Key points

- Despite most major central banks being close to the top of the interest rate cycle, bond yields have been rising again.

- This is due to a better economic backdrop keeping interest rate expectations elevated, the fading of yield curve control in Japan, the deterioration in the US fiscal situation and an increase in US Treasury bond issuance.

- Rising bond yields threaten the equity outlook because it makes equities look relatively more expensive.

- Bond yields could rise further if the US fiscal situation deteriorated further (beyond a short-lived government shutdown) or if inflation rebounded again. This is a risk, but high recession risks for 2024 should keep a lid on bond yields.

Introduction

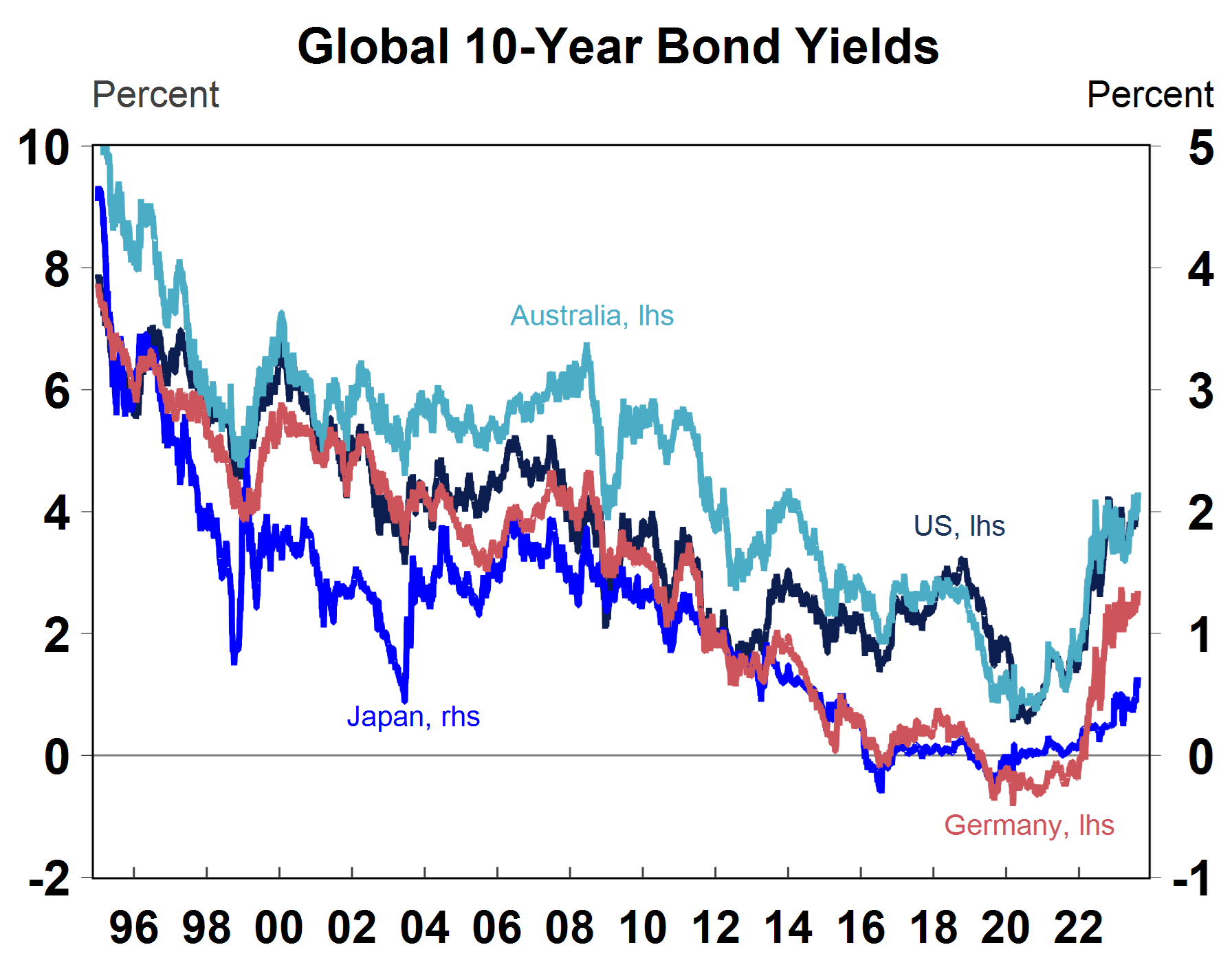

Global bond yields are rising again, despite interest rates across most major economies at or close to a peak for this cycle. Higher US yields are leading the charge. US 10-year bond yields reached over 4.3% in August, its highest level since 2007 (see the chart below). The rise in yields has been driven by several simultaneous factors including a better economic backdrop keeping interest rate expectations elevated, the fading of yield curve control in Japan which has lifted Japanese bond yields and flowed through to other countries and the deterioration in the US fiscal situation which has also led to higher US treasury issuance. We go through these factors in this edition of Econosights and look at the impact of rising bond yields.

Source: Macrobond, AMP

Real interest rates and inflation expectations

The nominal interest rate on a bond is the combination of a real yield (a compensation for the risk of investing in the security which is influenced by expectations for the level of real interest rates set in the economy) and expected inflation (often referred to as “breakeven inflation”). Inflation expectations increased in early-mid 2022 and pushed up bond yields at the time but more recently, the rise in bond yields has been due to a rise in real yields (see the chart below) which has occurred as the Federal Reserve has lifted interest rates, while inflation expectations have been stable.

Source: Bloomberg, AMP

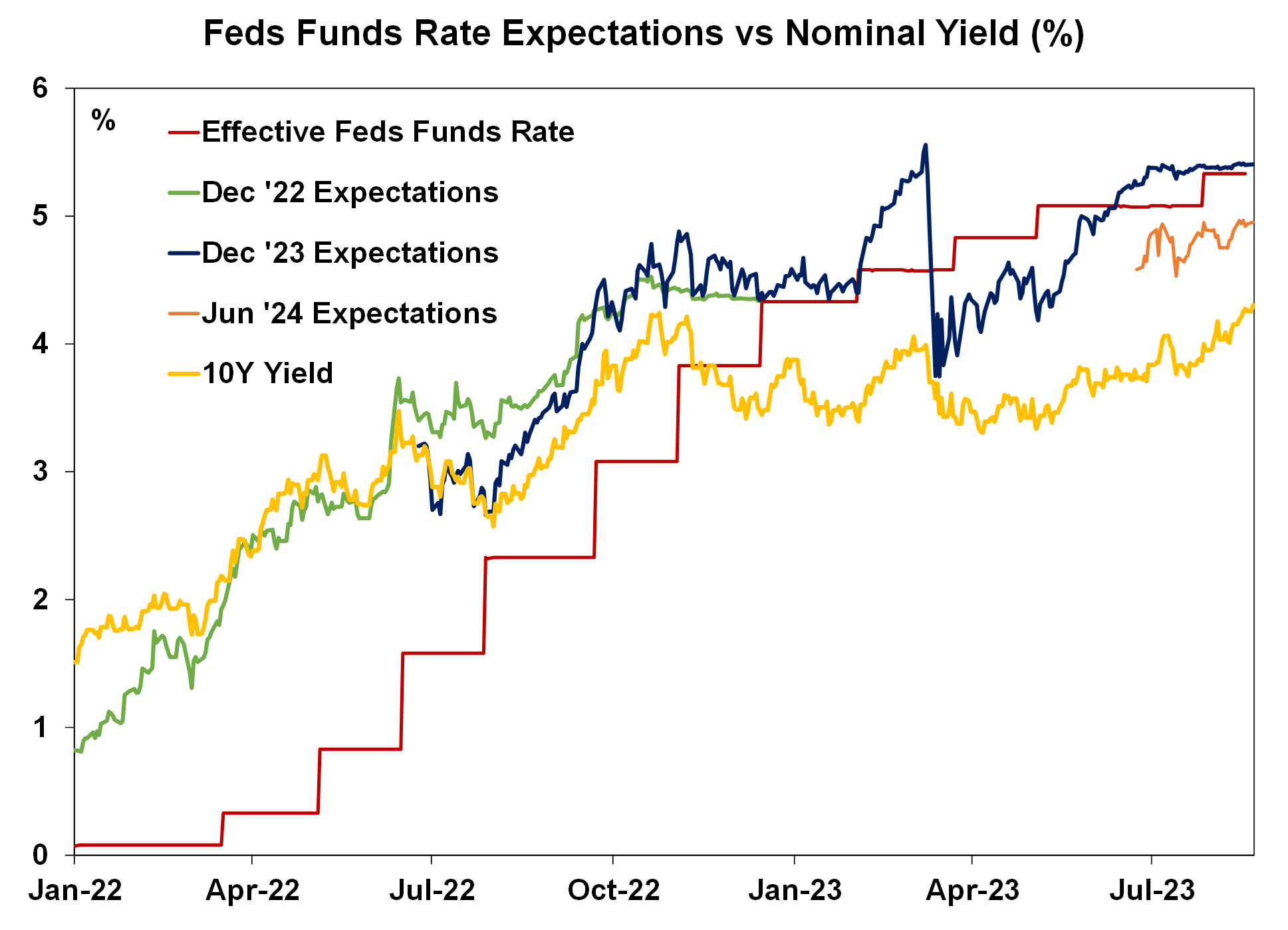

A year ago, markets were expecting a 3.4% Fed Funds rate by December 2023 and this increased to a peak of 5.5% in March 2023 which led to some rise in bond yields. The banking crisis in March 2023 then saw Fed Funds rate expectations plunge (see the chart below). Since March, markets have been increasing their expectations for the Fed Funds rate, now expecting 5.4% by December this year (which has been consistent over recent months) and just under 5% by June 2024 (which indicates some rate cuts). A few months ago, markets were expecting more rate cuts in 2024 due to high recession risks and were projecting a fed funds rate of around 4.5% by June 2024. Strong US economic data is prolonging the economic cycle, keeping interest rate expectations elevated and pushing recession expectations further out which is helping to lift bond yields.

Source: Bloomberg, AMP

The risk of a US recession in 2023 is now low. The Atlanta Fed’s GDPNow forecast of third quarter annualised GDP growth has increased to a strong 5.8% (after 2.4% in the second quarter) thanks to a recent boost from strong housing and retail sales figures. However, the risk of a downturn in 2024 remains high.

The deterioration in the US fiscal situation

Rising bond yields also reflect concern about the deteriorating US fiscal backdrop. The budget deficit has improved from a Covid high of 18.4% of GDP to 5% in October 2022 but has started deteriorating again (it is currently around 8.4%) due to the pressures of lower tax revenue, higher interest rates and more discretionary spending (see the chart below). The polarisation between the Democrat and Republicans has not been helpful to address progress on some of the long-term pressures on the budget. As a result, it wasn’t surprising that ratings agency Fitch downgraded the US credit rating from AAA to AA+ in August.

Source: Macrobond, AMP

Recent government policy announcements like the Inflation Reduction Act and CHIPS Act will add to the budget deficit from FY24. Deals done around the time of the debt ceiling imposed some spending caps for the next two years but did little for the long-term structural pressures on the budget.

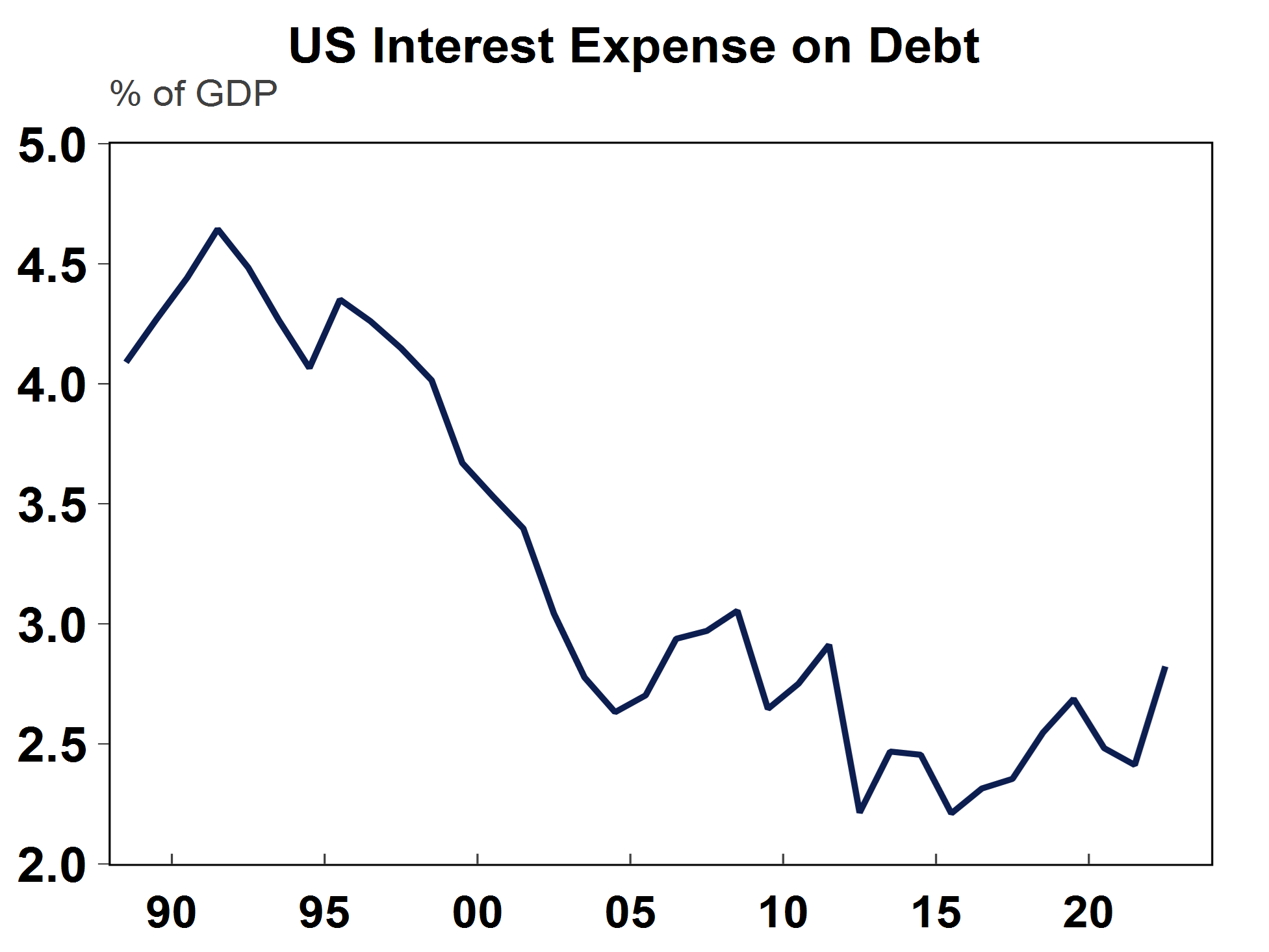

In particular, rising interest payments are a major issue for the budget deficit with interest payments as a share of GDP rising to 2.8% in 2022, its highest level since 2011 and is projected to reach 3.8% over the next decade – see the chart below.

Source: Macrobond, AMP

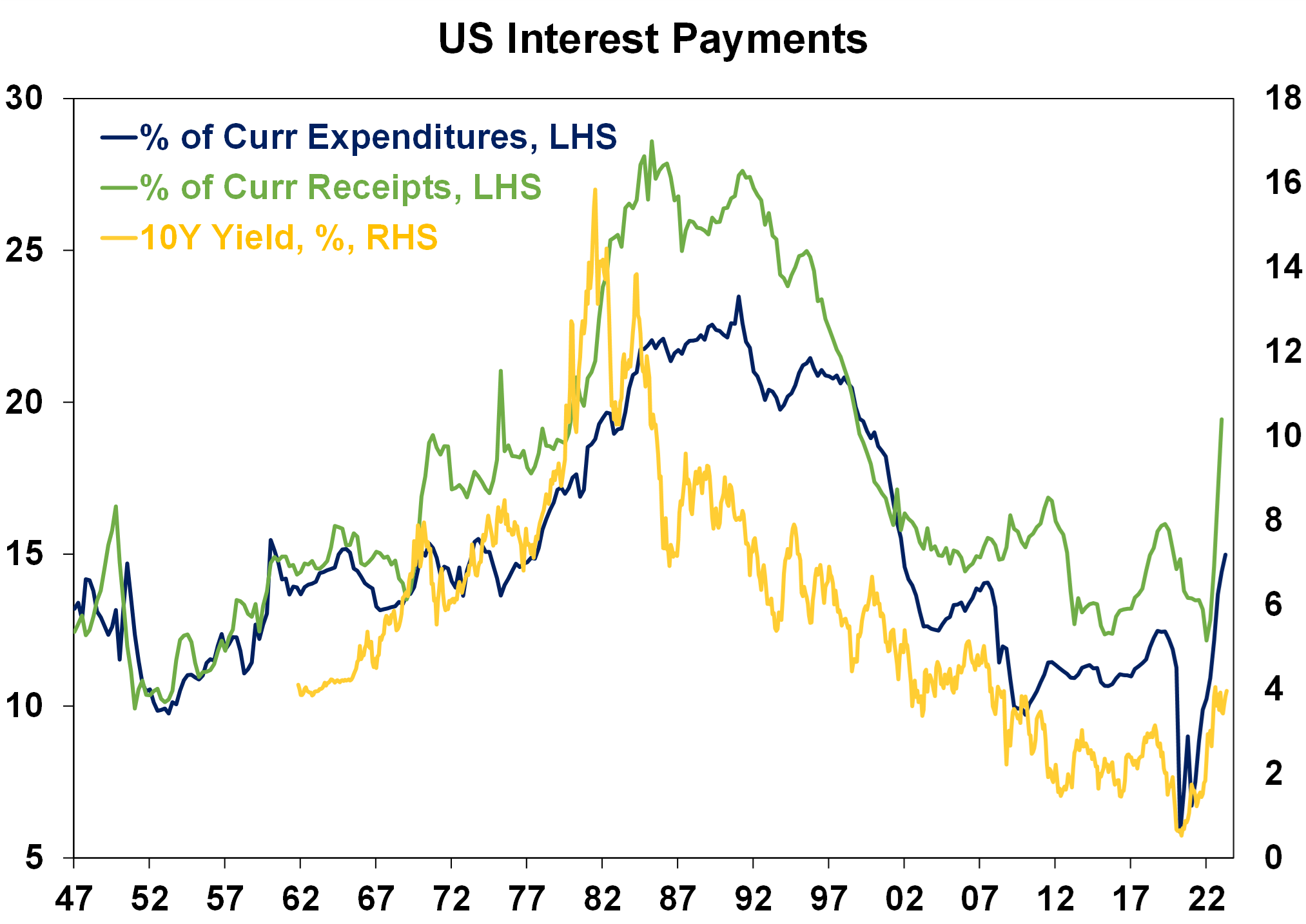

Interest payments will increase further from here, because interest payments lag bond yields. Interest payments have risen to 19.4% of revenue (its highest level since 1998) and 15% of expenditure (the highest levels since 2001) - see the next chart.

The deterioration in the US fiscal situation will result in some confrontation between the Democrats and Republicans when the budget and appropriate bills (which keep the government funded) are due to be passed by 30 September.

Source: Bloomberg, AMP

The Democrats will want to pass these bills in a timely manner to avoid a “government shutdown” (when many government facilities shut down because they can’t pay staff) which has happened historically (last time was in December 2018). Democrats would also not want to cut spending too much before the 2024 Presidential election which could add to fears of an economic slowdown and would make re-election difficult. However, the Republicans will try to use this opportunity to reduce spending in the forward years given the fiscal pressure on the US, likely resulting in a stand off between the parties. While a government shut-down usually has only very short-term impacts on the economy and financial markets, this time the impacts on markets could be worse because of the broader concern about the US fiscal situation. Moodys still rank the US as Aaa (its highest rating) but if there are delays with passing bills in October then this rating may also be downgraded which would be negative for bonds. The increase in the US budget deficit is also leading to an increase in US Treasury issuance which is adding to upward pressure on yields.

Japan and yield curve control

In late July, the Bank of Japan indicated that they would allow 10-year bond yields to reach 1%, beyond the cap of 0.5%. Given that Japan is a large holder of foreign bonds, an increase in Japanese bond yields could create some substitution away from global bonds to Japanese bonds, which would contribute to higher global bond yields. This could be partly playing out now through higher yields however, Japan’s interest rates and bond yields are much lower than global peers so the impact to global bond markets from a loosening in yield curve control is minor.

Implications for investors

Rising bond yields threaten the outlook for equities because a higher yield on a “safe” bond means that equities look more expensive or less attractive. While we still have a positive outlook for equities on a 6-12 month view, the recent uplift in bond yields could keep downward pressure on equities, especially for US stocks which have had a strong rally over 2023.

Higher yields also mean tighter financial conditions through a lift in borrowing rates (in the US mortgage rates are directly tied to bond yields), which is negative for new borrowers.

Bond yields could rise further if the US fiscal situation deteriorated further (beyond a short-lived government shutdown) or if inflation rebounded again. This is a risk, but high recession risks for 2024 should keep a lid on bond yields.

Weekly market update 22-11-2024

22 November 2024 | Blog Against a backdrop of geopolitical risk and noise, high valuations for shares and an eroding equity risk premium, there is positive momentum underpinning sharemarkets for now including the “goldilocks” economic backdrop, the global bank central cutting cycle, positive earnings growth and expectations of US fiscal spending. Read more

Oliver's insights - Trump challenges and constraints

19 November 2024 | Blog Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory. Read more

Econosights - strong employment against weak GDP growth

18 November 2024 | Blog The persistent strength in the Australian labour market has occurred against a backdrop of poor GDP growth, which is unusual. We go through this issue in this edition of Econosights. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.