Key points

- Public and private debt (as a share of GDP) is declining from its 2020 record highs as the pandemic resulted in a spending splurge (particularly for governments) but it is occurring slowly. The recent increase in fiscal stimulus as governments attempt to assist households with cost-of-living pressures has been small and should not add significantly to public debt (as a share of GDP).

- Government fiscal stimulus measures to assist households with cost-of-living issues need to be targeted and funded by cost-saving measures to help get inflation down, otherwise central bank efforts in raising interest rates will end up being futile.

- Global fiscal policy was contractionary in 2022 (and in 2021) and will continue to be contractionary in 2023 (even accounting for recent stimulus measures) as budget deficits normalise post-Covid which will weigh on economic growth but will be helpful in reducing inflation.

Introduction

Prior to the Covid pandemic, fiscal policy was seen as a slow-moving tool used by governments to have long-term impacts on the economy while monetary policy was used as the main policy lever and the driver of financial markets. This radically shifted in 2020 as fiscal policy became the main tool used to support households and businesses during the pandemic and ended up being a primary factor behind the lift in inflation from 2021‑now. Monetary policy was still useful in keeping yields and interest rates low during the pandemic, but it became less effective as a redistribution tool for households and corporates during the health crisis.

After 2020/21, fiscal policy was expected to become less important as the pandemic faded and the risk to economic growth declined. However, the surge in inflation this year, particularly for essential items like food, and the energy crisis (especially in Europe) has complicated the situation as governments are trying to support households through the cost-of-living “crisis”. But a lift in government spending right now risks exacerbating inflation impacts even further and risks entrenching high budget deficits for the long-term which is a risk for future economic growth. With the International Monetary Fund releasing their Global Fiscal Monitor recently, this Econosights gives an update on the global debt situation and recent fiscal policy announcements.

Global debt

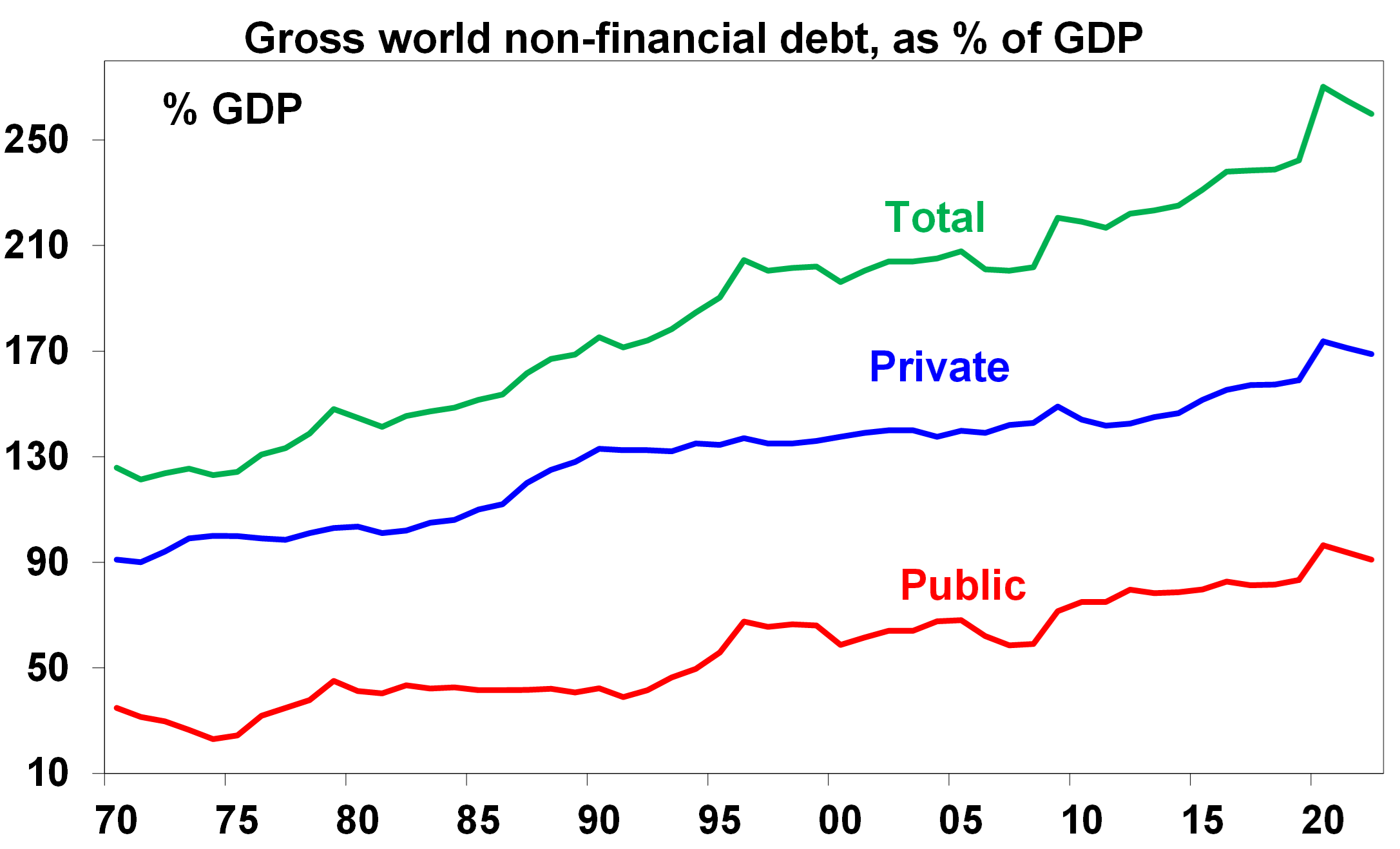

The 2020 Covid-19 pandemic led to a surge in public debt, which lifted to over 96% of GDP across the world in 2020, from 83% in 2019 and is expected to decline to 91% in 2022 which is still high relative to historical averages (see the chart below). Private debt also increased in 2020 to a record high of nearly 174% of GDP, from 159% in the prior year and is expected to decline to decline to 169% of GDP in 2022. Public debt tends to be higher as a share of GDP in developed countries, compared to emerging markets, as developed countries can afford to borrow at a lower cost. Emerging markets tend to have higher levels of private debt, as households typically save a large portion of salaries as a form of a pension.

Source: IMF, Ned Davis, Haver Analytics, AMP

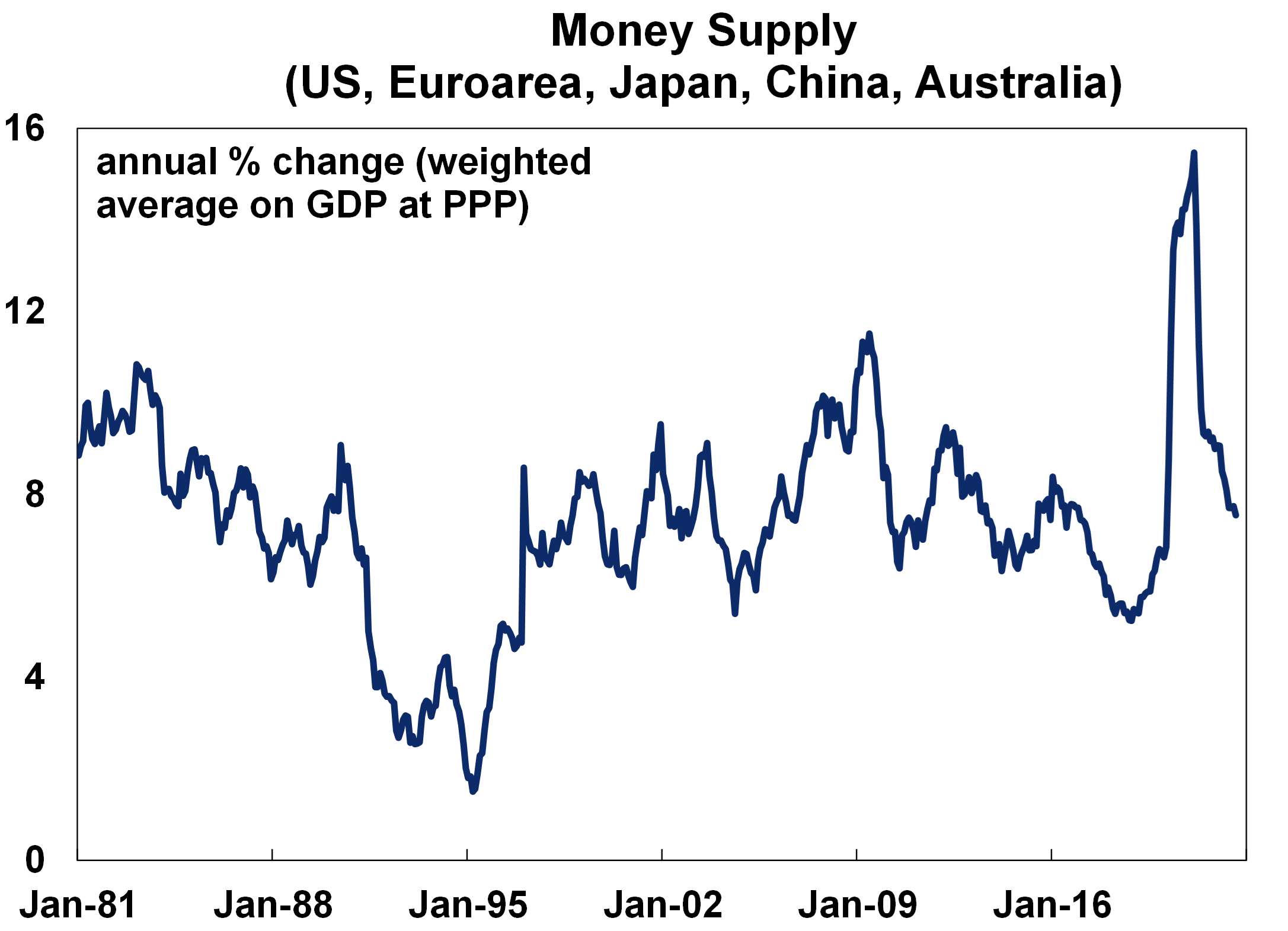

The surge in global debt in 2020 and associated loosening in monetary policy (with declines in interest rate, quantitative easing and bond yield targets in some countries) was a big reason for the surge in the money supply in 2020/21 (see the chart below) which has been one of the reasons behind the lift in inflation.

Source: Bloomberg, AMP

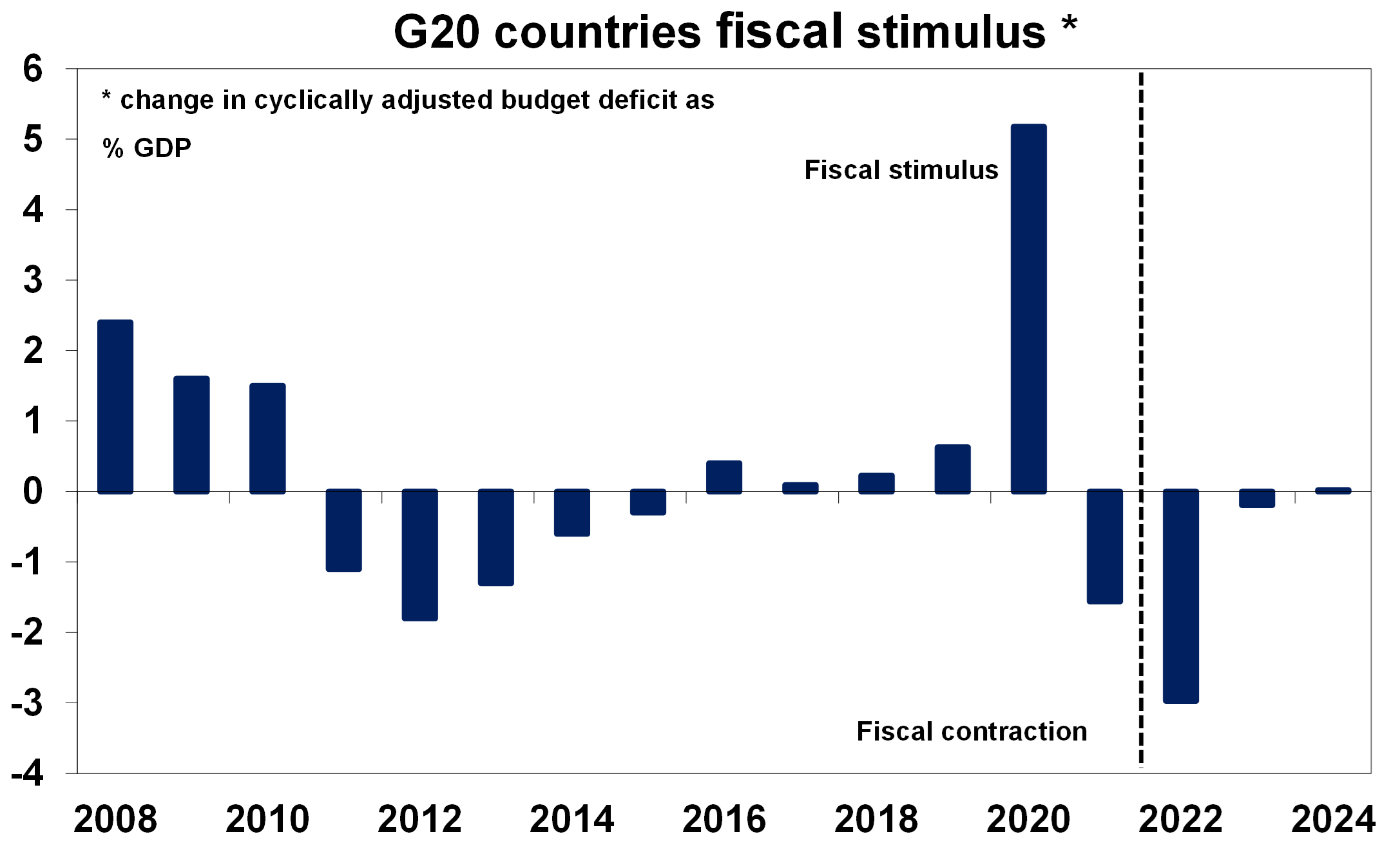

Since the splurge in spending in 2020/21, most governments are expecting to rein in the pace of expenditure, with a decline in government budget deficits forecast across the advanced world. This means that fiscal stimulus will continue to be contractionary in 2023 (and monetary policy will also be contractionary) which will help to get inflation down.

Fiscal policy

The impact of fiscal stimulus (whether it is stimulatory or contractionary) can be measured by comparing changes in annual budget deficits (most advanced economies run budget deficits). In 2022, fiscal policy was contractionary as budget deficits improved across the G20 economies (see the chart below) as Covid-19 spending programs were unwound. Just as the positive fiscal stimulus in 2020 worked with a lag for inflation (with inflation not rising until 2021/22), the fiscal contraction will also work with a lag and help to bring down inflation in 2023. Fiscal policy is expected to be contractionary again in 2023, although not as contractionary as in 2022.

Source: IMF, AMP

A reduction in global debt from pandemic highs across both the private and public sectors is necessary to bring economies back to more “normal” debt holdings and reduce risks with holding high debt loads, especially as bond yields are rising (which increases the cost of debt, especially for poorer nations). High holdings of debt leave countries vulnerable to a shock (the main risks include a currency shock, a liquidity crisis or a fall in GDP growth). Currency movements are more important for countries that have large holdings of currencies outside their jurisdiction and especially for emerging markets which have a high share of US-denominated foreign debt. With the US dollar appreciating by 17% since the beginning of the year, emerging market debt holdings have soared.

Recent fiscal stimulus announcements

A “cost of living crisis” mostly across the advanced world (from high inflation especially for essential items like food and energy) has led to renewed pressure on governments to support households via welfare transfers. This is a difficult situation because, while vulnerable households may need help assistance in the short-term, more fiscal stimulus risks making inflation higher in the near-term, at a time when central banks are trying to reduce inflation. The best measure is to support households by cutting spending in other areas, or increasing taxes on energy companies who have benefitted from recent high prices and use the revenue raised to subsidise low and middle income household energy bills.

The problem with pushing through significant fiscal stimulus was recently seen in the UK catastrophe, with the Truss government initially announcing an unfunded fiscal stimulus worth 12.5% of GDP (over 3-5 years) through cutting taxes to households and reversing a corporate tax hike. Financial markets had a big negative reaction because of the upside inflation implications, with a surge in bond yields causing issues in the pension industry, leading to the government reversing all decisions to cut taxes.

UBS tracks the fiscal policies of 35 countries and found that recently announced fiscal stimulus was worth around 1.5% of GDP on average recently (most of the measures have been done in Europe given high energy prices) which is relatively small and should have minimal impacts on inflation.

In some countries like China, more fiscal policy would be welcome because inflation is not an issue (consumer price inflation was 2.8% over the year to September versus because 8.2% per annum in the US) and as the economy deals with the negative hits to economic growth from the zero Covid policy, the property market downturn and droughts earlier in the year. China has already pushed through fiscal stimulus worth around 7% of GDP this year but it hasn’t had much of an upside impact on economic activity.

In the US, after generous government spending in 2021 with the “American Rescue Plan of 2021” (worth just under 10% of GDP), the government implemented the “Inflation Reduction Act” (which wasn’t actually very beneficial in reducing inflation because the measures were more long-term) but the US budget deficit has been coming down and is currently at just over 5% of GDP, well down from the 22% of GDP during the pandemic. US fiscal policy changes are likely to be limited in the near‑term as Democrats are likely to lose control of at least the House of Representatives after the November mid-term elections (with the risk that the Senate also goes to the Republicans).

Australia Labor 2022/23 Federal Budget

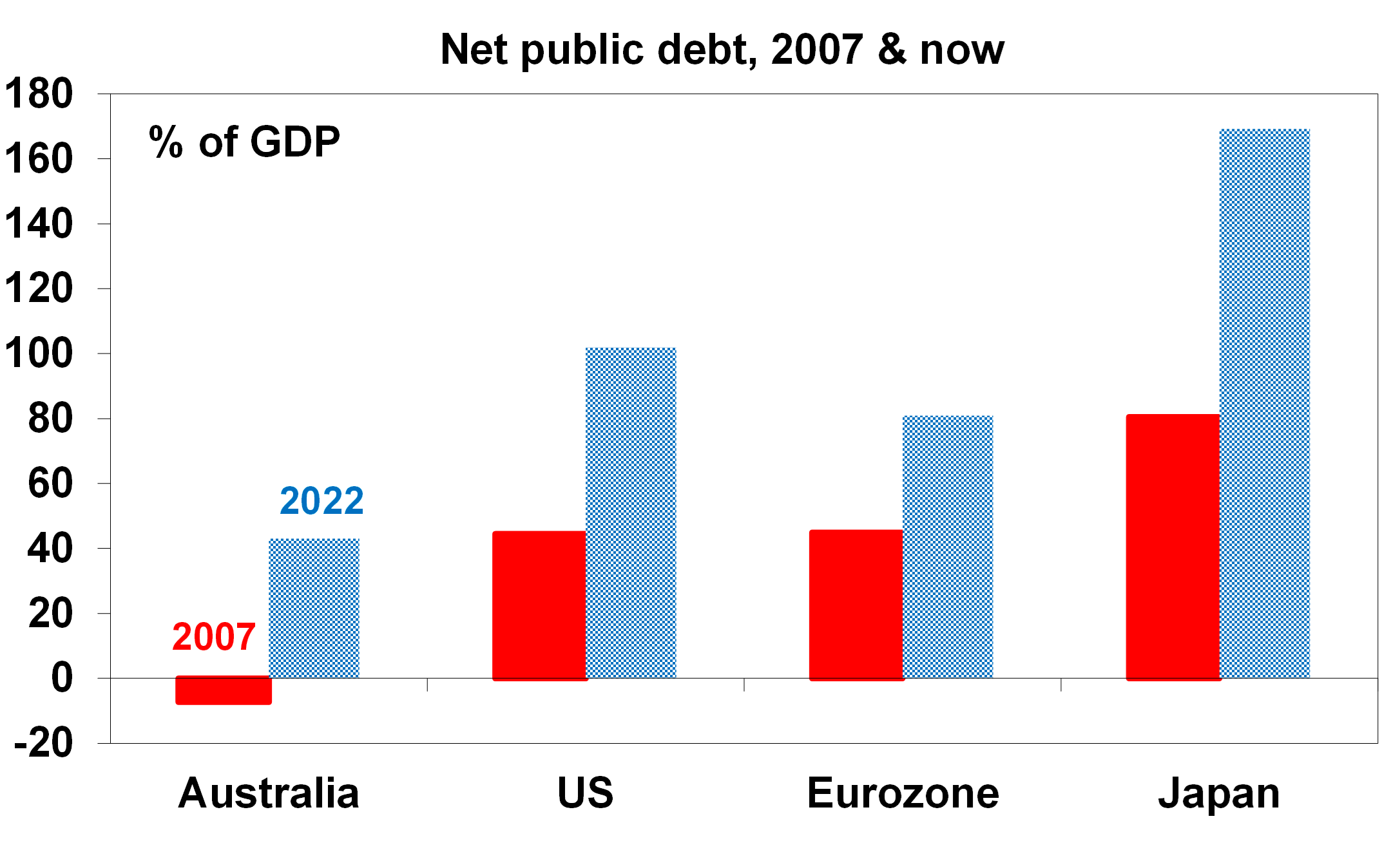

Labor’s victory in this year’s Federal election means that another budget will be handed down on Tuesday 25 October. Treasury estimates are expected to show lower budget deficits over the forecast horizon (but still high compared to history), around $40bn in 2022/23 (or ~1.7% of GDP) and $35bn in 2023/24, well below earlier estimates thanks to the big rise in commodity prices and higher inflation which lifts nominal growth. Any new additional government spending will be small and focused on election promises of childcare, parental leave and aged care. Some minor cost of living and flood assistance measures are also likely. The government will also need to address the blow out in National Disability Insurance Scheme spending and public debt interest costs. Budget savings are expected to come from spending cuts to some government programs and potential changes to superannuation caps. Australia’s net debt is expected to reach 43% in 2022 which is well above 2007 levels (when net debt was actually negative) but is much lower compared to many global peers (see the chart below). This is good news for Australia maintaining its AAA credit rating.

Source: IMF, AMP

Conclusion

Recent fiscal stimulus measures aimed at cost of living relief in advanced economies have been small and should not add significantly to public debt or inflation. The recent UK experience shows that large-scale fiscal stimulus is difficult now - because it risks causing more inflation and makes the job for central banks harder.

On average, public and private debt holdings are expected to come down over the next few years. This makes sense as higher debt burdens are negative for long-run GDP growth, especially as the cost of debt has gone up with bond yields.

More investment insights

Weekly market update 26-07-2024

26 July 2024 | Blog Dr Shane Oliver discusses the risk off as tech hit continues; correction risks into August/September; global rate cutting cycle underway; Australian June quarter CPI to rise but the hurdle to another RBA rate hike should be high; and more. Read more

Oliver's insights - rise of populism and bigger government

24 July 2024 | Blog This article takes a look at the rise of populism and what it means for economic policies and investors. Read more

Weekly market update 19-07-2024

19 July 2024 | Blog This week shares are down; US election/Trump prospects starting to impact; global rates easing cycle on track; China Plenum; Australian jobs still tight but easing so RBA needs to be careful; and more. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.