Investment markets and key developments

Markets were up this week, follow some weakness in the prior one. US economic data reinforced signals that the Fed will be cutting interest rates next week (although the debate about whether it should be a 25 basis point or 50 basis point cut heated up) but again no signs that the US economy is deteriorating significantly. The US S&P500 rose by 4% over the week, and is just shy of its record high. The ASX200 was up by 1.1% and is nearly touching its all time high. Eurozone and Japanese shares also rose while Chinese shares fell. US bond yields fell, oil prices rose, gold prices continued to increase and metals prices were also generally higher. The $A rose to 0.672 USD.

We remain of the view that shares are at high risk of further falls in the short-term because valuations are high, seasonality is a problem in September, there could be more downside for tech names like Nvidia, economic data could start moving into “concerning” territory as activity has slowed which will increase fears of recession and geopolitical risks like the US election and the issues in the Middle East could see investor uneasiness. But, over a medium-term view we are still optimistic on the outlook for shares because inflation is slowing, central banks are cutting rates, earnings growth looks reasonable and economic growth is holding up for now.

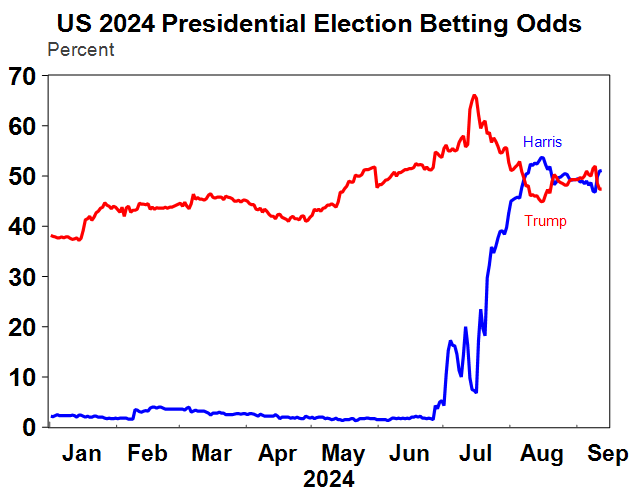

This week saw the first (and only?) Presidential Debate between Trump and Harris. A US televised debate has been running for 64 years and while it most often does not change election outcomes, as we saw from the Biden performance, it can make a difference, especially at the current juncture when voters are still getting to know Harris as a candidate. Prior to the debate, Trump had slightly better odds of winning the election (at 51%) but Harris was thought to have “won” the debate with Trumps odds falling to 47% and Harris rising to 51% (from 47%) - see the chart below. Maybe Taylor Swift’s endorsement of Harris after the debate also improved her odds!

The debate is worth a watch. After little information about election policies from the Democrats, Harris did speak about some of her priorities, referencing extending tax cuts for low-income households, increasing small business tax incentive and restoring the Child Tax Credit, which she is calling the “opportunity economy”. Harris also wants to increase the corporate tax rate (to 28% from 21%) and increase some taxes on higher income households. There was nothing new on the Trump policy front. The tariffs Trump wants to implement were mentioned as well as a cut to the corporate tax rate and an extension of the personal tax cuts.

Source: Macrobond, RealClearPolitics, AMP

It was disappointing to see both sides focus less on actual concrete policies and spending more time defending their positions on certain issues or historical mishaps and attacking each other. Harris improved over the debate, with Trump getting visibly angry about comments over his rallies and his relationship with “autocrats” and “strongmen”. Harris had her own stumbles around why the Democrats kept the Trump tariffs in place at a time of high inflation and flip-flopping on issues around the border. The election outcome remains a coin-toss!

Major global economic events and implications

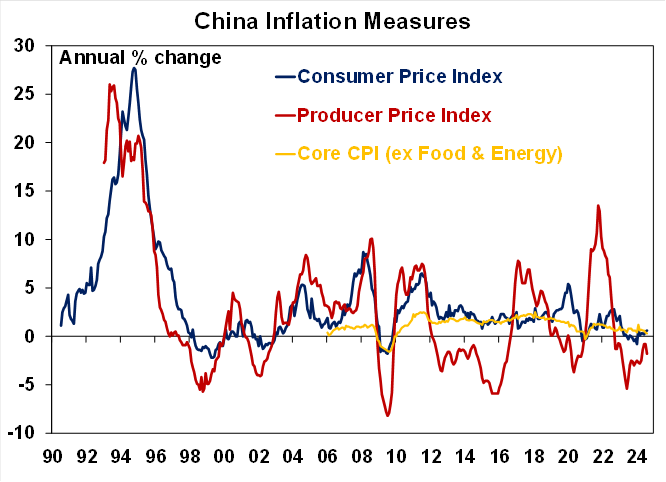

Chinese inflation data was soft, with headline consumer price growth of 0.6% over the year to August (despite high food prices driven by extreme weather) and producer prices were down by 1.8% over the year (see the chart below). Chinese low inflation data is a sign of poor domestic demand.

Source: Bloomberg, AMP

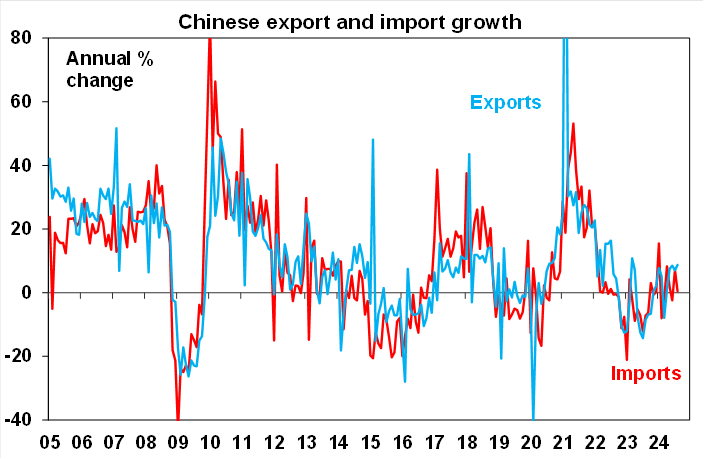

Chinese trade data showed export growth of 8.7% over the year to August and import trade data rose by 0.5% over the year (see the chart below). Strong export growth has been a key pillar of strength for the Chinese economy, offsetting weak property investment and low retail sales growth.

Source: Bloomberg, AMP

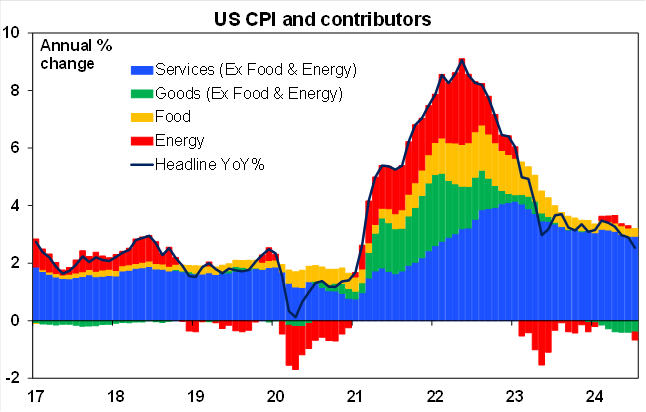

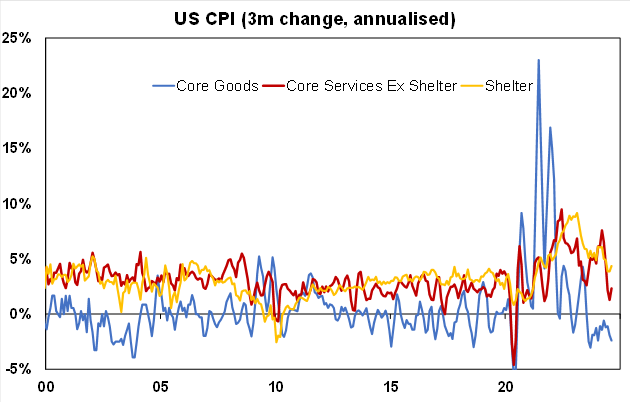

The US August consumer price index rose by 0.2% over the month, or 2.5% over the year, in line with expectations. Core inflation (excluding food and energy) rose by 0.3% (a touch above expectations) and annual core inflation was 3.2% higher over the year – in line with expectations. Energy prices fell (-0.8% over the month) in August, core goods prices declined (-0.2%) but core services prices rose by 0.4%, driven by airfares, hotels and rents.

Source: Bloomberg, AMP

In our view, there is still further downside to US CPI from here, especially in the services components. Services inflation will slow further from here given that forward-looking rents have moderated and lower wages growth (as a result of the weakening labour market) will help to weaken services inflation.

Source: Bloomberg, AMP

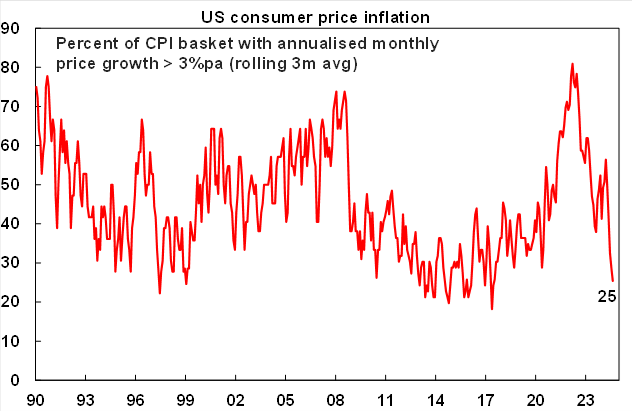

Widespread high inflation is not a problem in the US anymore. Our breadth measure of inflation, that tracks the percentage of the CPI basket that has monthly annualised inflation >3% per annum is at a cycle low of 25% (see the chart below) which has fall from its high of 81%.

Source: Bloomberg, AMP

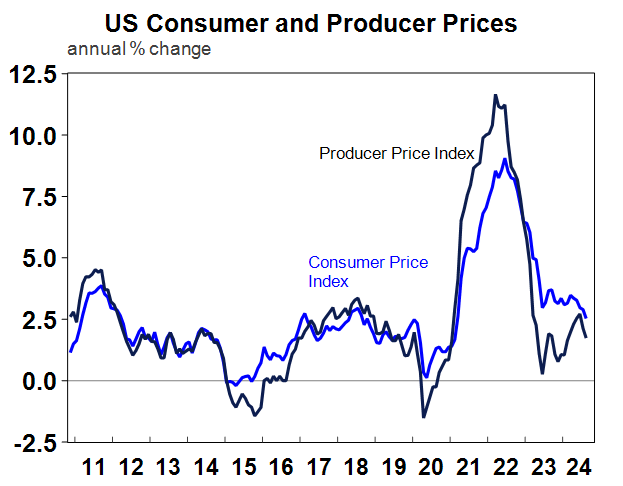

The August US producer price index rose by 0.2% over the month (expectations were for 0.1%), with annual growth at 1.7%. The producer and consumer prices are a good guide to the “personal consumption expenditure” deflator – the Fed’s preferred inflation gauge which comes out later this month and is tracking to be up by ~2.3% over the year to August.

Source: Macrobond, AMP

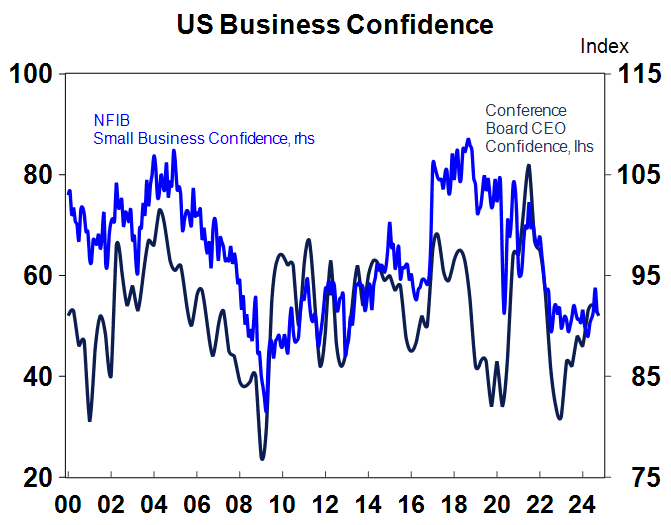

The US NFIB survey fell slightly in August and remains low, after showing signs of improvement in recent months. In contrast, CEO business confidence has been trending up (see the chart below).

Source: Macrobond, AMP

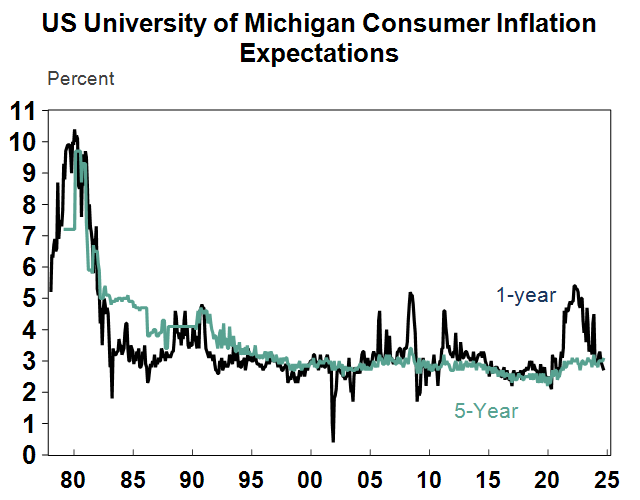

US September University of Michigan consumer sentiment improved although is still well below its long-run average.

Source: Macrobond, AMP

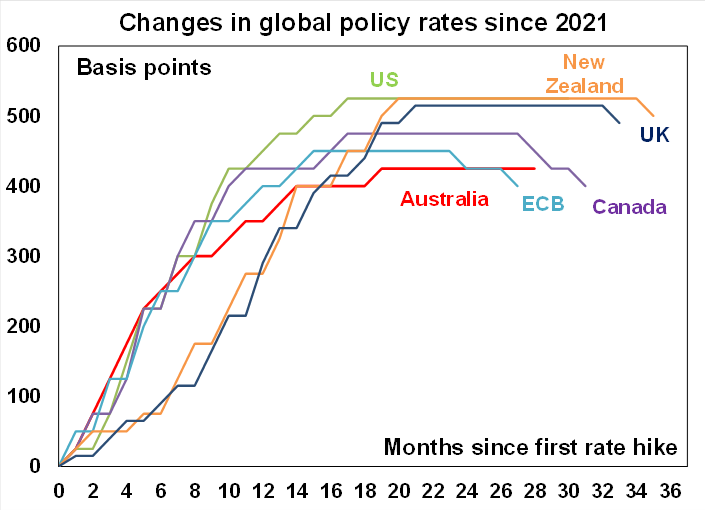

The European Central Bank cut the deposit rate for the second time, taking interest rates to 3.5%. The ECB didn’t give much forward guidance, as core inflation still remains elevated (at 2.8% year on year in August) but the growth outlook is soft. Another ECB rate cut is likely before the end of the year.

Source: Bloomberg, Macrobond, AMP

Australian economic events and implications

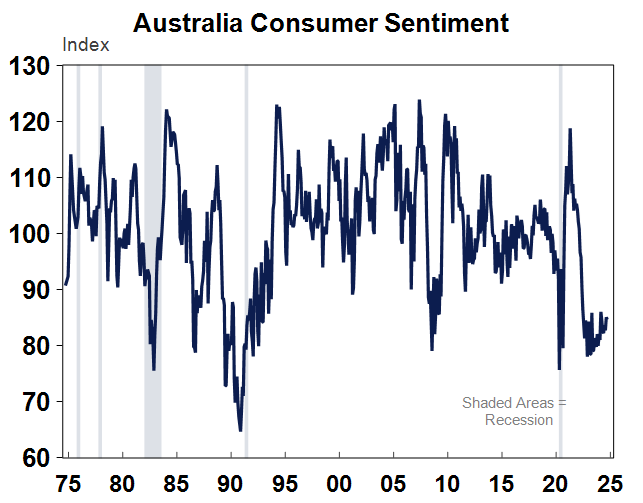

Australian consumer confidence fell again in September to an index reading of 84.6 (which means that consumers are still feeling negative as an index level of 100 divides the number of optimists vs pessimists). Confidence is stuck at levels usually associated with a recession (see the chart below).

Source: Macrobond, AMP

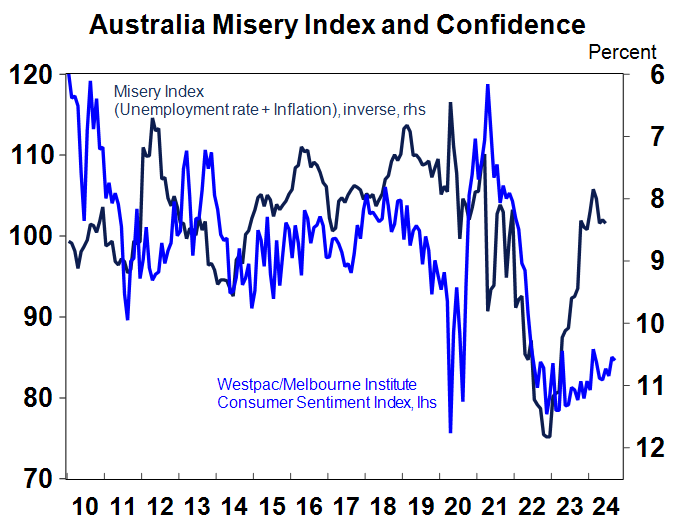

Consumers are feeling the most negative around their family finances compared to a year ago (but are more optimistic about the future). Economic conditions over the next 12 months are also low, but longer-term expectations for conditions are better. It’s interesting that consumer confidence has remained so low despite better inflation and the labour market holding up. The so called “Misery Index” is the sum of the unemployment rate and inflation and usually moves fairly in line with consumer confidence, but despite an improvement in the misery index (see the chart below), confidence is still very low.

Source: Macrobond, AMP

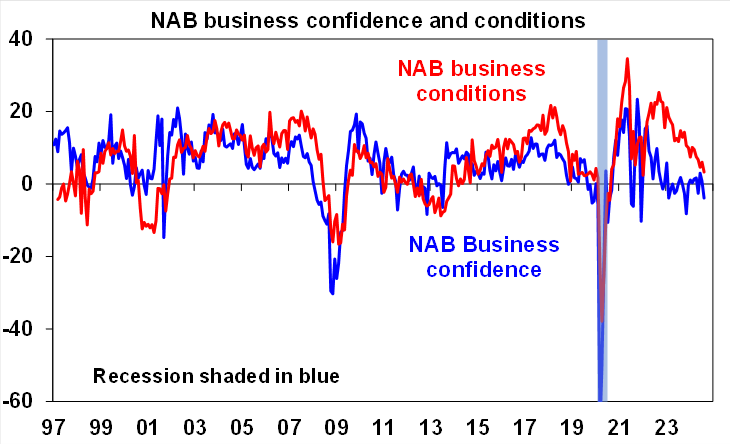

The August NAB business survey was disappointing. Conditions fell back to below average and confidence fell into negative territory. Employment conditions declined, along with trading conditions and profitability and forward orders remained negative. However, capacity utilisation remains high.

Source: Bloomberg, NAB, AMP

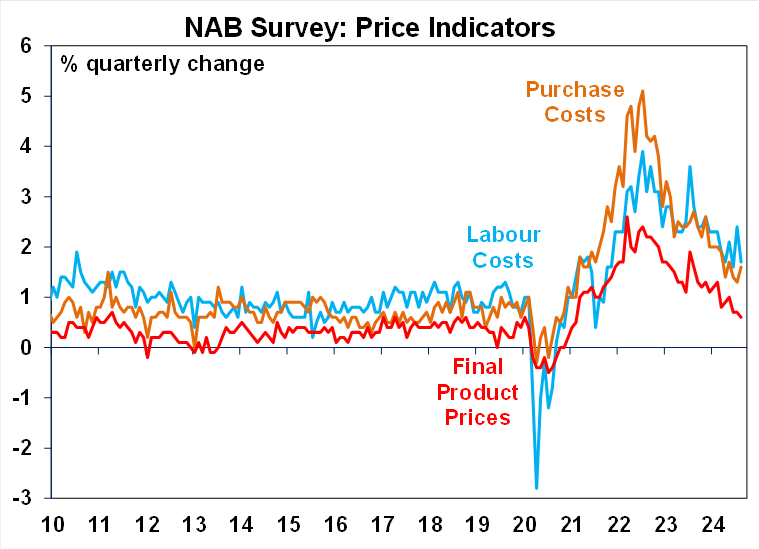

The price indices showed that labour costs growth eased, purchase cost growth went up and final product price growth slowed. The broad trend in price indicators is down (see the chart below). The softening in the business survey reflects the weak pace of economic growth in Australia.

Source: Bloomberg, NAB, AMP

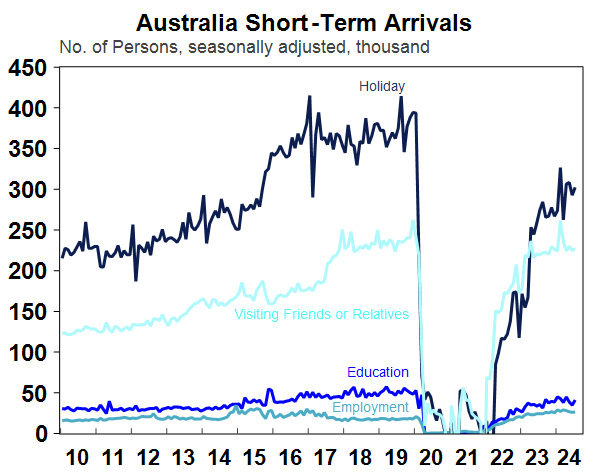

The monthly arrivals and departures data in Australia contain information on short and long-term movement in the population.

Short-term arrivals are still not back to their pre-Covid levels, with lower levels of holidaymakers and short-term education arrivals.

Source: Macrobond, AMP

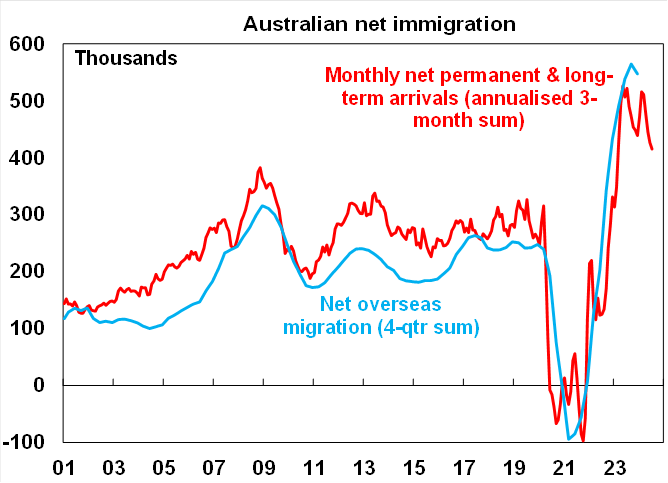

The long-term and permanent arrivals data showed a further slowing in net arrivals, tracking at an annualised rate of ~400K, lower than last year’s record high but still very high for Australia.

Source: ABS, Macrobond, AMP

RBA Assistant Governor Sarah Hunter spoke this week on “Understanding the Journey to Full Employment”. The RBA uses a broad range of indicator to assess full employment including the traditional labour market indicators like the unemployment rate, underutilisation rate and employment growth as well as leading indicators like job vacancies, hires, and employment intentions. The RBA is still of the view that conditions in the labour market are tight, relative to full employment and that demand is exceeding supply which is keeping upward pressure on wages and inflation. The RBA expect a lift in the unemployment rate to 4.4% by mid-2025 but we see a slightly higher unemployment rate of 4.5% in late 2024 with upside risks in early 2025. The RBA expect that the further unwind in the labour market will partly come from a decline in hours worked and employment, while we think that that employment growth will slow more.

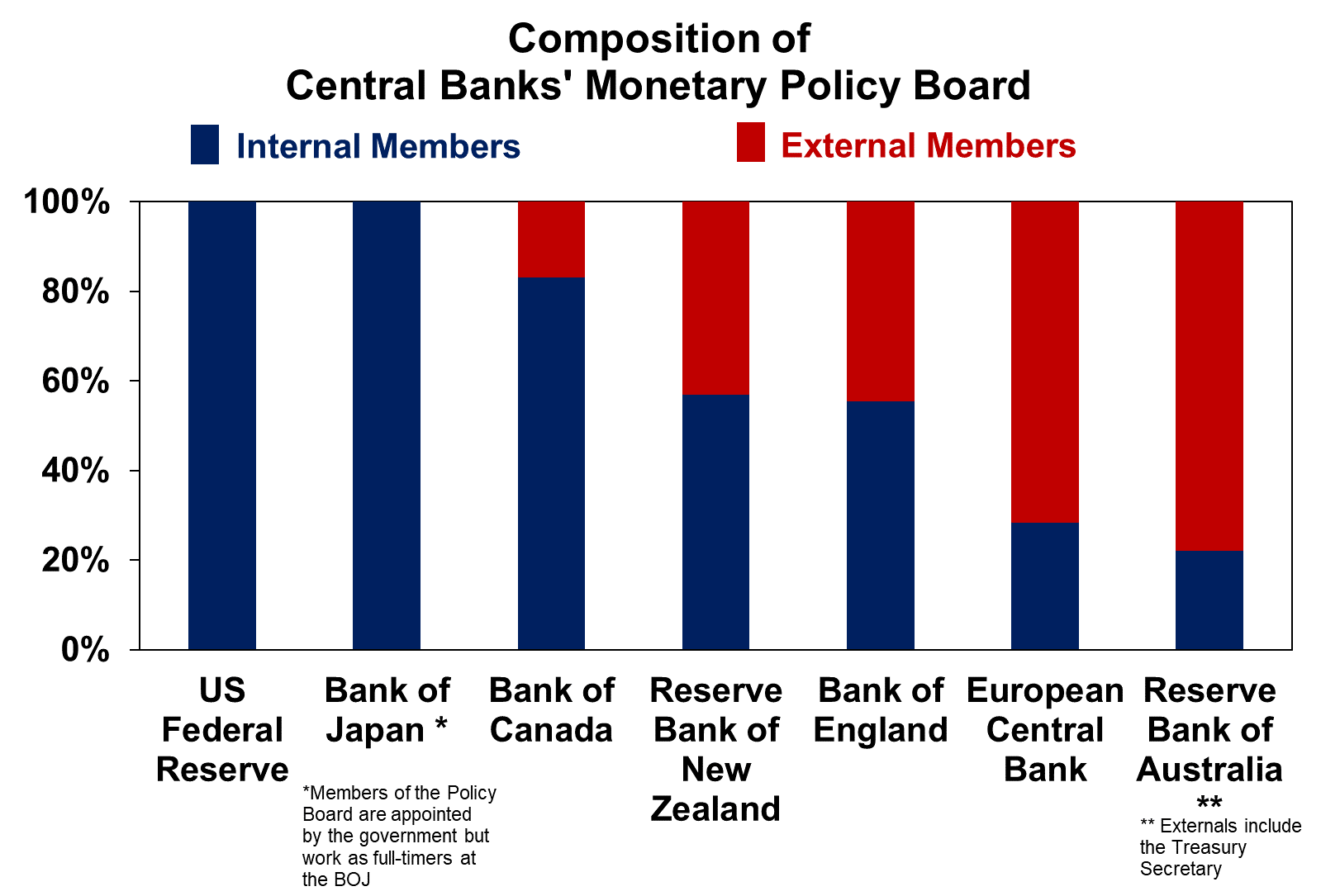

More government vs the RBA tensions this week. As part of the RBA review, there was a plan to have two different Boards, one for setting interest rates and one for governance which the government has been trying to pass in a bill. This week, shadow Treasurer Angus Taylor said he will not be supporting the bill to move the current members of the interest rate board to the governance board because of risk that Labor would then “stack” the interest rate setting board with Labor-aligned members before an election next year. This leaves the government either going with the current settings, or trying to negotiate with the Greens and crossbench to get the reform through. Dismantling the current interest rate board right before the RBA may potentially starts cutting interest rates doesn’t seem right for policy settings. As our Chief Economist Shane Oliver wrote here about the RBA review, there is no evidence that having a dual board structure would improve how the central bank sets policy. The review indicated that having a specialist monetary policy board would allow more debate within the board meetings, as in the past decade the Board has always voted with the RBA recommendation. But, the RBA has always arguably always has more independence to its Board compared to other global central banks (see the chart below) because they have a higher share of externals on the Board (the Fed has 100% internal Fed Board members!) And, having external part-time board members who are very opinionated about monetary policy, voting in the meetings (with the votes being published) and speaking at events could end up seeing the externals with more power than the RBA, which could diminish the value of the RBA institution, who has been tasked with the job to set interest rates. This whole drama around seems like noise and has little implications for actual interest rate settings.

Source: Central Bank Websites, AMP

What to watch over the next week?

In Australia, RBA Assistant Governor Brad RBA Jones speaks at the Intersekt Festival in Melbourne. The August labour force data is expected to show 30K employment growth which would be enough to keep the unemployment rate at 4.2% but the risk is of a higher unemployment rate.

Next week, New Zealand June quarter GDP is expected to show a decline of 0.3%, which would take annual growth to -0.5%.

The monthly August Chinese data is released on Saturday. Industrial production and fixed asset investment are likely to remain solid but retail sales and property investment are expected to be weak again.

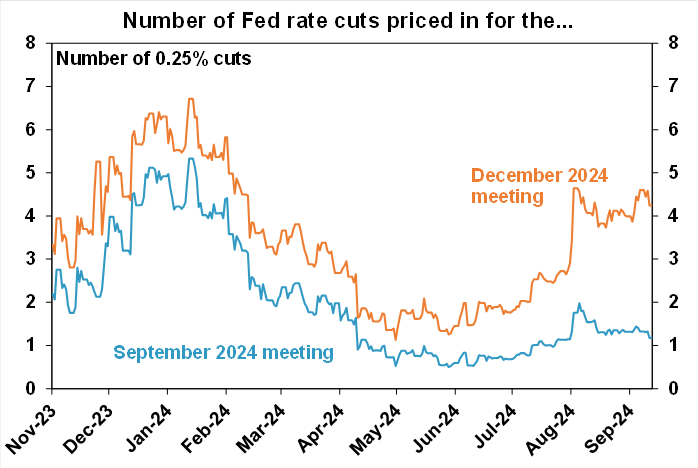

The US Federal Reserve meet and are expected to cut the Fed Funds rate by 0.25%, taking interest rates to 5-5.25%. Market pricing is still somewhere between a 25 and a 50 basis point cut which increased late into the week after newspaper articles from “Fed Whisperers” that the Fed was considering a larger hike – see the chart below. A 50 basis point cut may send a signal that things are bad and that the Fed is significantly behind the curve, which would get the market worried so we think the Fed will opt for 25 basis points.

Source: Bloomberg, AMP

Next week’s US economic data includes the usual monthly activity indicators like retail sales (expected to fall in August but up by 0.3% excluding automobiles and gas), industrial production should be up slightly and housing starts and building permits are expected to rise over August.

Canadian consumer price data next week is expected to show annual growth of 2.1% in August, from 2.5% last month with the trimmed mean at 2.6%.

The Bank of England meet next week and are expected to keep the official bank rate on hold at 5% after a cut in August. Services inflation in the UK still remains high.

The Bank of Japan also meet next week and expectations are for the target rate to be kept at 0.25%. Given the huge volatility last month associated with the Bank of Japan raising rates, we think the BoJ will opt to take a cautious approach and lift rates later this year. The August CPI data is also out and economists expect headline inflation of 3% over the year to August and 2% on the core measure.

Outlook for investment markets

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025-26 should make for reasonable investment returns over 2024-25. However, with a high risk of recession, poor valuations and significant geopolitical risks particularly around the US election, the next 12 months are likely to be more constrained and rougher compared to 2023-24 and there is a high risk of a further correction in the next few months. A recession is the main threat for shares and there is a risk that we may have already seen the high for the year in the Australian share market after it reached our year-end target of 8100 in early August.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows, and central banks cut rates.

Unlisted commercial property returns are likely to remain negative due to the lagged impact of high bond yields and working from home reducing office space demand.

Australian home prices are likely to see more constrained gains over the next 12 months as the supply shortfall remains, but still high interest rates constrain demand and unemployment rises. The delay in rate cuts and talk of rate hikes risks renewed falls in property prices as its likely to cause buyers to hold back and distressed listings to rise.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.70 over the next 12 months, due to a fall in the overvalued $US and a narrowing in the interest rate differential between the Fed and the RBA. A recession is the main downside risk.

Oliver's insights - Trump challenges and constraints

19 November 2024 | Blog Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory. Read more

Econosights - strong employment against weak GDP growth

18 November 2024 | Blog The persistent strength in the Australian labour market has occurred against a backdrop of poor GDP growth, which is unusual. We go through this issue in this edition of Econosights. Read more

Weekly market update 15-11-2024

15 November 2024 | Blog Global share markets were messy over the last week, not helped by the ongoing rise in bond yields and a wind back in Fed rate cut expectations after some elevated US inflation data and slightly hawkish comments from Fed chair Powell. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.