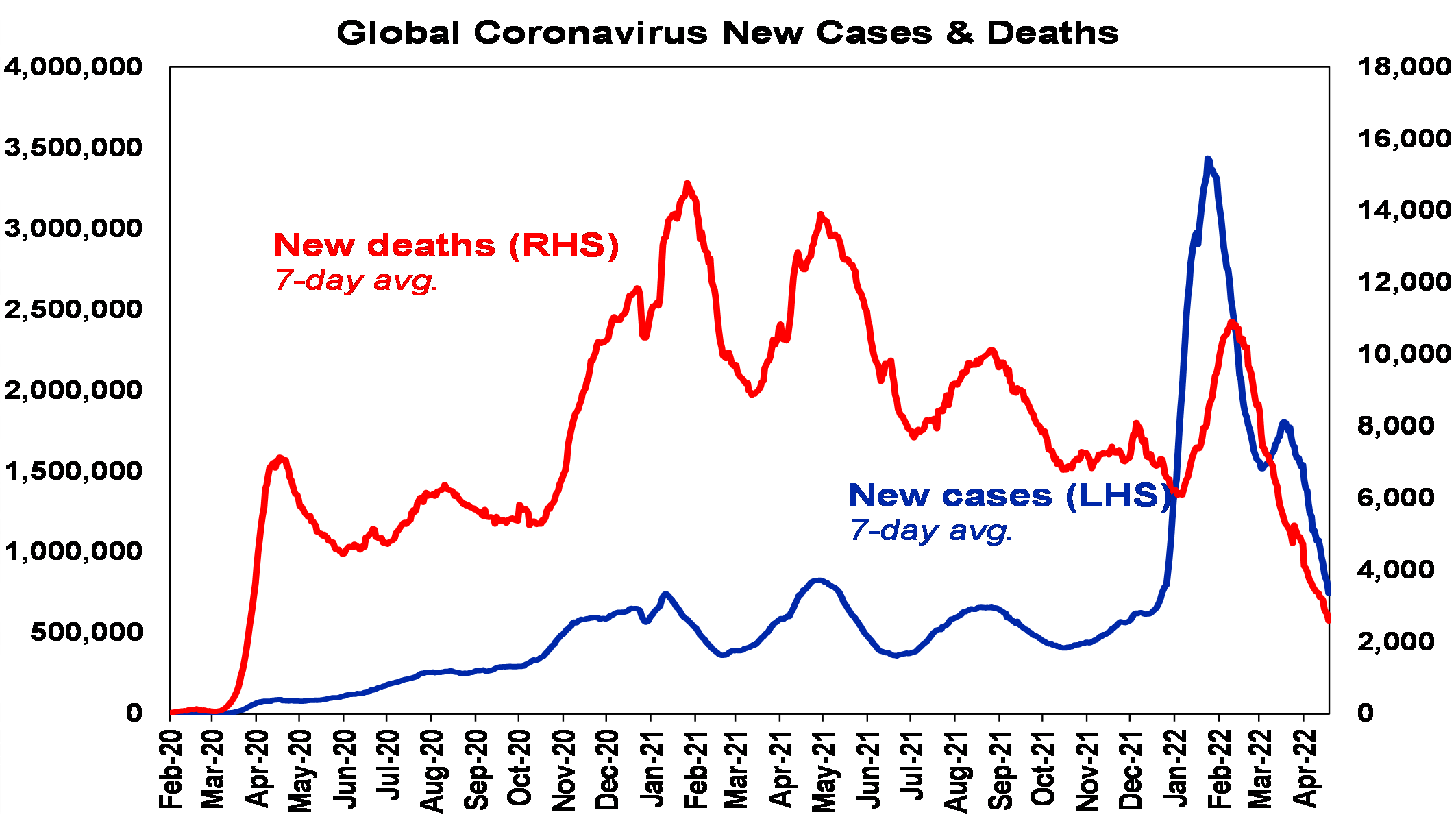

Investment markets and key developments over the past week

Share markets had a good start to the past week, helped by solid US earnings results and expectations that the worst of likely central bank rate hikes may be factored in, but they got hit hard latter in the week as inflation and interest rate concerns returned with a vengeance. While this left Japanese shares flat for the week and Eurozone shares down just 0.1%, US shares fell 2.8% and are now getting close to their March low again. Chinese shares also fell 4.2%, taking them back to their March low. Australian shares almost made it to a record high earlier in the week, but got dragged down on Friday by the resumption of interest rate concerns, particularly after hawkish comments from the US Federal Reserve (Fed). For the week, the ASX 200 fell 0.7%, with sharp falls in resources and information technology shares more than offsetting gains in health, industrial and utility shares. Bond yields continued to rise. Metal, oil and iron ore prices fell, as did the $A, with the $US continuing to rise.

While the Australian share market was dragged down over the last week, it remains up slightly year to date in contrast to US, European and Japanese shares, which are down significantly year to date. The main driver of its relative resilience is its high commodity exposure – which is similar to the experience of the UK, Brazilian and Mexican share markets, which are also flat to up year to date. The Australian share market’s relative outperformance is likely to continue as commodity prices remain strong and in a new super cycle, albeit there are likely to be a few gyrations along the way, as commodity prices in the short term are vulnerable to the slowdown in China.

The bad news is that share market volatility is likely to remain high in the short term, with the risk of further sharp falls and a possible re-test of March lows. Increasingly hawkish central banks in the face of high inflation, higher bond yields, continuing uncertainty around the war in Ukraine which now looks to be escalating again, China’s COVID lockdowns depressing growth and adding to supply delays and new talk of possible tax hikes in the US to fund a slimmed down Build Back Better program ahead of the US mid-terms all risk making for a continuing volatile short term ride in share markets.

More high inflation numbers and hawkish comments from central banks. On the inflation/interest rate front, a further sharp increase in Canadian inflation to 6.7%yoy and NZ inflation to 6.9%yoy in March will keep their central banks on track for further rate hikes. Comments from Fed officials continue to point to more aggressive rate hikes ahead taking the Fed Funds rate to “neutral” or above, with Chair Powell saying a 0.5% hike is “on the table” for May and indicating support for the idea of “front-end loading” rate hikes. While European Central Bank (ECB) President Lagarde was balanced in her comments, several ECB council members were hawkish, leaning to a rate hike in the September quarter. Reserve Bank of Australia (RBA) minutes also confirmed that it’s gearing up for the start of rate hikes, noting that higher inflation and wages growth “have brought forward the likely timing of the first increase in interest rates.”

March quarter Australian inflation data to be released Wednesday will likely further pressure the RBA to start raising rates. Our base case remains that the first RBA rate hike will be 0.15%, taking the cash rate to 0.25% and come in June, as the RBA will prefer to avoid hiking in the election campaign and wants to see March quarter wages data (due 18 May) before moving. But it’s now a very close call as to whether the first hike will be in May or June. Business surveys and numerous anecdotes of price rises point to another surge in inflation in the March quarter. We are expecting an increase in the CPI of 1.7%qoq or 4.6%yoy for the March quarter, with trimmed mean inflation of 1.2%qoq or 3.4%yoy. This is well above implied RBA expectations from February for a 0.7-0.8%qoq rise in both. The likely further blowout in Australian inflation means that Australia is now starting to face the same risk as in various other countries; that inflation expectations will get out of control, locking in higher than target inflation, making it even harder to get inflation back down again. As such, if inflation comes in around our forecasts, there will be a strong case for the RBA to hike in May and that the first hike should be 0.4% (taking the cash rate to 0.5%), as 0.15% won’t send a particularly strong signal in terms of its resolve to keep inflation expectations down. By year end, we expect the cash rate to have increased to 1-1.25%, but market expectations for a rise to 2.4% look too hawkish and seem to be taking their lead from expectations for the Fed.

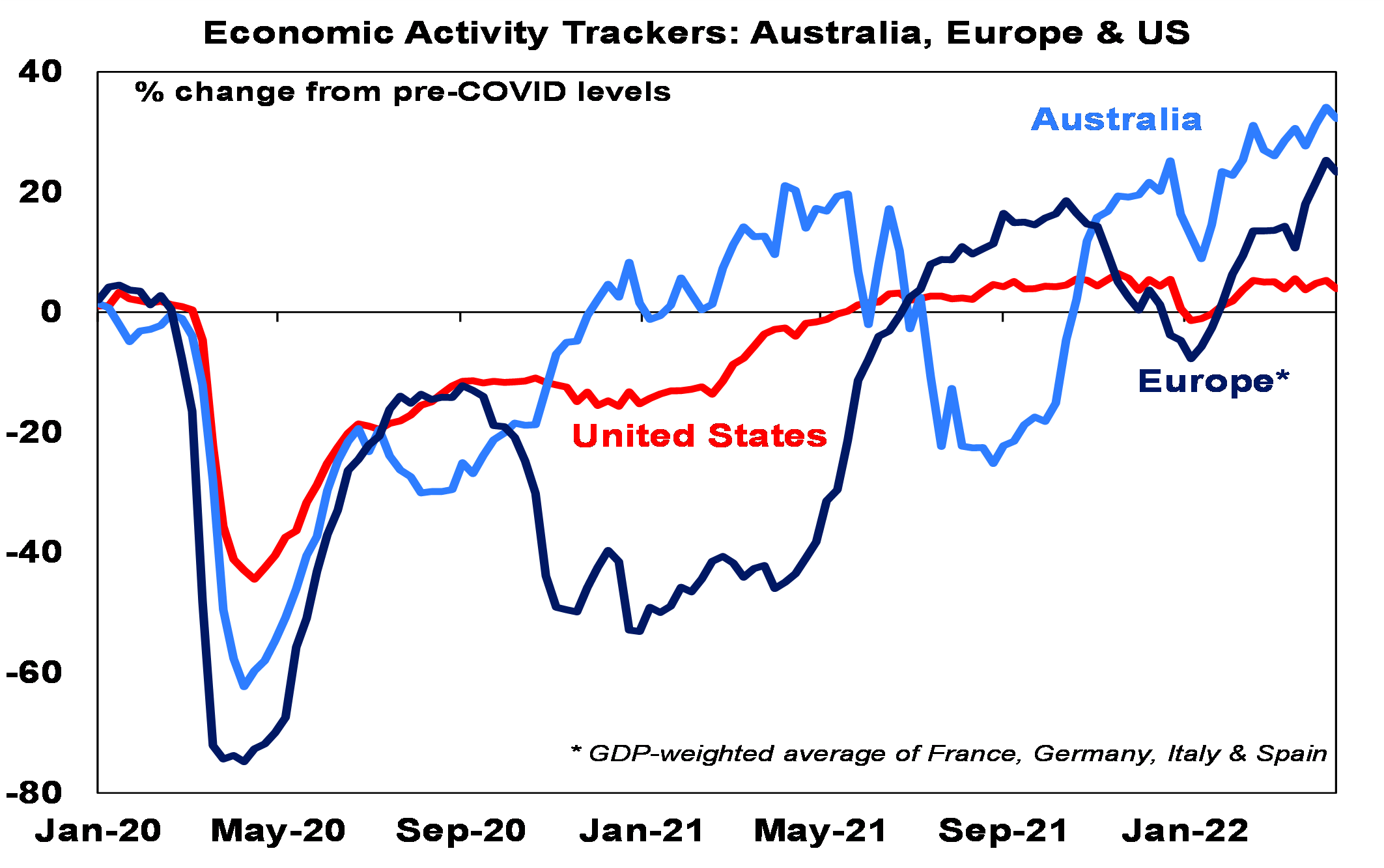

However, the good news is that recession still looks like it can be avoided in the next 12 months, and this should enable shares to be higher on a 12 month horizon. While Europe is most at risk of recession, so far, our European Economic Activity Tracker is still rising. In the US the 10yr/2yr bond yield curve has steepened again and the traditional 10yr/Fed Funds rate version of the yield curve is also still steepening and even if they do both invert soon, the lag to recession in the US from such an inversion has historically averaged 18 months. This takes us to late next year, which is too far away for share markets to get too worried about just yet. In the meantime, March quarter US earnings are coming in far stronger than expected again. In Australia meanwhile, there is no sign of recession and even if the RBA starts hiking in May, tight monetary policy is unlikely to be reached until mid-next year.

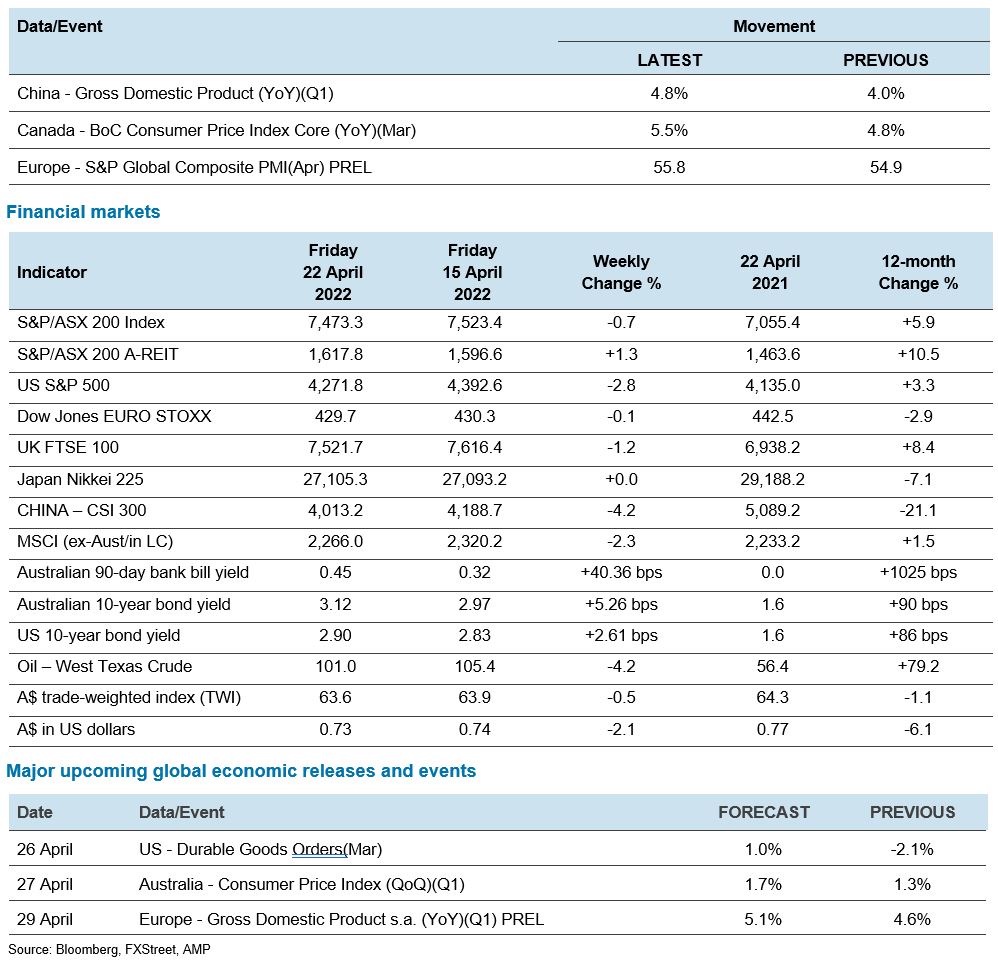

Some relief for central banks is also likely later this year, as various indications suggest inflationary pressures may be peaking – as evident in our US Pipeline Inflation Indicator.

Based on commodity prices, shipping rates, PMI price components. Source: Macrobond, AMP

Base effects (where very high CPI increases a year ago start to drop out of year-on-year calculations), a rolling over in petrol prices, easing shipping costs and used car prices and rising inventory levels suggest we may have seen the peak in year-on-year inflation in the US and this will likely apply to other countries too – albeit with a lag as we don’t expect Australia inflation to peak to mid-year. Inflation will still be too high to stop short term monetary tightening but a peaking in inflation may allow some slowing in the pace of rate hikes later this year.

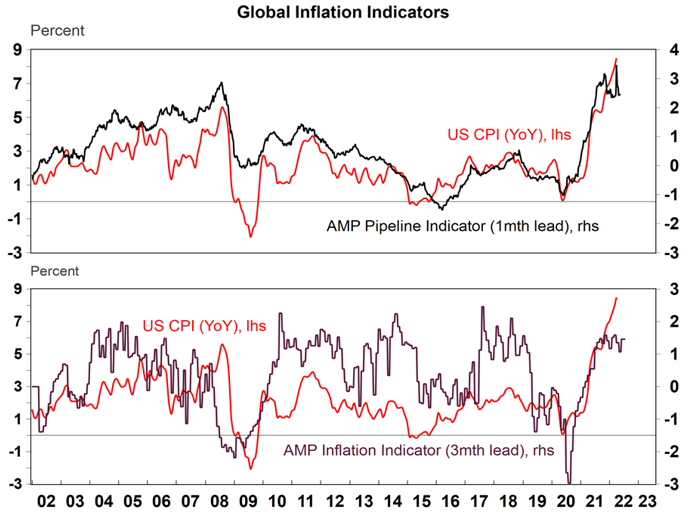

While the IMF downgraded its global growth forecast to 3.6% for this year from 4.4% and revised its inflation forecasts up, this is old news as private forecasters and investment markets had already moved to factor it in. The revision was mainly due to the disruption to economic activity and boost to inflation from the invasion of Ukraine. Russia’s growth forecast was revised to -8.5% and European growth was revised down to 2.8%. The IMF’s growth forecast for Australia was revised up to 4.2% (our forecast is 4.5%) – one of the few major countries to see an upgrade!

Source: IMF, AMP

Emmanuel Macron returned as French president with a projected 58% of the vote, which is around 1-2% ahead of the more recent polls in the second-round runoff with Marine Le Pen. This is positive for continued European integration, European resolve against Russia and a continuation of President Macron’s French economic reform program, depending on June parliamentary elections. Which in turn means it’s a positive outcome for European assets.

Despite the possible perception that I may be mostly stuck in or around 1969 music wise, I do listen to a lot of other stuff. Vance Joy is really impressive with Lay It On Me and Riptide being super cool.

Coronavirus update

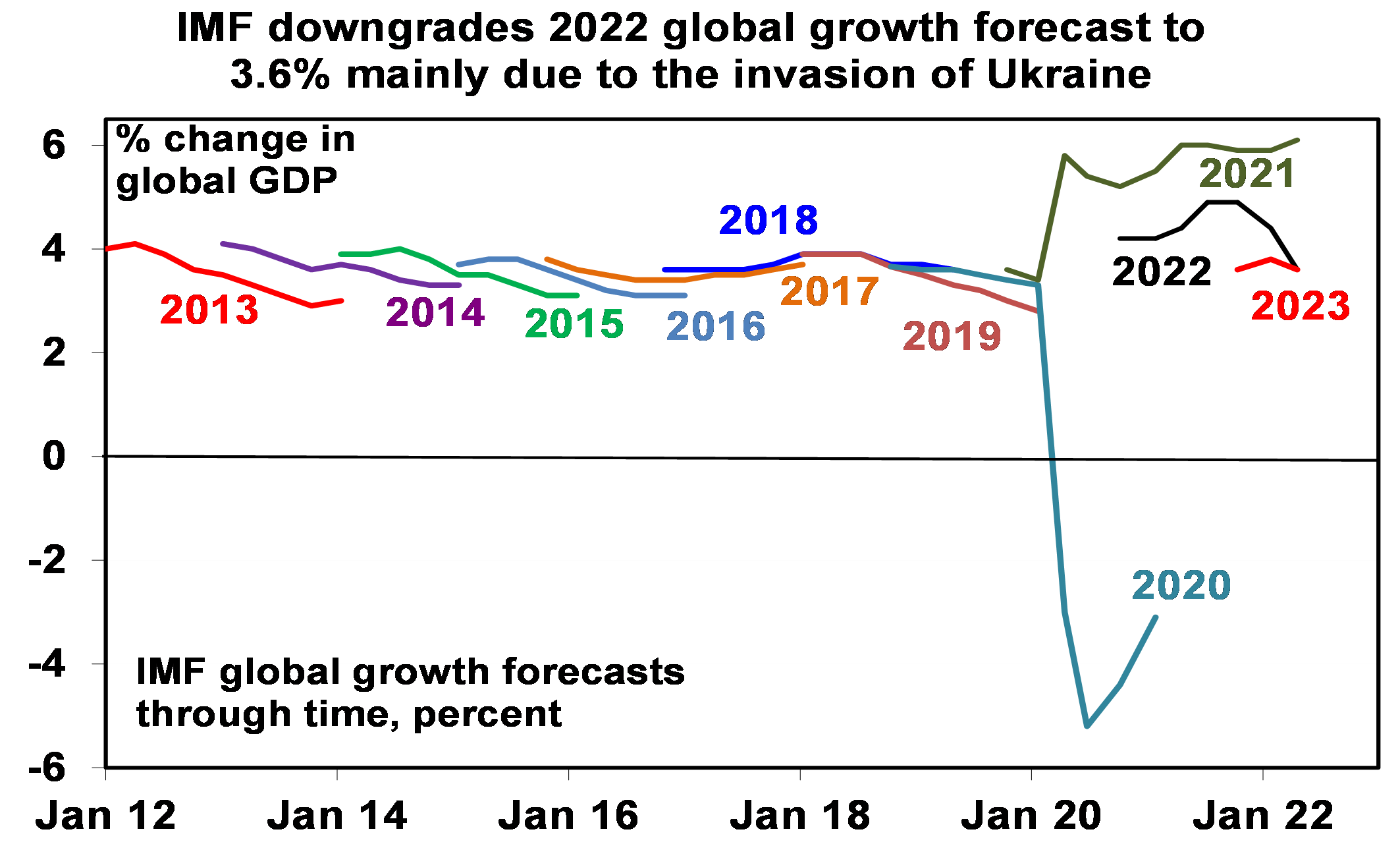

New global Covid cases are continuing to fall sharply with declines in Europe, the UK and Asia.

Source: ourworldindata.org, AMP

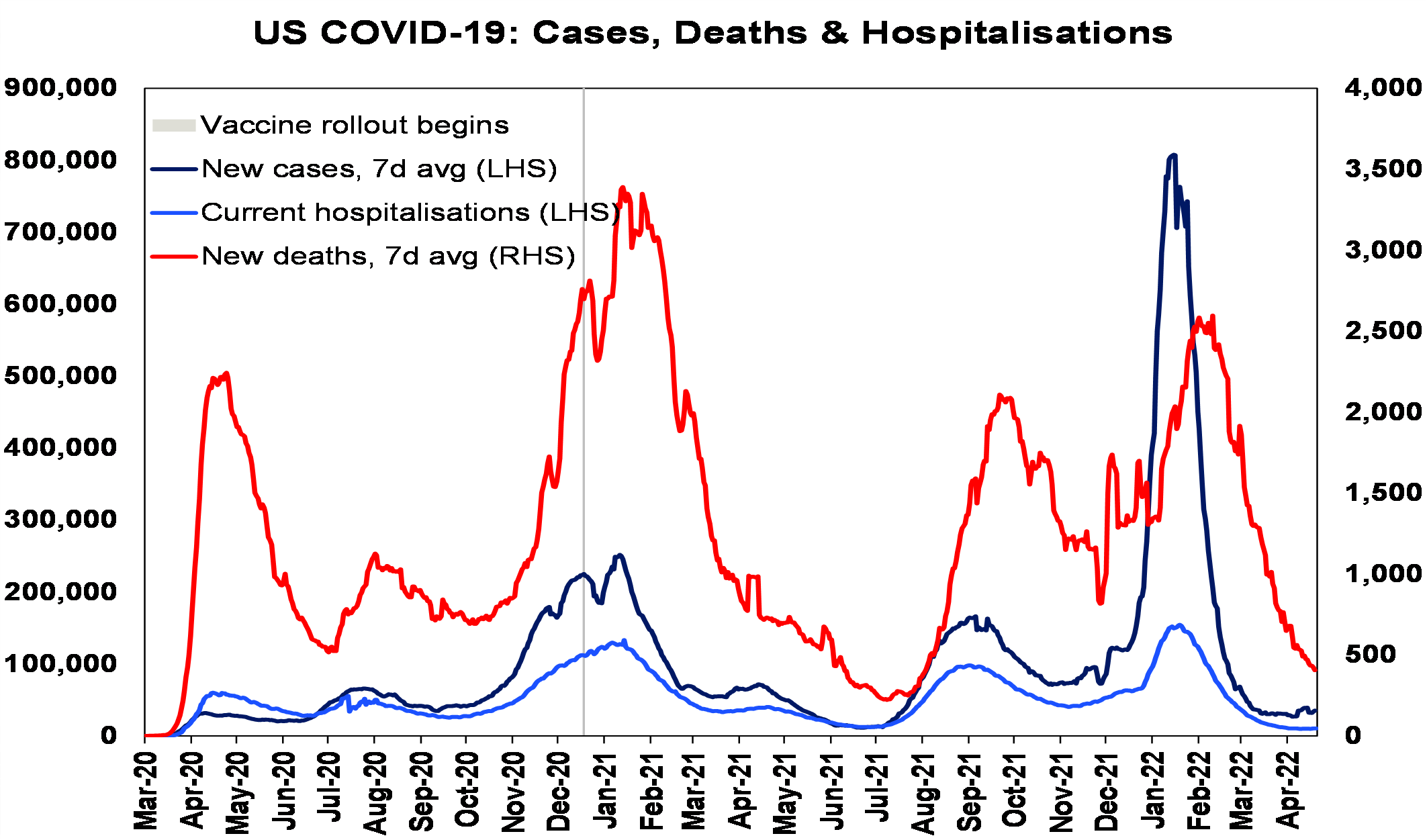

The US has seen an increasing proportion of states seeing rising new cases, but overall new cases remain relatively low.

Source: ourworldindata.org, AMP

China has seen some slowing in new cases but is continuing to see a rise in restrictions threatening Chinese growth and adding to global supply chain disruptions.

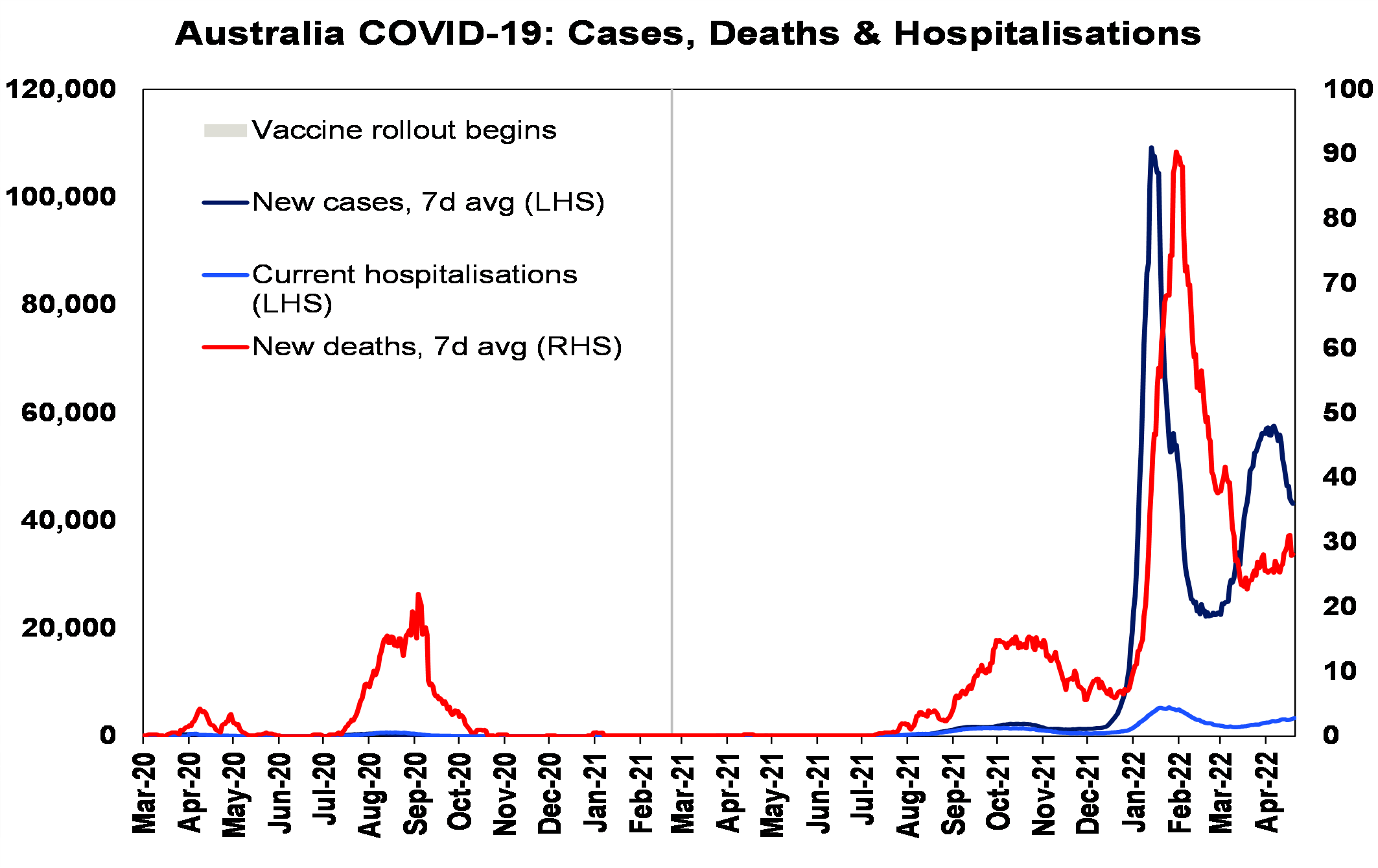

New cases in Australia have continued to trend down although this looks to have been exaggerated over Easter by a fall in testing.

Source: ourworldindata.org, AMP

Hospitalisation and death rates generally remain low across various major countries compared to pre-Omicron waves, with vaccines and prior exposure providing protection against serious illness, better treatments and the Omicron variants being less harmful than prior covid variants. 59% of the global population is now vaccinated with two doses and 23% have had a booster. In developed countries its 75% and 47%, with Australia at 84% and 52%. The main risk remains the mutation of a more contagious and more harmful variant in lowly vaccinated poor countries where vaccination rates are only rising very slowly.

Economic activity trackers

Our Australian Economic Activity Tracker fell slightly over the last week but remains strong suggesting the economy is continuing to grow at a solid pace. Our European and US Trackers also fell slightly with that for Europe remaining surprisingly strong.

Based on weekly data for e.g, job ads, restaurant bookings, confidence, mobility, credit & debit card transactions, retail foot traffic, hotel bookings. Source: AMP

Major global economic events and implications

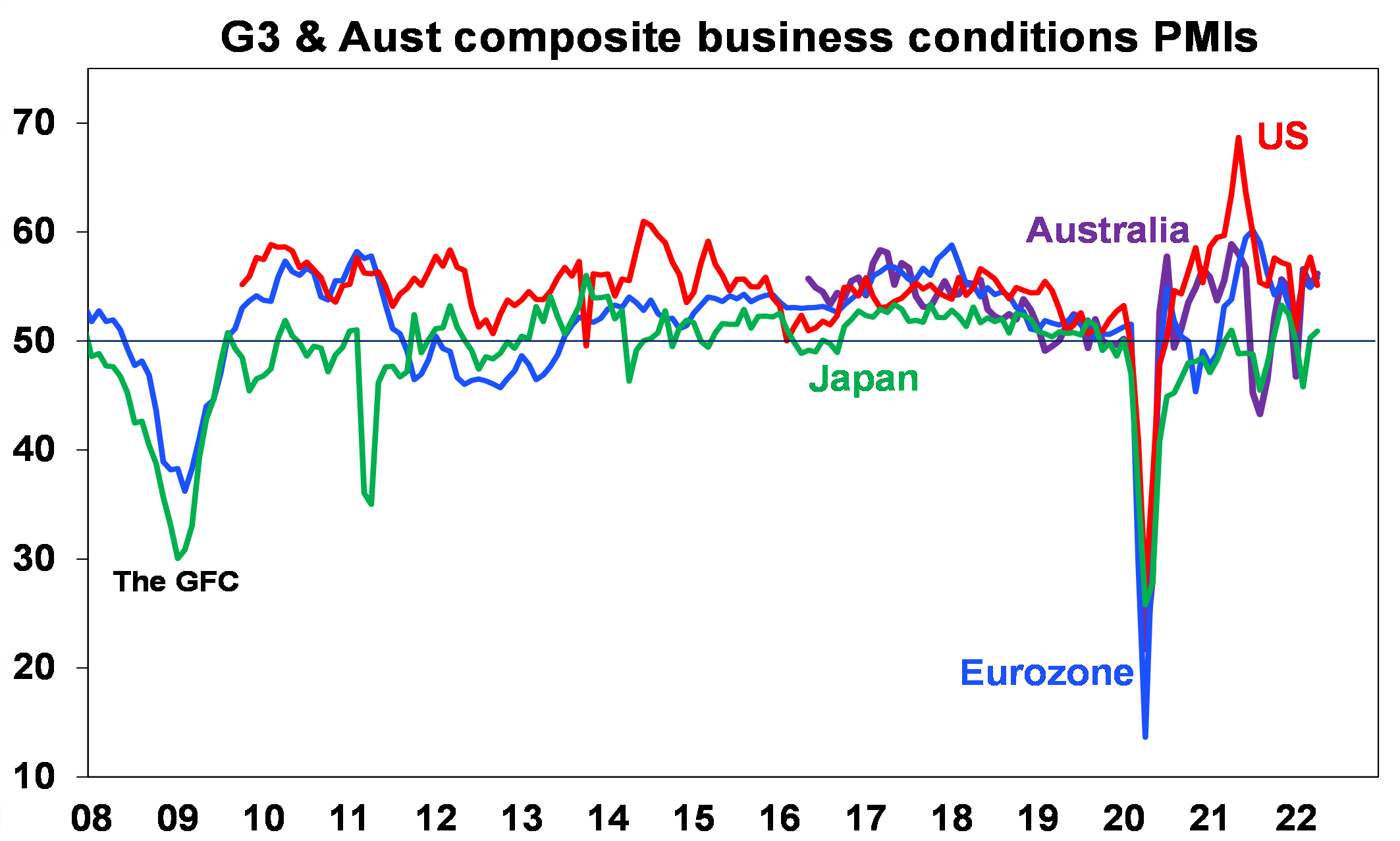

Business conditions PMIs remained reasonably strong in April, with declines in the US and UK, but increases in Europe, Japan and Australia. The G3 average composite PMI fell 0.8pts, but to a stillstrong 54.7.

Source: Bloomberg, AMP

Unfortunately, input and output price measures for manufacturers generally rose further in major developed countries. US data was dominated by housing related releases in the past week, and they were mixed. While housing starts and permits surprisingly rose, the NAHB’s home builder conditions index and existing home sales fell - with mortgage rates rising above their last high of 2018 not helping. That said, the weakness in home sales may largely reflect a lack of stock on the market and the homeowner vacancy rate is at a record low, suggesting that home building will likely remain relatively strong. Meanwhile, manufacturing conditions remained strong in April, with the manufacturing conditions PMI rising and strong readings for the Philadelphia and New York manufacturing indexes. Services conditions weakened though, which dragged down the US composite PMI for April. Jobless claims fell, with continuing claims at their lowest since 1970. The PMI survey showed price pressures remaining very high.

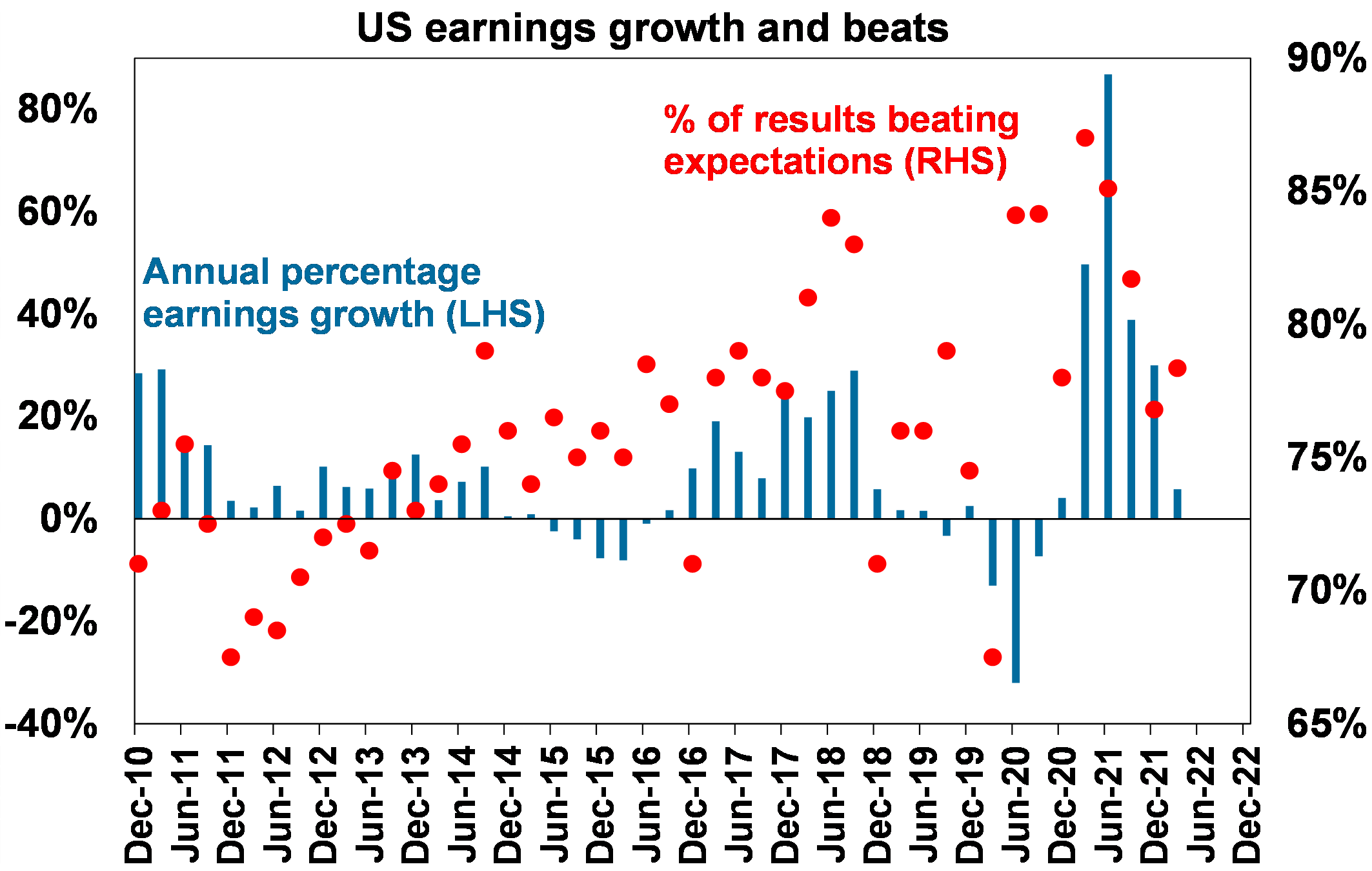

So far, 20% of US S&P 500 companies have reported December quarter earnings, with 78% beating expectations (compared to a norm of 76%). Consensus earnings expectations for the quarter have moved up from 4.3%yoy a week ago to now 5.8%yoy, but with the average beat running at around 8%, its likely to end up at around 12%yoy. This is well down from the growth pace seen in the previous four quarters, but they were pushed up by the initial recovery from the pandemic. Energy, materials and industrials are seeing the strongest earnings growth. The continuing strength in earnings is an ongoing source of support for the US share market - Key to watch going forward though will be the impact of rising costs.

Source: Bloomberg, AMP

Eurozone business conditions PMIs rose in April, with manufacturing in Germany down but services up. Price pressures remained very high.

Canadian CPI inflation rose more than expected to 6.7%yoy in March, with underlying inflation rising to 3.8%yoy, keeping the Bank of Canada on track for further rate hikes.

Similarly in New Zealand, inflation rose to 6.9%, with further rises in underlying inflation. While fractionally less than expected, it will also keep the Royal Bank of New Zealand on track for further rate hikes.

Japanese business conditions PMI’s rose in April, but only to a relatively soft reading of 50.9. Inflation rose to 1.2%yoy in March on the back of higher energy prices, but core inflation only rose to -0.7%yoy.

Chinese economic activity data slowed in March by less than expected, but further weakness is likely. March quarter GDP growth came in slightly stronger than expected, at 4.8%yoy and industrial production and investment slowed in March, but by less than expected. However, March retail sales contracted by 3.5%yoy and unemployment rose. With COVID lockdowns expanding and continuing into this quarter and high frequency weekly data running well below levels from a year ago, a further sharp slowing in growth is likely. More policy support is likely, but the People’s Bank of China (PBOC), with just a 0.25% cut to bank required reserves last week and no cut to interest rates, appears reluctant to be too aggressive. So much of the focus will likely be on credit easing and fiscal stimulus.

Australian economic events and implications

Australian business conditions PMIs remained strong in April, actually rising slightly, suggesting that economic growth remains solid despite Omicron’s continuing disruptions for the workforce and supply constraints (see the last chart above). Price pressures remain high though.

What to watch over the next week?

In the US, March durable goods orders are likely to have increased, home prices are likely to show another strong rise and consumer confidence is likely to be little changed (all due Tuesday), March quarter GDP (Thursday) is likely to show a 1.0% annualised rise well down from the December quarter gain of 6.9%, March quarter employment costs are likely to have increased by a strong 1.1%qoq and March core private final consumption deflator inflation is likely to have slowed slightly to 5.3%yoy from 5.4%yoy (all due Friday). The March quarter earnings reporting season will also continue.

Eurozone March GDP data (Friday) is likely to have been depressed by the start of the war in Ukraine with the consensus expecting a 0.3%qoq rise or 5.1%yoy. Economic confidence data for April (Friday) is likely to have fallen further but April inflation data is likely to show a further acceleration. And as noted earlier the second round of the French presidential election is on 24th April, with investment markets only likely to react (negatively) if there is a Le Pen victory.

The Bank of Japan (Thursday) is likely to leave its extremely easy monetary policy on hold but will be watched closely to see whether it maintains its yield curve control in the face of the falling Yen. Jobs data is due Tuesday and industrial production data is due Thursday.

China’s business conditions PMIs for April due on Friday and Saturday are likely to weaken further reflecting covid lockdowns.

In Australia, another blowout inflation report for the March quarter on Wednesday is likely to confirm that the start of RBA interest rate hikes is imminent. We expect the CPI to rise by 1.7%qoq or 4.6%yoy driven in particular by a 9.5% rise in petrol prices, a strong rise in food prices not helped by the floods and the war and a surge in home building costs but with the trimmed mean measure of underlying inflation also up a strong 1.2%qoq or 3.4%yoy. Various business surveys, the Melbourne Institutes’ Inflation Gauge and numerous anecdotes of prices hikes in the quarter for everything from fridges to canned good point to another high inflation reading with the risks on the upside to our forecasts. As a result, inflation is likely to come in well above implied RBA forecasts for a 0.7-0.8%qoq rise in the CPI and underlying inflation. The RBA may yet wait till after it gets to see March quarter wages data on 18th May and until after the 21 May election and tighten in June, but another blowout inflation outcome in line or higher than our forecasts would suggest it should really start hiking in May.

In other data in Australia, which is all due on Friday, March quarter producer price inflation is also likely to rise sharply and credit data is likely to show continuing strength in housing credit growth reflecting record housing finance commitments.

Outlook for investment markets

Shares are likely to see continued volatility as the Ukraine crisis continues to unfold and inflation, monetary tightening, the US mid-term elections and geopolitical tensions with China and maybe Iran impact. However, we see shares providing upper single digit returns on a 12 month horizon as global recovery continues, profit growth slows but remains solid and interest rates rise but not to onerous levels at least for the next year.

Still low yields & a capital loss from a further rise in yields are likely to result in negative returns from bonds.

Unlisted commercial property may see some weakness in retail and office returns (as online retail activity remains well above pre-covid levels and office occupancy remains well below pre-covid levels), but industrial property is likely to be strong. Unlisted infrastructure is expected to see solid returns.

Australian home price gains are likely to slow further with average prices falling from mid-year as poor affordability, rising mortgage rates, reduced home buyer incentives and rising listings impact. Expect a 10 to 15% top to bottom fall in prices from mid-year year into 2024 but with large variation between regions. Sydney and Melbourne prices may have already peaked.

Cash and bank deposits are likely to provide poor returns, given the ultra-low cash rate of just 0.1% at present but rising through the second half of the year as the RBA raises interest rates.

A rising trend in the $A is likely over the next 12 months helped by strong commodity prices, probably taking it to around $US0.80.

More investment insights

Super and tax changes that could affect you from 1 July 2024

01 July 2024 | Blog A number of changes to the super and tax system could create opportunities for Australians of all ages. Here’s what’s happening. Read more

Super bring-forward rules now apply to more people

01 July 2024 | Super More Australians can make up to three years’ worth of non-concessional super contributions in the same financial year, with the government making this option available to individuals up to the age of 75. Read more

Paying off mortgage or contribute to super?

01 July 2024 | Blog Are you better off putting extra money into superannuation or the mortgage? Here are some rules you can follow to work out what’s right for you Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.