Investment markets and key developments

Global shares surged over the last week helped by lower than expected US inflation for October, which is seen as taking pressure off the Fed and ultimately other central banks including the RBA (as US inflation led inflation in other countries including Australia on the way up). For the week US shares rose 5.9%, Eurozone shares rose 4.8%, Japanese shares gained 3.9% and Chinese shares rose 0.6% (helped by more signs of an easing in Covid rules). The positive global lead helped push up the Australian share market by 3.9% for the week with gains led utilities (which also got a boost from M&A activity), materials, health and property stocks. The lower US inflation data also pushed bond yields down sharply. While oil prices fell, metal, gold and iron ore prices benefitted from the risk on tone which also saw the $US fall. As a result, the $A rose to around $US0.67.

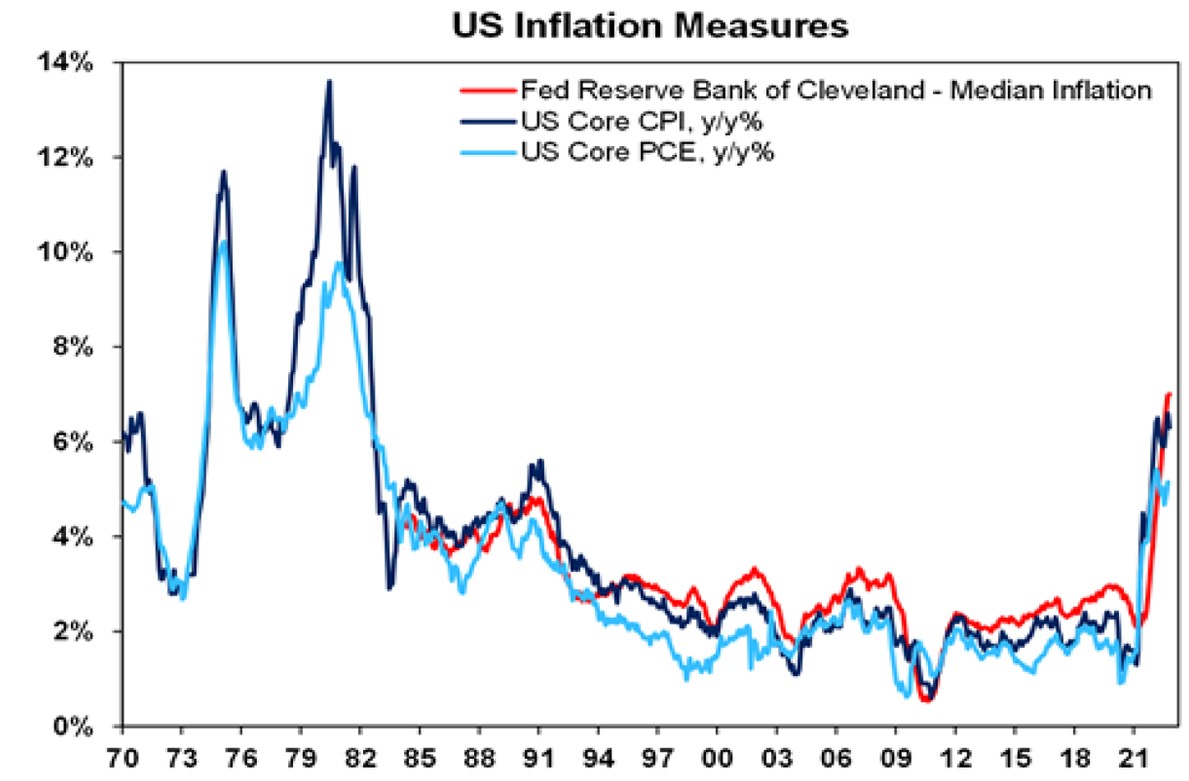

Oh Happy Day. It been a long time coming, but underlying US inflation finally appears to be easing. Headline inflation in October dropped down to 7.7%yoy (and is now well down from a peak of 9.1% in June) but more importantly core inflation came in at a slower than expected 0.3%mom, easing to 6.3% yoy from 6.6%. Prices for used cars, household furnishings, medical care and airfares fell.

Source: Bloomberg, AMP

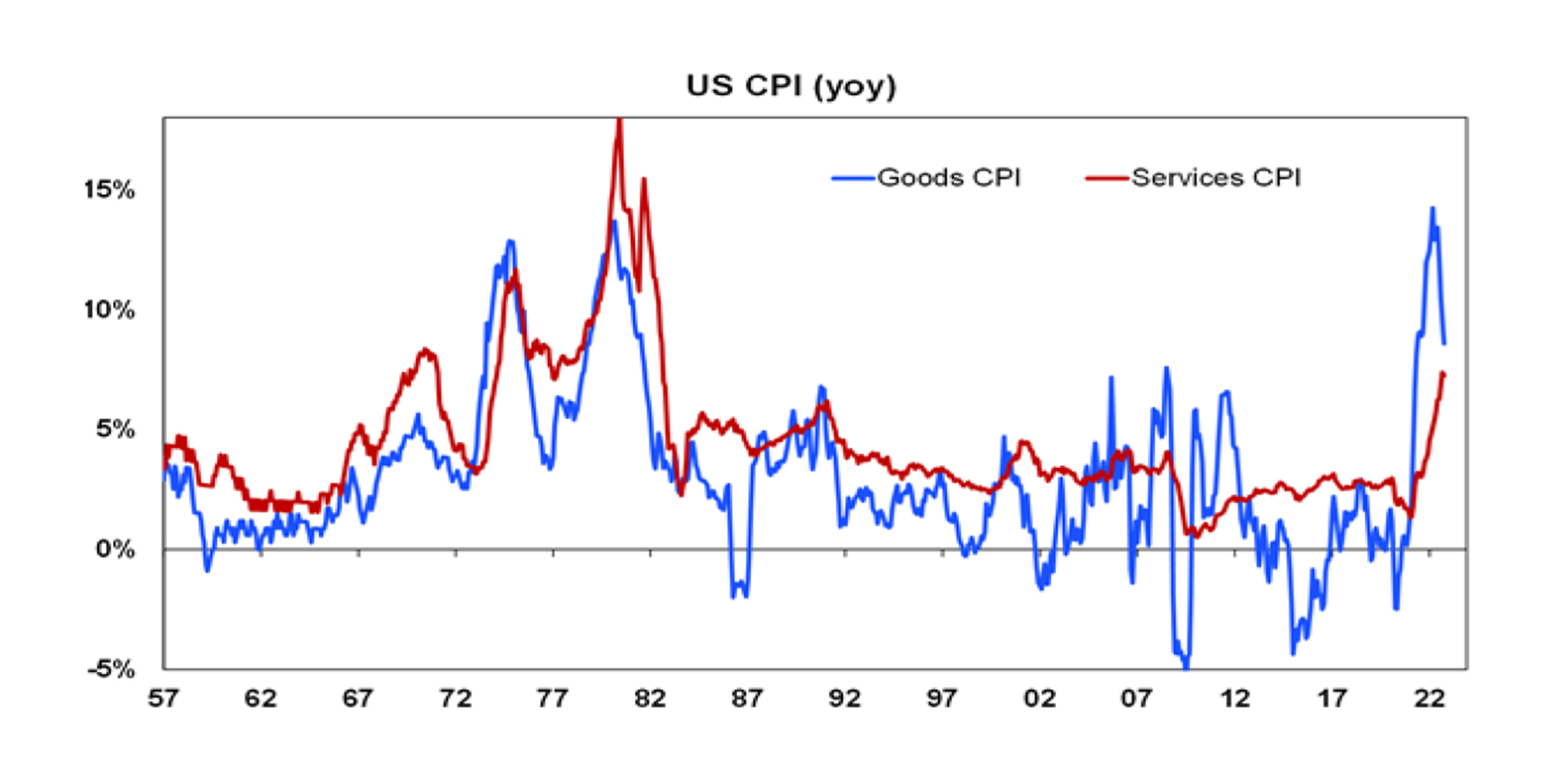

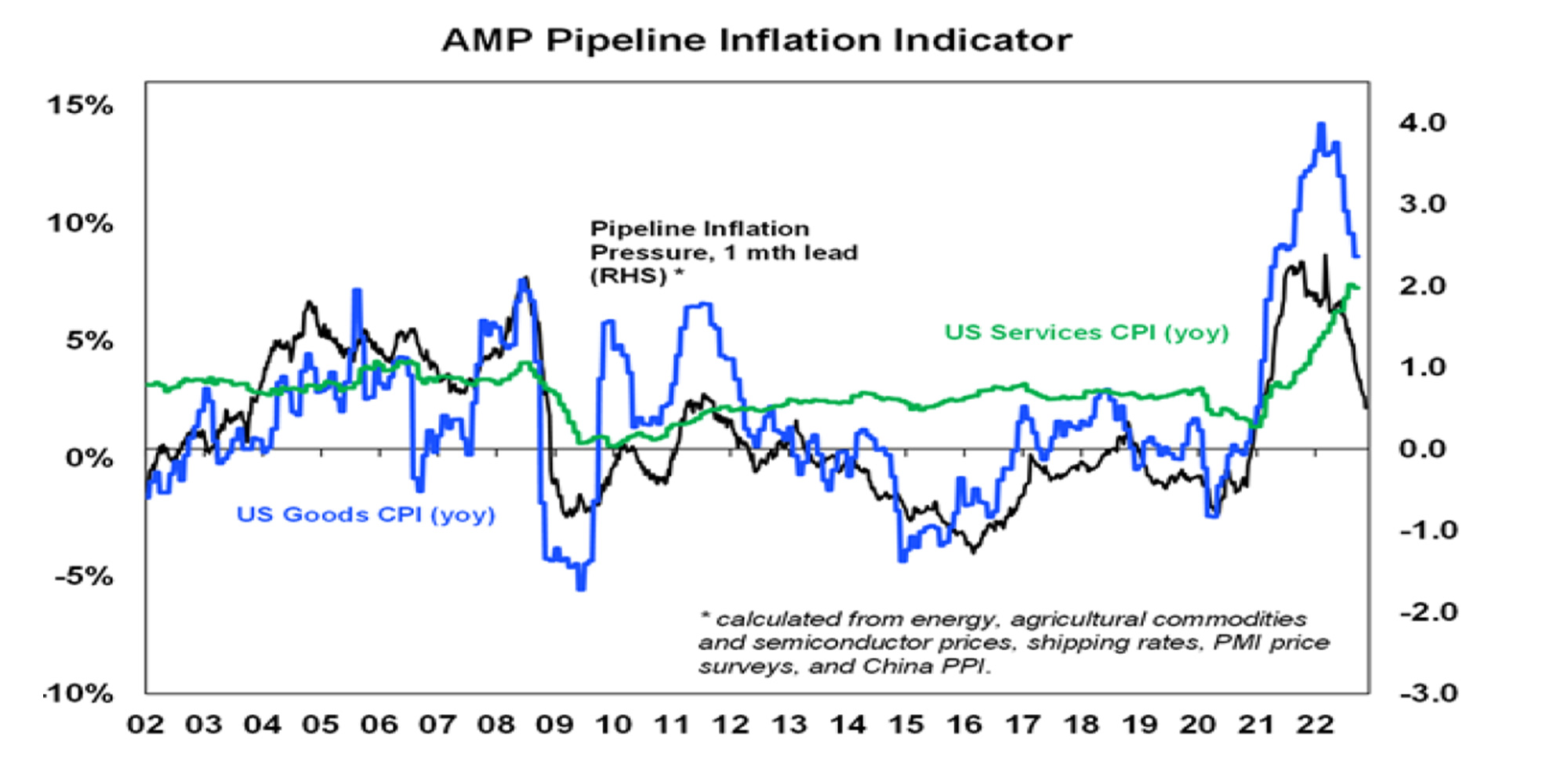

US goods price inflation has rolled over and this tends to lead services price inflation at major turning points.

Source: Bloomberg, AMP

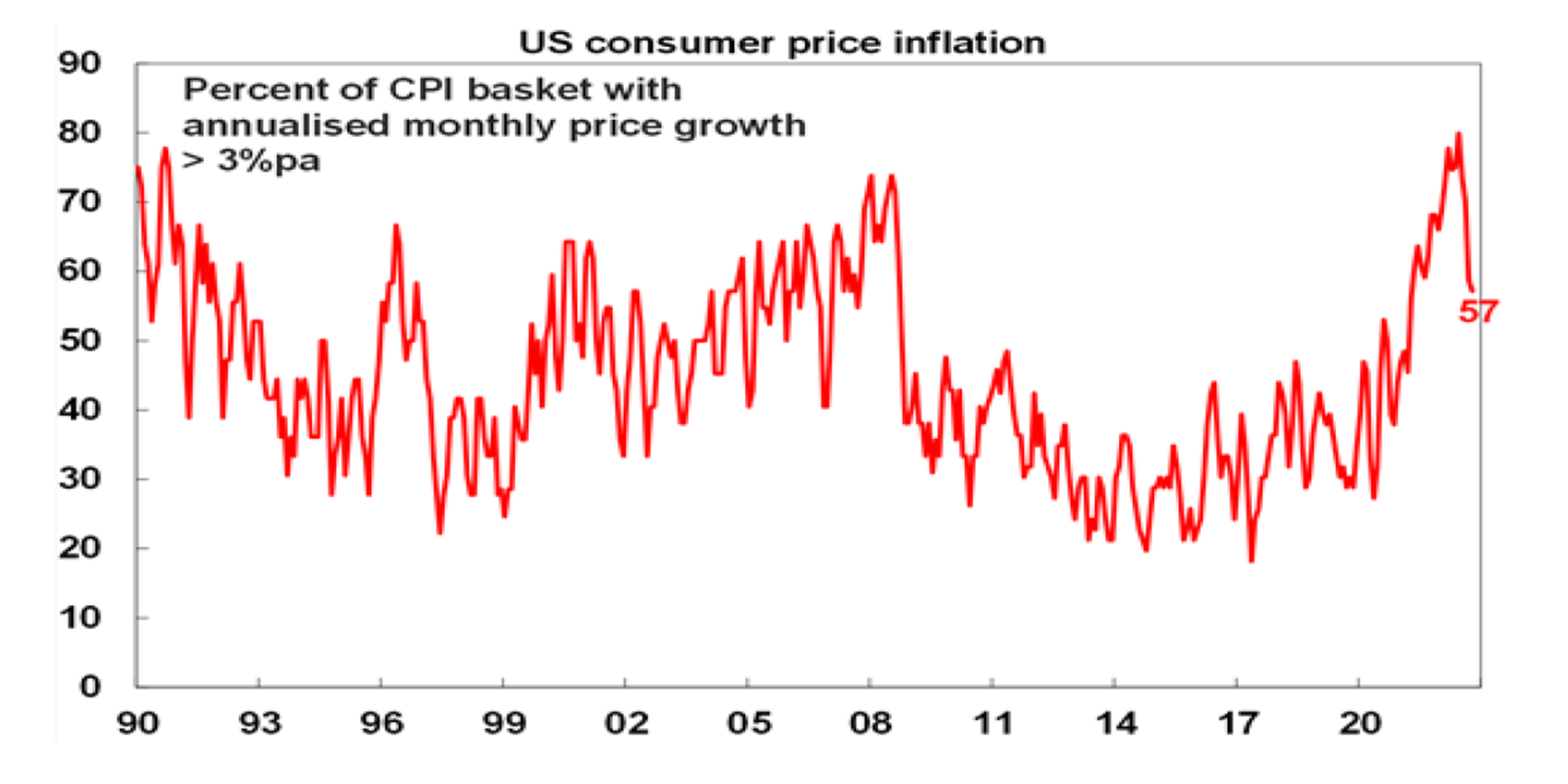

While trimmed mean inflation (a measure of underlying inflation) in the US remained unchanged at 7%yoy this is likely to soon start to slow with a sharp fall in the proportion of CPI components running annualised monthly inflation above 3%yoy.

Source: Bloomberg, AMP

Importantly, our Pipeline Inflation Indicator is continuing to trend down and points to a further fall in US inflation. This correlates more with goods price inflation (which is slowing) but as this leads services price inflation its likely to slow too in the months ahead. It’s also worth noting that rents account for about one third of the US CPI and rapidly slowing rents for new leases in the US point to a fall in average rent inflation in the CPI over the next six months. Inflation in Australia is lagging the US by around 6 months, so it should start to decline here from early next year.

Source: Bloomberg, AMP

US inflation is still too high so the Fed will remain hawkish and wary for a while yet, but October’s lower than expected inflation outcome and increasing signs that the cyclical peak in inflation is behind us is consistent with a downshift to a 0.5% hike at the Fed meeting next month. Money market expectations for a peak in the Fed Funds rate near 5% next year may be a bit too hawkish.

In Australia, RBA Deputy Governor Bullock reiterated the RBA’s more gradualist approach to returning inflation to target in order to hopefully keep the economy on an even keel and again hinted at a possible pause in rate hikes. She reiterated its resolve to lower inflation and its hawkish bias with the expectation to raise rates further. However, she indicated that the Bank is prepared to stretch out the return of inflation to target in order to preserve some of the gains on employment. And she also noted in Parliamentary testimony that “there might be an opportunity to sit and wait and look a little bit” which is the second reference lately from the RBA about pausing at some point. The key message being that the RBA is prepared to remain in the gradual lane on rate hikes, unless of course there’s more far worse than expected news on inflation. Although a pause is possible next month (if upcoming wages, jobs and CPI data are softish), our base case is for another 0.25% rate hike in December to 3.1% (with the risk of one final hike in February), but then for the cash rate to peak in the low 3’s as it becomes clear that growth is slowing sharply next year and that this will push inflation down.

As we have been noting, evidence is continuing to build that RBA rate hikes are working and it’s only a matter of waiting for the lags to play out: housing indicators are all very weak with HIA data in the last week showing a sharp plunge in new home sales; already depressed consumer confidence has now fallen to a new cycle low; real retail sales appear to be stalling; and in the last week NAB credit and debit card data showed a fall in consumer spending in October with a fall in discretionary spending.

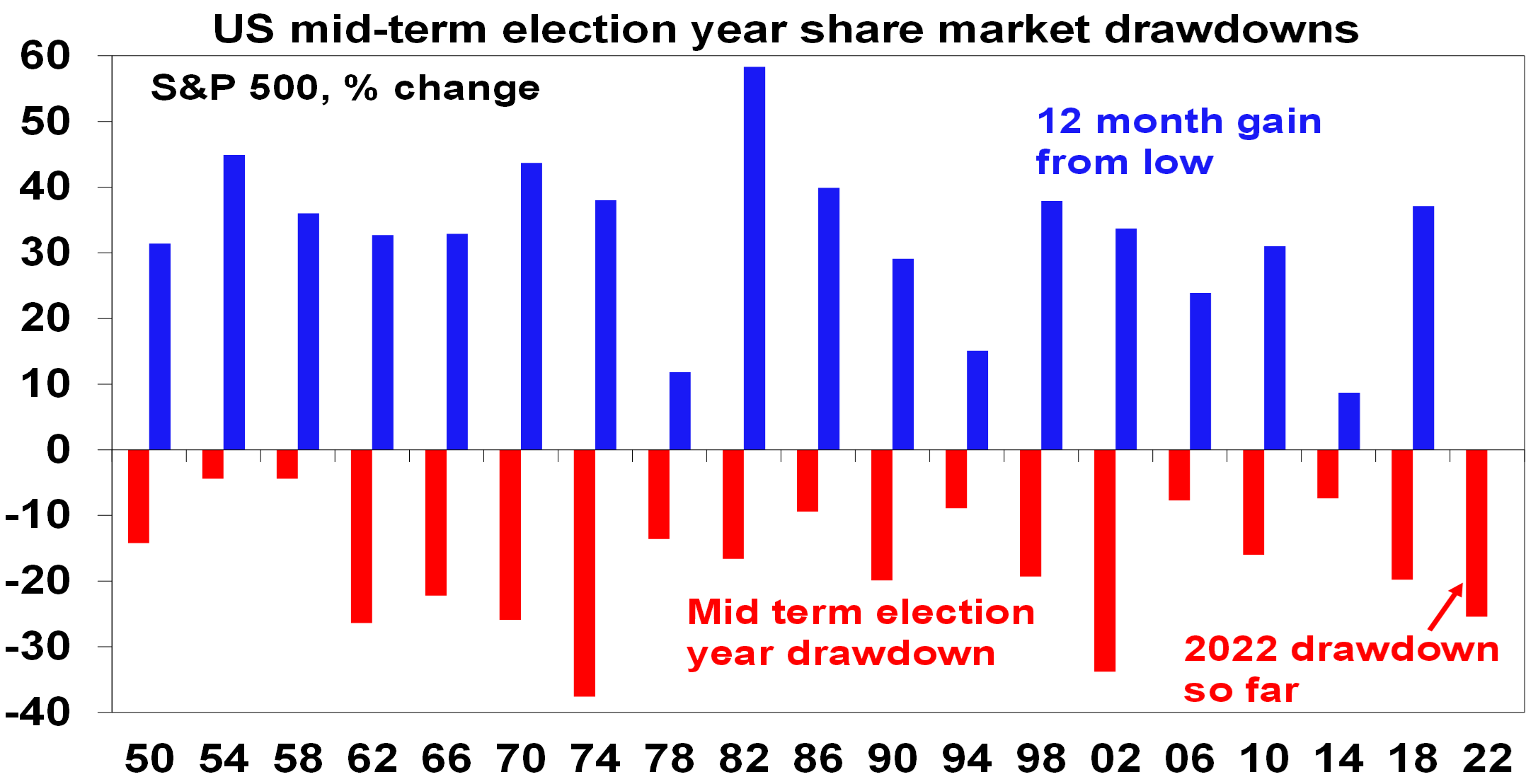

Shares showing more signs of having bottomed. The ride for shares may still remain choppy and new lows still can’t be ruled out if the economic outlook deteriorates a lot further (and specifically if the US slides into a deep recession) and/ or geopolitical problems escalate further. But the increasing evidence of a peak in US inflation (which will lead other countries) and central banks moving towards at least slowing their rate hikes which should help avoid a hard landing for global and Australian growth along with positive seasonals in the months ahead and the track record of US shares rallying after the mid terms adds to our confidence that the next 12 months will be positive for shares.

Source: Strategas, Bloomberg, AMP

The US mid-term elections saw no GOP wave as the Democrats performed far better than expected. Although the Republican’s will probably get control of the House (where they only needed to pick up a net five seats), it looks like being only a slim majority with the Republican’s picking up maybe just 7 seats which is far less than the swing seen in the past with the Republicans gaining 53 seats in 1994 under Clinton, 63 in 2010 under Obama and the Democrats picking up 40 in 2018 under Trump. And the Senate has been retained by the Democrats. Exit polls indicate the abortion issue (favouring Democrats) almost offset the inflation issue (favouring the GOP). The weaker than expected GOP showing will weaken Trump’s chances going into the 2024 presidential race relative to Florida GOP Governor Ron DeSantis and make it easier for the Democrats to regain control in 2024. That said the US is likely still heading into divided government and for markets the key implications of this would be as follows:

- First, getting the mid-terms out of the way and legislative gridlock in Congress (which prevents extreme economic policies) have historically been good for US shares resulting in shares rising in the 12 months after the each of the mid-terms since 1950 and higher than average returns in the third year of presential election cycle.

- Second, divided government will see a return to battles over funding the Government (to avoid a shutdown) which will next need to be resolved from 16th December and to raise the debt ceiling (to avoid default) which will likely be necessary by the September quarter. A somewhat smoother path with less risk would have occurred if the Republicans got control of both the House and Senate (as they would take most the blame politically for a shutdown or default) but their likely relatively narrow victory in the House means they may not be as obstructionist because moderate Republican’s may vote with the Democrats to avoid major problems.

- Finally, with the passage of legislation through Congress likely now more difficult President Biden is likely to adopt a more hawkish foreign policy stance keeping geopolitical risk high. An even more hawkish US stance toward China could impact Australia via increased sanctions on China along with an increased risk of conflict over Taiwan.

We have pointed out regularly that in the 12 months after mid term elections US shares have rallied historically, but what if there is a recession next year in the US? Deutsche Bank analysis has pointed out that since 1950 the third year of the presidential term has not had recessions in quarters 2 to 4 and that this may partly explain why shares have been strong in the third year. So if the US goes into recession next year it could break the record of positive returns after the mid-terms. A counter argument is that the share market slump this year has been consistent with past mid-term election year slumps (in fact its been deeper at 25% versus an average drop of 17% since 1950) so it may have already discounted a mild recession so would not preclude share market behaviour over the next 12 months in line with the post mid-term average even if there is a recession next year providing its mild.

What about the latest problems in crypto currency land? Bitcoin fell to a new cycle low on liquidity problems at FTX crypto exchange (which has since filed for bankruptcy). Cryptos were a beneficiary of easy money and have been suffering from its withdrawal. Financial accidents are common outcomes of Fed tightening cycles and the latest crypto problems could have further to go. While this may be bad news for crypto traders and Lamborghini sales its unlikely to have a major impact on global growth and share markets as investor and financial system exposure to it is relatively low. Gold looks to be a key beneficiary.

NSW stamp duty reform now passed into law giving first home buyers the choice to pay stamp duty or land tax. As we have already pointed out it’s a step in the right direction, but its disappointingly narrow and looks like yet another flawed demand side “solution” to poor housing affordability. Replacing stamp duty with land tax makes fundamental sense – stamp duty is a huge up-front impost that distorts decisions to buy and sell property. But NSW’s step down this path is so small it may cause more problems than its worth. It only applies to first home buyers on properties worth less than $1.5million. As such it brings forward first home buyer demand without boosting sales by downsizers and so runs the risk of simply boosting demand, resulting in higher than otherwise prices in the sub $1.5million part of the market. And it could lock in FHBs into their first property because once they trade up they will no longer be FHBs and face a big stamp duty impost (as would a buyer of their property if they are not an FHB). Of course, FHBs will also need to allow for their long term land tax bill and banks will likely allow for this in determining how much they will lend. So FHBs may find it easier to save the upfront costs of getting into a property but banks may then lend them less. The barrier to more fundamental stamp duty reform is that stamp duty accounts for 20% of NSW government revenue so swapping all stamp duty for land tax entails a short-term revenue loss.

Coronavirus update

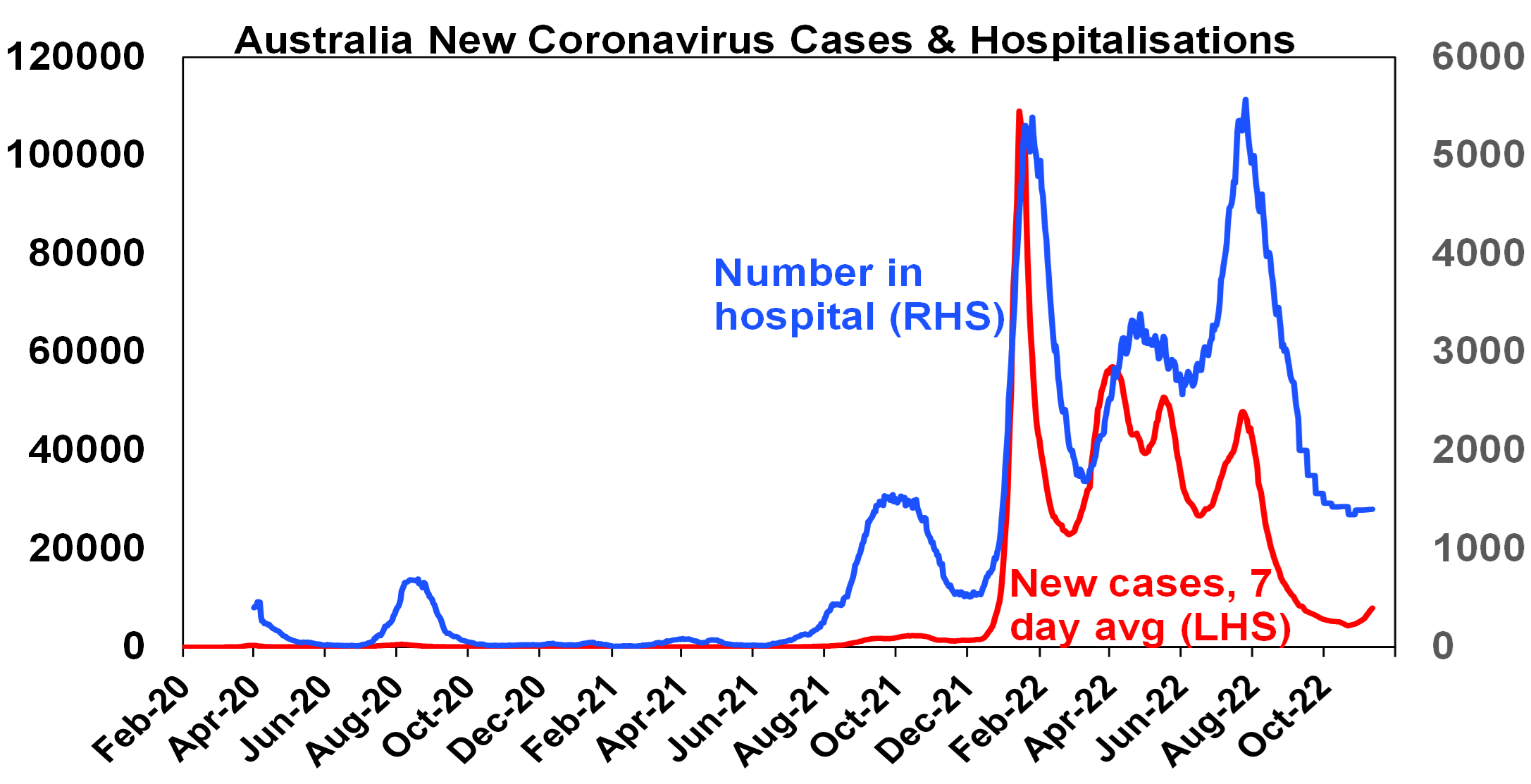

New global covid cases & deaths remain low. Australia is seeing an upswing in new cases from a low level with Queensland returning mask recommendations, but the new Omicron variants (eg BQ.1 and XBB) do not appear to be more harmful and fully vaccinated people remain less likely to fall seriously ill. Singapore saw a similar wave recently that quickly rolled over again.

Source: covidlive.com.au, AMP

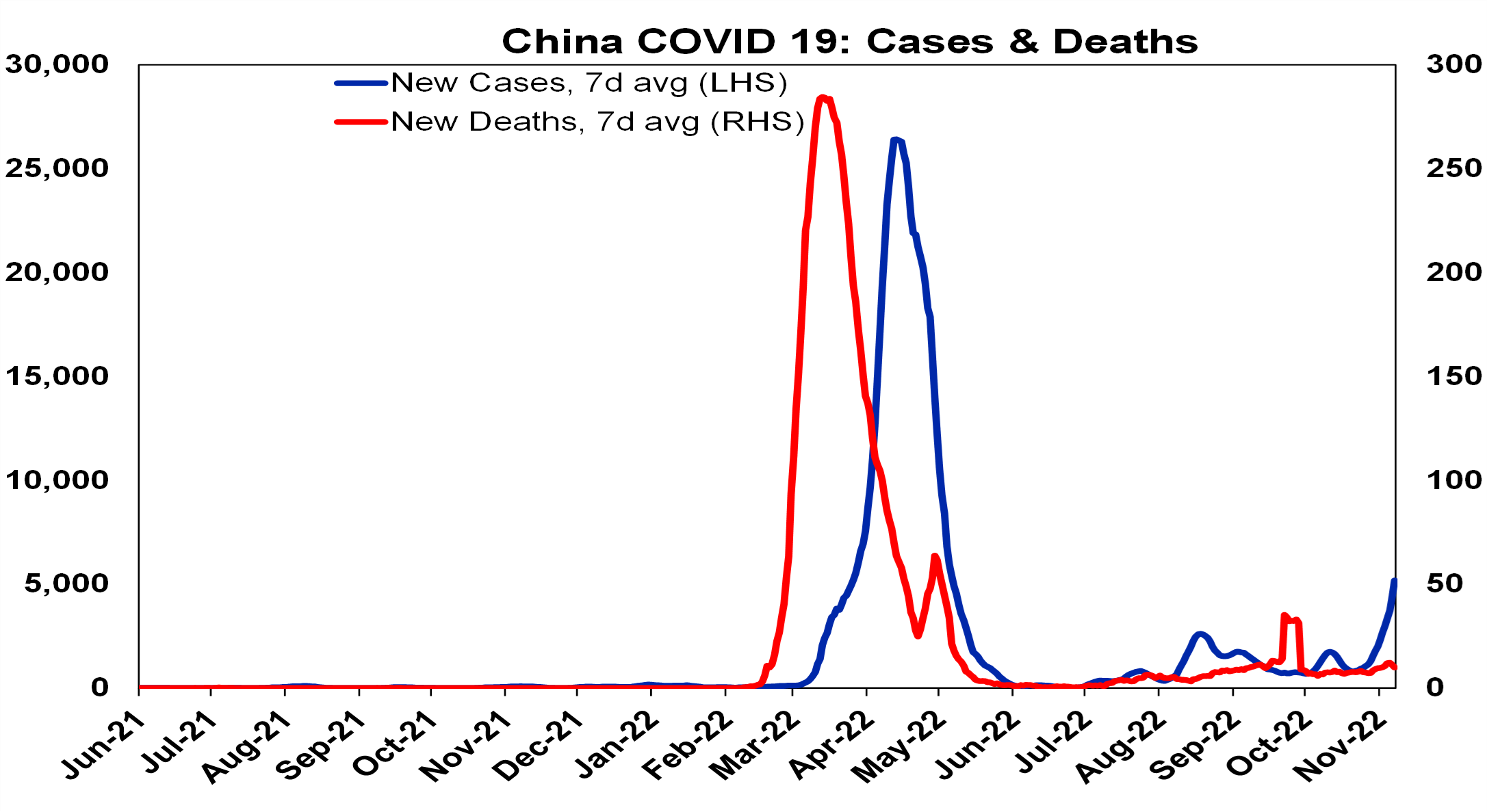

China is seeing another upswing in new case threatening more disruption. However, while Chinese health officials indicated that they will “unswervingly” stick to their Covid controls, there are many signs pointing to an exit ahead from the zero-Covid policy, probably around March next year: with the People’s Daily running an article downplaying long Covid; a relaxation of PCR test requirements in some regions; Pfizer’s vaccine being made available to foreigners in China; some regions building new makeshift hospitals; China getting closer to its own mRNA vaccines and treatments; and a Politburo Standing Committee meeting announcing measures to “optimize” (ease) Covid controls to reduce economic damage and in particular speed up medical preparations. This could mean that after surprising on the downside this year, Chinese growth will likely surprise on the upside next year, which in turn could boost global growth.

Source: covidlive.com.au, AMP

Economic activity trackers

Our Australian, US and European Economic Activity Trackers all fell over the last week with broad based declines in Australia and the US.

Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions, retail foot traffic hotel bookings. Source: AMP

Major global economic events and implications

US economic data was soft. Small business optimism and CEO confidence data stayed weak, jobless claims edged up & the Fed’s lending survey showed a significant tightening in bank lending standards. But at least the proportion of small firms raising selling prices is continuing to trend down, albeit it remains high.

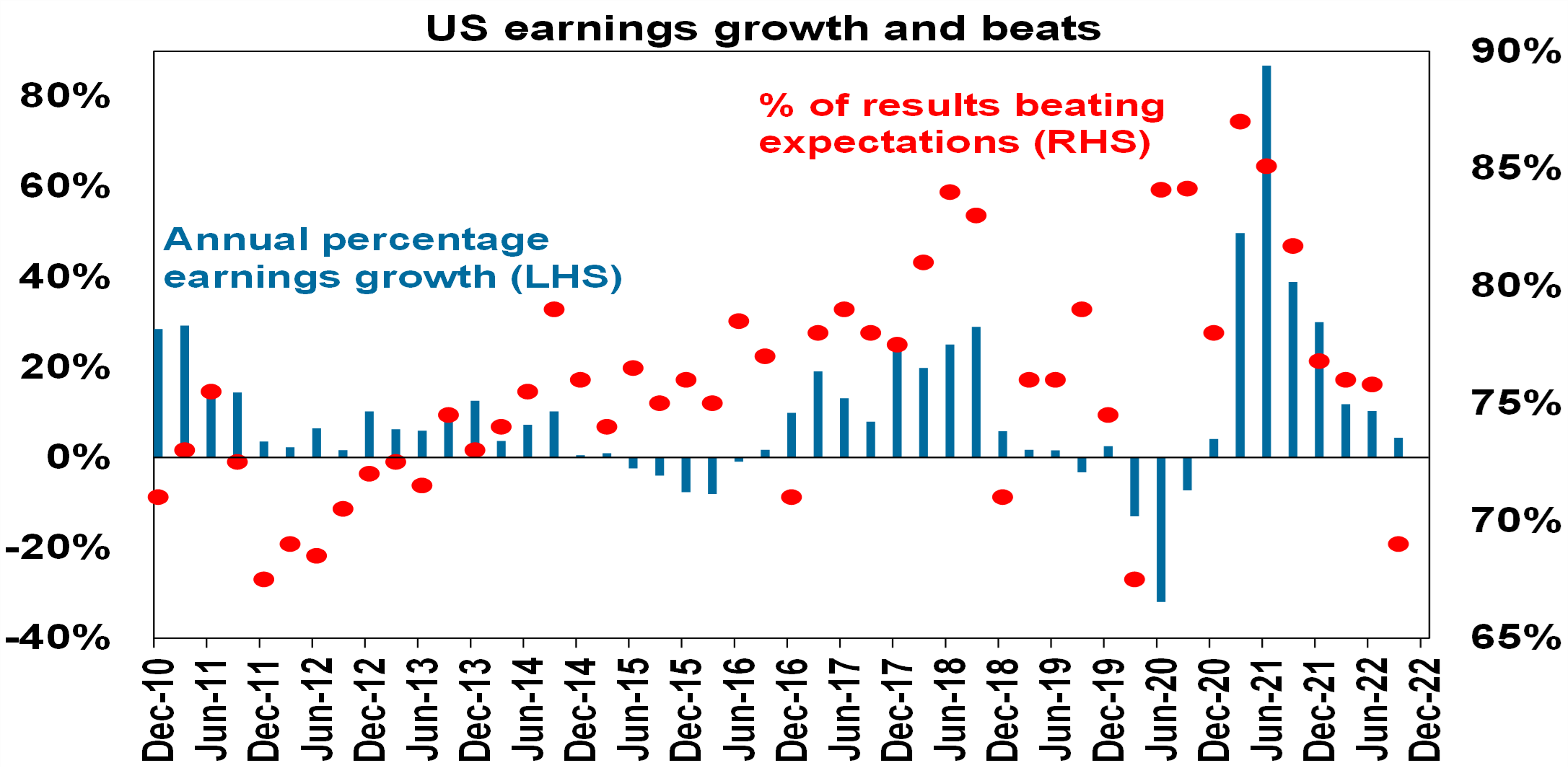

US September quarter earnings coming in on the soft side. 92% of US S&P 500 companies have now reported, but only 69% have surpassed expectations which is well below the norm of around 76%, earnings growth now looks like coming in around 4.5%yoy which is up from 2.6% at the start of the reporting season but lower than the normal uplift; excluding energy, earnings are down 3.5%yoy; and fourth quarter earnings are being revised down at a faster than average pace.

Source: Bloomberg, AMP

Japan’s Economy Watchers economic sentiment survey improved again and real household spending rose solidly in September helped by the earlier reopening and the absence of monetary tightening. Nominal wages growth is accelerating helped by overtime and bonuses but remains soft at 2.1%yoy.

Chinese exports and imports contracted and were weaker than expected in October, reflecting weak global and domestic demand not helped by zero-Covid related disruptions. Credit growth also slowed far more than expected in October as Covid restrictions weakened economic activity and credit demand. Inflation readings also softened with core CPI inflation just 0.6% and producer prices falling for the first time since 2020. Inflation is clearly no problem in China and no barrier to further policy stimulus. Time will tell though whether it rebounds when China reopens as it has in other countries post covid lockdowns.

Australian economic events and implications

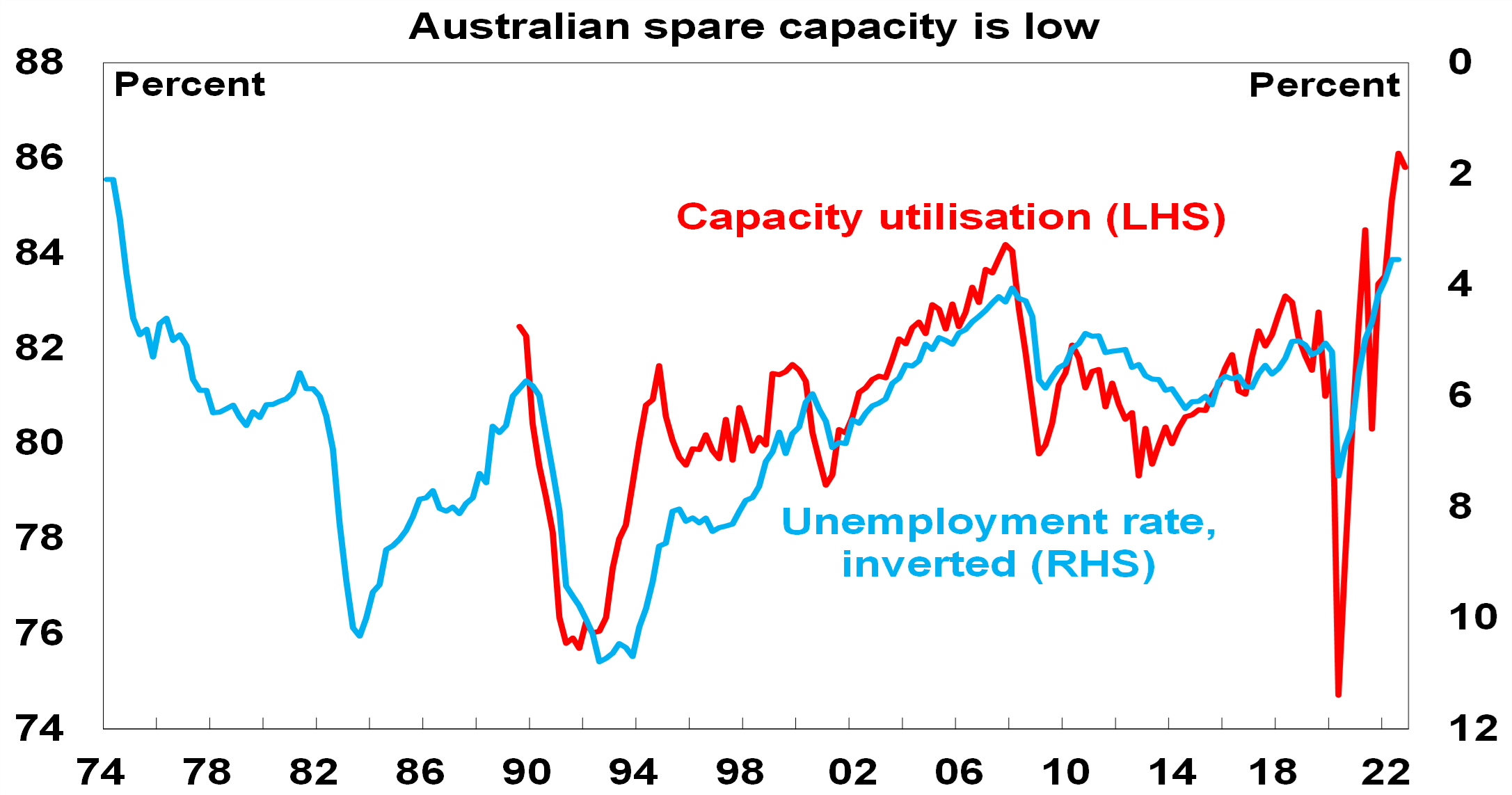

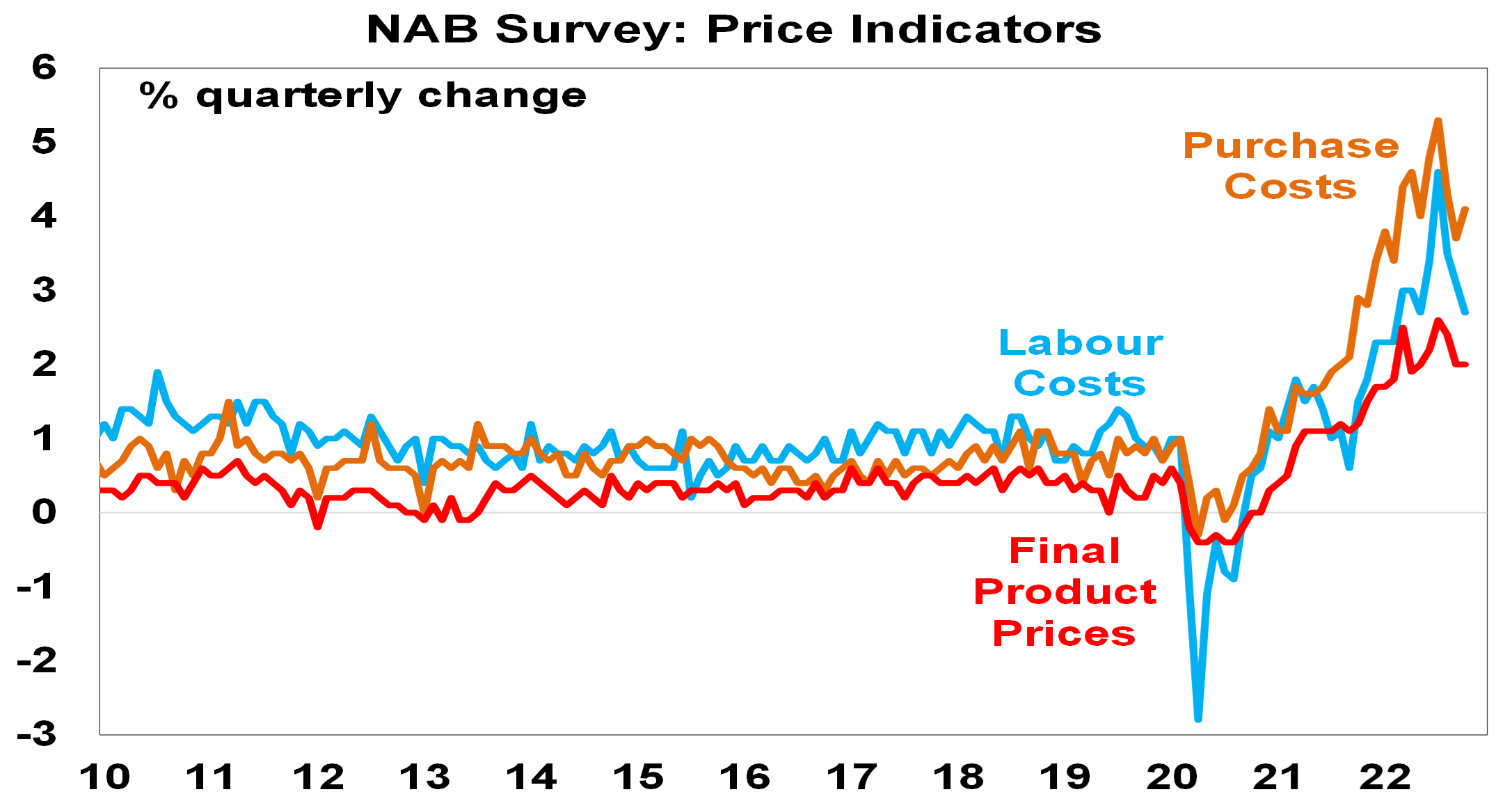

The October NAB business survey showed some slowing in business confidence but still strong business conditions. Capacity utilisation remains ultra strong, but its showing tentative signs of rolling over and cost and price pressures are trending down.

Source, NAB, ABS, AMP

Source: NAB, ABS, AMP

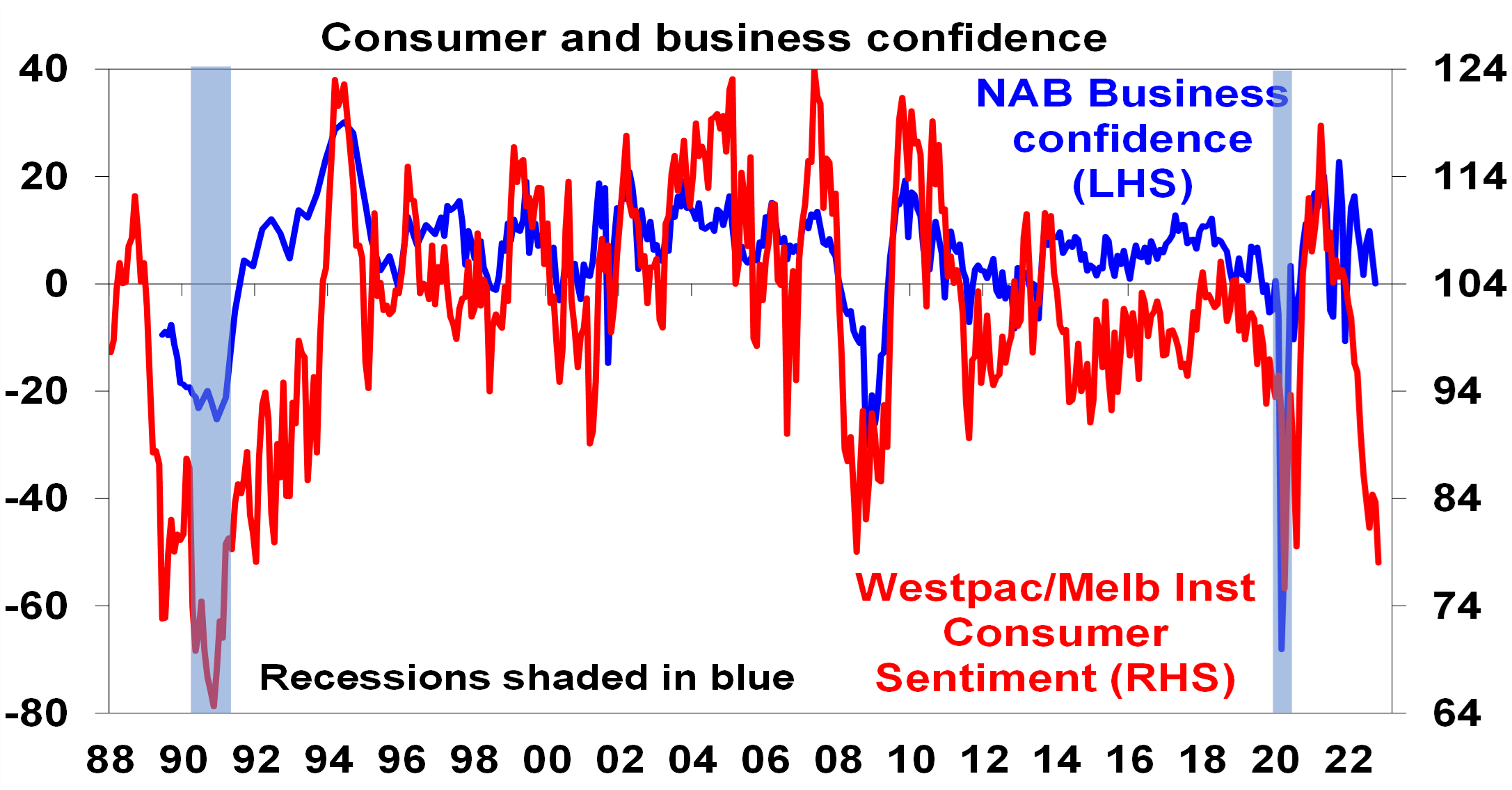

However, consumer confidence plunged to a new cycle low and points to a deterioration in consumer spending along with business confidence and conditions ahead. The fall in confidence was broad based and likely reflects reports of ongoing sharp rises in energy costs and continuing interest rate hikes.

Source: ABS, Melbourne Institute, AMP

Home sales continuing to plunge – with the HIA’s survey of new sales showing a 22.8% plunge in October on the back of rate hikes. Sales are down around 35% on a year ago.

What to watch over the next week?

In the US, producer price inflation for October (Tuesday) is expected to slow slightly to 8.4%yoy, manufacturing conditions in November in the New York and Philadelphia regions (due Tuesday and Thursday) are expected to remain weak, industrial production growth in October is expected to be soft but retail sales growth is likely to bounce back (with both due Wednesday), the NAHB home building conditions index (also Wednesday) is expected to be weak with further falls likely in housing starts (Thursday) and existing home sales (Friday).

UK inflation data is likely to show a rise to 10.5%yoy but Canadian inflation is likely to fall back to 6.8%yoy (both Wednesday)

Japanese September quarter GDP (Tuesday) is expected to rise 0.3%qoq, down from 0.9% in the June quarter, as consumer spending growth slows, and net exports detract. CPI inflation (Friday) for October is likely to have increased to 3.5%yoy but core CPI inflation is likely to rise to just 1.2%yoy.

Chinese economic activity data for October (Tuesday) is expected to be soft with industrial production growth slowing to 5.2%yoy and retail sales slowing to just 0.7%yoy.

In Australia, the minutes from the last RBA Board meeting (Tuesday) are likely to reiterate that it remains committed to bringing inflation back to target and that it expects to raise interest rates further but that its happy moving in 0.25% increments. Interest will be on whether there are any more signs of a pause on rates. September quarter wages data (Wednesday) are likely to be watched closely given the very tight jobs market and the RBA’s comment on “the importance of avoiding a prices-wages spiral”. We expect a further acceleration in wages growth to 0.9%qoq taking it o 3%yoy with the start of the flow through of the 4.6-5.2% increase in minimum-award wages. 3%yoy wages growth will be the strongest pace since 2013 and is roughly in line with RBA forecasts for a rise to 3.1%yoy for year end. Jobs data (Thursday) is expected to show a 20,000 gain in employment and unemployment remaining at 3.5% consistent with the slowing evident in recent months

Outlook for investment markets

Shares are not completely out of the woods yet as central banks continue to tighten, uncertainty about recession remains high and geopolitical risks continue. However, we are now in a favourable part of the year for shares from a seasonal perspective and we see shares providing reasonable returns on a 12-month horizon as valuations have improved, global growth ultimately picks up again and inflationary pressures ease through next year allowing central banks to ease up on the monetary brakes.

With bond yields likely at or close to peaking for now, short-term bond returns should improve.

Unlisted commercial property may see some weakness in retail & office returns & the lagged impact of higher bond yields is likely to drag down unlisted property and infrastructure returns.

Australian home prices are expected to fall 15 to 20% top to bottom into the September quarter next year as poor affordability & rising mortgage rates impact. This assumes the cash rate tops out around 3% but if it rises to 4% or so as the money market is assuming then home prices will likely fall 30%.

Cash and bank deposit returns remain low but are improving as RBA cash rate increases flow through.

The $A remains at risk of further falls in the short term as global uncertainties persist and as the RBA remains a bit less hawkish than the Fed. However, a rising trend is likely over the medium term as commodity prices ultimately remain in a super cycle bull market.

Weekly market update 22-11-2024

22 November 2024 | Blog Against a backdrop of geopolitical risk and noise, high valuations for shares and an eroding equity risk premium, there is positive momentum underpinning sharemarkets for now including the “goldilocks” economic backdrop, the global bank central cutting cycle, positive earnings growth and expectations of US fiscal spending. Read more

Oliver's insights - Trump challenges and constraints

19 November 2024 | Blog Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory. Read more

Econosights - strong employment against weak GDP growth

18 November 2024 | Blog The persistent strength in the Australian labour market has occurred against a backdrop of poor GDP growth, which is unusual. We go through this issue in this edition of Econosights. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.