Investment markets and key developments

Share markets mostly rose over the last week helped by mostly good news on inflation and despite escalating Middle East turmoil. For the week US shares rose 1.8%, Eurozone shares gained 0.3% and Japanese shares rose 6.6% having broken out of resistance seen over the last six months. Against this, Chinese shares fell 1.3% with ongoing concerns about the Chinese economy. Australian shares rose helped by lower-than-expected inflation but only by 0.1% with falls in utilities, materials and consumer staples offsetting gains in IT, real estate and consumer discretionary shares. Bond yields fell in the US, Japan and Australia but rose in the UK and Germany. The oil price fell despite the escalating turmoil in the Middle East. Metal and iron ore prices fell. The $A fell despite little change in the $US.

Shares went up too far, too fast late last year leaving them vulnerable to a short-term correction. From their October lows to their late December highs US shares rebounded 15.8%, global shares rose 14.4% and Australian shares rose 12.1%. A rise in shares was fundamentally supported by ongoing news of falling inflation and central banks pivoting towards a peak in rates and eventual rate cuts and it was also consistent with the normal seasonal rally. However, the extent of the rally has left shares overextended and vulnerable to a pullback as central banks may not start to cut rates as early as markets are assuming, the risk of recession remains high and the creeping widening in the Israel/Hamas conflict poses a risk to global growth and inflation - with eg Houthi attacks on Red Sea shipping adding to transport costs as ships have to go around Africa and the US and UK launching airstrikes on Houthis in Yemen adding to the risk of Iran being directly drawn in to the conflict which would threaten oil supplies. From a seasonal perspective a weaker patch is often evident into February or March after seasonal strength from October. The next chart shows seasonal indexes for the US and Australian share markets. While we expect shares to provide reasonable returns this year they are likely to be more constrained and vulnerable than last year and worries about delays in rate cuts, recession and geopolitics could drive a deeper first half pullback than seen last year.

Source: Bloomberg, AMP

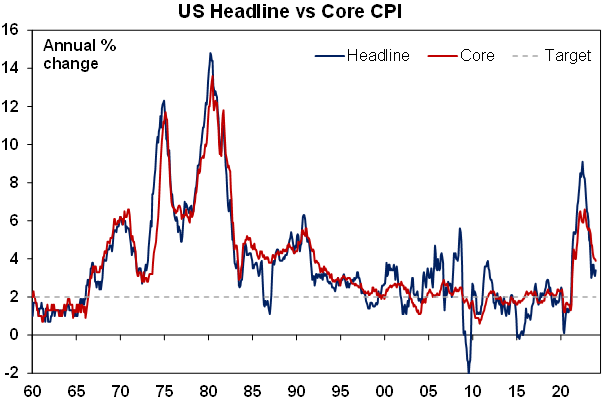

But while shares have likely run ahead of themselves, the good news on inflation has mostly continued. Putting aside normal volatility, inflation in major countries appears to be falling almost just as quickly as it went up.

- Eurozone inflation rose to 2.9%yoy in December but core inflation fell further to 3.4%yoy.

- US CPI inflation rose to 3.4%yoy in December with higher-than-expected energy and food prices and still sticky services inflation. But the trend remains down with a fall likely in the months ahead as high increases in January and February last year drop out of annual calculations, core inflation fell further to 3.9%yoy, other measures of underlying inflation continue to fall, the breadth of high price increases is falling and producer price inflation was less than expected in December. The six-month annualised rate of core private final consumption deflator inflation which fell below the Fed’s 2% target in November is likely to have fallen further to 1.8% in December.

Source: Bloomberg, AMP

- Our US Pipeline Inflation Indicator continues to point to lower inflation ahead. The drop out of high monthly increases a year ago and lower gasoline and used car prices are likely to result in a fall in inflation this month.

Source: Bloomberg, AMP

- Inflation surprised on the downside in the last week in a range of countries including Chile, Taiwan, The Philippines, Taiwan, Poland and Norway.

- Australian inflation surprised on the downside for the second month in a row falling to 4.3%yoy in November, as large price rise a year ago in areas like food, transport, auto fuel and travel are replaced by more modest price rises or falling prices. While price rises are still rapid in rents, electricity and insurance they are slower or falling for fuel, holiday travel, food, clothing and household equipment and underlying inflation measures are also cooling. In fact, we expect December 2023 monthly inflation to fall to around 3.3%yoy as the 1.5%monthly surge in December 2022 (which was largely due to a 27% rise in travel costs) drops out of the annual calculation.

Source: ABS, AMP

- While there has been much angst about Australian inflation being higher than that in the US and Europe this mainly reflects the fact that it lagged on the way up, lagged by around 3 to 6 months at the top and so is lagging on the way down. And if it has fallen to around 3.3%yoy in December as we expect then that will take it down close to US and European levels.

Source: Bloomberg, AMP

- Our Pipeline Inflation Indicator for Australian inflation still points down.

Source: Bloomberg, AMP

There will likely still be a few bumps along the way, but major central banks are on track to start cutting interest rates this year. Middle East problems and possible supply side threats (including from higher shipping costs flowing from the Red Sea problems and the DP World port disruptions in Australia) along with still sticky services inflation could pose short term risks to the fall in inflation. And the Fed and ECB are a bit more wary than markets are – as evident in comments from a range of officials from each central bank over the last week - which could cause a short term upset in markets. But while March may be a bit too early for the Fed to start easing, central banks are now data dependent and with inflation likely to continue to trend down, by the June quarter both the Fed and ECB are likely to have started to cut rates. We expect the Fed to start cutting in May with five cuts this year and the ECB to start cutting around April also with five cuts this year.

In Australia, we continue to expect the RBA to start cutting in June with the cash rate falling to 3.6% by year end. The sharper than expected fall in inflation recently means that the RBA’s inflation forecasts (for 4.5%yoy in the December quarter 2023 and to only reach 2.9%yoy by end 2025) are looking too hawkish. Supply side problems associated with Red Sea shipping and the DP World ports dispute pose near term risks to inflation, but assuming they are resolved in the next few months we expect the quarterly CPI to show inflation around 3.5% in the June quarter and 3% by December this year. But with shorter term inflation momentum falling and growth weak the RBA (and other central banks) shouldn’t have to wait for inflation as measured on a 12-month ended basis to be back at target before starting to cut rates.

The US SEC approved ETFs to invest directly into Bitcoin. Australian regulators are likely to follow. This will improve and widen access to Bitcoin by making it easier to access via regular investment accounts rather than, eg, crypto exchanges that have had issues. As a result, anticipation of the move has been a factor pushing up the price of Bitcoin in recent months. It also brings the crypto industry closer to the world of regulated traditional finance. Making it easier to get into and out of an “asset” should mean higher valuations – just as the progression from individual share investing to managed funds, indexed funds, futures, ETFs, etc, with ever more liquid stock exchanges, etc, has added to the liquidity of share markets meaning that shares are now able to trade on higher PEs than was the case say in 1900. The only problem is that despite being 15 years old now, Bitcoin is yet to establish a clear use (beyond being something to speculate on or for use in illicit transactions) so it lacks the fundamental E in a PE. It’s very unlikely to be used on a broad basis for transactions in well managed countries (and that does not include El Salvador!), its extreme volatility means that it’s not a good store of value and it’s not a good hedge against inflation having collapsed in 2022 just when inflation surged. This makes it impossible to value unlike say property or shares where a stream of rent or earnings provide a basis for valuation and very different to commodities that have industrial and consumer uses. There is use value in blockchain technology (for decentralised finance, contracts, etc) which is positive for crypto currencies like Ethereum, but this is very hard to value too. So I remain a sceptic and fear Bitcoin and much of the recurring and expanding buzz around crypto is just a house of cards. Of course, none of this means Bitcoin can’t go higher - particularly with its next “halving” coming up - for those keen to “hodl” (“hold on for dear life”) or trade it using technicals. So far though the ETF announcement has proven to be a case of buy on the rumour, sell on the fact.

Economic activity trackers

Our Economic Activity Trackers have seen a bit of an uptick over the last few weeks (partly seasonal) but are still not showing anything decisive for the direction of activity.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence and credit & debit card transactions. Source: AMP

Major global economic events and implications

Global economic data released so far this year remains consistent with soft growth and falling inflation. December composite business conditions PMIs rose slightly but remained soft. Price indicators also rose slightly but remain well down from their highs.

US economic data has been a bit mixed. December payrolls rose strongly but prior months were revised down, temporary employment fell, hours worked fell and job openings, hiring and quits fell all consistent with an ongoing cooling in the US labour market. The employment component of the ISM business surveys also point to a slowing jobs market. Jobless claims remain low though.

German industrial production continued to fall in November with orders remaining weak. While Eurozone unemployment fell slightly to 6.4% continued weak business conditions PMIs and flat to slightly down GDP suggest that its at or close to the bottom. Retail sales remain down on a year ago and economic confidence improved slightly but remains weak.

Chinese consumer and producer prices remained in deflation in December, although it eased slightly, and core inflation remained weak but positive at 0.6%yoy. There is nothing to prevent further PBOC stimulus measures with a PBOC official hinting at further easing. With money supply and credit data for December coming in weaker than expected we expect further PBOC rate and reserve requirement ratio cuts in the months ahead. Trade data showed stronger than expected exports and imports but they are only up 2.3%yoy and 0.2%yoy respectively.

Source: Bloomberg, AMP

Australian economic events and implications

Australian economic data released at the start of the year has been mixed but is consistent with slow growth, easing inflation and the RBA having peaked on rates.

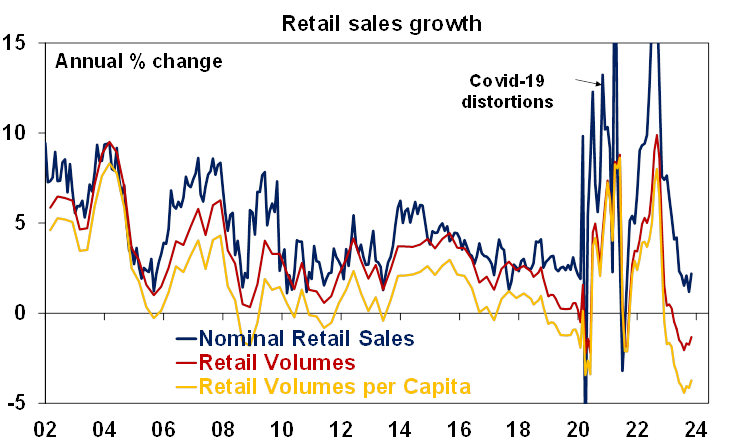

Retail sales rose a stronger than expected 2% in November leaving them up 2.2%yoy, but this was boosted by longer and bigger Black Friday sales and more consumers seeking bargains in the face of cost of living pressures. This means that spending has been brought forward again from December where we expect to see a 3% or so fall based on the experience of the last few years. Real retail sales per person remains weak.

Source: ABS, AMP

Similarly the ABS’s new household spending indicator rose in November with Black Friday also impacting but the trend remains weak with real annual growth still negative suggesting real annual growth in consumer spending could have gone negative in the last quarter. It also shows that while non-discretionary spending rose 5.8%yoy, cost of living pressures saw discretionary spending growth virtually stall at just 0.3%yoy.

Source: ABS, AMP

Housing related indicators were mixed. Building approvals rose 1.6% in November but remain soft and well below levels consistent with underlying demand. Housing finance rose 1% in November but remains 19% below its record high in early 2022 highlighting that last year’s home price rebound came on low volumes. Home prices rose 8.1%yoy in 2023, but the monthly pace of growth slowed further to 0.4%mom as high mortgage rates started to get the upper hand over the supply shortfall & high immigration.

Source: ABS, AMP

Job vacancies fell for the sixth quarter in a row in November. They are still high relative to unemployment indicating the jobs market remains tight but its cooling which will take pressure off wages growth.

Source: ABS, AMP

Trade data showed a big rebound in Australia’s goods trade surplus in November reflecting solid exports and a fall back in imports of motor vehicles, other consumer goods and aircraft.

What to watch over the next week?

In the US, expect some improvement in the January New York and Philadelphia regional business surveys (due Tuesday and Thursday), modest growth in December retail sales but a fall in industrial production (both Wednesday), a further rise in home builder conditions (also Wednesday) but a fall in housing starts. US December quarter earnings reports are starting to flow with the consensus expecting earnings growth of 4.3%yoy with tech expected to be strong but the rest of the market still weak.

Canadian inflation for December (Wednesday) is likely to be around 3.2%yoy.

UK inflation for December (also Wednesday) is likely to have fallen slightly to 3.8%yoy.

Japanese inflation for December (Friday) is likely to have fallen to 2.6%yoy.

Chinese December quarter GDP growth is likely to have come in around 1%qoq or 5.2%yoy, with annual growth boosted by the depressed base a year ago due to covid restrictions. December data is likely to show industrial production unchanged at 6.6%yoy but retail sales growth slowing to 8%yoy.

Watch Taiwan and US Government funding. The Taiwanese election (13 Jan) has the potential to escalate or de-escalate tensions with China depending on whether the ruling pro-independence Democratic Progressive Party is returned, or the opposition wins. And while US Congressional leaders have reportedly reached agreement on funding the US Government it is unclear as to whether it will be passed in time to avoid a shutdown of around 20% of the Government from 19 January.

In Australia, the Westpac/MI consumer sentiment index for January (Tuesday) is likely to have drifted up a bit on the back of more talk that rates have peaked but its likely to remain very weak. Jobs data (Thursday) for December is likely to show employment flat (after a 61,500 gain in November) and unemployment unchanged at 3.9%.

Outlook for investment markets for 2024

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for okay investment returns in 2024. However, with growth still slowing, shares historically tending to fall during the initial phase of rate cuts, a very high risk of recession and investors and share market valuations no longer positioned for recession, it’s likely to be a rougher and more constrained ride than in 2023.

Global shares are expected to return a far more constrained 7%. The first half could be rough as growth weakens and possibly goes negative and valuations are less attractive than a year ago, but shares should ultimately benefit from rate cuts, lower bond yields and the anticipation of stronger growth later in the year and in 2025.

Australian shares are likely to outperform global shares, after underperforming in 2023 helped by somewhat more attractive valuations. A recession could threaten this though so it’s hard to have a strong view. Expect the ASX 200 to return 9% in 2024.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows and central banks cut rates.

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields & working from home.

Australian home prices are likely to fall in the next six months or so as high interest rates constrain demand again and unemployment rises. The supply shortfall should prevent a sharper fall & expect a wide dispersion with prices still rising in Adelaide, Brisbane & Perth. Rate cuts from mid-year should help prices bottom and start to rise again later in the year.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.72, due to a fall in the overvalued $US & the Fed moving to cut rates earlier and by more than the RBA.

Weekly market update 15-11-2024

15 November 2024 | Blog Global share markets were messy over the last week, not helped by the ongoing rise in bond yields and a wind back in Fed rate cut expectations after some elevated US inflation data and slightly hawkish comments from Fed chair Powell. Read more

Oliver's insights - staying focused as an investor

12 November 2024 | Blog Dr Shane Oliver suggests five ways to help manage the noise and stay focussed as an investor with the changes in the macro enviroment. Read more

Weekly market update 08-11-2024

08 November 2024 | Blog It was all about the US Presidential election this week. Despite concerns that the election outcome would be extremely close, the Republican victory was stronger than the polls and betting markets were suggesting into the lead up. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.