraction”.

Source: Bloomberg, AMP

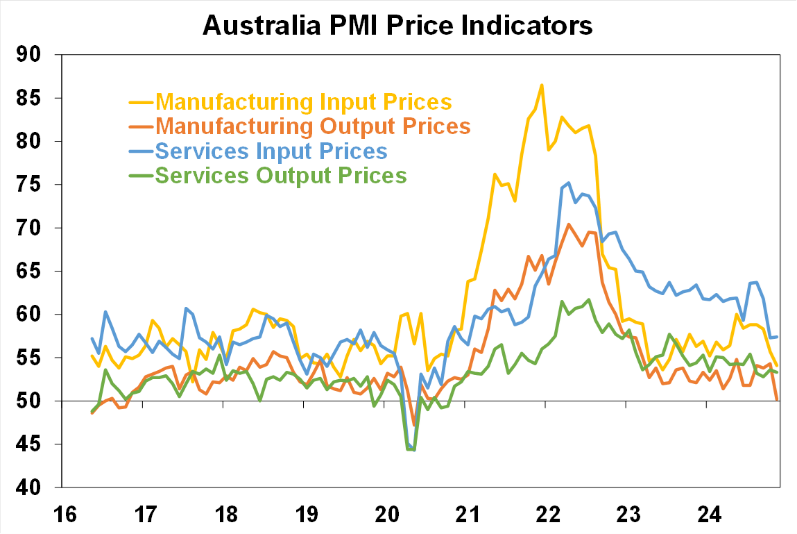

The input and output price components of the PMI’s have been falling since their 2022 highs. Manufacturing prices continue to fall but services prices have stalled recently (see the chart below). Price indicators are still consistent with inflation lower than its current levels.

Source: Bloomberg, AMP

What to watch over the next week?

In Australia, monthly consumer price data should show headline inflation or 2.2% over the year, which would imply a fall of 0.2% in prices over October. In October, there are many updates on goods prices but few on services. Cost-of-living rebates from the government are still flowing through and are reducing electricity prices and fuel prices also fell in October. Don’t forget that the monthly CPI data is not a full picture of inflation so we can’t read too much into its signal if it surprises significantly. There is also the September quarter construction work done data which we expect to rise by 0.7%, with residential, non-residential building and engineering construction all up over the quarter. The September quarter capital expenditure data will give an update on business investment. We expect private capital spending to rise by 1.1% over the September quarter and the fourth estimate of 2025-25 capital spending to increase by 6.5% from its previous estimate, coming in at $182bn. RBA governor Michelle Bullock speaks on Thursday at the CEDA conference. October private sector credit data is also released and is expected to rise by 0.5% over October.

Later tonight, global PMI’s are released in the US, Japan and Eurozone. Services activity has been outperforming manufacturing and this is likely to continue and we may get the first read around any sentiment impact from the US election.

Next week in the US, the FOMC meeting minutes for the November meeting are released, there is S&P CoreLogic home price data for September, consumer confidence board sentiment (expected to be up) and new home sales data.

In Eurozone, the November CPI is key an is expected to be up by 2.5% over the year to November (down from 2.7% last month).

In China, October industrial profits are released for October.

Canadian September quarter GDP is expected to be up by 0.9% or 1.7% year on year, an improvement from 1.3% last quarter.

In Japan, there is industrial production data, the unemployment rate and retail sales.

Outlook for investment markets

Easing inflation pressures, central banks cutting rates, China ramping up policy stimulus and prospects for stronger growth in 2025-26 should make for reasonable investment returns over the next 6-12 months. However, with a still high risk of recession, poor valuations and significant geopolitical risks particularly around the Middle East and Trump’s policies, the next 12 months are likely to be more constrained and rougher compared to 2023-24.

Bonds are likely to provide returns around running yield as inflation slows, and central banks cut rates. They could face more losses in the near term though given uncertainty around Trump’s policies.

Unlisted commercial property returns are likely to start to improve next year as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices are likely to see some further slowing over the next few months as the supply shortfall remains, but still high interest rates constrain demand and unemployment rises. Lower interest rates should help the market next year though and we see average property prices rising by around 5% in 2025.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the rise in cash rates.

A rising trend in the $A is likely taking it to $US0.70 over the next 12 months, due to a fall in the overvalued $US and a narrowing in the interest rate differential between the Fed and the RBA. A recession and US tariffs under Trump are the main downside risks.

Oliver's insights - Trump challenges and constraints

19 November 2024 | Blog Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory. Read more

Econosights - strong employment against weak GDP growth

18 November 2024 | Blog The persistent strength in the Australian labour market has occurred against a backdrop of poor GDP growth, which is unusual. We go through this issue in this edition of Econosights. Read more

Weekly market update 15-11-2024

15 November 2024 | Blog Global share markets were messy over the last week, not helped by the ongoing rise in bond yields and a wind back in Fed rate cut expectations after some elevated US inflation data and slightly hawkish comments from Fed chair Powell. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.