Investment markets and key developments

Sharemarkets have started the year on a strong footing after a disappointing December, because of the easing in China’s Covid restrictions which will boost global growth, further signs of a deceleration in inflation, expectations of a slowing in central bank rate hikes and a good start to the December quarter US earnings season. US shares were 2.7% higher over the week (with gains across all sectors except health care and consumer staples), Eurozone shares lifted by 3.3%, Japanese shares rose by 1.2%, Chinese stocks were up by 2.4% and Australian shares rallied by 3.1% (with gains across all sectors except utilities). US bond yields fell after the US December CPI data (because market pricing for Fed interest rate hikes declined slightly) but rose by the end of the week with the 10 year at 3.5% (although still well below its cycle high of 4.2% in October 2022). The US dollar fell and has fallen by 10% from its September high.

Commodity prices are well down from their 2022 highs. European gas prices have plunged and are back to early 2022 levels. The collapse in gas prices over recent months means a reduced risk of a near-term Eurozone recession. Oil prices are around $80USD/barrel, agricultural commodity prices are mostly down on 2022 levels while iron ore has been rallying again, up to $114USD/tonne on China’s reopening which will lead to a lift in industrial production.

Coronavirus update

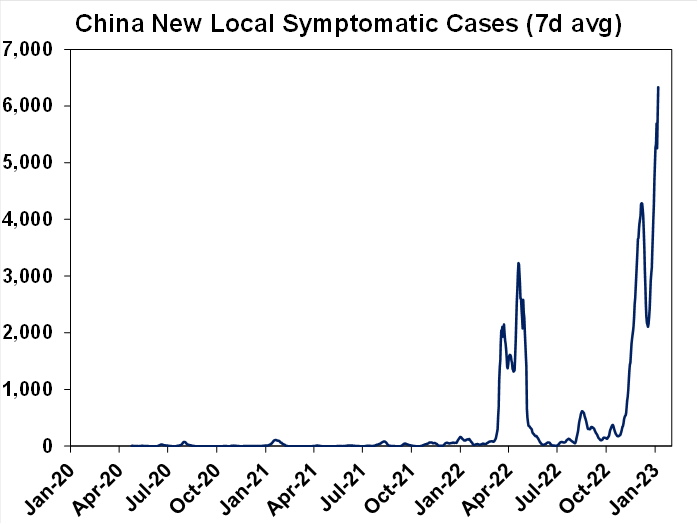

China hasn’t posted an update of coronavirus cases all week, leading to concern that cases are skyrocketing and that recent data is unreliable as mass testing was dropped and narrow definitions of active cases are being used by authorities. On the last measure, just under a week ago, local symptomatic cases were averaging at ~6K/day (see the chart below). We wrote a note on China’s reopening here and its implications for the Chinese economy and the rest of the world. High case numbers pose a risk to the healthcare system in China (especially outside of Tier-1 and Tier-2 cities) and will disrupt March quarter economic activity but this will be temporary as Chinese vaccination rates are high, Covid variants are milder now compared to earlier strains and antivirals are available. A strong consumer-led recovery in economic growth is expected in the second half of the year which will boost global growth as Chinese imported demand rises and as inbound and outbound tourism resumes.

Source: Bloomberg, Chinese Centre for Disease Control and Prevention, AMP

Economic activity trackers

Our Economic Activity Trackers spiked over the holiday period, from rising hotel and restaurant bookings as the Christmas period in 2022 was the first time since the pandemic that restrictions around travel were virtually non-existent. Economic activity trackers are likely to slow from here (see the chart below).

Based on weekly data for eg job ads, restaurant bookings, confidence, mobility, credit & debit card transactions, retail foot traffic, hotel bookings.

Source: AMP

Our Inflation Tracker continues to track down, pointing to further downside in inflation readings across the major economies.

Source: Bloomberg, AMP

Major global economic events and implications

The US December consumer price index (CPI) was the key data release this week, coming in right on expectations. Headline consumer prices fell by -0.1% (or up by 6.5% over the year) and core CPI was 0.3% higher over the month (or 5.7% over the year). Annual inflation has fallen from its peak of 9.1% in June 2022 and will continue to decline from here. Goods price inflation is slowing (core goods price fell by 0.3% over the month) driven by a fall in commodity prices, lower consumer demand and supply improvements, core services excluding shelter is starting to soften as wages growth looks to have peaked but shelter inflation is still elevated (rising by 0.8% over the month) although rent prices for newly signed agreements have rolled over significantly (which should lead to lower shelter inflation.

Source: Bloomberg, AMP

Although inflation is headed in the right direction, a few more interest rate hikes from the Fed are still likely to ensure that there is little to no chance of another inflation breakout this year. The better inflation dynamics are consistent with a slower pace of rate hikes, with a 0.25% interest rate hike likely from the US Fed at its next meeting in early February (a reduction in the pace of tightening compared to some of the super-sized rate hikes in 2022). The Fed is getting close to the end of its rate hiking cycle, with another 2-3 hikes likely from here before a pause.

As well this week in the US, December quarter earnings started positively with a few banks reporting including JP Morgan, Bank of America, Citigroup and Wells Fargo. December NFIB Small Business confidence declined close to its post-pandemic low (see the chart below) with businesses reporting a decline in hiring plans and job openings (more signs of a looming labour market slowdown), initial continuing jobless claims both came in below forecasts and MBA mortgage applications were down into the last week of December. Comments from numerous Federal Reserve Board members this week indicated more support for a 0.25% rate hike in February (rather than 0.50% or more) although Fed officials still see the need to get interest rates to 5% or above and then be on hold for a “long time” with no sense that Fed members see the need for rate cuts later this year (we think this view will be challenged when the economy and inflation slow more than expected later in 2023).

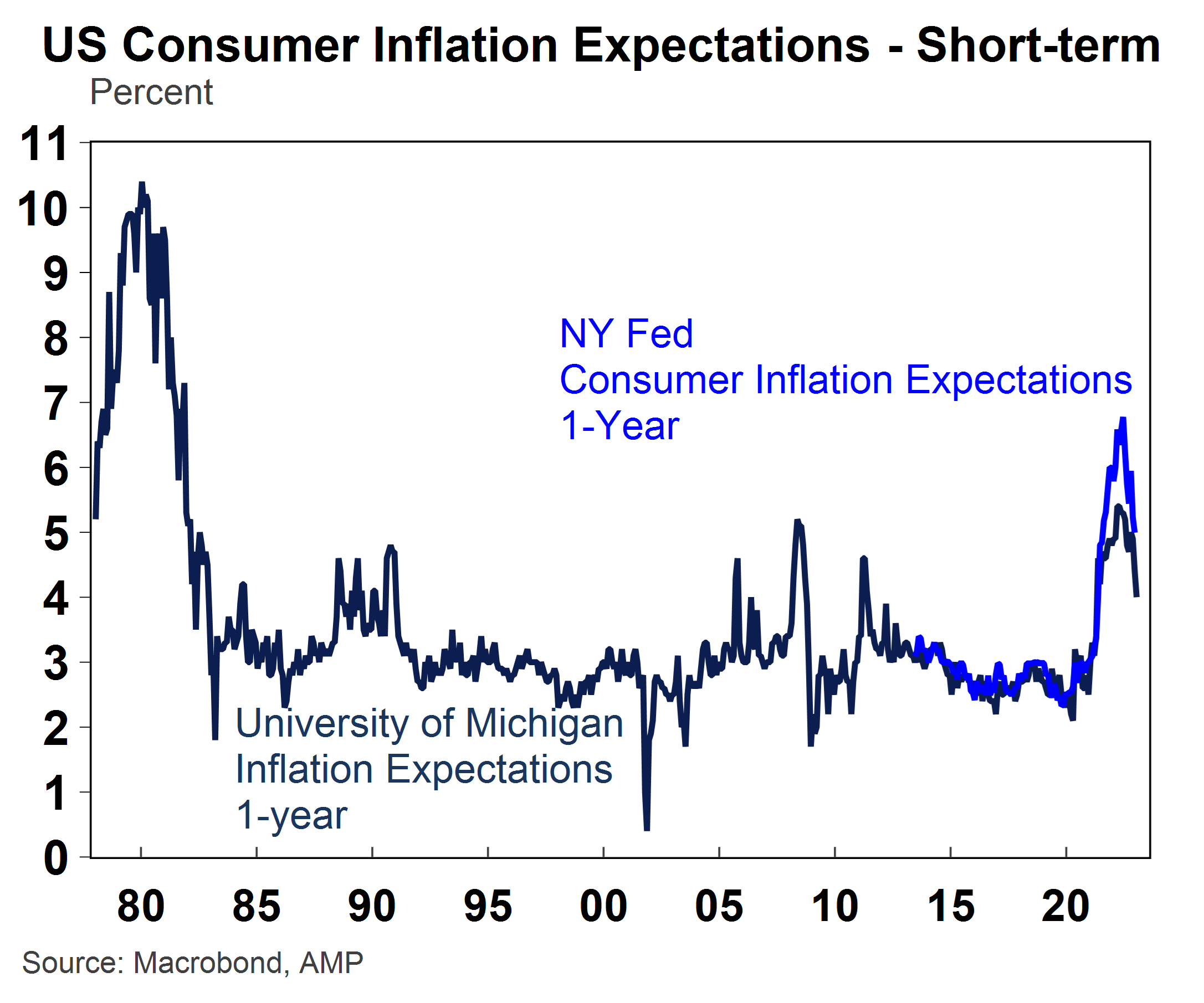

US December import prices surprised to the upside, rising by 0.4% (against expectations for a 0.9% fall) with annual growth rising to 3.5%. But export prices fell more than expected, down by 2.6% over the month (expectations were for a 0.7% decline) with annual growth declining to 5%. The University of Michigan consumer sentiment index rebounded to 64.6 in January, its strongest level since a year ago. University of Michigan 1-year inflation expectations fell down to 4% (from 4.4% last month and at its lowest level since April 2021) and the 5-year remain well anchored at 3%. Inflation expectations are not becoming unanchored – see the chart below.

Eurozone industrial production was strongest than expected in November, up by 1% (expectations were for a 0.5% lift) and the trade deficit narrowed in November.

Japan’s Tokyo consumer price index was in line with consensus, up by 4% over the year to December.

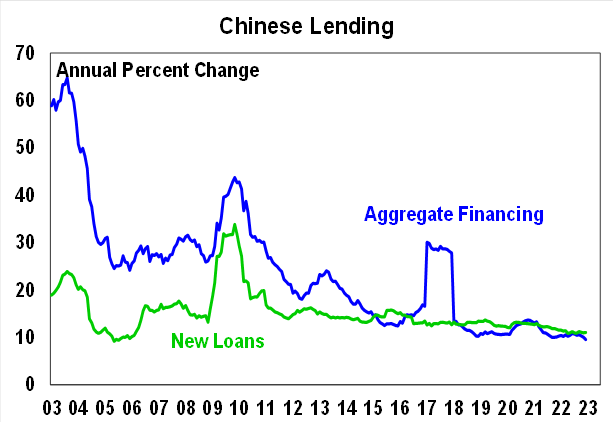

Chinese data this week showed total social financing (or credit growth) was up by 9.6%, down from a 10% rate last month which was lower than expected as rising Covid-19 cases are disrupting economic growth, producer prices were down by 0.7% over the year to December, and consumer prices were up by 1.8% over the year to December. The December trade surplus expanded to just over $78bn, from $69.8bn in the prior month.

Source: Bloomberg, AMP

Australian economic events and implications

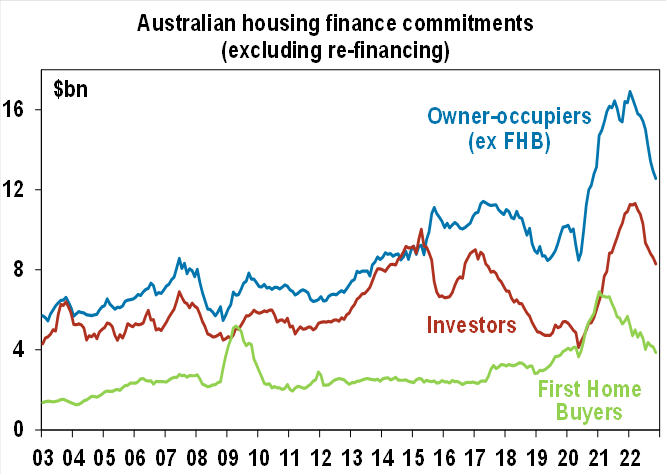

Building approvals fell by 9% in November, driven by a 19.9% decline in apartments. In the short-term there is probably more downside for approvals as demand was brought forward into 2021/22 to utilise the HomeBuilder subsidy and as impacts of RBA interest rate hikes in 2022 are yet to make their full impact on consumers and the housing market. Housing finance declined by 3.7% in November (see the chart below) or a 24.3% decline over the year, more than the 2% forecast by consensus, with lending to owner-occupiers down by 3.8%, investors -3.6% and first-home buyers -6.7% which is not surprising given the aggressive increases to interest rates in 2022. Further declines in lending are likely as rate hikes haven’t had their full impact on the economy yet.

Source: ABS, AMP

The November trade balance was higher than expected, with the trade surplus rising to $13.2bn, from $12.7bn last month as imports fell (which is a sign of slowing consumer demand) and a slight decline in exports as commodity prices fell. November retail sales surged by 1.4%, higher than expected, driven by higher household goods, clothing and soft goods, department stores and other retailing which reflects the sales (mostly Black Friday and Cyber Monday) during the month which brought forward consumer demand and seasonal adjustment issues (as the sales haven’t been around for long in Australia) which means that monthly growth looks exaggerated. December retail spending is expected to be low or even negative. Job vacancies fell by 4.9% over the three months to November. The ratio of available jobs to the number of unemployed people has dipped to 0.9 (see the chart below) which shows that while the labour market is still very tight, it is starting to weaken.

Source: ABS, AMP

What to watch over the next week?

US December quarter earnings season gets more underway and analysts are expecting earnings growth to be down ~2% compared to a year ago. Energy earnings are still holding up while technology earnings are under pressure. Earnings results next week include Goldman Sachs, Morgan Stanley and Netflix. Other US data includes December retail sales (expected to be down over the month), housing indicators including December building permits, housing starts, existing home sales which should remain under pressure given the tightening in interest rates. The US Fed also releases its Beige Book and there are more speeches from US Fed members.

In Europe, the ZEW December survey is released along with November construction data. Eurozone economic activity has been holding up despite the very steep increase in energy prices over the past 12 months and with gas prices declining considerably over the past few months, the Eurozone will probably avoid an early 2023 recession.

In China, December economic activity data is released including industrial production data (likely to be low given the lift in Covid 19 cases over the month), retail sales (expected to be negative), fixed asset investment and fourth quarter GDP which is expected to be negative over the quarter with annual growth at just under 2%. The People’s Bank of China is also due to meet and no change is expected to the major interest rates in China.

In Canada, December consumer price data is likely to show inflation tracking at sub 7% over the year, down from an 8% peak.

In the UK, the November unemployment rate is likely to be around 3.7%, unchanged on last month but increases are expected this year and the December consumer price index will indicate a further moderation in inflation, with annual CPI around 10.5% (after peaking at just over 11% in October).

The Bank of Japan meets next week and no change is expected after December’s unexpected move to widen the band around its yield target (with the 10-year bond yield now able to move 0.50% either side of a 0% target, up from 0.25% before). The December national consumer price data is expected to show headline consumer inflation running at around 4% on an annual basis – the highest rate of inflation since December 1990 as Japan also experienced an inflation and wages rebound in the past year.

In Australia, the November employment data is released and we expect softer employment growth of 10K in December, with the unemployment rate remaining at 3.4%. January consumer sentiment is also released for January and is likely to remain negative given the broader macroeconomic challenges for consumers and the December Melbourne Institute inflation gauge will give another monthly inflation signal before the quarterly CPI.

Outlook for investment markets

2023 is likely to see easing inflation pressures, central banks hiking rates less aggressively (before an eventual pause to hikes this year and the risk of rate cuts in late 2023) and economic growth weakening but proving stronger than feared. This along with improved valuations should make for better returns in 2023. But there are likely to be bumps on the way – particularly regarding recession risks – & this could involve a retest of 2022 lows or new lows in shares before the upswing resumes.

Global shares are expected to return around 7%. The post mid-term election year normally results in above average gains in US shares, but US shares are likely to remain a relative underperformer compared to non-US shares reflecting still higher price to earnings multiples (17.5 times forward earnings in the US versus 12 times forward earnings for non-US shares). The $US is also likely to weaken which should benefit emerging and Asian shares.

Australian shares are likely to outperform again, helped by stronger economic growth than in other developed countries and ultimately stronger growth in China supporting commodity prices and as investors continue to like the grossed-up dividend yield of around 5.5%. Expect the ASX 200 to end 2023 at around 7,600.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks become less hawkish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of weaker share markets and higher bond yields (on valuations).

Australian home prices are likely to fall further as rate hikes continue to impact, resulting in a top to bottom fall of 15-20%, but with prices expected to bottom around the September quarter, ahead of gains late in the year as the RBA moves toward rate cuts.

Cash and bank deposits are expected to provide returns of around 3%, reflecting the back up in interest rates through 2022.

A rising trend in the $A is likely over the next 12 months, reflecting a downtrend in the now overvalued $US, the Fed moving to cut rates and solid commodity prices helped by stronger Chinese growth.

Weekly market update 22-11-2024

22 November 2024 | Blog Against a backdrop of geopolitical risk and noise, high valuations for shares and an eroding equity risk premium, there is positive momentum underpinning sharemarkets for now including the “goldilocks” economic backdrop, the global bank central cutting cycle, positive earnings growth and expectations of US fiscal spending. Read more

Oliver's insights - Trump challenges and constraints

19 November 2024 | Blog Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory. Read more

Econosights - strong employment against weak GDP growth

18 November 2024 | Blog The persistent strength in the Australian labour market has occurred against a backdrop of poor GDP growth, which is unusual. We go through this issue in this edition of Econosights. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.