Key points

- Recent commentary from US Federal Reserve Governors and Presidents has been more hawkish, lifting expectations for US near-term interest rates and reducing rate cut expectations for late 2023/early 2024.

- Forward-looking inflation indicators are all suggesting downside to consumer price inflation. But, this is not occurring as quickly as the Fed would like.

- The risk is that the US Fed continues to hike at a time when inflation is falling and growth slowing, risking a recession in the process and threatening the recent gains in equities.

Introduction

Despite hopes that the US Federal Reserve was finished raising interest rates (after the last increase in May) expectations of another rate rise are growing, potentially as early as June. We look at what’s caused the rise in recent rate hike expectations in this edition of Econosights.

Market expectations and Fedspeak

The US Federal Reserve has lifted the fed funds at every meeting since March 2022, taking interest rates from 0-0.25% to 5-5.25% (by 5% or 500 basis points). After the last hike in May, financial markets were expecting no further increases and a series of rate cuts towards the end of the year. However, expectations have changed in the past two weeks, with a high chance of another 0.25% rate hike now anticipated in June and only one rate cut by early 2024 (see chart below).

Source: Bloomberg, AMP

Why have market expectations for interest rates changed? Recent US economic data has been mixed, but not particularly strong, with moderate retail spending, some rise in jobless claims (although still at low levels), a weakening in the manufacturing PMI but strong services, some improvement in housing indicators and inflation as measured by the core personal consumption expenditure deflator still high at 4.7%pa. However, recent “Fedspeak” (or commentary from members of the Federal Open Markets Committee or FOMC who set monetary policy) has been more hawkish over the past two weeks and has been the main driver for the change in market expectations for interest rates.

The FOMC is made up of 12 members (7 Board of Governors and 5 Presidents from the districts) who vote on policy decisions. It is not unusual to see some divergence of views about policy through their public comments or speech. Recent comments from FOMC members have leaned more hawkish. Governor Christopher Waller (voter in 2023) indicated concern that goods prices were not slowing as much as expected (hinting that goods deflation was needed), rental growth was too high and continued concerns about wages growth and Dallas Fed President Lorie Logan (voter) said that a pause in interest rates in June was “not yet convincing”. Non-voting member Cleveland Fed President Loretta Mester said that the Fed is not yet at a point where interest rates can be held steady and that rates needed to be taken higher and St Louis President James Bullard (also a non-voter this year), who has been hawkish on interest rates in this cycle said that another rate rise would be “insurance” against elevated inflation.

Other Fed members were more neutral on interest rates. Minneapolis Fed President Neel Kashkari (voter) said that although he would consider a pause at the June meeting, this wouldn’t be a signal that the Fed was done in lifting rates, Chicago Fed President Austan Goolsbee (voter) said that there was a lot of important data to come before the June meeting that needed to be analysed, Richmond Fed President Tom Barkin (non-voter) was neutral on the June meeting itself but more hawkish on other meetings through the year, San Francisco Fed President Mary Daly (non-voter) said that the Fed must now be more data dependent than ever and Atlanta Fed President Raphael Bostic (non-voter) was seeing a cooling in demand but activity was not “cold” yet. Fed President (voting member) John Williams was the most dovish, noting the lags involved in the process with raising interest rates and Governor Philip Jefferson was also more sympathetic to the lags, noting that a year was not enough time to see the full effects of higher interest rates. Fed Chair Jerome Powell has swayed towards indicating a pause at the June meeting (for now).

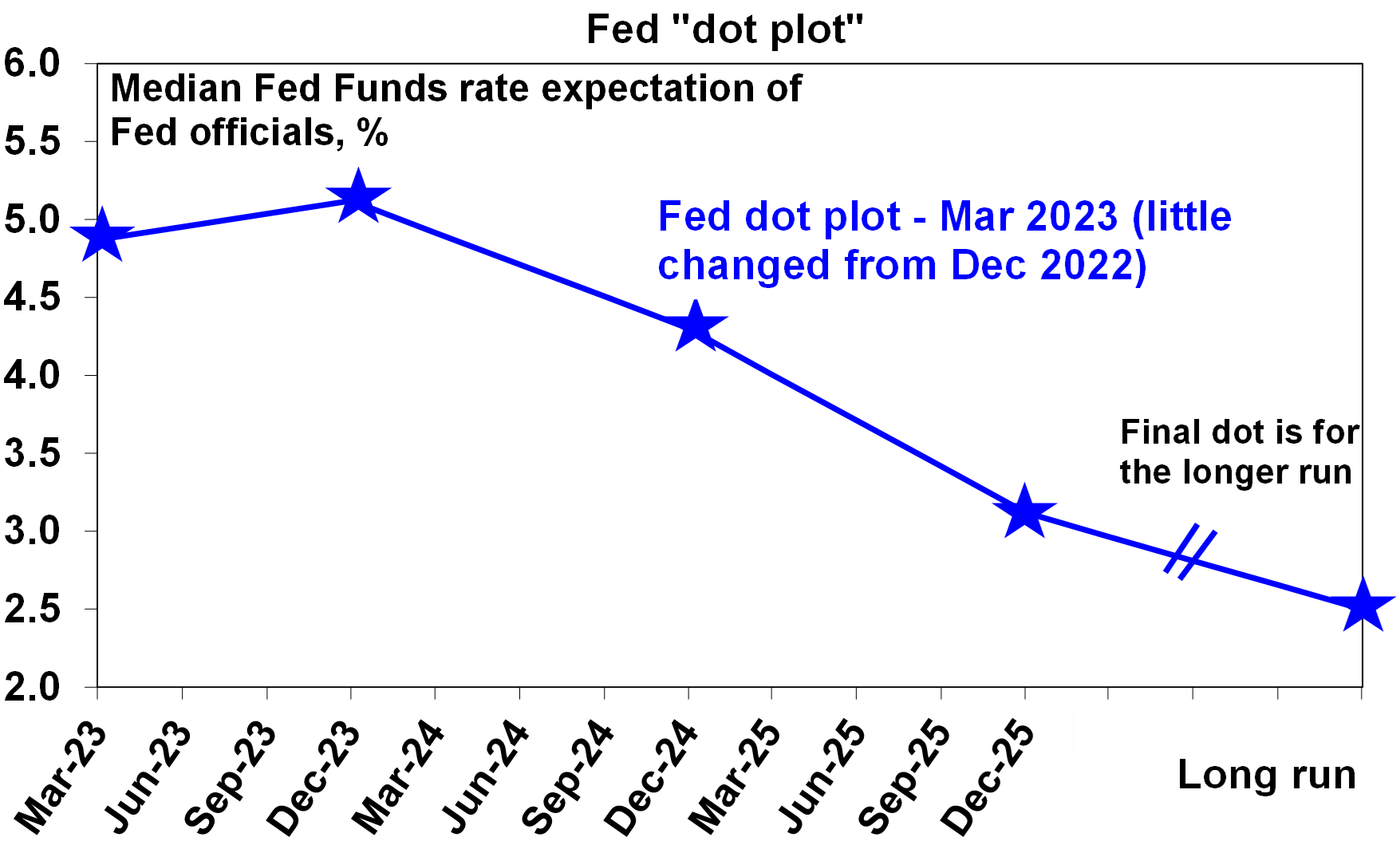

In March, Fed members’ interest rate expectations for the ed funds rate (expressed as a “dot plot”) showed that the Fed themselves expected to stop hiking interest rates once the fed funds rate got to its current level of 5-5.25% (see the chart below),

Source: Federal Reserve, AMP

Although, there were also a decent amount of dots above 5.25%, which means that the risk is for interest rates to surprise to the upside.

So, US economic data is still too strong for the Fed’s liking and inflation data is too high. In our view, inflation will start to decline quicker in the second half of the year, based on the downtrend across most inflation indicators.

What are forward-looking inflation indicators showing?

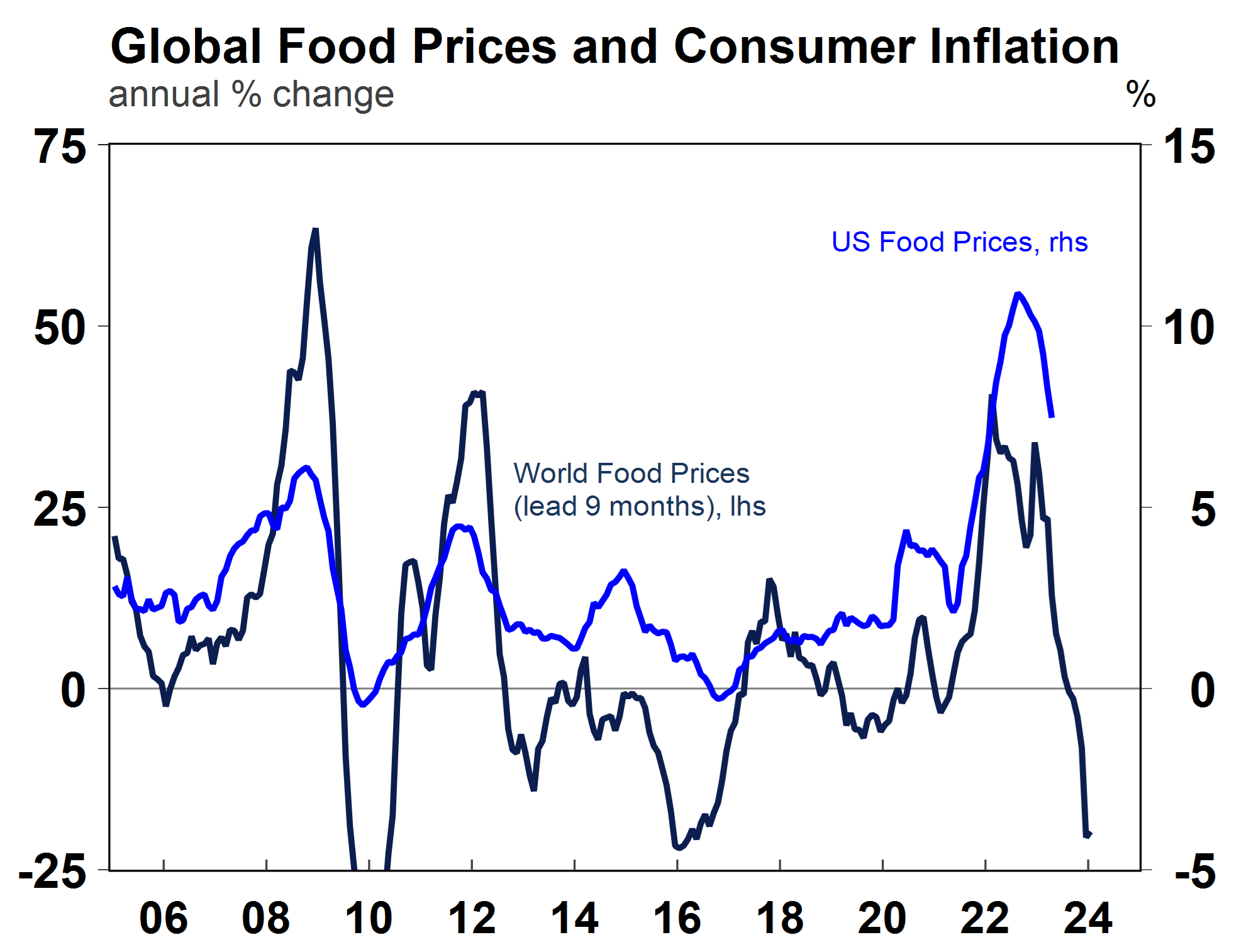

The actual inflation data is backward looking so it’s important to monitor forward-looking indicators. US core goods inflation has come down considerably, from 12.4% in February 2022 at its peak to its current level of 2.1%. Further falls are expected, and deflation in parts of the goods sector is likely. World food prices are negative on a year ago (see the chart below) which should lead food inflation down, oil has fallen compared to 2022 levels and is trading below $80/barrel, even though OPEC tried to boost prices by cutting production, European natural gas prices are down by 90% compared to a year ago, metals prices have fallen, shipping and air cargo rates are close to or below pre-Covid levels, airfare prices are now declining and price indicators in business surveys (like PMI’s) continue to fall. But it takes time for these factors to show up in the actual inflation data and often has to be accompanied by weakness in spending volumes, which is occurring in some parts of consumer spending.

Source: Macrobond, AMP

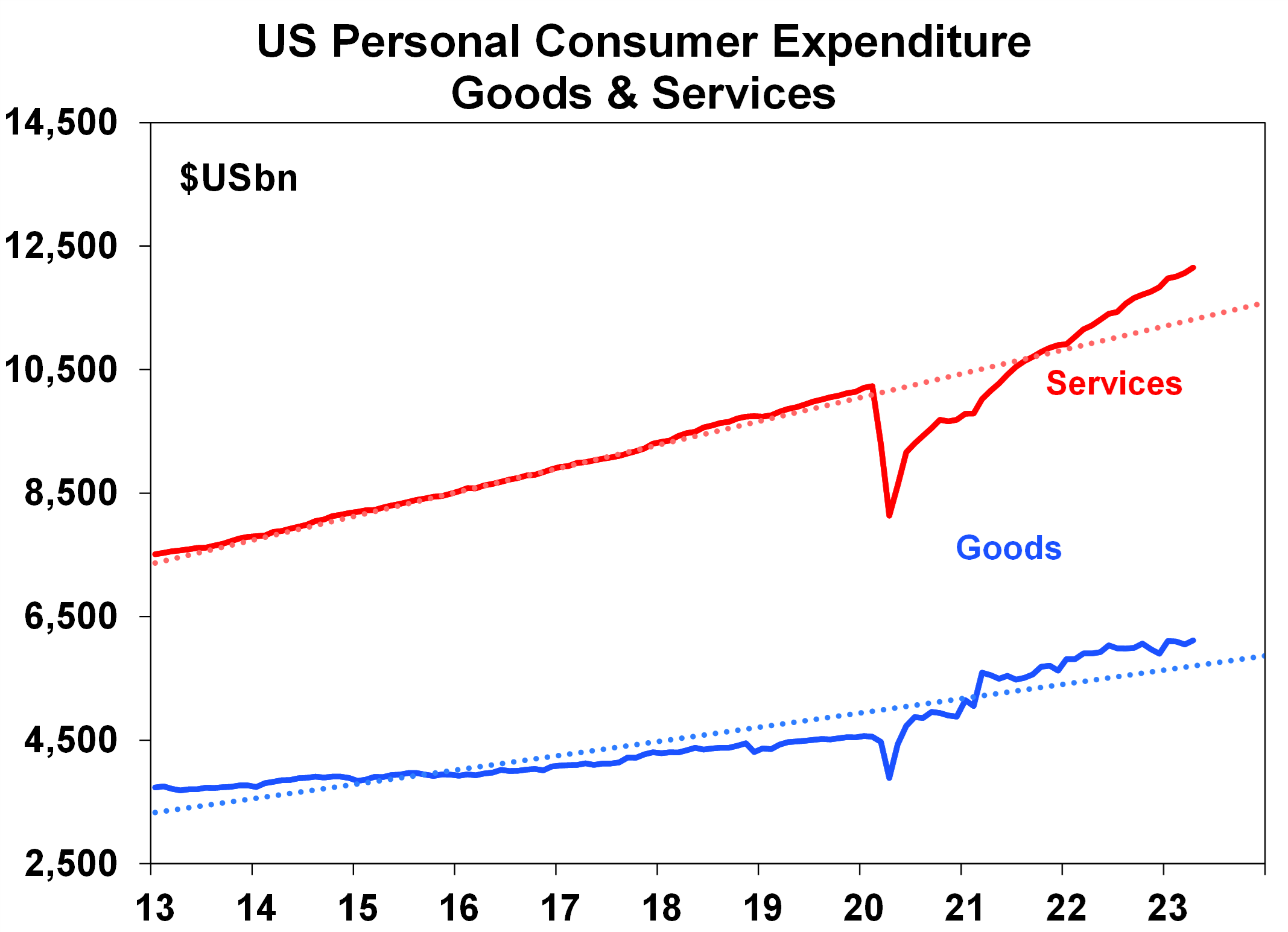

Consumer spending on goods is slowing to more normal levels (the chart below shows goods spending moving down towards its long-term trend) but services spending is still elevated.

Source: Macrobond, AMP

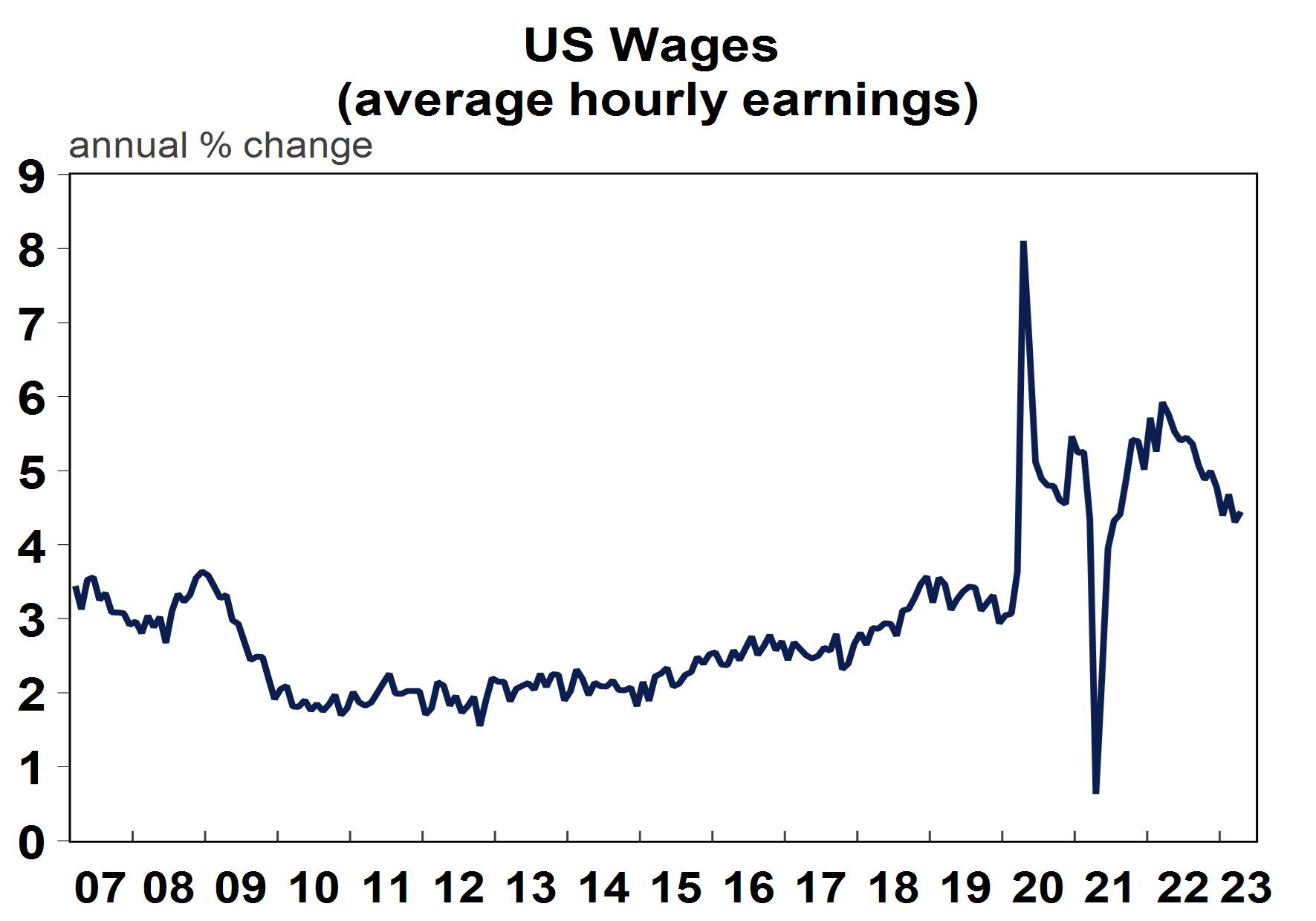

The US labour market remains tight as the unemployment rate at 3.4% is at its lowest level since 1969, but job openings are falling and wages growth has slowed from its highs of 5.9% in March 2022 to its current level of 4.4% (see the chart below). Wages growth needs to be somewhere between 3-4% for the Fed to be happy with inflation progress.

Source: Macronbond, AMP

Housing inflation is set to slow. Rents for new leases have declined considerably, with the Zillow Rent Index running at 5.3% over the year, down from its high of 16.9% in early 2022 and TheApartmentList Rent Index is up by 1.7% over the year, down from its low of 18.3% in late 2021.

Implications for investors

While the forward-looking inflation indicators are all moving in the right direction, the Fed needs to see confirmation that this is being passed on to to consumer prices. So far, the decline in consumer inflation has occurred slowly. While we think the inflation data will weaken in the second half of the year (and end 2023 around 3.5%-4%), it may not occur as quickly as the Fed would like so we now expect another interest rate hike possibly in July after a pause in June with the risk of more after this, until both activity and inflation data weaken further. Expectations for further rate hikes from here could give another leg up to bond yields, although more rate hikes also increase the risk of a recession significantly which put downward pressure on long-term yields and it could threaten recent sharemarket gains (the US S&P is up by 9.5% year to date).

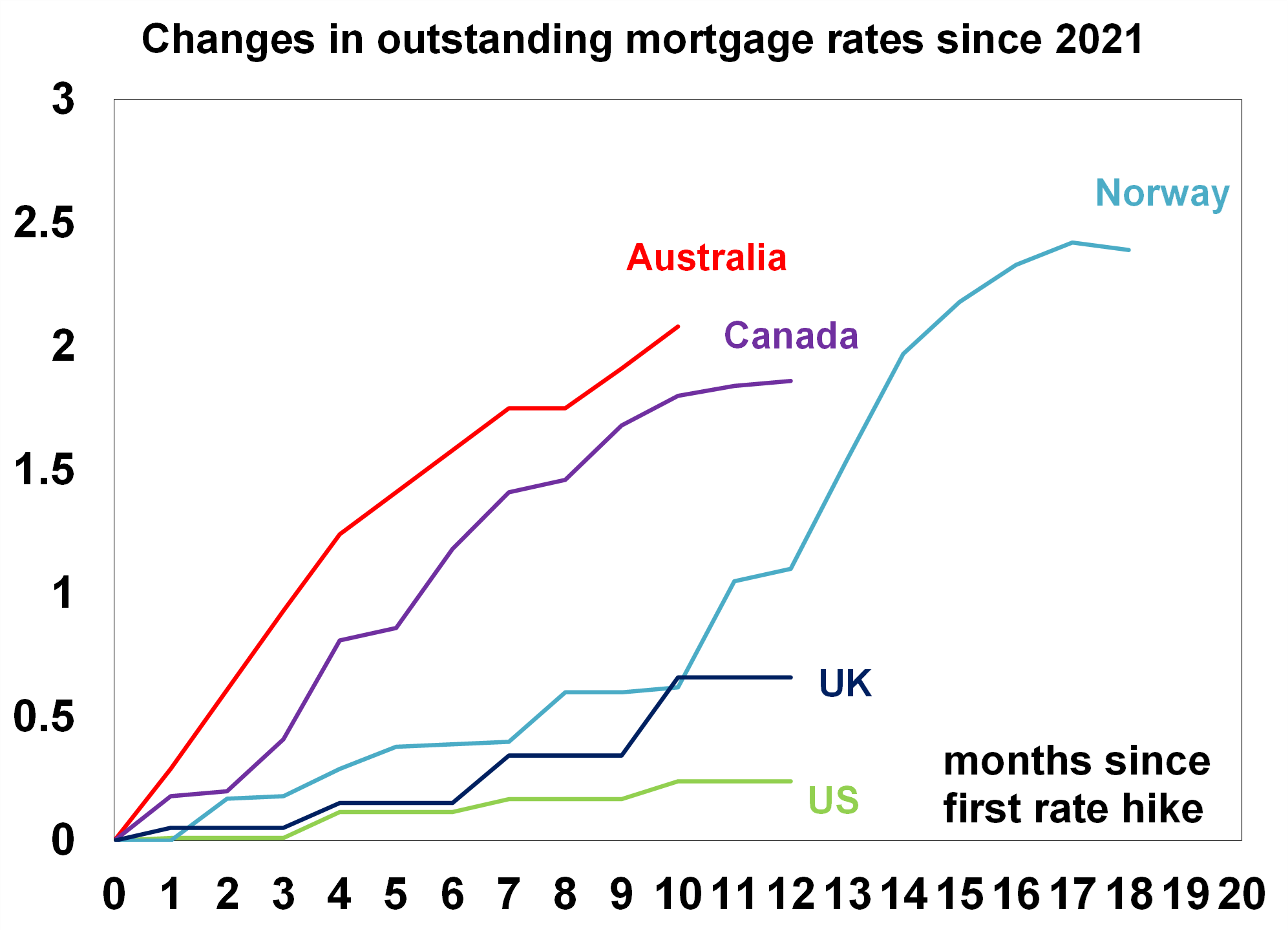

Another issue to consider is that the lags involved with changes in monetary policy are arguably longer in the US, as most indebted households can fix their mortgages for 30 years or so which shields them from rising interest rates (the situation is different for new borrowers of course) For example, the US mortgage rate had only increased by 0.24% between 2021 and March 2022, when the Fed had lifted interest rates by 4.75% (see the chart below) which is low relative to other comparable countries.

Source: Macrobond, AMP

More Fed rate hikes could lead to expectations for the Reserve Bank of Australia to follow suit by taking the cash rate higher. However, the economic data is slowing quicker in Australia with poor retail spending rising trend in the unemployment rate, as the potency of monetary policy is stronger in Australia given record-high household debt and a high level of variable mortgages, which is likely to keep interest rates lower in Australia.

Weekly market update 25-10-2024

25 October 2024 | Blog Rising bond yields threaten shares; US tech share nearly at 2000 levels; is Australia really that bad on inflation?; Trump and share markets; Australian underlying inflation to fall; and more. Read more

Oliver's insights - ineffective investors

22 October 2024 | Blog In the confusing and often seemingly illogical world of investing, investors often make various mistakes that keep them from reaching their financial goals. This note takes a look at the nine most common mistakes. Read more

Econosights - global housing trends

22 October 2024 | Blog The common belief that Australian homes have become unaffordable is understandable, as all the metrics around affordability have deteriorated. But how does the housing situation in Australia compare to our global peers? We go through this issue in this edition of Econosights. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.