Key points

- The negatives weighing on consumers (high inflation, rising mortgage repayments and declining household wealth) now outweigh the positives which kept consumer spending elevated in 2022 (high household savings, a low unemployment rate and pent-up services demand). This should mean lower retail volume growth in coming months.

- We expect poor growth in consumer spending in 2023 in Australia, running at less than 1% per annum by late 2023 which is well below more normal levels of ~2.5%.

Introduction

The Christmas holiday period is the most important time of the year for retailers. But in 2022, there are a lot of negative factors impacting consumers at once and is likely to result in weaker-than-usual holiday spending. We look at these issues in this Econosights.

How are consumers feeling?

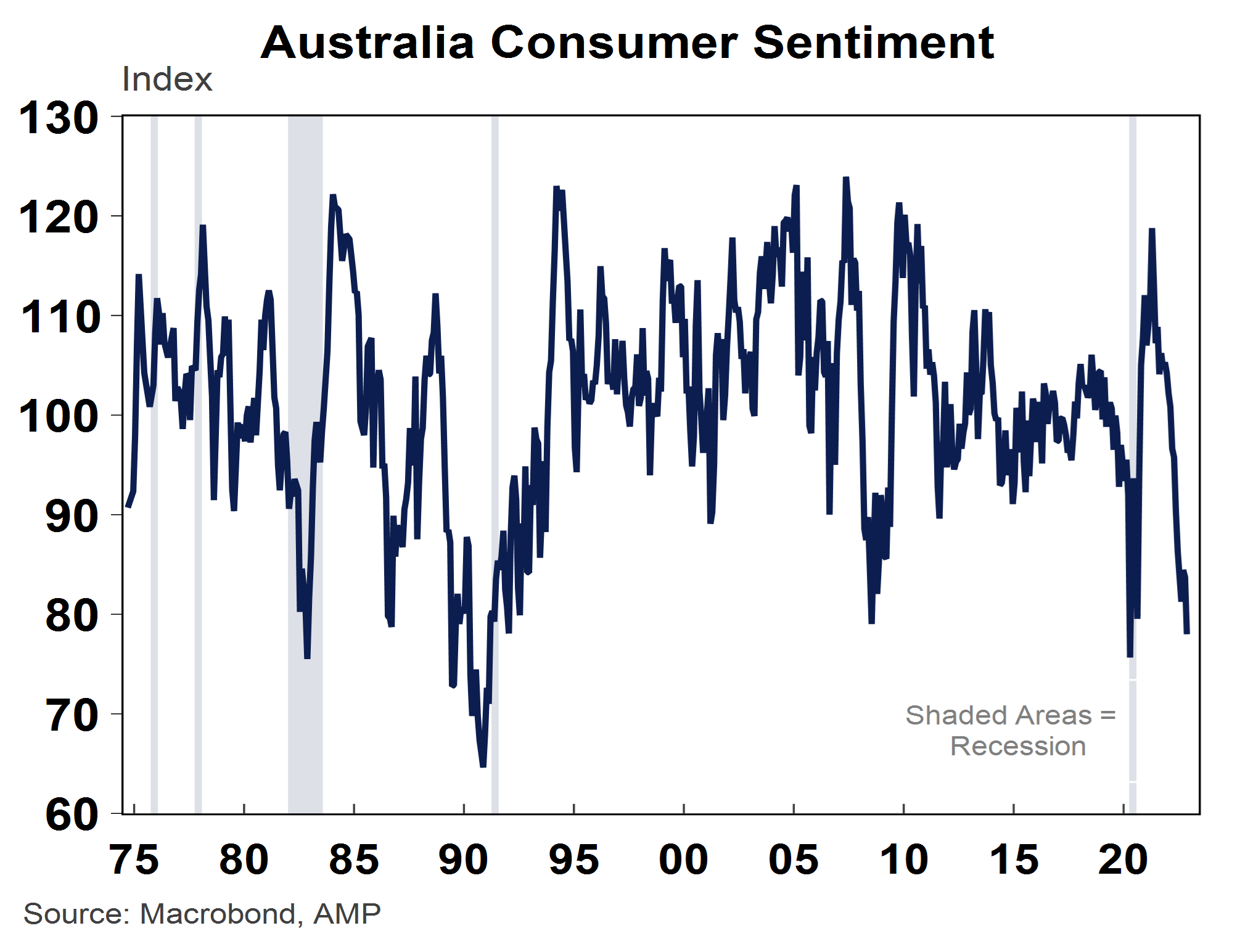

Consumers are not feeling optimistic about current conditions or the outlook, with Australian consumer sentiment at recessionary-like levels (see the chart below).

In the November Westpac/Melbourne Institute consumer sentiment survey, there was a question asked around Christmas spending, to which consumers were asked whether they expect to spend the same, less or more on gifts than last year. Usually, around 33% say that they want to spend less but this year it was closer to 40% which was the biggest cutback to spending plans since 2009 (which was then impacted by the Global Financial Crisis). In the US, Evercore ISI research have been conducting a survey of Christmas tree sales since 2018 and in the first survey week of 2022 (the last week of November), sales were up by 6% over the year, which is the slowest rate of sales since 2018.

So, what are some of the factors weighing on consumers?

Inflation is too high… especially for essentials

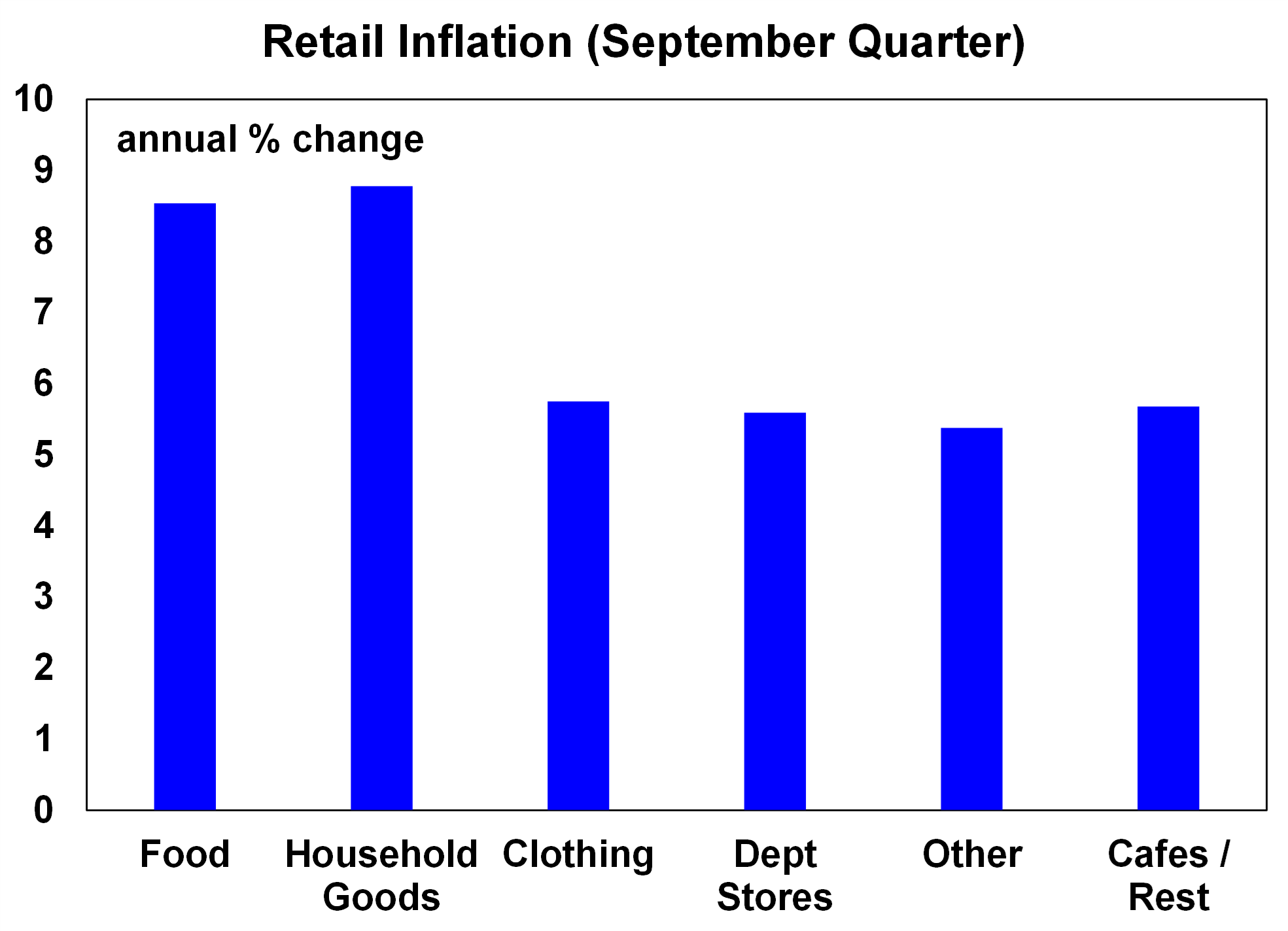

Retail price inflation was up by 7.1% over the year to September, the highest pace of growth since 1985, with the strongest rate of growth in food and household goods (see the chart below). High inflation weighs on consumer spending power (especially if it is in essential items like food) and will result in lower retail spending volumes. Spending volumes have been slowing in Australia since the start of the year and were negative in the month of October.

Source: ABS, AMP

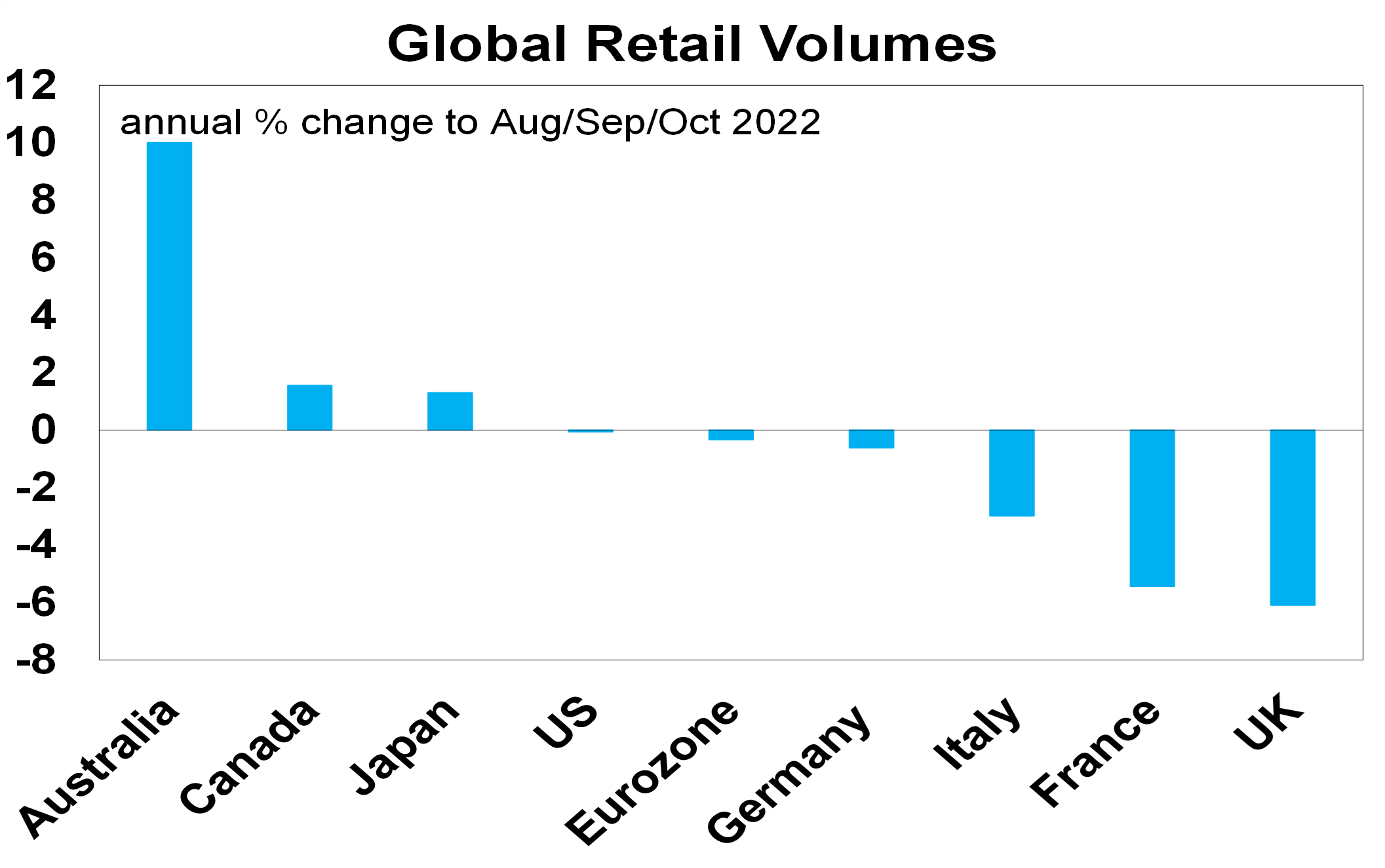

Global retail volumes have also slowed a lot across other advanced countries (see the chart below). Australia looks better compared to global peers because of base effects from the lockdown in late 2021.

Source: Macrobond, AMP

Mortgage repayments are rising as a share of income

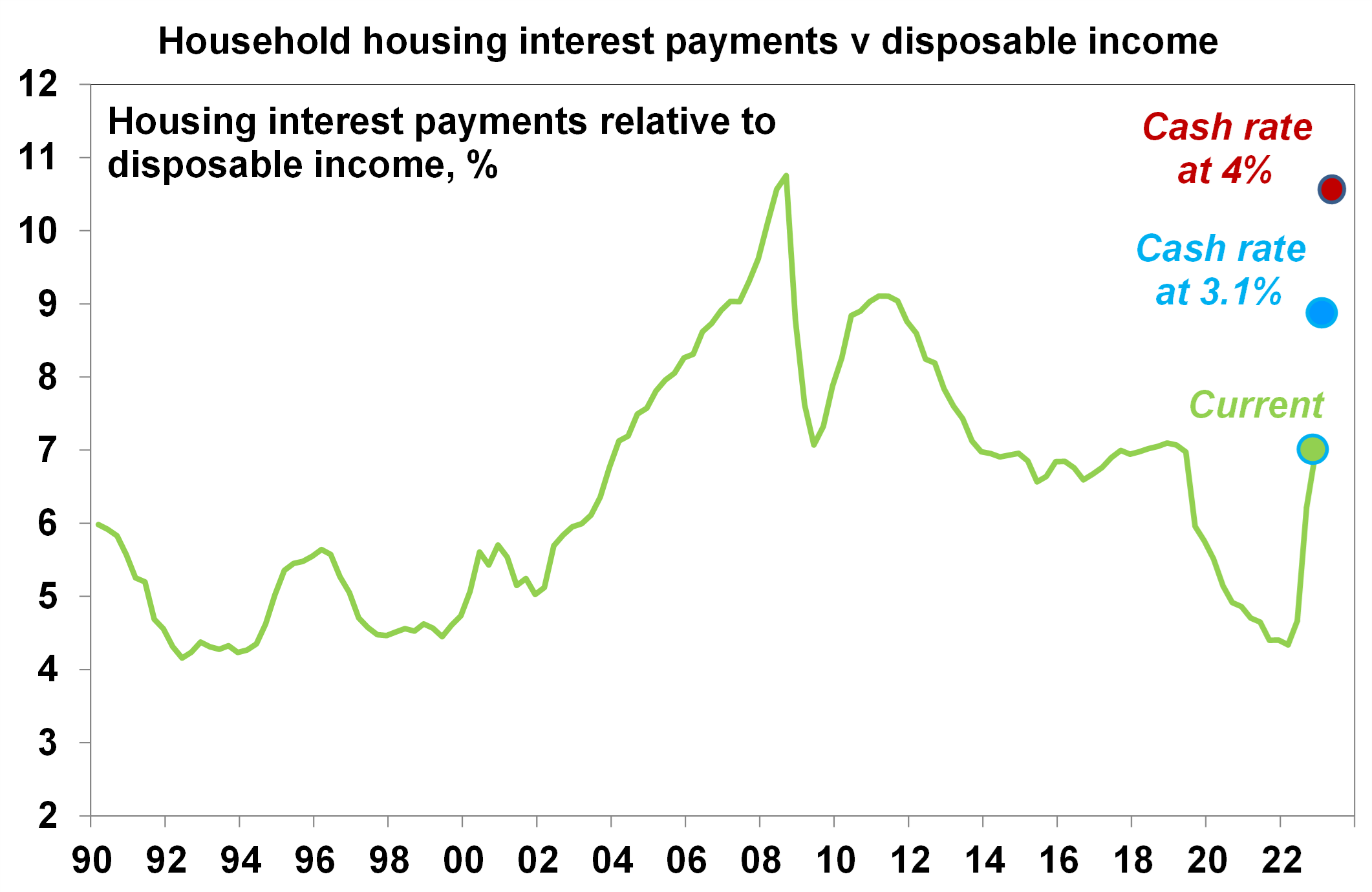

The Reserve Bank of Australia has increased the cash rate by 2.75% since May, the most aggressive tightening cycle since 1994. These interest rate rises are lifting interest costs for indebted households (30% of households have a mortgage). The average discounted variable mortgage rate has increased to 6.2% in November from 3.45% in April and the three-year fixed mortgage rate has lifted to 6.2% after bottoming at 2.1% in March 2021 (the fixed rate moved on expectations of RBA interest rate hikes). Housing interest payments, as a share of income reached a bottom of 4.3% in early 2022 and we expect it to double to 8% if the RBA lifts the cash rate to 3.1% (as we expect at this week’s meeting). This would take housing interest payments (as a share of income) back to their highest level since 2010 – see the chart below.

In Australia, around 65% of mortgages are on variable rates (which is lower than the usual 85-90% as households took advantage of ultra low fixed rates). The flow through from RBA cash rate changes to actual repayment is around three months, so the cumulative impact of rate hikes has not yet been felt by these households. For those households on fixed-rate mortgages, the impact of rate rises has been muted for now. But by the end of 2023, two-thirds of these fixed-rate mortgages will have expired and these households could be facing mortgage rates 2-3 times initial rates, with 50-60% of borrowers seeing at least a 40% lift in repayments (assuming a cash rate at 3.1%). Housing interest payments as a share of income will lift significantly from these impacts in the next 6-12 months. If the cash rate reaches 4% as the market expects it would take housing interest as a share of income to over 11%, a new high.

Source: ABS, AMP

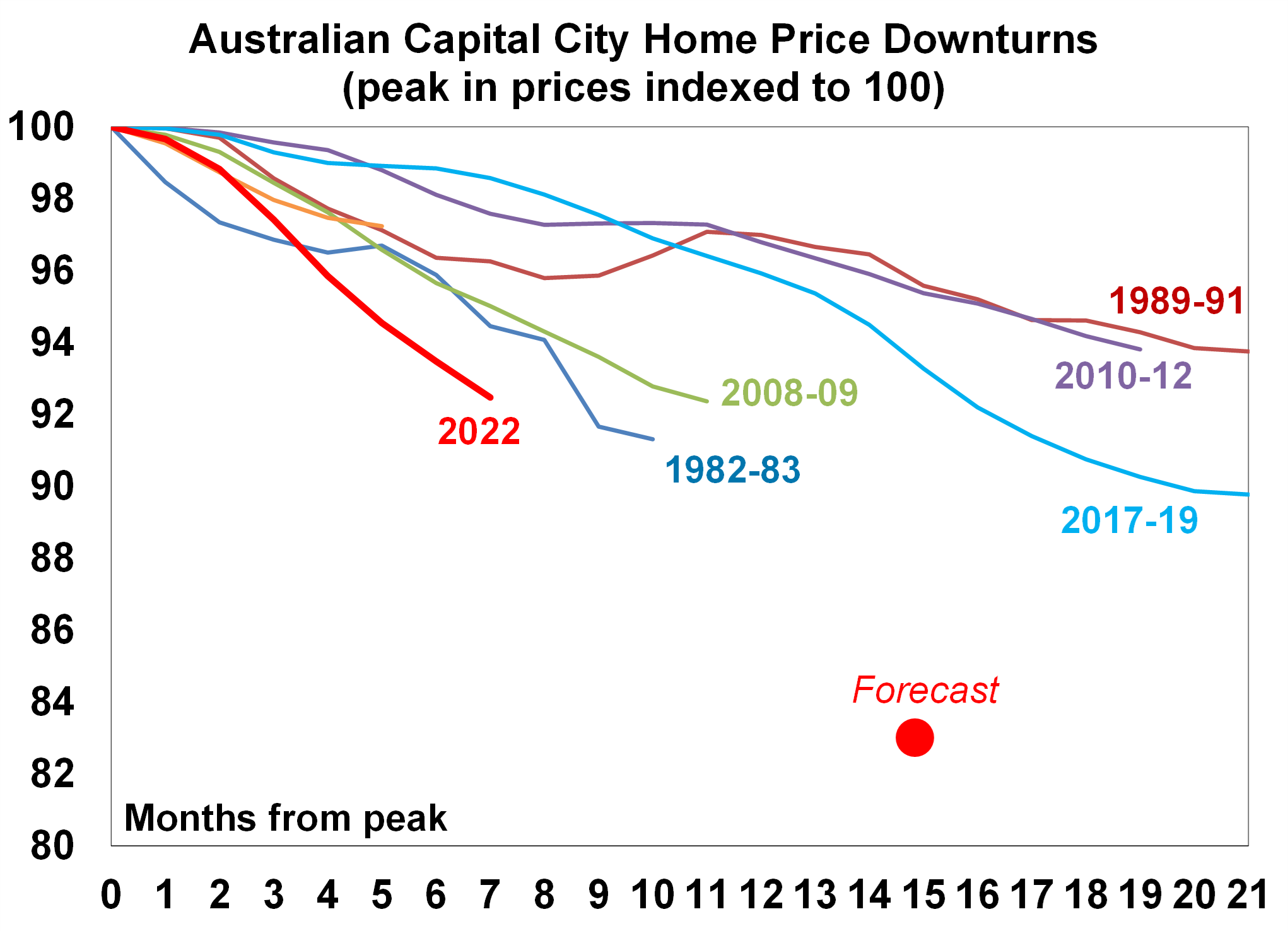

Household wealth is declining, and will fall more

Australian capital city home prices are down by 7.5% since their peak in April this year and are experiencing the fastest cyclical decline in prices since the data started in 1980 (see the chart below). If our forecasts of a 15-20% peak to trough decline in prices end up being correct, this will be the largest peak-to-trough decline in prices on record going back to 1980. Housing is the single biggest source of household wealth (at 65%) and declining wealth tends to be negative for consumer spending, known as the “wealth effect”.

Source: CoreLogic, AMP

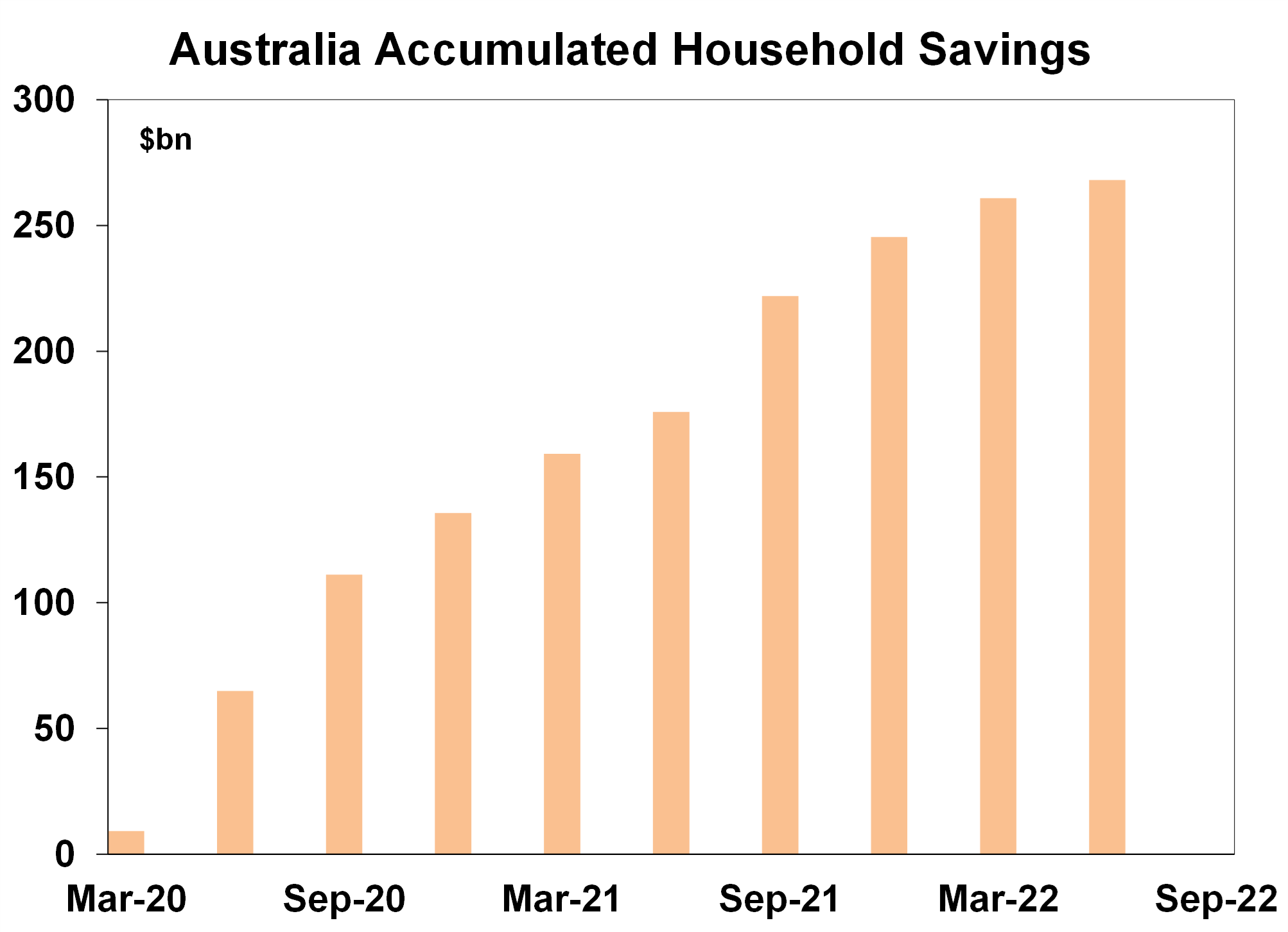

But, household savings are still high

Households accumulated a lot of excess savings over 2020/21 from fiscal stimulus worth close to $270bn (or 12% of GDP). Households are likely to start drawing down on accumulated savings (with the next update for savings for the September quarter released this week).

Source: ABS, AMP

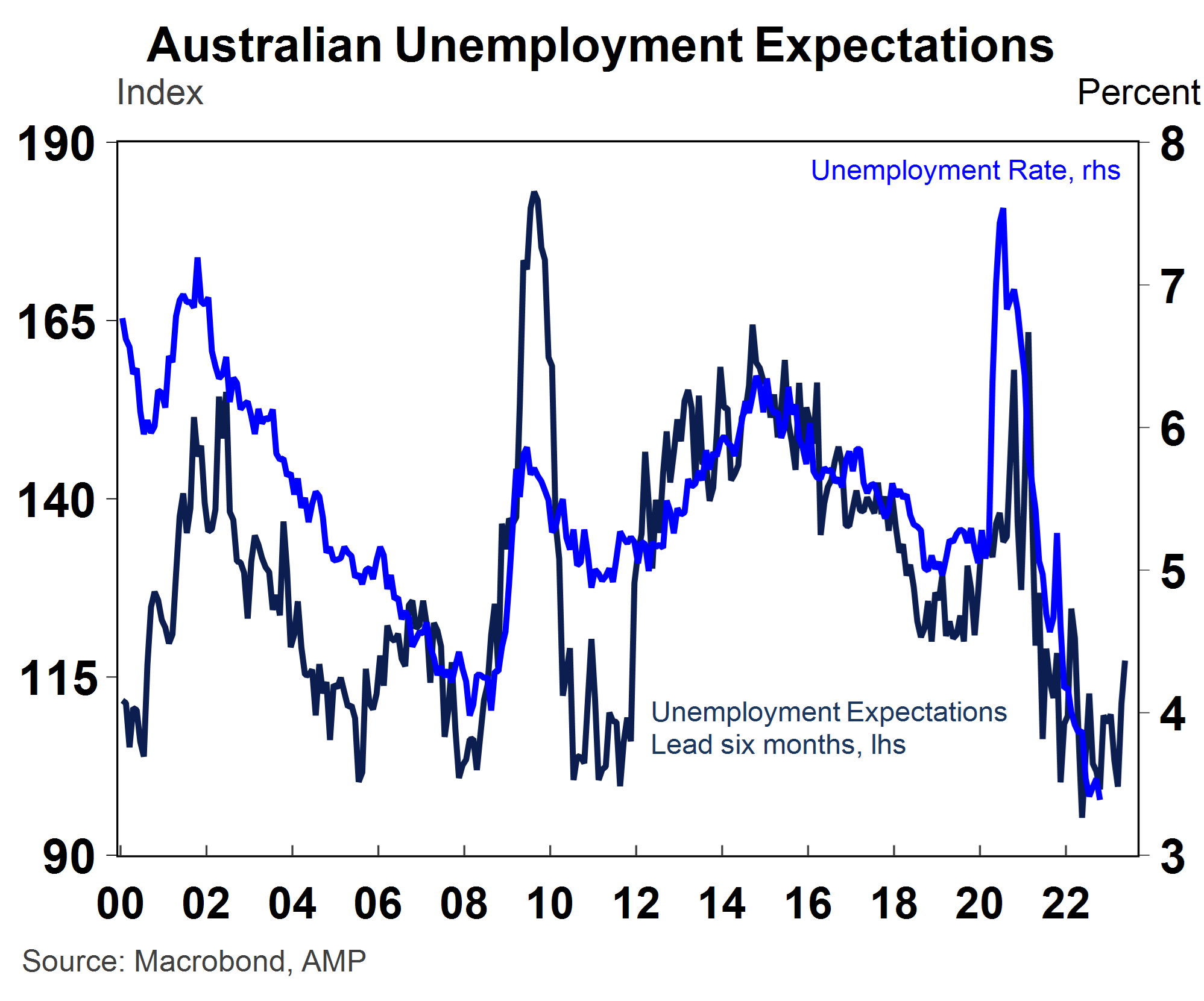

The labour market is strong

The tightness in the labour market is evident across many indicators. The unemployment rate is at a 48-year low and every unemployed person could find a job if they wanted to, as job vacancies are so high. However, the labour market looks to have now reached full capacity and will slow from here, although a sudden lift in unemployment is unlikely for now. Leading indicators of employment growth like job advertisements, hiring intentions and job vacancies are still holding up and we don’t expect the unemployment rate to start rising until the second half of 2023. Consumer unemployment expectations have also started to increase (see the chart below) which is normally a leading indicator by around 6 months for the unemployment rate. Heightened unemployment fears are negative for consumer spending intentions.

Conclusion

Christmas spending will be lower in 2022 compared to recent years in volume terms in Australia and the US (and a lot of it was probably brought forward in the Black Friday/Cyber Monday sales). While high inflation may keep business profits more elevated than expected, a drop off in spending volumes next year will put pressure on corporate profits (which have been holding up better than expected as businesses were able to pass on higher costs to consumers). We expect Australian consumer spending of below 1% per annum in 2023, well below its more normal levels of around 2.5%. Expect consumer discretionary spending to slow next year.

Weekly market update 13-12-2024

13 December 2024 | Blog Global shares were mixed over the last week with a backup in bond yields and a bit of profit taking after a strong run up weighing on US and Eurozone shares leading to small falls. Read more

Oliver's insights - Australia's falling living standards

11 December 2024 | Blog Falling real wages and a surge in tax and interest payments have led to a slump in Australian living standards. Key policies to boost productivity growth include: tax reform; a cap on public spending as a share of the economy, deregulation; greater incentives to invest; and competition reforms. Read more

Econosights - the basics of tariffs

11 December 2024 | Blog In this edition of Econosights we look at the basics of tariffs to help us understand the impact of Trump 2.0 tariffs. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.