Key points

- The economic and financial environment today is more challenging than when Trump first took over in 2017: inflation is a bit higher, the budget deficit is worse, bond yields are higher and shares are more expensive.

- He also faces constraints from: rising bond yields; not wanting a sharp fall in shares; a razor thin House majority; and a political mandate to get the “cost of living” down.

- This could mean his more populist policies may ultimately be contained resulting in a better outlook for shares than many fear, albeit it will likely still be rough along the way.

Introduction

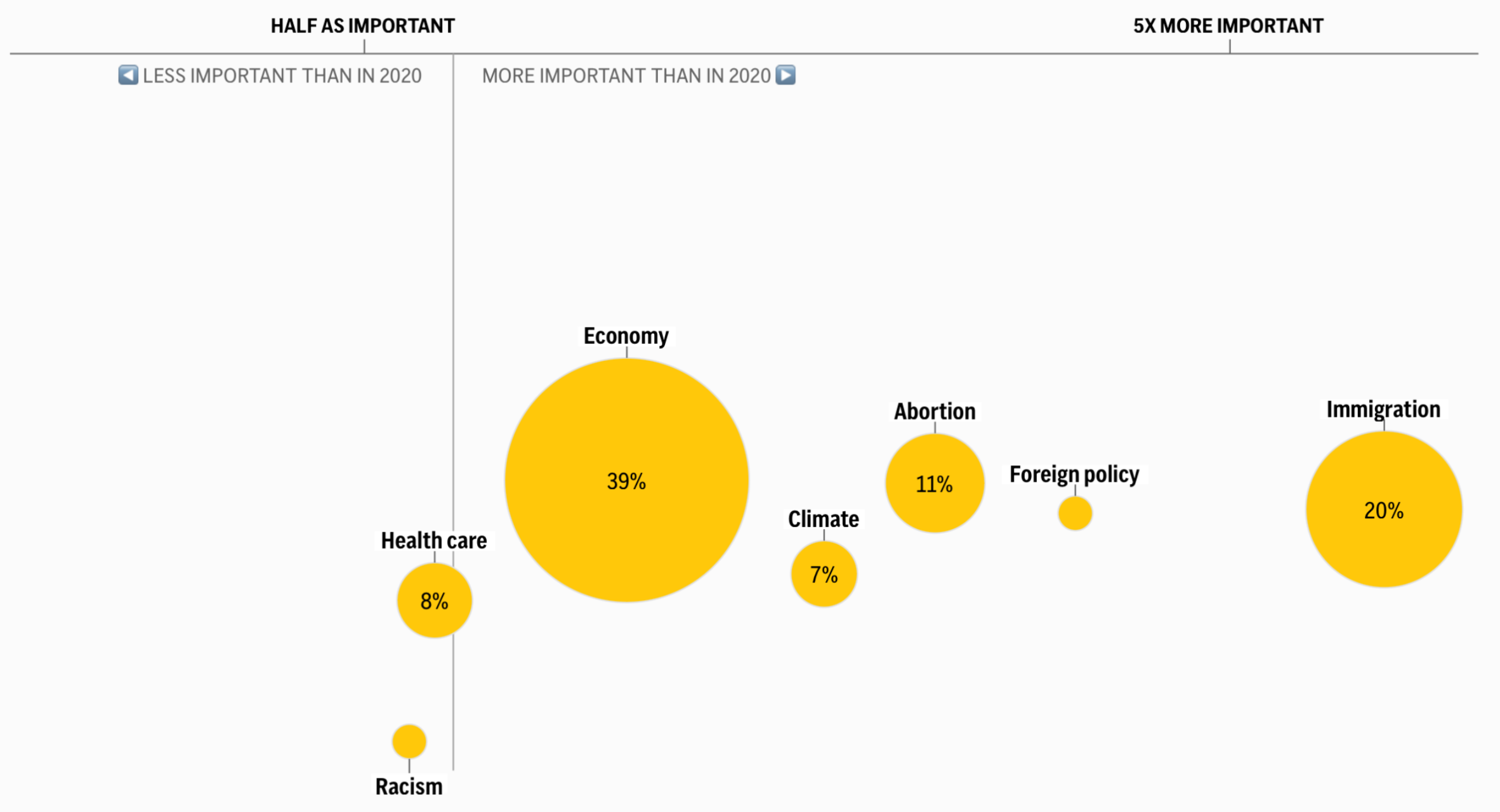

Donald Trump’s US election victory – that saw him win the popular vote (albeit only by 1.7%) with increased support from low income voters, various racial groups, women, the young, etc, with Republican’s having control of Congress - has shocked many. Particularly here in Australia where support for him was always low versus Harris. His detractors – and don’t forget 48.3% of American voters voted for Harris - see him as bad for the environment, diversity/equity and inclusion (DEI), inequality, democracy, the rule of law, global peace and the economy (via bigger budget deficits, inflation and trade wars). Weaker checks and balances this time around – including his inability to run again and more MAGA loyalists in his team suggesting a quick move to implement his policies – are seen as adding to such concerns. On the environment and DEI, it’s hard to argue otherwise as a majority of American voters have clearly put the economy ahead of the environment and DEI. But the old-fashioned “hip-pocket nerve” dominating in times of economic stress is nothing new - with the main issue in the US (Australia and elsewhere) being the rise in the cost of living and the fall in real wages over the last 4 years.

Share of voters saying each issue was the most important

Source: AP VoteCast survey

But environmental and social issues aside, his supporters see him reinvigorating the US and being great for world peace. As is often the case the truth is probably in between, but it could be rough along the way. Straight after the US election result we had a close look at the implications both for investment markets and for Australia in Donald Trump elected President of the US (again). This note looks at the differences between now and when Trump first took over in 2017 and the constraints he faces.

The market reaction becoming more nuanced

Trump’s key policies are to continue the 2017 personal tax cuts, cut corporate tax, impose a 10-20% general tariff and a 60% tariff on China, deregulate and cut bureaucracy, slash immigration and deport people, potentially reduce Fed independence and reverse Biden’s climate policies. The market response to Trump’s victory is becoming a bit more nuanced:

- US bond yields are up 0.8% since mid-September partly on fears his policies will drive higher inflation, budget deficits & Fed interest rates.

- This has seen the $US surge to its highest in more than a year.

- Bitcoin and other crypto currencies have surged (notably Dogecoin) as Bitcoin broke its downtrend since March and on expectations Trump would be supportive of crypto (along with Elon Musk’s appointment to co-run the “department of government efficiency (DOGE)).

- But global shares are starting to have a tougher time with US shares reversing 50% of their post-election surge and non-US shares have been underperforming on concerns US tariffs will be bad news, albeit it hasn’t held Australian shares back which have hit a record high.

There is good reason for this more nuanced response from shares.

Big differences compared 2016

Some point to the Trump 1.0 experience of 2017-20 as being okay economically (apart from Covid which wasn’t Trump’s fault, albeit the US response was messy). Through that period shares rose in 3 years out of the 4 for an average gain of 17% pa. Aside from the reality that the world was a bit more peaceful in the 2017-2020 period compared to now, the economic and financial environment today is a bit more difficult.

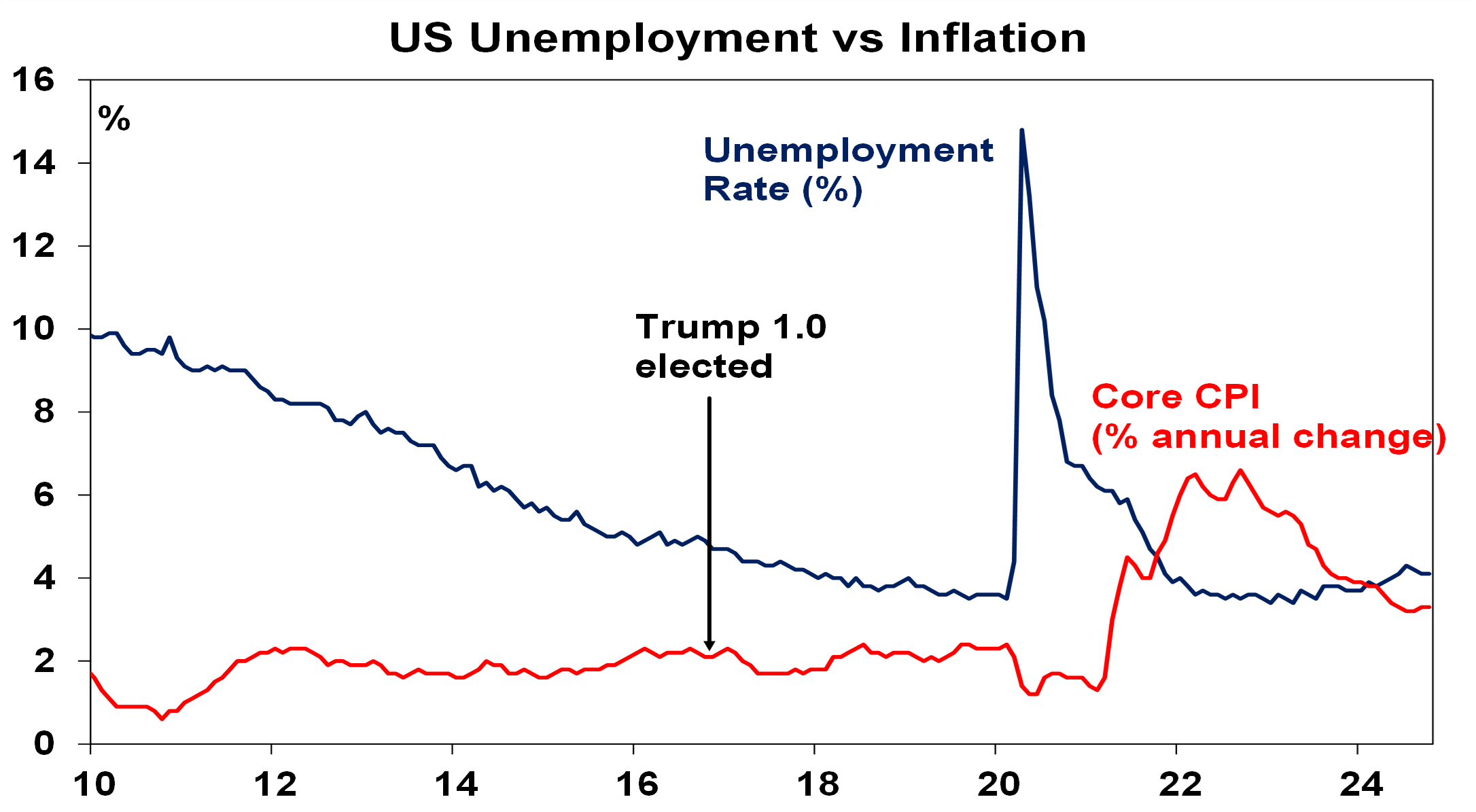

- Inflation is a bit higher: underlying inflation was running around 2% in 2017 with long term inflation expectations around 2.5%, whereas now they are both around 3% with inflation psychology a bit less anchored than it was then after the blow out over the last four years.

Source: Bloomberg, AMP

- Unemployment is bit lower: it was around 5% in early 2017, whereas now it’s just above 4% suggesting the jobs market is tighter.

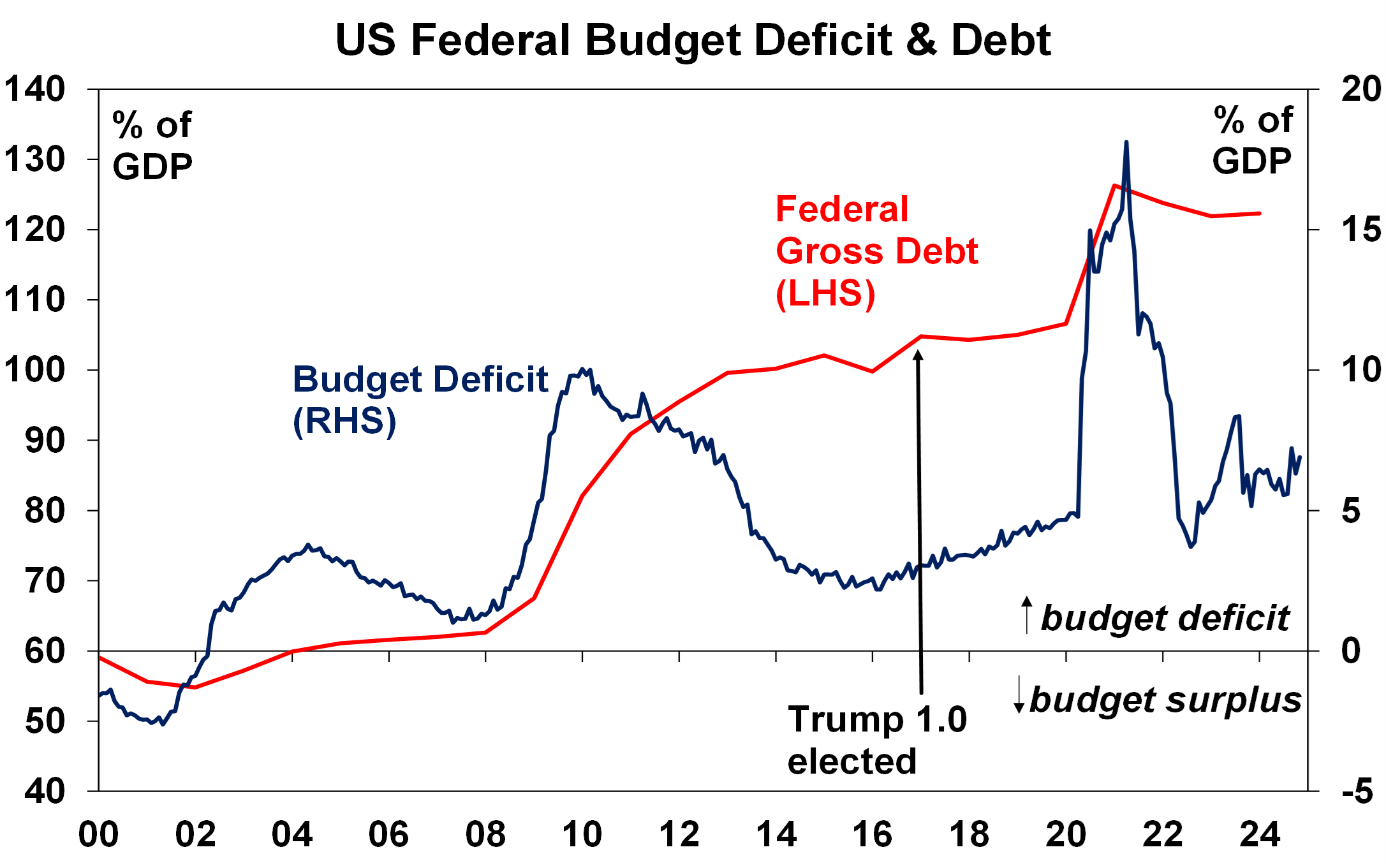

- The budget deficit is worse: in 2017 the budget deficit was around 3% of GDP and gross Federal debt was around 105% whereas they are now pushing 7% and 125% of GDP respectively.

Source: Bloomberg, AMP

- Bond yields are higher: when Trump was elected in 2016 the US 10-year bond yield was 1.8% as disinflation was all the rage, but it’s now 4.4% reflecting the somewhat higher inflationary environment, higher Fed interest rates and the higher budget deficit. Similarly, Australian 10-year bond yields were 2.4% back then versus 4.6% now.

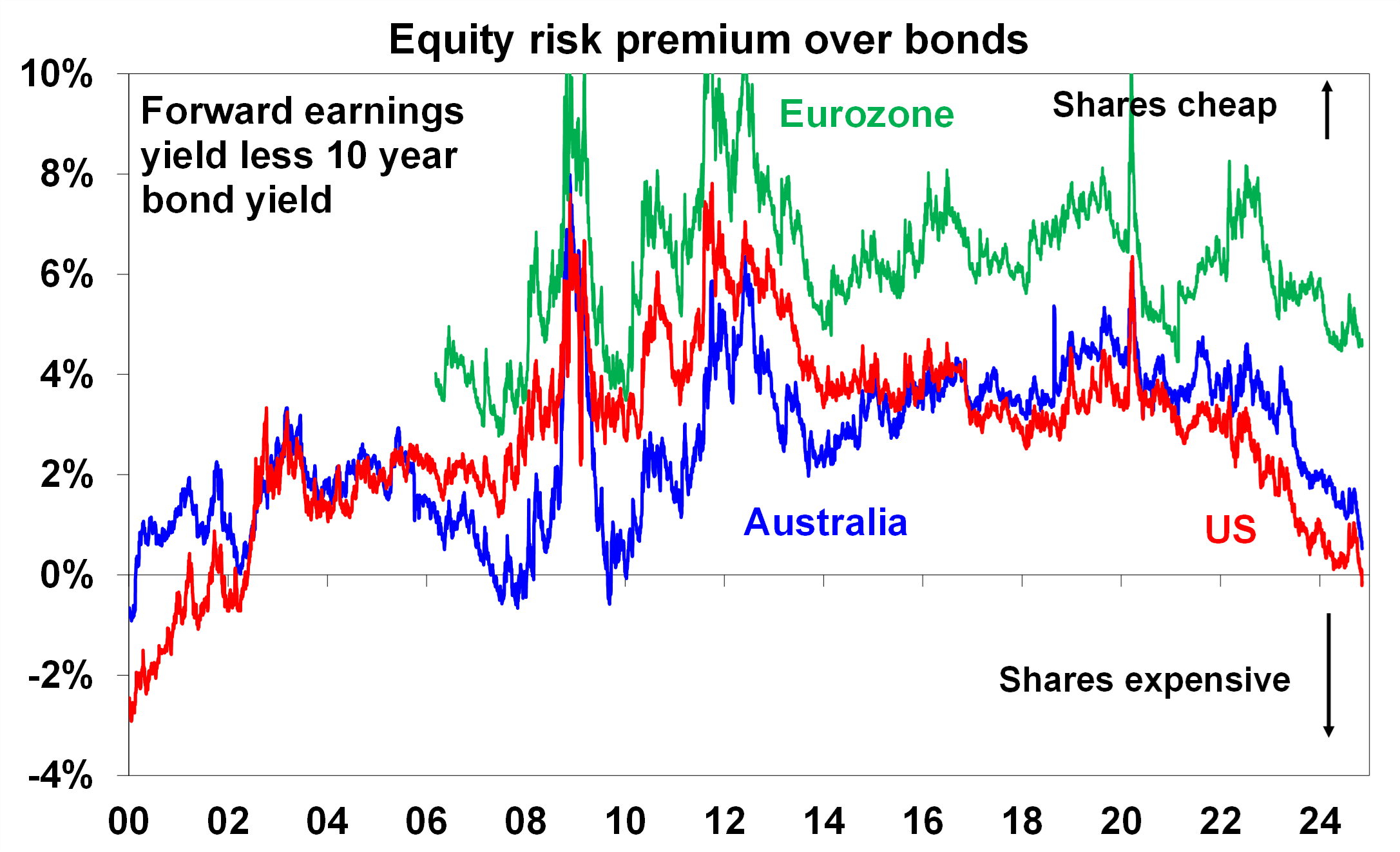

- Shares are more expensive: when Trump was elected in 2016 US shares were trading on a price to consensus 12 months ahead earnings expectations of 17.2 times having just recovered from a rough patch in 2015-16 that saw a 14% correction, but it’s now around 23.7 times after several years of good gains. Don’t forget that just as shares rose strongly over the 2017-20 period under Trump 1.0, they also rose strongly over the last four years under Biden with shares up 3 years out of 4 for an average gain of 16% pa.

- This means US shares are now offering a zero-risk premium over bonds: the gap between the earnings yield using consensus expected 12 months ahead earnings and the 10-year bond yield was around 3% when Trump was elected in 2016, but it’s now slightly negative. It’s a similar story for Australian shares but at least it’s still positive. Similarly, Eurozone shares are now less attractive than in 2016, albeit they offer far more attractive valuations than US shares do.

Source: Bloomberg, AMP

Put simply and taken together this means that the economic and investment environment is more challenging than it was in 2016 at the time of Trump’s last victory. This in turn suggests that the upside in share markets is potentially far more constrained than it was in 2016. This in turn will impose some constraints on Trump which hopefully will constrain his worst policy making.

Constraints on Trump

While the constraints on Trump are not as numerous as was the case in 2017-2020, they are still significant and may help limit his worst populist tendencies. The key constraints are:

- The so-called bond vigilantes – the starting point of higher bond yields and higher public debt means a greater risk of a bond market panic if the deficit outlook gets worse, than was the case in 2017. Back then debt interest expenses on general government debt in the US were around 6% of spending whereas it’s now pushing 10.5% which is worse than Italy. A further sharp rise in yields would threaten US economic growth (with the housing market already back under pressure) and lead to intense political pressure on the Trump Administration to curtail the tax cuts. Much like occurred with the brief UK Truss Government.

- The share market – Trump is still likely to regard the share market as a barometer of his success and would prefer to see it go up. This was evident in 2018 when the near 20% slump (19.8% to be precise) in the US share market from its high in September to low on Christmas Eve 2018 partly in response to the then trade war unnerved him and saw him pivot to the Phase One trade deal with China. In other words, he can tolerate some weakness in shares but once it approaches bear market levels (20% or more) he gets nervous and backs off.

- Conservative Republicans and the mid-terms – The Republican’s razor thin majority in the House means that it will only take a few budget hardline Republican members to insist Trump scale back his tax cuts or fund them via more spending cuts. What’s more 2026 will be another election year and if Republicans are struggling due to a backlash against his policies – e.g. due to cuts to Federal services due to the efforts by Musk’s DOGE to slash government spending or higher inflation flowing from a tariff hikes or a bigger budget deficit or higher interest rates – it will intensify pressure on Trump to tone it down.

- Mandated spending – while Musk has claimed he will cut $US2 trillion out of the Federal spending this is harder than it looks. The total budget is $US6.75 trillion and about two thirds of that is in defence, social security and health and it’s doubtful voters will support that being slashed. Which leaves only $US2.25 trillion to play with.

- Trump’s mandate – while Trump had a strong victory it was mainly around improving the cost of living and controlling immigration. The former likely goes to containing spending (but without slashing it such that ordinary American’s see their cost-of-living rise via higher health and education expenses) and deregulating but not to huge tariff hikes as this will add to the cost of living via higher prices. On this it’s noteworthy that various surveys show that worries about globalisation and trade ranked very low on the list of concerns that voters had. So it's doubtful that American’s will be supportive of a rise in their cost of living flowing from a sharp rise in tariffs.

Concluding comment

Taken together these constraints may ultimately serve to nudge Trump more towards Reagan like supply side reforms and less towards populism with a focus on tariffs. Which could ultimately be a good outcome for investment markets. That said it could still be a rough ride along way – possibly including another perhaps bigger version of the 2018 fall in shares before Trump moderates his policies. But overall, while the starting point for shares is not nearly as positive as it was in 2017 the outlook may not be as bleak as some fear, with global shares likely to provide constrained but still okay returns.

Econosights - strong employment against weak GDP growth

18 November 2024 | Blog The persistent strength in the Australian labour market has occurred against a backdrop of poor GDP growth, which is unusual. We go through this issue in this edition of Econosights. Read more

Weekly market update 15-11-2024

15 November 2024 | Blog Global share markets were messy over the last week, not helped by the ongoing rise in bond yields and a wind back in Fed rate cut expectations after some elevated US inflation data and slightly hawkish comments from Fed chair Powell. Read more

Oliver's insights - staying focused as an investor

12 November 2024 | Blog Dr Shane Oliver suggests five ways to help manage the noise and stay focussed as an investor with the changes in the macro enviroment. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.