How to compare super funds

Choosing the right fund could mean more money in the future, so it’s important to consider your options. Look at the different ways to compare your super fund and the factors to consider.

Choosing the right fund could mean more money in the future, so it’s important to consider your options. Look at the different ways to compare your super fund and the factors to consider.

According to the government’s MoneySmart website, there are 5 things you should consider when choosing a super fund. The following table helps you understand each of them and how that fits with Amatil Super.

Administration and member fees are discounted because of the size of Amatil Super.

AMP has designed a default MySuper arrangement, specifically for Amatil employees - called CCA MySuper Future Directions LifeStages. CCA MySuper Future Directions LifeStages automatically lowers your investment risk profile as you get older by switching your savings to less risky investments. A number of other investment options are also available, and you have the flexibility to switch between these options.

Members have access to the Coca-Cola Amatil Allocated Pension, so when you’re closer to retirement you can start a pension account with AMP.

Flexible insurance options for Amatil employees are underwritten by AMP Life Limited. You enjoy group insurance rates for Death, and Total and Permanent Disability, and Temporary Salary Continuance Insurance. Amatil will pay the premiums and stamp duty on the default cover that you are eligible for as set out in the relevant plan summary.

Workplace Managers can provide you with access to general financial product advice through one-on-one super health checks and group education sessions. These are organised via your employer and may be face to face (F2F)1 or web based. You’ve also got access to a dedicated phone number and email address.

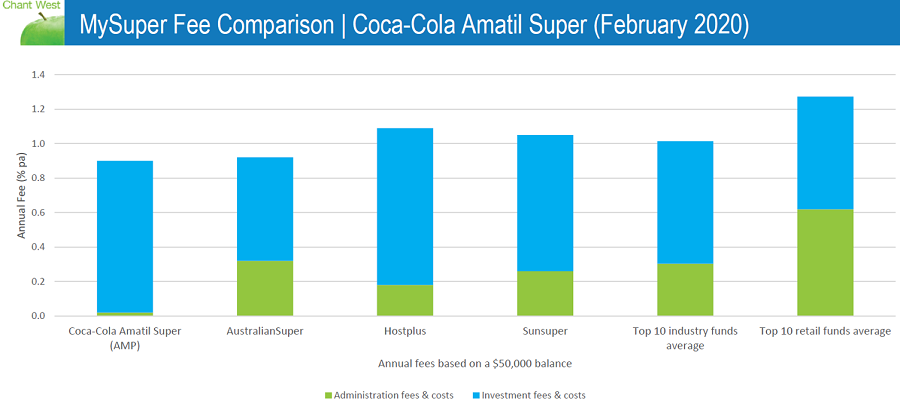

Amatil Super provides access to discounts on the administration and member fees. So, to help you compare, we’ve engaged independent ratings agency Chant West to compare the Amatil Super fees with some of the largest super funds in Australia.

The example below provides the annual total fee as a percentage, based on a $50,000 balance, invested in the relevant MySuper option for each superannuation fund2.

As at February 2020

1 Education activities are organised via your employer and may not be available for employees in all locations.

2 Fees & costs are for each fund's MySuper option for a $50,000 balance. The Top 10 industry funds and Top 10 retail funds have been selected based on total assets under management, excluding AMP. For lifecycle products, the fee for the lifecycle option for a member aged 54 has been used as the asset allocation at this age is similar to most other MySuper products. Fees and costs are based on information sourced from publicly available disclosure documents or directly from product providers and are believed to be accurate at 28 February 2019, except for Coca-Cola Amatil Super where the fee is that which applies from 1 March 2019 to 30 June 2020 and AustralianSuper where the administration fee that will apply from 30 March 2019 has been included. Fees and costs are gross of income tax - where the benefit of the tax deduction relating to a fee is not passed on to members as either reduced contributions tax or a reduced fee, the fee has been 'grossed-up' (i.e. divided by 0.85).

Administration fees & costs include all non-investment fees including member fees, %-based administration fees, expense recoveries and the Operational Risk Financial Requirement (ORFR). Investment fees & costs include investment fees, indirect costs and performance-based fees.

Transaction fees, contribution fees and financial advice fees have been excluded from the comparison. These fees may be payable in addition to the fees shown above.

This comparison only considers fees and costs. When selecting superannuation funds, other issues such as investment options, investment performance, insurance and services provided should be considered.

Source & Disclaimer: © Chant West Pty Limited ABN 75 077 595 316 (www.chantwest.com.au) 2019. The data provided by Chant West is based on information supplied by third parties. While such information is believed to be accurate, Chant West does not accept responsibility for any inaccuracy in such information. The data provided by Chant West does not contain all of the information that is required in order to evaluate the nominated service providers, and you are responsible for obtaining such further information. The data provided by Chant West does not constitute financial product advice. However to the extent that this data may be considered to be general financial product advice, Chant West warns that: (a) Chant West has not considered any individual person’s objectives, financial situation or particular needs; (b) individuals need to consider whether the advice is appropriate in light of their goals, objectives and current situation; and (c) individuals should obtain a product disclosure statement from the relevant fund provider before making any decision about whether to acquire a financial product from that fund provider. A Financial Services Guide has been made available by Chant West through its website at www.chantwest.com.au. Chant West is an independent superannuation research firm established in 1997. It conducts research on most of the leading superannuation and pension funds, asset consultants and implemented consultants in Australia. Its research is purchased by most of Australia’s leading superannuation suppliers and its comparison tools are widely used by consumers, funds and financial advisers.

Coca-Cola Amatil (Amatil) does not publish this site and does not endorse or assume responsibility for any advice contained here.