Key points

- After a soft patch since 2021, there is good reason to expect the $A to rise into next year: it’s undervalued; interest rate differentials look likely to shift in favour of Australia; sentiment towards the $A is negative; commodities still look to have entered a new super cycle; and Australia is a long way from the current account deficits of the past.

- There is a case for Australian-based investors to remain tilted a bit to hedged global investments but while maintaining a still decent exposure to foreign currency.

- The main downside risks for the $A would be if there is a recession or a new Trump trade war.

Introduction

Changes in the value of the Australian dollar are important as they impact Australia’s international export competitiveness and the cost of imports, including that of going on an overseas holiday. They are also important for investors as they directly impact the value of international investments and indirectly impact the performance of domestic assets like shares via the impact on Australia’s competitiveness. But currency movements are also notoriously hard to forecast. Late last year it seemed the $A was at last on a recovery path but it topped out in December and slid back to $US0.64. Lately it’s been looking stronger again getting above $US0.67. So maybe the five reasons we thought would drive the $A higher in a note last November (see here) are at last starting to work?

The $A has been weak since the mining boom ended

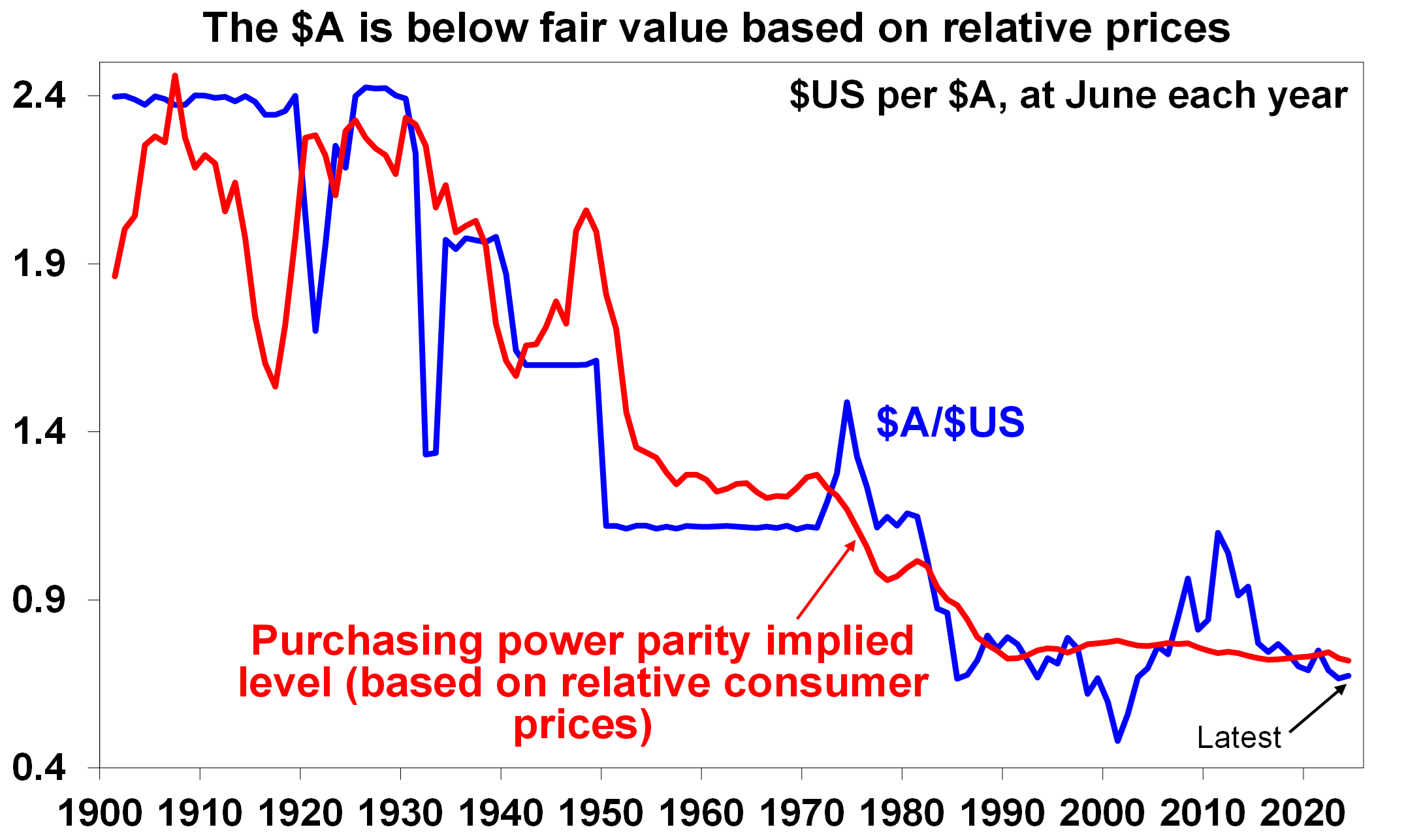

But first some history. Way back in 1901 one $A bought $US2.40 (after converting from pounds to $A pre 1966), but it was a long downhill ride to a low around $US0.48 a century later. See the blue line in next chart.

Source: RBA, ABS, AMP

Thanks to the mining boom of the 2000s, the $A clawed back to $US1.1 by 2011, its highest since the 1981. But since 2011, the $A has been mostly in a downtrend again briefly hitting a low around $US0.57 in the pandemic after which there was a nice rebound into 2021 up to near $US0.80 but with weakness quickly resuming. The key drivers of the weakness since 2011 have been: the end of the commodity boom; increasing worries about the outlook for China which takes around 35% of Australia’s goods exports; a narrowing gap between Australian and US interest rates (which makes it less attractive for investors to park their cash in Australian dollars); and a long term upswing in the value of the $US generally. See the next chart.

Source: Bloomberg, AMP

But there remain five reasons to expect the $A to rise

Back in November we saw five reasons to expect a higher $A. These largely remain valid and the $A seems to be perking up again.

- Firstly, from a long-term perspective the $A remains somewhat cheap. The best guide to this is what is called purchasing power parity (PPP) according to which exchange rates should equalise the price of a basket of goods and services across countries – see the red line in the first chart. If over time Australian prices and costs rise relative to the US, then the value of the $A should fall to maintain its real purchasing power. And vice versa if Australian inflation falls relative to the US. Consistent with this the $A tends to move in line with relative price differentials – or its purchasing power parity implied level – over the long-term. This concept has been popularised over many years by the Big Mac Index in The Economist magazine. Over the last 25 years the $A has swung from being very cheap (with Australia being seen as an old economy in the tech boom) to being very expensive into the early 2010s with the commodity boom. Right now, it’s modestly cheap again at just above $US0.67 compared to fair value around $US0.72 on a purchasing power parity basis.

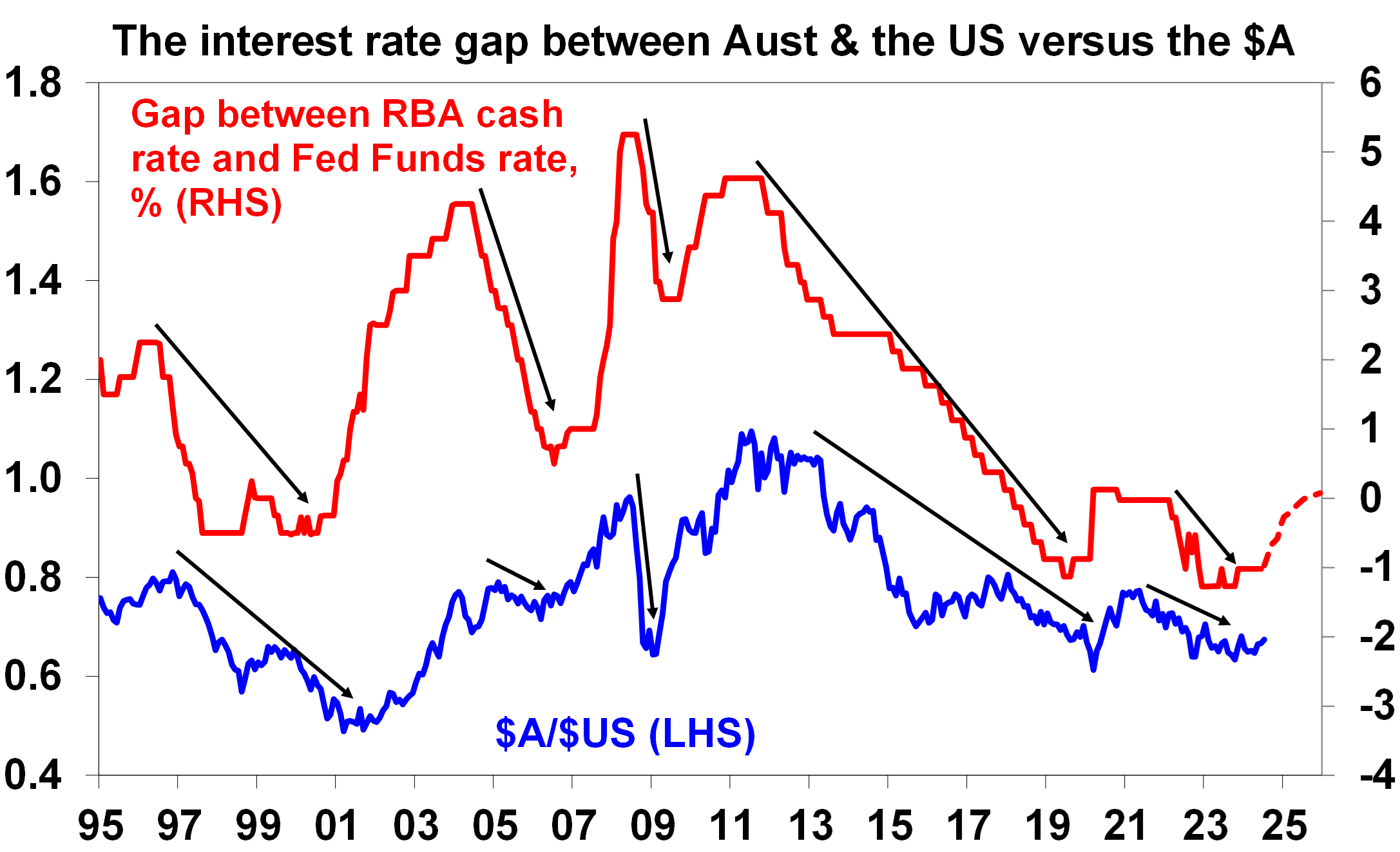

- Second, after much angst not helped by another US inflation scare, relative interest rates might be starting to swing in Australia’s favour with increasing signs that the Fed is set to start cutting rates from September whereas there is still a high risk that the RBA will hike rates further. Central banks in Switzerland, Sweden, Canada and the ECB have already started to cut rates. Money market expectations show a narrowing of the negative gap between the RBA’s cash rate and the Fed Funds rate as the Fed is expected to cut by more than the RBA. As can be seen in the next chart, periods when the gap between the RBA cash rate and the Fed Funds rate falls have seen a fall in the value of the $A (see arrows – and this been the case more recently) whereas periods where the gap is widening have tended to be associated with a rising $A. More broadly the $US is expected to fall further against major currencies as US interest rates top out.

The dashed part of the rate gap line reflects money mkt expectations. Source: Bloomberg, AMP

- Third, global sentiment towards the $A remains somewhat negative, and this is reflected in short or underweight positions. In other words, many of those who want to sell the $A may have already done so, and this leaves it susceptible to a further rally if there is any good news.

Source: Bloomberg, AMP

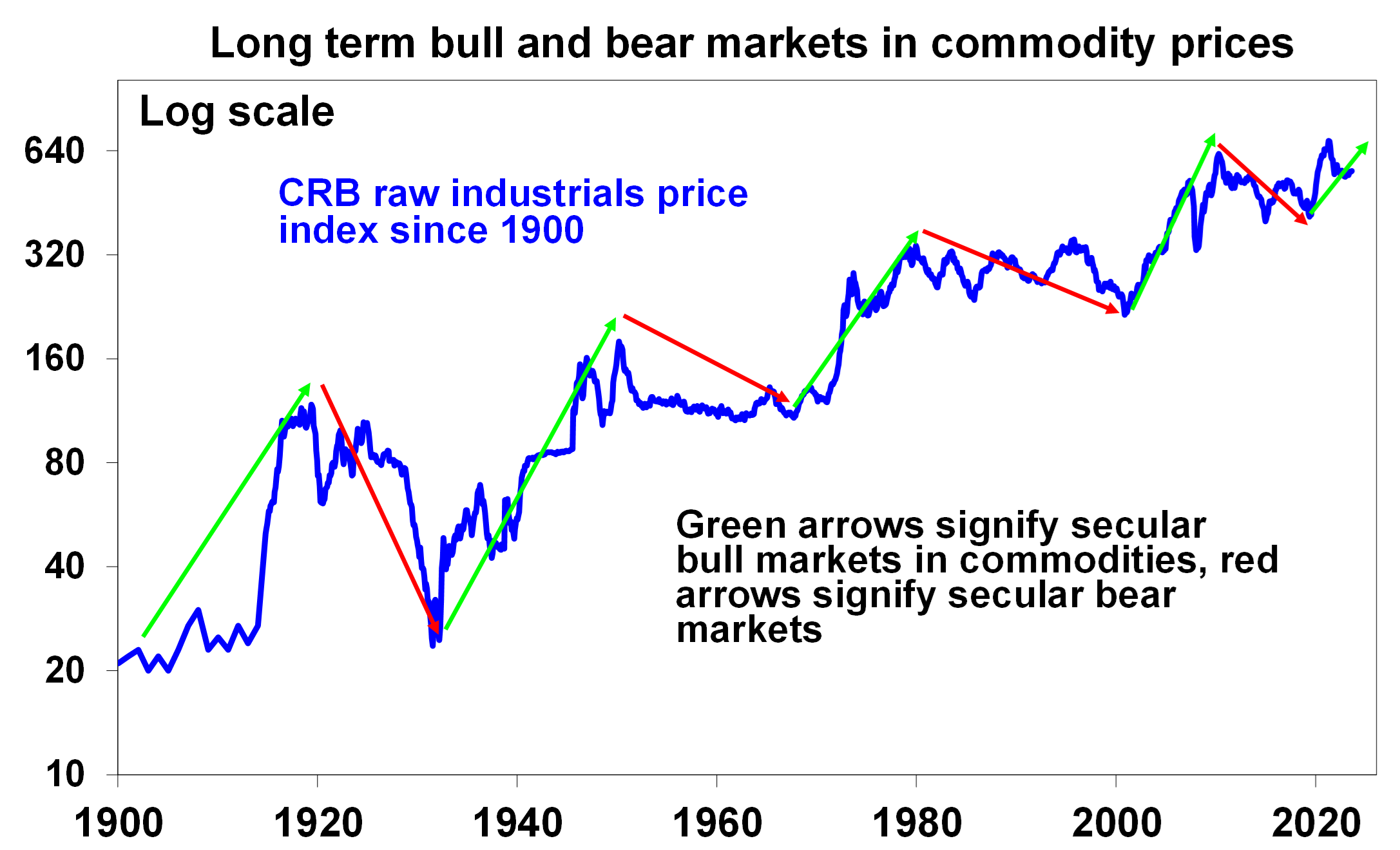

- Fourth, commodity prices look to be embarking on a new super cycle. The key drivers are the trend to onshoring reflecting a desire to avoid a rerun of pandemic supply disruptions and increased nationalism, the demand for clean energy and vehicles and increasing global defence spending all of which require new metal intensive investment compounded by global underinvestment in new commodity supply. This is positive for Australia’s industrial commodity exports.

Source: Bloomberg, AMP

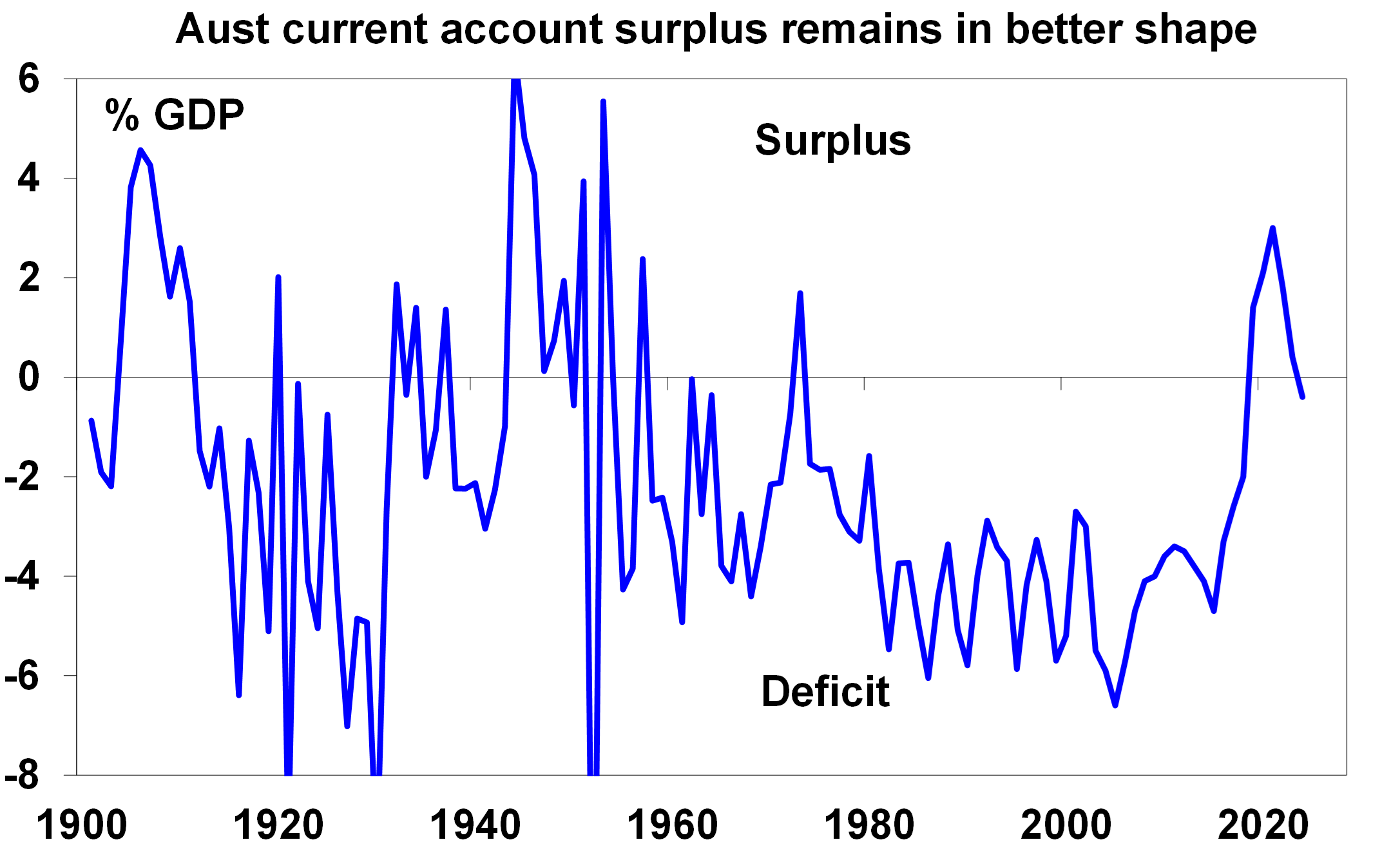

- Finally, Australia’ current account surplus has slipped back into a small deficit as commodity prices have cooled and services imports have risen (particularly, Australian’s travelling overseas) but it remains much better than it used to be over the decades prior to the pandemic. A current account around balance means roughly balanced natural transactional demand for and supply of the $A. This is a far stronger position than pre-COVID when there was an excess of supply over demand for the $A which periodically pushed the $A down.

Source: ABS, AMP

Where to from here?

We expect the combination of the Fed cutting earlier and more aggressively than the RBA, a falling $US at a time when the $A is undervalued and positioning towards it is still short, to push the $A up to around or slightly above $US0.70 into next year.

Recession & a new Trump trade war are the main risks

There are two main downside risks for the $A. The first is if the global and/or Australian economies slide into recession – this is not our base case but it’s a very high risk. The second big risk would be if Trump is elected and sets off a new global trade war with his campaign plans for 10% tariffs on all imports and a 60% tariff on imports from China. If either or both of these occur it could result in a new leg down in the $A, as it is a growth sensitive currency, and a rebound in the relatively defensive $US.

What would a rise in the $A mean for investors?

For Australian-based investors, a rise in the $A will reduce the value of international assets (and hence their return), and vice versa for a fall in the $A. The decline in the $A over the last three years has enhanced the returns from global shares in Australian dollar terms. When investing in international assets, an Australian investor has the choice of being hedged (which removes this currency impact) or unhedged (which leaves the investor exposed to $A changes). Given our expectation for the $A to rise further into next year there is a case for investors to stay tilted towards a more hedged exposure of their international investments.

However, this should not be taken to an extreme. First, currency forecasting is hard to get right. And with recession and geopolitical risk remaining high the rebound in the $A could turn out to be short lived. Second, having foreign currency in an investor’s portfolio via unhedged foreign investments is a good diversifier if the economic and commodity outlook turns sour as over the last few decades major falls in global shares have tended to see sharp falls in the $A which offsets the fall in global share values for Australian investors. So having an exposure to foreign exchange provides good protection against threats to the global outlook.

Weekly market update 12-07-2024

12 July 2024 | Blog Disinflation resumes in the US, RBNZ pivots = positive signs for the RBA; Australian shares hit record, year end forecast revised to 8100; surge in shipping costs less threatening than 3 yrs ago; and more. Read more

Weekly market update 05-07-2024

05 July 2024 | Blog This weekly economic and market report reviews the key developments of the past week for investment markets and the outlook. Read more

Financial year end performance update - July 2024

04 July 2024 | Blog Hear from Stuart Eliot, Head of Portfolio, Stephen Flegg, Senior Portfolio Manager and My Bui, Economist at AMP Investments as they will provide an overview of the financial year end performance for June 2024, and discuss the key drivers and trends in the economy. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.