Key points

- Global manufacturing activity is contracting and is weighing on global growth. Forward-looking indicators of manufacturing activity suggest more downside is likely. While solid demand for services has helped to offset manufacturing weakness for the time being, services spending will slow due to the rise in interest rates and the anticipated lift in the unemployment rate. Global growth is expected to be lower in 2024 compared to 2023.

- The impact to manufacturing-intensive countries has been mixed. The manufacturing post-Covid rebound in China has been weak, Germany’s economy has slipped into a mild recession, but Japan’s economy has been solid.

- There will be varied outcomes within the manufacturing sector. The outlook for textiles, clothing, footwear, plastics manufacturing, furniture, household goods and vehicles is challenging however machinery and equipment is likely do better because of demand for tech goods.

Introduction

After a post-Covid boom, the global manufacturing sector is in a downturn. This Econosights looks at the outlook for manufacturing and whether the downturn in manufacturing will push the global economy into a recession.

What the leading indicators are saying

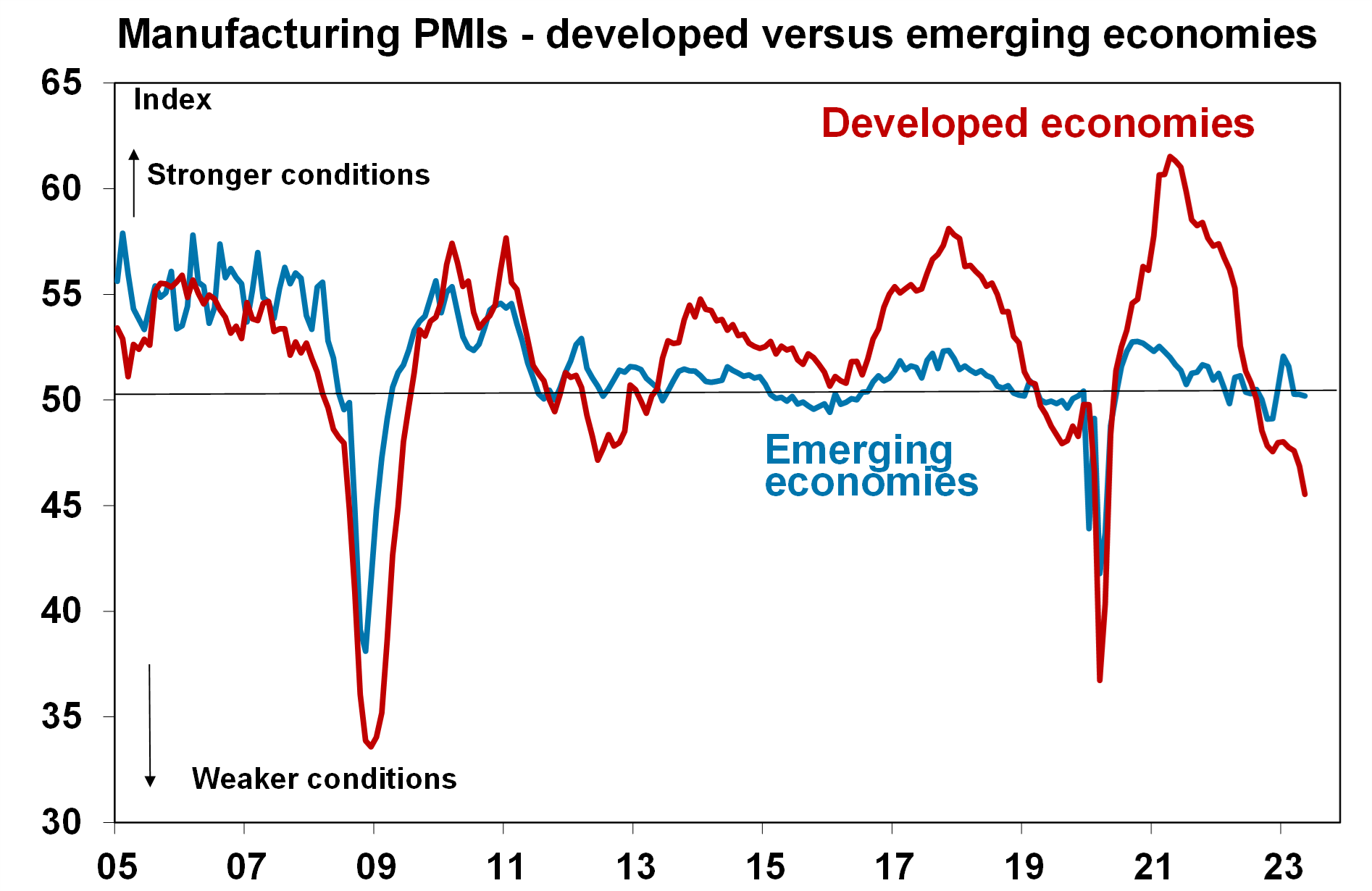

Purchasing Managers Indices (or PMIs) are surveys conducted across large global companies in manufacturing and services industries and are a leading indicator for GDP growth. Surveyed firms give monthly updates on forward-looking measures like orders, prices, employment and inventories. When PMIs are below 50, this suggests activity is contracting and when the reading is above 50 it means that activity is expanding. The consistent measurement of PMIs across countries means easy comparisons between countries. Global manufacturing took a hit during the initial stages of the pandemic in 2020 but thanks to massive monetary and fiscal stimulus which led to a fast rebound in goods demand, manufacturing had a very fast turn rebound in 2021 which lifted global growth – see the next chart. The slowing in global growth over 2022-23 as monetary policy was tightened resulted in a weakening in manufacturing conditions (with a short-lived turnaround in early 2023 from the China reopening) and activity is now contracting (with the global GDP-weighed PMI at 48.8) but are not consistent with historical recessionary-like conditions (when PMIs reach levels around 40 or lower). Weakness in manufacturing conditions has historically coincided with a slowing in global GDP growth. The sub-components of the PMIs indicate further weakness in new orders, a decline in inventories, a large improvement in supplier delivery times and employment still holding up, which shows some further downside in manufacturing activity from here, which will weigh on global growth.

Source: Bloomberg, AMP

Manufacturing and global trade also tend to move in tandem, so the weakness in manufacturing will weigh on trade volumes (see chart below).

Source: Bloomberg, AMP

Developed market manufacturing conditions look worse compared to emerging markets (see the chart below) driven by poor outcomes in Europe and the US. But, Chinese manufacturing indicators are also weak and indicate a contraction in activity. Conditions are holding up in the Middle East, India and Indonesia.

Source: Bloomberg, AMP

Historically, manufacturing has tended to go through 18-month up and downcycles. The peak in manufacturing PMIs was in mid-2021 (and has been declining since) which suggests that we may be close to the end of the down-cycle. However, the forward-looking indicators of manufacturing demand suggest that there is further weakness to come, especially as consumers spending has further to slow. So perhaps the pandemic has resulted in some disruption to the usual ups and downs in the manufacturing cycle. Services PMIs were rising in early 2023 but have started to hook down (see the chart below) and are likely to weaken further as consumers slow spending on services.

Source: Bloomberg, AMP

Which countries are most impacted?

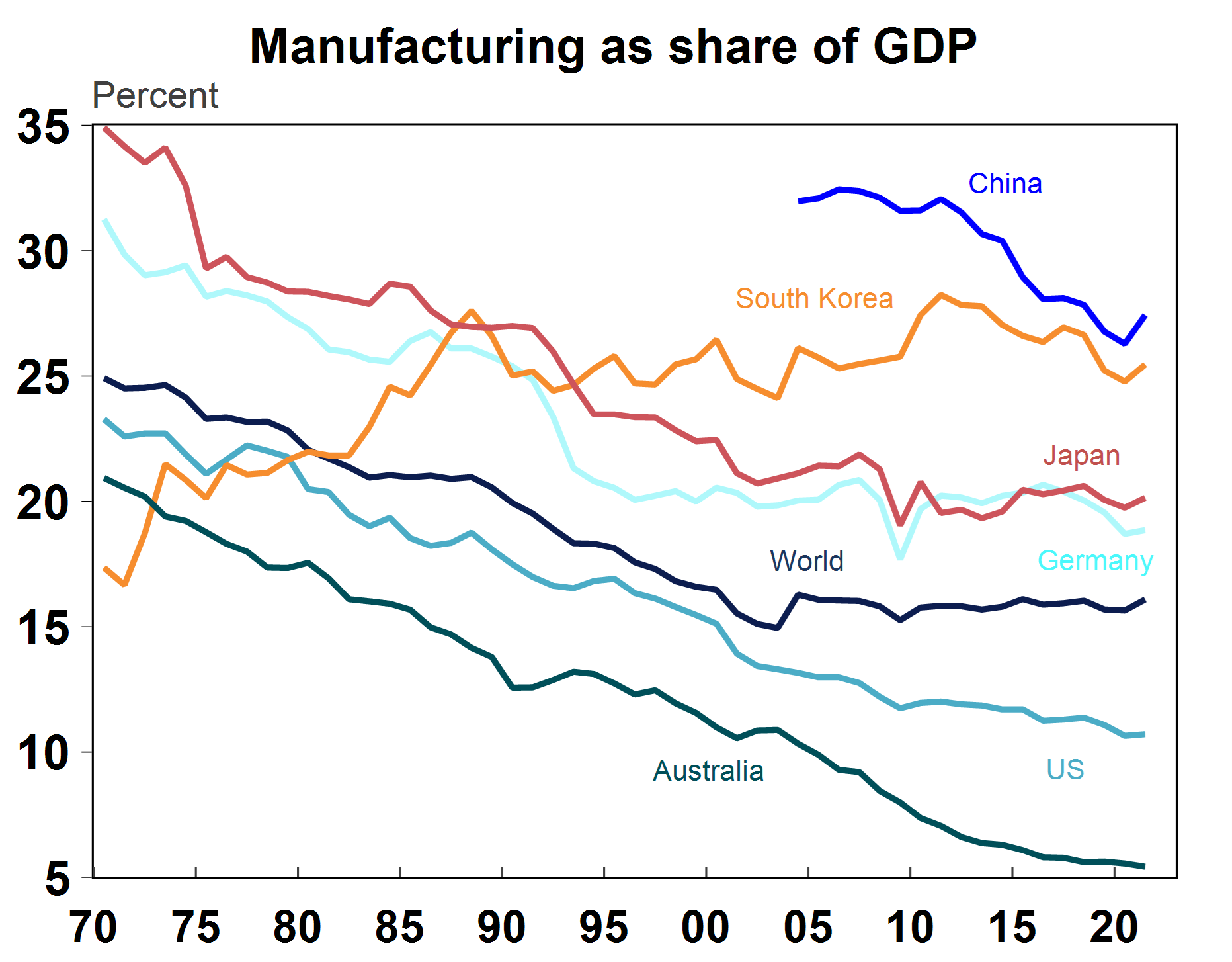

Manufacturing makes up around 16% of global GDP, having fallen from ~25% in 1970. The countries most exposed to manufacturing are China (27% of GDP), South Korea (25.5%), Japan (20%) and Germany (19%) – see the chart below. For the US, manufacturing is nearly 11% and Australia is 5.4%. However, many industries are inputs into the manufacturing process (like commodities), which means that countries can still be reliant on global manufacturing without direct exposure to it (like in Australia which is reliant on the Chinese manufacturing sector as a major trade partner).

Source: Macrobond, AMP

The impact of the manufacturing downturn has been unequal across manufacturing-intensive economies. The Chinese post-Covid growth rebound has been softer than expected in manufacturing but also more broadly across the economy, including in the property market. Germany was in a technical recession from December – March (albeit it was mild) and has seen a rise in its unemployment rate (from 5% in May 2022 to 5.7% in June 2023). However, despite Japan’s high dependence on manufacturing, growth has been solid which also reflects the low interest rate settings by the Bank of Japan (and lower compared to its global peers) which is helping to support the economy.

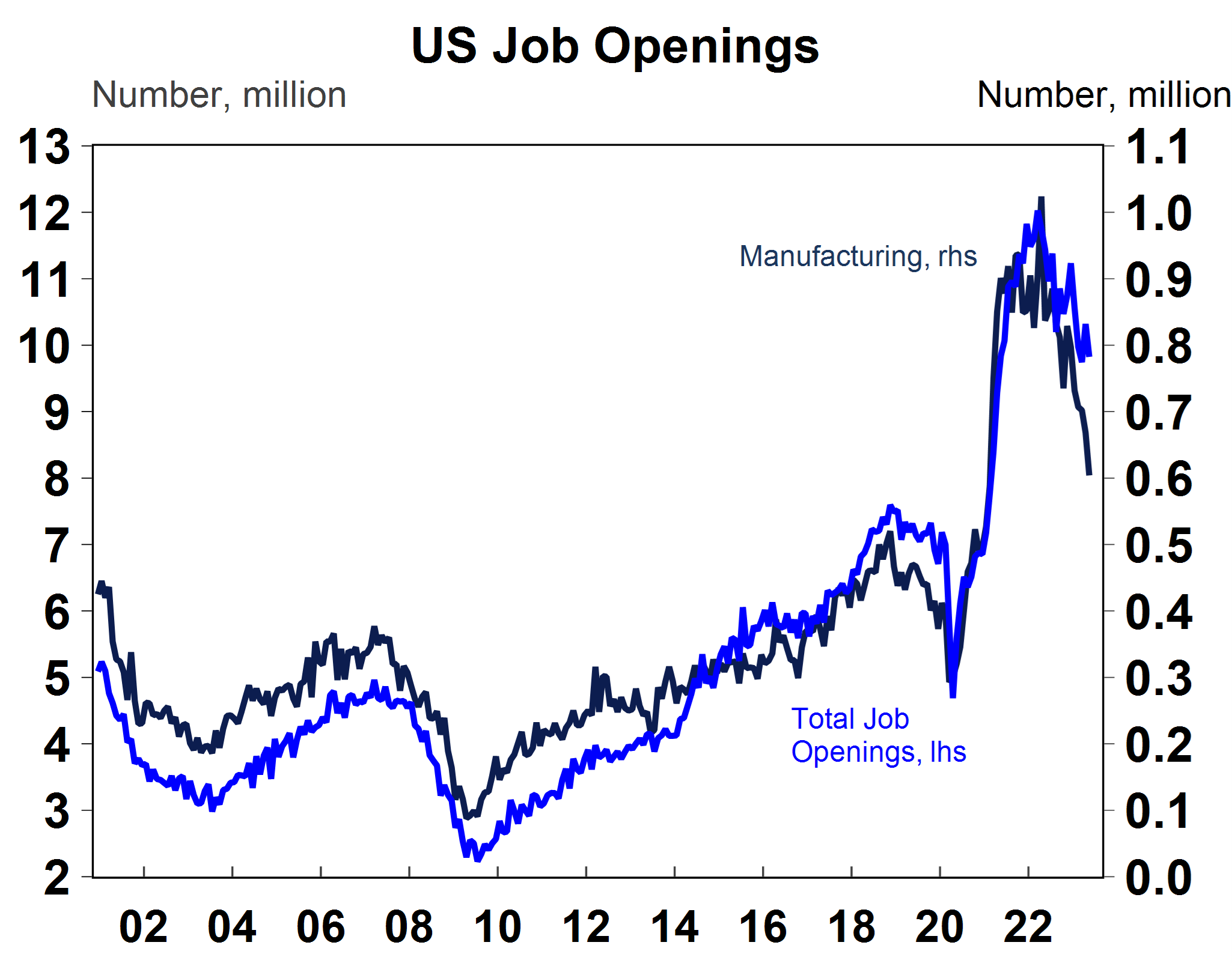

While the US reliance on manufacturing as a share of the economy is moderate and lower compared to the global average, it is still likely to weigh on growth over coming months and manufacturing job openings have fallen by more compared to total job openings (see the chart below).

Source: Macrobond, AMP

Implications for investors

Weak global manufacturing conditions are negative for global growth but have been partly offset by strong services activity. We expect global growth to be around 2.7% this year which is below historical average growth of around 3%. But growth in 2024 is expected to be even weaker, at around 2.3%, as services activity slows from the lagged impact of rising interest rates with the high risk of a recession in the US, UK, New Zealand and Australia. The outlook for manufacturing also remains challenging in the high interest rate environment which is confirmed in forward-looking indicators like manufacturing new orders which look very poor.

The impact to sharemarkets from the manufacturing downturn has been mixed. The broad weakness in the Chinese economy and concern about future potential growth has led to poor performance in Chinese shares in 2023 (so far) while investors have looked through Germany’s technical recession, with solid growth in shares (German shares are up by 12% year to date) although arguably markets were forward-looking and anticipated the weakness with a big fall in equities in the first 9 months of 2022. And in Japan, sharemarkets have been tracking around their highest levels since 1989 (although they have weakened in recent weeks). Differences in monetary and fiscal policy settings across these countries explain some of the divergences in sharemarket performance.

While the near-term outlook for manufacturing still looks challenging, there will be varied outcomes within manufacturing itself. Expected further slowing of consumer demand for goods means a poor outlook for textiles, clothing, footwear, plastics manufacturing , furniture, household goods and vehicles. However, machinery and equipment manufacturing are likely to do better, given demand for tech goods. The continued trade disputes between the US and China around semiconductors which are used in electronic equipment and devices also means that the Western world will attempt to bring more manufacturing back on their own shores or onto friendly trade partners, instead of relying on China which will result in a redistribution of trade between countries over time.

Weekly market update 22-11-2024

22 November 2024 | Blog Against a backdrop of geopolitical risk and noise, high valuations for shares and an eroding equity risk premium, there is positive momentum underpinning sharemarkets for now including the “goldilocks” economic backdrop, the global bank central cutting cycle, positive earnings growth and expectations of US fiscal spending. Read more

Oliver's insights - Trump challenges and constraints

19 November 2024 | Blog Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory. Read more

Econosights - strong employment against weak GDP growth

18 November 2024 | Blog The persistent strength in the Australian labour market has occurred against a backdrop of poor GDP growth, which is unusual. We go through this issue in this edition of Econosights. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.