Investment markets and key developments

US sharemarkets initially rose this week after encouraging inflation figures and strong gains in tech. European sharemarkets were a sea of red after some surprises from the European Parliamentary elections and Asian sharemarkets were mixed, with Japan higher after the Bank of Japan meeting but China down over the week. The Australian ASX200 was down by 1.3% this week, with the largest falls in materials, utilities and industrials while consumer discretionary and tech shares were stronger. The ASX200 is only up by 1.7% this year while the US S&P500 is 14% higher with massive gains in tech shares like Nvidia (which is up by 166% this year). A weaker Euro this week after election uncertainty gave more support to the US dollar and the $A was up slightly to 0.661USD. Commodity prices were mixed, metals like aluminium, copper, nickel and silver were all weaker after recent gains while oil prices were up with WTI at $78 USD/barrel.

The move away from a globalised world continues. The European Commission will impose tariffs ranging between 17%-38% on imports of Chinese electric vehicles which will be levied on top of the existing 10% across-the-board tariff on all Chinese electric vehicle imports which didn’t come as a total surprise after the recent increase in US tariffs on Chinese EV’s. It's expected that China may retaliate by launching its own additional tariffs on European exports such as French cognac, large-engine cars from Germany, Airbus and pork exports. Chinese producers will look to shift production into the EU or Morocco. Trade wars rarely create any “winners” with the main losers being consumers!

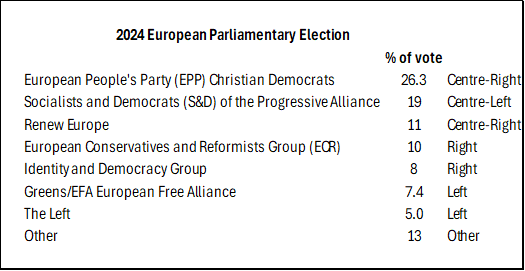

The European Parliamentary elections took place over 6-9 June, which happens every 5 years and this year ~720 Members of the European Parliament were elected. The role of these members is around issues like representing their EU citizens, deciding how the EU’s money is spent and agreeing on the budget. While this election is not an outright vote on the countries leaders, it is a reflection of citizens satisfaction with the current leadership and there were some important outcomes at this year’s election. Despite the fear-mongering media headlines about the far-right gaining control, the centre still held the majority of votes at 56% or 403 seats but this was less than the last election when the centre got 417 seats. The far-right received more seats compared to last election particularly in France and Germany.

In France Marine Le Pen and Jordan Bardella’s National Rally (far right) party received over 31% of the vote, which was more than double President Macron’s party. As a result, Macron called a snap election for the National Assembly, (three years earlier than the next election was scheduled), to be held on June 30th and the second round on July 7th. This election would dissolve Parliament, but Macron would remain President until 2027. The two likely outcomes are either the National Rally (Le Pen’s party) obtaining a majority to form a government with Bardella likely to be Prime Minister or that some sort of broad centrist alliance is formed. Macron’s rationale for holding an early election appears to be a way to bring National Rally into power for a short period of time without giving away the Presidency, hoping to demonstrate that the National Rally party is not fit for governing France. The French sharemarket lost 6% this week on this uncertainty for France and question markets over the future of the Eurozone bloc and bond yields were higher market concern that National Rally could bring in looser fiscal policy with Moody’s this week saying that the snap parliamentary elections negative for country’s credit score given widening fiscal deficit.

Source: Europa, AMP

However its important to keep in mind that not all of Europe is moving far to the right, with Denmark actually seeing an increase in support for left parties so overall there is still broad level support for support for the Eurozone although there is still clearly a populist challenge and there were setbacks for the left/Greens parties which argues that there should be some give on the climate transition in particular.

Major global economic events and implications

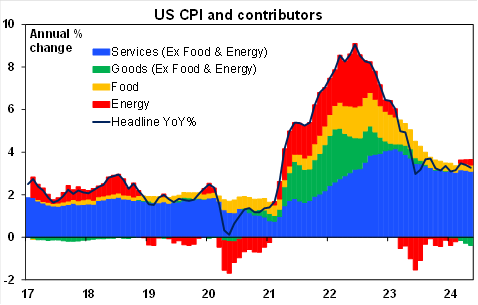

The US May consumer price data surprised to the downside for the first time all year and is showing further progress in getting inflation back towards the Fed’s goals. Headline consumer price inflation was flat over the month, and annual growth slowed to 3.3%. Goods prices fell (mostly due to a decline in new car prices and some other discretionary goods like furnishings, apparel and sporting and recreational goods) offsetting a rise in used car prices. Goods prices detracted from inflation, energy contributed to inflation (despite a fall in gasoline prices), food inflation remains positive and services is still the biggest contributor to price growth (see the chart below).

Source: Bloomberg, AMP

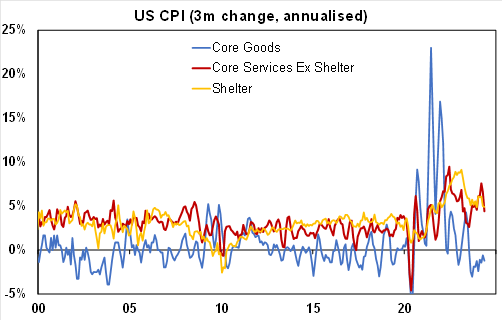

Core CPI (excluding food and energy) rose by 0.2% or 3.4% over the year, also below expectations. Core shelter costs are still elevated (see the chart below) but core services ex shelter (what the Fed now calls “supercore” inflation) fell by a small 0.02% (which is the first fall in over 3 years) driven by lower transportation services (airline fares, auto insurance and repair).

Source: Bloomberg, AMP

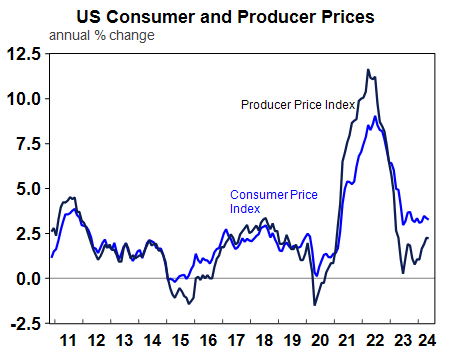

Another gauge of inflation, the producer price data, fell by 0.2% in May, with annual growth at 2.2%, lower than expected. Core PPI was flat or 2.3% year on year was also lower than expected. The Fed’s preferred PCE measure includes some components from both the CPI and the PPI (with PPI items including airfares, finance and insurance and medical) and the softer May readings should be good news for the PCE data out later in June.

Source: Macrobond, AMP

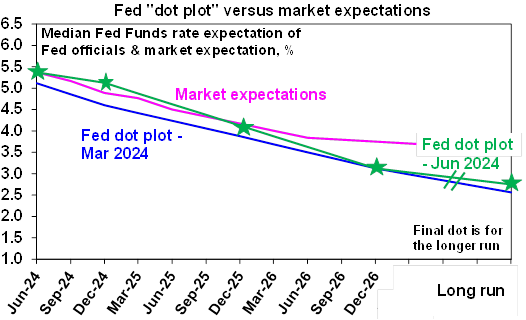

The US Federal Reserve kept the Fed Funds rate unchanged at 5.25-5.5% this weeks meeting, as expected by economists and markets. The CPI data printed during the meeting which would have given time for policymakers to discuss the data, but is unlikely to have caused big changes to the “dots”. Xx projected two cuts. The press conference after the meeting was more dovish than the changes to the dot plot. Powell is dovish. But the lower May CPI data probably does open the door for a potential September rate cut (before the US Presidential election), with Powell commenting that the May CPI data was “better than anyone expected”. Fed policymakers expect only one cut this year (from 3 cuts in the March projection) and now four rate cuts in 2024. The longer-run rate increased to 2.8% (higher than the 2.6% in March).

Source: Federal Reserve, AMP

Powell’s comments and tone in the press conference after the meeting leaned dovish and despite the changes to the dot plot for 2024, there is still the change of a September rate cut (before the Presidential election).

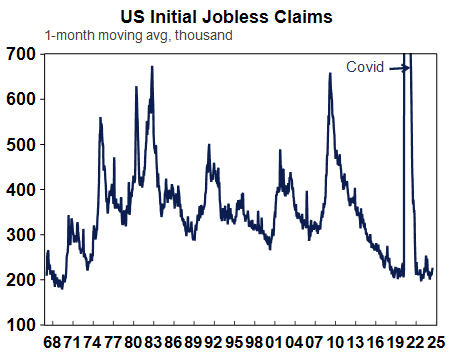

Jobless claims were higher over the week to 8 June, at 242K (expected to be 225K), the highest level in 9 months due to a rise in California’s claims which may be due to a new law in California that mandates a $20 minimum wage for fast food workers. Weekly jobless claims can be volatile week by week but there does seem to be an increasing trend in jobless claims.

After the US inflation data and pick up in jobless claims, the market is now pricing in two full Fed interest rate cuts by the end of the year, versus 1-1.5 cuts priced a week ago.

Source: Macrobond, AMP

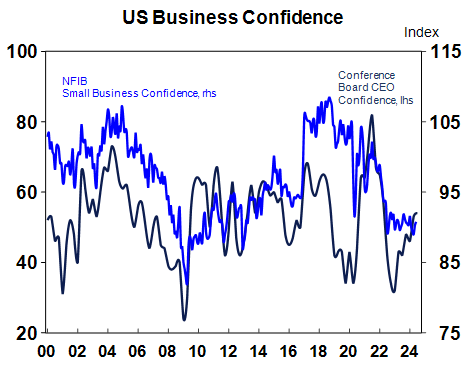

The US NFIB small business optimism index improved to 90.5 in May, from 89.7 last month and above expectations. Small business optimism has been basically flat over recent years while CEO confidence (usually associated with larger firms) has risen significantly since 2022 (see the chart below).

Source: Macrobond, AMP

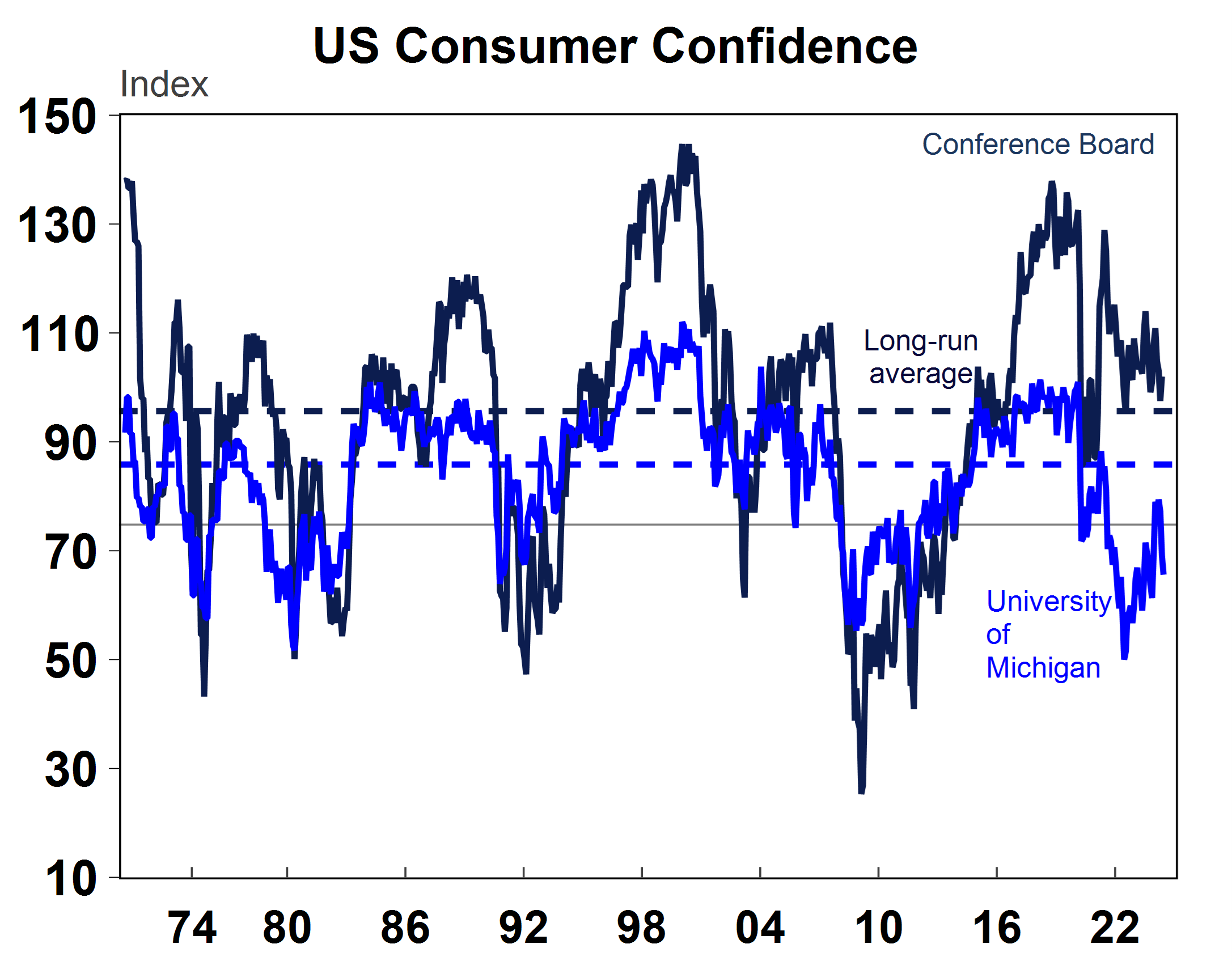

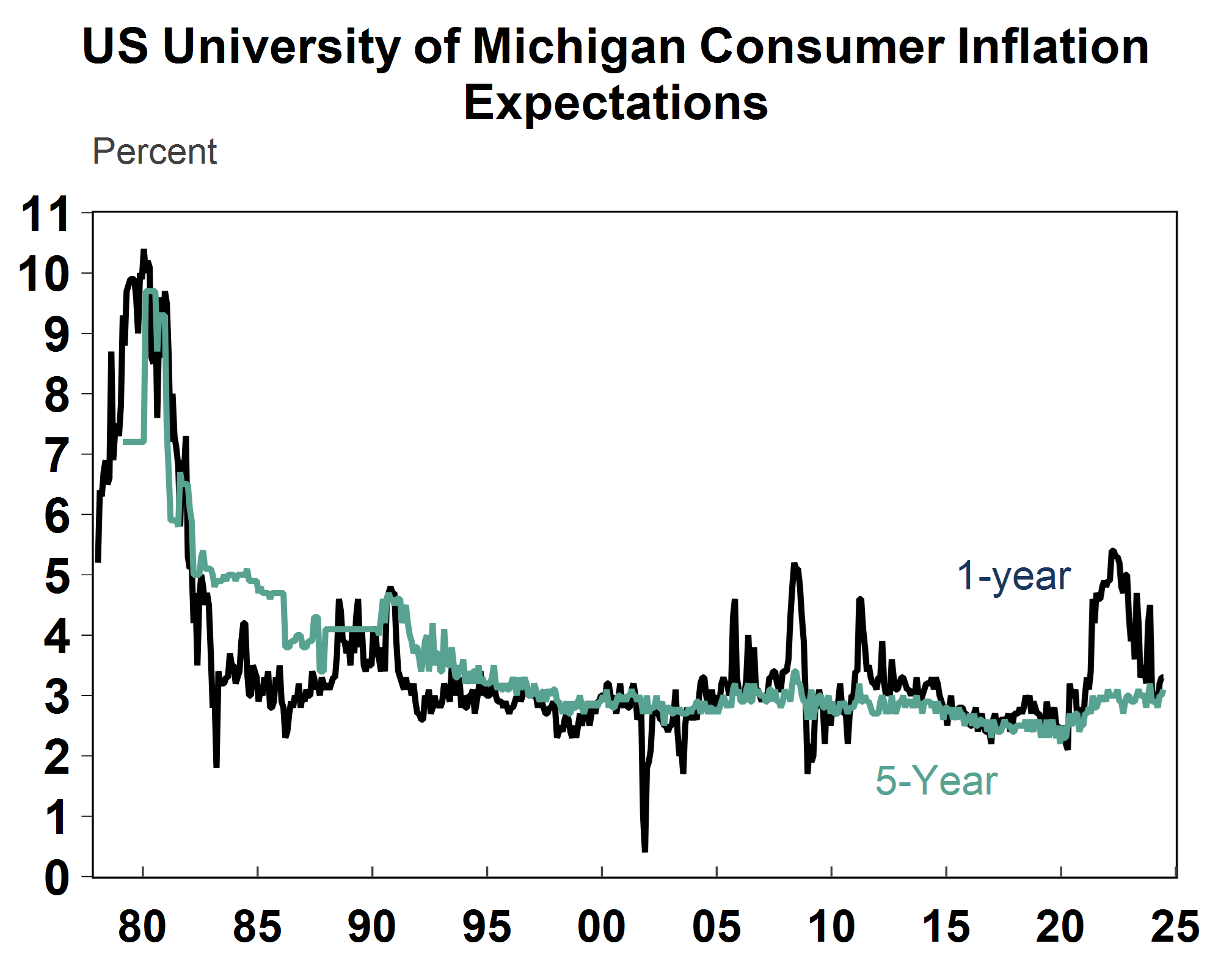

The University of Michigan consumer sentiment index fell to a 7-month low driven by consumer concern over inflation and cost-of-living challenges.

Source: Macrobond

1-year inflation expectations were unchanged at 3.3% and 5-year inflation expectations ticked up slightly to 3.1% (from 3.0%) which is higher relative to pre-pandemic averages.

Source: Macrobond, AMP

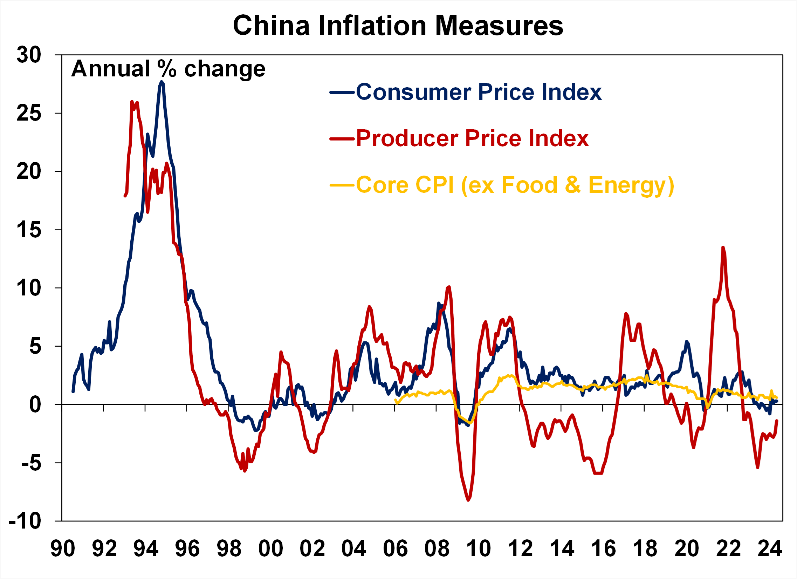

China’s producer prices are still in deflation, down by 1.4% over the year to May. Consumer prices are positive but now, up by 0.3% over the year to May (see the chart below).

Source: ABS, AMP

The Bank of Japan kept interest rates unchanged at 0.1% this week but will reduce the amount of government bond purchases, (as was expected). However, the central bank said that it would give more detail on its bond purchases at the next meeting while investors were waiting for details around the reduction in bond purchases which was taken as a dovish tilt by the Bank of Japan.

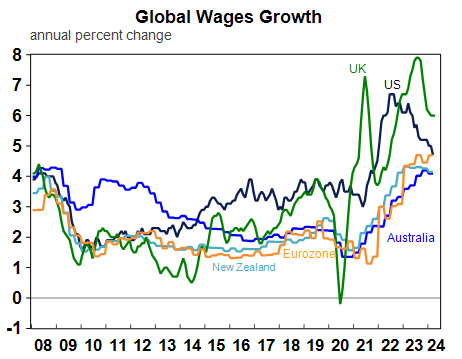

UK wages growth was unchanged at 6% over the three months to April, which is still too high and the unemployment rate rose slightly to 4.4% in April.

Source: Macrobond, AMP

Australian economic events and implications

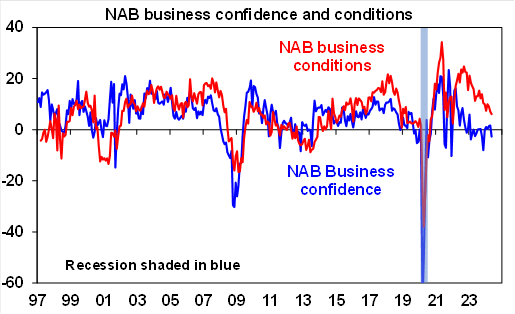

The May NAB business survey showed a decline in confidence, back into negative and business conditions fell and appear to be “catching down” to the fall in business confidence and the broad slowing in economic activity.

Source: NAB, Bloomberg, AMP

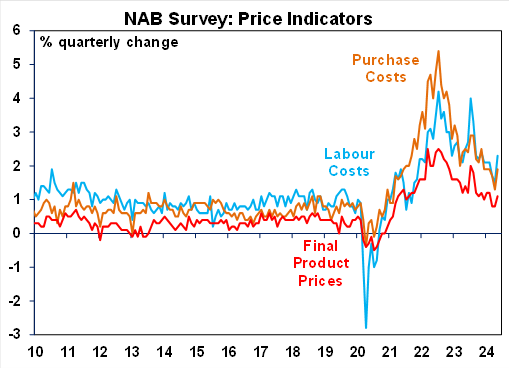

The business survey also gives a guide to price pressures which all rose in May (across labour costs, input and output prices) but can be noisy month-by-month and are still on an overall downtrend.

Source: NAB, Bloomberg, AMP

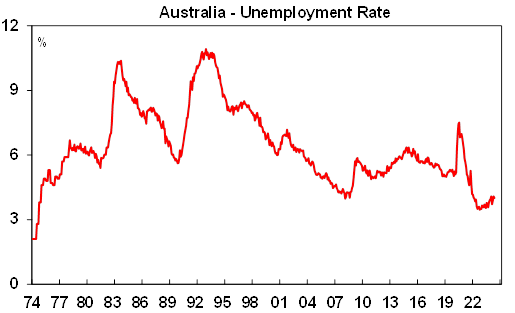

The May jobs data was mostly as excepted. Monthly jobs growth was solid at +39.7K (which also reflects the strong growth in the labour force from high population growth) and the unemployment rate fell back to 4.0%.

Source: ABS, AMP

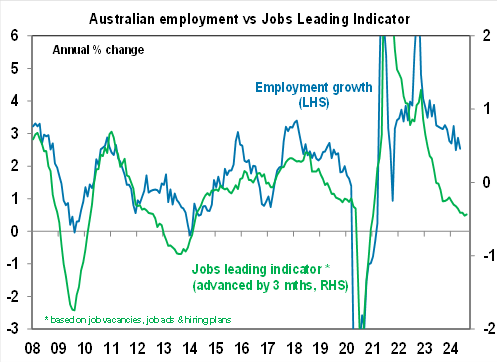

The labour market in Australia remains in good shape but leading indicators suggest some further slowing in jobs growth over the next 6 months and a gradual rise in the unemployment rate, as per the jobs leading indicator (see the next chart).

Source: ABS, AMP

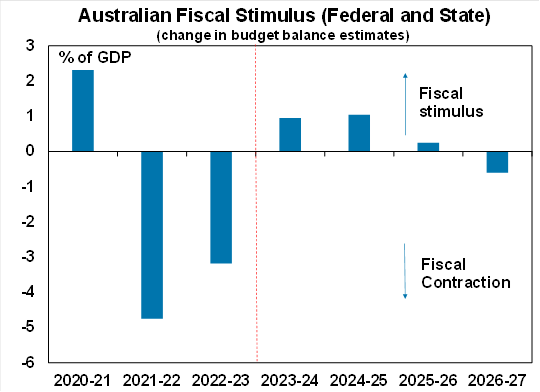

The Queensland 2024-25 Federal Budget showed an improvement in the 2023-24 year to an operating balance of $0.6bn thanks to high coal prices and royalties from coal before a deterioration in the out-years (a budget deficit of $2.6bn is expected in 2024-25), from increased spending and the broader longer-term pressures on the budget (like interest expense, aged care, NDIS) following the trends of the other states and the Federal government. Budget projections for net debt are also higher due to larger budget deficits in the out-years and a large capital spending program.

The cost-of-living relief was worth over $11bn including the $1000 energy rebate, 50 cent public transport costs for 6 months (from August), a 20% cut to vehicle registration costs for 12 months, half price Airtrain tickets to the airport, FairPlay vouchers for children and teens for sport. The impact on inflation we estimate will reduce headline national inflation by just under 0.2 percentage points for the year to June-25. There could be some impact on underlying inflation if lower headline prices help to reduce wage and inflation expectations and seep into other items that are indexed to inflation. Similar to the Federal budget, we don’t see the cost-of-living relief adding significant to consumer spending because relative to the increase in mortgage repayments, these measures are small.

There was also an increase in the value of properties eligible for the first home concession, with a number of the states now offering increased support to first-home buyers which risks inflating home prices further.

On our estimates the total value of fiscal stimulus across the States and Federal Government is worth around 1% of GDP in 2024-25 which is basically unchanged after the Queensland budget and is a tad higher compared to 2023-24.

Source: Commonwealth and State Treasuries, AMP

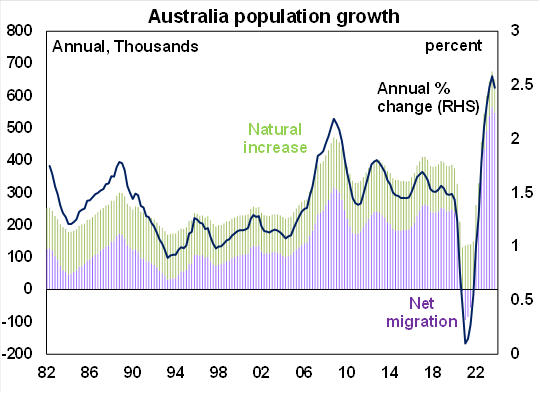

December quarter 2023 population data confirmed that Australia’s population grew by 2.5% over to December or 651.2K people, with net migration contributing 547.2K people and natural increase up by 103.9K (see the next chart).

Source: ABS, AMP

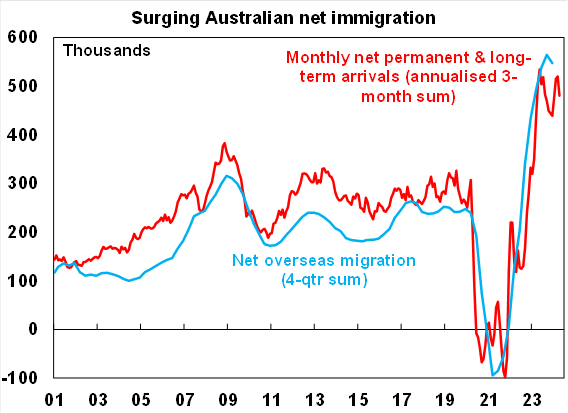

The population in December stood at just under 27 million people. The overseas monthly arrivals and departures data this week (see the chart below) indicated some slowing in the pace of net permanent and long-term migrants, which should result in lower population growth this year.

Source: ABS, AMP

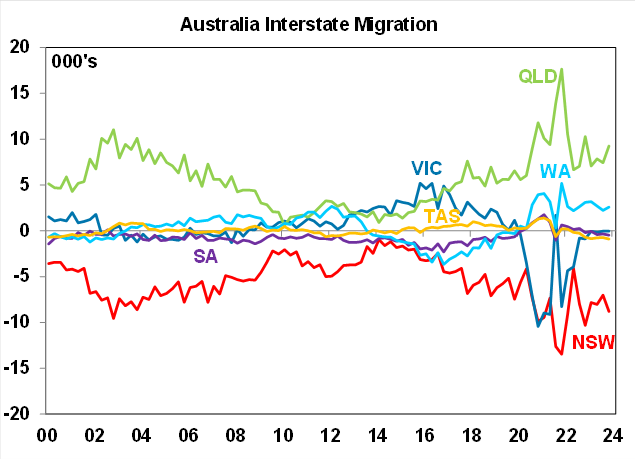

The interstate migration data showed a further outflow from NSW, with inflows into Qld and WA. Vic and SA was basically flat while Tas is also experiencing outflows (after inflows during the pandemic). The territories are also in outflow.

Source: ABS, AMP

What to watch over the next week?

In Australia, the Reserve Bank meets on Tuesday. The cash rate is expected to be held at 4.35% (with all economists looking for no change to interest rates) but more importantly will be the commentary in the post-meeting statement and press conference. The economic data since the last meeting in May has mostly been in line with the RBA’s expectations. The 2024-25 Federal Budget and state budgets released so far have been probably had more spending then the RBA would have liked to see but the Fair Work Commission decision around minimum wages was a tad lower than expected. So all up, there is no reason for the RBA to changes its assessment that the current stance of monetary policy is appropriate but that they cant rule anything “in or out” in terms of interest rates. The board will probably debate the merits of a rate hike at the meeting but this is not a sign that the RBA is willing or ready to raise interest rates again. We continue to expect the next move to be a rate cut around the end of the year. Other economic data next week includes ANZ job advertisements and the June PMI which is likely to show some slowing in services conditions.

In the US, next week May retail sales are expected to show a rise in spending, industrial production is likely to be stronger in May and a suite of housing indicators is also due like the NAHB housing index, housing starts and home sales. The June PMI’s next week are expected to show a deceleration in services conditions as US growth is slowing and unchanged manufacturing conditions.

Chinese data includes the broad suite of monthly indicators which should show positive outcomes across industrial production, fixed asset investment, an improvement in retail spending but continued poor growth in property investment.

In New Zealand, there will be March quarter GDP (Thursday) which should show that the NZ economy moved out of a technical recession, with growth rising by 0.1% over the quarter which is a paltry 0.2% over the year.

In the UK, May CPI is due along with retail sales figures and the monthly PMI’s. The Bank of England meet and are expected to keep interest rates unchanged at 5.25%, although what will be more interesting is the voting on interest rates by participants with some members looking for lower interest rates.

Eurozone PMI’s should show an improvement in services conditions, as growth has increased but manufacturing conditions are still likely to be negative.

Japan’s consumer price data next week is expected to show a further lift in headline CPI, up by 2.9% over the year to May (from 2.5% last month) and the PMI’s are likely to also show positive business conditions.

The Swiss National Bank meet and expected to keep the policy rate unchanged at 1.5% after a rate cut in March.

Outlook for investment markets

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for reasonable investment returns this year. However, with a high risk of recession, delays to rate cuts and significant geopolitical risks, the remainder of the year is likely to be rougher and more constrained than the first five months were.

We expect the ASX 200 to return 9% this year and end the year around 7900. A recession is probably the main threat.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows, and central banks cut rates.

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields & working from home.

Australian home prices are likely to see more constrained gains this year as the supply shortfall remains, but still high interest rates constrain demand and unemployment rises. The delay in rate cuts and talk of rate hikes risks renewed falls in property prices as its likely to cause buyers to hold back and distressed listings to rise.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.70 over the next 12 months, due to a fall in the overvalued $US, but in the near term the risks for the $A are on the downside.

Weekly market update 28-06-2024

28 June 2024 | Blog Dr Shane Oliver observes strong financial year returns - but can it continue?; Trump odds up after debate - watch trade war risks; risk of another RBA hike up but not fait accompli; Australian jobs market cooling; another big Australian budget surplus and more. Read more

Oliver's insights - investing 40 years

25 June 2024 | Blog Dr Shane Oliver shaes his nine most important lessons from investing over the past 40 years. Read more

Weekly market update 21-06-2024

21 June 2024 | Blog This week, narrowing US share gains; drip feed of falling global inflation & rates is good sign for RBA; Federal & state governments making the RBA's job harder; the pros & cons of nuclear; and more. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.