Key points

- Australian inflation rate peaked in the December quarter but has been slower to decline than some global peers. While interest rate rises are helping to reduce inflation (especially as discretionary consumer spending slows), rises in domestic energy prices, a tight rental market and a lagged pick up in wages have contributed to higher-than-expected inflation outcomes.

- The main policy available in the RBA’s toolkit to manage inflation is interest rates, which is a blunt tool because of its unequal impact on households with debt.

- The burden of interest rate increases falls on households with mortgage debt. Businesses and investors are also impacted but the deductibility of interest provides some offset.

- Some countries in Europe have opted to use price controls for essential items to reduce inflation, with mixed results. Price controls tend to add distortions to the market and rent controls are not helpful while housing supply is limited (like in Australia).

- But the government still has a role to play in helping the RBA achieve its 2-3% inflation target through keeping fiscal policy neutral/contractionary if inflation is high, ensuring a well-functioning energy market, maintaining sustainable wage increases, regulating businesses to discourage price-gouging and monopolistic behaviour and calibrating appropriate migration targets to match housing supply.

Introduction

Australian inflation is very high. Consumer prices were up by 7% over the year to March, around a 33-year high, but this was a decline from a cyclical peak of 7.8% in December 2022. The Reserve Bank of Australia (RBA) has been focussing on reducing inflation through the main policy tool available in the central bank’s toolkit – interest rates. The cash rate has risen from 0.1% in April 2022 to 4.1% in June – a 4% lift in just over a year. But, the impact on inflation so far has been lower than expected. As a result, we are often asked whether interest rates are actually having an impact on inflation or whether there are better tools available to policymakers, especially as interest rate hikes are having an unequal impact across household groups. We go through some of these issues in this Econosights.

Are interest rate hikes working to reduce inflation?

Interest rate hikes have led to a slowing in consumer demand which is helping to reduce inflation. Discretionary spending fell in the March quarter and the volumes of retail spending was negative over the December-March quarter. Without the lift in interest rates, inflation may have increased further and consumer and market-based medium-long term inflation expectations could have kept rising well above the RBA’s 2-3% inflation target.

Some might say that rate hikes should have worked faster or better by now to reduce inflation. The problem has been that there have been numerous supply-driven elements of the inflation story that have been less sensitive to interest rate changes. Covid-driven supply chain disruptions led to big increases in shipping costs, commodity prices like energy, metals and agriculture increased significantly in 2021-22 mostly from supply disruptions, domestic energy supply issues led to an Australian energy crisis and multiple domestic floods led to higher food prices. While these issues may not be directly influenced by the level of change in interest rates, it is the responsibility of the RBA to ensure that supply-driven price changes do not leak into consumer prices. A lot of these supply-related issues are now resolved, but it takes time for it to be reflected in the final inflation figures.

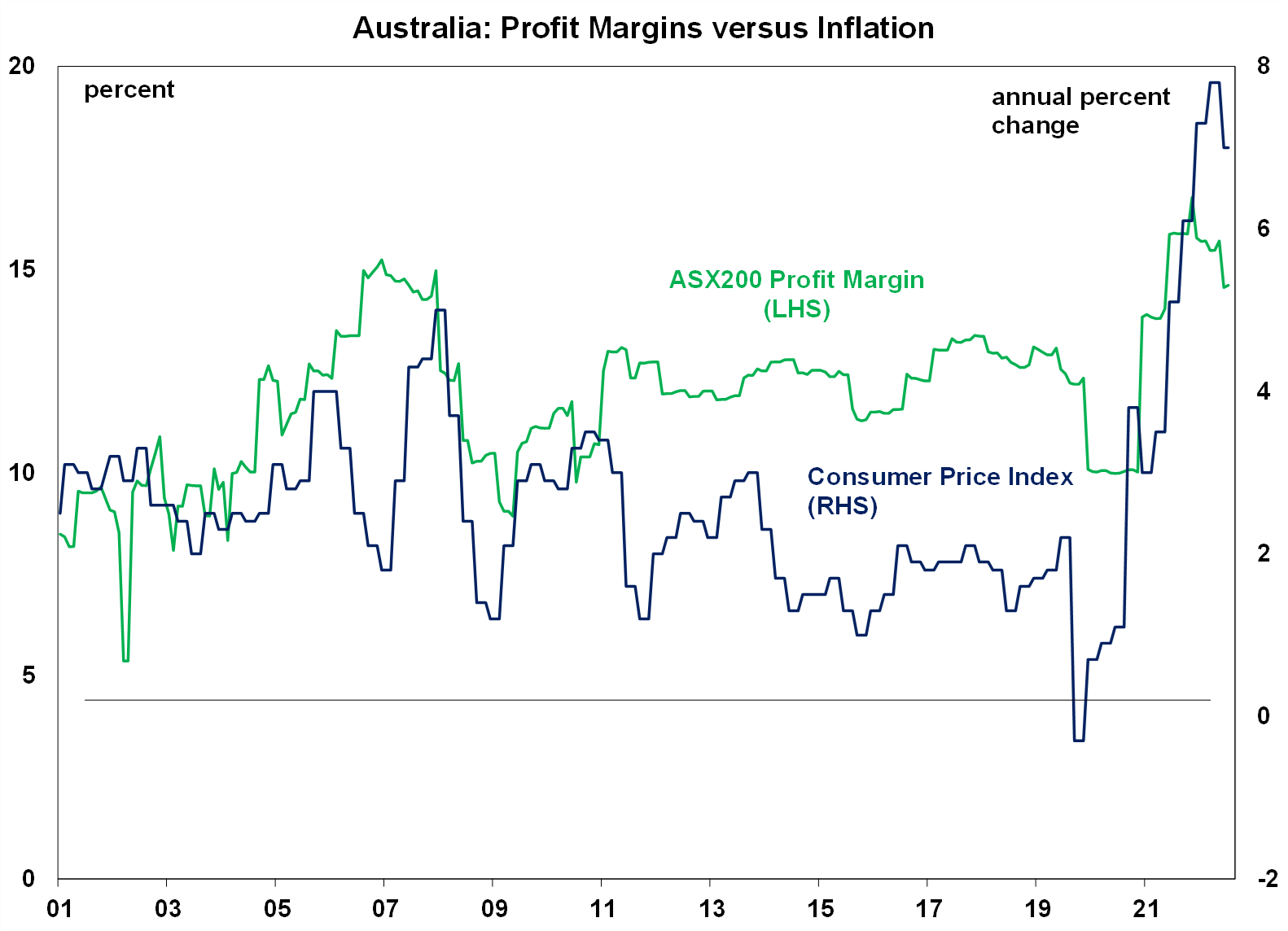

Evidence of excessive price gouging by businesses is not obvious. Profit margins have expanded (increasing from 10% in 2020 to a recent high of ~16%) but have generally moved in proportion to the rise in inflation (see the chart below) and are now declining. The profit share (ex mining) of GDP has also been fairly stable. And slowing consumer discretionary spending means that continued profit margin expansion will be unlikely.

Source: Bloomberg, AMP

The peak of Australian inflation (in December 2022) also occurred later compared to some global peers which means that the slowing in inflation appears like its taking longer. US inflation peaked at 9.1% in June 2022 and in the Eurozone at 10.6% in October 2022 (see the next chart).

Source: Macrobond, AMP

Australia’s energy crisis occurred later relative to the Northern hemisphere, because of a raft of our own domestic issues like supply challenges with coal, a poor national plan for the energy transition and higher global prices. This meant that both the US and Europe were more impacted by an energy price surge in early 2022 from the war in Ukraine and the winter weather. Australia’s rental market also tightened significantly over the past year as net migration rebounded to record highs after the pandemic, pushing vacancy rates to ultra-low levels in the capital cities and lifted rents, although recent vacancy rates across the capital cities have ticked up and newly advertised rental growth is slowing. Australia’s wage setting system also seems to have more “inertia”, with the minimum wage decision occurring once a year and many other wages like awards also based off this annual decision or driven by changes to headline inflation, which only peaked in December 2022.

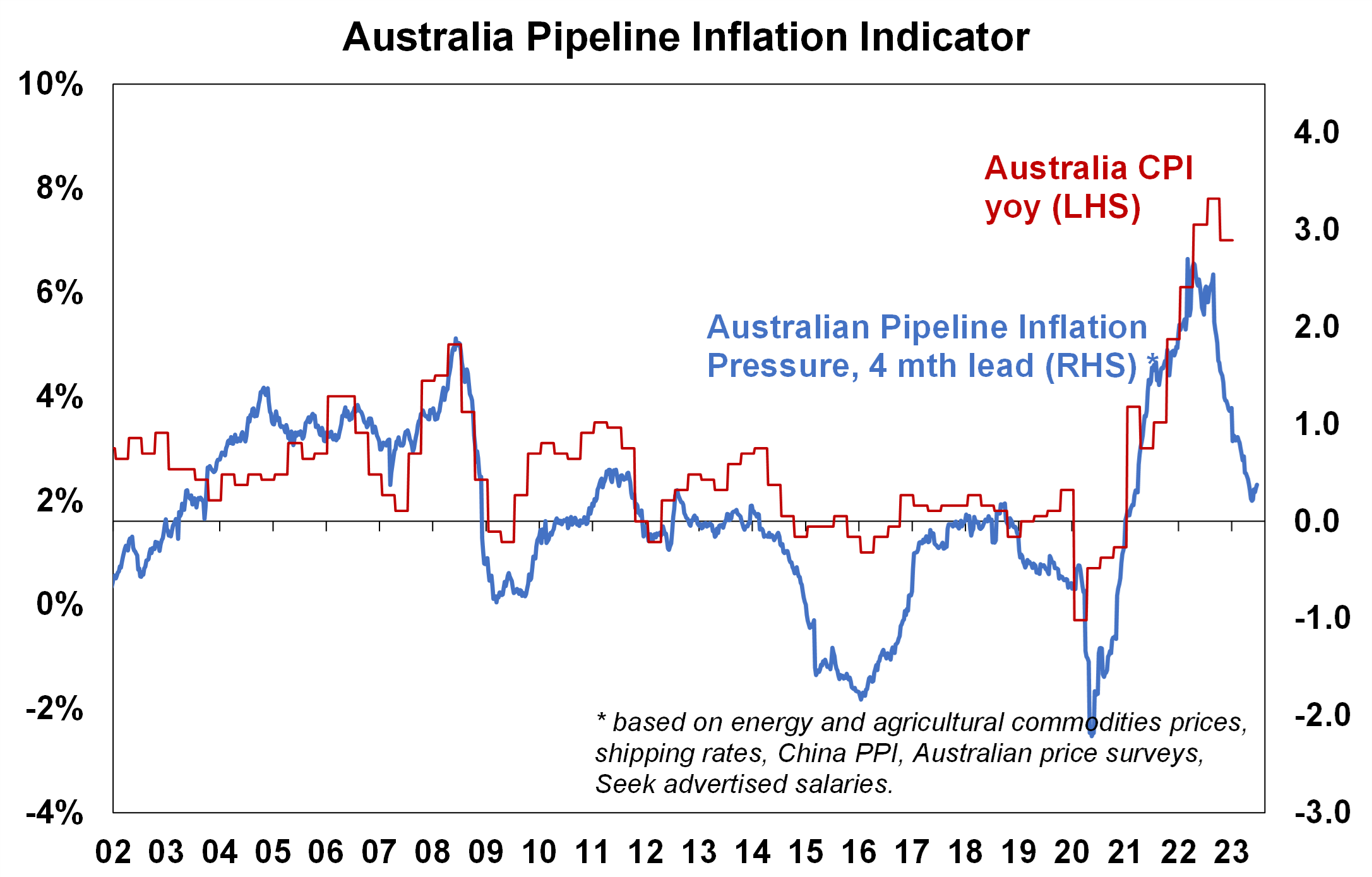

While these factors all suggest that inflation in Australia could remain higher for longer for now, the good news is that our Pipeline Inflation indicator still suggests significant downside to Australian inflation over the next six months and we expect headline consumer prices to be at the top end of the RBA’s target band by early 2024 (on a 6-month annualised basis).

Source: Bloomberg, AMP

Are interest rate hikes increasing inequality?

The impact of monetary policy works primarily through the lending channel because borrowing rates are priced off the cash rate. Households with a mortgage are the most impacted by interest rate changes. Businesses and individual investors are arguably less impacted because they can deduct the debt interest expenses. There are also other financial market channels that monetary policy works through, mostly through the exchange rate.

The high level of household debt now means that mortgage holders will bear the brunt of monetary policy changes. Renters can also be affected from higher interest rates if landlords are able to pass on the higher cost of debt servicing through higher rents. This is only usually an option in a tight rental market (which the current situation is allowing for).

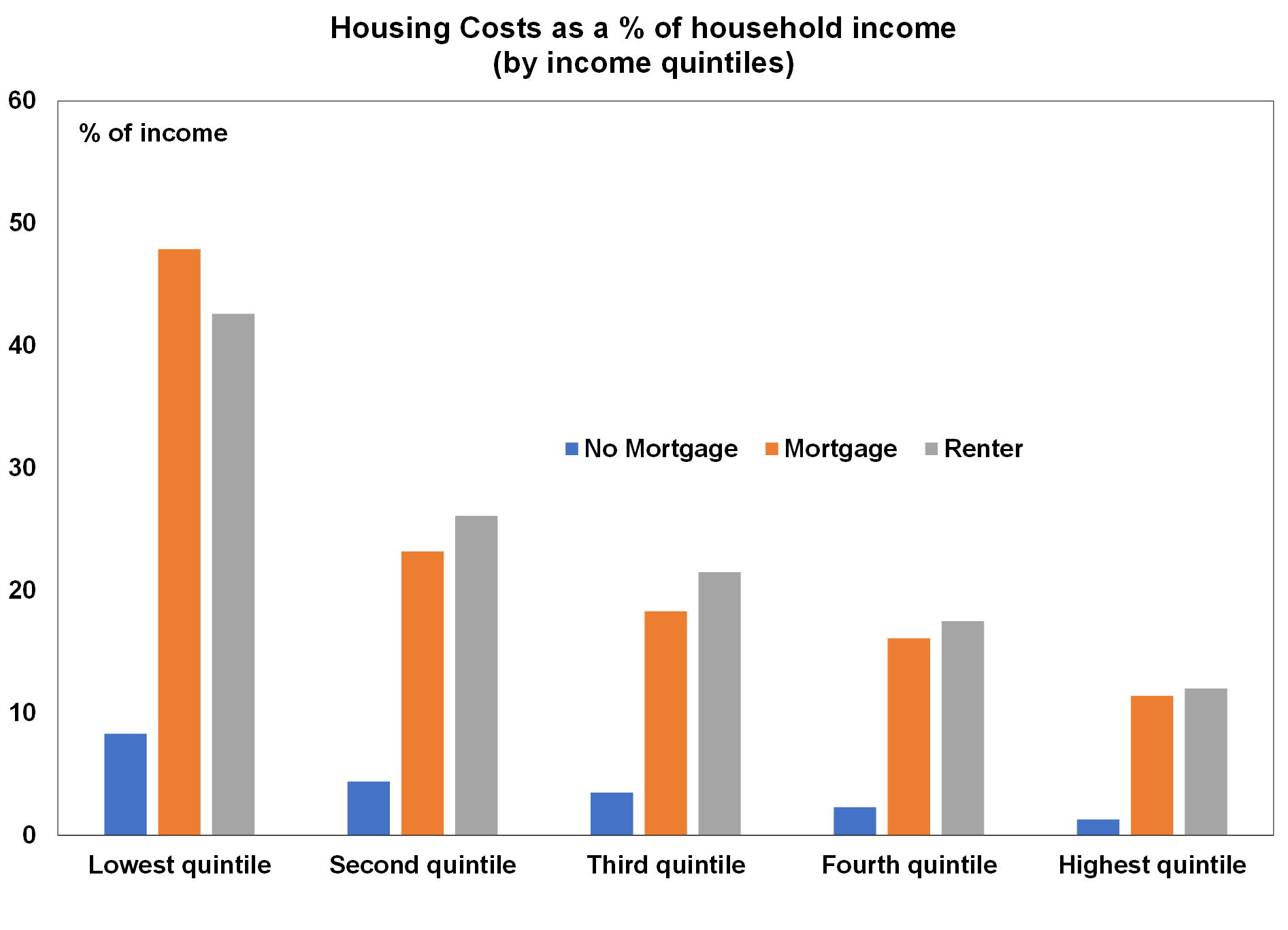

In Australia, 37% of households have a mortgage (using data from 2019-20), 29% rent and 30% own their own outright. Detailed ABS data on housing costs shows that households with a mortgage spend close to 16% of their gross household income on “housing costs” (mortgage or rent and rate payments) as at 2019-20, owners without a mortgage spend 3% of their income on housing costs and the average renter spends close to 20% of their income on housing. And there are divergences across income quintiles (see the chart below) with the lowest income quintiles spending a very large share of income on housing costs.

Source: Bloomberg, AMP

Are there other options to combat high inflation?

The high degree of supply-related factors that have increased inflation, the slow reduction in prices despite aggressive interest rate hikes and the high burden placed on households with a mortgage has led to questions about whether there are other options available to reduce the level of inflation.

The RBA has been tasked with the responsibility for the 2-3% inflation target. But the only tool at its disposal is monetary policy. While the range of options within the toolkit has expanded beyond interest rates (including yield targets and quantitative easing) all of these measures ultimately influence the money supply and therefore the cost of borrowing.

The government has more tools at its disposal compared to the RBA through its spending and taxation decisions as well as regulation. However, these tools are slow moving and do not have as much of a direct impact on inflation. Some have argued that price controls need to be considered in Australia. Food price caps have recently been tried in Europe for some essential items, including in France, Croatia and Hungary with mixed impacts as measured inflation went down but there were reports of some food shortages. Usually, economists do not advocate for price controls or caps because it’s a distortion in the market and leads to problems like supply shortages. However, the Federal government did impose energy price caps domestically, so it is already being utilised in some capacity. Talk of rent controls would likely add to supply constraints across Australia at a time when housing supply needs to lift.

But, the government does have a role to play in many components that impact inflation, such as by ensuring a well-regulated electricity market, sustainable outcomes for minimum award and public sector wages which set the tone for the rest of the market, ensuring that fiscal policy (both state and federal) is appropriate for the state of the economy (we think the impact of the May Federal budget is more or less neutral but with the addition of some state cost of living benefits it could be marginally inflationary and the government could consider raising taxes to help get inflation down), regulation of retailers to ensure adequate competition and ensuring adequate housing for the migration targets.

Implications for investors

For investors, the good news is that inflation is expected to decline through the rest of the year which should mean that central banks are close to the top of their tightening cycles. This is generally positive for sharemarkets however, the further interest rates increase, the higher the risk of recession which is a risk for sharemarkets. The RBA’s recent hawkish stance means that further increases to the cash rate are likely in Australia. We expect another 2 interest rate increases from here, taking the cash rate to 4.6% which risks a recession in the next 12 months because of the heightened sensitivity of households to interest rate hikes in Australia.

Oliver's insights - Trump challenges and constraints

19 November 2024 | Blog Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory. Read more

Econosights - strong employment against weak GDP growth

18 November 2024 | Blog The persistent strength in the Australian labour market has occurred against a backdrop of poor GDP growth, which is unusual. We go through this issue in this edition of Econosights. Read more

Weekly market update 15-11-2024

15 November 2024 | Blog Global share markets were messy over the last week, not helped by the ongoing rise in bond yields and a wind back in Fed rate cut expectations after some elevated US inflation data and slightly hawkish comments from Fed chair Powell. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.