Key points

- It is expected that accumulated household savings in Australia will help to cushion some of the negative impacts of higher interest rates, which will keep discretionary spending from collapsing in late 2023 and into 2024.

- Accumulated savings remain high on average and indicate that consumers could have another 2-3 years before excess savings are fully run-down. However, this masks divergences across different groups of households with older households (who are less impacted by rising interest rates because they tend to have smaller mortgages) holding a larger share of deposits.

- We expect the run-down of savings to pick up pace throughout the remainder of 2023 and expect accumulated savings to be mostly exhausted by late 2024. On our forecasts, consumer spending will slow significantly over the next 12 months as excess savings fall and housing mortgage repayments rise to a record high.

- US households have been drawing down excess savings at a faster pace than in Australia, with accumulated savings down by 70% of savings since a peak in August 2021. At this rate, US households will exhaust their excess savings by March 2024.

Introduction

Consumers in Australia have faced numerous headwinds over the past 18 months including high inflation (especially for items like groceries, electricity, gas and petrol which are essential and makes it difficult to reduce spending) which has also led to negative real wages growth and a large increase in mortgage repayments (due to the rise in interest rates since May 2022). This challenging backdrop for consumers has resulted in some decline in consumer spending, with discretionary spending down by 4% on an annualised basis in the March quarter and retail volumes have been negative over 3 consecutive quarters to June. However, we had thought that consumer spending would have fallen by more now than it has. Consumer spending appears to be supported by a high level of pent-up savings that has allowed households to cushion some of the recent negative hits. This edition of Econosights looks at how much longer households can draw down on savings and what the outlook is for consumer spending.

Measuring accumulated savings

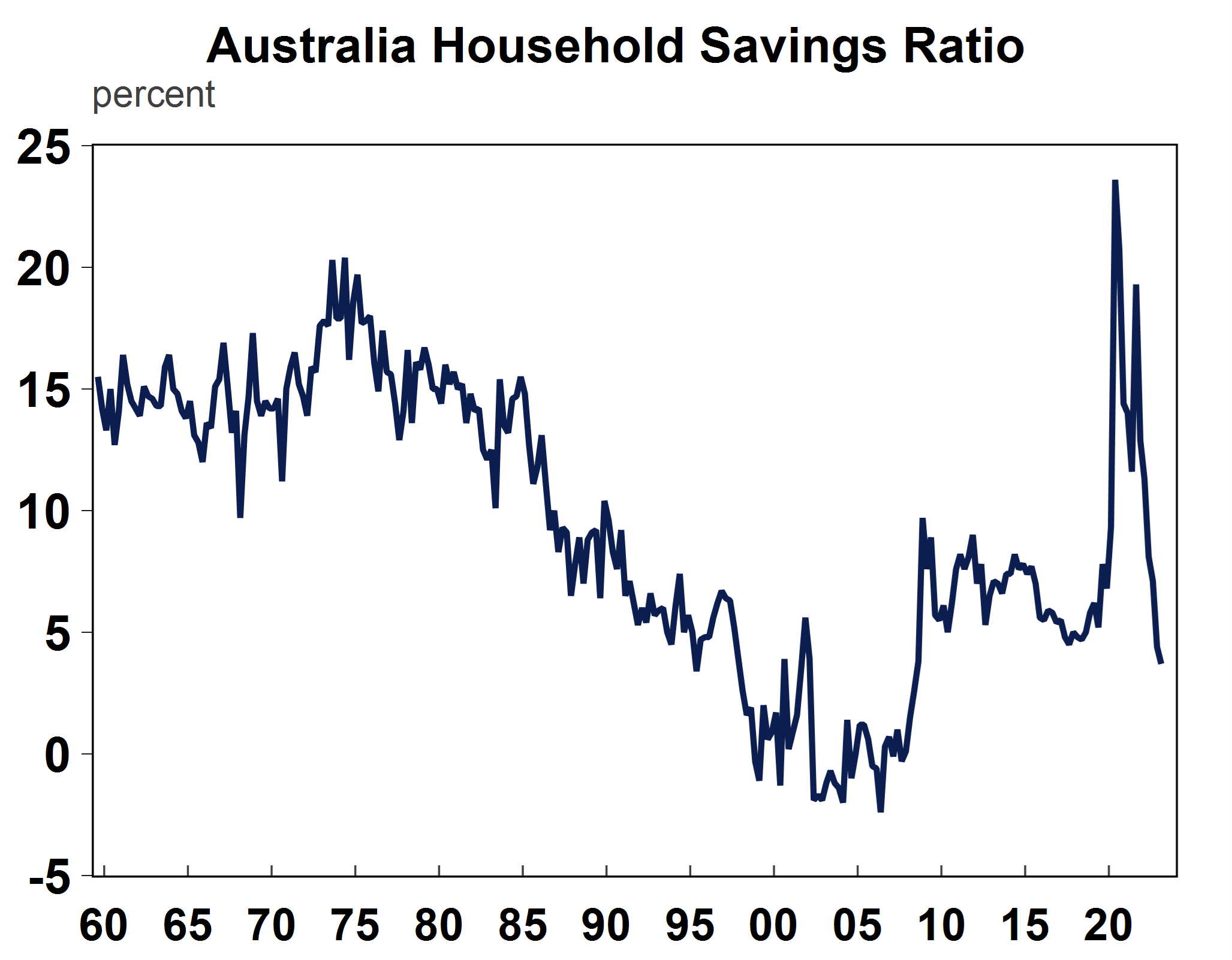

The consumer savings rate is a measure of household savings (which are measured as the difference between household disposable income and consumer spending) as a percentage of household disposable income. Since September 1959, the savings rate in Australia has averaged at 9.4% (see the chart below).

Source: Macrobond, AMP

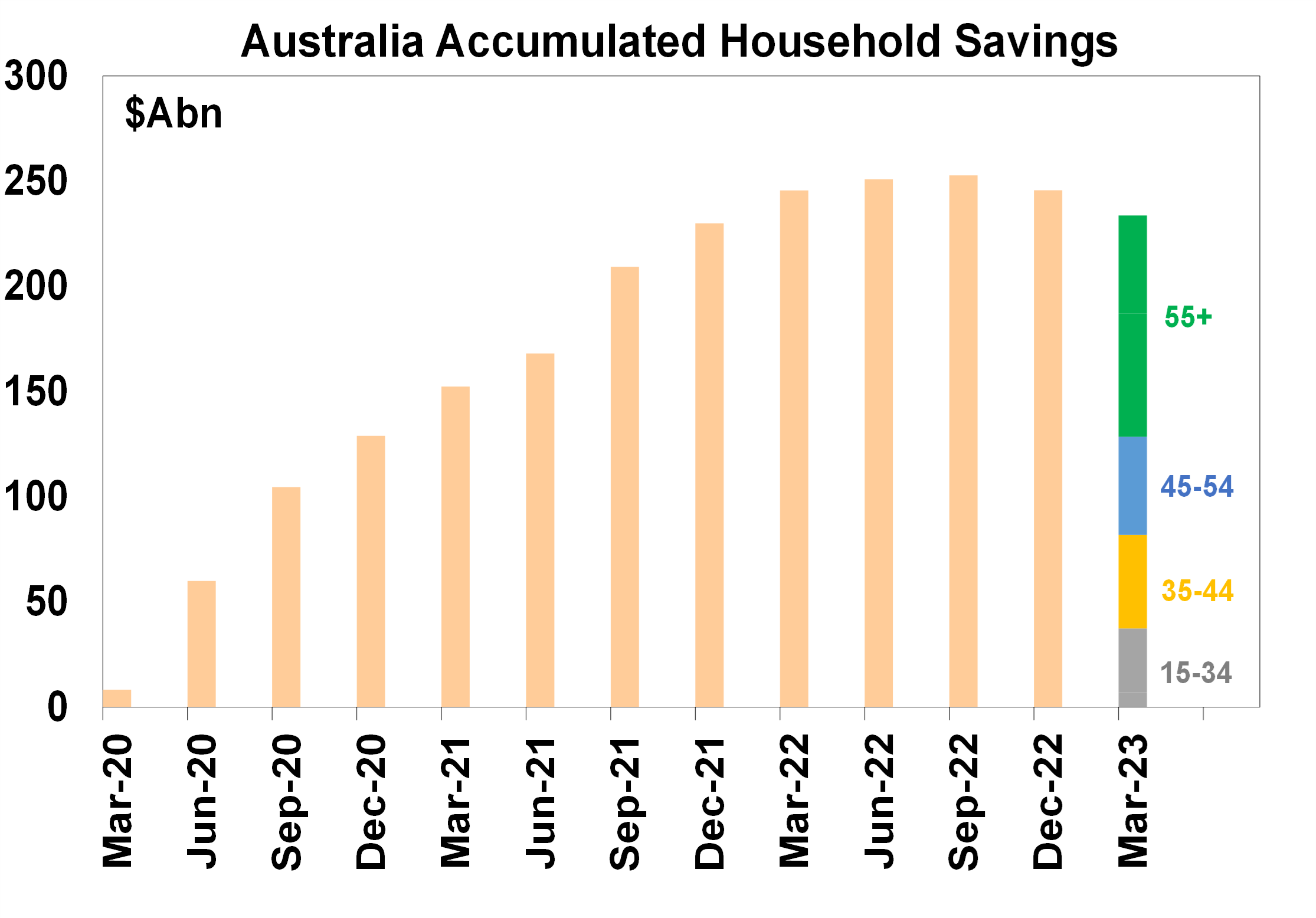

In 2020, the savings rate shot up as consumer incomes got a boost from numerous government stimulus packages (JobKeeper, JobSeeker, one-off pandemic cheques for low and middle income households, free childcare, access to superannuation and freezing of housing repayments) and consumer spending declined as services were limited in lockdowns and high uncertainty made consumers cautious about spending. After reaching a high of 23.6% in March, the savings rate fell through 2020/21 but remained high and above its pre-COVID average. In March 2023, it was at 3.7%. This meant that through 2020 until mid-2022, consumers were building up additional savings that would not have existed without the COVID-19 pandemic. On our calculations, this excess savings reached a high of $253 billion(see the chart below) and 11% of annual GDP or 22% of annual consumer spending.

Source: ABS, AMP

Since this peak, consumers have drawn down just 7% of their excess savings (up to March 2023). This means that consumers still have a relatively high degree of excess savings and at the current slow run-down of savings it would imply that consumers could still have another 2-3 years of excess savings to work through. However, we expect the run-down of savings to pick up pace throughout the remainder of 2023 because of the lagged impact of prior rate rises, the roll-off of fixed-rate mortgages to variable rates that are 2-3 times the level they were fixed at and from impacts of elevated inflation which is a hit to consumer purchasing power. We expect the accumulated extra savings to be mostly exhausted by late 2024. There is also a chance that accumulated excess savings never completely go back to pre-COVID levels, if households have locked them away in deposits or investments, especially as it looks like accumulated excess savings are concentrated in older households (more on this below), who are less likely to be stressed by high interest rates.

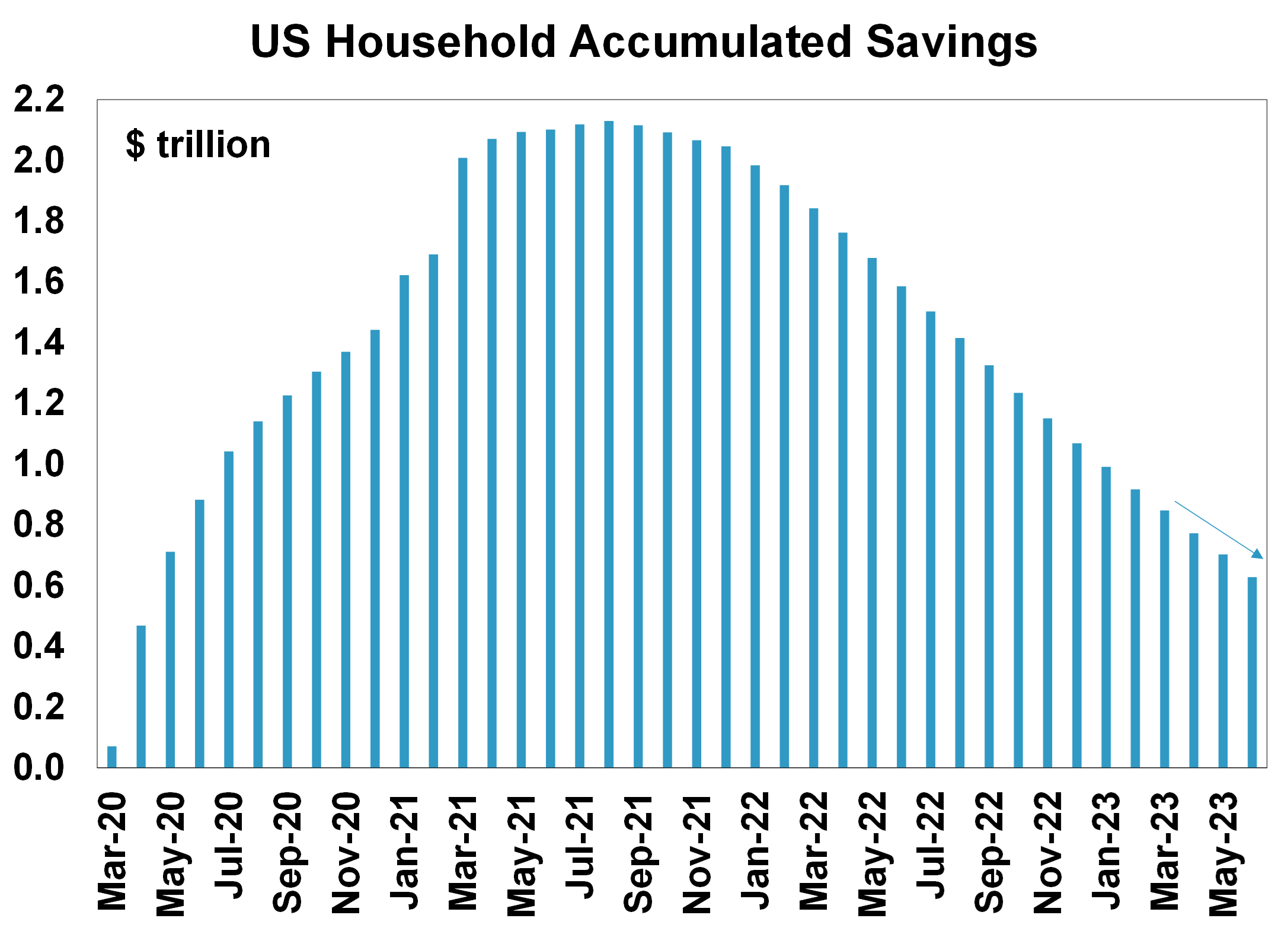

The US could be a good case for Australia to monitor because its data is timelier and can be used as a leading indicator for Australia, as our reopening occurred after the US. The US household savings data shows that household savings reached a high of $2.1tn in August 2021 (7.9% of annual GDP or 12.3% of consumer spending) and have drawn down 70% of total accumulated savings (see the chart below). If savings continue to be run-down at the same pace, accumulated excess savings will be exhausted by March-2024. US households are running down their savings faster than in Australia, despite a lower pass-through of interest rate hikes to households because of a higher share of fixed-rate mortgages (although US inflation peaked at a higher rate than in Australia which is negative for household purchasing power).

Source: Bloomberg, AMP

Are excess savings evenly distributed?

Annual data around household wealth distribution allows us to estimate how savings are broken down by different households. It shows that older households (aged 55+) hold a large share of household accumulated savings (see the next chart). This is also in line with recent earnings results from banks which showed that older households accounted for the highest share of deposits.

The argument around high accumulated excess household savings is that these will help consumers to meet higher mortgage repayments and cost of living pressures which will keep consumer spending from falling significantly. However, if accumulated excess savings are concentrated in older households, that makes them less significant as older households tend to have smaller mortgages, so are less impacted by rising interest rates. Older households may also be less inclined to spend excess savings if it expected to be used in retirement. Older households would still be impacted by the cost-of-living issues around high inflation so excess savings would be useful in meeting spending requirements from price rises.

The middle-aged households (those aged 35-54) are most impacted by the rising interest rate environment as they are the ones that hold a large share of mortgage debt. This group has little excess savings so will have to cut back spending. This is why we expect that even if accumulated savings appear elevated, this masks a divergence of outcomes for different household groups.

Source: ABS, AMP

Implications for consumers

As household savings are run down, we expect total consumer spending volumes to turn negative by late 2023 and into early 2024 which will weigh on GDP growth. The quarterly consumer spending data is a broader measure of consumer spending (compared to the monthly retail data) and includes motor vehicle spending, transport and recreation and culture which are all sensitive to changes in interest rates. While retail volumes have already turned negative (they are 33% of consumer spending), further weakness in broader consumer spending is likely as the cash rate remains high (with the risk of another rate rise) throughout the rest of 2023 and into early 2024 which will send household mortgage repayments as a share of income to a record high (see the next chart). The expected weakening in the labour market is also a risk for consumers. We see the unemployment rate rising from its current level of 3.5% to a peak of over 4.5% by mid-2024, which will put a strain on household spending.

Source: Bloomberg, AMP

It's also important to consider upside risks to consumers, which could come from a rise in real wages growth, as headline inflation has slowed and nominal wages growth has risen which will help to lift real wages growth from negative levels or if the unemployment rate doesn’t rise as much as we are expecting.

Weekly market update 22-11-2024

22 November 2024 | Blog Against a backdrop of geopolitical risk and noise, high valuations for shares and an eroding equity risk premium, there is positive momentum underpinning sharemarkets for now including the “goldilocks” economic backdrop, the global bank central cutting cycle, positive earnings growth and expectations of US fiscal spending. Read more

Oliver's insights - Trump challenges and constraints

19 November 2024 | Blog Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory. Read more

Econosights - strong employment against weak GDP growth

18 November 2024 | Blog The persistent strength in the Australian labour market has occurred against a backdrop of poor GDP growth, which is unusual. We go through this issue in this edition of Econosights. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.