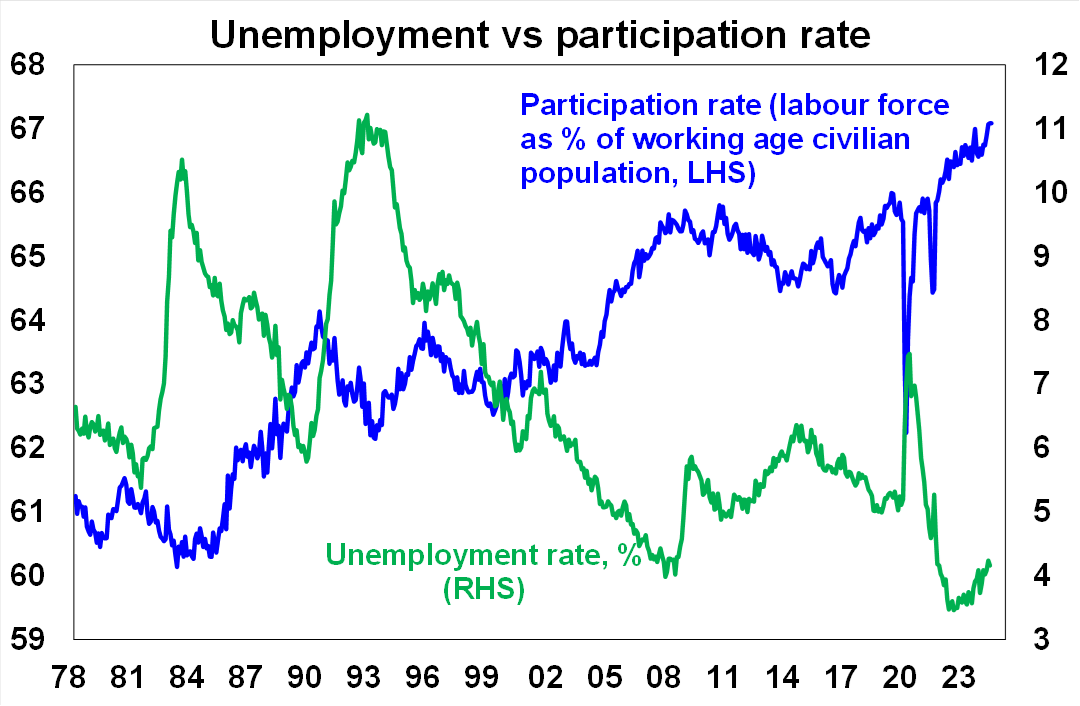

Employment growth in Australia surprised to the upside for the 5th consecutive month, rising by 47.5k over the month of August – almost double the 26k figure predicted by economists. The labour market in Australia is quite resilient: over the past year, the total number of employed people in Australia has grown by 2.7%, and the participation rate has continued to grow to a record high level of 67.1%. While cost-of-living pressures may have pushed more households to enter the labour force to look for work, the fact that many of these people are still able to be matched to jobs (as unemployment rate is unchanged at 4.2%) is clear evidence of a still strong domestic labour market.

Source: ABS, AMP

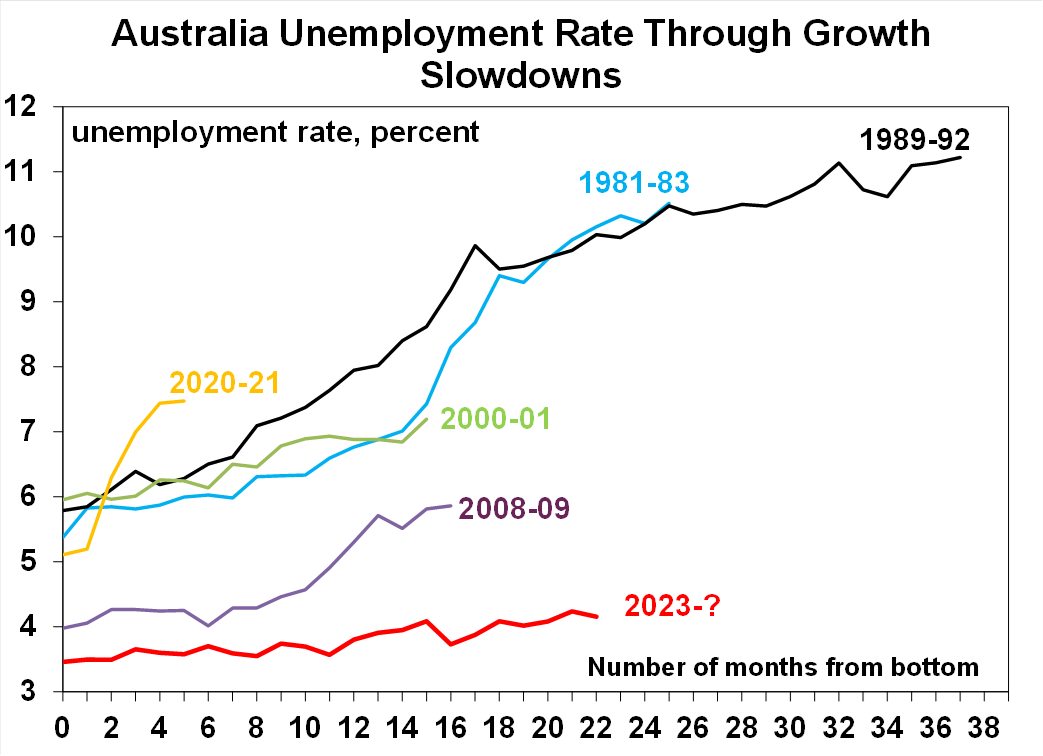

Over the prior 6 months, however, employment growth has been revised down by a total of 35k due to a re-benchmarking of population growth in August. Due to these revisions and the fact that employment growth fluctuates with population size, the best way to evaluate the health of the labour market is not in the headline jobs growth figures, but in the path of unemployment rate as well as a range of other leading indicators. Australia’s unemployment rate has now increased by 0.7 percentage point from the trough and is hovering around the highest level since late 2021, but is still very low by historical standard.

Source: ABS, AMP

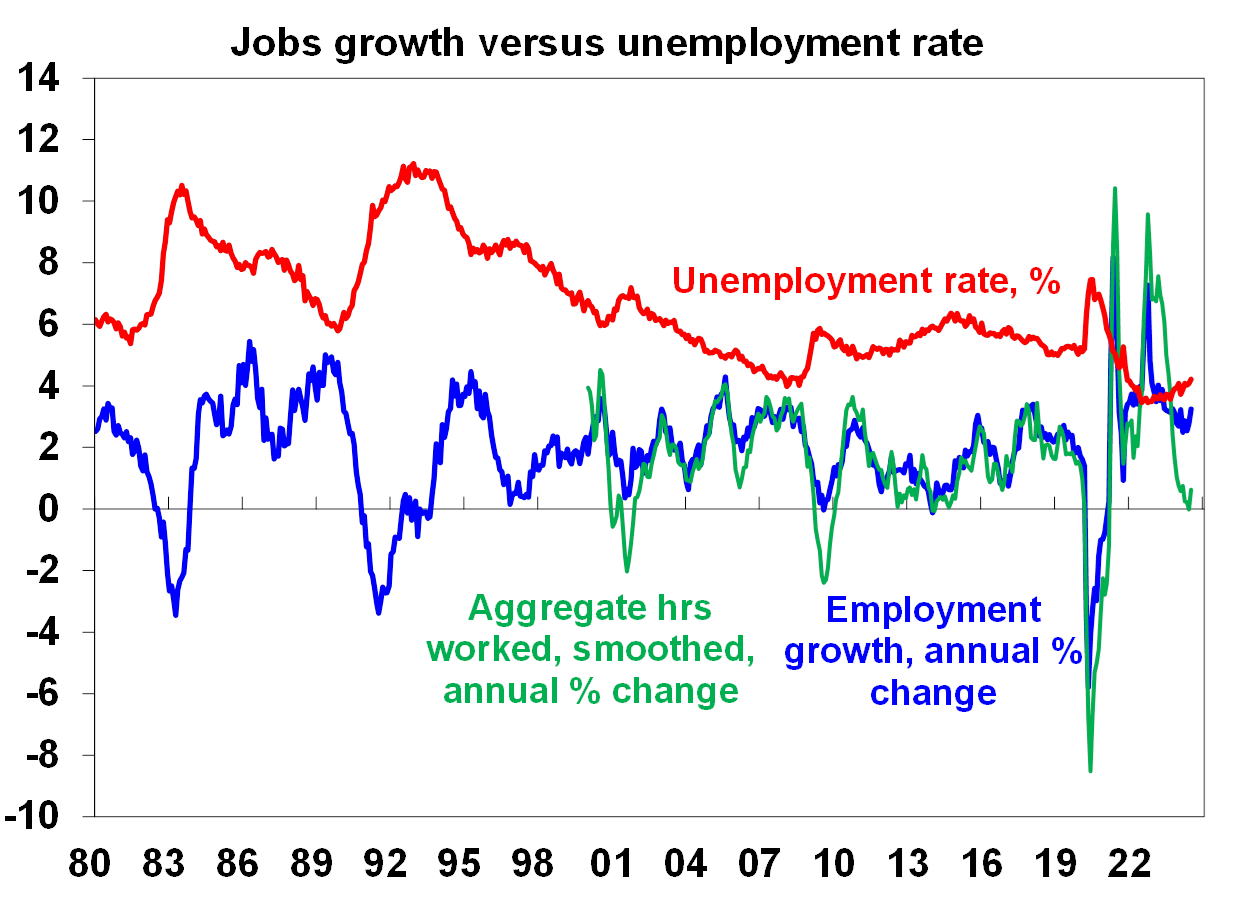

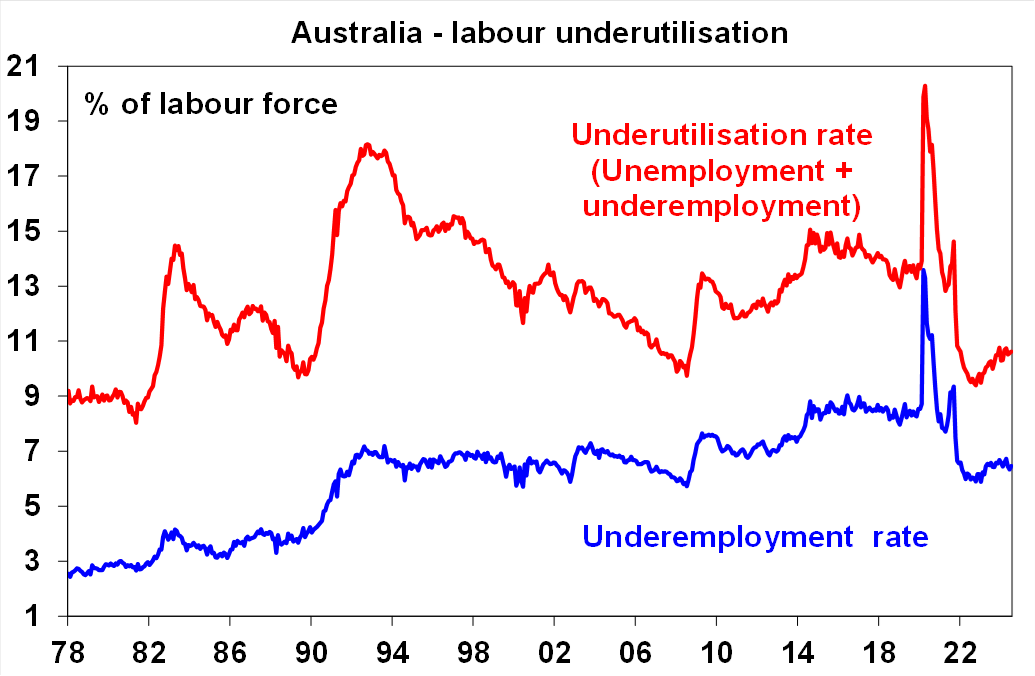

Nevertheless, the devil is in the details of the recent employment reports. Growth has been driven by part-time jobs which grew 50.6k over the month of August or +4.9%yoy, rather than full-time employment (+1.7%yoy). Total hours worked in Australia also only rose by 0.4% in August and 1.7% over the year (green line below), much lower than the pace of jobs growth (blue line). In fact, the percentage of those who are employed but would like to work more hours (aka the “underemployment rate”) has also ticked up to 6.5% from 6.3% last month; but similar to unemployment rate, it hasn’t increased to concerning levels.

Source: ABS, AMP

Source: ABS, AMP

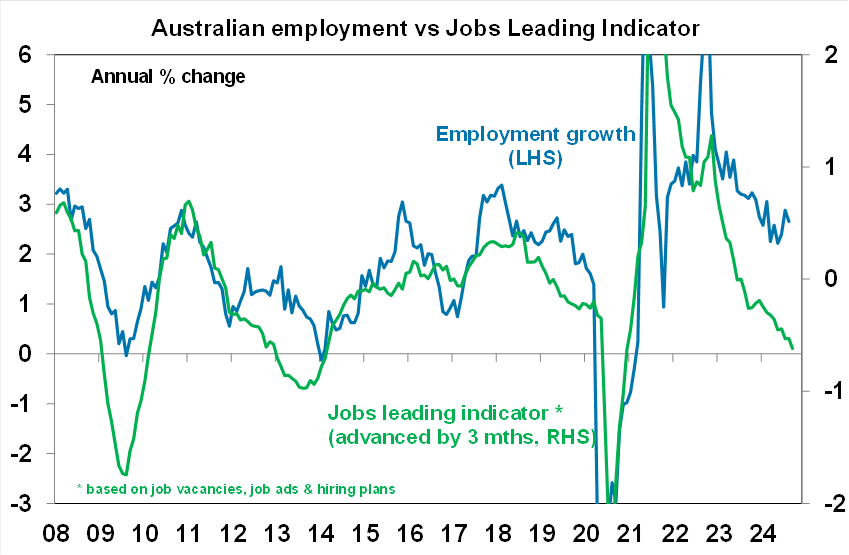

The unemployment rate is considered a lagging indicator, because it tends to rise after the economy has already weakened (ie. Australia’s GDP growth is now at the lowest level since the 90s, outside of pandemic distortions). In this cycle, for example, we have seen Australian companies responding to slowing demand by first reducing online job advertisements as well as actual job openings, in addition to cutting hours of the existing workforce if possible (because it is costly to retrain and rehire workers in case situations improve). As a result, it now takes longer for a job seeker to find work, and the percentage of voluntary job quitters has declined – but the overall unemployment rate hasn’t spiked (yet!).

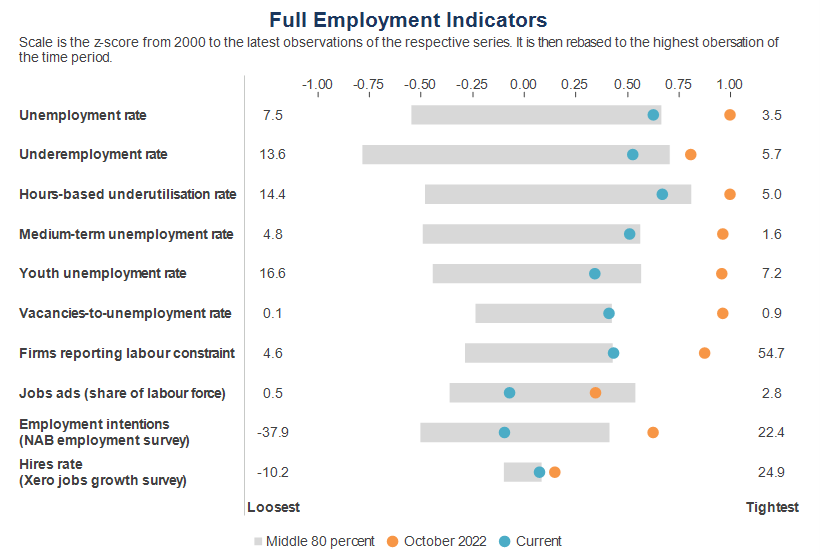

Overall, looking at a wide range of both lagging and leading indicators; we continue to see a still healthy labour market (blue dots), albeit less tight than in October 2022 (orange dots). Most importantly, the employment landscape has started to show some small cracks that point to further slowdown from here, with job vacancies and hiring intentions all implying more declines in employment growth. For now, it is probably not time for the RBA to cut rates yet, given that their assessment of labour supply remains tight versus demand; but looking forward, jobs leading indicators are all telling us that labour demand is already weakening and will potentially deteriorate further, which allows room for the Reserve Bank to ease early in 2025.

Source: ABS, NAB, Jobs & Skills Australia, Xero, Macrobond, AMP

Source: ABS, Macrobond, AMP

Weekly marketing update 29-11-2024

29 November 2024 | Blog Shares have been mixed over the last week with lots of noise around Trump including tariff posts, political uncertainty in France and another elevated inflation reading in the US, but mostly solid US economic data and news of a cease fire between Israel and Hezbollah. Read more

Weekly market update 22-11-2024

22 November 2024 | Blog Against a backdrop of geopolitical risk and noise, high valuations for shares and an eroding equity risk premium, there is positive momentum underpinning sharemarkets for now including the “goldilocks” economic backdrop, the global bank central cutting cycle, positive earnings growth and expectations of US fiscal spending. Read more

Oliver's insights - Trump challenges and constraints

19 November 2024 | Blog Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory. Read moreWhat you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.