Key points

- The last few months of inflation data have surprised higher in Australia which is leading to speculation that the RBA will need to hike rates again.

- In contrast, 4 major developed central banks have already begun cutting rates and others like the US Fed and Reserve Bank of New Zealand are hinting at cuts later this year.

- Australia’s global peers currently have lower inflation readings, especially for core inflation. But, wages growth among global peers has been higher and Australian consumers are faring worse which is a risk for GDP growth.

- In our view, Australia will end up following the same lower inflation trajectory as its global peers, but it is happening with a lag due to differences in industry structure, regulation and impacts of government policy.

- A higher-than-expected June quarter inflation print could see the RBA hiking again in August but we think it’s more likely that rates are unchanged until February 2025, when we see the RBA starting to cut interest rates.

Introduction

Global central banks have begun the interest rate cutting cycle, starting with Swiss National Bank in March, Sweden’s central bank in May and both the Bank of Canada and the European Central Bank in June. And more recently, other major central banks have changed their tone towards signalling interest rate cuts sometime soon. The Reserve Bank of New Zealand shifted to an easing bias at its July meeting and financial markets are now pricing in close to 3 rate cuts by the end of the year, some members of The Bank of England voted for a rate cut at the June meeting and comments from members of the US Federal Reserve including Chair Powell indicated that the Board is becoming increasingly confident with the inflation outlook which was helped by the recent June inflation data leading markets to expect nearly 3 interest rate cuts by December.

In contrast, the talk in Australia is of potential interest rate hikes by the Reserve Bank of Australia, as soon as the next meeting in August. A few economists are forecasting a 0.25 percentage point rate rise in 2024, and financial markets expect some chance of a rate hike this year, with a full rate cut only expected by August 2025, although it does bounce around a bit.

But what explains this difference in interest rate expectations between Australia and other major global economies? We look at this issue in this Econosights.

Inflation trends around the world

Between January – March this year, US inflation was tracking above expectations at over 3% per annum, leading to concerns of a second-round increase in inflation and talk of more Fed hikes. But in the second quarter, inflation started moderating, with the most recent data for June showing headline inflation at 3% and core at 3.3%. This is still above the US Fed’s target of 2% but much lower than the peak of 9.1% in mid-2022.

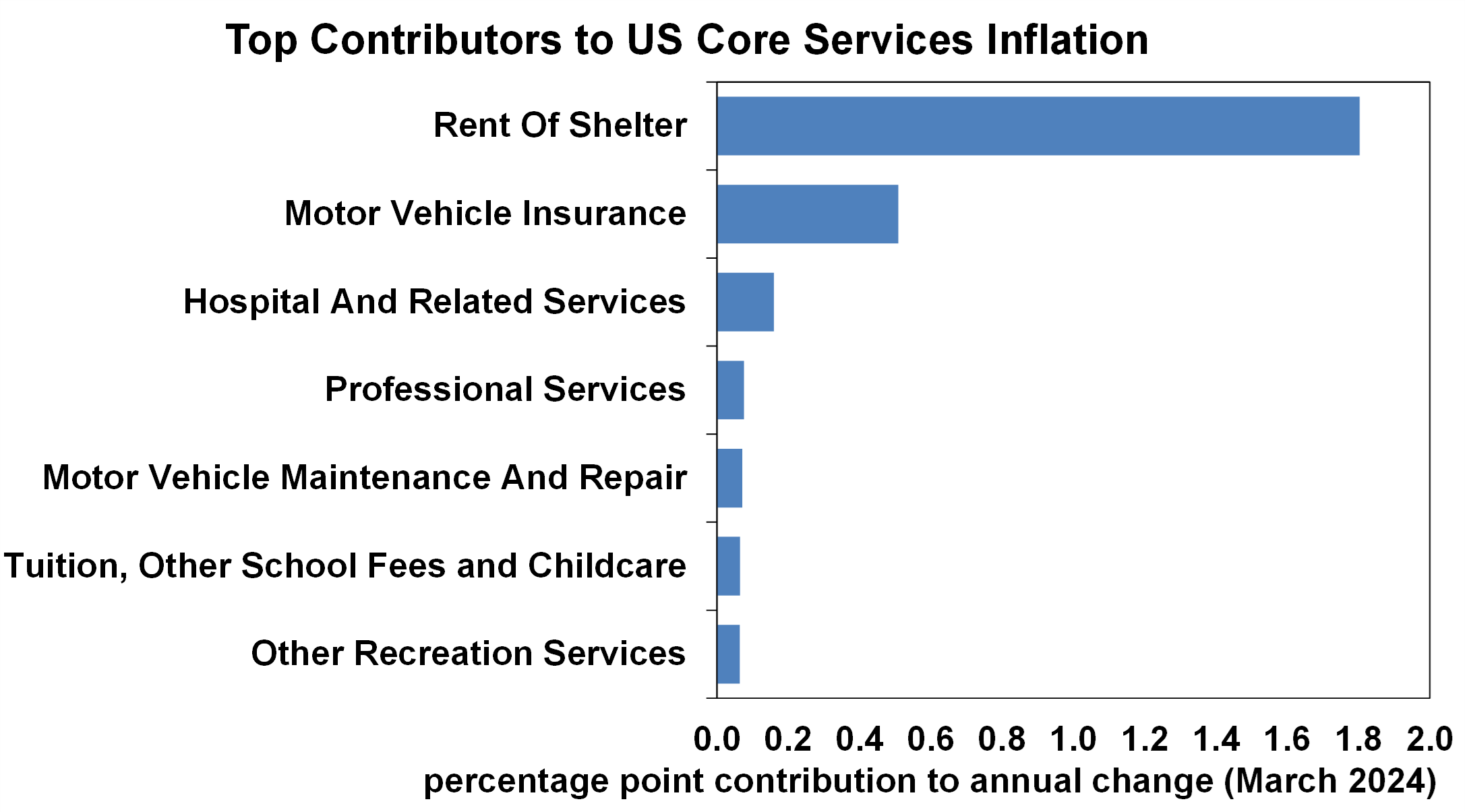

High and “sticky” services inflation has been the concern in the US but also globally. This has been the hardest component of inflation to reduce. In the US, the key contributors to services inflation have been rent (both owner’s equivalent which is a guide to how much a homeowner would rent their own home for and market rents), motor vehicle insurance, hospital services, professional services and school fees (see the chart below). A slowing in services inflation in recent months has been a key component of the broader softening in US inflation.

Source: Bloomberg, BLS, AMP

In New Zealand, the June quarter inflation data is expected to show headline inflation of ~3.5% over the year and core inflation at ~3.8% year on year. In Canada, headline and core inflation is expected to be just under 3%. In the Eurozone, headline inflation is likely to be at 2.5% and core is at 2.9%. UK headline inflation is likely to be under 2% over the year to June but core inflation is tracking at 3.5%.

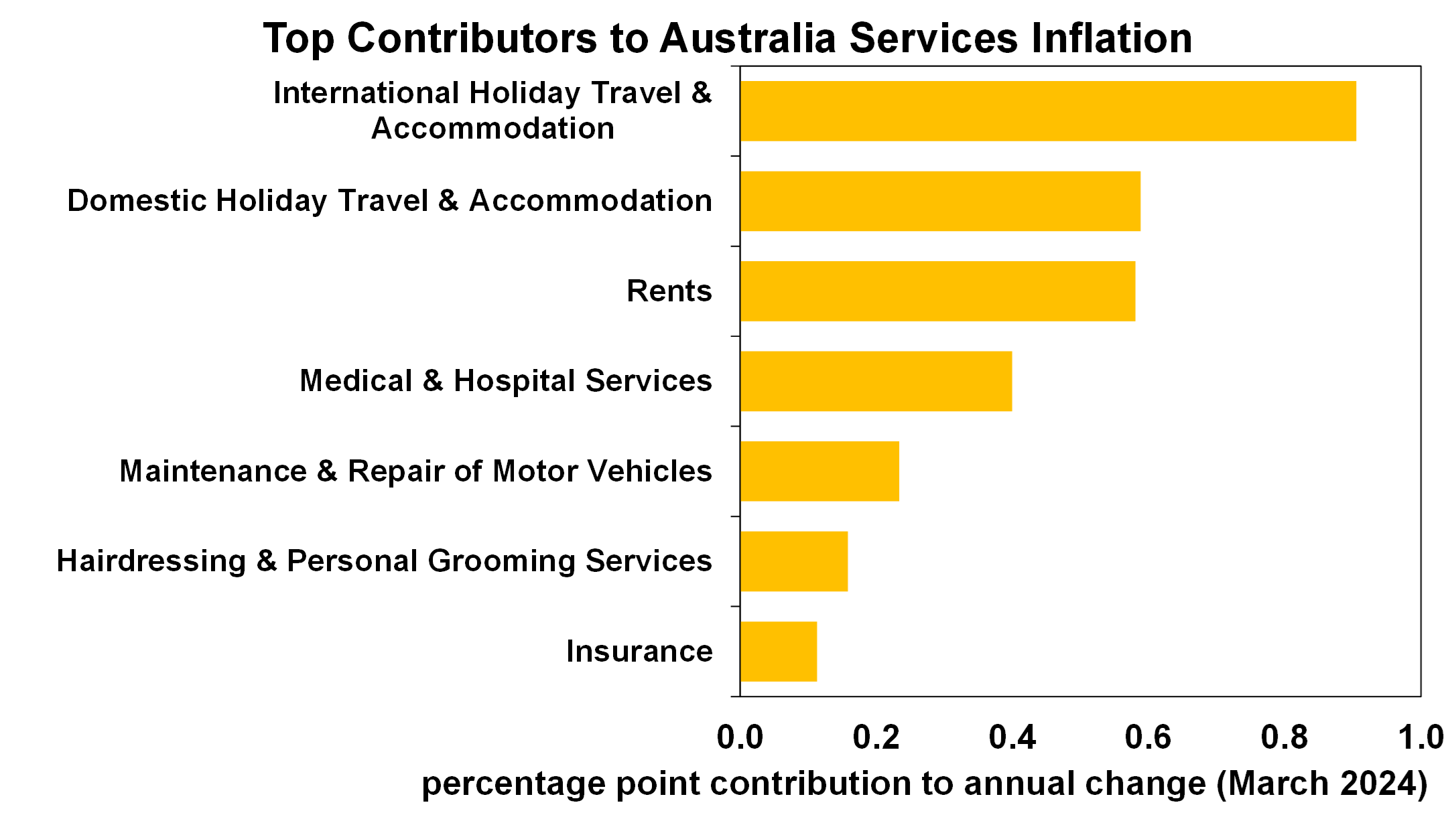

In Australia, the quarterly inflation data is out at the end of this month. The monthly inflation data is not a complete accurate guide to inflation trends because each category is not surveyed every month. On our forecasts, headline inflation will be 3.8% over the year to June and “trimmed mean” (or core) inflation will be 4% year on year. So, inflation in Australia is still high relative to its global peers. The main issue is around elevated services inflation which is keeping the trimmed mean high. The major contributors to services inflation in Australia over the past year have been holiday travel (domestic and international), rents, medical services, motor vehicle maintenance, personal services and insurance (see the next chart).

Source: ABS, AMP

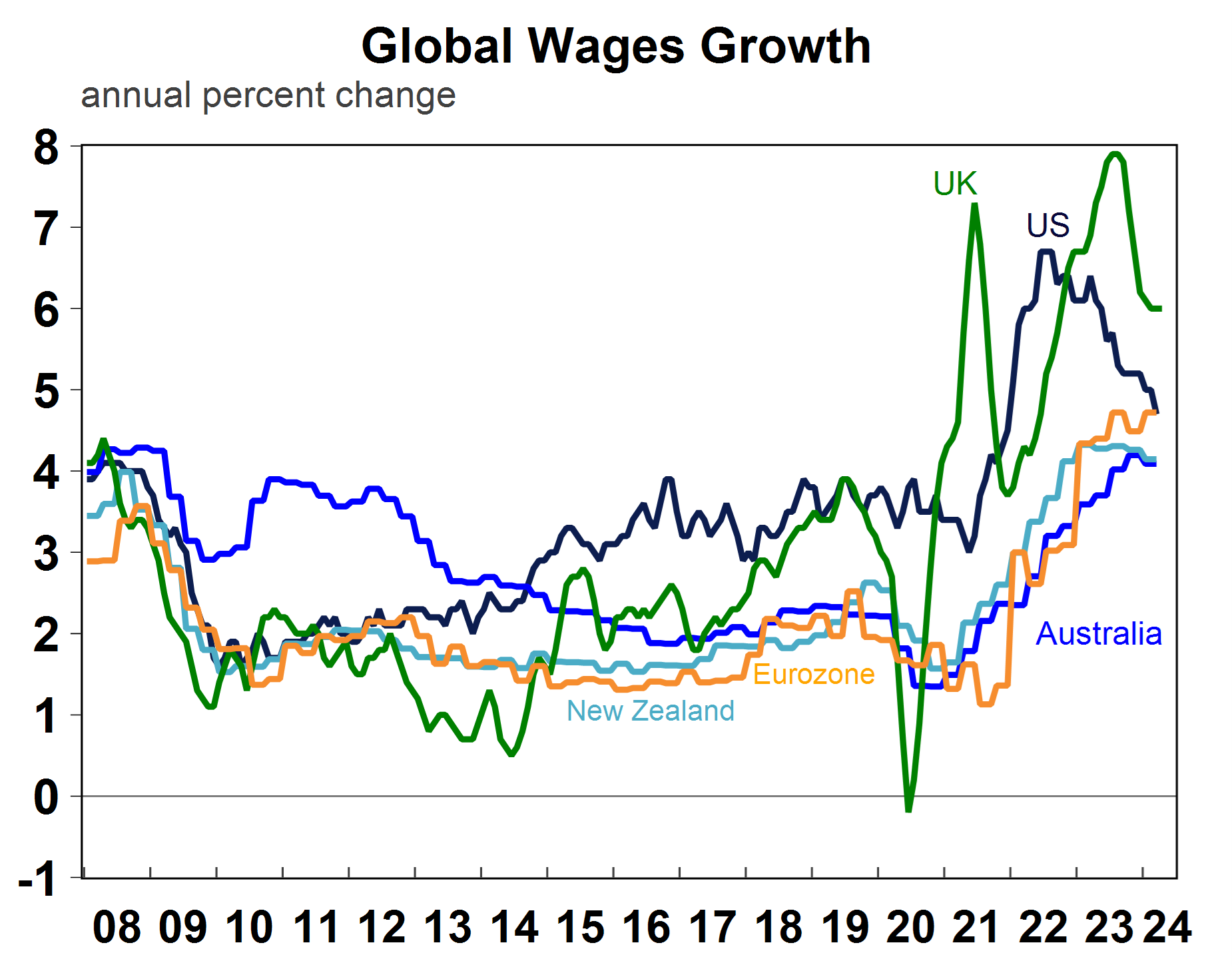

Often these services items lag what happens to goods inflation. Australian goods inflation has slowed to 3.3% per annum as at May while services inflation is at 4.8%. Holiday travel and personal care services inflation is likely to slow with continued weakness in consumer spending. Rents inflation is high but looks to have peaked based on new asking rents and permanent and long-term immigration data. Other parts of services like healthcare, insurance and education reflect broader inflation trends, the nature of the industry, government involvement and wages growth. Wages growth has an important bearing on services inflation. But wages growth has been lower in Australia relative to other advanced economies, (see the chart below) which is good news for services inflation.

Source: Macrobond, AMP

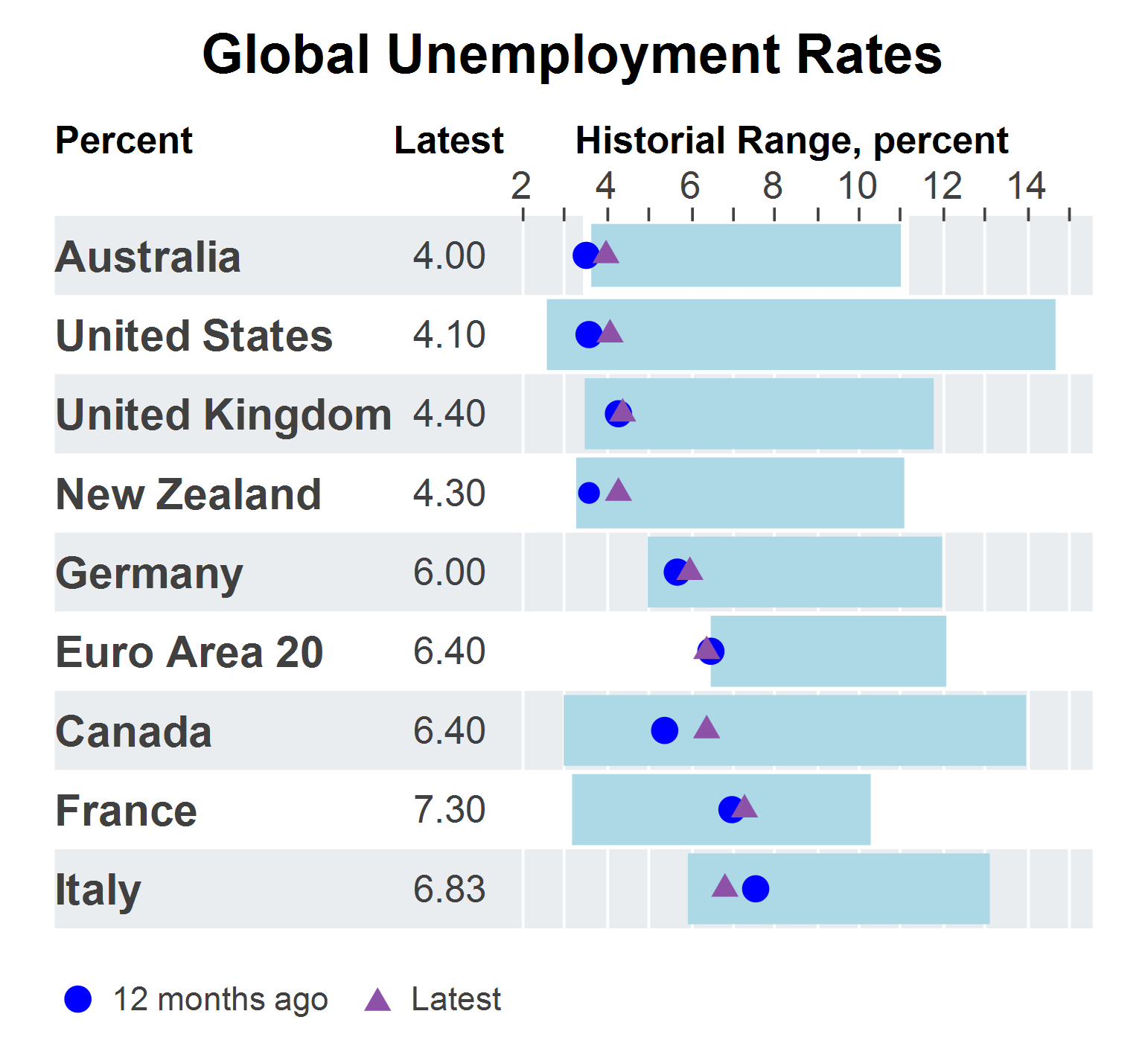

Wages growth is driven by outcomes in labour markets. Despite the interest rate hiking cycle which started in 2022, global labour markets have been in good shape, with unemployment rates still around the bottom end of its long-run historic range (see the chart below). Canada has seen the highest increase to their unemployment rate. Australia’s experience has been very similar to the US, with both markets now seeing a slowing in employment growth and some trend up in the unemployment rate which should result in lower wages growth.

Source: Macrobond, AMP

How have consumers responded to rate hikes?

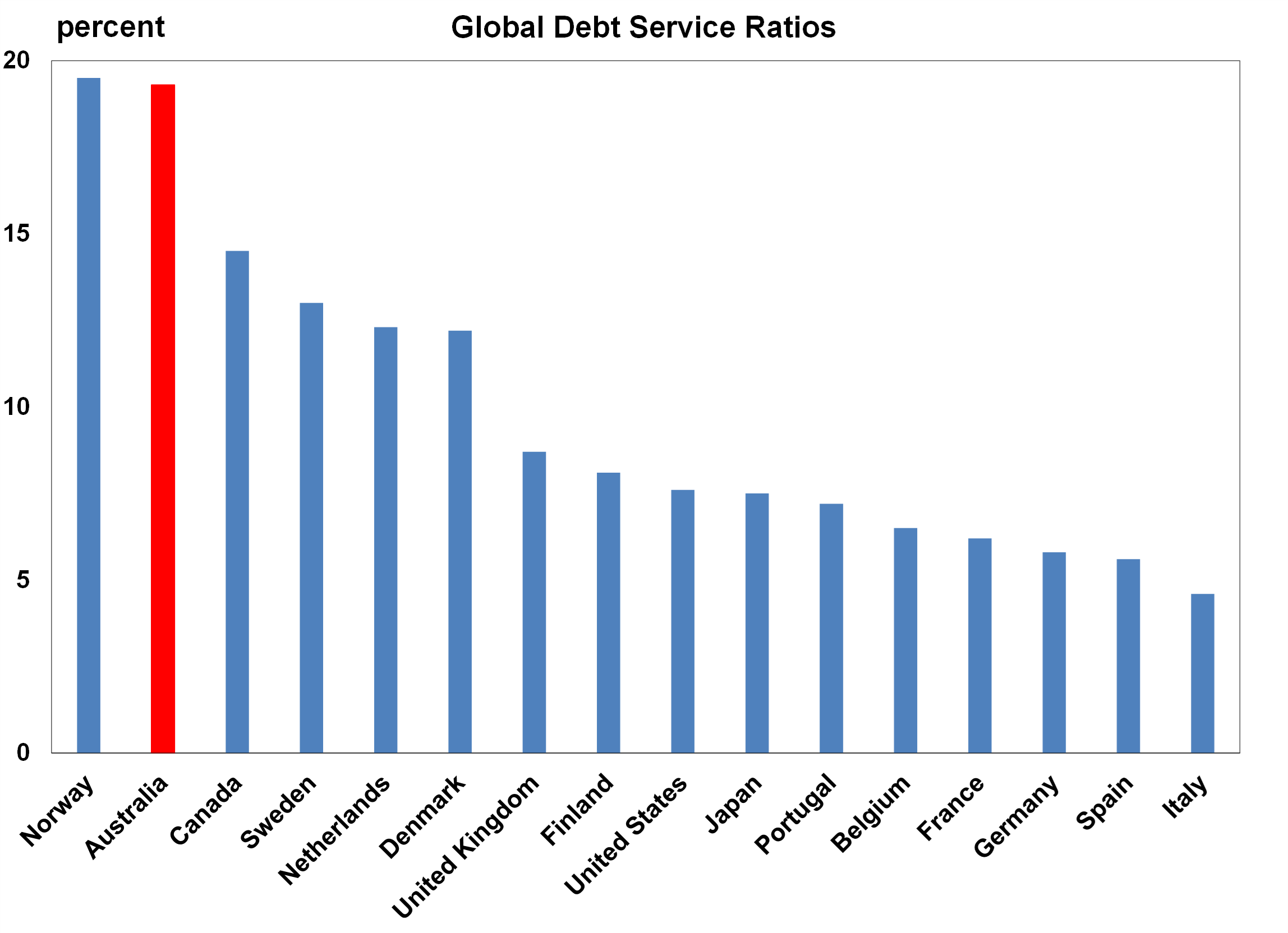

Australian consumers have generally fared worse in the past year relative to their global peers if you look at relative readings of consumer confidence, retail sales growth and per capita household disposable income growth. This reflects the faster pass-through of interest rates to outstanding mortgages. In Australia, nearly 80% of the increase in interest rates has flowed through to outstanding mortgages (both fixed and floating) compared to 65% in New Zealand, 53% in Canada, 32% in the UK, 31% in Germany and just 9% in the US. Another way to think about it is through the debt-service ratio (i.e. the ratio of debt servicing costs to household income). The chart below shows that Australia has the second-highest debt-service ratio in the world, after Norway.

Source: BIS, AMP

The vulnerability of Australian consumers to higher interest rates exposes Australian economic growth to downside risks, especially if interest rates are increased again.

Implications for interest rates

There is some argument that other central banks increased interest rates more than Australia, so therefore have to be quicker to normalise monetary policy. However, we think its better to take into account the flow-through of interest rates to outstanding mortgage holders which shows that Australian monetary policy is clearly working to slow consumer spending and economic growth which should see some impact on inflation.

While Australia’s core inflation data sits above its global peers we think this reflects a lag in domestic versus global inflation trends rather than a permanent difference in inflation dynamics. Wages growth in Australia has been below its peers and labour market conditions are mostly similar which should see wages growth slowing and leading to softer services inflation. On our forecasts, headline inflation will be just below 3% per annum by December, with trimmed mean inflation around 3.5%.

Based on our latest forecasts of inflation and growth and the RBA’s concern around inflation, we now see the interest rate cutting cycle starting later, in February 2025. However, a high trimmed mean June quarter inflation result (for example a quarterly increase of above 1%) would probably lead to the Reserve Bank hiking interest rates at its next meeting in August given that it would mean the central bank would be further away from its goal of inflation within the target range by 2026. However, further rate hikes risk sending the unemployment rate higher and therefore losing the gains made in the labour market as well as risk a further slowing in already poor GDP growth.

Oliver's insights - Trump challenges and constraints

19 November 2024 | Blog Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory. Read more

Econosights - strong employment against weak GDP growth

18 November 2024 | Blog The persistent strength in the Australian labour market has occurred against a backdrop of poor GDP growth, which is unusual. We go through this issue in this edition of Econosights. Read more

Weekly market update 15-11-2024

15 November 2024 | Blog Global share markets were messy over the last week, not helped by the ongoing rise in bond yields and a wind back in Fed rate cut expectations after some elevated US inflation data and slightly hawkish comments from Fed chair Powell. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.